Key Insights

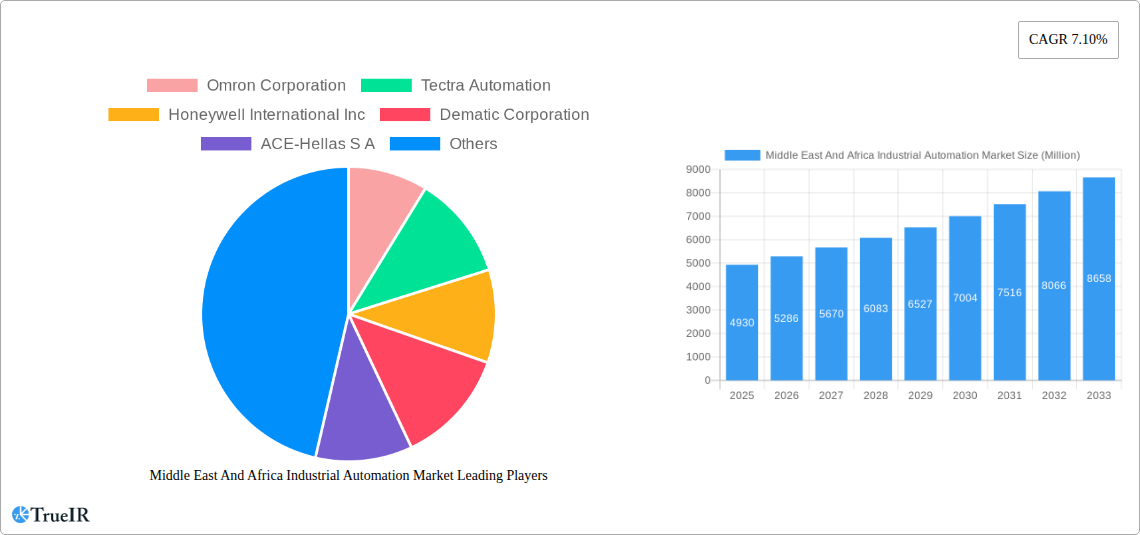

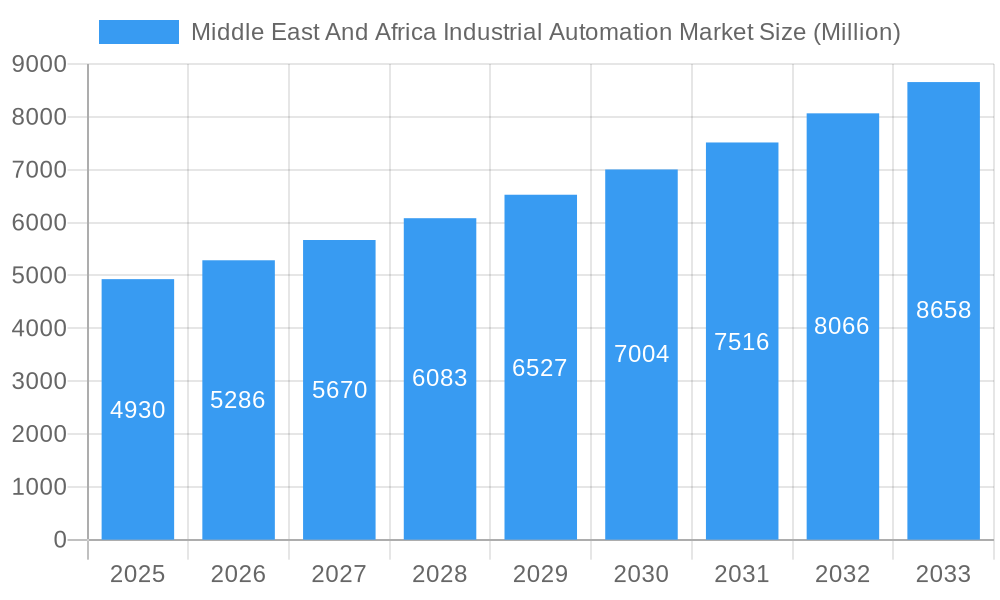

The Middle East and Africa Industrial Automation Market is poised for significant expansion, projected to reach approximately USD 4.93 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.10% anticipated to continue through 2033. This growth is propelled by a confluence of factors, including the escalating demand for enhanced operational efficiency and productivity across diverse industries, particularly in manufacturing and general merchandise sectors. The increasing adoption of smart technologies and Industry 4.0 principles, driven by government initiatives aimed at economic diversification and digital transformation, is a primary catalyst. Furthermore, the burgeoning e-commerce landscape is fueling the need for sophisticated warehouse automation, including Automated Storage and Retrieval Systems (AS/RS) and Conveyor/Sortation Systems, to manage complex supply chains. The region's strategic investments in infrastructure development and its growing industrial base are creating fertile ground for the widespread implementation of both automated material handling and factory automation solutions.

Middle East And Africa Industrial Automation Market Market Size (In Billion)

The market is segmented into advanced solutions such as Automated Storage and Retrieval Systems (AS/RS), conveyor and sortation systems, and Automatic Identification and Data Capture (AIDC) technologies within automated material handling. In factory automation, key segments include industrial robots, sensors, motors, and field devices. Leading end-users are manufacturing industries, followed by healthcare, FMCG/non-durable goods, and general merchandise. Emerging economies within the Middle East, such as Saudi Arabia and the United Arab Emirates, are expected to be key growth drivers, owing to their ambitious industrialization plans and substantial investments in modernizing their manufacturing and logistics sectors. While the market presents immense opportunities, challenges such as the high initial investment cost for automation technologies and a potential shortage of skilled labor to operate and maintain these advanced systems may moderate the pace of adoption in some segments.

Middle East And Africa Industrial Automation Market Company Market Share

This report provides an in-depth analysis of the Middle East and Africa (MEA) Industrial Automation Market, forecasting its trajectory from 2025 to 2033. Leveraging high-volume keywords such as "Industrial Automation MEA," "Factory Automation Middle East," "Robotics Africa," and "Process Control MEA," this SEO-optimized description aims to attract and inform industry professionals, investors, and decision-makers. We delve into market structure, key trends, dominant segments, product innovations, growth drivers, challenges, and a competitive landscape shaped by industry leaders like Siemens AG, Rockwell Automation Inc, ABB Limited, and Omron Corporation. The study period spans 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, building upon historical data from 2019–2024.

Middle East And Africa Industrial Automation Market Market Structure & Competitive Landscape

The MEA Industrial Automation Market exhibits a moderately concentrated structure, characterized by the presence of both large multinational corporations and emerging regional players. Innovation drivers are primarily fueled by the increasing demand for enhanced operational efficiency, cost reduction, and the adoption of Industry 4.0 technologies across various sectors. Regulatory impacts are evolving, with governments in key nations like the UAE and Saudi Arabia actively promoting industrial diversification and technological adoption through supportive policies and investment incentives. Product substitutes, while present in legacy systems, are increasingly being phased out by advanced automation solutions. The end-user segmentation reveals a significant reliance on manufacturing and non-manufacturing industries, with growing adoption in sectors like General Merchandise, Healthcare, and FMCG/Non-durable Goods. Mergers & Acquisitions (M&A) trends are observed as key players seek to expand their market reach and technological capabilities within the region. For instance, strategic partnerships and acquisitions are becoming more prevalent as companies aim to consolidate their market share and offer comprehensive automation solutions. The market concentration ratio is estimated to be around 45-55%, indicating a significant presence of the top five players. M&A activities in the historical period (2019-2024) have seen approximately 10-15 significant deals focused on expanding service offerings and geographical footprint.

Middle East And Africa Industrial Automation Market Market Trends & Opportunities

The MEA Industrial Automation Market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and dynamic competitive forces. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033), reaching an estimated market value of over $35,000 million by 2033. Technological shifts are prominently featuring the widespread adoption of Industrial Internet of Things (IIoT), Artificial Intelligence (AI), Machine Learning (ML), and advanced robotics, enabling smarter and more connected manufacturing and industrial processes. Consumer preferences are increasingly leaning towards customized products, higher quality standards, and faster delivery times, which in turn necessitates greater automation and efficiency in production and logistics. Competitive dynamics are intensifying, with global players investing heavily in research and development to introduce innovative solutions tailored to the specific needs of the MEA region, such as robust solutions for harsh environmental conditions and specialized applications in the oil and gas sector. Opportunities abound in the expansion of smart factories, the automation of supply chains, and the implementation of predictive maintenance strategies to minimize downtime and optimize asset utilization. The market penetration rate for advanced automation technologies, while still nascent in some sub-regions, is rapidly increasing, creating a fertile ground for further investment and innovation. The growing focus on sustainability and energy efficiency within industrial operations also presents a significant opportunity for automation providers offering solutions that reduce waste and optimize resource consumption. Furthermore, the digital transformation initiatives undertaken by governments across the MEA region are a key catalyst for the adoption of industrial automation, creating a ripple effect across various industries.

Dominant Markets & Segments in Middle East And Africa Industrial Automation Market

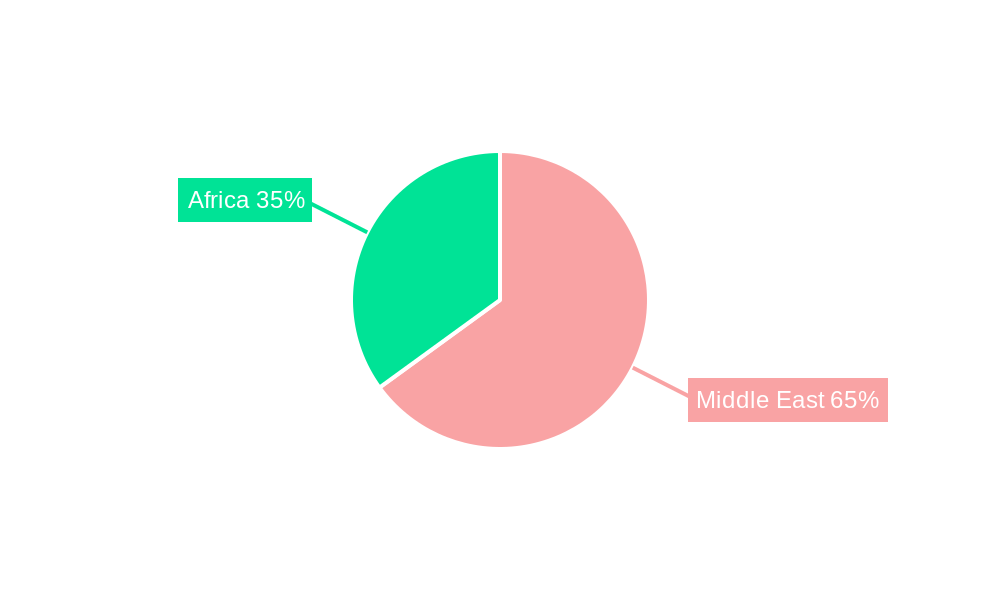

The MEA Industrial Automation Market is characterized by the dominance of specific regions and segments driven by robust economic development, strategic government initiatives, and the presence of key industrial sectors. Saudi Arabia and the United Arab Emirates (UAE) are emerging as the leading geographical markets, fueled by ambitious national visions for industrial diversification, massive infrastructure projects, and significant investments in advanced manufacturing and smart city initiatives. These nations are actively promoting the adoption of cutting-edge automation technologies to enhance their non-oil sectors and attract foreign direct investment.

Within the Solution Type segmentation, Factory Automation Solutions hold a significant market share. This is largely attributed to the burgeoning manufacturing sectors in countries like Egypt, Turkey, and South Africa, alongside the established industrial bases in the Gulf Cooperation Council (GCC) states.

- Key Growth Drivers for Factory Automation Solutions:

- Industrial Robotics: Increasing demand for precision, speed, and safety in automotive, electronics, and general manufacturing.

- Sensors and Transmitters: Essential for data acquisition and real-time monitoring in complex industrial processes, crucial for predictive maintenance and quality control.

- Motors and Drives: Critical components for energy efficiency and performance optimization in machinery and production lines.

- Field Devices: Facilitate communication and control at the operational level, enabling greater integration and flexibility.

The Automated Material Handling Solutions segment is also witnessing substantial growth, particularly driven by the expansion of e-commerce, logistics, and warehousing operations. The development of large-scale distribution hubs and the need for efficient inventory management are propelling the adoption of Conveyor/Sortation Systems and Automated Storage and Retrieval Systems (AS/RS).

- Key Growth Drivers for Automated Material Handling Solutions:

- Warehousing and Logistics: The rapid growth of e-commerce necessitates efficient warehousing solutions to manage increasing order volumes and ensure timely deliveries.

- Conveyor/Sortation Systems: Essential for streamlining material flow in manufacturing plants and distribution centers.

- Automated Storage and Retrieval System (AS/RS): Addresses the need for high-density storage and efficient retrieval in space-constrained facilities.

In terms of End Users, the Manufacturing sector remains a dominant force, encompassing industries like Food and Beverage, Pharmaceuticals, and Durable Manufacturing. The push for higher production yields, improved product quality, and adherence to stringent international standards is driving automation adoption.

- Key Dominant End-User Segments (Manufacturing):

- Food and Beverage: Automation enhances hygiene, consistency, and production speed, crucial for this high-volume sector.

- Pharmaceuticals: Stringent regulatory requirements and the need for precision necessitate advanced automation in production and quality control.

- Durable Manufacturing: Increasing demand for efficiency and reduced labor costs in the production of vehicles, machinery, and consumer durables.

The Non-Manu (Non-Manufacturing) sector, particularly within Automated Material Handling Market (encompassing General Merchandise and Healthcare), is emerging as a significant growth area. The expansion of retail operations, the demand for efficient healthcare supply chains, and the need for streamlined inventory management in various service industries are fueling this trend.

- Key Dominant End-User Segments (Non-Manufacturing):

- General Merchandise: E-commerce growth and the need for efficient retail logistics are major drivers.

- Healthcare: Automation in laboratories, pharmacies, and supply chain management enhances efficiency and patient care.

The overall market dominance is a result of targeted investments in industrial infrastructure, supportive government policies encouraging technological adoption, and a growing awareness of the benefits of automation in terms of productivity, cost-effectiveness, and competitiveness.

Middle East And Africa Industrial Automation Market Product Analysis

The MEA Industrial Automation Market is characterized by a wave of innovative product launches and advancements designed to meet the region's unique industrial demands. Key product innovations include the development of more robust and adaptable industrial robots capable of operating in challenging environmental conditions, such as extreme temperatures and dusty environments prevalent in parts of the Middle East. The integration of AI and machine learning into sensors and control systems is enabling predictive maintenance, enhanced data analytics, and greater operational intelligence. Furthermore, advancements in IIoT platforms are facilitating seamless connectivity and data exchange between disparate industrial assets, leading to optimized production workflows and improved supply chain visibility. Competitive advantages are being gained through solutions that offer increased energy efficiency, enhanced safety features, and greater flexibility to adapt to rapidly changing production requirements.

Key Drivers, Barriers & Challenges in Middle East And Africa Industrial Automation Market

Key Drivers:

The MEA Industrial Automation Market is propelled by several key drivers. Technologically, the widespread adoption of Industry 4.0 principles, including IIoT, AI, and robotics, is transforming industrial operations. Economically, a strong impetus comes from governments' strategic initiatives to diversify economies away from oil dependence, fostering the growth of manufacturing and logistics sectors. For instance, Saudi Vision 2030 and UAE's industrial strategies are actively promoting automation. Policy-driven factors, such as tax incentives for technology adoption and the establishment of industrial zones, are further accelerating market growth. The increasing need for enhanced productivity, improved product quality, and reduced operational costs across diverse industries also plays a pivotal role.

Barriers & Challenges:

Despite the growth, the market faces significant challenges. Supply chain issues, particularly the reliance on imported components and the logistical complexities within the vast MEA region, can lead to delays and increased costs, impacting projects with an estimated impact of 5-10% on project timelines. Regulatory hurdles and the lack of standardized automation protocols in some countries can create complexities for implementation. Furthermore, a shortage of skilled labor capable of operating and maintaining advanced automation systems remains a critical constraint, requiring substantial investment in training and development programs. Competitive pressures from global players and the initial high capital investment required for automation solutions can also pose a barrier for smaller enterprises, with estimated upfront costs ranging from $50,000 to over $1 million depending on the scale of implementation.

Growth Drivers in the Middle East And Africa Industrial Automation Market Market

The Middle East and Africa Industrial Automation Market is experiencing robust growth driven by several key factors. Technologically, the escalating adoption of Industry 4.0 technologies such as the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), and advanced robotics is central to this expansion. Economically, significant government investments in industrial diversification strategies, particularly in nations like Saudi Arabia and the UAE, are creating a fertile ground for automation. For example, Saudi Vision 2030 aims to develop robust manufacturing and logistics sectors, directly boosting demand for automation solutions. Regulatory frameworks are also evolving, with governments increasingly implementing policies to encourage technological adoption, offering incentives and setting standards that favor automated systems. The growing demand for enhanced productivity, superior product quality, and cost optimization across various industries, from manufacturing to logistics, acts as a constant impetus for growth.

Challenges Impacting Middle East And Africa Industrial Automation Market Growth

Several challenges continue to impact the growth of the Middle East and Africa Industrial Automation Market. Regulatory complexities and a lack of uniform standards across different countries can create implementation hurdles and increase project lead times. Supply chain disruptions and the reliance on imported components often lead to extended delivery times and higher costs, potentially affecting project budgets by as much as 5-10%. Competitive pressures from established global players and the significant upfront capital investment required for advanced automation solutions present a considerable barrier, especially for small and medium-sized enterprises (SMEs). Moreover, a persistent shortage of skilled labor capable of operating, maintaining, and troubleshooting sophisticated automation systems remains a critical constraint, necessitating substantial investment in workforce development and training programs.

Key Players Shaping the Middle East And Africa Industrial Automation Market Market

- Omron Corporation

- Tectra Automation

- Honeywell International Inc

- Dematic Corporation

- ACE-Hellas S A

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- ABB Limited

- Saudi Controls Ltd

- FLIR Systems Inc

- Mitsubishi Electric Corporation

- Siemens AG

Significant Middle East And Africa Industrial Automation Market Industry Milestones

- December 2022: Rockwell Automation introduced FactoryTalk Vault, a cloud-native solution designed to store and protect industrial files, automate project analysis, and streamline work processes for manufacturing design teams, enhancing design insights through access control and version management.

- December 2022: ABB launched the "ABB SWIFT CRB 1300" cobot, specifically designed to automate warehouse tasks such as palletizing and pick-and-place operations, offering customers increased efficiency, flexibility, and resilience in their operations and addressing labor shortages.

- January 2022: DHL Express inaugurated the Middle East's largest robotic sorting center in central Israel, a USD 80 million investment that significantly reduced cargo plane handling time from four hours to 50 minutes, and required 70% less human resources for sorting.

Future Outlook for Middle East And Africa Industrial Automation Market Market

The future outlook for the MEA Industrial Automation Market is exceptionally bright, driven by a continued surge in digital transformation initiatives and a strong governmental push for industrial modernization. The increasing adoption of AI, machine learning, and advanced robotics will lead to more intelligent and autonomous industrial operations. Opportunities for growth are abundant in smart manufacturing, predictive maintenance, and the automation of complex supply chains, particularly in response to the burgeoning e-commerce sector. Strategic investments in infrastructure and a growing emphasis on sustainability will further propel the demand for energy-efficient and environmentally friendly automation solutions. The market is expected to witness a greater integration of cloud technologies and edge computing, enabling real-time data processing and enhanced decision-making across industrial ecosystems. This dynamic landscape presents significant potential for both established players and emerging innovators to capitalize on the region's evolving industrial needs.

Middle East And Africa Industrial Automation Market Segmentation

-

1. Solution Type

-

1.1. Automated Material Handling Solutions

- 1.1.1. Conveyor/Sortation Systems

- 1.1.2. Automated Storage and Retrieval System (AS/RS)

- 1.1.3. Mobile R

- 1.1.4. Automatic Identification and Data Capture (AIDC)

- 1.1.5. Warehous

-

1.2. Factory Automation Solutions

- 1.2.1. Industri

- 1.2.2. Field Devices

- 1.2.3. Industrial Robotics

- 1.2.4. Sensors and Transmitters

- 1.2.5. Motors and Drives

- 1.2.6. Others

-

1.1. Automated Material Handling Solutions

-

2. End Users

-

2.1. Automated Material Handling Market

- 2.1.1. Manufacturing

- 2.1.2. Non-Manu

- 2.1.3. General Merchandise

- 2.1.4. Healthcare

- 2.1.5. FMCG/Non-durable Goods

- 2.1.6. Other En

-

2.2. Factory Automation Market

- 2.2.1. Food and Beverage

- 2.2.2. Pharmaceuticals

- 2.2.3. Durable Manufacturing

- 2.2.4. Textiles

- 2.2.5. Other En

-

2.1. Automated Material Handling Market

Middle East And Africa Industrial Automation Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Industrial Automation Market Regional Market Share

Geographic Coverage of Middle East And Africa Industrial Automation Market

Middle East And Africa Industrial Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need For Better Inventory Management And Control; Rising Incidences of Cyberattacks

- 3.3. Market Restrains

- 3.3.1. ; Initiative of Zero Routine Flaring by 2030

- 3.4. Market Trends

- 3.4.1. Penetration in Oil & Gas Industry to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Industrial Automation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Automated Material Handling Solutions

- 5.1.1.1. Conveyor/Sortation Systems

- 5.1.1.2. Automated Storage and Retrieval System (AS/RS)

- 5.1.1.3. Mobile R

- 5.1.1.4. Automatic Identification and Data Capture (AIDC)

- 5.1.1.5. Warehous

- 5.1.2. Factory Automation Solutions

- 5.1.2.1. Industri

- 5.1.2.2. Field Devices

- 5.1.2.3. Industrial Robotics

- 5.1.2.4. Sensors and Transmitters

- 5.1.2.5. Motors and Drives

- 5.1.2.6. Others

- 5.1.1. Automated Material Handling Solutions

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Automated Material Handling Market

- 5.2.1.1. Manufacturing

- 5.2.1.2. Non-Manu

- 5.2.1.3. General Merchandise

- 5.2.1.4. Healthcare

- 5.2.1.5. FMCG/Non-durable Goods

- 5.2.1.6. Other En

- 5.2.2. Factory Automation Market

- 5.2.2.1. Food and Beverage

- 5.2.2.2. Pharmaceuticals

- 5.2.2.3. Durable Manufacturing

- 5.2.2.4. Textiles

- 5.2.2.5. Other En

- 5.2.1. Automated Material Handling Market

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Omron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tectra Automation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dematic Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ACE-Hellas S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rockwell Automation Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yokogawa Electric Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ABB Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Controls Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 FLIR Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mitsubishi Electric Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Siemens AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Omron Corporation

List of Figures

- Figure 1: Middle East And Africa Industrial Automation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Industrial Automation Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Industrial Automation Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 2: Middle East And Africa Industrial Automation Market Volume K Unit Forecast, by Solution Type 2020 & 2033

- Table 3: Middle East And Africa Industrial Automation Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 4: Middle East And Africa Industrial Automation Market Volume K Unit Forecast, by End Users 2020 & 2033

- Table 5: Middle East And Africa Industrial Automation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East And Africa Industrial Automation Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Industrial Automation Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 8: Middle East And Africa Industrial Automation Market Volume K Unit Forecast, by Solution Type 2020 & 2033

- Table 9: Middle East And Africa Industrial Automation Market Revenue Million Forecast, by End Users 2020 & 2033

- Table 10: Middle East And Africa Industrial Automation Market Volume K Unit Forecast, by End Users 2020 & 2033

- Table 11: Middle East And Africa Industrial Automation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle East And Africa Industrial Automation Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle East And Africa Industrial Automation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle East And Africa Industrial Automation Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Industrial Automation Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Middle East And Africa Industrial Automation Market?

Key companies in the market include Omron Corporation, Tectra Automation, Honeywell International Inc, Dematic Corporation, ACE-Hellas S A, Rockwell Automation Inc, Yokogawa Electric Corporation, ABB Limited, Saudi Controls Ltd, FLIR Systems Inc, Mitsubishi Electric Corporation, Siemens AG.

3. What are the main segments of the Middle East And Africa Industrial Automation Market?

The market segments include Solution Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need For Better Inventory Management And Control; Rising Incidences of Cyberattacks.

6. What are the notable trends driving market growth?

Penetration in Oil & Gas Industry to Grow Significantly.

7. Are there any restraints impacting market growth?

; Initiative of Zero Routine Flaring by 2030.

8. Can you provide examples of recent developments in the market?

December 2022: Rockwell Automation introduced FactoryTalk Vault to store and protect industrial files, automate project analysis, and streamline work processes. FactoryTalk VaultTM provides centralized, secure, cloud-native storage for manufacturing design teams. FactoryTalk Vault enables deeper examination of controller projects for more design insights with its access control, contemporary version, and enhanced Design Tools.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Industrial Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Industrial Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Industrial Automation Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Industrial Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence