Key Insights

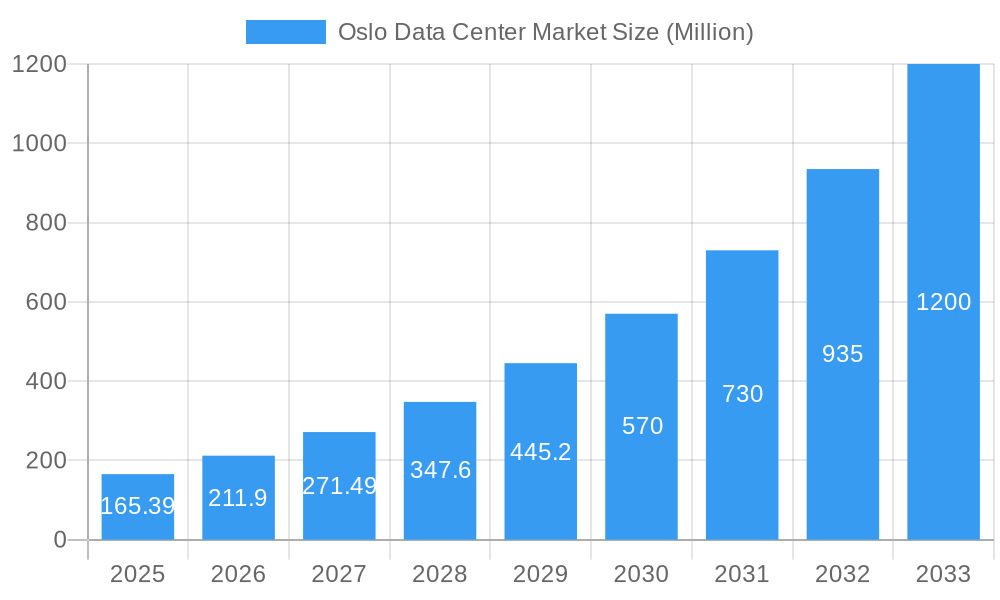

The Oslo Data Center Market is poised for substantial expansion, projecting a market size of $165.39 million in 2025, driven by an impressive CAGR of 25.86%. This rapid growth is fueled by increasing digital transformation initiatives across various sectors, including cloud computing, telecommunications, and media. The burgeoning demand for robust IT infrastructure, coupled with Norway's commitment to renewable energy sources, positions Oslo as an attractive hub for data center development and operations. Key drivers include the escalating adoption of cloud services, the need for localized data processing and storage to meet low-latency requirements, and the expansion of hyperscale data center investments. Emerging trends indicate a heightened focus on sustainability, with an emphasis on energy efficiency and green energy sources, which aligns perfectly with Norway's environmental policies. The market is experiencing significant growth across all DC sizes, from small enterprises to massive hyperscale facilities, and across Tier 1 & 2 to Tier 4 data centers, signifying a broad-based demand.

Oslo Data Center Market Market Size (In Million)

The market's robust growth trajectory is further supported by the increasing utilization of colocation services, particularly in retail, wholesale, and hyperscale segments, catering to the diverse needs of end-users like Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, and E-Commerce. While the market benefits from strong growth drivers and emerging trends, it also faces certain restraints. These may include the high upfront capital investment required for data center construction, stringent environmental regulations, and the availability of skilled labor. However, the projected strong CAGR suggests that these challenges are being effectively navigated, and the market's inherent advantages, such as a stable political environment and access to clean energy, are likely to outweigh potential hurdles, paving the way for sustained innovation and capacity expansion.

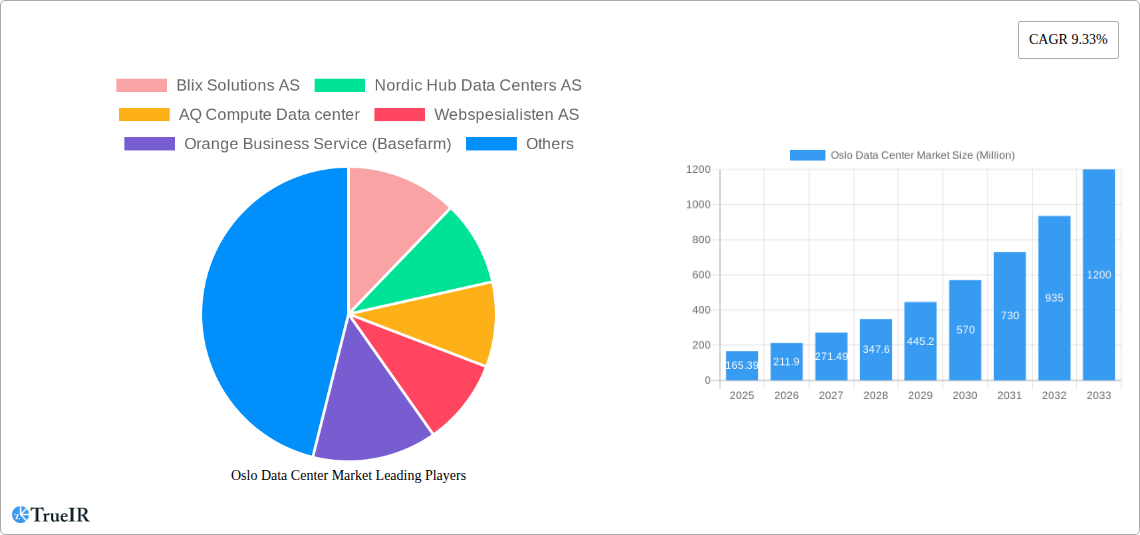

Oslo Data Center Market Company Market Share

Oslo Data Center Market: Comprehensive Analysis, Trends, and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Oslo Data Center Market, delving into its structure, competitive landscape, evolving trends, and future projections. Leveraging high-volume keywords such as "Oslo data center market," "Nordic colocation," "hyperscale data centers Norway," "renewable energy data centers," and "digital infrastructure Oslo," this report is meticulously crafted for industry professionals, investors, and stakeholders seeking critical insights into one of Europe's most promising digital hubs. The study period spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

Oslo Data Center Market Market Structure & Competitive Landscape

The Oslo data center market is characterized by a moderately concentrated structure, with a few key players holding significant market share in terms of power capacity (MW). Innovation drivers are primarily fueled by the increasing demand for hyperscale and wholesale colocation services, driven by cloud providers and large enterprises. Regulatory frameworks, while supportive of green initiatives, also present compliance considerations for new entrants. Product substitutes are limited, with direct competition revolving around power, connectivity, security, and sustainability offerings. End-user segmentation reveals a strong dominance of Cloud & IT, followed by Telecom and BFSI. Mergers and acquisitions (M&A) activity, though not extensive, indicates a consolidation trend as larger entities seek to expand their footprint and service offerings. For instance, the integration of acquired entities and strategic partnerships play a crucial role in shaping market concentration. The market exhibits robust growth, attracting significant investment and fostering a competitive environment focused on efficiency and sustainability.

Oslo Data Center Market Market Trends & Opportunities

The Oslo data center market is experiencing robust growth, projected to expand significantly due to escalating demand for digital infrastructure and advanced computing services. This growth is propelled by several key trends, including the sustained expansion of cloud computing adoption, the increasing need for low-latency connectivity for emerging technologies like 5G and AI, and the burgeoning digital economy in Norway and the wider Nordic region. The market's commitment to sustainability is a major differentiating factor, with a strong emphasis on powered 100% renewable energy sources, a trend highly valued by environmentally conscious enterprises and hyperscalers. Opportunities abound for data center operators to leverage Norway's abundant renewable energy resources, favorable climate for free cooling, and a stable regulatory environment.

Technological shifts are continuously reshaping the market, with a growing focus on energy-efficient designs, advanced cooling solutions, and edge computing deployments to bring processing closer to end-users. Consumer preferences are increasingly leaning towards colocation providers that offer not only high reliability and security but also demonstrable sustainability credentials and competitive pricing. The competitive dynamics are intensifying, with both established players and new entrants vying for market share. This heightened competition is fostering innovation and driving down costs, making Oslo an attractive location for data center investment. The market penetration rate for sophisticated data center solutions is steadily increasing across various end-user segments. The continuous evolution of digital services and the ongoing digital transformation across industries are set to fuel sustained demand for data center capacity.

Dominant Markets & Segments in Oslo Data Center Market

The Oslo data center market exhibits distinct dominance across various segments, driven by specific industry needs and infrastructure capabilities.

DC Size:

- Massive and Mega Data Centers: These segments are experiencing the most significant growth, driven by hyperscalers and large cloud providers requiring vast amounts of computing power and storage. The availability of land and robust power infrastructure in and around Oslo are key enablers for these large-scale deployments.

- Large Data Centers: These also represent a substantial and growing segment, catering to enterprises with significant IT footprints and dedicated colocation needs.

Tier Type:

- Tier 3 & Tier 4 Data Centers: The demand is heavily skewed towards Tier 3 and Tier 4 facilities, reflecting the critical nature of the services hosted and the requirement for high availability, redundancy, and fault tolerance. End-users in BFSI, Government, and Cloud & IT sectors prioritize these tiers for mission-critical applications.

Absorption:

- Utilized:

- Hyperscale Colocation: This sub-segment within colocation is the dominant force, driven by the expansion strategies of major cloud service providers.

- Wholesale Colocation: Enterprises and mid-to-large businesses are increasingly opting for wholesale solutions to gain dedicated capacity and control over their infrastructure.

- End-User (Cloud & IT): This is the largest end-user segment, fueled by the massive demand for cloud services, data analytics, and digital transformation initiatives.

- End-User (Telecom): The rollout of 5G networks and the increasing demand for data transmission are driving significant growth in this segment.

- End-User (BFSI): Financial institutions require highly secure and available data center solutions for their critical operations and regulatory compliance.

- Non-Utilized: While a certain level of non-utilized capacity is expected for scalability and new deployments, the trend indicates a rapid absorption rate for purpose-built and well-located facilities.

- Utilized:

Key growth drivers for these dominant segments include the expansion of global cloud providers, the increasing adoption of digital technologies across all industries, and Norway's strategic geographical position as a gateway to Nordic and European markets. Favorable government policies supporting digital infrastructure development and a commitment to renewable energy further bolster the attractiveness of Oslo for data center investment. The dense fiber optic network infrastructure also plays a crucial role in enabling high-speed connectivity, essential for large-scale data center operations.

Oslo Data Center Market Product Analysis

The Oslo data center market's product offerings are centered around high-density, secure, and sustainable colocation solutions. Innovations are primarily focused on enhancing energy efficiency through advanced cooling technologies, utilizing waste heat for district heating systems, and ensuring robust power redundancy with 100% renewable energy sources. Competitive advantages are gained through superior connectivity options, scalability, and adherence to stringent security standards. The market effectively caters to hyperscale, wholesale, and retail colocation needs, with a growing emphasis on customized solutions for specific end-user requirements, particularly within the Cloud & IT, Telecom, and BFSI sectors.

Key Drivers, Barriers & Challenges in Oslo Data Center Market

Key Drivers:

- Abundant Renewable Energy: Norway's extensive hydropower resources offer a cost-effective and sustainable power supply, a major draw for eco-conscious businesses.

- Increasing Demand for Cloud Services: The pervasive adoption of cloud computing by enterprises and governments fuels the need for scalable data center capacity.

- Strategic Location: Oslo serves as a strategic hub for connectivity within the Nordic region and to wider European markets.

- Government Support: Favorable policies and incentives for digital infrastructure development and green initiatives encourage investment.

Barriers & Challenges:

- Supply Chain Constraints: Global supply chain disruptions can impact the timely delivery of critical equipment, potentially delaying project timelines.

- Skilled Workforce Shortage: A growing demand for specialized data center professionals can lead to challenges in recruitment and retention.

- Land Availability and Cost: While opportunities exist, securing large tracts of land in prime locations at competitive prices can be challenging.

- Increasing Power Demand: Rapid expansion can lead to increased competition for grid capacity and potential strain on local power infrastructure if not adequately planned.

Growth Drivers in the Oslo Data Center Market Market

The Oslo data center market's growth is significantly propelled by the insatiable demand for digital services, including cloud computing, big data analytics, and AI, all of which require robust and scalable infrastructure. Norway's unique advantage of abundant, low-cost renewable energy, primarily hydropower, positions it as a premier destination for environmentally conscious hyperscalers and enterprises seeking to reduce their carbon footprint. Furthermore, the strategic geographical location of Oslo provides excellent connectivity to Nordic and European markets, making it an attractive hub for data localization and content delivery. Supportive government policies and investments in digital infrastructure further accelerate market expansion by fostering a favorable business environment for data center development and operation.

Challenges Impacting Oslo Data Center Market Growth

The Oslo data center market faces several critical challenges that can impact its growth trajectory. Regulatory complexities, while generally supportive, can sometimes lead to delays in permitting and approvals for new large-scale developments. Supply chain disruptions, a global concern, can affect the availability and cost of essential hardware and construction materials, potentially leading to project delays and increased capital expenditure. Intense competitive pressures among existing and emerging players necessitate continuous innovation and cost optimization to maintain market share. Additionally, the increasing demand for power can strain existing grid infrastructure, requiring significant investment in grid upgrades and expansion to meet the growing needs of data center facilities.

Key Players Shaping the Oslo Data Center Market Market

- Blix Solutions AS

- Nordic Hub Data Centers AS

- AQ Compute Data center

- Webspesialisten AS

- Orange Business Service (Basefarm)

- Bulk Infrastructure Group AS

- Green Mountain AS

- Stack Infrastructure Inc

Significant Oslo Data Center Market Industry Milestones

- September 2022: Bulk Infrastructure announced significant expansion initiatives at its Norwegian data center locations, focusing on securing long-term power and land availability. These initiatives involve providing highly connected and scalable sites powered by 100% renewable energy. Amidst European power restrictions and surging demand, Bulk successfully installed the N01 onsite substation, providing 125 MVA of dual connections to the adjacent Kristiansand substation.

- September 2022: Stack Infrastructure successfully connected an Oslo data center (OSL01) to the local district heating system. This project, initiated by DigiPlex four years prior, links the facility to Hafslund Oslo Celsio's district heating network. Post a one-year ramp-up period, waste heat from the data center is projected to supply heat and hot water to approximately 5,000 households.

Future Outlook for Oslo Data Center Market Market

The future outlook for the Oslo data center market is exceptionally promising, driven by continued global demand for digital infrastructure and Norway's unique competitive advantages. The market is poised for substantial growth, particularly in the hyperscale and wholesale colocation segments, as major cloud providers and large enterprises expand their operations in the region. The strong emphasis on sustainability, powered by 100% renewable energy, will continue to be a key differentiator, attracting businesses with ESG (Environmental, Social, and Governance) mandates. Strategic investments in expanding power capacity, enhancing connectivity, and fostering a skilled workforce will be crucial to capitalize on emerging opportunities. Innovations in cooling technologies and the potential for edge computing deployments will further solidify Oslo's position as a leading data center hub in Northern Europe.

Oslo Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

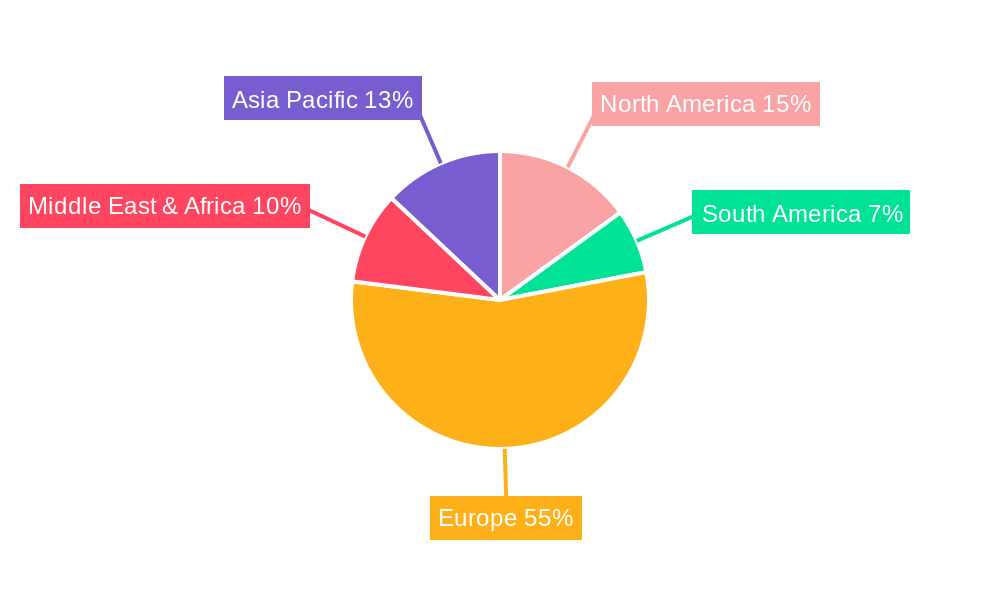

Oslo Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oslo Data Center Market Regional Market Share

Geographic Coverage of Oslo Data Center Market

Oslo Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of Number of Social Media Users; Increased Emphasis on Target Marketing and Competitive Intelligence

- 3.3. Market Restrains

- 3.3.1. Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers

- 3.4. Market Trends

- 3.4.1. Tier 3 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oslo Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Oslo Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End-User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Oslo Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End-User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Oslo Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End-User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Oslo Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End-User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Oslo Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End-User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Blix Solutions AS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nordic Hub Data Centers AS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AQ Compute Data center

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Webspesialisten AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Orange Business Service (Basefarm)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bulk Infrastructure Group AS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Green Mountain AS*List Not Exhaustive 7 2 Market share analysis (In terms of MW)7 3 List of Companie

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stack Infrastructure Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Blix Solutions AS

List of Figures

- Figure 1: Global Oslo Data Center Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Oslo Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 3: North America Oslo Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 4: North America Oslo Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 5: North America Oslo Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 6: North America Oslo Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 7: North America Oslo Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 8: North America Oslo Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Oslo Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Oslo Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 11: South America Oslo Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 12: South America Oslo Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 13: South America Oslo Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 14: South America Oslo Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 15: South America Oslo Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 16: South America Oslo Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Oslo Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Oslo Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 19: Europe Oslo Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 20: Europe Oslo Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 21: Europe Oslo Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 22: Europe Oslo Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 23: Europe Oslo Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 24: Europe Oslo Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Oslo Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Oslo Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 27: Middle East & Africa Oslo Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 28: Middle East & Africa Oslo Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 29: Middle East & Africa Oslo Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 30: Middle East & Africa Oslo Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 31: Middle East & Africa Oslo Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 32: Middle East & Africa Oslo Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Oslo Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Oslo Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 35: Asia Pacific Oslo Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 36: Asia Pacific Oslo Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 37: Asia Pacific Oslo Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 38: Asia Pacific Oslo Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 39: Asia Pacific Oslo Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 40: Asia Pacific Oslo Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Oslo Data Center Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oslo Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 2: Global Oslo Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 3: Global Oslo Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 4: Global Oslo Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Oslo Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 6: Global Oslo Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 7: Global Oslo Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Global Oslo Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Oslo Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 13: Global Oslo Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 14: Global Oslo Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 15: Global Oslo Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Oslo Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 20: Global Oslo Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 21: Global Oslo Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 22: Global Oslo Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Oslo Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 33: Global Oslo Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 34: Global Oslo Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 35: Global Oslo Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Oslo Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 43: Global Oslo Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 44: Global Oslo Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 45: Global Oslo Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Oslo Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oslo Data Center Market?

The projected CAGR is approximately 25.86%.

2. Which companies are prominent players in the Oslo Data Center Market?

Key companies in the market include Blix Solutions AS, Nordic Hub Data Centers AS, AQ Compute Data center, Webspesialisten AS, Orange Business Service (Basefarm), Bulk Infrastructure Group AS, Green Mountain AS*List Not Exhaustive 7 2 Market share analysis (In terms of MW)7 3 List of Companie, Stack Infrastructure Inc.

3. What are the main segments of the Oslo Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of Number of Social Media Users; Increased Emphasis on Target Marketing and Competitive Intelligence.

6. What are the notable trends driving market growth?

Tier 3 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers.

8. Can you provide examples of recent developments in the market?

September 2022: Bulk announced several expansion initiatives at its Norwegian data center locations, with investments focused on ensuring long-term power and land availability. Highly connected and scalable sites powered by 100% renewable energy are provided. With many European locations battling with power restrictions and increasing demand for data center capacity, Bulk completed the installation of the N01 onsite substation, which provides 125 MVA of dual connections to the adjacent Kristiansand substation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oslo Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oslo Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oslo Data Center Market?

To stay informed about further developments, trends, and reports in the Oslo Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence