Key Insights

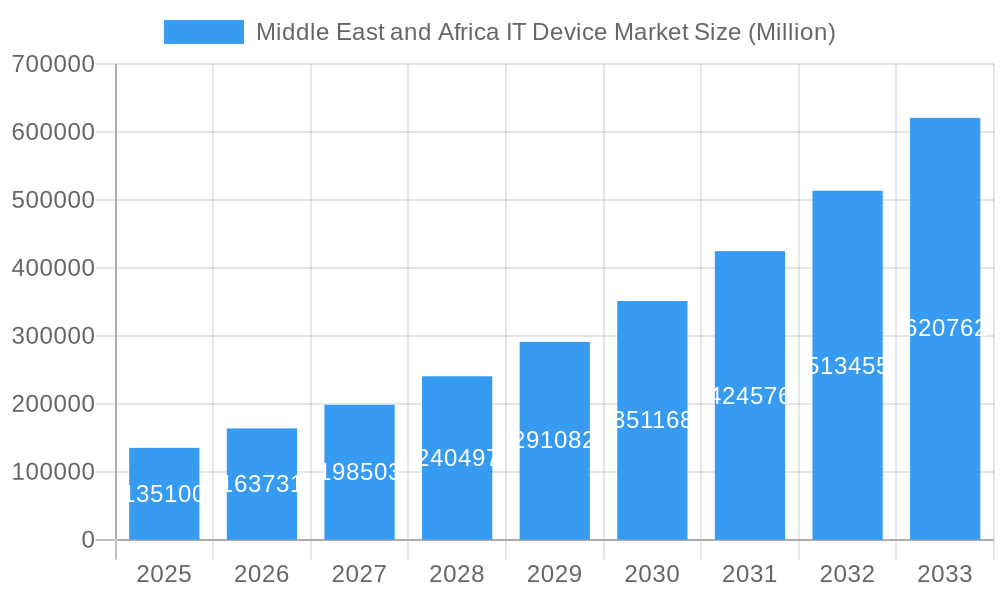

The Middle East and Africa (MEA) IT Device Market is poised for remarkable expansion, projected to reach an estimated USD 135.1 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 21.2% anticipated over the forecast period of 2025-2033. This surge is fueled by a confluence of factors, including escalating digital transformation initiatives across both public and private sectors, increasing disposable incomes in key economies, and a burgeoning young, tech-savvy population. The widespread adoption of smartphones and personal computers, driven by the need for enhanced connectivity, productivity, and entertainment, is a primary catalyst. Furthermore, government investments in digital infrastructure and smart city projects are creating fertile ground for the IT device market's continued upward trajectory.

Middle East and Africa IT Device Market Market Size (In Billion)

The market dynamics are further shaped by evolving technological trends. The proliferation of 5G networks is accelerating the demand for advanced smartphones and connected devices, while the growing popularity of cloud computing and the Internet of Things (IoT) is driving the adoption of a wider range of IT hardware, from laptops and tablets to specialized devices. While the market experiences significant growth, certain factors could influence its pace. The increasing cost of some advanced components and geopolitical uncertainties in specific regions represent potential restraints. However, the inherent demand for digital services, coupled with competitive pricing strategies from major manufacturers, is expected to largely mitigate these challenges, ensuring sustained and dynamic market evolution across the Middle East and Africa.

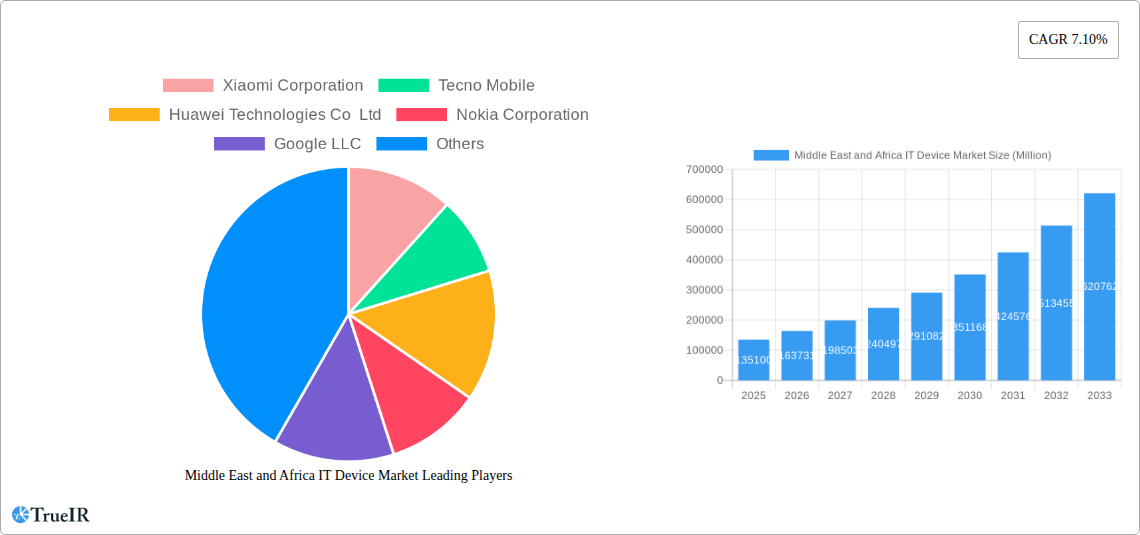

Middle East and Africa IT Device Market Company Market Share

Middle East and Africa IT Device Market: Comprehensive Analysis & Forecast (2019–2033)

Unlock unparalleled insights into the dynamic Middle East and Africa (MEA) IT device market with this in-depth report. Covering a projected market size exceeding tens of billions of dollars by 2033, this analysis delves into the intricate landscape of PCs and phones, from cutting-edge laptops and smartphones to essential feature phones and landlines. We dissect regional dominance across key economies like Saudi Arabia, UAE, South Africa, and Nigeria, offering a granular view of market penetration and growth trajectories. Leverage our extensive historical data (2019-2024) and precise forecasts (2025-2033), anchored by a robust base year of 2025, to understand evolving consumer preferences, technological advancements, and the competitive strategies of industry giants such as Samsung Electronics, Apple Inc., Xiaomi Corporation, and Huawei Technologies.

Middle East and Africa IT Device Market Market Structure & Competitive Landscape

The Middle East and Africa IT Device Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share, particularly in the smartphone segment. However, a robust presence of regional and emerging brands fosters healthy competition. Innovation remains a key driver, fueled by the rapid adoption of new technologies and a growing demand for feature-rich devices across all segments. Regulatory impacts vary across countries, with some nations implementing policies to promote local manufacturing and digital inclusion, while others focus on import tariffs. Product substitution is a significant factor, especially between premium and mid-range smartphones, and between laptops and tablets for certain use cases. End-user segmentation is diverse, spanning individual consumers, educational institutions, small and medium-sized enterprises (SMEs), and large corporations, each with distinct purchasing patterns and device requirements. Mergers and acquisitions (M&A) activity, while not as prevalent as in more mature markets, is expected to increase as larger players seek to consolidate their positions and acquire innovative technologies or market access. For instance, an estimated XX billion worth of M&A deals are anticipated within the forecast period. Concentration ratios for the top five players in the smartphone segment are estimated to be around XX%, highlighting the competitive intensity.

Middle East and Africa IT Device Market Market Trends & Opportunities

The Middle East and Africa IT Device Market is poised for substantial growth, with an estimated market size projected to reach over XX billion by the end of 2033. This expansion is driven by a confluence of factors including increasing disposable incomes, a burgeoning young population with a high propensity for technology adoption, and significant investments in digital transformation across various sectors. The market penetration for smartphones is already high and continues to climb, while the PC segment is experiencing a resurgence due to the rise of remote work and digital education initiatives. Technological shifts are profoundly influencing market dynamics. The rollout of 5G infrastructure across key MEA nations is creating new opportunities for high-speed data-reliant devices, from advanced smartphones to powerful laptops and tablets. The proliferation of Artificial Intelligence (AI) and Machine Learning (ML) capabilities integrated into devices is enhancing user experience and opening avenues for premium product sales.

Consumer preferences are increasingly leaning towards devices that offer a seamless blend of performance, portability, and affordability. There's a growing demand for devices with enhanced camera capabilities, longer battery life, and robust security features. The gaming segment within the IT device market is also a significant growth area, with consumers seeking high-performance PCs and mobile devices capable of handling demanding applications. Competitive dynamics are evolving rapidly. While global giants like Samsung Electronics, Apple Inc., and Huawei Technologies continue to dominate, local and regional brands such as Tecno Mobile and Xiaomi Corporation are aggressively capturing market share, particularly in the mid-range and budget segments, through innovative product offerings and aggressive pricing strategies. The e-commerce channel is also playing a pivotal role, facilitating wider reach and enabling brands to connect directly with consumers across the vast geographical expanse of MEA. Opportunities abound in segments like affordable laptops for education, ruggedized tablets for industrial applications, and feature phones for unbanked or digitally nascent populations. The projected CAGR for the MEA IT Device Market is estimated to be XX% during the forecast period. Market penetration rates for smartphones are anticipated to reach over XX% in key urban centers by 2033.

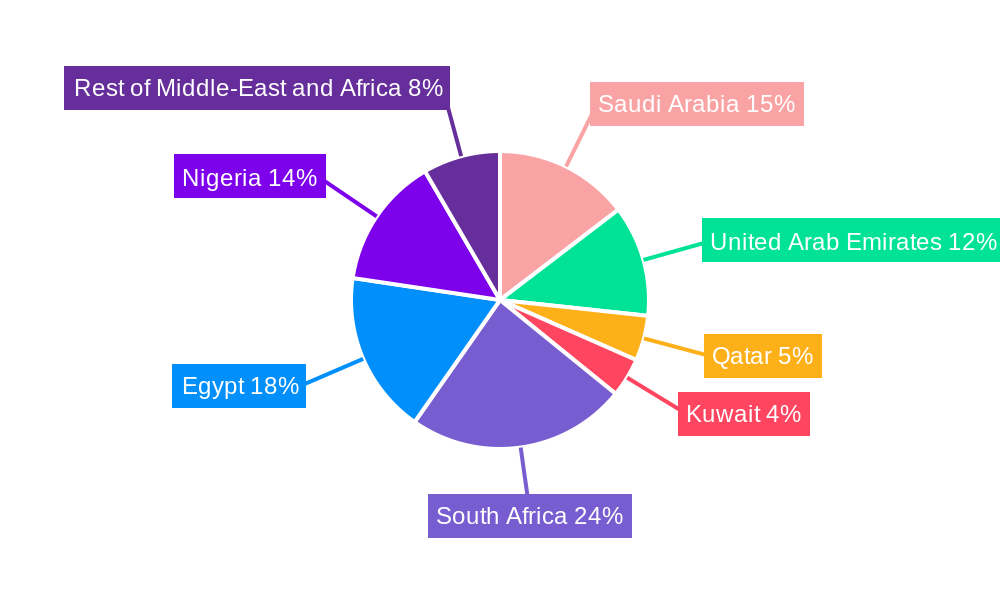

Dominant Markets & Segments in Middle East and Africa IT Device Market

The Middle East and Africa IT Device Market exhibits a clear dominance in specific geographical regions and product segments. Saudi Arabia and the United Arab Emirates consistently lead the market in terms of value and volume for high-end IT devices, driven by affluent populations, significant government investment in technology, and a strong appetite for premium products. These countries are early adopters of new technologies and have robust digital infrastructure. South Africa and Nigeria represent the largest markets in terms of volume, particularly for smartphones and feature phones, owing to their substantial populations and growing middle class. However, the average selling price (ASP) in these regions tends to be lower compared to the Gulf nations.

Within the Phones segment, smartphones are the undisputed leaders, accounting for an estimated over XX% of the total market value and volume. This dominance is fueled by their versatility, increasing affordability, and essential role in communication, entertainment, and productivity. The demand for 5G-enabled smartphones is a significant growth driver. Feature phones, while experiencing a decline in some developed markets, continue to hold a substantial share in lower-income demographics and rural areas of MEA, offering basic connectivity at an accessible price point. Landline phones are largely niche.

In the PC's segment, laptops are experiencing robust growth, propelled by remote work trends, digital education initiatives, and the demand for portable computing solutions. Tablets offer a complementary device for content consumption and light productivity, bridging the gap between smartphones and laptops. Desktop PCs remain relevant for specific enterprise and gaming applications.

Key Growth Drivers for Dominant Markets:

- Saudi Arabia & UAE:

- Vision 2030 and similar national digital transformation agendas driving massive technology investments.

- High disposable incomes and a strong demand for premium and innovative devices.

- Rapid 5G network expansion and adoption.

- A young, tech-savvy population actively seeking the latest gadgets.

- South Africa & Nigeria:

- Large, growing populations with increasing mobile penetration.

- Expanding middle class with rising purchasing power.

- Government initiatives to promote digital inclusion and affordable internet access.

- Growth of e-commerce platforms facilitating device accessibility.

The “Rest of Middle-East and Africa” category encompasses a diverse set of markets, some of which, like Egypt and Qatar, exhibit significant growth potential due to specific economic development plans and increasing digital literacy. The overall market’s trajectory is a testament to the region’s rapid embrace of digital technologies across all strata of society.

Middle East and Africa IT Device Market Product Analysis

The MEA IT Device Market is witnessing a surge in product innovation focused on delivering enhanced user experiences and catering to diverse consumer needs. In the smartphone category, advancements in camera technology, featuring higher megapixel counts and AI-powered enhancements, along with longer battery life and faster charging capabilities, are key competitive advantages. The integration of 5G connectivity is becoming standard in mid-to-high-end devices, promising significantly faster data speeds. For PCs, innovations are centered on thinner and lighter designs, improved processing power, and enhanced display technologies for both laptops and tablets. The application scope is widening, with devices increasingly serving as primary tools for work, education, and entertainment.

Key Drivers, Barriers & Challenges in Middle East and Africa IT Device Market

Key Drivers:

The Middle East and Africa IT Device Market is propelled by several potent drivers. Technological advancements, including the widespread adoption of 5G networks and the integration of AI in devices, are creating demand for newer, more capable hardware. Economic growth in several MEA nations is leading to increased disposable incomes, allowing more consumers to purchase IT devices. Government initiatives promoting digital transformation, digital inclusion, and e-learning are also significant catalysts. For instance, the digital transformation drives in the UAE are creating a substantial market for enterprise-grade PCs and high-performance tablets.

Barriers & Challenges:

Despite the positive outlook, the market faces several barriers and challenges. Economic volatility and fluctuating currency exchange rates in some countries can impact affordability. Inconsistent regulatory frameworks and import duties across different nations create complexity for manufacturers and distributors. Supply chain disruptions, exacerbated by global events, can lead to stock shortages and increased costs, with an estimated impact of XX% on production timelines for certain components. Intense competition, particularly from low-cost manufacturers, puts pressure on profit margins, especially in price-sensitive segments. The digital divide and varying levels of digital literacy in certain regions also present challenges for widespread adoption of advanced IT devices.

Growth Drivers in the Middle East and Africa IT Device Market Market

Several factors are fueling the growth of the Middle East and Africa IT Device Market. Technological leaps, such as the accelerated deployment of 5G infrastructure across key countries like Saudi Arabia and the UAE, are driving demand for compatible devices. Economic development and rising disposable incomes in nations like Nigeria and Egypt are expanding the consumer base for IT products. Government policies focused on digital transformation, such as smart city initiatives and digital education programs, are creating significant market opportunities. The increasing penetration of e-commerce platforms is also crucial, enhancing accessibility and reach for a wider range of devices across geographically dispersed populations.

Challenges Impacting Middle East and Africa IT Device Market Growth

The growth of the Middle East and Africa IT Device Market is not without its hurdles. Regulatory complexities and varying import duties across different countries can hinder market entry and increase operational costs, leading to an estimated XX% increase in logistical expenses for some businesses. Supply chain vulnerabilities, including the availability of critical components and shipping logistics, remain a persistent challenge, potentially delaying product launches and impacting inventory levels. Intense competitive pressures, especially from local and emerging brands offering aggressive pricing, can squeeze profit margins for established players. Furthermore, disparities in economic development and digital literacy across the vast MEA region mean that market penetration strategies need to be highly localized and adaptable to diverse consumer needs and purchasing power.

Key Players Shaping the Middle East and Africa IT Device Market Market

- Samsung Electronics Co Ltd

- Apple Inc

- Xiaomi Corporation

- Huawei Technologies Co Ltd

- Lenovo Group Limited

- Tecno Mobile

- HP Inc

- Dell Technologies

- ASUSTek Computer Inc

- Guangdong Oppo Mobile Telecommunications Corp Ltd

- Nokia Corporation

- Google LLC

- Acer Group

- Motorola Inc

- Sony Corporation

- Microsoft Corporation

Significant Middle East and Africa IT Device Market Industry Milestones

- October 2022: Xiaomi, the top smartphone manufacturer, launched the 12T Series in the Saudi Market. The event was arranged to give customers in the Kingdom access to the Xiaomi 12T smartphone series and a variety of luxury tech solutions as part of its mission to make high-quality technology available to individuals and communities worldwide.

- September 2022: Lenovo introduced brand-new ThinkPad computers in the UAE, showcasing striking, innovative designs that defy convention and add new hues and materials to its premium business laptop line-up.

Future Outlook for Middle East and Africa IT Device Market Market

The future outlook for the Middle East and Africa IT Device Market is exceptionally promising, driven by a continued surge in digital adoption and a young, tech-enthusiastic population. Strategic opportunities lie in catering to the growing demand for 5G-enabled devices, sustainable and energy-efficient products, and integrated smart home solutions. The expansion of e-commerce will further democratize access to technology, while government investments in digital infrastructure and education will create sustained demand for PCs and mobile devices. The market is expected to witness increasing innovation in affordability and feature sets, making advanced technology accessible to a broader segment of the population. The overall market potential remains vast, with continued growth anticipated as economies develop and digital literacy continues to expand.

Middle East and Africa IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Qatar

- 2.4. Kuwait

- 2.5. South Africa

- 2.6. Egypt

- 2.7. Nigeria

- 2.8. Rest of Middle-East and Africa

Middle East and Africa IT Device Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Kuwait

- 5. South Africa

- 6. Egypt

- 7. Nigeria

- 8. Rest of Middle East and Africa

Middle East and Africa IT Device Market Regional Market Share

Geographic Coverage of Middle East and Africa IT Device Market

Middle East and Africa IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Usage Across the Region; Robust Demand for Online Gaming

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Inflation Impacting the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Smartphones

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Qatar

- 5.2.4. Kuwait

- 5.2.5. South Africa

- 5.2.6. Egypt

- 5.2.7. Nigeria

- 5.2.8. Rest of Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Kuwait

- 5.3.5. South Africa

- 5.3.6. Egypt

- 5.3.7. Nigeria

- 5.3.8. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. PC's

- 6.1.1.1. Laptops

- 6.1.1.2. Desktop PCs

- 6.1.1.3. Tablets

- 6.1.2. Phones

- 6.1.2.1. Landline Phones

- 6.1.2.2. Smartphones

- 6.1.2.3. Feature Phones

- 6.1.1. PC's

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Qatar

- 6.2.4. Kuwait

- 6.2.5. South Africa

- 6.2.6. Egypt

- 6.2.7. Nigeria

- 6.2.8. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. PC's

- 7.1.1.1. Laptops

- 7.1.1.2. Desktop PCs

- 7.1.1.3. Tablets

- 7.1.2. Phones

- 7.1.2.1. Landline Phones

- 7.1.2.2. Smartphones

- 7.1.2.3. Feature Phones

- 7.1.1. PC's

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Qatar

- 7.2.4. Kuwait

- 7.2.5. South Africa

- 7.2.6. Egypt

- 7.2.7. Nigeria

- 7.2.8. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Qatar Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. PC's

- 8.1.1.1. Laptops

- 8.1.1.2. Desktop PCs

- 8.1.1.3. Tablets

- 8.1.2. Phones

- 8.1.2.1. Landline Phones

- 8.1.2.2. Smartphones

- 8.1.2.3. Feature Phones

- 8.1.1. PC's

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Qatar

- 8.2.4. Kuwait

- 8.2.5. South Africa

- 8.2.6. Egypt

- 8.2.7. Nigeria

- 8.2.8. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Kuwait Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. PC's

- 9.1.1.1. Laptops

- 9.1.1.2. Desktop PCs

- 9.1.1.3. Tablets

- 9.1.2. Phones

- 9.1.2.1. Landline Phones

- 9.1.2.2. Smartphones

- 9.1.2.3. Feature Phones

- 9.1.1. PC's

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Qatar

- 9.2.4. Kuwait

- 9.2.5. South Africa

- 9.2.6. Egypt

- 9.2.7. Nigeria

- 9.2.8. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. PC's

- 10.1.1.1. Laptops

- 10.1.1.2. Desktop PCs

- 10.1.1.3. Tablets

- 10.1.2. Phones

- 10.1.2.1. Landline Phones

- 10.1.2.2. Smartphones

- 10.1.2.3. Feature Phones

- 10.1.1. PC's

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. United Arab Emirates

- 10.2.3. Qatar

- 10.2.4. Kuwait

- 10.2.5. South Africa

- 10.2.6. Egypt

- 10.2.7. Nigeria

- 10.2.8. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Egypt Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. PC's

- 11.1.1.1. Laptops

- 11.1.1.2. Desktop PCs

- 11.1.1.3. Tablets

- 11.1.2. Phones

- 11.1.2.1. Landline Phones

- 11.1.2.2. Smartphones

- 11.1.2.3. Feature Phones

- 11.1.1. PC's

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. United Arab Emirates

- 11.2.3. Qatar

- 11.2.4. Kuwait

- 11.2.5. South Africa

- 11.2.6. Egypt

- 11.2.7. Nigeria

- 11.2.8. Rest of Middle-East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Nigeria Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. PC's

- 12.1.1.1. Laptops

- 12.1.1.2. Desktop PCs

- 12.1.1.3. Tablets

- 12.1.2. Phones

- 12.1.2.1. Landline Phones

- 12.1.2.2. Smartphones

- 12.1.2.3. Feature Phones

- 12.1.1. PC's

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Saudi Arabia

- 12.2.2. United Arab Emirates

- 12.2.3. Qatar

- 12.2.4. Kuwait

- 12.2.5. South Africa

- 12.2.6. Egypt

- 12.2.7. Nigeria

- 12.2.8. Rest of Middle-East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Rest of Middle East and Africa Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. PC's

- 13.1.1.1. Laptops

- 13.1.1.2. Desktop PCs

- 13.1.1.3. Tablets

- 13.1.2. Phones

- 13.1.2.1. Landline Phones

- 13.1.2.2. Smartphones

- 13.1.2.3. Feature Phones

- 13.1.1. PC's

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. Saudi Arabia

- 13.2.2. United Arab Emirates

- 13.2.3. Qatar

- 13.2.4. Kuwait

- 13.2.5. South Africa

- 13.2.6. Egypt

- 13.2.7. Nigeria

- 13.2.8. Rest of Middle-East and Africa

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Xiaomi Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tecno Mobile

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Huawei Technologies Co Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Nokia Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Google LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Lenovo Group Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 ASUSTek Computer Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Acer Group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Guangdong Oppo Mobile Telecommunications Corp Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Samsung Electronics Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Apple Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Motorola Inc *List Not Exhaustive

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Sony Corporation

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Microsoft Corporation

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Dell Technologies

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 HP Inc

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.1 Xiaomi Corporation

List of Figures

- Figure 1: Middle East and Africa IT Device Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa IT Device Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Middle East and Africa IT Device Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 21: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa IT Device Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Middle East and Africa IT Device Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 27: Middle East and Africa IT Device Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa IT Device Market?

The projected CAGR is approximately 21.2%.

2. Which companies are prominent players in the Middle East and Africa IT Device Market?

Key companies in the market include Xiaomi Corporation, Tecno Mobile, Huawei Technologies Co Ltd, Nokia Corporation, Google LLC, Lenovo Group Limited, ASUSTek Computer Inc, Acer Group, Guangdong Oppo Mobile Telecommunications Corp Ltd, Samsung Electronics Co Ltd, Apple Inc, Motorola Inc *List Not Exhaustive, Sony Corporation, Microsoft Corporation, Dell Technologies, HP Inc.

3. What are the main segments of the Middle East and Africa IT Device Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Usage Across the Region; Robust Demand for Online Gaming.

6. What are the notable trends driving market growth?

Growing Demand for Smartphones.

7. Are there any restraints impacting market growth?

Adverse Effects of Inflation Impacting the Market.

8. Can you provide examples of recent developments in the market?

October 2022: Xiaomi, the top smartphone manufacturer, launched the 12T Series in the Saudi Market. The event was arranged to give customers in the Kingdom access to the Xiaomi 12T smartphone series and a variety of luxury tech solutions as part of its mission to make high-quality technology available to individuals and communities worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa IT Device Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence