Key Insights

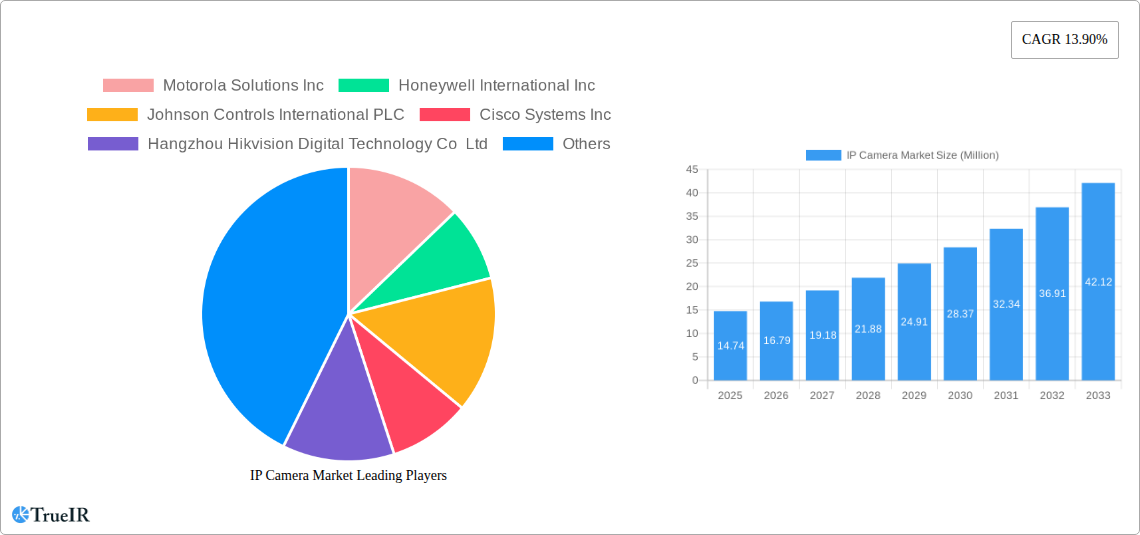

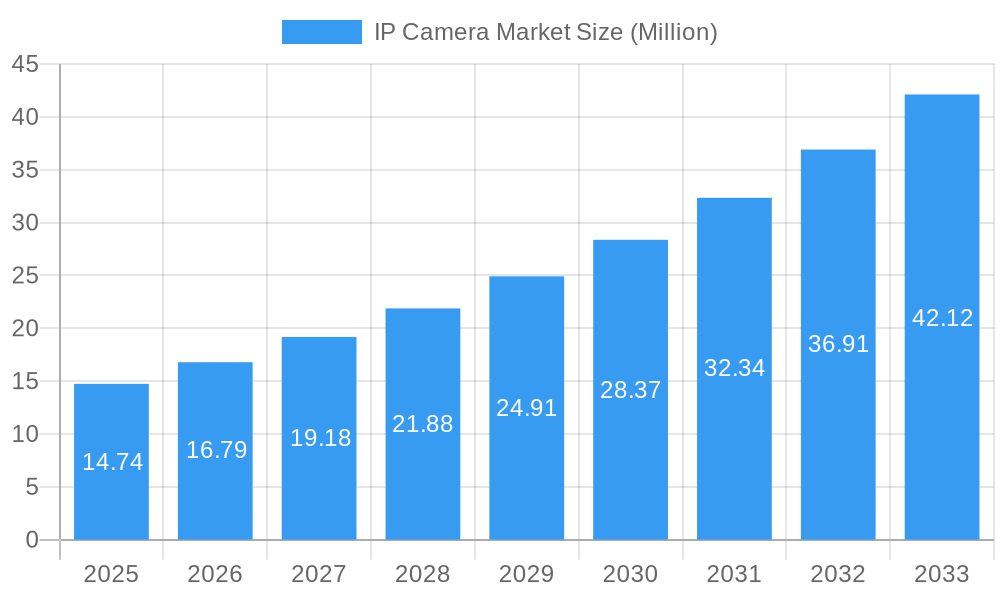

The global IP camera market is poised for significant expansion, currently valued at approximately $14.74 million. This robust growth is underpinned by an impressive compound annual growth rate (CAGR) of 13.90%, indicating a dynamic and rapidly evolving industry. The primary drivers fueling this surge include the escalating demand for enhanced security and surveillance solutions across diverse sectors, coupled with the continuous technological advancements in areas like artificial intelligence (AI), high-resolution imaging, and cloud connectivity. The increasing adoption of smart home devices and the growing need for remote monitoring in both commercial and industrial settings further propel market penetration. Furthermore, government initiatives focused on public safety and smart city development are creating substantial opportunities for IP camera manufacturers.

IP Camera Market Market Size (In Million)

The IP camera market is segmented by type into Fixed, Pan-Tilt-Zoom (PTZ), and Varifocal cameras, with PTZ cameras likely to see accelerated adoption due to their advanced functionalities. End-user industries span Residential, Commercial, Industrial, and Government and law enforcement, each presenting unique growth trajectories. Commercial and industrial sectors, driven by the need for operational efficiency and robust security, are expected to be major contributors. Government and law enforcement segments, influenced by counter-terrorism efforts and urban surveillance needs, will also exhibit strong growth. While the market benefits from these drivers, potential restraints such as high initial investment costs for sophisticated systems and data privacy concerns may temper growth in certain regions. However, ongoing innovation in affordability and data security measures is mitigating these challenges.

IP Camera Market Company Market Share

IP Camera Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global IP Camera market. Leveraging high-volume keywords and detailed segmentation, this report offers critical insights for industry stakeholders, investors, and strategists. The study period spans from 2019 to 2033, with a base year of 2025.

IP Camera Market Market Structure & Competitive Landscape

The IP Camera market is characterized by a moderately concentrated structure, with a significant presence of both established multinational corporations and emerging players. Innovation serves as a primary driver, with companies heavily investing in research and development to enhance features such as AI-powered analytics, superior image quality, and robust cybersecurity. Regulatory landscapes, particularly concerning data privacy and surveillance, play a crucial role in shaping market dynamics. The threat of product substitutes, while present from analog systems and alternative surveillance technologies, is diminishing as the cost-effectiveness and advanced capabilities of IP cameras become more pronounced.

End-user segmentation reveals a strong demand across Commercial and Industrial sectors, driven by the need for enhanced security, operational efficiency, and remote monitoring. The Residential segment is also experiencing steady growth, fueled by increasing awareness and affordability of smart home security solutions. Mergers and acquisitions (M&A) are a significant trend, with companies like Motorola Solutions Inc. actively acquiring specialized technology providers to expand their portfolios and market reach. The concentration ratio for the top five players is estimated to be around 65% in 2025, indicating substantial market power held by key entities. Recent M&A activities, such as Motorola Solutions' acquisition of Silent Sentinel in February 2024, highlight a strategic consolidation focused on advanced capabilities and long-range surveillance.

IP Camera Market Market Trends & Opportunities

The global IP Camera market is poised for significant expansion, driven by an escalating demand for advanced security solutions across diverse industries. The market size is projected to grow from approximately $7 Billion in 2025 to an estimated $15 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033). Technological advancements are a cornerstone of this growth, with a notable shift towards smarter, more integrated surveillance systems. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into IP cameras is transforming capabilities, enabling features such as intelligent video analytics (IVA), facial recognition, object detection, and anomaly detection. This move from basic video recording to proactive threat identification is a key differentiator.

Consumer preferences are increasingly leaning towards high-resolution imaging (4K and beyond), improved low-light performance, and enhanced cybersecurity features to protect against data breaches. The proliferation of the Internet of Things (IoT) ecosystem further bolsters the IP camera market, as these devices become integral components of smart buildings, smart cities, and connected security networks. The growing adoption of cloud-based video management systems (VMS) offers scalability, remote accessibility, and simplified data management, attracting more businesses and individuals. Opportunities abound in sectors like retail, where IP cameras are used for loss prevention and customer analytics; transportation, for traffic monitoring and public safety; and healthcare, for patient monitoring and facility security. Emerging economies, with their rapidly developing infrastructure and increasing security concerns, represent significant untapped potential. The competitive landscape is dynamic, with established players continuously innovating and new entrants focusing on niche applications and disruptive technologies. The trend towards wireless IP cameras and Power over Ethernet (PoE) continues to simplify installation and reduce infrastructure costs, making IP camera solutions more accessible.

Dominant Markets & Segments in IP Camera Market

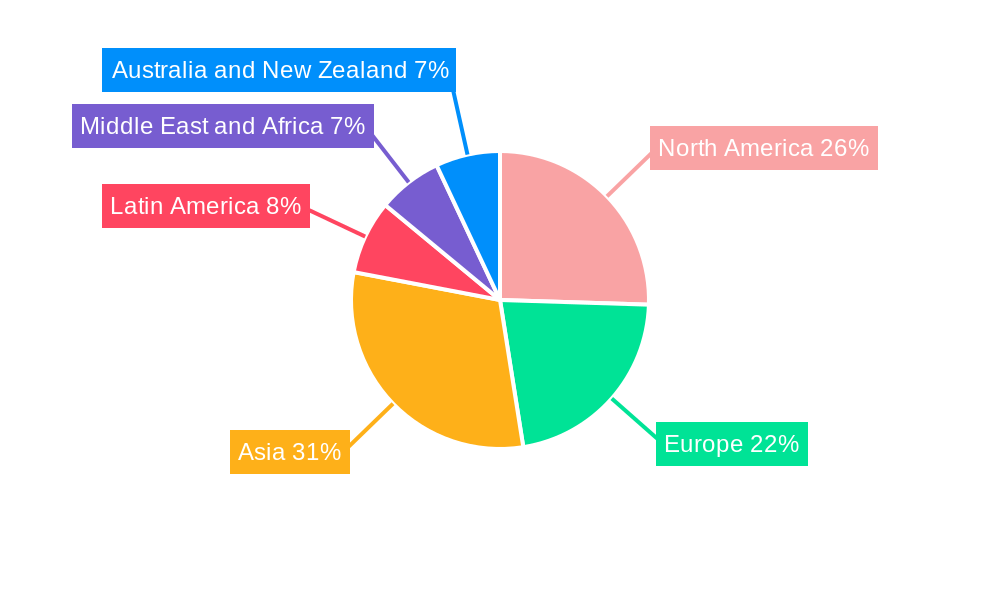

The global IP Camera market is experiencing robust growth, with distinct dominance observed across various regions and segments. North America and Asia-Pacific are anticipated to be the leading regions, driven by high levels of technological adoption, significant investments in smart city initiatives, and stringent security regulations. The United States and China, in particular, are expected to spearhead market expansion due to large-scale deployments in commercial and government sectors.

Dominant Segments by Type:

- Fixed Cameras: These constitute the largest segment, accounting for an estimated 55% of the market share in 2025. Their widespread adoption is attributed to their cost-effectiveness, ease of deployment, and suitability for continuous surveillance in fixed locations. Key growth drivers include the burgeoning demand for robust perimeter security and internal monitoring in both commercial and industrial settings.

- Pan-Tilt-Zoom (PTZ) Cameras: While smaller in market share (approximately 25% in 2025), PTZ cameras are witnessing significant growth. Their ability to cover wider areas and provide detailed surveillance makes them indispensable for applications requiring dynamic monitoring, such as public spaces, large facilities, and traffic management. Infrastructure development and the increasing need for sophisticated surveillance in smart city projects are major catalysts for PTZ camera adoption.

- Varifocal Cameras: Occupying the remaining market share (around 20% in 2025), Varifocal cameras offer flexibility in adjusting focal length, allowing for customized field of view and optimal image clarity at varying distances. Their versatility makes them suitable for a broad range of applications where specific surveillance zones need to be monitored effectively.

Dominant Segments by End-user Industry:

- Commercial: This sector is a primary growth engine, contributing an estimated 40% to the market value in 2025. It encompasses retail, hospitality, BFSI (Banking, Financial Services, and Insurance), and corporate offices, all seeking enhanced security, operational efficiency, and customer insights. The increasing adoption of IP cameras for video analytics, such as customer flow analysis and inventory management, fuels this segment's dominance.

- Industrial: A significant contributor (approximately 30% in 2025), the industrial sector includes manufacturing plants, warehouses, and critical infrastructure. The need for stringent safety protocols, asset protection, and process monitoring drives the demand for reliable and high-performance IP camera systems.

- Government and Law Enforcement: This segment, accounting for around 20% of the market share in 2025, is characterized by large-scale deployments for public safety, surveillance of public spaces, border security, and intelligent transportation systems. Government initiatives and increasing concerns about terrorism and crime are key drivers.

- Residential: While currently a smaller segment (about 10% in 2025), the residential market is experiencing rapid growth. The increasing penetration of smart homes, rising crime rates, and growing consumer awareness of home security solutions are driving this expansion.

IP Camera Market Product Analysis

Product innovation in the IP camera market is focused on delivering higher resolution, enhanced low-light performance, and advanced analytics. Technologies like 4K and 8K imaging, Wide Dynamic Range (WDR), and infrared capabilities are becoming standard, ensuring clear footage in challenging conditions. The integration of AI and machine learning enables features such as object detection, facial recognition, and anomaly detection, transforming cameras from passive recording devices to intelligent security tools. Competitive advantages are derived from robust cybersecurity measures, user-friendly interfaces, and seamless integration with broader security ecosystems, including VMS and cloud platforms.

Key Drivers, Barriers & Challenges in IP Camera Market

The IP Camera market is propelled by several key drivers. Technological advancements, particularly in AI and IoT integration, are creating smarter and more efficient surveillance solutions. The escalating global security concerns, coupled with increasing instances of crime and terrorism, are driving demand for robust monitoring systems. Government initiatives promoting smart cities and critical infrastructure protection further fuel market growth. Economic factors, such as the increasing affordability of IP cameras and the demonstrable ROI from enhanced security and operational efficiency, also play a crucial role.

However, the market faces significant barriers and challenges. Cybersecurity threats and data privacy concerns pose a considerable restraint, as robust encryption and secure data management are paramount. Regulatory complexities and compliance requirements, varying across different regions, can hinder widespread adoption and increase implementation costs. Supply chain disruptions, as seen in recent years, can impact product availability and lead times. Intense competition among numerous players, leading to price pressures, also presents a challenge for sustained profitability.

Growth Drivers in the IP Camera Market Market

The IP camera market is experiencing robust growth fueled by several critical factors. Technological Advancements are paramount, with the integration of Artificial Intelligence (AI) for intelligent video analytics, object detection, and facial recognition transforming surveillance capabilities. The proliferation of IoT devices enables seamless integration of IP cameras into smart homes and smart city ecosystems, creating interconnected security networks. Increasing global security concerns, including rising crime rates and terrorism, are a major impetus for enhanced surveillance solutions. Furthermore, government initiatives focused on smart city development, critical infrastructure protection, and public safety are driving large-scale deployments. The decreasing cost of advanced technologies and the demonstrable return on investment (ROI) through improved security and operational efficiency also contribute significantly to market expansion.

Challenges Impacting IP Camera Market Growth

Despite its strong growth trajectory, the IP camera market faces several significant challenges. Cybersecurity vulnerabilities and the potential for data breaches remain a primary concern, necessitating robust encryption and secure network management. Regulatory complexities and data privacy laws, such as GDPR and CCPA, create compliance hurdles that vary by region and can increase operational costs. Supply chain disruptions, including shortages of components and logistical challenges, can impact product availability and lead times, affecting market responsiveness. Furthermore, the intense competitive landscape with numerous manufacturers often leads to price wars, challenging profitability margins for some players. The need for skilled professionals for installation, maintenance, and system management also presents a potential bottleneck in certain markets.

Key Players Shaping the IP Camera Market Market

- Motorola Solutions Inc.

- Honeywell International Inc.

- Johnson Controls International PLC

- Cisco Systems Inc.

- Hangzhou Hikvision Digital Technology Co Ltd

- D-Link Limited

- Matrix Comsec Pvt Ltd

- 3dEYE Inc.

- Panasonic Corporation

- Ajax Systems Inc.

- Sony Corporation

Significant IP Camera Market Industry Milestones

- February 2024: Motorola Solutions acquired Silent Sentinel, a provider of specialized, long-range cameras based in Ware, United Kingdom. This acquisition enhances Motorola's portfolio with highly accurate detection capabilities for extended perimeter security.

- January 2024: Johnson Controls India unveiled new security cameras—Illustra Standard Gen3. This line aligns with India's "Make in India" initiative and offers integrated solutions across access control, cloud, video surveillance, and intrusion detection for various sectors.

Future Outlook for IP Camera Market Market

The future outlook for the IP camera market is exceptionally promising, driven by continuous technological innovation and a sustained demand for advanced security solutions. The increasing integration of AI and machine learning will lead to more predictive and proactive surveillance capabilities, moving beyond mere monitoring to intelligent threat assessment. The expansion of smart cities and the growing adoption of IoT across various sectors will create new avenues for IP camera deployment. Opportunities in emerging economies, coupled with the ongoing need for enhanced security in both commercial and residential spaces, will continue to fuel market expansion. Strategic partnerships and acquisitions will likely remain a key trend as companies seek to consolidate their market positions and broaden their technological offerings, ensuring robust growth in the coming years.

IP Camera Market Segmentation

-

1. Type

- 1.1. Fixed

- 1.2. Pan-Tilt-Zoom (PTZ)

- 1.3. Varifocal

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commerci

- 2.3. Industrial

- 2.4. Government and law enforcement

IP Camera Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

- 6. Australia and New Zealand

IP Camera Market Regional Market Share

Geographic Coverage of IP Camera Market

IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing integration of IP cameras with smart home technologies and expansion of smart cities; Rising demand for security surveillance; Growing demand for high-resolution cameras

- 3.3. Market Restrains

- 3.3.1. Data privacy and security concerns; High installation and maintenance costs

- 3.4. Market Trends

- 3.4.1. The Commercial Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed

- 5.1.2. Pan-Tilt-Zoom (PTZ)

- 5.1.3. Varifocal

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commerci

- 5.2.3. Industrial

- 5.2.4. Government and law enforcement

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.3.6. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed

- 6.1.2. Pan-Tilt-Zoom (PTZ)

- 6.1.3. Varifocal

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Residential

- 6.2.2. Commerci

- 6.2.3. Industrial

- 6.2.4. Government and law enforcement

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed

- 7.1.2. Pan-Tilt-Zoom (PTZ)

- 7.1.3. Varifocal

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Residential

- 7.2.2. Commerci

- 7.2.3. Industrial

- 7.2.4. Government and law enforcement

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed

- 8.1.2. Pan-Tilt-Zoom (PTZ)

- 8.1.3. Varifocal

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Residential

- 8.2.2. Commerci

- 8.2.3. Industrial

- 8.2.4. Government and law enforcement

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed

- 9.1.2. Pan-Tilt-Zoom (PTZ)

- 9.1.3. Varifocal

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Residential

- 9.2.2. Commerci

- 9.2.3. Industrial

- 9.2.4. Government and law enforcement

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed

- 10.1.2. Pan-Tilt-Zoom (PTZ)

- 10.1.3. Varifocal

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Residential

- 10.2.2. Commerci

- 10.2.3. Industrial

- 10.2.4. Government and law enforcement

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Australia and New Zealand IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Fixed

- 11.1.2. Pan-Tilt-Zoom (PTZ)

- 11.1.3. Varifocal

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Residential

- 11.2.2. Commerci

- 11.2.3. Industrial

- 11.2.4. Government and law enforcement

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Motorola Solutions Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johnson Controls International PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cisco Systems Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hangzhou Hikvision Digital Technology Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 D-Link Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Matrix Comsec Pvt Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 3dEYE Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Panasonic Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Ajax Systems Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sony Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Global IP Camera Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia and New Zealand IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Australia and New Zealand IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Australia and New Zealand IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Australia and New Zealand IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Australia and New Zealand IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Australia and New Zealand IP Camera Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global IP Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IP Camera Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the IP Camera Market?

Key companies in the market include Motorola Solutions Inc, Honeywell International Inc, Johnson Controls International PLC, Cisco Systems Inc, Hangzhou Hikvision Digital Technology Co Ltd, D-Link Limited, Matrix Comsec Pvt Ltd, 3dEYE Inc, Panasonic Corporation, Ajax Systems Inc, Sony Corporation.

3. What are the main segments of the IP Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing integration of IP cameras with smart home technologies and expansion of smart cities; Rising demand for security surveillance; Growing demand for high-resolution cameras.

6. What are the notable trends driving market growth?

The Commercial Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Data privacy and security concerns; High installation and maintenance costs.

8. Can you provide examples of recent developments in the market?

February 2024 - Motorola Solutions acquired Silent Sentinel, a provider of specialized, long-range cameras based in Ware, United Kingdom. Equipped with highly accurate detection capabilities, Silent Sentinel's cameras are claimed to be capable of identifying anomalies from up to 20 miles away (30 km) to extend the perimeter of security and support a faster, more informed response.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IP Camera Market?

To stay informed about further developments, trends, and reports in the IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence