Key Insights

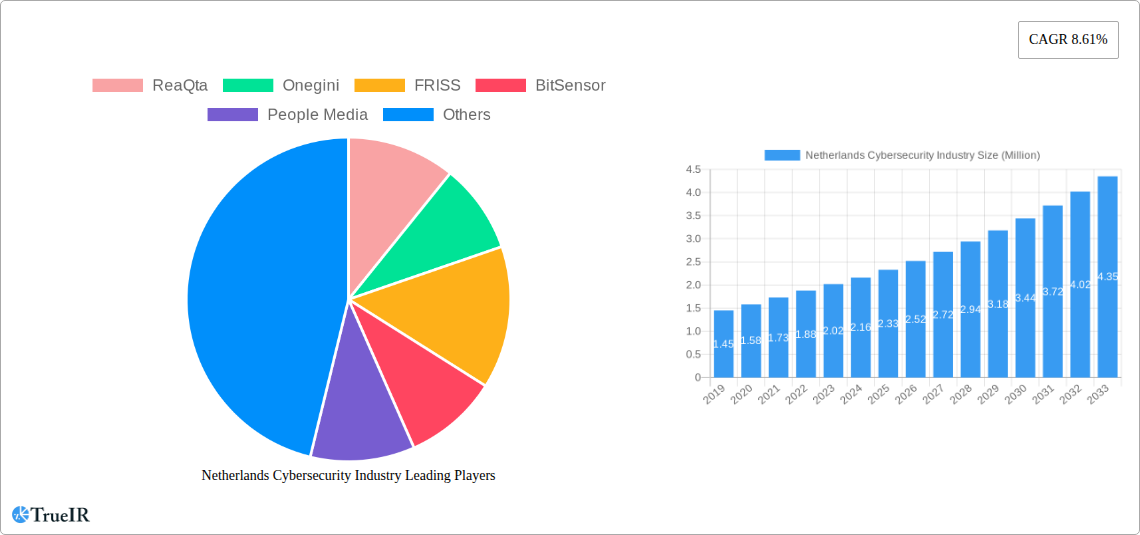

The Netherlands cybersecurity market is poised for substantial growth, projected to reach $2.16 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.61% through 2033. This robust expansion is driven by a confluence of factors, including escalating cyber threats targeting critical infrastructure, the rapid digital transformation across various sectors, and increasing regulatory compliance demands. The market's dynamism is further fueled by a growing awareness of the imperative for robust data security and identity and access management solutions, particularly within the BFSI, healthcare, and government sectors. Emerging trends such as the adoption of cloud security solutions, advancements in AI-powered threat detection, and the increasing demand for comprehensive infrastructure protection are shaping the competitive landscape. The Netherlands' strong digital economy and commitment to innovation position it as a key player in the European cybersecurity arena.

Netherlands Cybersecurity Industry Market Size (In Million)

Despite the immense growth potential, the market faces certain restraints. The persistent shortage of skilled cybersecurity professionals presents a significant challenge, potentially hindering the widespread implementation of advanced security solutions. Furthermore, the substantial initial investment required for sophisticated cybersecurity technologies can be a barrier for small and medium-sized enterprises (SMEs). However, the increasing reliance on cloud-based services for agility and scalability, coupled with the growing sophistication of cyberattacks, is compelling businesses to prioritize cybersecurity investments. The market is segmented across various security types, including cloud security, data security, and identity access management, with services and deployment models like cloud and on-premise catering to diverse organizational needs. Key end-user industries like IT and telecommunication, manufacturing, and government and defense are actively seeking advanced cybersecurity solutions to safeguard their operations and sensitive data.

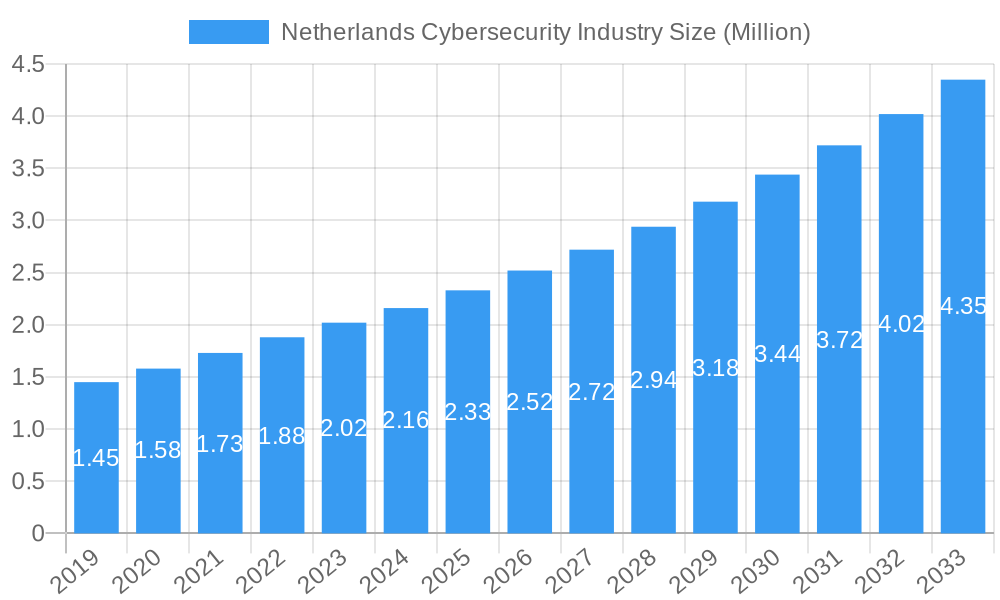

Netherlands Cybersecurity Industry Company Market Share

Netherlands Cybersecurity Industry Market Report: Unlocking Growth and Navigating Emerging Threats (2019-2033)

This comprehensive report provides an in-depth analysis of the Netherlands cybersecurity industry, encompassing a detailed market structure, competitive landscape, dynamic trends, and future outlook. Leveraging high-volume keywords such as "Netherlands cybersecurity," "cyber threat intelligence," "data security solutions," "cloud security Nederland," and "identity and access management Netherlands," this report is engineered for optimal SEO performance and aims to engage a broad audience of industry professionals, investors, and policymakers. The study period spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019-2024.

Netherlands Cybersecurity Industry Market Structure & Competitive Landscape

The Netherlands cybersecurity market exhibits a moderately concentrated structure, characterized by a blend of established global players and a burgeoning ecosystem of innovative local firms. The primary innovation drivers stem from the increasing sophistication of cyber threats, the rapid adoption of digital technologies, and a strong governmental push for digital sovereignty and resilience. Regulatory impacts are significant, with GDPR and NIS2 directives shaping compliance requirements and driving demand for advanced security solutions. Product substitutes exist, particularly in the commoditized segments of basic antivirus and firewall solutions, pushing vendors to differentiate through specialized offerings like advanced threat detection and managed security services.

End-user segmentation is diverse, with the BFSI, IT and Telecommunication, and Government & Defense sectors representing the largest consumers of cybersecurity solutions. The historical period (2019-2024) saw a steady increase in cybersecurity investments across all segments, driven by high-profile breaches and a growing awareness of digital risks. Mergers and acquisitions (M&A) trends indicate a consolidation of specialized capabilities, with larger entities acquiring niche players to bolster their portfolios. For instance, the acquisition of OneWelcome by Thales for €100 million in July 2022 exemplifies this trend, integrating advanced Customer Identity and Access Management (CIAM) capabilities. Current concentration ratios are estimated to be around 55-65% for the top 5 players, with significant room for smaller, specialized companies to gain market share.

Netherlands Cybersecurity Industry Market Trends & Opportunities

The Netherlands cybersecurity industry is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period (2025-2033). This robust expansion is fueled by several interconnected trends. Firstly, the escalating sophistication and volume of cyber threats, including ransomware, phishing, and advanced persistent threats (APTs), necessitate continuous investment in advanced security measures. The increasing digital transformation across all sectors, from e-commerce to critical infrastructure, expands the attack surface, thereby creating a perpetual demand for comprehensive cybersecurity solutions.

Technological shifts are also playing a pivotal role. The widespread adoption of cloud computing, the Internet of Things (IoT), and artificial intelligence (AI) presents both opportunities and challenges. While these technologies offer efficiency and innovation, they also introduce new vulnerabilities that require specialized security expertise. AI-powered threat detection and response systems are becoming increasingly crucial, offering predictive capabilities and automated defense mechanisms. Consumer preferences are evolving, with individuals and businesses alike demanding greater transparency and control over their data security. This is driving the market for privacy-enhancing technologies and robust data security solutions.

Competitive dynamics are intensifying, with a constant race to develop and deploy cutting-edge security products and services. The market is witnessing a rise in managed security service providers (MSSPs) and security operations centers (SOCs) as organizations increasingly outsource their cybersecurity needs to specialized experts. Opportunities abound in niche segments such as industrial control system (ICS) security, supply chain security, and AI-driven security analytics. The Dutch government's commitment to fostering a secure digital ecosystem, coupled with significant R&D investments, further bolsters the industry's growth trajectory. Market penetration rates for advanced security solutions are projected to rise from an estimated 60% in 2025 to over 85% by 2033.

Dominant Markets & Segments in Netherlands Cybersecurity Industry

Within the Netherlands cybersecurity industry, Cloud Security is emerging as a dominant segment, driven by the accelerated migration of businesses and government entities to cloud-based infrastructure and services. This trend is particularly pronounced in the IT and Telecommunication sector, which acts as both a provider and a significant consumer of cloud security solutions. The demand for securing sensitive data and applications in public, private, and hybrid cloud environments is unparalleled. Key growth drivers include the need for scalable and flexible security architectures, regulatory compliance mandates for data residency, and the increasing complexity of multi-cloud deployments.

The BFSI sector also represents a substantial and dominant market, driven by stringent regulatory requirements and the high value of financial data, making it a prime target for cybercriminals. Here, Identity and Access Management (IAM) solutions are paramount, ensuring secure authentication, authorization, and access control for millions of users and transactions. The increasing adoption of digital banking services and FinTech innovations further amplifies the need for robust IAM capabilities, including multi-factor authentication and privileged access management.

Data Security as a security type is gaining significant traction across all end-user segments, fueled by heightened awareness of data privacy and the economic value of information. The Government & Defense sector, along with Healthcare, demonstrates a strong reliance on advanced data security measures to protect sensitive citizen information and national security assets. Key growth drivers in this segment include the increasing volume of data generated and stored, the need for granular data access controls, encryption technologies, and data loss prevention (DLP) strategies.

In terms of deployment, Cloud-based solutions are rapidly outpacing On-premise deployments, reflecting the broader shift in IT infrastructure. However, on-premise solutions remain critical for organizations with highly sensitive data or specific legacy system requirements, particularly within the Manufacturing sector for protecting Operational Technology (OT) and industrial control systems. Services are becoming increasingly crucial, with Managed Security Services (MSS) and threat intelligence platforms playing a vital role in addressing the cybersecurity skills gap and the complexity of modern threat landscapes. The IT and Telecommunication sector, with its inherent reliance on technological advancement and service delivery, leads in the adoption of integrated security services.

Netherlands Cybersecurity Industry Product Analysis

The Netherlands cybersecurity industry is characterized by continuous product innovation, with a strong focus on advanced threat detection, prevention, and response. Companies are developing sophisticated solutions leveraging AI and machine learning for proactive threat identification, anomaly detection, and automated incident remediation. Key applications include cloud security posture management, identity and access management solutions with advanced biometric authentication, and data loss prevention tools designed for complex hybrid environments. Competitive advantages are being built around integration capabilities, real-time threat intelligence feeds, and user-friendly interfaces that empower organizations to manage their security posture effectively. Technological advancements are enabling more granular control, faster incident response times, and enhanced resilience against evolving cyber threats.

Key Drivers, Barriers & Challenges in Netherlands Cybersecurity Industry

Key Drivers:

- Increasing Sophistication of Cyber Threats: The constant evolution of cyberattack methods necessitates ongoing investment in advanced security solutions.

- Digital Transformation Acceleration: The widespread adoption of cloud, IoT, and AI expands the attack surface, driving demand for comprehensive security.

- Stringent Regulatory Landscape: Directives like GDPR and NIS2 mandate robust security measures, creating a compliance-driven market.

- Growing Awareness of Data Value: The increasing recognition of data as a critical asset fuels demand for data security and privacy solutions.

- Governmental Support and Investment: National initiatives to bolster cybersecurity resilience and foster innovation provide significant impetus.

Barriers & Challenges:

- Cybersecurity Skills Shortage: A persistent lack of qualified cybersecurity professionals hinders effective implementation and management of security solutions.

- High Implementation Costs: Advanced cybersecurity solutions can be expensive, posing a barrier for small and medium-sized enterprises (SMEs).

- Interoperability Issues: Integrating disparate security solutions from various vendors can be complex and resource-intensive.

- Supply Chain Vulnerabilities: Reliance on third-party software and hardware introduces potential risks that are difficult to fully mitigate.

- Evolving Threat Landscape: The rapid pace of threat evolution requires continuous adaptation and investment to stay ahead of attackers.

Growth Drivers in the Netherlands Cybersecurity Industry Market

The Netherlands cybersecurity industry is experiencing robust growth driven by a confluence of technological, economic, and policy factors. The relentless advancement of cyber threats, from sophisticated ransomware attacks to state-sponsored espionage, acts as a primary catalyst, compelling organizations to continuously upgrade their defenses. Furthermore, the accelerating pace of digital transformation across all sectors, encompassing cloud adoption, IoT proliferation, and the integration of AI, inherently expands the attack surface, thereby fueling the demand for comprehensive cybersecurity solutions. Regulatory mandates, such as the General Data Protection Regulation (GDPR) and the upcoming NIS2 directive, play a crucial role by enforcing stringent data protection and cybersecurity requirements, translating directly into market opportunities. The growing economic value placed on data as a critical business asset also underpins the need for advanced data security and privacy solutions.

Challenges Impacting Netherlands Cybersecurity Industry Growth

Despite the significant growth potential, the Netherlands cybersecurity industry faces several critical challenges that can impede its expansion. A persistent and pervasive shortage of skilled cybersecurity professionals remains a major restraint, impacting the ability of organizations to effectively implement, manage, and monitor their security infrastructure. The high cost associated with deploying cutting-edge cybersecurity solutions can present a significant barrier for small and medium-sized enterprises (SMEs), limiting their access to advanced protection. Furthermore, the complexity of integrating disparate security solutions from various vendors often leads to interoperability issues, creating gaps in security coverage and increasing operational overhead. The inherent vulnerabilities within global supply chains, encompassing both software and hardware components, introduce unpredictable risks that are challenging to fully mitigate.

Key Players Shaping the Netherlands Cybersecurity Industry Market

- ReaQta

- Onegini

- FRISS

- BitSensor

- People Media

- LogSentinel

- RedSocks

- EclecticIQ

- SecurityMatters

- eharmony Inc

- Madaster

- Praesidion Smart Security Solutions

- Keezel

Significant Netherlands Cybersecurity Industry Industry Milestones

- July 2022: Thales announces agreement to acquire OneWelcome for €100 million, bolstering its cybersecurity expansion strategy by integrating OneWelcome's leading Customer Identity and Access Management capabilities to offer a comprehensive Identity Platform.

Future Outlook for Netherlands Cybersecurity Industry Market

The future outlook for the Netherlands cybersecurity industry is exceptionally strong, driven by a persistent and evolving threat landscape, coupled with increasing digitalization across all economic sectors. Strategic opportunities lie in the continued growth of cloud security, identity and access management, and the burgeoning demand for AI-powered security analytics and managed security services. Government initiatives aimed at fostering innovation and national digital resilience will continue to be a significant growth catalyst. The market potential is substantial, with an anticipated sustained high CAGR, indicating a robust demand for advanced cybersecurity solutions and services as organizations strive to protect their digital assets and maintain business continuity in an increasingly interconnected world.

Netherlands Cybersecurity Industry Segmentation

-

1. Offer

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government & Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Netherlands Cybersecurity Industry Segmentation By Geography

- 1. Netherlands

Netherlands Cybersecurity Industry Regional Market Share

Geographic Coverage of Netherlands Cybersecurity Industry

Netherlands Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Cyberattacks in Different Industry; Growing Need of Identity Access Management

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure

- 3.4. Market Trends

- 3.4.1. The Netherlands Introduces Legislation to Make Working from Home a Legal Right

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offer

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government & Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Offer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ReaQta

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Onegini

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FRISS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BitSensor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 People Media

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LogSentinel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RedSocks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EclecticIQ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SecurityMatters

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 eharmony Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Madaster

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Praesidion Smart Security Solutions

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Keezel

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 ReaQta

List of Figures

- Figure 1: Netherlands Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Cybersecurity Industry Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Cybersecurity Industry Revenue Million Forecast, by Offer 2020 & 2033

- Table 2: Netherlands Cybersecurity Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Netherlands Cybersecurity Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Netherlands Cybersecurity Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Netherlands Cybersecurity Industry Revenue Million Forecast, by Offer 2020 & 2033

- Table 6: Netherlands Cybersecurity Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Netherlands Cybersecurity Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Netherlands Cybersecurity Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Cybersecurity Industry?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the Netherlands Cybersecurity Industry?

Key companies in the market include ReaQta, Onegini, FRISS, BitSensor, People Media, LogSentinel, RedSocks, EclecticIQ, SecurityMatters, eharmony Inc, Madaster, Praesidion Smart Security Solutions, Keezel.

3. What are the main segments of the Netherlands Cybersecurity Industry?

The market segments include Offer, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Cyberattacks in Different Industry; Growing Need of Identity Access Management.

6. What are the notable trends driving market growth?

The Netherlands Introduces Legislation to Make Working from Home a Legal Right.

7. Are there any restraints impacting market growth?

Lack of Infrastructure.

8. Can you provide examples of recent developments in the market?

July 2022 - As part of its cybersecurity expansion strategy, Thales has signed an agreement to acquire OneWelcome, a European leader in the rapidly growing market of Customer Identity and Access Management market, for €100 million. Thales' existing Identity services (secure credential enrollment, issuance, and management, Know Your Customer, and so on) will be supplemented by OneWelcome's strong digital identity lifecycle management capabilities to provide the industry's most comprehensive Identity Platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Netherlands Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence