Key Insights

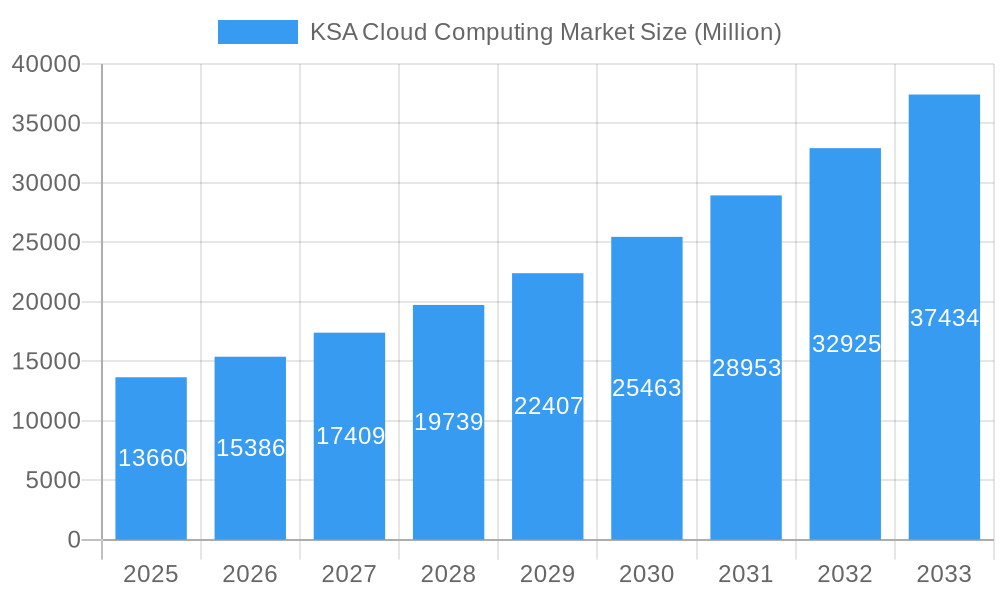

The global cloud computing market is poised for substantial expansion, projected to reach a valuation of $13.66 billion with a robust Compound Annual Growth Rate (CAGR) of 12.66%. This significant growth trajectory is underpinned by a confluence of powerful market drivers, including the escalating demand for scalable and flexible IT infrastructure, the widespread adoption of digital transformation initiatives across industries, and the increasing reliance on data analytics and AI to derive business insights. Cloud computing's inherent ability to reduce operational costs, enhance collaboration, and facilitate remote work further fuels its market penetration. Emerging trends like the rise of edge computing, the increasing integration of artificial intelligence within cloud services, and a growing focus on cloud security and compliance are expected to shape the market landscape, driving innovation and creating new avenues for growth. The market is segmenting into Public Cloud (IaaS, PaaS, SaaS), Private Cloud, and Hybrid Cloud solutions, catering to a diverse range of organizational needs. SMEs and Large Enterprises alike are leveraging these solutions to optimize their operations and enhance competitiveness.

KSA Cloud Computing Market Market Size (In Billion)

The end-user industry analysis reveals a broad spectrum of adoption, with Manufacturing, Education, Retail, Transportation and Logistics, Healthcare, BFSI, Telecom and IT, and Government and Public Sector sectors leading the charge. These industries are recognizing the transformative power of cloud computing in areas such as supply chain management, personalized customer experiences, remote learning, data-driven decision-making, and citizen service delivery. While the market experiences tremendous growth, certain restraints, such as concerns around data security and privacy, potential vendor lock-in, and the complexity of migration for legacy systems, need to be addressed by market players. Nevertheless, the pervasive benefits and continuous technological advancements in cloud security and management are expected to mitigate these challenges, ensuring sustained expansion. Leading companies like Amazon.com Inc. (AWS), Google LLC, Microsoft Corporation, IBM Corporation, and Oracle Corporation are at the forefront of this market, driving innovation and offering comprehensive cloud solutions.

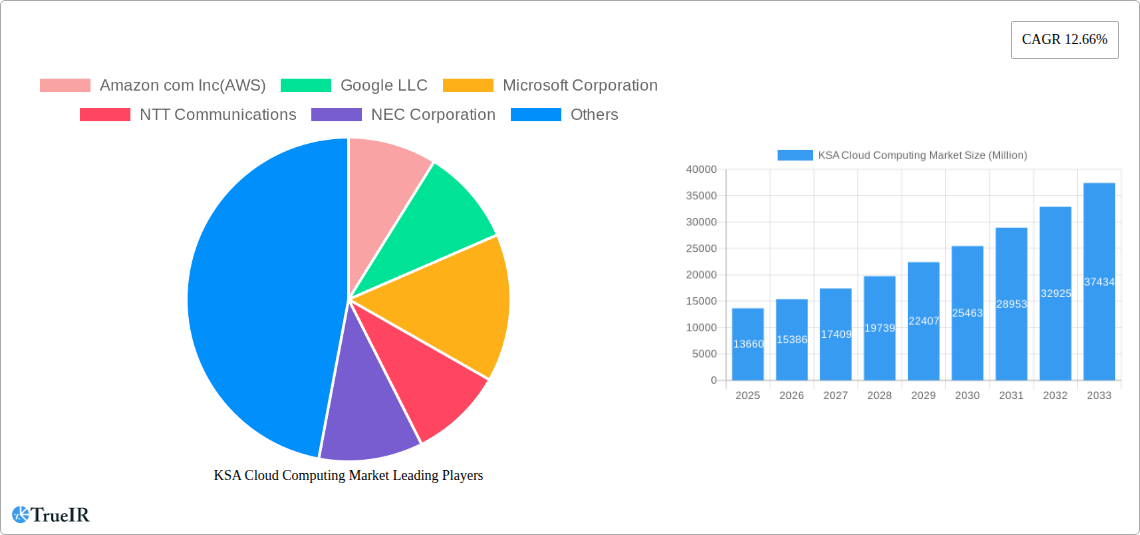

KSA Cloud Computing Market Company Market Share

Dive into the burgeoning KSA Cloud Computing Market with this in-depth report, meticulously analyzing the Saudi Arabian cloud infrastructure landscape from 2019 to 2033. This report provides unparalleled insights into the Kingdom of Saudi Arabia's cloud adoption, digital transformation, and the emerging cloud services market. Covering IaaS, PaaS, SaaS, private cloud, and hybrid cloud solutions, this study is essential for understanding market dynamics, cloud strategy, and investment opportunities within the region. We dissect key segments including SMEs and Large Enterprises, and critically examine end-user industries such as Manufacturing, Education, Retail, Transportation and Logistics, Healthcare, BFSI, Telecom and IT, and Government and Public Sector.

The report leverages high-volume keywords such as Saudi Arabia cloud market, KSA cloud services, GCC cloud adoption, digital Saudi Vision 2030, cloud migration KSA, cloud security Saudi Arabia, and enterprise cloud solutions to ensure maximum SEO visibility. Discover the growth trajectory, technological advancements, and competitive strategies of leading players including Amazon com Inc (AWS), Google LLC, Microsoft Corporation, NTT Communications, NEC Corporation, Rackspace Technology Inc, Oracle Corporation, IBM Corporation, Alibaba Cloud (Aliyun), Salesforce Inc, and SAP SE.

KSA Cloud Computing Market Market Structure & Competitive Landscape

The KSA cloud computing market is characterized by a dynamic and evolving structure, with a notable trend towards increased competition and specialized service offerings. Innovation is a key driver, fueled by the Kingdom's ambitious Vision 2030, which mandates significant digital transformation across all sectors. This necessitates robust and scalable cloud solutions to support emerging technologies and business models. Regulatory impacts are significant, with data localization and sovereignty requirements influencing cloud deployment strategies. Companies are actively navigating these regulations to ensure compliance and build trust with local enterprises. Product substitutes, such as on-premise solutions, are gradually being phased out in favor of the agility and cost-efficiency of cloud services. End-user segmentation reveals a strong demand from large enterprises, particularly in the BFSI and Government sectors, driven by their need for secure and compliant data management. SMEs are also increasingly adopting cloud solutions to leverage advanced technologies and enhance operational efficiency. Mergers and acquisitions (M&A) are becoming more prevalent as established players seek to consolidate their market position and expand their service portfolios. For instance, the past three years have seen an estimated 15-20 M&A activities focused on niche cloud technologies and localized service providers, with concentration ratios in key segments like IaaS remaining high, dominated by the top three global providers.

- Market Concentration: High in core infrastructure (IaaS), with leading global providers dominating.

- Innovation Drivers: Vision 2030, AI adoption, data analytics, cybersecurity.

- Regulatory Impacts: Data sovereignty, localization policies, compliance standards.

- Product Substitutes: Declining preference for on-premise due to cloud benefits.

- End-User Segmentation: Strong adoption by BFSI and Government, growing uptake by SMEs.

- M&A Trends: Increasing consolidation and acquisition of specialized cloud service providers.

KSA Cloud Computing Market Market Trends & Opportunities

The KSA cloud computing market is experiencing exponential growth, driven by a confluence of factors including government initiatives, increasing digitalization, and the burgeoning demand for advanced technologies. The market size is projected to reach approximately USD 15 billion by the end of 2025, with a Compound Annual Growth Rate (CAGR) of over 25% anticipated for the forecast period (2025-2033). This robust growth trajectory is further propelled by technological shifts towards AI, machine learning, and big data analytics, all of which are heavily reliant on scalable cloud infrastructure. Consumer preferences are increasingly leaning towards cloud-native applications and services that offer flexibility, scalability, and cost-effectiveness. Organizations are actively seeking solutions that can support their digital transformation journeys, enhance customer experiences, and optimize operational efficiencies. Competitive dynamics are intensifying, with global cloud giants vying for market share while local players are emerging with specialized offerings and a deeper understanding of regional needs. The strategic focus is shifting towards hybrid and multi-cloud environments, providing enterprises with enhanced agility and disaster recovery capabilities. Opportunities abound in niche segments like cloud security, data management, and industry-specific cloud solutions for sectors such as healthcare and manufacturing. The increasing penetration of cloud services, estimated to be around 60% for large enterprises and 35% for SMEs in 2025, presents a significant runway for future expansion. The ongoing investment in digital infrastructure and the growing appetite for cloud-based innovation create a fertile ground for market players.

Dominant Markets & Segments in KSA Cloud Computing Market

The KSA cloud computing market exhibits distinct dominance across various segments, reflecting the diverse needs and developmental stages of its industries. Public Cloud, particularly its IaaS, PaaS, and SaaS offerings, emerges as the most dominant segment, driven by its inherent scalability, cost-efficiency, and the broad range of applications it supports. Within the public cloud, SaaS applications are experiencing rapid adoption due to their ease of deployment and immediate business value. Hybrid Cloud solutions are rapidly gaining traction, especially among Large Enterprises and organizations in regulated sectors like BFSI and Government and Public Sector, seeking to balance the benefits of public cloud with the control and security of private environments.

Dominant Segment by Type:

- Public Cloud (IaaS, PaaS, SaaS): Continues to lead due to its accessibility and broad applicability. SaaS, in particular, sees significant growth for business applications.

- Hybrid Cloud: Growing rapidly as organizations seek a balanced approach to security, compliance, and agility, especially for mission-critical workloads.

Dominant Segment by Organization Size:

- Large Enterprises: Currently represent the largest share of cloud spending, driven by their complex IT needs, large data volumes, and ambitious digital transformation projects.

- SMEs: Exhibiting the fastest growth rate, as cloud solutions become more affordable and accessible, enabling them to compete with larger players.

Dominant End-User Industries:

- Government and Public Sector: A major driver, fueled by national digital transformation initiatives and the need for secure, efficient public services.

- BFSI (Banking, Financial Services, and Insurance): High adoption rates due to stringent security and compliance requirements, driving demand for cloud-based financial solutions and data analytics.

- Telecom and IT: Leading the way in adopting advanced cloud technologies and services, often serving as early adopters and influencers for other sectors.

- Healthcare: Growing demand for cloud solutions to manage patient data, enhance research capabilities, and improve healthcare delivery.

Key growth drivers include substantial government investment in digital infrastructure under Vision 2030, the increasing adoption of AI and IoT technologies, and a growing awareness of the benefits of cloud computing in terms of agility, cost savings, and innovation. The push for economic diversification and the development of a robust digital ecosystem further solidify the dominance of cloud services in the Kingdom.

KSA Cloud Computing Market Product Analysis

The KSA cloud computing market is witnessing a surge in innovative product offerings, primarily focused on enhancing security, scalability, and AI-driven capabilities. Leading providers are continuously refining their IaaS, PaaS, and SaaS solutions to meet the evolving demands of businesses undergoing digital transformation. Emphasis is placed on robust data governance, advanced analytics tools, and seamless integration with emerging technologies like AI and machine learning. These advancements aim to provide enterprises with greater control over their data while unlocking new insights and efficiencies. Competitive advantages lie in offering localized cloud regions that ensure data sovereignty and low latency, coupled with comprehensive support services tailored to the specific needs of the Saudi market. The trend towards industry-specific cloud solutions, such as those for healthcare and finance, is also gaining momentum, offering pre-built functionalities and compliance features.

Key Drivers, Barriers & Challenges in KSA Cloud Computing Market

The KSA cloud computing market is propelled by powerful drivers, including the Kingdom's aggressive digital transformation agenda under Vision 2030, significant government investment in ICT infrastructure, and the increasing adoption of emerging technologies like AI and IoT. The demand for enhanced data analytics, improved operational efficiency, and cost optimization further fuels market expansion. Businesses are recognizing cloud computing as a critical enabler for innovation and competitiveness.

However, several barriers and challenges impede growth. Regulatory complexities, particularly around data localization and privacy laws, require careful navigation by service providers and enterprises. Supply chain issues for specialized hardware and skilled cloud professionals can create bottlenecks. Intense competitive pressures from global giants and emerging local players necessitate continuous innovation and customer-centric strategies. The ongoing need for cybersecurity enhancements and the potential for vendor lock-in also present ongoing challenges for market participants.

Growth Drivers in the KSA Cloud Computing Market Market

The KSA cloud computing market is experiencing significant growth, primarily driven by the Saudi government's ambitious Vision 2030 initiative, which prioritizes economic diversification and digital transformation across all sectors. This includes substantial investments in ICT infrastructure and the promotion of cloud adoption to foster innovation and enhance public services. The increasing demand for advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) necessitates scalable and robust cloud platforms for data processing and analytics. Furthermore, the growing awareness among businesses, from SMEs to large enterprises, of the benefits of cloud computing, including cost savings, enhanced agility, improved disaster recovery, and faster deployment of new services, is a key growth catalyst. The expansion of localized cloud data centers by major providers also addresses data sovereignty concerns and reduces latency, further accelerating adoption.

Challenges Impacting KSA Cloud Computing Market Growth

Despite the strong growth trajectory, the KSA cloud computing market faces several challenges. Regulatory complexities, particularly concerning data privacy, sovereignty, and local content requirements, can pose compliance hurdles for international cloud providers and necessitate careful strategic planning. The shortage of skilled cloud professionals, including cloud architects, security specialists, and data scientists, can hinder the effective deployment and management of cloud solutions, impacting adoption rates and operational efficiency. Intense competitive pressure from established global players and the emergence of local cloud providers requires constant innovation and competitive pricing strategies. Additionally, concerns about vendor lock-in and the ongoing need for robust cybersecurity measures to protect sensitive data are critical factors that businesses must address when migrating to or expanding their cloud footprint. Supply chain disruptions for specialized hardware and the integration of legacy systems with cloud environments can also present significant operational challenges.

Key Players Shaping the KSA Cloud Computing Market Market

- Amazon com Inc (AWS)

- Google LLC

- Microsoft Corporation

- NTT Communications

- NEC Corporation

- Rackspace Technology Inc

- Oracle Corporation

- IBM Corporation

- Alibaba Cloud (Aliyun)

- Salesforce Inc

- SAP SE

Significant KSA Cloud Computing Market Industry Milestones

- August 2024: Google Cloud announced enhanced data sovereignty, security, and AI features for its Dammam region, following its November 2023 region launch, to support digital transformation and regulatory compliance for organizations in Saudi Arabia.

- March 2024: Amazon Web Services (AWS) revealed plans to establish a new infrastructure Region in Saudi Arabia by 2026, with an investment exceeding USD 5.3 billion (approximately 19.88 billion Saudi riyal), aiming to empower local businesses and ensure content remains within the Kingdom.

- April 2024: Informatica launched its AI-driven Intelligent Data Management Cloud (IDMC) in Saudi Arabia, establishing a new Point of Delivery (PoD) in Riyadh to offer scalable, cloud-centric data management solutions.

- March 2024: YASH Technologies and Huawei Cloud formalized a strategic alliance at LEAP 2024 through an MOU, committing to deliver transformative cloud computing, AI, ML, and data analytics solutions.

Future Outlook for KSA Cloud Computing Market Market

The future outlook for the KSA cloud computing market is exceptionally bright, projected for sustained and robust growth over the next decade. Key growth catalysts include the relentless pursuit of digital transformation objectives aligned with Vision 2030, significant ongoing investments in cloud infrastructure, and the increasing demand for advanced technologies like AI, machine learning, and data analytics. The expanding adoption of cloud services by SMEs, coupled with the continued migration of large enterprises to cloud-native environments, will further fuel market expansion. Strategic opportunities lie in the development of specialized cloud solutions for emerging sectors, the enhancement of cloud security and compliance offerings, and the cultivation of local talent to support the growing industry. The Kingdom's commitment to fostering a digitally advanced economy positions its cloud computing market for significant expansion and innovation, making it a key destination for cloud service providers and technology adopters alike.

KSA Cloud Computing Market Segmentation

-

1. Type

-

1.1. Public Cloud

- 1.1.1. IaaS

- 1.1.2. PaaS

- 1.1.3. SaaS

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

1.1. Public Cloud

-

2. Organization Size

- 2.1. SMEs

- 2.2. Large Enterprises

-

3. End-user Industries

- 3.1. Manufacturing

- 3.2. Education

- 3.3. Retail

- 3.4. Transportation and Logistics

- 3.5. Healthcare

- 3.6. BFSI

- 3.7. Telecom and IT

- 3.8. Government and Public Sector

- 3.9. Other En

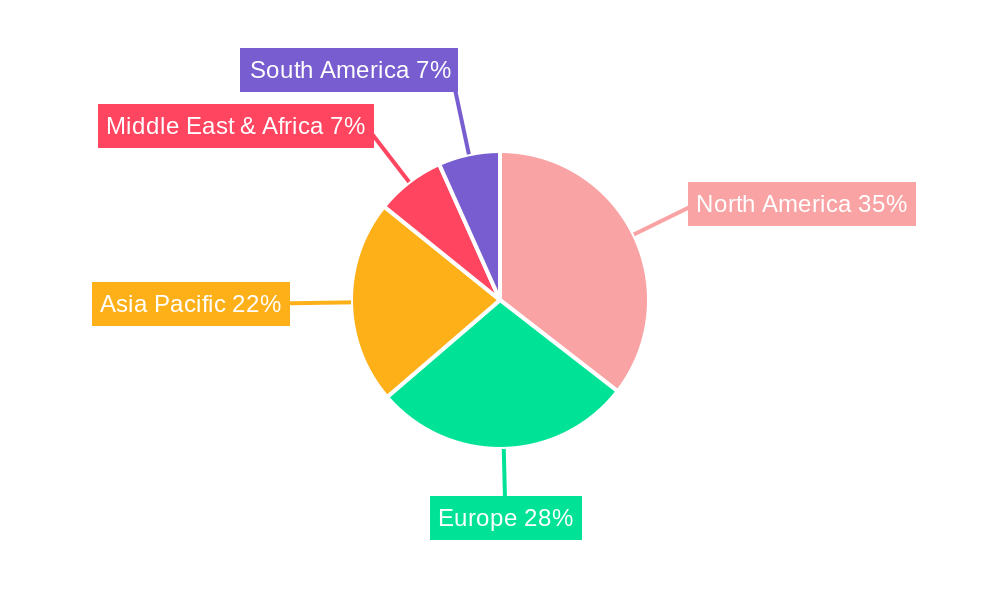

KSA Cloud Computing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

KSA Cloud Computing Market Regional Market Share

Geographic Coverage of KSA Cloud Computing Market

KSA Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.3. Market Restrains

- 3.3.1. Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services

- 3.4. Market Trends

- 3.4.1. Robust Shift Towards Digital Transformation Across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global KSA Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Public Cloud

- 5.1.1.1. IaaS

- 5.1.1.2. PaaS

- 5.1.1.3. SaaS

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.1.1. Public Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. SMEs

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Manufacturing

- 5.3.2. Education

- 5.3.3. Retail

- 5.3.4. Transportation and Logistics

- 5.3.5. Healthcare

- 5.3.6. BFSI

- 5.3.7. Telecom and IT

- 5.3.8. Government and Public Sector

- 5.3.9. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America KSA Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Public Cloud

- 6.1.1.1. IaaS

- 6.1.1.2. PaaS

- 6.1.1.3. SaaS

- 6.1.2. Private Cloud

- 6.1.3. Hybrid Cloud

- 6.1.1. Public Cloud

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. SMEs

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by End-user Industries

- 6.3.1. Manufacturing

- 6.3.2. Education

- 6.3.3. Retail

- 6.3.4. Transportation and Logistics

- 6.3.5. Healthcare

- 6.3.6. BFSI

- 6.3.7. Telecom and IT

- 6.3.8. Government and Public Sector

- 6.3.9. Other En

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America KSA Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Public Cloud

- 7.1.1.1. IaaS

- 7.1.1.2. PaaS

- 7.1.1.3. SaaS

- 7.1.2. Private Cloud

- 7.1.3. Hybrid Cloud

- 7.1.1. Public Cloud

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. SMEs

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by End-user Industries

- 7.3.1. Manufacturing

- 7.3.2. Education

- 7.3.3. Retail

- 7.3.4. Transportation and Logistics

- 7.3.5. Healthcare

- 7.3.6. BFSI

- 7.3.7. Telecom and IT

- 7.3.8. Government and Public Sector

- 7.3.9. Other En

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe KSA Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Public Cloud

- 8.1.1.1. IaaS

- 8.1.1.2. PaaS

- 8.1.1.3. SaaS

- 8.1.2. Private Cloud

- 8.1.3. Hybrid Cloud

- 8.1.1. Public Cloud

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. SMEs

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by End-user Industries

- 8.3.1. Manufacturing

- 8.3.2. Education

- 8.3.3. Retail

- 8.3.4. Transportation and Logistics

- 8.3.5. Healthcare

- 8.3.6. BFSI

- 8.3.7. Telecom and IT

- 8.3.8. Government and Public Sector

- 8.3.9. Other En

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa KSA Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Public Cloud

- 9.1.1.1. IaaS

- 9.1.1.2. PaaS

- 9.1.1.3. SaaS

- 9.1.2. Private Cloud

- 9.1.3. Hybrid Cloud

- 9.1.1. Public Cloud

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. SMEs

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by End-user Industries

- 9.3.1. Manufacturing

- 9.3.2. Education

- 9.3.3. Retail

- 9.3.4. Transportation and Logistics

- 9.3.5. Healthcare

- 9.3.6. BFSI

- 9.3.7. Telecom and IT

- 9.3.8. Government and Public Sector

- 9.3.9. Other En

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific KSA Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Public Cloud

- 10.1.1.1. IaaS

- 10.1.1.2. PaaS

- 10.1.1.3. SaaS

- 10.1.2. Private Cloud

- 10.1.3. Hybrid Cloud

- 10.1.1. Public Cloud

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. SMEs

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by End-user Industries

- 10.3.1. Manufacturing

- 10.3.2. Education

- 10.3.3. Retail

- 10.3.4. Transportation and Logistics

- 10.3.5. Healthcare

- 10.3.6. BFSI

- 10.3.7. Telecom and IT

- 10.3.8. Government and Public Sector

- 10.3.9. Other En

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amazon com Inc(AWS)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Google LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microsoft Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NTT Communications

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NEC Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rackspace Technology Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oracle Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IBM Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alibaba Cloud (Aliyun)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Salesforce Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAP SE*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Amazon com Inc(AWS)

List of Figures

- Figure 1: Global KSA Cloud Computing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global KSA Cloud Computing Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America KSA Cloud Computing Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America KSA Cloud Computing Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America KSA Cloud Computing Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America KSA Cloud Computing Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America KSA Cloud Computing Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 8: North America KSA Cloud Computing Market Volume (Billion), by Organization Size 2025 & 2033

- Figure 9: North America KSA Cloud Computing Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: North America KSA Cloud Computing Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 11: North America KSA Cloud Computing Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 12: North America KSA Cloud Computing Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 13: North America KSA Cloud Computing Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 14: North America KSA Cloud Computing Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 15: North America KSA Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America KSA Cloud Computing Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America KSA Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America KSA Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America KSA Cloud Computing Market Revenue (Million), by Type 2025 & 2033

- Figure 20: South America KSA Cloud Computing Market Volume (Billion), by Type 2025 & 2033

- Figure 21: South America KSA Cloud Computing Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America KSA Cloud Computing Market Volume Share (%), by Type 2025 & 2033

- Figure 23: South America KSA Cloud Computing Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 24: South America KSA Cloud Computing Market Volume (Billion), by Organization Size 2025 & 2033

- Figure 25: South America KSA Cloud Computing Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 26: South America KSA Cloud Computing Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 27: South America KSA Cloud Computing Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 28: South America KSA Cloud Computing Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 29: South America KSA Cloud Computing Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 30: South America KSA Cloud Computing Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 31: South America KSA Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America KSA Cloud Computing Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America KSA Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America KSA Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe KSA Cloud Computing Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Europe KSA Cloud Computing Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Europe KSA Cloud Computing Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe KSA Cloud Computing Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe KSA Cloud Computing Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 40: Europe KSA Cloud Computing Market Volume (Billion), by Organization Size 2025 & 2033

- Figure 41: Europe KSA Cloud Computing Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 42: Europe KSA Cloud Computing Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 43: Europe KSA Cloud Computing Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 44: Europe KSA Cloud Computing Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 45: Europe KSA Cloud Computing Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 46: Europe KSA Cloud Computing Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 47: Europe KSA Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe KSA Cloud Computing Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe KSA Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe KSA Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa KSA Cloud Computing Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East & Africa KSA Cloud Computing Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East & Africa KSA Cloud Computing Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East & Africa KSA Cloud Computing Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East & Africa KSA Cloud Computing Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 56: Middle East & Africa KSA Cloud Computing Market Volume (Billion), by Organization Size 2025 & 2033

- Figure 57: Middle East & Africa KSA Cloud Computing Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 58: Middle East & Africa KSA Cloud Computing Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 59: Middle East & Africa KSA Cloud Computing Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 60: Middle East & Africa KSA Cloud Computing Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 61: Middle East & Africa KSA Cloud Computing Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 62: Middle East & Africa KSA Cloud Computing Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 63: Middle East & Africa KSA Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa KSA Cloud Computing Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa KSA Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa KSA Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific KSA Cloud Computing Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Asia Pacific KSA Cloud Computing Market Volume (Billion), by Type 2025 & 2033

- Figure 69: Asia Pacific KSA Cloud Computing Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Asia Pacific KSA Cloud Computing Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Asia Pacific KSA Cloud Computing Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 72: Asia Pacific KSA Cloud Computing Market Volume (Billion), by Organization Size 2025 & 2033

- Figure 73: Asia Pacific KSA Cloud Computing Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 74: Asia Pacific KSA Cloud Computing Market Volume Share (%), by Organization Size 2025 & 2033

- Figure 75: Asia Pacific KSA Cloud Computing Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 76: Asia Pacific KSA Cloud Computing Market Volume (Billion), by End-user Industries 2025 & 2033

- Figure 77: Asia Pacific KSA Cloud Computing Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 78: Asia Pacific KSA Cloud Computing Market Volume Share (%), by End-user Industries 2025 & 2033

- Figure 79: Asia Pacific KSA Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific KSA Cloud Computing Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Asia Pacific KSA Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific KSA Cloud Computing Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global KSA Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global KSA Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global KSA Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: Global KSA Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: Global KSA Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 6: Global KSA Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 7: Global KSA Cloud Computing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global KSA Cloud Computing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global KSA Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global KSA Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global KSA Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: Global KSA Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: Global KSA Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 14: Global KSA Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 15: Global KSA Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global KSA Cloud Computing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global KSA Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global KSA Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global KSA Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 26: Global KSA Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 27: Global KSA Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 28: Global KSA Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 29: Global KSA Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global KSA Cloud Computing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Brazil KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global KSA Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global KSA Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 39: Global KSA Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 40: Global KSA Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 41: Global KSA Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 42: Global KSA Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 43: Global KSA Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global KSA Cloud Computing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Germany KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: France KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Italy KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Spain KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Benelux KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Nordics KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global KSA Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global KSA Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 65: Global KSA Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 66: Global KSA Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 67: Global KSA Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 68: Global KSA Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 69: Global KSA Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global KSA Cloud Computing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Turkey KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Israel KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: GCC KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: North Africa KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: South Africa KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Global KSA Cloud Computing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 84: Global KSA Cloud Computing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 85: Global KSA Cloud Computing Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 86: Global KSA Cloud Computing Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 87: Global KSA Cloud Computing Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 88: Global KSA Cloud Computing Market Volume Billion Forecast, by End-user Industries 2020 & 2033

- Table 89: Global KSA Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global KSA Cloud Computing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 91: China KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: India KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: Japan KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Korea KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 101: Oceania KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific KSA Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific KSA Cloud Computing Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the KSA Cloud Computing Market?

The projected CAGR is approximately 12.66%.

2. Which companies are prominent players in the KSA Cloud Computing Market?

Key companies in the market include Amazon com Inc(AWS), Google LLC, Microsoft Corporation, NTT Communications, NEC Corporation, Rackspace Technology Inc, Oracle Corporation, IBM Corporation, Alibaba Cloud (Aliyun), Salesforce Inc, SAP SE*List Not Exhaustive.

3. What are the main segments of the KSA Cloud Computing Market?

The market segments include Type, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

6. What are the notable trends driving market growth?

Robust Shift Towards Digital Transformation Across the Country.

7. Are there any restraints impacting market growth?

Robust Shift Towards Digital Transformation Across the Country; Data Privacy Concerns Are Driving Increased Adoption Of Public Cloud Services.

8. Can you provide examples of recent developments in the market?

August 2024: Following the introduction of the Google Cloud region in Saudi Arabia (KSA) in November 2023, enhanced data sovereignty, security, and AI features for the Dammam region were unveiled. These advancements are tailored to bolster the digital transformation of organizations in Saudi Arabia, especially those with regulatory obligations, such as multinational corporations.March 2024: Amazon Web Services (AWS), a subsidiary of Amazon.com, announced plans to establish an AWS infrastructure Region in the Kingdom of Saudi Arabia by 2026. This new AWS Region will empower developers, startups, entrepreneurs, enterprises, and organizations in sectors like healthcare, education, gaming, and nonprofits to run applications and serve end users from local data centers. This ensures that customers wishing to keep their content within the Kingdom can do so. Demonstrating its long-term commitment, AWS has pledged an investment exceeding USD 5.3 billion (approximately 19.88 billion Saudi riyal) in the Kingdom.April 2024: Informatica, an enterprise cloud data management company, introduced its AI-driven Intelligent Data Management Cloud (IDMC) in Saudi Arabia, marking a first for the nation. This initiative encompasses establishing a new Point of Delivery (PoD) in Riyadh, emphasizing a dedication to local, scalable, cloud-centric data management solutions. This move reinforces Informatica's foothold in the Middle East and follows its inaugural regional PoD launch in Abu Dhabi, UAE, in 2023.March 2024: YASH Technologies, a global technology consultancy, and Huawei Cloud, a cloud service provider, forged a strategic alliance at LEAP 2024, the premier technology event in the Middle East and North Africa (MENA) region. The duo formalized their collaboration through a Memorandum of Understanding (MOU), underscoring their joint commitment to delivering transformative solutions in pivotal domains such as cloud computing, AI, machine learning, and data analytics to their shared clientele.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "KSA Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the KSA Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the KSA Cloud Computing Market?

To stay informed about further developments, trends, and reports in the KSA Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence