Key Insights

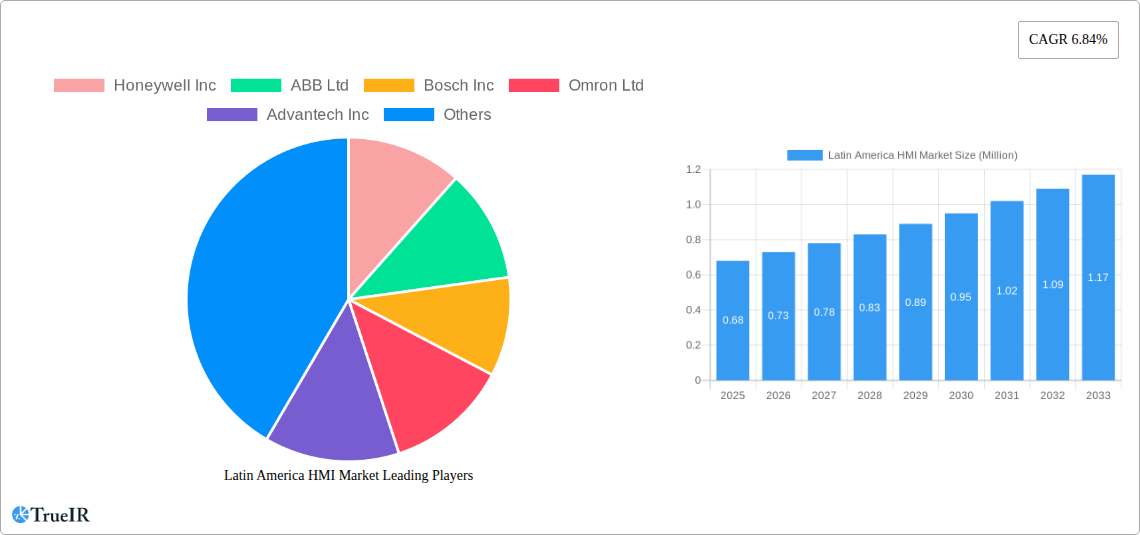

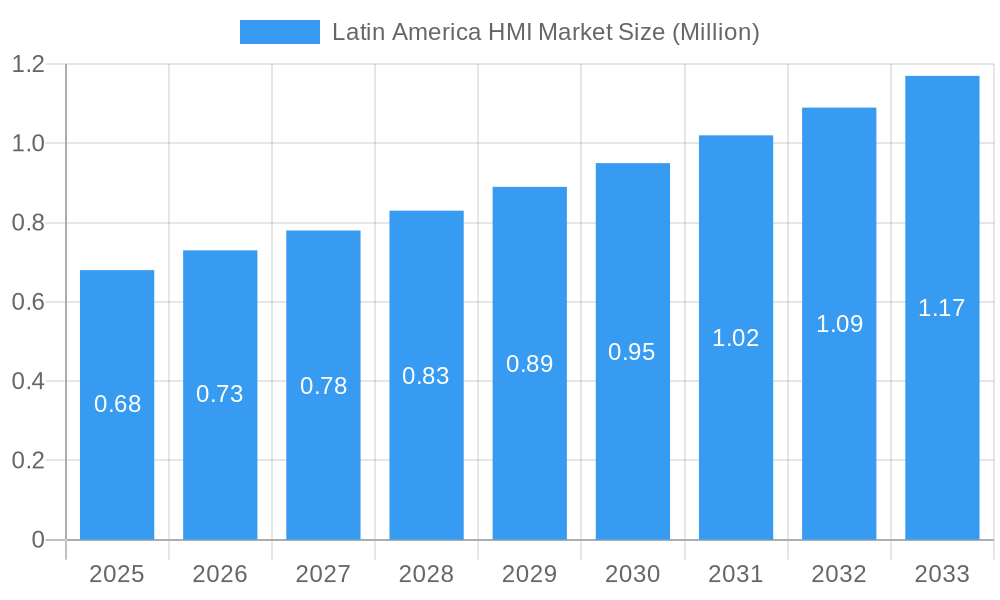

The Latin America Human-Machine Interface (HMI) market is poised for robust expansion, projected to reach a substantial market size of USD 0.59 billion. This growth trajectory is underpinned by a strong Compound Annual Growth Rate (CAGR) of 6.84% from 2019 to 2033, with the forecast period of 2025-2033 indicating continued upward momentum. The driving forces behind this expansion are multifaceted, stemming from increasing industrial automation initiatives across key sectors like automotive, food and beverage, and pharmaceuticals. These industries are actively adopting advanced HMI solutions to enhance operational efficiency, improve product quality, and ensure greater process control and safety. Furthermore, the growing demand for smart manufacturing and Industry 4.0 adoption in Latin America is creating a fertile ground for HMI market growth. Companies are investing in sophisticated HMI systems that offer intuitive interfaces, advanced analytics, and seamless integration with other automation components, thereby boosting productivity and reducing downtime.

Latin America HMI Market Market Size (In Million)

The market's progression is further bolstered by significant trends such as the increasing integration of IoT capabilities into HMI devices, enabling remote monitoring and predictive maintenance. Advancements in display technologies, including touchscreens and high-resolution graphics, are also enhancing user experience and operational effectiveness. While the market is characterized by a competitive landscape featuring major global players like Siemens AG, Rockwell Automation Ltd., and Honeywell Inc., alongside regional contributors, opportunities for innovation and market penetration remain. Restraints such as the initial high cost of advanced HMI systems and the need for skilled workforce training are being addressed through gradual cost reductions, cloud-based solutions, and the development of user-friendly interfaces. The diverse range of end-user industries, from energy-intensive sectors like Oil & Gas and Metal & Mining to highly regulated fields such as Pharmaceuticals, presents a broad spectrum of demand, ensuring sustained market vitality.

Latin America HMI Market Company Market Share

Here's a dynamic, SEO-optimized report description for the Latin America HMI Market, incorporating your specifications without any placeholders:

This in-depth report provides a comprehensive analysis of the Latin America Human-Machine Interface (HMI) Market. Spanning the historical period of 2019-2024 and extending through a robust forecast period of 2025-2033, with a base year of 2025, this study offers critical insights into market dynamics, technological advancements, and competitive strategies. The Latin America HMI market size is projected to reach $1,200 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period. Driven by increasing industrial automation, digitalization initiatives, and the growing adoption of smart manufacturing across key sectors, this market presents significant opportunities for stakeholders.

Latin America HMI Market Market Structure & Competitive Landscape

The Latin America HMI market exhibits a moderately concentrated structure, with a few key players holding substantial market share. Innovation drivers are primarily centered around enhanced connectivity, advanced visualization capabilities, and the integration of AI and IoT for predictive maintenance and optimized operational efficiency. Regulatory impacts, while evolving, are largely influenced by industry-specific safety standards and the push for digital transformation. Product substitutes, such as traditional control panels and standalone sensors, are gradually being replaced by sophisticated HMI solutions offering greater flexibility and data insights. End-user segmentation reveals a strong reliance on industrial applications, with significant contributions from sectors like Oil & Gas and Food & Beverage. Merger and acquisition (M&A) trends indicate strategic consolidation aimed at expanding product portfolios and market reach. The estimated M&A volume in the historical period was $350 Million.

- Key aspects of market structure include:

- Moderate market concentration with leading players.

- Innovation driven by IoT, AI, and cloud integration.

- Evolving regulatory landscape supporting digitalization.

- Substitution of traditional controls by advanced HMIs.

- Dominance of industrial end-user segments.

- Strategic M&A activities for market expansion.

Latin America HMI Market Market Trends & Opportunities

The Latin America HMI market is experiencing significant growth, fueled by the rapid industrialization and digitalization efforts across countries like Brazil, Mexico, and Argentina. The market size is estimated to have reached $750 Million in 2025 and is poised for substantial expansion. A major trend is the increasing adoption of IIoT (Industrial Internet of Things) enabled HMIs, which facilitate seamless data exchange, remote monitoring, and predictive analytics. This technological shift is leading to the development of more intuitive and user-friendly interfaces, often incorporating touch screen technology and advanced graphical capabilities. Consumer preferences are leaning towards HMIs that offer greater flexibility, scalability, and integration with existing enterprise systems, thereby enhancing operational efficiency and reducing downtime. The competitive dynamics are characterized by a blend of global manufacturers and emerging local players, each vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. The market penetration rate for advanced HMI solutions is steadily increasing, particularly in the manufacturing, automotive, and food and beverage sectors. Opportunities abound for companies offering cybersecurity-resilient HMIs, customized solutions for specific industry needs, and comprehensive service packages including installation, maintenance, and training. The forecast period anticipates a continued surge in demand for high-performance HMIs that support complex automation processes and real-time data visualization, further solidifying the market's upward trajectory. The estimated market size growth during the forecast period is projected at $1,200 Million.

Dominant Markets & Segments in Latin America HMI Market

The Latin America HMI market is characterized by a few dominant regions and segments that are driving overall growth and innovation. Brazil and Mexico emerge as the leading countries, owing to their robust industrial infrastructure, significant manufacturing output, and government initiatives promoting Industry 4.0 adoption. In terms of Component Type, Hardware continues to hold the largest market share, driven by the demand for advanced displays, processors, and input devices. However, the Software segment is exhibiting the highest CAGR, reflecting the increasing complexity of HMI functionalities, the need for advanced visualization tools, and the integration of AI and machine learning capabilities. Services, including installation, maintenance, and customization, are also gaining traction as businesses seek end-to-end solutions.

Among End-user Industries, the Food and Beverage sector is a significant contributor, driven by the need for precise process control, enhanced safety compliance, and efficient production management. The Automotive industry is another key segment, with HMIs playing a crucial role in assembly lines and quality control processes. The Oil and Gas sector, with its inherently hazardous environments, demands robust and reliable HMIs for monitoring and controlling critical operations. Other significant end-user industries include Packaging, Pharmaceutical, and Metal and Mining.

- Leading Countries:

- Brazil: Strong manufacturing base, government support for digitalization.

- Mexico: Automotive hub, growing industrial automation demand.

- Dominant Component Type:

- Hardware: Continued demand for advanced displays and processing units.

- Software: Fastest growing segment due to IIoT integration and AI capabilities.

- Key End-user Industries:

- Food and Beverage: Critical for process control, safety, and efficiency.

- Automotive: Essential for assembly lines and quality assurance.

- Oil and Gas: Robust HMIs for critical operation monitoring and safety.

- Packaging: Driving demand for automation and precision.

- Pharmaceutical: High demand for compliance and sterile environment control.

- Metal and Mining: Rugged HMIs for harsh operational conditions.

Latin America HMI Market Product Analysis

The Latin America HMI market is witnessing a wave of product innovations focused on enhancing user experience, connectivity, and data analytics. Key advancements include the integration of advanced touch screen technologies with superior responsiveness and durability, along with the development of HMIs with embedded AI capabilities for predictive maintenance and real-time anomaly detection. Competitive advantages are increasingly derived from HMIs offering seamless integration with IIoT platforms, cloud connectivity for remote monitoring and control, and robust cybersecurity features to protect sensitive operational data. Applications span across diverse industrial sectors, from sophisticated process visualization in food and beverage plants to ruggedized interfaces for harsh environments in oil and gas operations.

Key Drivers, Barriers & Challenges in Latin America HMI Market

The Latin America HMI market is propelled by several key drivers, including the escalating adoption of Industry 4.0 technologies, increasing government initiatives to boost manufacturing competitiveness, and the growing demand for automation to enhance operational efficiency and reduce labor costs. Technological advancements in areas like AI, IoT, and cloud computing are enabling the development of more sophisticated and intelligent HMI solutions.

However, the market faces significant challenges. Supply chain disruptions, exacerbated by geopolitical factors, can impact the availability and cost of essential components. Regulatory hurdles, though evolving, can create complexities for market entry and product compliance in different countries. Furthermore, competitive pressures from both established global players and emerging local manufacturers can lead to price wars and reduced profit margins. The initial investment cost for advanced HMI systems can also be a barrier for small and medium-sized enterprises (SMEs). The estimated impact of supply chain disruptions on market growth is around 5-7%.

Growth Drivers in the Latin America HMI Market Market

The Latin America HMI market is experiencing robust growth driven by several critical factors. The pervasive adoption of Industry 4.0 principles across various industrial sectors is a primary catalyst, fostering a demand for interconnected and intelligent automation solutions. Government initiatives aimed at boosting domestic manufacturing and promoting digital transformation also play a significant role. Technological advancements, particularly in the realms of Artificial Intelligence (AI) and the Industrial Internet of Things (IIoT), are enabling the development of more sophisticated HMIs with enhanced analytical and predictive capabilities. This technological evolution directly supports the need for more intuitive and efficient human-machine interaction.

Challenges Impacting Latin America HMI Market Growth

Several challenges are impacting the growth trajectory of the Latin America HMI market. Regulatory complexities and varying compliance standards across different countries can create barriers to market entry and product standardization. Supply chain vulnerabilities, including the availability and cost of critical electronic components, pose a significant risk to timely production and deployment. Intense competitive pressures from both global giants and agile local players necessitate continuous innovation and cost-effectiveness. Furthermore, cybersecurity concerns are paramount, as the increasing connectivity of HMI systems makes them potential targets for cyberattacks, requiring significant investment in robust security measures.

Key Players Shaping the Latin America HMI Market Market

- Honeywell Inc

- ABB Ltd

- Bosch Inc

- Omron Ltd

- Advantech Inc

- Rockwell Automation Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Beijer Electronics Inc

- Yokogawa Electric Corporation

- GE Ltd

- Panasonic Corporation

- Eaton Corporation

Significant Latin America HMI Market Industry Milestones

- March 2024: Spyrosoft announced a strategic partnership with Candera, a leading provider of human-machine interface and embedded software tools. This collaboration aims to foster the creation of innovative and user-friendly interfaces for industries such as automotive, healthcare, and home automation, enhancing Spyrosoft's access to advanced toolkits and expertise.

- August 2023: Exor, a prominent player in industrial automation solutions, launched the Exor X5 Wireless HMI product. This advanced device is designed to significantly transform how industrial operators interact with machinery and equipment, introducing enhanced wireless capabilities and user interface improvements.

Future Outlook for Latin America HMI Market Market

The future outlook for the Latin America HMI market is exceptionally positive, driven by the sustained momentum of digital transformation and the ongoing pursuit of operational excellence across industries. Strategic opportunities lie in the development of HMI solutions tailored for emerging technologies like 5G, edge computing, and advanced robotics, which will further enhance automation capabilities. The increasing demand for smart factories and the growing emphasis on predictive maintenance and energy efficiency will continue to fuel market expansion. Companies that focus on providing integrated software and hardware solutions, coupled with robust cybersecurity and comprehensive after-sales services, are well-positioned for significant growth and market leadership in the coming years. The market potential is vast, with an estimated increase in market value of $450 Million anticipated by 2033.

Latin America HMI Market Segmentation

-

1. Component Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Food and Beverage

- 2.3. Packaging

- 2.4. Pharmaceutical

- 2.5. Oil and Gas

- 2.6. Metal and Mining

- 2.7. Other End-user Industries

Latin America HMI Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America HMI Market Regional Market Share

Geographic Coverage of Latin America HMI Market

Latin America HMI Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage in Industrial Automation; Shift toward Industry 4.0 and Adoption of IoT; Increasing Focus on Developing Manufacturing Processes

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America HMI Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Food and Beverage

- 5.2.3. Packaging

- 5.2.4. Pharmaceutical

- 5.2.5. Oil and Gas

- 5.2.6. Metal and Mining

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bosch Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Omron Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Advantech Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rockwell Automation Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Electric Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Beijer Electronics Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yokogawa Electric Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GE Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Panasonic Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Eaton Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Honeywell Inc

List of Figures

- Figure 1: Latin America HMI Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America HMI Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America HMI Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 2: Latin America HMI Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Latin America HMI Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America HMI Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 5: Latin America HMI Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Latin America HMI Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America HMI Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America HMI Market?

The projected CAGR is approximately 6.84%.

2. Which companies are prominent players in the Latin America HMI Market?

Key companies in the market include Honeywell Inc, ABB Ltd, Bosch Inc, Omron Ltd, Advantech Inc, Rockwell Automation Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Beijer Electronics Inc, Yokogawa Electric Corporation, GE Ltd, Panasonic Corporation, Eaton Corporation.

3. What are the main segments of the Latin America HMI Market?

The market segments include Component Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage in Industrial Automation; Shift toward Industry 4.0 and Adoption of IoT; Increasing Focus on Developing Manufacturing Processes.

6. What are the notable trends driving market growth?

Automotive is Expected to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

March 2024: Spyrosoft announced a partnership with Candera, one of the leading providers of human-machine interface and embedded software tools for industries such as automotive, healthcare, or home automation. Through this collaboration, Spyrosoft has access to Candera’s toolkit and expertise, allowing the creation of innovative and user-friendly interfaces across various industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America HMI Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America HMI Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America HMI Market?

To stay informed about further developments, trends, and reports in the Latin America HMI Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence