Key Insights

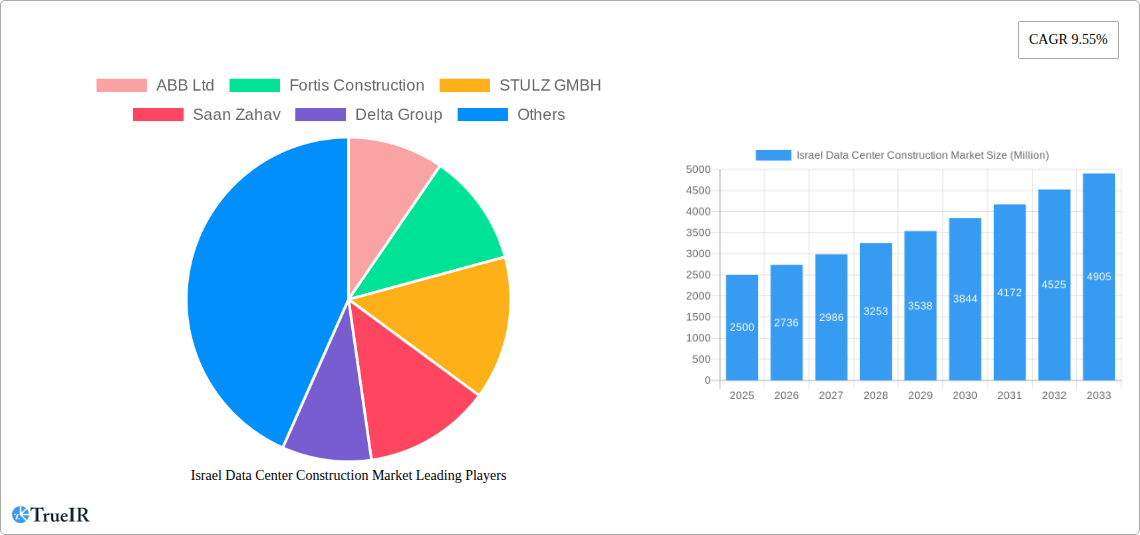

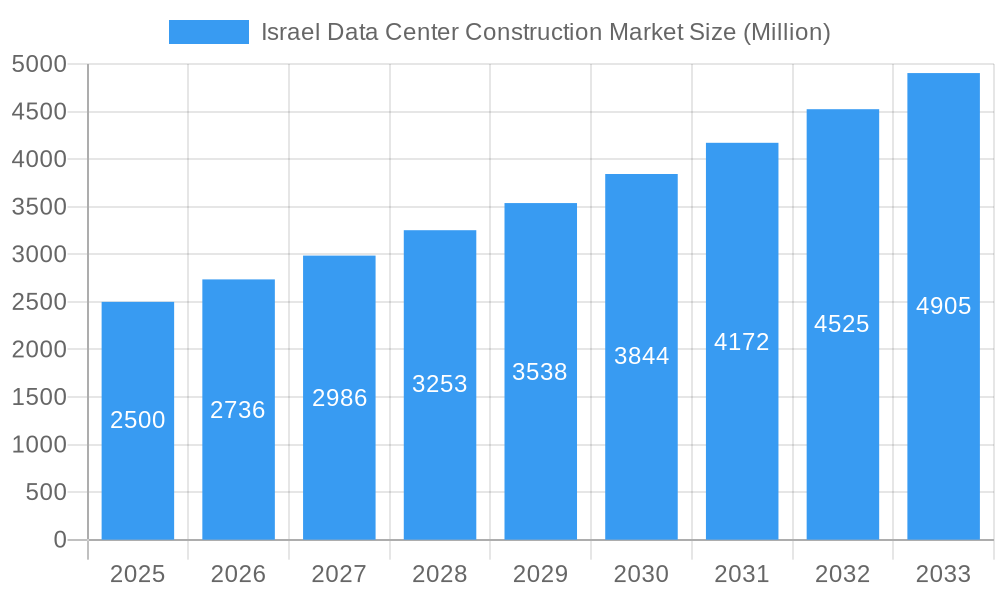

The Israel Data Center Construction Market is projected for substantial growth, expected to reach $1.05 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.54% through 2033. This expansion is driven by the increasing need for digital infrastructure, fueled by widespread adoption of cloud computing, big data analytics, and the expanding Internet of Things (IoT) ecosystem in Israel. The nation's advanced technological ecosystem and its strategic position as a regional hub attract significant domestic and international investment in data center development. Furthermore, rising demand for enhanced cybersecurity and data localization mandates are prompting organizations to invest in secure, on-premise or near-premise data center solutions, bolstering market momentum. The growth of hyperscale data centers by major cloud providers and ongoing digital transformation across sectors like BFSI, IT & Telecommunications, and Healthcare are creating sustained demand for sophisticated and scalable data center solutions.

Israel Data Center Construction Market Market Size (In Billion)

Market segmentation reveals balanced investment in electrical and mechanical infrastructure. Critical components include power distribution solutions such as PDUs, transfer switches, and switchgear, alongside essential power backup solutions like UPS and generators for uninterrupted operations. The mechanical infrastructure segment is experiencing a surge in demand for advanced cooling systems, including immersion cooling and direct-to-chip cooling, necessitated by the increasing power density of modern IT equipment. The proliferation of Tier 3 and Tier 4 data centers, offering enhanced redundancy and availability, signifies market maturation. Key industry players, including ABB Ltd, Schneider Electric SE, and STULZ GMBH, are actively contributing innovative solutions focused on efficiency, reliability, and sustainability in data center construction. The government and defense sectors also represent a significant opportunity, with an increasing emphasis on secure and resilient data storage.

Israel Data Center Construction Market Company Market Share

Israel Data Center Construction Market: Forecast to 2033 – Key Drivers, Industry Trends, and Competitive Landscape

The Israel Data Center Construction Market is set for significant expansion, propelled by escalating demand for digital infrastructure, advancements in cloud computing, and the burgeoning AI and IoT landscapes. This comprehensive report offers an in-depth analysis of the market's trajectory from 2019 to 2033, with a focus on the forecast period of 2025–2033. Explore key growth catalysts, market segmentation insights, dominant trends, and the strategic approaches of leading players shaping this dynamic sector. Gain a thorough understanding of the electrical and mechanical infrastructure, tier standards, and end-user demands that are collectively driving investment in advanced data center facilities across Israel.

Israel Data Center Construction Market Market Structure & Competitive Landscape

The Israel Data Center Construction Market exhibits a moderately consolidated structure, with key players investing heavily in expanding their footprint and enhancing service offerings. Innovation drivers are primarily centered around energy efficiency, advanced cooling solutions (such as immersion and direct-to-chip cooling), and the integration of AI-driven management systems. Regulatory impacts, while present in terms of construction and environmental standards, are largely supportive of the growth of digital infrastructure. Product substitutes are minimal for core data center construction services, though technological advancements in hardware and software can influence the scale and type of physical infrastructure required. The end-user segmentation reveals a strong reliance on IT and Telecommunications, followed closely by Banking, Financial Services, and Insurance (BFSI), Government and Defense, and Healthcare sectors. Mergers and acquisitions (M&A) are a significant trend, indicative of strategic consolidation and the pursuit of market dominance. For instance, the acquisition of a stake in MedOne by Berkshire Partners for over USD 215 million, valuing the company at USD 430 Million, highlights the substantial investor interest and consolidation activities.

- Market Concentration: Moderate, with strategic M&A activities increasing consolidation.

- Innovation Focus: Energy efficiency, advanced cooling technologies, AI integration.

- End-User Dominance: IT & Telecommunications, BFSI, Government & Defense.

- M&A Activity: Significant, with recent high-value transactions indicating investor confidence.

Israel Data Center Construction Market Market Trends & Opportunities

The Israel Data Center Construction Market is experiencing a robust growth trajectory, with the market size projected to expand considerably by 2033. This expansion is fueled by an insatiable demand for data storage, processing power, and low-latency connectivity, driven by the widespread adoption of cloud services, big data analytics, artificial intelligence (AI), and the Internet of Things (IoT). Technological shifts are evident in the move towards hyperscale and edge data centers, with a growing emphasis on sustainability and energy-efficient designs. Consumer preferences are increasingly leaning towards colocation services, hybrid cloud solutions, and data centers that can offer a high degree of security and compliance. Competitive dynamics are intensifying, with both established global players and emerging local companies vying for market share through strategic partnerships, capacity expansions, and the development of specialized facilities. The market penetration rates for modern data center infrastructure are steadily increasing as organizations recognize the critical role of robust digital foundations for their operations. The CAGR for the forecast period is expected to be robust, reflecting sustained investment and demand.

The market presents numerous opportunities for stakeholders. The increasing adoption of AI and machine learning applications necessitates advanced computing power, driving the demand for high-density data center solutions. Furthermore, the ongoing digital transformation across various industries, including finance, healthcare, and government, is creating a continuous need for scalable and secure data center capacity. The development of specialized data centers, such as those catering to high-performance computing (HPC) or hyperscale requirements, represents a significant growth avenue. Investments in renewable energy sources for powering data centers and the implementation of advanced cooling techniques to reduce operational costs and environmental impact are also key trends creating new market opportunities.

Dominant Markets & Segments in Israel Data Center Construction Market

Within the Israel Data Center Construction Market, the Electrical Infrastructure segment, particularly Power Distribution Solution, is a dominant force. The critical need for uninterrupted power supply and efficient energy management makes solutions like Power Distribution Units (PDUs), Transfer Switches (Static and Automatic), and Switchgear (Low-voltage and Medium-voltage) fundamental to data center operations. Power Backup Solutions, including UPS and Generators, are equally crucial, ensuring resilience against power outages. The Mechanical Infrastructure segment, especially Cooling Systems, is also experiencing substantial growth. With increasing rack densities and the heat generated by high-performance computing, advanced cooling solutions such as Immersion Cooling, Direct-to-chip Cooling, Rear Door Heat Exchangers, and In-row and In-rack Cooling are becoming indispensable.

General Construction forms the foundational layer for all data center developments, encompassing site selection, civil works, and building construction, and is inherently significant. The IT and Telecommunications end-user segment is the largest consumer of data center services, driving the demand for hyperscale and enterprise-grade facilities. The Banking, Financial Services, and Insurance (BFSI) sector follows closely, requiring high levels of security, reliability, and compliance. The Government and Defense sector's growing need for secure and resilient data infrastructure also contributes significantly to market demand.

- Key Growth Drivers in Electrical Infrastructure:

- Increasing power demands from high-density computing.

- Need for robust power redundancy and failover systems.

- Integration of smart grid technologies for efficiency.

- Key Growth Drivers in Mechanical Infrastructure:

- Rising heat loads from advanced processors and servers.

- Demand for energy-efficient and sustainable cooling solutions.

- Technological advancements in liquid cooling.

- Dominant End Users:

- IT and Telecommunications: Driving demand for hyperscale and colocation facilities.

- Banking, Financial Services, and Insurance: Requiring high security, compliance, and uptime.

- Government and Defense: Prioritizing data sovereignty and advanced security.

- Tier Type Significance: While Tier 3 and Tier 4 data centers represent the high-availability segment, the market sees construction across all tiers, with growing demand for resilient Tier 3 and Tier 4 facilities.

Israel Data Center Construction Market Product Analysis

The Israel Data Center Construction Market is characterized by a suite of sophisticated products designed to enhance performance, efficiency, and reliability. Key innovations in Electrical Infrastructure include advanced Power Distribution Units (PDUs) with intelligent monitoring capabilities, highly efficient UPS systems, and sophisticated switchgear solutions for seamless power management. In Mechanical Infrastructure, the focus is on cutting-edge Cooling Systems, such as immersion cooling for extreme heat dissipation and direct-to-chip cooling for localized thermal management, alongside efficient in-row and in-rack cooling solutions. Racks are evolving to support higher load capacities and better airflow management. These products offer competitive advantages by enabling higher power densities, reducing operational costs through energy efficiency, and ensuring maximum uptime, which are critical for meeting the demands of modern digital operations and advanced computing workloads.

Key Drivers, Barriers & Challenges in Israel Data Center Construction Market

The Israel Data Center Construction Market is propelled by a confluence of powerful drivers. The escalating demand for cloud computing services, the rapid growth of AI and machine learning applications, and the proliferation of IoT devices are creating an unprecedented need for data processing and storage capacity. Government initiatives promoting digitalization and investment in technological infrastructure also play a crucial role. Economic growth and a robust technology sector further fuel demand.

However, the market faces significant barriers and challenges. Supply chain disruptions for specialized components can lead to project delays and cost overruns. Stringent regulatory requirements related to land use, environmental impact, and energy consumption can complicate the construction process. The high initial capital investment required for building state-of-the-art data centers, coupled with the ongoing operational costs, presents a financial hurdle. Furthermore, the competitive pressure from established global players and the need to attract and retain skilled labor for specialized construction and maintenance tasks are ongoing challenges that impact market growth.

Growth Drivers in the Israel Data Center Construction Market Market

The Israel Data Center Construction Market is primarily driven by the exponential growth in data generation and consumption across various sectors. The widespread adoption of digital transformation initiatives by businesses, coupled with the increasing reliance on cloud services, necessitates the expansion of robust data center infrastructure. Advancements in artificial intelligence (AI) and the Internet of Things (IoT) are creating a demand for higher computing power and storage, directly translating into the need for more sophisticated data center facilities. Government support for the technology sector and digital innovation, along with favorable economic conditions and a burgeoning tech ecosystem, further catalyze growth. Strategic investments by global hyperscalers and colocation providers are also significant contributors, aiming to capitalize on Israel's advanced technological landscape and strategic location.

Challenges Impacting Israel Data Center Construction Market Growth

Despite its promising growth, the Israel Data Center Construction Market encounters several critical challenges. The complex and often lengthy regulatory approval processes for new construction projects can cause significant delays and increase project costs. Supply chain vulnerabilities, particularly for specialized electrical and mechanical components, pose a constant risk of disruptions and price volatility. The high upfront capital expenditure required for developing modern, high-tier data centers is a substantial barrier, especially for smaller players. Additionally, the increasing focus on sustainability and energy efficiency necessitates the adoption of advanced, often more expensive, technologies and practices, adding to the cost burden. Fierce competition among market players also exerts downward pressure on pricing and margins.

Key Players Shaping the Israel Data Center Construction Market Market

- ABB Ltd

- Fortis Construction

- STULZ GMBH

- Saan Zahav

- Delta Group

- Schneider Electric SE

- Turner Construction Co

- DPR Construction Inc

- Caterpillar Inc

- Rittal GmbH & Co KG

- Delta Electronics

- STULZ GMB

- Mercury Engineering

- AECOM Limited

- Legrand

- CyrusOne Inc

- AECOM

- Canovate Group

- EAE Group

- Alfa Laval AB

- M+W Group (Exyte)

Significant Israel Data Center Construction Market Industry Milestones

- July 2022: Berkshire Partners announced to pay more than USD 215 million to acquire a 49% stake in MedOne. The company was evaluated at NIS 1.5 billion (USD 430 Million), signaling substantial investor interest and consolidation in the Israeli data center market.

- August 2021: EdgeConneX announced its agreement to acquire Global Data Center (GDC), an Israeli data center operator based in the Herzliya district. This acquisition was set to bring two new facilities into the EdgeConneX global data center platform, including GDC's highly secure underground facilities in Herzliya and Petah Tikva, near Tel Aviv, underscoring the strategic importance of the Israeli market for global players.

Future Outlook for Israel Data Center Construction Market Market

The future outlook for the Israel Data Center Construction Market is exceptionally bright, driven by sustained demand for digital infrastructure. The continued expansion of cloud computing, the explosive growth of AI and machine learning, and the increasing penetration of IoT devices will necessitate substantial investments in new data center capacity and the upgrade of existing facilities. Emerging technologies like 5G connectivity will further amplify data traffic, requiring localized and high-performance data centers. Opportunities lie in the development of hyperscale facilities, specialized edge computing infrastructure, and sustainable, energy-efficient data centers that leverage renewable energy sources. Strategic partnerships and mergers are expected to continue as companies seek to scale their operations and enhance their competitive positioning in this rapidly evolving market. The market is poised for robust growth, fueled by technological innovation and a strong demand for cutting-edge digital services.

Israel Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Ba

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Panels and Components

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Ba

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Panels and Components

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Ba

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Panels and Components

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Israel Data Center Construction Market Segmentation By Geography

- 1. Israel

Israel Data Center Construction Market Regional Market Share

Geographic Coverage of Israel Data Center Construction Market

Israel Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 9.1 Rising Adoption of Renewable Energy Sources9.2 Increase in 5G Deployments Fueling Edge Data Center Investments9.3 Smart City Initiatives Driving Data Center Investments

- 3.3. Market Restrains

- 3.3.1. 10.1 Security Challenges in Data Centers10.2 Location Constraints on the Development of Data Centers

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Ba

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Panels and Components

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Ba

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Panels and Components

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Ba

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Panels and Components

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fortis Construction

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STULZ GMBH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saan Zahav

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delta Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Turner Construction Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DPR Construction Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caterpillar Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rittal GmbH & Co KG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Delta Electronics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 STULZ GMB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mercury Engineering

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AECOM Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Legrand

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 CyrusOne Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 AECOM

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Canovate Group

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 EAE Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Alfa Laval AB

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 M+W Group (Exyte)

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Israel Data Center Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Israel Data Center Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Israel Data Center Construction Market Revenue billion Forecast, by Infrastructure 2020 & 2033

- Table 2: Israel Data Center Construction Market Revenue billion Forecast, by Electrical Infrastructure 2020 & 2033

- Table 3: Israel Data Center Construction Market Revenue billion Forecast, by Power Distribution Solution 2020 & 2033

- Table 4: Israel Data Center Construction Market Revenue billion Forecast, by Power Backup Solutions 2020 & 2033

- Table 5: Israel Data Center Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Israel Data Center Construction Market Revenue billion Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 7: Israel Data Center Construction Market Revenue billion Forecast, by Cooling Systems 2020 & 2033

- Table 8: Israel Data Center Construction Market Revenue billion Forecast, by Racks 2020 & 2033

- Table 9: Israel Data Center Construction Market Revenue billion Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 10: Israel Data Center Construction Market Revenue billion Forecast, by General Construction 2020 & 2033

- Table 11: Israel Data Center Construction Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 12: Israel Data Center Construction Market Revenue billion Forecast, by Tier 1 and 2 2020 & 2033

- Table 13: Israel Data Center Construction Market Revenue billion Forecast, by Tier 3 2020 & 2033

- Table 14: Israel Data Center Construction Market Revenue billion Forecast, by Tier 4 2020 & 2033

- Table 15: Israel Data Center Construction Market Revenue billion Forecast, by End User 2020 & 2033

- Table 16: Israel Data Center Construction Market Revenue billion Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 17: Israel Data Center Construction Market Revenue billion Forecast, by IT and Telecommunications 2020 & 2033

- Table 18: Israel Data Center Construction Market Revenue billion Forecast, by Government and Defense 2020 & 2033

- Table 19: Israel Data Center Construction Market Revenue billion Forecast, by Healthcare 2020 & 2033

- Table 20: Israel Data Center Construction Market Revenue billion Forecast, by Other End Users 2020 & 2033

- Table 21: Israel Data Center Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 22: Israel Data Center Construction Market Revenue billion Forecast, by Infrastructure 2020 & 2033

- Table 23: Israel Data Center Construction Market Revenue billion Forecast, by Electrical Infrastructure 2020 & 2033

- Table 24: Israel Data Center Construction Market Revenue billion Forecast, by Power Distribution Solution 2020 & 2033

- Table 25: Israel Data Center Construction Market Revenue billion Forecast, by Power Backup Solutions 2020 & 2033

- Table 26: Israel Data Center Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 27: Israel Data Center Construction Market Revenue billion Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 28: Israel Data Center Construction Market Revenue billion Forecast, by Cooling Systems 2020 & 2033

- Table 29: Israel Data Center Construction Market Revenue billion Forecast, by Racks 2020 & 2033

- Table 30: Israel Data Center Construction Market Revenue billion Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 31: Israel Data Center Construction Market Revenue billion Forecast, by General Construction 2020 & 2033

- Table 32: Israel Data Center Construction Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 33: Israel Data Center Construction Market Revenue billion Forecast, by Tier 1 and 2 2020 & 2033

- Table 34: Israel Data Center Construction Market Revenue billion Forecast, by Tier 3 2020 & 2033

- Table 35: Israel Data Center Construction Market Revenue billion Forecast, by Tier 4 2020 & 2033

- Table 36: Israel Data Center Construction Market Revenue billion Forecast, by End User 2020 & 2033

- Table 37: Israel Data Center Construction Market Revenue billion Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 38: Israel Data Center Construction Market Revenue billion Forecast, by IT and Telecommunications 2020 & 2033

- Table 39: Israel Data Center Construction Market Revenue billion Forecast, by Government and Defense 2020 & 2033

- Table 40: Israel Data Center Construction Market Revenue billion Forecast, by Healthcare 2020 & 2033

- Table 41: Israel Data Center Construction Market Revenue billion Forecast, by Other End Users 2020 & 2033

- Table 42: Israel Data Center Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Data Center Construction Market?

The projected CAGR is approximately 10.54%.

2. Which companies are prominent players in the Israel Data Center Construction Market?

Key companies in the market include ABB Ltd, Fortis Construction, STULZ GMBH, Saan Zahav, Delta Group, Schneider Electric SE, Turner Construction Co, DPR Construction Inc, Caterpillar Inc, Rittal GmbH & Co KG, Delta Electronics, STULZ GMB, Mercury Engineering, AECOM Limited, Legrand, CyrusOne Inc, AECOM, Canovate Group, EAE Group, Alfa Laval AB, M+W Group (Exyte).

3. What are the main segments of the Israel Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.05 billion as of 2022.

5. What are some drivers contributing to market growth?

9.1 Rising Adoption of Renewable Energy Sources9.2 Increase in 5G Deployments Fueling Edge Data Center Investments9.3 Smart City Initiatives Driving Data Center Investments.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

10.1 Security Challenges in Data Centers10.2 Location Constraints on the Development of Data Centers.

8. Can you provide examples of recent developments in the market?

July 2022: Berkshire Partners announced to pay more than USD 215 million to acquire a 49% stake in MedOne. The company was evaluated at NIS 1.5 billion (USD 430 Million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Israel Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence