Key Insights

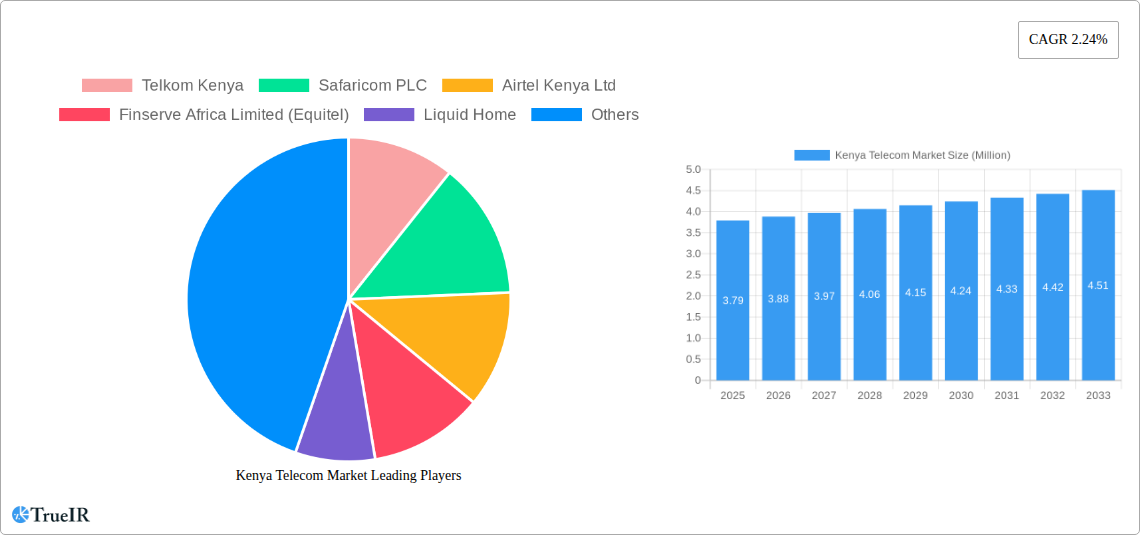

The Kenyan telecommunications market is poised for steady growth, with a projected market size of USD 3.79 Million and a Compound Annual Growth Rate (CAGR) of 2.24% between 2025 and 2033. This expansion is primarily fueled by increasing digital adoption across various sectors, including growing demand for high-speed data services, the proliferation of smartphones, and the ongoing digital transformation initiatives by both government and private enterprises. The mobile segment, encompassing voice and data, continues to be the dominant force, driven by a youthful and tech-savvy population actively engaging with mobile internet and social media. Furthermore, the burgeoning Over-The-Top (OTT) and PayTV services are witnessing significant uptake, catering to evolving entertainment and communication needs, presenting lucrative opportunities for service providers.

Kenya Telecom Market Market Size (In Million)

Despite the positive outlook, the market faces certain restraints that could temper its growth trajectory. These include intense competition among established players, which can lead to price wars and reduced profit margins. Additionally, the ongoing need for substantial infrastructure investment to expand network coverage, particularly in rural and underserved areas, remains a significant challenge. Regulatory frameworks, while aiming to foster fair competition, can sometimes introduce complexities and compliance costs. However, the consistent demand for reliable connectivity, the expansion of 5G technology trials and potential deployment, and the increasing adoption of cloud-based services and IoT solutions are expected to counterbalance these restraints, ensuring a dynamic and evolving telecommunications landscape in Kenya. Key players like Safaricom PLC, Airtel Kenya Ltd, and Telkom Kenya are at the forefront of navigating these trends and challenges.

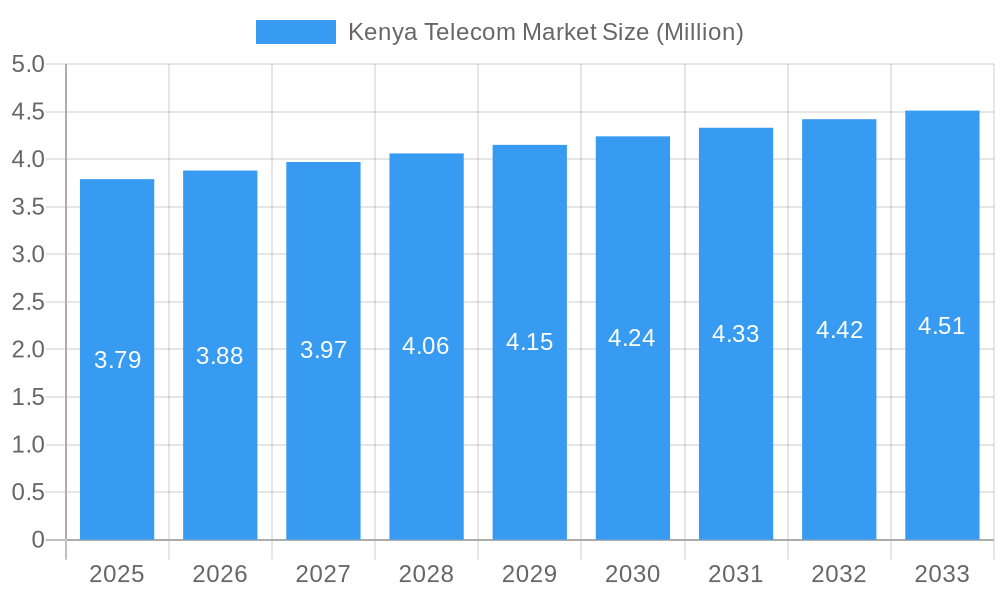

Kenya Telecom Market Company Market Share

This in-depth report provides a dynamic, SEO-optimized analysis of the Kenya Telecom Market, leveraging high-volume keywords to enhance search rankings and engage industry audiences. Covering the study period from 2019 to 2033, with a base year and estimated year of 2025, and a forecast period of 2025–2033, this report offers critical insights into market structure, trends, dominant segments, product innovations, key players, and future outlook. Historical data from 2019–2024 is incorporated for a holistic view of market evolution.

Kenya Telecom Market Market Structure & Competitive Landscape

The Kenya Telecom Market exhibits a moderately concentrated structure, with a few dominant players driving innovation and market share. Safaricom PLC stands as a leading force, characterized by continuous innovation in mobile money, data services, and expanding network reach. Airtel Kenya Ltd and Telkom Kenya are key competitors, actively vying for market share through competitive pricing and service diversification. Finserve Africa Limited (Equitel) leverages its unique position within the banking sector to offer integrated mobile financial services. Liquid Home and Wananchi Group (Zuku) are significant players in the fixed broadband and PayTV segments, focusing on expanding home and business connectivity. Jamii Telecommunications Limited (Faiba) is a growing contender, particularly in the data services space. Innovation drivers include the rapid adoption of 4G and 5G technologies, the burgeoning demand for data-intensive services, and the expansion of mobile financial solutions. Regulatory impacts, while aiming to foster competition, occasionally introduce complexities. Product substitutes are increasingly prevalent, particularly with the rise of Over-The-Top (OTT) services impacting traditional voice and messaging revenues. End-user segmentation is diverse, ranging from individual consumers seeking affordable connectivity to enterprises demanding robust data solutions. Mergers and acquisition (M&A) trends, such as the reported interest in Wananchi Group by Axian Telecom, highlight ongoing consolidation efforts and strategic investments aimed at expanding service portfolios and geographical reach. Concentration ratios indicate a significant market share held by the top two to three operators, yet the landscape remains dynamic with new entrants and service expansions.

Kenya Telecom Market Market Trends & Opportunities

The Kenya Telecom Market is on a robust growth trajectory, driven by increasing internet penetration and the insatiable demand for data and digital services. Market size is projected to expand significantly over the forecast period (2025–2033), with an anticipated Compound Annual Growth Rate (CAGR) of xx.xx%. Technological shifts are paramount, with the ongoing rollout of 4G and the early stages of 5G deployment enabling higher speeds and more sophisticated applications. Consumer preferences are rapidly evolving, shifting from basic voice calls to an emphasis on high-speed internet access for streaming, social media, and online productivity. The growing middle class and increasing smartphone adoption are key indicators of this trend. Competitive dynamics are intense, with operators constantly innovating to offer bundled packages, competitive data plans, and value-added services. The rise of Over-The-Top (OTT) services presents both a challenge and an opportunity, pushing traditional telcos to develop their own digital content and platforms. Mobile money services, spearheaded by M-PESA, continue to be a cornerstone of the Kenyan digital economy, with ongoing expansion and integration into broader financial ecosystems. Opportunities abound in the expansion of broadband infrastructure to underserved rural areas, the development of enterprise solutions leveraging IoT and cloud technologies, and the creation of localized digital content and services. The market penetration rate for mobile services is already high, but the penetration of high-speed mobile data and fixed broadband continues to grow, presenting a significant opportunity for service providers. The digital transformation across various sectors, including finance, education, and healthcare, further fuels the demand for reliable and advanced telecommunication services.

Dominant Markets & Segments in Kenya Telecom Market

The Data and Messaging Services segment is emerging as a dominant force within the Kenya Telecom Market, exhibiting substantial growth driven by increasing smartphone penetration and the ubiquitous use of social media and over-the-top (OTT) communication platforms. The average monthly data consumption per user is projected to rise, fueled by a growing appetite for video streaming, online gaming, and cloud-based applications. Safaricom PLC and Airtel Kenya Ltd are at the forefront of this segment, continually investing in network infrastructure to enhance data speeds and capacity.

- Key Growth Drivers for Data and Messaging Services:

- Infrastructure Development: Extensive rollout of 4G and the nascent stages of 5G networks provide the backbone for enhanced data delivery.

- Affordable Devices: Increasing availability of affordable smartphones and data-capable devices lowers the barrier to entry for consumers.

- Content Consumption: Growing popularity of video streaming services, social media platforms, and online gaming drives data demand.

- Digitalization: Increased adoption of digital services in education, e-commerce, and government services necessitates robust data connectivity.

- Competitive Pricing: Intense competition among operators leads to more affordable data bundles and promotional offers.

While Voice Services (Wired and Wireless) remain fundamental, their market share is gradually being impacted by the rise of digital communication alternatives. However, wireless voice services continue to be a primary revenue stream, particularly in areas with limited internet access. OTT and PayTV Services represent a rapidly evolving segment. PayTV providers like Wananchi Group (Zuku) are actively expanding their offerings, often bundling internet services with entertainment packages. The growth of OTT services, while posing competition to traditional PayTV, also signifies an opportunity for telcos to partner with or develop their own streaming platforms. The expansion of mobile money, a crucial component of digital financial services, is also a significant driver, with Finserve Africa Limited (Equitel) and Safaricom's M-PESA leading the charge in transforming financial inclusion. The government's push for digital transformation and e-governance initiatives further underscores the importance of robust data infrastructure and services across the nation.

Kenya Telecom Market Product Analysis

The Kenya Telecom Market is characterized by rapid product innovation, primarily focused on enhancing connectivity and expanding digital service ecosystems. Key innovations include the widespread deployment of 4G LTE networks, offering significantly faster mobile internet speeds, and the initial exploration of 5G technology for future high-capacity applications. Operators are increasingly bundling voice, data, and messaging services into attractive, cost-effective packages to retain subscribers and attract new ones. The evolution of mobile money platforms, such as Safaricom's M-PESA, represents a critical product advancement, transforming financial inclusion and enabling a wide range of transactions. Competitive advantages are derived from superior network coverage, aggressive data pricing, innovative value-added services (VAS), and strategic partnerships. The increasing integration of IoT solutions for enterprise applications and the development of localized digital content platforms are also emerging as significant product differentiators in this dynamic market.

Key Drivers, Barriers & Challenges in Kenya Telecom Market

Key Drivers: The Kenya Telecom Market is propelled by several significant drivers. Technological advancements, particularly the expansion of 4G and the anticipation of 5G, are crucial. Increasing smartphone penetration and a growing demand for high-speed internet for entertainment, education, and business are key economic drivers. Government initiatives promoting digital transformation and ICT adoption also play a vital role.

Key Barriers & Challenges: Despite growth, the market faces challenges. Infrastructure development in remote areas remains a significant hurdle due to high deployment costs. Regulatory complexities and the need for consistent policy frameworks can impact investment. Intense competitive pressures, particularly in pricing, can strain profitability. Supply chain issues for essential equipment, though less prevalent, can also pose a risk. The high cost of spectrum allocation can also be a barrier to entry for new players.

Growth Drivers in the Kenya Telecom Market Market

The Kenya Telecom Market is experiencing robust growth fueled by several pivotal factors. The relentless expansion of mobile broadband infrastructure, including 4G and the impending rollout of 5G, is a primary technological enabler. The burgeoning demand for digital services, driven by increased smartphone adoption and a growing middle class with disposable income, serves as a significant economic catalyst. Government policies aimed at fostering digital inclusion and ICT innovation, such as e-government initiatives and investments in digital skills, provide a supportive regulatory environment. Furthermore, the continued evolution and widespread adoption of mobile money platforms are transforming financial inclusion, creating new revenue streams and opportunities for telcos.

Challenges Impacting Kenya Telecom Market Growth

Several challenges exert pressure on the growth trajectory of the Kenya Telecom Market. The significant capital investment required for network expansion, especially into underserved rural regions, presents a substantial financial barrier. Evolving regulatory landscapes, while aiming to promote competition, can introduce uncertainties and compliance costs. Intense price competition among major operators can compress profit margins and necessitate innovative revenue diversification strategies. Supply chain disruptions for critical telecommunications equipment, although less frequent, can still impact deployment timelines and project execution. Furthermore, the persistent digital divide, where access to reliable internet remains limited in certain areas, hinders universal service adoption.

Key Players Shaping the Kenya Telecom Market Market

- Telkom Kenya

- Safaricom PLC

- Airtel Kenya Ltd

- Finserve Africa Limited (Equitel)

- Liquid Home

- Wananchi Group (Zuku)

- Jamii Telecommunications Limited (Faiba)

Significant Kenya Telecom Market Industry Milestones

- October 2024: Safaricom expanded its M-PESA Global service to include Ethiopia, enabling mobile money transfers from Kenya to Ethiopia. This initiative aims to enhance mobile money utilization, stimulate local economies, and provide new prospects for individuals and businesses, reflecting a commitment to innovative financial solutions.

- September 2024: Axian Telecom was reportedly exploring the acquisition of Wananchi Group, a Kenyan-based mobile, internet, and TV provider. This potential acquisition, involving Axian Telecom Fibre seeking 99.63% of Wananchi, which trades under the Zuku brand, highlights consolidation trends in the region's telecommunications sector.

Future Outlook for Kenya Telecom Market Market

The future outlook for the Kenya Telecom Market is exceptionally promising, driven by sustained demand for digital services and ongoing technological advancements. Key growth catalysts include the continued expansion of 4G and the gradual rollout of 5G networks, which will unlock new possibilities for high-speed connectivity and advanced applications. Strategic opportunities lie in further developing robust data infrastructure to support the burgeoning digital economy, expanding mobile financial services beyond basic transactions, and catering to the growing demand for integrated entertainment and connectivity solutions. The increasing focus on enterprise solutions, including IoT and cloud services, coupled with government support for digitalization, positions the market for continued innovation and substantial growth over the forecast period.

Kenya Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Kenya Telecom Market Segmentation By Geography

- 1. Kenya

Kenya Telecom Market Regional Market Share

Geographic Coverage of Kenya Telecom Market

Kenya Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for 4G and 5G services; Growth of IoT usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Rising demand for 4G and 5G services; Growth of IoT usage in Telecom

- 3.4. Market Trends

- 3.4.1. The Demand for 4G and 5G Services is Rising

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kenya Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Kenya

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Telkom Kenya

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Safaricom PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airtel Kenya Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Finserve Africa Limited (Equitel)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liquid Home

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wananchi Group (Zuku)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jamii Telecommunications Limited (Faiba)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Telkom Kenya

List of Figures

- Figure 1: Kenya Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Kenya Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Kenya Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Kenya Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 3: Kenya Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Kenya Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Kenya Telecom Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Kenya Telecom Market Volume Billion Forecast, by Services 2020 & 2033

- Table 7: Kenya Telecom Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Kenya Telecom Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kenya Telecom Market?

The projected CAGR is approximately 2.24%.

2. Which companies are prominent players in the Kenya Telecom Market?

Key companies in the market include Telkom Kenya, Safaricom PLC, Airtel Kenya Ltd, Finserve Africa Limited (Equitel), Liquid Home, Wananchi Group (Zuku), Jamii Telecommunications Limited (Faiba)*List Not Exhaustive.

3. What are the main segments of the Kenya Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for 4G and 5G services; Growth of IoT usage in Telecom.

6. What are the notable trends driving market growth?

The Demand for 4G and 5G Services is Rising.

7. Are there any restraints impacting market growth?

Rising demand for 4G and 5G services; Growth of IoT usage in Telecom.

8. Can you provide examples of recent developments in the market?

October 2024: Safaricom has expanded its M-PESA Global service to include Ethiopia, enabling users to transfer mobile money from Kenya to Ethiopia. With this growth, the two companies strive to enhance the utilization and reach of mobile money in Ethiopia, which can help stimulate local economies and provide new prospects for people and businesses in the area. This partnership reflects our dedication to providing creative financial options that meet the changing demands of our clients.September 2024: Axian Telecom was reportedly looking to acquire Kenya-based mobile, internet and TV provider Wananchi Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kenya Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kenya Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kenya Telecom Market?

To stay informed about further developments, trends, and reports in the Kenya Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence