Key Insights

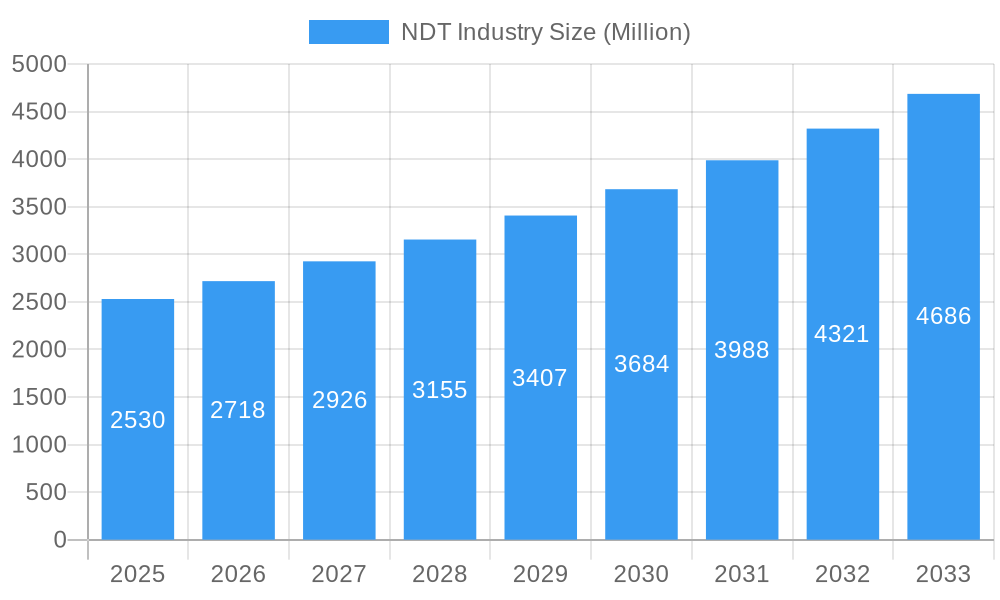

The Non-Destructive Testing (NDT) industry, valued at $2.53 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.35% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing infrastructure development globally, particularly in emerging economies, necessitates rigorous quality control and safety measures, driving demand for NDT services and equipment. The rising adoption of advanced testing technologies, such as automated ultrasonic testing and digital radiography, enhances efficiency and accuracy, further boosting market growth. Stringent safety regulations across various industries, including aerospace, automotive, and energy, mandate comprehensive NDT inspections, creating a significant market opportunity. Growth in renewable energy sectors like wind and solar power also contributes to increased NDT demand as these technologies require extensive quality checks throughout their lifecycles.

NDT Industry Market Size (In Billion)

However, the market faces certain restraints. High initial investment costs associated with advanced NDT equipment can limit adoption, especially for smaller companies. The skilled labor shortage in the NDT field poses a challenge to meeting the growing demand for qualified technicians and engineers. Furthermore, the cyclical nature of some end-user industries, such as construction and oil & gas, can impact market growth in the short term. Despite these challenges, the long-term outlook for the NDT industry remains positive, driven by technological advancements, increasing regulatory requirements, and the overall growth of global infrastructure and industrial sectors. The market segmentation reveals significant opportunities across various testing technologies (radiography, ultrasonic, etc.), end-user industries (oil & gas, aerospace, etc.), and service types (equipment vs. services), offering diverse avenues for growth and specialization within the NDT landscape.

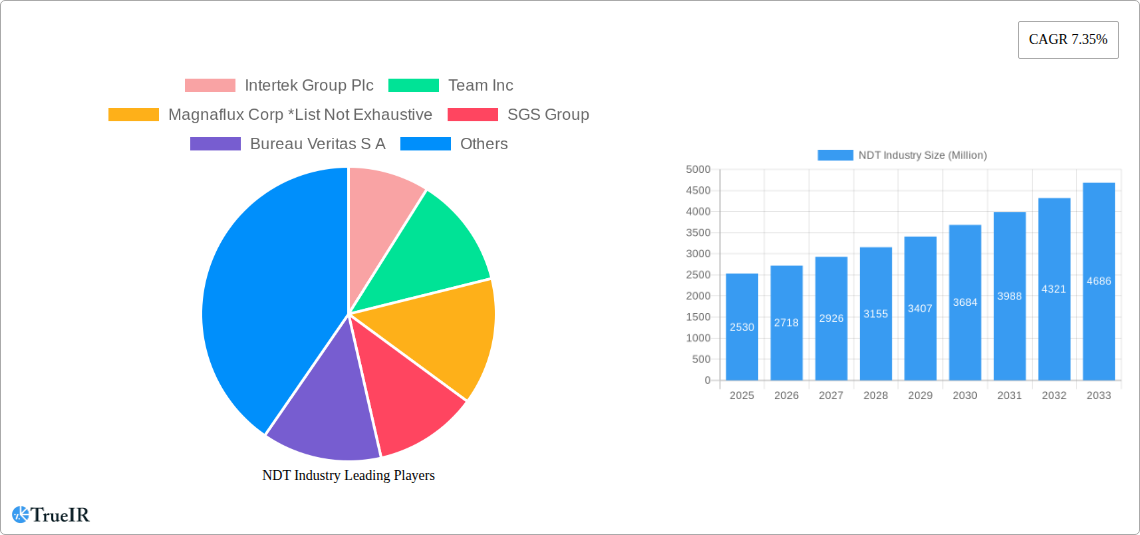

NDT Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Non-Destructive Testing (NDT) industry, projecting a market value exceeding $XX Billion by 2033. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. This report is essential for industry stakeholders, investors, and researchers seeking actionable insights into this rapidly evolving market.

NDT Industry Market Structure & Competitive Landscape

The Non-Destructive Testing (NDT) market is characterized by a moderately concentrated landscape, with a select group of major global players holding a significant share. Key industry leaders such as Intertek Group Plc, SGS Group, and Bureau Veritas S.A., alongside other prominent entities, engage in fierce competition. This dynamic environment actively fosters innovation, strategic partnerships, and impactful acquisitions. The Herfindahl-Hirschman Index (HHI) for the NDT market is estimated to be approximately [Insert HHI Value Here] (2025), substantiating a moderately concentrated market structure.

Innovation is predominantly propelled by advancements in testing methodologies. Notable breakthroughs include the integration of AI-powered image analysis for radiographic inspections, leading to more precise defect detection, and the development of significantly improved sensor technology for ultrasonic testing, enabling greater penetration and enhanced signal-to-noise ratios. Regulatory compliance, particularly stringent in sectors like aerospace and energy, exerts a profound influence on market dynamics, often mandating the use of advanced NDT techniques for safety assurance. While alternative inspection methods exist, they generally fall short in offering the unparalleled precision, reliability, and safety assurances that NDT techniques provide for critical infrastructure assessments.

The segmentation of end-users profoundly impacts market demand. The oil & gas, aerospace, and automotive industries stand out as major consumers of NDT services and equipment. The past five years have seen a notable surge in Mergers & Acquisitions (M&A) activity, with an estimated [Insert Number of M&A Here] mergers and acquisitions occurring between 2019 and 2024. This trend signifies a clear move towards consolidation and an intensified effort by major players to expand their market share and service portfolios.

- Market Concentration: Moderately concentrated, with an HHI estimated at [Insert HHI Value Here] (2025).

- Key Innovators: Driven by advancements in AI-powered image analysis and enhanced sensor technology for improved testing capabilities.

- Regulatory Influence: Significant impact from stringent safety and compliance regulations, particularly in high-risk industrial sectors.

- Product Substitutes: Limited availability of effective alternatives that can match the precision and safety assurance of NDT methods.

- Dominant End-Users: The oil & gas, aerospace, and automotive sectors represent the primary demand drivers.

- M&A Trends: An increasing trend of market consolidation, evidenced by approximately [Insert Number of M&A Here] M&A activities between 2019 and 2024.

NDT Industry Market Trends & Opportunities

The NDT market is poised for robust growth, propelled by several interconnected factors. The continuous global expansion of infrastructure development, coupled with an escalating demand for stringent quality control across diverse manufacturing processes, forms a strong foundational driver. Furthermore, the ever-increasing stringency of safety regulations across a multitude of industries significantly boosts the adoption of NDT solutions. The market size is projected to reach $XX Billion by 2033, reflecting a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025 to 2033.

Technological advancements are revolutionizing NDT operations. The increasing integration of robotics and automation into NDT workflows is dramatically reshaping market dynamics, leading to greater efficiency and reduced human error. Consumer preferences are clearly shifting towards inspection methods that are not only faster but also demonstrably more efficient and accurate. This evolution fuels the development and widespread adoption of advanced NDT technologies, particularly those that leverage the power of Artificial Intelligence (AI) and Machine Learning (ML) for data interpretation and predictive analysis. The competitive landscape remains dynamic, with established players continuously enhancing their service offerings and innovative emerging companies introducing novel solutions to the market. Market penetration rates exhibit regional variations, with developed economies typically demonstrating higher adoption rates compared to developing regions, presenting significant untapped opportunities.

The paramount importance of safety and reliability in critical infrastructure projects, alongside a growing emphasis on preventive maintenance strategies across industries, is set to be a significant catalyst for further market expansion. The heightened global awareness regarding safety standards and the imperative for regulatory compliance are further bolstering the growth trajectory of the NDT market.

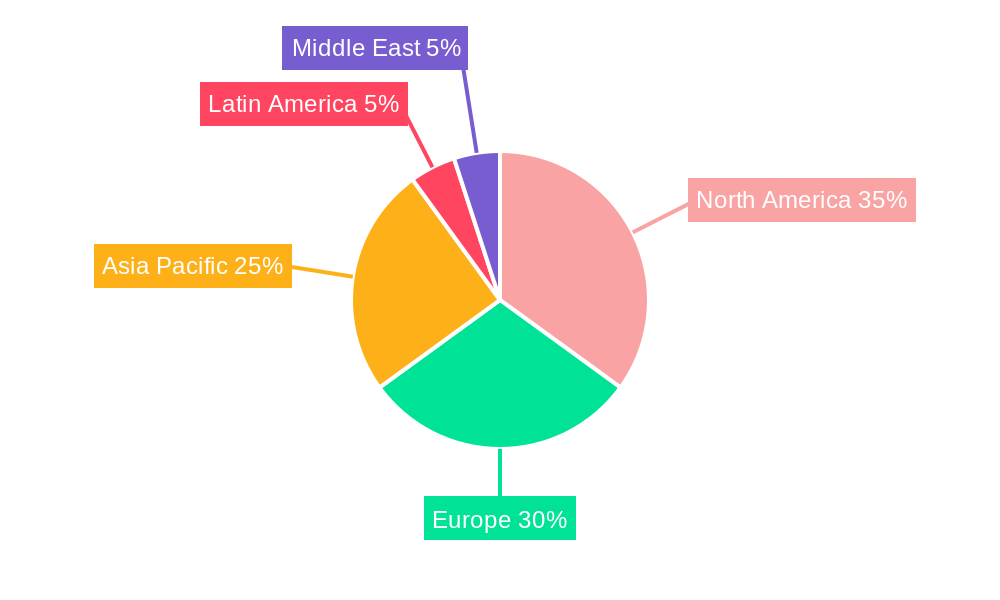

Dominant Markets & Segments in NDT Industry

The NDT market is geographically diverse, with North America and Europe currently dominating. However, the Asia-Pacific region is projected to experience significant growth, fueled by rapid industrialization and infrastructure development. Within testing technologies, Ultrasonic Testing and Radiography Testing hold the largest market share, primarily due to their versatility and applicability across various industries.

- Leading Region: North America, followed by Europe. Asia-Pacific is experiencing rapid growth.

- Leading Country: United States, followed by China and Germany.

- Leading Segment (by Testing Technology): Ultrasonic Testing and Radiography Testing.

- Leading Segment (by End-user Industry): Oil & Gas, Power & Energy, and Automotive & Transportation.

- Leading Segment (by Type): Services currently dominate, but equipment segment is showing promising growth.

Key Growth Drivers:

- Infrastructure Development: Significant investments in infrastructure projects globally.

- Stringent Safety Regulations: Increased emphasis on quality control and safety standards.

- Technological Advancements: Adoption of AI, automation, and advanced sensors.

NDT Industry Product Analysis

The NDT product landscape is in a state of continuous and rapid evolution, driven by a relentless pursuit of enhanced performance and user-friendliness. Recent significant innovations include the development of highly portable and wireless inspection devices, which offer unprecedented flexibility and ease of deployment in challenging environments. Advanced imaging techniques are now delivering improved resolution and clarity, enabling the detection of even finer defects. Furthermore, sophisticated automated data analysis software is streamlining the interpretation process, significantly reducing the time required for reporting and decision-making. The overarching trend is a clear shift towards integrating NDT methods seamlessly into automated manufacturing processes, paving the way for more streamlined production lines and substantial cost-effectiveness. The ongoing development of advanced sensor technologies is a cornerstone of this progress, offering heightened sensitivity, superior resolution, and the crucial capability for real-time data analysis.

Key Drivers, Barriers & Challenges in NDT Industry

Key Drivers: The NDT industry is experiencing robust growth fueled by several critical factors. The escalating demand from high-growth sectors such as renewable energy (wind, solar) and aerospace is a primary driver. An increasing global emphasis on quality control and safety assurance in manufacturing and infrastructure projects further propels market expansion. Additionally, continuous technological advancements are leading to more efficient, accurate, and cost-effective NDT solutions, making them more accessible and desirable.

Key Challenges & Restraints: Despite its positive trajectory, the NDT industry faces several significant hurdles. The high initial investment costs associated with acquiring advanced equipment and the necessity for comprehensive personnel training can be a deterrent for some organizations. Navigating the complex and often geographically varied regulatory environments presents a continuous challenge. The market also faces competition from cheaper, less sophisticated testing techniques that may suffice for non-critical applications. A persistent challenge is the shortage of skilled and certified NDT personnel. Furthermore, recent supply chain disruptions have introduced uncertainties in material availability and contributed to price fluctuations for essential components.

Growth Drivers in the NDT Industry Market

The NDT industry is propelled by increasing demand for safety and quality assurance across various sectors, particularly those involving critical infrastructure. Technological innovation, specifically the integration of AI and advanced sensors, is driving efficiency and accuracy, leading to higher adoption rates. Stringent regulatory standards, especially within the aerospace and energy industries, are also significant growth drivers. This is further fueled by the expansion of infrastructure projects worldwide and the need for preventive maintenance in existing facilities.

Challenges Impacting NDT Industry Growth

The industry faces challenges such as the high cost of advanced NDT equipment, a shortage of skilled personnel, and complex regulatory landscapes that vary across different regions. Supply chain disruptions and fluctuating material prices can also create uncertainty. Furthermore, competition from alternative testing methods and the need for continuous updates to stay ahead of technological advancements impose further challenges.

Key Players Shaping the NDT Industry Market

- Intertek Group Plc

- Team Inc

- Magnaflux Corp

- SGS Group

- Bureau Veritas S A

- Nikon Metrology NV

- Fujifilm Corporation

- TÜV Rheinland AG

- Mistras Group Inc

- Yxlon International Gmbh (Comet Holding Ag)

- Applus Services

- Olympus Corporation

- GE Measurement & Control Solutions

Significant NDT Industry Milestones

- 2021: Introduction of AI-powered flaw detection software by [Company Name].

- 2022: Acquisition of [Company A] by [Company B], expanding market share in the ultrasonic testing segment.

- 2023: Launch of a new portable X-ray inspection system by [Company Name], improving on-site testing efficiency.

- 2024: New regulatory guidelines issued in the European Union for NDT practices in the construction industry.

Future Outlook for NDT Industry Market

The NDT market is poised for continued growth, driven by technological advancements, increasing demand from various industries, and strengthening regulatory requirements. Strategic partnerships and collaborations are likely to increase, driving innovation and market expansion. The market's future is bright, with opportunities for substantial growth in emerging economies and specialized sectors. The integration of automation and AI will continue to enhance testing efficiency, accuracy and reduce operational costs.

NDT Industry Segmentation

-

1. Type

- 1.1. Equipment

- 1.2. Services

-

2. Testing Technology

- 2.1. Radiography Testing

- 2.2. Ultrasonic Testing

- 2.3. Magnetic Particle Testing

- 2.4. Liquid Penetrant Testing

- 2.5. Visual Inspection Testing

- 2.6. Eddy Current Testing

- 2.7. Other Testing Technologies

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Power and Energy

- 3.3. Construction

- 3.4. Automotive and Transportation

- 3.5. Aerospace

- 3.6. Defense

- 3.7. Other End User Industries

NDT Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

NDT Industry Regional Market Share

Geographic Coverage of NDT Industry

NDT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent Regulations Mandating Safety Standards; Increase in Demand for Flaw Detection to Reduce Repair Cost

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Workforce and Training Regulations

- 3.4. Market Trends

- 3.4.1. Power and Energy Sector Offers Potential Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NDT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Testing Technology

- 5.2.1. Radiography Testing

- 5.2.2. Ultrasonic Testing

- 5.2.3. Magnetic Particle Testing

- 5.2.4. Liquid Penetrant Testing

- 5.2.5. Visual Inspection Testing

- 5.2.6. Eddy Current Testing

- 5.2.7. Other Testing Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Power and Energy

- 5.3.3. Construction

- 5.3.4. Automotive and Transportation

- 5.3.5. Aerospace

- 5.3.6. Defense

- 5.3.7. Other End User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America NDT Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Equipment

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Testing Technology

- 6.2.1. Radiography Testing

- 6.2.2. Ultrasonic Testing

- 6.2.3. Magnetic Particle Testing

- 6.2.4. Liquid Penetrant Testing

- 6.2.5. Visual Inspection Testing

- 6.2.6. Eddy Current Testing

- 6.2.7. Other Testing Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Oil and Gas

- 6.3.2. Power and Energy

- 6.3.3. Construction

- 6.3.4. Automotive and Transportation

- 6.3.5. Aerospace

- 6.3.6. Defense

- 6.3.7. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe NDT Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Equipment

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Testing Technology

- 7.2.1. Radiography Testing

- 7.2.2. Ultrasonic Testing

- 7.2.3. Magnetic Particle Testing

- 7.2.4. Liquid Penetrant Testing

- 7.2.5. Visual Inspection Testing

- 7.2.6. Eddy Current Testing

- 7.2.7. Other Testing Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Oil and Gas

- 7.3.2. Power and Energy

- 7.3.3. Construction

- 7.3.4. Automotive and Transportation

- 7.3.5. Aerospace

- 7.3.6. Defense

- 7.3.7. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia NDT Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Equipment

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Testing Technology

- 8.2.1. Radiography Testing

- 8.2.2. Ultrasonic Testing

- 8.2.3. Magnetic Particle Testing

- 8.2.4. Liquid Penetrant Testing

- 8.2.5. Visual Inspection Testing

- 8.2.6. Eddy Current Testing

- 8.2.7. Other Testing Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Oil and Gas

- 8.3.2. Power and Energy

- 8.3.3. Construction

- 8.3.4. Automotive and Transportation

- 8.3.5. Aerospace

- 8.3.6. Defense

- 8.3.7. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand NDT Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Equipment

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Testing Technology

- 9.2.1. Radiography Testing

- 9.2.2. Ultrasonic Testing

- 9.2.3. Magnetic Particle Testing

- 9.2.4. Liquid Penetrant Testing

- 9.2.5. Visual Inspection Testing

- 9.2.6. Eddy Current Testing

- 9.2.7. Other Testing Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Oil and Gas

- 9.3.2. Power and Energy

- 9.3.3. Construction

- 9.3.4. Automotive and Transportation

- 9.3.5. Aerospace

- 9.3.6. Defense

- 9.3.7. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America NDT Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Equipment

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Testing Technology

- 10.2.1. Radiography Testing

- 10.2.2. Ultrasonic Testing

- 10.2.3. Magnetic Particle Testing

- 10.2.4. Liquid Penetrant Testing

- 10.2.5. Visual Inspection Testing

- 10.2.6. Eddy Current Testing

- 10.2.7. Other Testing Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Oil and Gas

- 10.3.2. Power and Energy

- 10.3.3. Construction

- 10.3.4. Automotive and Transportation

- 10.3.5. Aerospace

- 10.3.6. Defense

- 10.3.7. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa NDT Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Equipment

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Testing Technology

- 11.2.1. Radiography Testing

- 11.2.2. Ultrasonic Testing

- 11.2.3. Magnetic Particle Testing

- 11.2.4. Liquid Penetrant Testing

- 11.2.5. Visual Inspection Testing

- 11.2.6. Eddy Current Testing

- 11.2.7. Other Testing Technologies

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Oil and Gas

- 11.3.2. Power and Energy

- 11.3.3. Construction

- 11.3.4. Automotive and Transportation

- 11.3.5. Aerospace

- 11.3.6. Defense

- 11.3.7. Other End User Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Intertek Group Plc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Team Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Magnaflux Corp *List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 SGS Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bureau Veritas S A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nikon Metrology NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fujifilm Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 TÜV Rheinland AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Mistras Group Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Yxlon International Gmbh (Comet Holding Ag)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Applus Services

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Olympus Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 GE Measurement & Control Solutions

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global NDT Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America NDT Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America NDT Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America NDT Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 5: North America NDT Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 6: North America NDT Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America NDT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America NDT Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America NDT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe NDT Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe NDT Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe NDT Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 13: Europe NDT Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 14: Europe NDT Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe NDT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe NDT Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe NDT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia NDT Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia NDT Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia NDT Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 21: Asia NDT Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 22: Asia NDT Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia NDT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia NDT Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia NDT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand NDT Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Australia and New Zealand NDT Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Australia and New Zealand NDT Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 29: Australia and New Zealand NDT Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 30: Australia and New Zealand NDT Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Australia and New Zealand NDT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Australia and New Zealand NDT Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand NDT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America NDT Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Latin America NDT Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Latin America NDT Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 37: Latin America NDT Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 38: Latin America NDT Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America NDT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America NDT Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America NDT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa NDT Industry Revenue (Million), by Type 2025 & 2033

- Figure 43: Middle East and Africa NDT Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East and Africa NDT Industry Revenue (Million), by Testing Technology 2025 & 2033

- Figure 45: Middle East and Africa NDT Industry Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 46: Middle East and Africa NDT Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 47: Middle East and Africa NDT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Middle East and Africa NDT Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa NDT Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NDT Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global NDT Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 3: Global NDT Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global NDT Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global NDT Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global NDT Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 7: Global NDT Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global NDT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global NDT Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global NDT Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 13: Global NDT Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global NDT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global NDT Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global NDT Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 20: Global NDT Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global NDT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global NDT Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global NDT Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 27: Global NDT Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global NDT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global NDT Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global NDT Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 31: Global NDT Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 32: Global NDT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Mexico NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global NDT Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 37: Global NDT Industry Revenue Million Forecast, by Testing Technology 2020 & 2033

- Table 38: Global NDT Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global NDT Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: United Arab Emirates NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Saudi Arabia NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa NDT Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NDT Industry?

The projected CAGR is approximately 7.35%.

2. Which companies are prominent players in the NDT Industry?

Key companies in the market include Intertek Group Plc, Team Inc, Magnaflux Corp *List Not Exhaustive, SGS Group, Bureau Veritas S A, Nikon Metrology NV, Fujifilm Corporation, TÜV Rheinland AG, Mistras Group Inc, Yxlon International Gmbh (Comet Holding Ag), Applus Services, Olympus Corporation, GE Measurement & Control Solutions.

3. What are the main segments of the NDT Industry?

The market segments include Type, Testing Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.53 Million as of 2022.

5. What are some drivers contributing to market growth?

; Stringent Regulations Mandating Safety Standards; Increase in Demand for Flaw Detection to Reduce Repair Cost.

6. What are the notable trends driving market growth?

Power and Energy Sector Offers Potential Growth.

7. Are there any restraints impacting market growth?

; Lack of Skilled Workforce and Training Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NDT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NDT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NDT Industry?

To stay informed about further developments, trends, and reports in the NDT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence