Key Insights

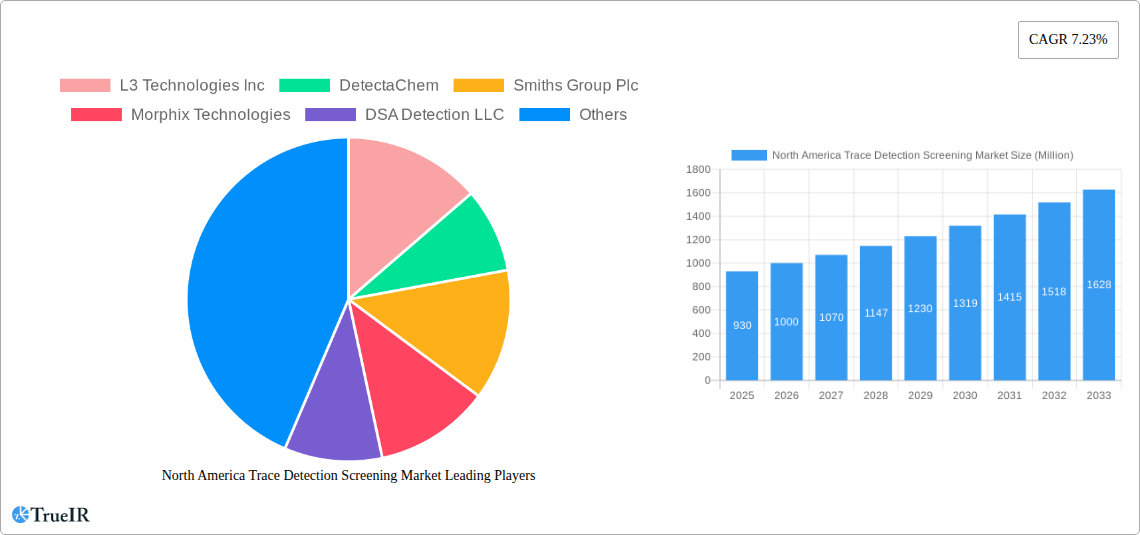

The North America trace detection screening market, valued at $0.93 billion in 2025, is projected to experience robust growth, driven by increasing security concerns across various sectors. The market's Compound Annual Growth Rate (CAGR) of 7.23% from 2025 to 2033 signifies a significant expansion, primarily fueled by the rising adoption of advanced trace detection technologies in commercial airports, military and defense establishments, law enforcement agencies, ports and border control, and public safety operations. This growth is further propelled by the increasing sophistication of threats and the need for rapid, accurate screening methods to detect explosives and narcotics. The market segmentation reveals a strong presence of handheld and portable devices, reflecting the need for mobility and ease of use in diverse settings. The United States dominates the North American market, followed by Canada, due to higher security spending and a greater concentration of end-user industries. While challenges such as high initial investment costs and the need for skilled personnel might act as restraints, the overall market outlook remains positive, with technological advancements leading to more efficient, sensitive, and user-friendly trace detection solutions.

North America Trace Detection Screening Market Market Size (In Million)

Continued advancements in technology, such as improved sensitivity and reduced false positives, are key factors shaping the market trajectory. The development of integrated systems that combine different detection methods is also expected to drive growth. Furthermore, increasing government regulations and stricter security protocols are contributing to higher adoption rates. The market is segmented by product type (handheld, portable/movable, fixed), end-user industry (commercial, military & defense, law enforcement, ports & borders, public safety), and by country (primarily the US and Canada). The dominance of the United States can be attributed to its larger economy, higher security spending, and widespread adoption of advanced security technologies across various sectors. Future growth will likely be influenced by factors such as technological innovation, regulatory changes, and government spending on homeland security.

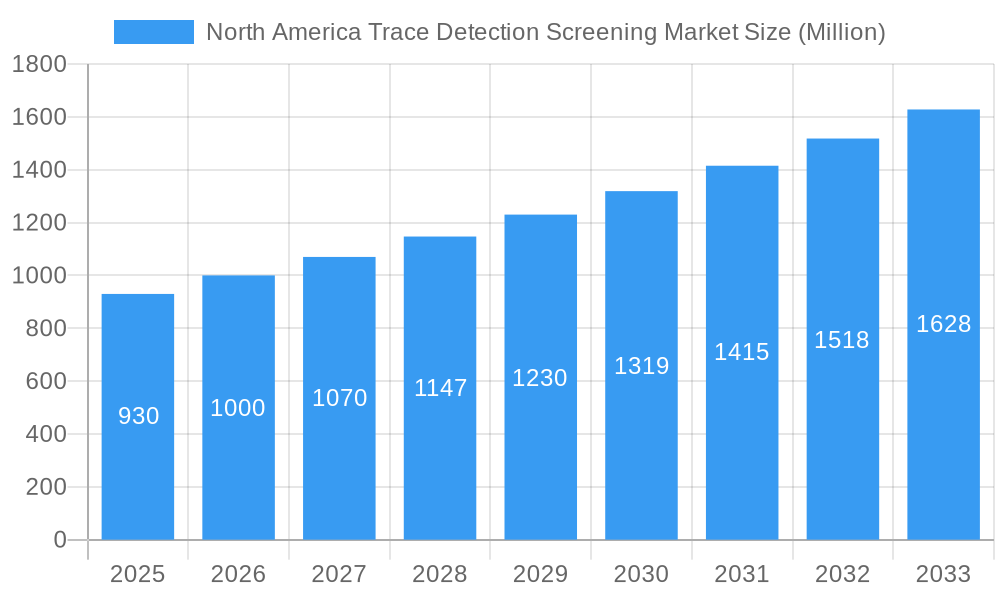

North America Trace Detection Screening Market Company Market Share

This comprehensive report provides an in-depth analysis of the North America trace detection screening market, offering invaluable insights for stakeholders across the security, defense, and law enforcement sectors. With a focus on market trends, competitive dynamics, and future growth projections, this report is an essential resource for strategic planning and investment decisions. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The market is segmented by end-user industry, country, type, and product, offering a granular understanding of market dynamics. The report projects a market value exceeding xx Million by 2033.

North America Trace Detection Screening Market Structure & Competitive Landscape

The North America trace detection screening market exhibits a moderately concentrated structure, with key players such as L3 Technologies Inc, Smiths Group Plc, and Bruker Corporation holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating moderate competition. Innovation plays a crucial role, driven by the need for enhanced sensitivity, portability, and speed in detection technologies. Stringent regulatory frameworks, particularly concerning homeland security and aviation safety, heavily influence market dynamics. Product substitutes, such as advanced imaging techniques, pose some competition, but the specialized nature of trace detection largely limits their impact.

- End-User Segmentation: The market is primarily driven by the military and defense, law enforcement, and ports and borders segments, with a growing contribution from the public safety sector.

- M&A Trends: The past five years have witnessed xx M&A deals in the North American trace detection screening market, predominantly focused on acquiring specialized technologies and expanding geographic reach. These transactions highlight the strategic importance of this market segment.

- Regulatory Impacts: The increasing regulatory scrutiny around security and safety significantly impacts the market, driving the demand for certified and compliant technologies.

- Innovation Drivers: Advancements in sensor technology, data analytics, and AI are key innovation drivers, improving the accuracy and speed of detection systems.

North America Trace Detection Screening Market Market Trends & Opportunities

The North America trace detection screening market is experiencing robust growth, driven by escalating security concerns, advancements in detection technologies, and increasing government spending on homeland security. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), expanding from an estimated value of xx Million in 2025 to xx Million by 2033. This growth is fueled by several key trends:

- The rising adoption of handheld and portable devices, offering enhanced mobility and ease of use for law enforcement and security personnel.

- Significant investments in advanced technologies like Raman spectroscopy and ion mobility spectrometry, improving detection accuracy and speed.

- The growing demand for integrated security systems, combining trace detection with other screening technologies for a comprehensive approach.

- The increasing focus on cybersecurity, leading to the integration of trace detection systems with advanced data analytics and threat intelligence platforms.

- The continuous development of new and more sensitive detectors to identify emerging threats and substances, ensuring security agencies stay ahead of evolving threats. This is coupled with the constant need for improved user-friendliness and reduced false positives.

Dominant Markets & Segments in North America Trace Detection Screening Market

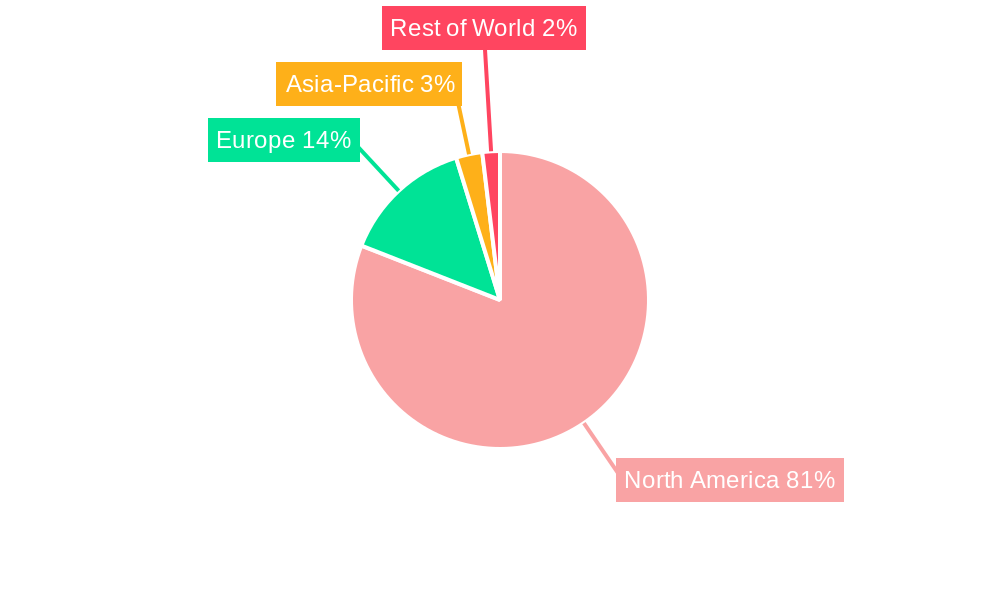

The United States dominates the North America trace detection screening market, accounting for xx% of the total market value in 2025. This dominance is attributed to significant government investments in homeland security, robust law enforcement infrastructure, and the presence of major market players.

- By End-User Industry: The Military and Defense segment holds the largest market share, driven by high government spending and the need for advanced security systems in military and defense operations. Law Enforcement follows closely, with growing demand for portable and handheld devices for field operations.

- By Country: The United States accounts for the largest market share, followed by Canada.

- By Type: Explosive trace detection currently holds the largest share due to stringent regulations surrounding aviation security and high demand in airports and other public transportation hubs.

- By Product: Handheld devices are witnessing the fastest growth due to their portability and ease of use, particularly for field applications. However, the fixed systems market remains sizable due to its application in high-security areas like airports and border crossings.

Key Growth Drivers:

- Increased government funding for homeland security initiatives.

- Stringent regulations mandating the use of trace detection systems in various settings.

- Technological advancements leading to more efficient and reliable detection technologies.

North America Trace Detection Screening Market Product Analysis

The market offers a diverse range of trace detection products, encompassing handheld, portable/movable, and fixed systems. Handheld devices are characterized by their portability and ease of use, making them ideal for field applications. Portable/movable systems offer increased sensitivity and analysis capabilities compared to handheld devices, while fixed systems provide high-throughput screening for high-volume locations like airports. Recent advancements focus on miniaturization, improved sensitivity, and the integration of advanced data analytics capabilities to enhance detection accuracy and speed. This market shows increasing demand for solutions that offer both improved sensitivity and reduced false positives, streamlining workflows and maximizing efficiency.

Key Drivers, Barriers & Challenges in North America Trace Detection Screening Market

Key Drivers: The market is propelled by rising security concerns, technological advancements, increasing government investments, and stringent regulatory requirements for security screenings at airports and borders. The increasing sophistication of threats, along with the demand for faster and more accurate detection systems, further fuel market growth.

Challenges: High initial investment costs for advanced systems can hinder adoption, especially among smaller agencies. Additionally, maintaining and calibrating these sophisticated systems requires specialized expertise and ongoing financial commitment. Supply chain disruptions and the potential for counterfeit components can also present challenges. Furthermore, regulatory compliance requirements and evolving threat landscapes necessitate continuous technological upgrades and adaptation. These factors can create significant operational hurdles for agencies and affect market growth.

Growth Drivers in the North America Trace Detection Screening Market Market

The North America trace detection screening market is driven primarily by heightened security concerns post 9/11 and other terrorist attacks. The ongoing demand for enhanced security measures at airports, border crossings, and public places significantly fuels the need for advanced detection technologies. Furthermore, technological innovation in detection methods, such as Raman spectroscopy and ion mobility spectrometry, continues to improve sensitivity and accuracy. Government investments in homeland security and collaborations between public and private sectors also drive market expansion.

Challenges Impacting North America Trace Detection Screening Market Growth

High costs associated with acquiring and maintaining advanced detection systems are a major challenge, particularly for smaller organizations. Regulatory complexities and the need for continuous system updates and recalibration also pose significant barriers to market expansion. The need for specialized personnel to operate and maintain these systems creates further challenges. Furthermore, the emergence of new and sophisticated threats necessitates constant innovation and adaptation, adding to the cost and complexity of maintaining effective security.

Key Players Shaping the North America Trace Detection Screening Market Market

- L3 Technologies Inc

- DetectaChem

- Smiths Group Plc

- Morphix Technologies

- DSA Detection LLC

- Rapiscan Systems Inc

- Leidos Holdings Inc

- Westminster Group PL

- Autoclear LLC

- Bruker Corporation

- Teledyne FLIR LLC

Significant North America Trace Detection Screening Market Industry Milestones

- September 2023: Rigaku Analytical Devices launched the handheld CQL Narc-ID 1064 nm Raman analyzer for presumptive narcotics identification, significantly impacting counter-narcotics efforts and law enforcement.

- August 2023: Smiths Detection's IONSCAN 600 explosives trace detector received Qualified Technology designation on the Air Cargo Screening Technology List, enhancing its market position in aviation security.

Future Outlook for North America Trace Detection Screening Market Market

The North America trace detection screening market is poised for continued growth, driven by persistent security concerns, technological advancements, and sustained government investments. The increasing adoption of advanced detection technologies, coupled with the rising demand for integrated security solutions, will create significant growth opportunities. Strategic partnerships between technology providers and end-users will be crucial in driving innovation and market expansion. The market's future prospects remain positive, with potential for substantial growth in the coming years.

North America Trace Detection Screening Market Segmentation

-

1. Type

- 1.1. Explosive

- 1.2. Narcotics

-

2. Product

- 2.1. Handheld

- 2.2. Portable/Movable

- 2.3. Fixed

-

3. End-User Industry

- 3.1. Commercial

- 3.2. Military and Defense

- 3.3. Law Enforcement

- 3.4. Ports and Borders

- 3.5. Public Safety

- 3.6. Other End-user Industries

North America Trace Detection Screening Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Trace Detection Screening Market Regional Market Share

Geographic Coverage of North America Trace Detection Screening Market

North America Trace Detection Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. Upsurge in Terror Activities Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosive

- 5.1.2. Narcotics

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Handheld

- 5.2.2. Portable/Movable

- 5.2.3. Fixed

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Commercial

- 5.3.2. Military and Defense

- 5.3.3. Law Enforcement

- 5.3.4. Ports and Borders

- 5.3.5. Public Safety

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 L3 Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DetectaChem

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Smiths Group Plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Morphix Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DSA Detection LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rapiscan Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leidos Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Westminster Group PL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Autoclear LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bruker Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Teledyne FLIR LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 L3 Technologies Inc

List of Figures

- Figure 1: North America Trace Detection Screening Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Trace Detection Screening Market Share (%) by Company 2025

List of Tables

- Table 1: North America Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: North America Trace Detection Screening Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: North America Trace Detection Screening Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: North America Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: North America Trace Detection Screening Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: North America Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Trace Detection Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Trace Detection Screening Market?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the North America Trace Detection Screening Market?

Key companies in the market include L3 Technologies Inc, DetectaChem, Smiths Group Plc, Morphix Technologies, DSA Detection LLC, Rapiscan Systems Inc, Leidos Holdings Inc, Westminster Group PL, Autoclear LLC, Bruker Corporation, Teledyne FLIR LLC.

3. What are the main segments of the North America Trace Detection Screening Market?

The market segments include Type, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening.

6. What are the notable trends driving market growth?

Upsurge in Terror Activities Across the Region.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

September 2023: Rigaku Analytical Devices announced the launch of the handheld CQL Narc-ID 1064 nm Raman analyzer. This device is designed for the presumptive identification of narcotics, precursor chemicals, and cutting agents, even in non-visible amounts, with the optional QuickDetect feature. It is intended for use by counter-narcotics agencies, law enforcement, crime laboratories, prison facilities, customs agencies, and public safety efforts. The CQL Narc-ID aims to directly impact the protection of communities from dangerous chemicals that are prevalent in the illicit drug supply market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Trace Detection Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Trace Detection Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Trace Detection Screening Market?

To stay informed about further developments, trends, and reports in the North America Trace Detection Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence