Key Insights

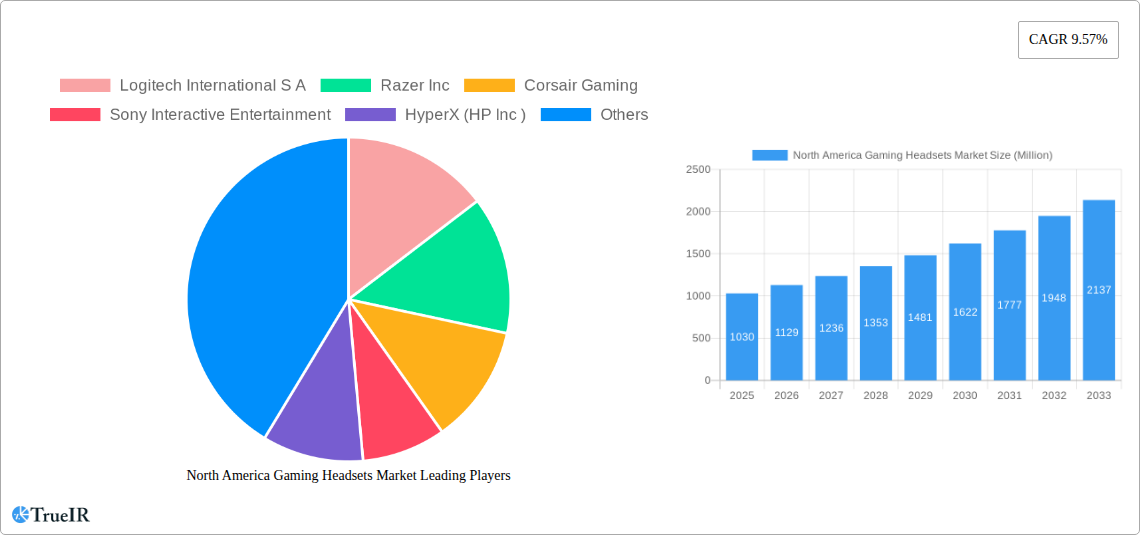

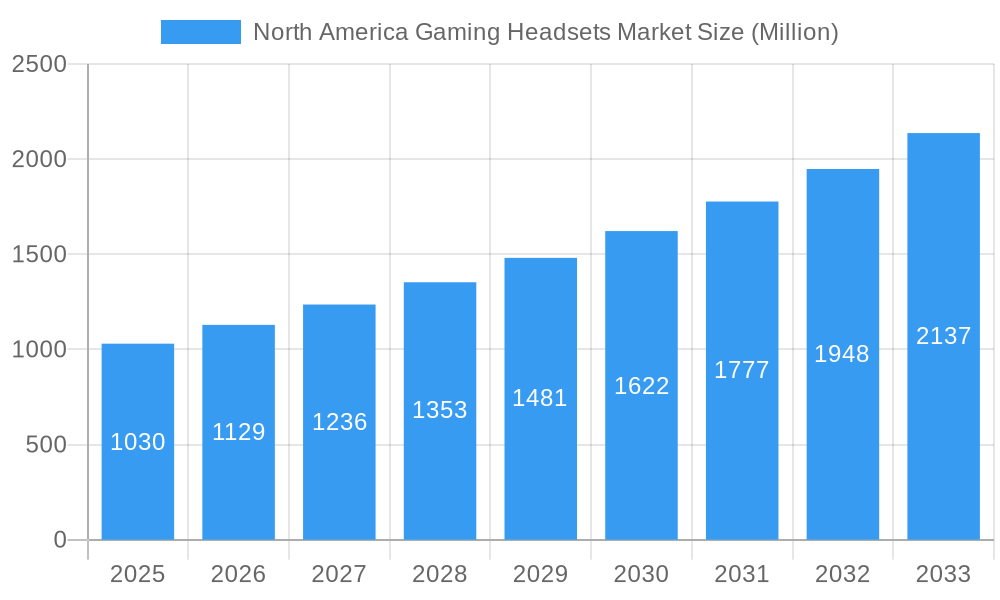

The North America Gaming Headsets Market is poised for robust expansion, with an estimated market size of $1,030 million in 2025. This growth is propelled by a significant Compound Annual Growth Rate (CAGR) of 9.57%, projected to continue through 2033. This upward trajectory is primarily driven by the increasing popularity of esports, the proliferation of high-fidelity gaming experiences across consoles and PCs, and the growing demand for immersive audio solutions that enhance gameplay. The market is also benefiting from advancements in wireless technology, offering greater freedom of movement, and the continuous release of innovative products featuring superior sound quality, comfort, and integrated features like advanced microphone systems. The burgeoning gaming community, coupled with increased disposable income allocated towards gaming peripherals, further solidifies the positive outlook for this sector.

North America Gaming Headsets Market Market Size (In Billion)

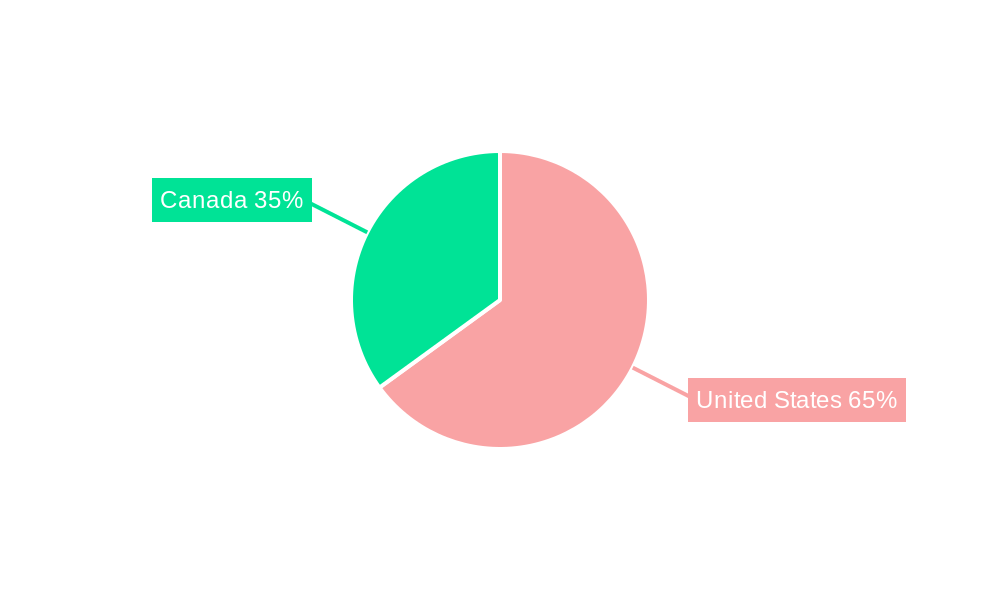

The market segmentation reveals a balanced demand for both console and PC headsets, reflecting the diverse gaming ecosystem. Connectivity-wise, wireless headsets are gaining significant traction due to their convenience, though wired options continue to cater to gamers prioritizing latency-free performance and affordability. Online sales channels are increasingly dominating the market, offering wider accessibility and competitive pricing. Geographically, the United States and Canada represent key markets, with strong consumer engagement and a well-established gaming culture. Key players like Logitech International S.A., Razer Inc., Corsair Gaming, Sony Interactive Entertainment, and HyperX (HP Inc.) are actively innovating and competing, introducing feature-rich products that cater to both casual and professional gamers. Despite the growth, potential restraints could include intense price competition, rapid technological obsolescence, and potential supply chain disruptions, although the overall trend indicates a dynamic and expanding market.

North America Gaming Headsets Market Company Market Share

North America Gaming Headsets Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the North America Gaming Headsets Market. Leveraging high-volume keywords such as "gaming headsets," "PC gaming," "console gaming," "wireless headsets," "esports audio," and "gaming peripherals," this report is meticulously crafted for industry professionals, investors, and technology enthusiasts seeking critical market intelligence. Dive deep into market structure, trends, dominant segments, product innovations, key players, and future outlook, with a focus on the period between 2019 and 2033, with a base and estimated year of 2025.

North America Gaming Headsets Market Market Structure & Competitive Landscape

The North America gaming headsets market exhibits a moderately concentrated structure, characterized by the presence of established global electronics giants and specialized gaming peripheral manufacturers. Innovation drivers are heavily influenced by advancements in audio technology, such as spatial audio and noise cancellation, alongside the increasing demand for wireless connectivity and ergonomic designs. Regulatory impacts, while generally less stringent in this consumer electronics sector, primarily revolve around product safety and compliance standards, with no significant market-altering policies identified. Product substitutes for gaming headsets include traditional headphones with microphones and integrated audio solutions within gaming consoles, though these offer a less immersive and specialized experience. End-user segmentation reveals a strong overlap between PC and console gamers, with a growing segment of mobile gamers seeking enhanced audio solutions. Merger and acquisition (M&A) trends are observed as companies aim to expand their product portfolios, gain market share, and acquire innovative technologies. Historical M&A volumes indicate a steady interest in consolidating the gaming peripheral space. Key companies like Logitech International S.A., Razer Inc., and Corsair Gaming are prominent, frequently engaging in strategic partnerships and product development to maintain their competitive edge. The competitive landscape is further shaped by a growing number of niche players offering specialized audio solutions.

North America Gaming Headsets Market Market Trends & Opportunities

The North America gaming headsets market is poised for substantial growth, driven by a confluence of evolving technological landscapes, shifting consumer preferences, and the ever-expanding esports ecosystem. The market size for gaming headsets in North America is projected to reach approximately $3,500 Million by 2025, with a Compound Annual Growth Rate (CAGR) of around 8.5% forecasted from 2025 to 2033. This robust expansion is fueled by the increasing penetration of gaming across demographics, particularly among millennials and Generation Z, who prioritize immersive gaming experiences. Technological advancements, including the integration of advanced audio drivers, virtual surround sound, and AI-powered noise cancellation, are becoming standard features, pushing the boundaries of audio fidelity. The demand for wireless gaming headsets continues to surge, offering unparalleled freedom of movement and a clutter-free gaming setup, further contributing to market penetration rates which are estimated to be over 60% for gaming households by 2025.

Consumer preferences are increasingly leaning towards headsets that offer a balance of high-fidelity audio, comfort for extended gaming sessions, and seamless compatibility with multiple gaming platforms. The rise of esports, with its professional tournaments and massive online viewership, has significantly elevated the importance of high-performance gaming headsets, driving demand for premium and specialized audio gear. This trend creates significant opportunities for manufacturers to innovate in areas such as low-latency wireless technology, customizable audio profiles, and integrated communication features. Furthermore, the growing popularity of cloud gaming services and cross-platform play is expanding the addressable market for gaming headsets, as gamers seek consistent audio experiences across different devices. The market is also witnessing a trend towards "prosumer" audio solutions, where gamers are willing to invest in higher-end headsets that offer professional-grade audio quality and build.

Competitive dynamics are intensifying, with both established players and emerging brands vying for market dominance. Companies are focusing on product differentiation through unique features, strategic marketing campaigns targeting specific gaming communities, and strategic collaborations with game developers and esports organizations. The aftermarket for gaming accessories, including headsets, is robust, offering continuous opportunities for sales and revenue generation. The increasing accessibility of gaming hardware and software, coupled with the ongoing digital transformation across various sectors, further solidifies the upward trajectory of the North America gaming headsets market. The report forecasts market growth to exceed $6,000 Million by 2033, underscoring the sustained appeal and essential role of gaming headsets in the modern entertainment landscape.

Dominant Markets & Segments in North America Gaming Headsets Market

The North America gaming headsets market is dominated by the United States, which represents the largest consumer base for gaming hardware and software. This dominance is attributed to a combination of factors including a large, affluent population with a high disposable income for entertainment and gaming, a mature esports infrastructure, and widespread adoption of high-speed internet, facilitating online multiplayer gaming and streaming.

Within the United States, the PC Headset segment holds a significant share, driven by the enduring popularity of PC gaming, the growth of competitive PC esports, and the increasing use of PCs for a multitude of entertainment and productivity tasks that benefit from superior audio.

- Key Growth Drivers in the United States:

- High disposable income enabling premium product purchases.

- Vibrant esports ecosystem with numerous tournaments and professional teams.

- Widespread availability of high-speed internet connectivity.

- Strong presence of major gaming hardware and software companies.

The Wireless Connectivity Type segment is experiencing the most rapid growth across North America, including Canada. This surge is a direct result of consumer demand for convenience, freedom of movement, and a desire to minimize cable clutter. Advances in wireless technology have significantly improved latency and audio quality, making wireless headsets nearly indistinguishable from their wired counterparts for most gaming applications.

- Key Growth Drivers for Wireless Headsets:

- Technological advancements in low-latency wireless technology.

- Increasing demand for user convenience and a tangle-free experience.

- Growing adoption of wireless gaming consoles and peripherals.

- Enhanced battery life and portability.

In terms of Sales Channel, the Online segment is outperforming retail, driven by e-commerce convenience, wider product selection, competitive pricing, and direct-to-consumer (DTC) strategies employed by manufacturers. Online platforms allow for easier price comparison and access to user reviews, influencing purchasing decisions.

- Key Growth Drivers for Online Sales Channel:

- Convenience of 24/7 shopping and home delivery.

- Wider product availability and competitive pricing.

- Detailed product information and customer reviews.

- Direct engagement opportunities for brands.

Canada also represents a significant and growing market for gaming headsets, mirroring many of the trends seen in the United States. While the market size is smaller, the adoption rate of gaming and advanced peripherals is high, supported by a technologically savvy population and a robust gaming culture. The demand for both PC and console headsets, along with wireless connectivity, is strong.

- Key Growth Drivers in Canada:

- Growing gaming community and increasing interest in esports.

- High adoption rate of gaming consoles and PCs.

- Increasing consumer spending on entertainment electronics.

The Console Headset segment remains a cornerstone of the market, directly tied to the sales and popularity of gaming consoles like PlayStation and Xbox. As new console generations are released, the demand for compatible, high-quality gaming headsets escalates.

- Key Growth Drivers for Console Headsets:

- New console releases and hardware upgrades.

- Popularity of console gaming genres like RPGs and action-adventure.

- Integration of immersive audio experiences in console games.

North America Gaming Headsets Market Product Analysis

The North America gaming headsets market is characterized by a continuous stream of product innovations focused on enhancing the immersive gaming experience. Manufacturers are increasingly incorporating advanced features such as 7.1 virtual surround sound, high-fidelity audio drivers for crisp highs and deep bass, and active noise cancellation (ANC) for reduced distractions. Wireless technologies are rapidly evolving, offering lower latency and longer battery life, making them highly competitive with wired options. Ergonomic designs, breathable materials, and customizable aesthetics are also key competitive advantages, catering to prolonged gaming sessions and individual player preferences. The integration of advanced microphone technology, including noise suppression and voice clarity enhancements, further strengthens the appeal of these products for team-based gaming and streaming.

Key Drivers, Barriers & Challenges in North America Gaming Headsets Market

Key Drivers: The North America gaming headsets market is propelled by several key drivers. The ever-expanding global gaming industry, with its growing player base and increasing engagement in esports, fuels the demand for immersive audio solutions. Technological advancements in audio fidelity, wireless connectivity, and microphone technology continuously push product innovation and consumer interest. The increasing disposable income and a youthful demographic with a high propensity for gaming entertainment also contribute significantly. Furthermore, the rise of content creation and streaming platforms necessitates high-quality audio equipment for both creators and viewers.

Barriers & Challenges: Despite the strong growth, the market faces certain barriers and challenges. Supply chain disruptions, particularly those impacting the availability of essential electronic components, can lead to production delays and increased costs, potentially impacting pricing and availability. Intense competition among numerous brands, ranging from global giants to niche manufacturers, can lead to price wars and reduced profit margins. Evolving consumer preferences and the rapid pace of technological change require continuous investment in research and development to stay relevant. Regulatory hurdles related to product safety and environmental standards, while generally manageable, add to compliance costs. The presence of substitutes like built-in speaker systems or standard headphones, though inferior for dedicated gaming, can still capture a segment of less discerning consumers.

Growth Drivers in the North America Gaming Headsets Market Market

The growth of the North America gaming headsets market is primarily driven by the sustained expansion of the global gaming industry. The increasing adoption of esports as a mainstream entertainment form, with its professional leagues and massive viewership, directly translates to a higher demand for high-performance gaming audio equipment. Technological advancements play a crucial role, with manufacturers consistently introducing innovations in areas such as virtual surround sound, low-latency wireless connectivity, and superior microphone quality, all of which enhance the immersive gaming experience. Furthermore, the growing accessibility of gaming across various platforms, including consoles, PCs, and mobile devices, coupled with the rising disposable income of target demographics, supports robust sales. Government policies promoting digital infrastructure and internet accessibility indirectly support the growth of online gaming and, consequently, gaming peripherals.

Challenges Impacting North America Gaming Headsets Market Growth

Several challenges can impact the growth of the North America gaming headsets market. Supply chain vulnerabilities, as evidenced by recent global events, can lead to component shortages and increased manufacturing costs, potentially affecting product availability and pricing. Intense competition among a multitude of players, including both established brands and emerging entrants, can exert downward pressure on profit margins and necessitate significant investment in marketing and product differentiation. Rapid technological obsolescence requires continuous R&D investment to keep pace with evolving consumer expectations and emerging audio technologies. Regulatory complexities, such as evolving product safety standards and environmental compliance requirements, can add to operational costs and development timelines. The threat of substitutes, such as integrated audio solutions on gaming consoles or high-end consumer headphones, can also present a challenge, albeit for a segment of the market seeking less specialized solutions.

Key Players Shaping the North America Gaming Headsets Market Market

- Logitech International S.A.

- Razer Inc.

- Corsair Gaming

- Sony Interactive Entertainment

- HyperX (HP Inc.)

- ASUSTeK Computer Inc.

- Microsoft Corporation

- Harman International Industries Incorporated

- SteelSeries

- Turtle Beach Corporation

Significant North America Gaming Headsets Market Industry Milestones

- July 2024: Chinese electronics firm OXS unveiled its latest gaming headset, the OXS Storm G2 Wireless, targeting budget-conscious gamers in the USA. The headset is available on Amazon and the official OXS website, featuring a suite of gaming-centric functionalities that aim to enhance affordability and performance.

- May 2024: SteelSeries expanded its Arctis Nova range with the launch of the Arctis Nova 5 series headsets. This launch was complemented by the introduction of the cutting-edge Nova 5 Companion App, designed to elevate the gaming audio experience for Xbox and PlayStation users by enhancing audio quality and offering a wireless gaming headset that balances premium features with affordability.

Future Outlook for North America Gaming Headsets Market Market

The future outlook for the North America gaming headsets market remains exceptionally bright, driven by sustained industry growth and continuous technological innovation. Strategic opportunities lie in the further integration of AI for personalized audio experiences, advanced haptic feedback for enhanced immersion, and more sophisticated wireless technologies addressing latency and battery life concerns. The increasing demand for multi-platform compatibility will also be a key focus, enabling gamers to seamlessly transition between consoles, PCs, and mobile devices. As esports continues its mainstream ascent and cloud gaming gains traction, the importance of high-quality, reliable gaming headsets will only be amplified, presenting significant market potential for manufacturers who can deliver on performance, comfort, and value. The market is expected to witness continued investment in research and development, leading to even more sophisticated and user-centric audio solutions in the coming years.

North America Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Gaming Headsets Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Gaming Headsets Market Regional Market Share

Geographic Coverage of North America Gaming Headsets Market

North America Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment

- 3.4. Market Trends

- 3.4.1. Console Headset Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Gaming Headsets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. United States North America Gaming Headsets Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6.1.1. Console Headset

- 6.1.2. PC Headset

- 6.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Retail

- 6.3.2. Online

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7. Canada North America Gaming Headsets Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7.1.1. Console Headset

- 7.1.2. PC Headset

- 7.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Retail

- 7.3.2. Online

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Logitech International S A

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Razer Inc

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Corsair Gaming

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Sony Interactive Entertainment

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 HyperX (HP Inc )

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 ASUSTeK Computer Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Microsoft Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Harman International Industries Incorporated

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 SteelSeries

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Turtle Beach Corporatio

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Logitech International S A

List of Figures

- Figure 1: Global North America Gaming Headsets Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North America Gaming Headsets Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States North America Gaming Headsets Market Revenue (Million), by Compatibility Type 2025 & 2033

- Figure 4: United States North America Gaming Headsets Market Volume (Billion), by Compatibility Type 2025 & 2033

- Figure 5: United States North America Gaming Headsets Market Revenue Share (%), by Compatibility Type 2025 & 2033

- Figure 6: United States North America Gaming Headsets Market Volume Share (%), by Compatibility Type 2025 & 2033

- Figure 7: United States North America Gaming Headsets Market Revenue (Million), by Connectivity Type 2025 & 2033

- Figure 8: United States North America Gaming Headsets Market Volume (Billion), by Connectivity Type 2025 & 2033

- Figure 9: United States North America Gaming Headsets Market Revenue Share (%), by Connectivity Type 2025 & 2033

- Figure 10: United States North America Gaming Headsets Market Volume Share (%), by Connectivity Type 2025 & 2033

- Figure 11: United States North America Gaming Headsets Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 12: United States North America Gaming Headsets Market Volume (Billion), by Sales Channel 2025 & 2033

- Figure 13: United States North America Gaming Headsets Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 14: United States North America Gaming Headsets Market Volume Share (%), by Sales Channel 2025 & 2033

- Figure 15: United States North America Gaming Headsets Market Revenue (Million), by Geography 2025 & 2033

- Figure 16: United States North America Gaming Headsets Market Volume (Billion), by Geography 2025 & 2033

- Figure 17: United States North America Gaming Headsets Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: United States North America Gaming Headsets Market Volume Share (%), by Geography 2025 & 2033

- Figure 19: United States North America Gaming Headsets Market Revenue (Million), by Country 2025 & 2033

- Figure 20: United States North America Gaming Headsets Market Volume (Billion), by Country 2025 & 2033

- Figure 21: United States North America Gaming Headsets Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: United States North America Gaming Headsets Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Canada North America Gaming Headsets Market Revenue (Million), by Compatibility Type 2025 & 2033

- Figure 24: Canada North America Gaming Headsets Market Volume (Billion), by Compatibility Type 2025 & 2033

- Figure 25: Canada North America Gaming Headsets Market Revenue Share (%), by Compatibility Type 2025 & 2033

- Figure 26: Canada North America Gaming Headsets Market Volume Share (%), by Compatibility Type 2025 & 2033

- Figure 27: Canada North America Gaming Headsets Market Revenue (Million), by Connectivity Type 2025 & 2033

- Figure 28: Canada North America Gaming Headsets Market Volume (Billion), by Connectivity Type 2025 & 2033

- Figure 29: Canada North America Gaming Headsets Market Revenue Share (%), by Connectivity Type 2025 & 2033

- Figure 30: Canada North America Gaming Headsets Market Volume Share (%), by Connectivity Type 2025 & 2033

- Figure 31: Canada North America Gaming Headsets Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 32: Canada North America Gaming Headsets Market Volume (Billion), by Sales Channel 2025 & 2033

- Figure 33: Canada North America Gaming Headsets Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 34: Canada North America Gaming Headsets Market Volume Share (%), by Sales Channel 2025 & 2033

- Figure 35: Canada North America Gaming Headsets Market Revenue (Million), by Geography 2025 & 2033

- Figure 36: Canada North America Gaming Headsets Market Volume (Billion), by Geography 2025 & 2033

- Figure 37: Canada North America Gaming Headsets Market Revenue Share (%), by Geography 2025 & 2033

- Figure 38: Canada North America Gaming Headsets Market Volume Share (%), by Geography 2025 & 2033

- Figure 39: Canada North America Gaming Headsets Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Canada North America Gaming Headsets Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Canada North America Gaming Headsets Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Canada North America Gaming Headsets Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 2: Global North America Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2020 & 2033

- Table 3: Global North America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 4: Global North America Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2020 & 2033

- Table 5: Global North America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: Global North America Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2020 & 2033

- Table 7: Global North America Gaming Headsets Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global North America Gaming Headsets Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 9: Global North America Gaming Headsets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global North America Gaming Headsets Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global North America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 12: Global North America Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2020 & 2033

- Table 13: Global North America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 14: Global North America Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2020 & 2033

- Table 15: Global North America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 16: Global North America Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2020 & 2033

- Table 17: Global North America Gaming Headsets Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global North America Gaming Headsets Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 19: Global North America Gaming Headsets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global North America Gaming Headsets Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global North America Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2020 & 2033

- Table 22: Global North America Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2020 & 2033

- Table 23: Global North America Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 24: Global North America Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2020 & 2033

- Table 25: Global North America Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 26: Global North America Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2020 & 2033

- Table 27: Global North America Gaming Headsets Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global North America Gaming Headsets Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 29: Global North America Gaming Headsets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global North America Gaming Headsets Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gaming Headsets Market?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the North America Gaming Headsets Market?

Key companies in the market include Logitech International S A, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUSTeK Computer Inc, Microsoft Corporation, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the North America Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

6. What are the notable trends driving market growth?

Console Headset Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in E-Sports Gaming to Fuel the Demand for Gaming Accessory Equipment.

8. Can you provide examples of recent developments in the market?

July 2024: Chinese electronics firm OXS unveiled its latest gaming headset, the OXS Storm G2 Wireless, targeting budget-conscious gamers in the USA. The headset is up for grabs on both Amazon and the official OXS website. It boasts a suite of gaming-centric features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the North America Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence