Key Insights

The Middle East Satellite-based Earth Observation Market is projected for significant expansion, with an estimated market size of $8.7 billion by 2025 and a Compound Annual Growth Rate (CAGR) of 7.6% through 2033. This growth is driven by increasing governmental and commercial investment in advanced satellite technologies for diverse regional applications. Key factors include the rising demand for high-resolution Earth Observation data, particularly from Low Earth Orbit (LEO) satellites, supporting critical sectors such as urban development, infrastructure projects, and climate change monitoring. The proliferation of value-added services derived from raw data is accelerating market adoption as end-users seek actionable insights. The region's strategic importance and ongoing digital transformation efforts highlight the crucial role of satellite-based Earth Observation in national development and security.

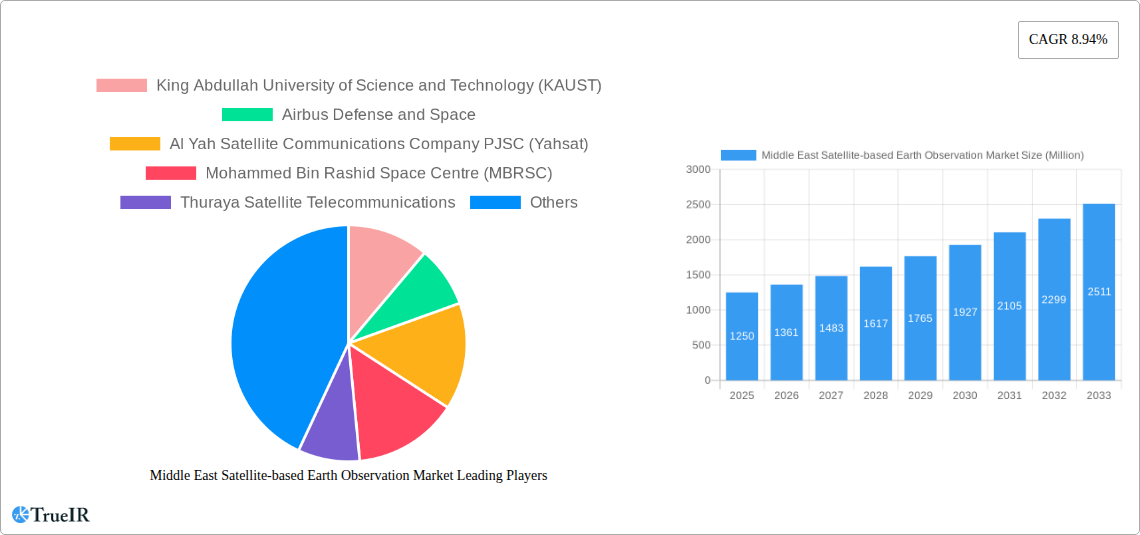

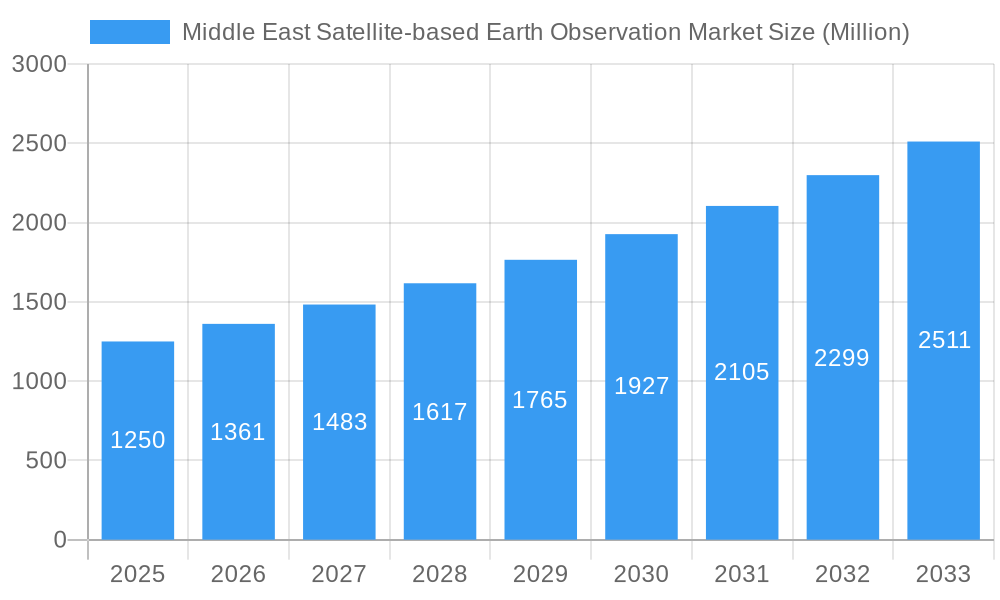

Middle East Satellite-based Earth Observation Market Market Size (In Billion)

Market evolution is further influenced by trends like the integration of AI and machine learning for advanced data analysis, enabling more precise forecasting and anomaly detection. Substantial investments in satellite infrastructure and the emergence of innovative companies and research institutions, including King Abdullah University of Science and Technology (KAUST), Airbus Defense and Space, and the Mohammed Bin Rashid Space Centre (MBRSC), are fostering a dynamic ecosystem. While the market shows strong growth potential, challenges such as high initial investment costs for satellite deployment and data acquisition, along with the need for skilled personnel for complex data management, require strategic mitigation. However, the compelling benefits in agriculture, energy exploration, climate services, and urban planning are expected to overcome these hurdles, driving sustained innovation and adoption across the Middle East.

Middle East Satellite-based Earth Observation Market Company Market Share

This comprehensive report delivers a dynamic, SEO-optimized analysis of the Middle East Satellite-based Earth Observation Market. Utilizing high-volume keywords and detailed market insights, it caters to industry professionals seeking to understand market dynamics, emerging trends, and future growth trajectories. The study covers a comprehensive analysis from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

Middle East Satellite-based Earth Observation Market Market Structure & Competitive Landscape

The Middle East satellite-based Earth Observation market exhibits a moderately concentrated structure, characterized by the presence of both established global players and burgeoning regional entities. Innovation drivers include advancements in satellite technology, cloud computing, and artificial intelligence, enabling sophisticated data analysis and value-added services (VAS). Regulatory impacts are gradually shaping the market, with governments in the region increasingly investing in space capabilities and data accessibility. Product substitutes, while limited for high-resolution satellite imagery, include aerial imagery and ground-based sensor networks. End-user segmentation reveals a strong demand from Urban Development and Cultural Heritage, Agriculture, and Infrastructure sectors, driven by national diversification agendas and smart city initiatives. Mergers and acquisitions (M&A) trends are anticipated to increase as companies seek to consolidate capabilities, expand market reach, and gain access to proprietary technologies. The market concentration ratio is estimated to be around XX%, indicating a significant market share held by the top few players. M&A volumes are projected to grow by XX% during the forecast period.

Middle East Satellite-based Earth Observation Market Market Trends & Opportunities

The Middle East satellite-based Earth Observation market is experiencing robust growth, fueled by increasing governmental investments in space infrastructure and the growing demand for geospatial data across various sectors. The market size is projected to expand at a compound annual growth rate (CAGR) of XX% from 2025 to 2033. Technological shifts are a major trend, with a notable increase in the deployment of Synthetic Aperture Radar (SAR) satellites, capable of all-weather and day/night imaging, thereby enhancing data acquisition capabilities. This is supported by the UAE's National Space Fund of USD 816 Million, aimed at bolstering the nation's space sector. Consumer preferences are evolving towards integrated solutions that combine raw Earth observation data with advanced analytics and actionable insights, driving the demand for value-added services. Competitive dynamics are intensifying, with both established international players and a growing number of regional companies vying for market share. Opportunities abound in developing specialized applications for sectors such as climate monitoring, precision agriculture, and disaster management, areas gaining significant traction due to regional environmental challenges and development goals. Market penetration rates for Earth observation data are expected to reach XX% by 2033, indicating widespread adoption across industries.

Dominant Markets & Segments in Middle East Satellite-based Earth Observation Market

The Earth Observation Data segment is currently the dominant market, driven by the fundamental need for raw satellite imagery and information. However, Value Added Services (VAS) are rapidly gaining prominence as end-users seek sophisticated analytical solutions and actionable insights derived from this data. In terms of satellite orbit, Low Earth Orbit (LEO) satellites are paramount due to their higher resolution and frequent revisits, crucial for applications requiring detailed and timely information. Geostationary Orbit (GEO) satellites also play a role in continuous monitoring of large areas, particularly for meteorological and environmental applications.

Key Growth Drivers for Dominant Segments:

- End-use: Urban Development and Cultural Heritage: Driven by rapid urbanization, smart city initiatives, and the need for infrastructure planning and monitoring.

- End-use: Agriculture: Growing adoption of precision agriculture techniques for crop monitoring, yield prediction, and resource management.

- End-use: Climate Services: Increasing focus on climate change monitoring, environmental impact assessment, and disaster preparedness.

- End-use: Infrastructure: Essential for the planning, construction, and maintenance of major infrastructure projects like transportation networks, energy facilities, and water resources.

The dominance of the Earth Observation Data segment is underpinned by foundational data acquisition capabilities. However, the accelerated growth within the Value Added Services segment signifies a market maturation where sophisticated interpretation and application of data are becoming increasingly critical. The UAE Space Agency's initiative to foster an innovative environment for Earth observation apps through a geospatial analytics platform exemplifies this trend, aiming to enhance access to satellite data for developing solutions and VAS.

Middle East Satellite-based Earth Observation Market Product Analysis

The Middle East satellite-based Earth Observation market is characterized by a growing sophistication in product offerings. Innovations range from enhanced resolution optical imagery to advanced Synthetic Aperture Radar (SAR) capabilities, enabling all-weather, day-and-night data acquisition. Applications are expanding beyond traditional uses to encompass AI-driven insights for precision agriculture, predictive analytics for infrastructure maintenance, and comprehensive climate modeling. Competitive advantages are increasingly derived from the ability to integrate diverse data streams, provide rapid analysis, and deliver customized solutions that address specific end-user needs, such as those highlighted by the UAE Space Agency's vision for developing space data apps and value-added services.

Key Drivers, Barriers & Challenges in Middle East Satellite-based Earth Observation Market

Key Drivers:

- Technological Advancements: Continuous improvements in satellite sensor technology, data processing, and AI algorithms are expanding the capabilities and applications of Earth observation.

- Governmental Investments: Significant national investments in space programs and Earth observation infrastructure across the Middle East, such as the UAE's National Space Fund (USD 816 Million), are a primary growth catalyst.

- Increasing Demand for Data: Growing awareness and adoption of Earth observation data across sectors like urban planning, agriculture, climate services, and energy are driving market expansion.

Barriers & Challenges:

- High Initial Investment Costs: The cost of developing, launching, and operating satellite constellations remains a significant barrier to entry for smaller players.

- Data Accessibility and Standardization: Ensuring seamless access to data and establishing standardized formats for interoperability across different platforms can be challenging.

- Skilled Workforce Shortage: A lack of adequately trained personnel in specialized areas of Earth observation data analysis and application development can hinder market growth.

- Regulatory Complexities: Navigating diverse regulatory frameworks and data sharing policies across different countries in the region can present hurdles.

Growth Drivers in the Middle East Satellite-based Earth Observation Market Market

Key growth drivers for the Middle East satellite-based Earth observation market are multifaceted. Technologically, advancements in sensor resolution and the development of multi-spectral and hyperspectral imaging capabilities are expanding the scope of applications. Economically, the region's focus on economic diversification, particularly in non-oil sectors like technology and smart infrastructure, is creating substantial demand for geospatial data. Regulatory factors are also playing a crucial role, with governments actively promoting space exploration and the development of domestic satellite capabilities, exemplified by the establishment of funds like the UAE's National Space Fund, which directly fuels innovation and infrastructure development.

Challenges Impacting Middle East Satellite-based Earth Observation Market Growth

Challenges impacting the Middle East satellite-based Earth observation market growth include inherent regulatory complexities in data sharing and intellectual property rights across different nations. Supply chain issues, particularly concerning the manufacturing and procurement of specialized satellite components and ground infrastructure, can lead to project delays. Furthermore, intense competitive pressures from established global players and emerging regional entities necessitate continuous innovation and cost-effectiveness. The high cost associated with developing and launching sophisticated satellite constellations also presents a significant financial barrier for new entrants.

Key Players Shaping the Middle East Satellite-based Earth Observation Market Market

- King Abdullah University of Science and Technology (KAUST)

- Airbus Defense and Space

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Mohammed Bin Rashid Space Centre (MBRSC)

- Thuraya Satellite Telecommunications

- SARsat Arabia

- Ayn Astra

- Perigon AI

- DigitalGlobe

- Geomap

Significant Middle East Satellite-based Earth Observation Market Industry Milestones

- December 2022: The UAE Space Agency and Bayanat inked a collaboration agreement to create and manage a geospatial analytics platform for the Space Data Centre. This initiative aims to foster an innovative environment for Earth observation apps, improve access to satellite data for a wide range of users, and develop solutions for national and global challenges through space data apps and value-added services (VAS).

- July 2022: The UAE Space Agency announced the establishment of The National Space Fund, a new AED3 billion (USD 816 Million) national investment and development fund for the space sector. This fund supports the development of advanced constellations, including Synthetic Aperture Radar (SAR) satellites, enhancing all-weather and day/night imaging capabilities.

Future Outlook for Middle East Satellite-based Earth Observation Market Market

The future outlook for the Middle East satellite-based Earth Observation market is exceptionally bright, characterized by sustained growth and innovation. Strategic opportunities lie in the increasing demand for AI-driven analytics, the expansion of multi-spectral and SAR satellite constellations, and the growing integration of Earth observation data into smart city frameworks and sustainable development initiatives. The market's potential is further amplified by ongoing governmental commitment to space exploration and the development of a robust national space economy, positioning the region as a significant player in the global Earth observation landscape.

Middle East Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

Middle East Satellite-based Earth Observation Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Satellite-based Earth Observation Market Regional Market Share

Geographic Coverage of Middle East Satellite-based Earth Observation Market

Middle East Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Investments; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Budget Constraints and Technological Limitations

- 3.4. Market Trends

- 3.4.1. Urban Development and Cultural Heritage is analyzed to hold significant share in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 King Abdullah University of Science and Technology (KAUST)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus Defense and Space

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Yah Satellite Communications Company PJSC (Yahsat)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mohammed Bin Rashid Space Centre (MBRSC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thuraya Satellite Telecommunications

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SARsat Arabia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ayn Astra

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Perigon AI

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DigitalGlobe

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Geomap

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 King Abdullah University of Science and Technology (KAUST)

List of Figures

- Figure 1: Middle East Satellite-based Earth Observation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East Satellite-based Earth Observation Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 3: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by End-use 2020 & 2033

- Table 4: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by Satellite Orbit 2020 & 2033

- Table 7: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by End-use 2020 & 2033

- Table 8: Middle East Satellite-based Earth Observation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East Satellite-based Earth Observation Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Satellite-based Earth Observation Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Middle East Satellite-based Earth Observation Market?

Key companies in the market include King Abdullah University of Science and Technology (KAUST), Airbus Defense and Space, Al Yah Satellite Communications Company PJSC (Yahsat), Mohammed Bin Rashid Space Centre (MBRSC), Thuraya Satellite Telecommunications, SARsat Arabia, Ayn Astra, Perigon AI, DigitalGlobe, Geomap.

3. What are the main segments of the Middle East Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Investments; Technological Advancements.

6. What are the notable trends driving market growth?

Urban Development and Cultural Heritage is analyzed to hold significant share in the market.

7. Are there any restraints impacting market growth?

Budget Constraints and Technological Limitations.

8. Can you provide examples of recent developments in the market?

December 2022 - The UAE Space Agency and Bayanat have inked a collaboration agreement to create and manage a geospatial analytics platform for the Space Data Centre, one of the UAE government's transformational projects. According to the terms of the agreement, Bayanat will take advantage of large-scale data handling and processing capabilities and provide analytical reports based on Earth observation satellites to develop an innovative environment for Earth observation apps. The UAE Space Agency indicates using the platform to improve access to satellite data for scientists, researchers, government and private institutions, startups, and community members to develop solutions that support national and global challenges in the form of space data apps and value-added services (VAS). In addition to its function in fostering worldwide collaboration and alliances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the Middle East Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence