Key Insights

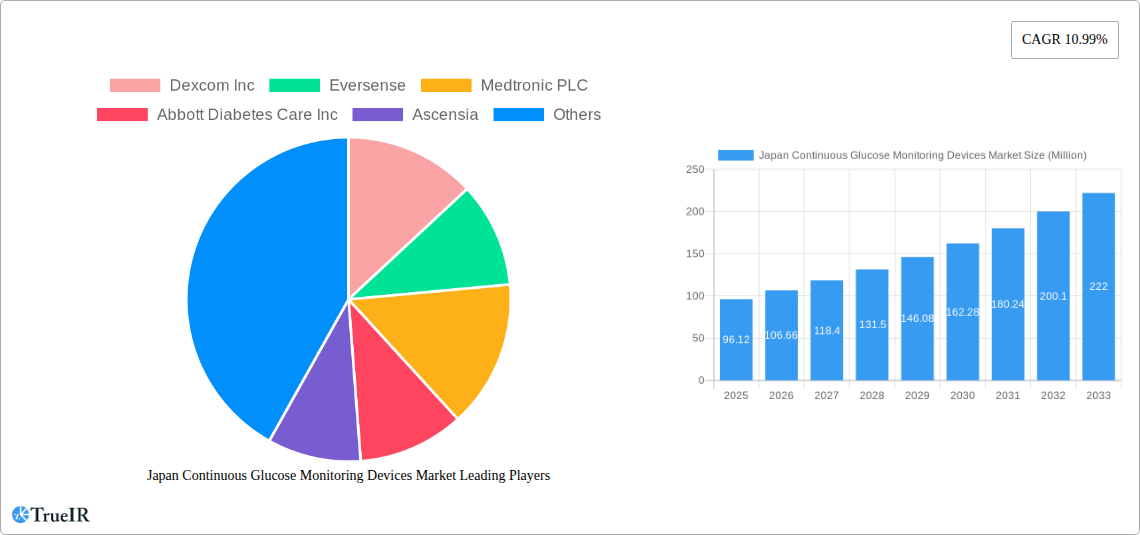

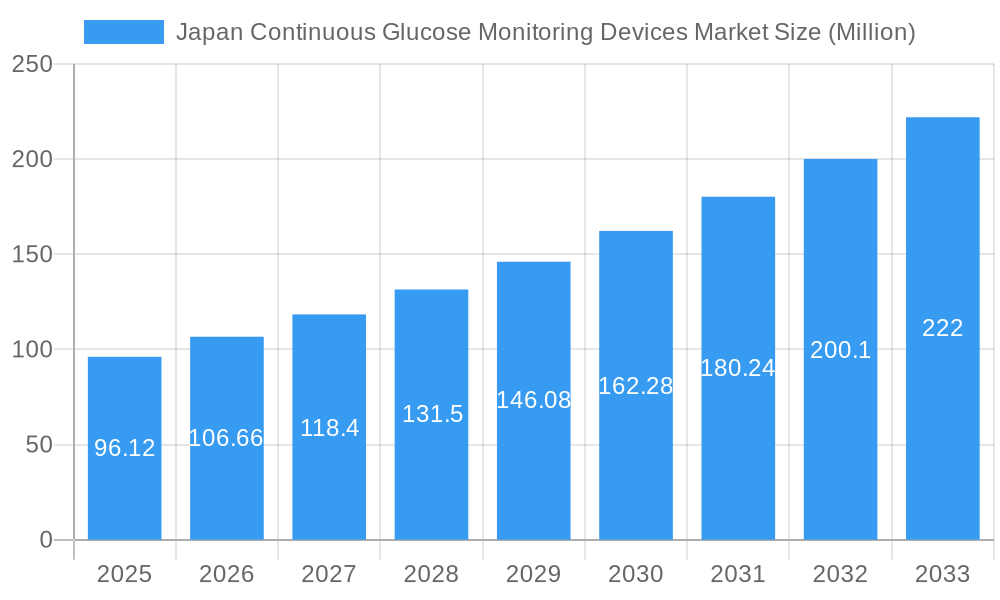

The Japan Continuous Glucose Monitoring (CGM) Devices Market is poised for significant expansion, projecting a robust market size of USD 96.12 million in 2025. This growth trajectory is fueled by an impressive Compound Annual Growth Rate (CAGR) of 10.99% anticipated from 2019 to 2033. The primary drivers propelling this market forward include the increasing prevalence of diabetes in Japan, a growing awareness among patients and healthcare providers regarding the benefits of proactive glucose management, and advancements in sensor technology leading to more accurate and user-friendly CGM devices. The aging population in Japan also contributes to the rising demand for sophisticated healthcare solutions, with CGM devices offering a critical tool for managing chronic conditions like diabetes more effectively and improving the quality of life for patients.

Japan Continuous Glucose Monitoring Devices Market Market Size (In Million)

Further analysis reveals that the market is segmented into key components, with 'Sensors' and 'Durables (Receivers and Transmitters)' representing the core product categories. Regionally, all provinces within Japan, including Hokkaido, Tohoku, Kanto, Chubu, and Kansai, are expected to witness increasing adoption of CGM technology. While specific restrainers are not detailed, common market challenges can include the initial cost of devices, reimbursement policies, and the need for continuous patient education and support. Major players such as Dexcom Inc., Eversense, Medtronic PLC, Abbott Diabetes Care Inc., and Ascensia are actively innovating and competing within this dynamic landscape, vying for market share by offering advanced features and expanding their distribution networks. The focus on early detection, personalized treatment, and improved patient outcomes is expected to sustain this upward market trend.

Japan Continuous Glucose Monitoring Devices Market Company Market Share

Japan Continuous Glucose Monitoring Devices Market: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a holistic analysis of the Japan Continuous Glucose Monitoring (CGM) Devices Market. With a study period spanning from 2019 to 2033, a base year of 2025, and an estimated year also in 2025, the report offers precise forecasts for the period 2025-2033, built upon a robust historical analysis from 2019-2024. The Japanese CGM market is experiencing significant expansion, driven by increasing diabetes prevalence, a growing aging population, and advancements in wearable technology. This report delves into market structure, competitive landscape, key trends, dominant segments, product analysis, crucial growth drivers, significant challenges, influential industry players, and pivotal milestones, culminating in a comprehensive future outlook. Leveraging high-volume keywords such as "Japan CGM Market," "Continuous Glucose Monitoring Japan," "Diabetes Technology Japan," and "Wearable Health Devices Japan," this analysis is optimized for search engines and designed to engage diabetes care professionals, medical device manufacturers, investors, and healthcare policymakers.

Japan Continuous Glucose Monitoring Devices Market Market Structure & Competitive Landscape

The Japan Continuous Glucose Monitoring Devices Market exhibits a moderately concentrated structure, with key players like Dexcom Inc., Eversense, Medtronic PLC, Abbott Diabetes Care Inc., and Ascensia holding significant market share. Innovation is a primary driver, with companies continuously investing in R&D to enhance sensor accuracy, improve user experience, and develop smaller, more discreet devices. Regulatory frameworks, particularly those established by the Pharmaceuticals and Medical Devices Agency (PMDA), play a crucial role in product approval and market access. The threat of product substitutes, such as traditional blood glucose meters, is diminishing as CGM technology offers superior glycemic insights and reduces the burden of fingerstick testing. End-user segmentation focuses on Type 1 diabetes, Type 2 diabetes, and gestational diabetes, each with distinct needs and adoption rates. Mergers and acquisitions (M&A) activity, while not extensively prevalent, can be strategic for consolidating market presence and expanding product portfolios. In the historical period (2019-2024), an estimated volume of 2-3 M&A deals have influenced market dynamics, primarily focused on acquiring innovative technologies or expanding distribution networks. Concentration ratios, particularly for the top 3 players, are estimated to be around 65-70% of the market value by the end of 2024, indicating a competitive yet consolidated landscape.

Japan Continuous Glucose Monitoring Devices Market Market Trends & Opportunities

The Japan Continuous Glucose Monitoring Devices Market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 12.5% projected for the forecast period (2025-2033). This surge is fueled by an escalating prevalence of diabetes, estimated to affect over 10 Million individuals in Japan by 2025, coupled with an increasing awareness among patients and healthcare providers about the benefits of proactive glucose management. Technological advancements are at the forefront of this trend, with a continuous push towards developing smaller, more accurate, and user-friendly CGM systems. The integration of artificial intelligence (AI) and machine learning (ML) into CGM platforms is enabling predictive analytics for glycemic events, offering unparalleled insights for both patients and clinicians. Consumer preferences are shifting towards non-invasive or minimally invasive technologies, and devices that offer seamless integration with smartphones and other digital health platforms. The market penetration rate for CGM devices in Japan, currently estimated at 15% in 2025, is expected to rise significantly as reimbursement policies evolve and technological adoption accelerates. The demand for real-time glucose data for personalized diabetes management is a key driver, empowering individuals to make informed lifestyle choices and optimize their treatment regimens. Furthermore, the aging demographic in Japan presents a significant opportunity, as older adults often face complex diabetes management challenges that can be effectively addressed by CGM technology. The growing emphasis on preventive healthcare and the management of chronic diseases further solidifies the positive trajectory of the Japanese CGM market. Opportunities also lie in expanding the application of CGM beyond diabetes management, exploring its potential in areas such as critical care and sports medicine. The market is also witnessing a trend towards connected health ecosystems, where CGM data integrates with other health devices and electronic health records, providing a comprehensive view of a patient's well-being. This interconnectedness will drive further innovation and adoption of advanced CGM solutions.

Dominant Markets & Segments in Japan Continuous Glucose Monitoring Devices Market

Within the Japan Continuous Glucose Monitoring Devices Market, the Sensors segment is projected to dominate, driven by its recurring purchase necessity and technological sophistication. The Kantō region, encompassing major urban centers like Tokyo, is expected to lead in market share due to its higher population density, advanced healthcare infrastructure, and greater accessibility to cutting-edge medical technologies. This dominance is further reinforced by a concentration of leading healthcare institutions and a higher disposable income among its residents, facilitating quicker adoption of premium CGM devices.

- Component: Sensors: This segment is expected to command a market share of approximately 60-65% of the total market value by 2025. Key growth drivers include advancements in sensor accuracy, longer wear times, and the development of more comfortable and less invasive sensor designs. The recurring nature of sensor replacement ensures a consistent revenue stream and sustained market growth.

- Provinces (Quantitative Analysis):

- Kantō: Expected to contribute over 40% of the total market revenue, driven by high population, advanced healthcare facilities, and significant diabetes patient population. Government initiatives promoting digital health and diabetes management are also more pronounced in this region.

- Kansai: Anticipated to hold a substantial share of around 20-25%, benefiting from its strong industrial base, a significant aging population, and robust healthcare networks.

- Chūbu: Likely to represent 10-15% of the market, with growing awareness and increasing adoption rates.

- Tōhoku & Hokkaido & Other Provinces: Collectively expected to account for the remaining market share, with gradual growth driven by expanding healthcare access and increasing health consciousness.

The dominance of the Kantō region is a reflection of its economic prowess and its role as a hub for medical innovation and adoption. The concentration of specialists and diabetes centers in this area leads to higher prescription rates and greater patient engagement with CGM technology. Government policies and private sector investments in healthcare infrastructure in these leading provinces further accelerate the adoption of advanced medical devices like CGM.

Japan Continuous Glucose Monitoring Devices Market Product Analysis

Product innovation in the Japan Continuous Glucose Monitoring Devices Market is characterized by a relentless pursuit of enhanced accuracy, improved patient comfort, and seamless data integration. Leading devices feature advanced sensor technologies that offer near real-time glucose readings with minimal lag time, crucial for effective diabetes management. Competitive advantages are derived from features like extended sensor wear duration, wireless connectivity for smartphone integration, and user-friendly interfaces that simplify data interpretation for patients and healthcare providers. For instance, the Dexcom G6's proven accuracy and ease of use have positioned it favorably, while emerging technologies are exploring even more discreet and longer-lasting sensor options.

Key Drivers, Barriers & Challenges in Japan Continuous Glucose Monitoring Devices Market

The Japan Continuous Glucose Monitoring Devices Market is propelled by several key drivers, including the rising incidence of diabetes, a growing preference for technologically advanced healthcare solutions, and supportive government initiatives aimed at improving chronic disease management. Technological advancements in sensor accuracy and device miniaturization are also significant catalysts.

However, the market faces considerable challenges. High device costs and limited reimbursement coverage for certain patient segments can act as barriers to widespread adoption. Regulatory complexities in approving new technologies, although designed for patient safety, can lead to extended market entry timelines. Furthermore, the need for robust cold chain logistics for sensor distribution and the potential for supply chain disruptions present ongoing operational hurdles.

Growth Drivers in the Japan Continuous Glucose Monitoring Devices Market Market

The primary growth drivers for the Japan Continuous Glucose Monitoring Devices Market include the escalating diabetes prevalence, estimated to affect over 10 Million individuals by 2025, and an increasing patient demand for proactive and convenient glucose monitoring solutions. Technological innovation, particularly in sensor accuracy and device connectivity, plays a pivotal role. Government initiatives and increasing health awareness are also significant factors. For example, Japan's aging population and the associated rise in type 2 diabetes cases create a fertile ground for CGM adoption.

Challenges Impacting Japan Continuous Glucose Monitoring Devices Market Growth

Challenges impacting the Japan Continuous Glucose Monitoring Devices Market include the substantial cost of CGM devices, which can be a barrier for many patients, and the often-limited reimbursement landscape in Japan. Strict regulatory approval processes by the PMDA can prolong the time-to-market for new innovations. Competitive pressures from established players and the potential for disruptive new technologies also present ongoing challenges. Supply chain complexities, particularly for maintaining the integrity of temperature-sensitive components, require efficient logistics and inventory management.

Key Players Shaping the Japan Continuous Glucose Monitoring Devices Market Market

- Dexcom Inc.

- Eversense

- Medtronic PLC

- Abbott Diabetes Care Inc.

- Ascensia

Significant Japan Continuous Glucose Monitoring Devices Market Industry Milestones

- October 2023: Terumo and Dexcom mutually agreed to conclude their domestic sales agency contract by the end of March 2024. Upon the termination of the distributor agreement, Terumo will no longer be responsible for the sales and support of Dexcom's CGM device in Japan. Dexcom will assume full responsibility for these operations within the country. Both Terumo and Dexcom are committed to ensuring a smooth transition and will continue to provide the same level of services and support to patients and healthcare professionals during the transition period, which will extend until the end of March 2024. This strategic shift signifies Dexcom's direct commitment to the Japanese market and its intent to enhance its presence and operations independently.

- May 2023: Dexcom showcased the accuracy, reliability, and ease of use of its Dexcom G6 CGM System and highlighted the latest clinical evidence that demonstrates the effectiveness of Dexcom CGM during the 66th Annual Meeting of the Japan Diabetes Society held in Kagoshima, Japan. This event underscored Dexcom's dedication to advancing diabetes care in Japan and reinforced the clinical validation of its offerings.

Future Outlook for Japan Continuous Glucose Monitoring Devices Market Market

The future outlook for the Japan Continuous Glucose Monitoring Devices Market is exceptionally positive. Growth catalysts include advancements in sensor technology leading to more accurate and longer-lasting devices, and improved integration with telemedicine platforms, enhancing remote patient monitoring capabilities. Opportunities for market expansion lie in increasing reimbursement coverage, driving down costs, and broadening awareness campaigns about the benefits of CGM for diabetes management across various patient demographics. Strategic partnerships between device manufacturers and healthcare providers are expected to further accelerate adoption, solidifying the market's trajectory towards becoming a cornerstone of diabetes care in Japan. The market is projected to reach an estimated value of over $500 Million by 2033.

Japan Continuous Glucose Monitoring Devices Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables (Receivers and Transmitters)

-

2. Provinces (Quantitative Analysis)

- 2.1. Hokkaido

- 2.2. Tohoku

- 2.3. Kanto

- 2.4. Chubu

- 2.5. Kansai

- 2.6. Other Provinces

Japan Continuous Glucose Monitoring Devices Market Segmentation By Geography

- 1. Japan

Japan Continuous Glucose Monitoring Devices Market Regional Market Share

Geographic Coverage of Japan Continuous Glucose Monitoring Devices Market

Japan Continuous Glucose Monitoring Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. The Durables Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables (Receivers and Transmitters)

- 5.2. Market Analysis, Insights and Forecast - by Provinces (Quantitative Analysis)

- 5.2.1. Hokkaido

- 5.2.2. Tohoku

- 5.2.3. Kanto

- 5.2.4. Chubu

- 5.2.5. Kansai

- 5.2.6. Other Provinces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Kanto Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2020-2032

- 7. Kansai Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2020-2032

- 8. Chubu Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2020-2032

- 9. Kyushu Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2020-2032

- 10. Tohoku Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2020-2032

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dexcom Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eversense

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Diabetes Care Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ascensia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Dexcom Inc

List of Figures

- Figure 1: Japan Continuous Glucose Monitoring Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Continuous Glucose Monitoring Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 3: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Component 2020 & 2033

- Table 5: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Provinces (Quantitative Analysis) 2020 & 2033

- Table 6: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Provinces (Quantitative Analysis) 2020 & 2033

- Table 7: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 11: Kanto Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Kanto Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Kansai Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Kansai Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Chubu Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Chubu Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Kyushu Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Kyushu Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Tohoku Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Tohoku Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Component 2020 & 2033

- Table 23: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Provinces (Quantitative Analysis) 2020 & 2033

- Table 24: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Provinces (Quantitative Analysis) 2020 & 2033

- Table 25: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Continuous Glucose Monitoring Devices Market?

The projected CAGR is approximately 10.99%.

2. Which companies are prominent players in the Japan Continuous Glucose Monitoring Devices Market?

Key companies in the market include Dexcom Inc, Eversense, Medtronic PLC, Abbott Diabetes Care Inc, Ascensia.

3. What are the main segments of the Japan Continuous Glucose Monitoring Devices Market?

The market segments include Component, Provinces (Quantitative Analysis).

4. Can you provide details about the market size?

The market size is estimated to be USD 96.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

The Durables Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

October 2023: Terumo and Dexcom mutually agreed to conclude their domestic sales agency contract by the end of March 2024. Upon the termination of the distributor agreement, Terumo will no longer be responsible for the sales and support of Dexcom's CGM device in Japan. Dexcom will assume full responsibility for these operations within the country. Both Terumo and Dexcom are committed to ensuring a smooth transition and will continue to provide the same level of services and support to patients and healthcare professionals during the transition period, which will extend until the end of March 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Continuous Glucose Monitoring Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Continuous Glucose Monitoring Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Continuous Glucose Monitoring Devices Market?

To stay informed about further developments, trends, and reports in the Japan Continuous Glucose Monitoring Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence