Key Insights

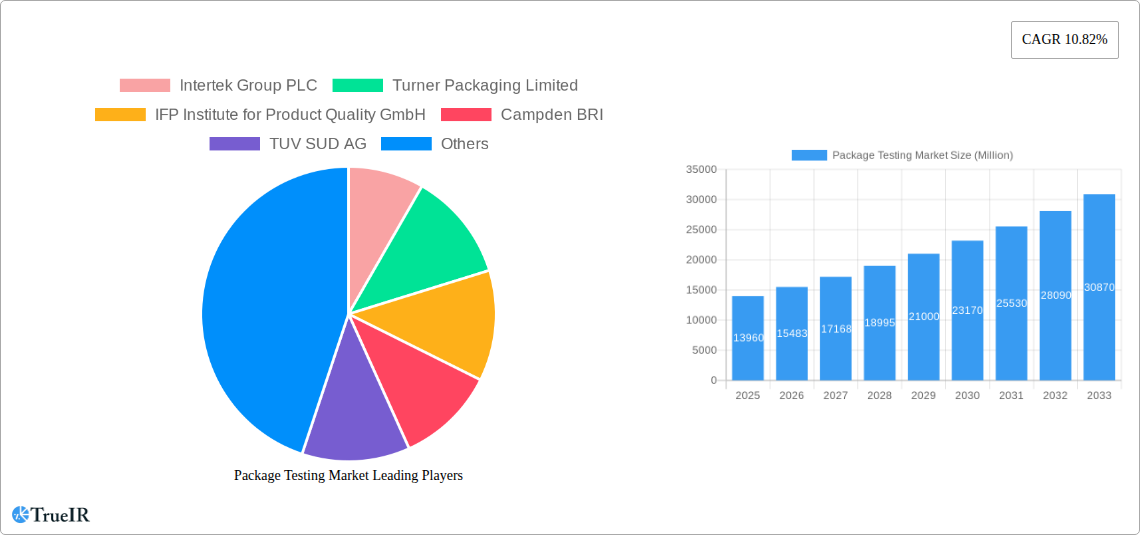

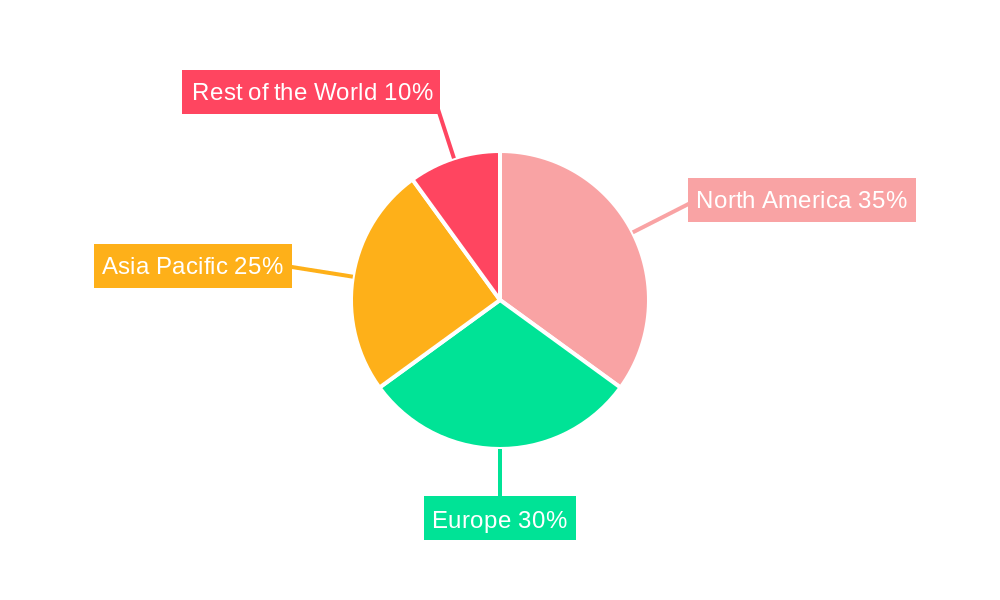

The global package testing market, valued at $13.96 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 10.82% from 2025 to 2033. This expansion is driven by several key factors. Increasing consumer demand for safe and durable products necessitates rigorous testing protocols, boosting demand for package testing services. E-commerce's rapid growth fuels the need for robust packaging capable of withstanding the rigors of transit, further driving market expansion. Furthermore, stringent regulatory compliance standards across various industries, particularly food and beverage, healthcare, and pharmaceuticals, mandate comprehensive package testing to ensure product safety and quality. The rising adoption of advanced testing techniques, such as accelerated life testing and virtual simulation, also contributes to market growth. Segmentation analysis reveals that the plastic packaging segment holds significant market share due to its widespread usage, while drop tests remain the most frequently employed testing type. Geographically, North America and Europe currently dominate the market, but the Asia-Pacific region is expected to witness significant growth due to its expanding manufacturing and e-commerce sectors.

Package Testing Market Market Size (In Billion)

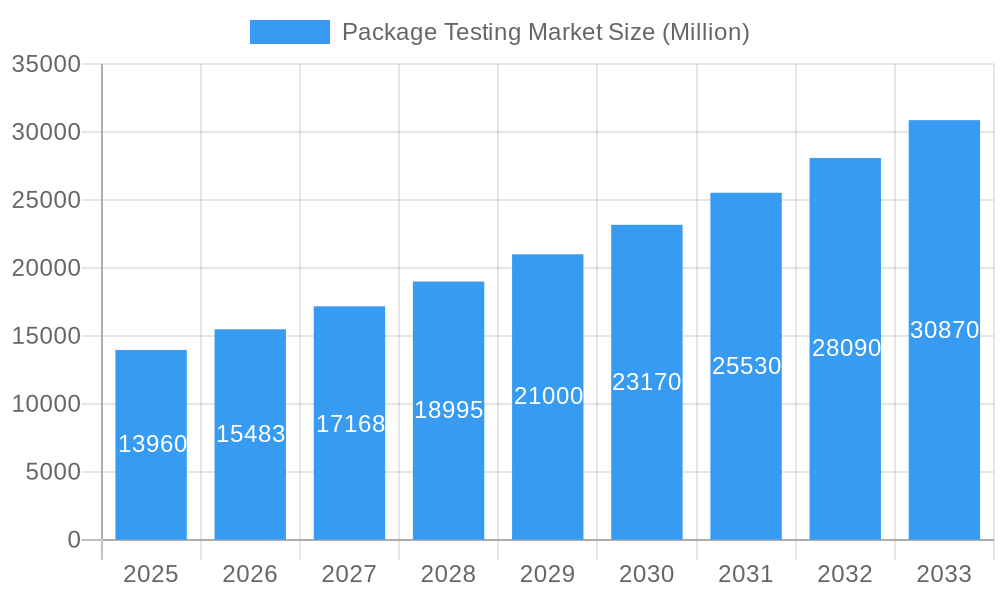

Major players in the package testing market, including Intertek, SGS, and TÜV SÜD, are investing heavily in R&D and expanding their service offerings to capture a larger market share. The market's competitive landscape is characterized by both large multinational corporations and specialized testing labs. However, challenges such as high testing costs and the need for specialized equipment could potentially restrain market growth to some extent. Despite these challenges, the overall outlook for the package testing market remains extremely positive, fueled by ongoing technological advancements, increasing regulatory scrutiny, and the ever-growing demand for reliable and secure packaging across diverse industries. The market is poised for continued expansion throughout the forecast period, presenting attractive opportunities for established players and new entrants alike.

Package Testing Market Company Market Share

Package Testing Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Package Testing Market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this study unveils market trends, competitive landscapes, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Package Testing Market Market Structure & Competitive Landscape

The Package Testing Market is characterized by a moderately concentrated competitive landscape, with several multinational players and specialized testing firms vying for market share. Key players like Intertek Group PLC, Turner Packaging Limited, IFP Institute for Product Quality GmbH, Campden BRI, TÜV SÜD AG, SGS SA, Nefab Group, DDL Inc (Integreon Global), Bureau Veritas SA, and Eurofins Scientific SE, amongst others, collectively hold a significant portion of the market. The market exhibits a Herfindahl-Hirschman Index (HHI) of xx, indicating a moderately consolidated structure.

Innovation is a critical driver, with companies continuously developing new testing methods and equipment to address evolving packaging materials and regulatory requirements. Stringent regulatory compliance across various end-user industries, particularly in food and healthcare, strongly influences the demand for package testing services. Substitutes exist, but are limited, primarily through in-house testing capabilities for larger companies. However, outsourcing remains prevalent due to cost-effectiveness and access to specialized expertise.

The market has witnessed several M&A activities in recent years, with xx acquisitions recorded between 2019 and 2024, primarily driven by the desire for geographic expansion and technological diversification. End-user segmentation is a key aspect, with significant variations in testing requirements across food & beverage, industrial, healthcare, and household/personal care sectors. These differences in regulatory standards and packaging materials necessitate specialized testing protocols.

Package Testing Market Market Trends & Opportunities

The Package Testing Market is experiencing robust growth, fueled by several key trends. The global market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, demonstrating a significant expansion driven by several factors. The increasing complexity of packaging materials, coupled with rising consumer demands for product safety and quality, drives substantial growth in the market. The rising adoption of e-commerce and the associated need for enhanced packaging durability and protection significantly contributes to the overall market expansion.

Technological advancements, such as automation and advanced analytical techniques, are streamlining testing processes and enhancing accuracy. Consumer preference for sustainable packaging solutions fuels the demand for testing eco-friendly materials. Furthermore, the growing stringency of regulatory frameworks in many regions necessitates comprehensive package testing to ensure compliance. This rise in regulation and increased consumer awareness around sustainability are significant opportunities for market growth. The market penetration rate for package testing services is currently estimated to be around xx% globally, with ample room for future expansion, particularly in emerging markets. The CAGR for the forecast period is estimated at xx%, showcasing promising growth potential. Competitive dynamics remain intense, with players constantly innovating to offer faster, more efficient, and more cost-effective testing solutions.

Dominant Markets & Segments in Package Testing Market

The Plastic segment dominates the market by primary material, accounting for xx% of the overall market share in 2024, followed by Paper (xx%), Metal (xx%), and Glass (xx%). This dominance is driven by the widespread use of plastic in various packaging applications. The Drop Test segment leads the type category, capturing xx% of the market share, followed by Vibration Test (xx%), Shock Test (xx%), and Temperature Testing (xx%). The high demand for drop tests stems from the need to assess the packaging's ability to withstand impacts during transportation and handling.

Within end-user industries, the Food and Beverage sector stands out as the dominant segment, representing xx% of the total market share, reflecting the stringent safety and quality regulations within this industry.

- Key Growth Drivers:

- Stringent regulatory requirements, especially within the food and beverage sector.

- Growing consumer awareness regarding product safety and quality.

- The rising popularity of e-commerce and the resulting need for more robust packaging.

- Increasing demand for sustainable and eco-friendly packaging solutions.

The North American region currently holds the largest market share, driven by its advanced packaging industry and stringent regulatory environment. However, Asia-Pacific is expected to experience the fastest growth in the coming years, driven by the burgeoning manufacturing sector and increased disposable income.

Package Testing Market Product Analysis

The package testing market offers a diverse range of testing services and equipment, spanning from basic drop tests to sophisticated analytical methods for evaluating packaging integrity under various conditions. Recent innovations include automated testing systems that enhance efficiency and accuracy, along with advanced technologies that allow for non-destructive testing. The market is witnessing a shift towards integrated testing solutions that combine different testing methods for a more comprehensive evaluation. This allows for quicker turnaround times and cost-effectiveness, making them highly attractive to clients. The market fit for these innovations is high, as companies prioritize faster results and comprehensive data analysis.

Key Drivers, Barriers & Challenges in Package Testing Market

Key Drivers: The rising adoption of advanced packaging materials, stringent regulatory norms across industries (especially food and pharmaceuticals), e-commerce expansion, and a globalized supply chain are all major drivers for market expansion. Technological innovations such as automation and AI-powered testing methods contribute significantly to market growth. Government regulations regarding food safety and consumer protection are also crucial drivers.

Challenges: Supply chain disruptions resulting in delays and increased costs, coupled with intense competition among testing service providers, pose considerable challenges. Regulatory complexities and variations across different regions add to the complexity of operations. The high capital investment required for sophisticated testing equipment can act as a barrier to entry for smaller companies.

Growth Drivers in the Package Testing Market Market

Technological advancements, particularly automation and advanced analytical techniques, play a crucial role in driving market growth. Growing regulatory scrutiny and the implementation of stringent standards in various industries further boost demand for testing services. The rising importance of sustainable packaging and the growing need to assess the environmental impact of packaging solutions represent significant growth drivers.

Challenges Impacting Package Testing Market Growth

The high cost of advanced testing equipment and the need for skilled personnel can limit market penetration. Inconsistencies in regulatory frameworks across different regions create challenges for companies operating in multiple markets. Competition from established players and the emergence of new entrants make it crucial to differentiate and innovate to thrive.

Key Players Shaping the Package Testing Market Market

- Intertek Group PLC

- Turner Packaging Limited

- IFP Institute for Product Quality GmbH

- Campden BRI

- TÜV SÜD AG

- SGS SA

- Nefab Group

- DDL Inc (Integreon Global)

- Bureau Veritas SA

- Eurofins Scientific SE

Significant Package Testing Market Industry Milestones

- August 2023: Testronix launched a vacuum leak tester, setting new standards for accuracy and ease of use in leak detection for containers.

- March 2023: Testronix launched innovative peel testing equipment designed to measure adhesive strength, enhancing testing capabilities across various industries.

Future Outlook for Package Testing Market Market

The Package Testing Market is poised for continued growth, driven by technological advancements, increased regulatory compliance needs, and rising consumer demand for high-quality products. The market presents significant opportunities for companies that can leverage automation, AI, and data analytics to offer efficient and cost-effective testing solutions. Strategic partnerships and acquisitions are likely to reshape the competitive landscape, further driving innovation and market consolidation. The expanding e-commerce sector and the increasing demand for sustainable packaging will continue to fuel market expansion, creating a positive outlook for the years to come.

Package Testing Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type

- 2.1. Drop Test

- 2.2. Vibration Test

- 2.3. Shock Test

- 2.4. Temperature Testing

- 2.5. Other Ty

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Industrial

- 3.3. Healthcare

- 3.4. Household and Personal Care Products

- 3.5. Other End-user Industries

Package Testing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Package Testing Market Regional Market Share

Geographic Coverage of Package Testing Market

Package Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions and Growing Demand for Packaged and Sustainable Products

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Package Testing

- 3.4. Market Trends

- 3.4.1. Food and Beverage Accounts for Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Drop Test

- 5.2.2. Vibration Test

- 5.2.3. Shock Test

- 5.2.4. Temperature Testing

- 5.2.5. Other Ty

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Industrial

- 5.3.3. Healthcare

- 5.3.4. Household and Personal Care Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. North America Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 6.1.1. Glass

- 6.1.2. Paper

- 6.1.3. Plastic

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Drop Test

- 6.2.2. Vibration Test

- 6.2.3. Shock Test

- 6.2.4. Temperature Testing

- 6.2.5. Other Ty

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Industrial

- 6.3.3. Healthcare

- 6.3.4. Household and Personal Care Products

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 7. Europe Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 7.1.1. Glass

- 7.1.2. Paper

- 7.1.3. Plastic

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Drop Test

- 7.2.2. Vibration Test

- 7.2.3. Shock Test

- 7.2.4. Temperature Testing

- 7.2.5. Other Ty

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Industrial

- 7.3.3. Healthcare

- 7.3.4. Household and Personal Care Products

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 8. Asia Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 8.1.1. Glass

- 8.1.2. Paper

- 8.1.3. Plastic

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Drop Test

- 8.2.2. Vibration Test

- 8.2.3. Shock Test

- 8.2.4. Temperature Testing

- 8.2.5. Other Ty

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Industrial

- 8.3.3. Healthcare

- 8.3.4. Household and Personal Care Products

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 9. Australia and New Zealand Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 9.1.1. Glass

- 9.1.2. Paper

- 9.1.3. Plastic

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Drop Test

- 9.2.2. Vibration Test

- 9.2.3. Shock Test

- 9.2.4. Temperature Testing

- 9.2.5. Other Ty

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Industrial

- 9.3.3. Healthcare

- 9.3.4. Household and Personal Care Products

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 10. Latin America Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Primary Material

- 10.1.1. Glass

- 10.1.2. Paper

- 10.1.3. Plastic

- 10.1.4. Metal

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Drop Test

- 10.2.2. Vibration Test

- 10.2.3. Shock Test

- 10.2.4. Temperature Testing

- 10.2.5. Other Ty

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food and Beverage

- 10.3.2. Industrial

- 10.3.3. Healthcare

- 10.3.4. Household and Personal Care Products

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Primary Material

- 11. Middle East and Africa Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Primary Material

- 11.1.1. Glass

- 11.1.2. Paper

- 11.1.3. Plastic

- 11.1.4. Metal

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Drop Test

- 11.2.2. Vibration Test

- 11.2.3. Shock Test

- 11.2.4. Temperature Testing

- 11.2.5. Other Ty

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Food and Beverage

- 11.3.2. Industrial

- 11.3.3. Healthcare

- 11.3.4. Household and Personal Care Products

- 11.3.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Primary Material

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Intertek Group PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Turner Packaging Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IFP Institute for Product Quality GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Campden BRI

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 TUV SUD AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SGS SA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Nefab Group*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 DDL Inc (Integreon Global)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bureau Veritas SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Eurofins Scientific SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global Package Testing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Package Testing Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 3: North America Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 4: North America Package Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Package Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Package Testing Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Package Testing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Package Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Package Testing Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 11: Europe Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 12: Europe Package Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Package Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Package Testing Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Package Testing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Package Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Package Testing Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 19: Asia Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 20: Asia Package Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Package Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Package Testing Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Package Testing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Package Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Package Testing Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 27: Australia and New Zealand Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 28: Australia and New Zealand Package Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Australia and New Zealand Package Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Australia and New Zealand Package Testing Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Australia and New Zealand Package Testing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Australia and New Zealand Package Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Package Testing Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 35: Latin America Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 36: Latin America Package Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Latin America Package Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Latin America Package Testing Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Package Testing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Package Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Package Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Package Testing Market Revenue (Million), by Primary Material 2025 & 2033

- Figure 43: Middle East and Africa Package Testing Market Revenue Share (%), by Primary Material 2025 & 2033

- Figure 44: Middle East and Africa Package Testing Market Revenue (Million), by Type 2025 & 2033

- Figure 45: Middle East and Africa Package Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Package Testing Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 47: Middle East and Africa Package Testing Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Middle East and Africa Package Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Package Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 2: Global Package Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Package Testing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Package Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 6: Global Package Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Package Testing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 10: Global Package Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Package Testing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 14: Global Package Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Package Testing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 18: Global Package Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Package Testing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 22: Global Package Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Package Testing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 26: Global Package Testing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Package Testing Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Package Testing Market?

The projected CAGR is approximately 10.82%.

2. Which companies are prominent players in the Package Testing Market?

Key companies in the market include Intertek Group PLC, Turner Packaging Limited, IFP Institute for Product Quality GmbH, Campden BRI, TUV SUD AG, SGS SA, Nefab Group*List Not Exhaustive, DDL Inc (Integreon Global), Bureau Veritas SA, Eurofins Scientific SE.

3. What are the main segments of the Package Testing Market?

The market segments include Primary Material, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions and Growing Demand for Packaged and Sustainable Products.

6. What are the notable trends driving market growth?

Food and Beverage Accounts for Significant Share in the Market.

7. Are there any restraints impacting market growth?

High Costs Associated with Package Testing.

8. Can you provide examples of recent developments in the market?

August 2023 - Testronix launched vaccum leak tester to detect leak containers. They are equipped with a built-in compressor and vacuum pump. According to Testronix, the instruments sets new standards for accuracy, reliability, and ease of use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Package Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Package Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Package Testing Market?

To stay informed about further developments, trends, and reports in the Package Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence