Key Insights

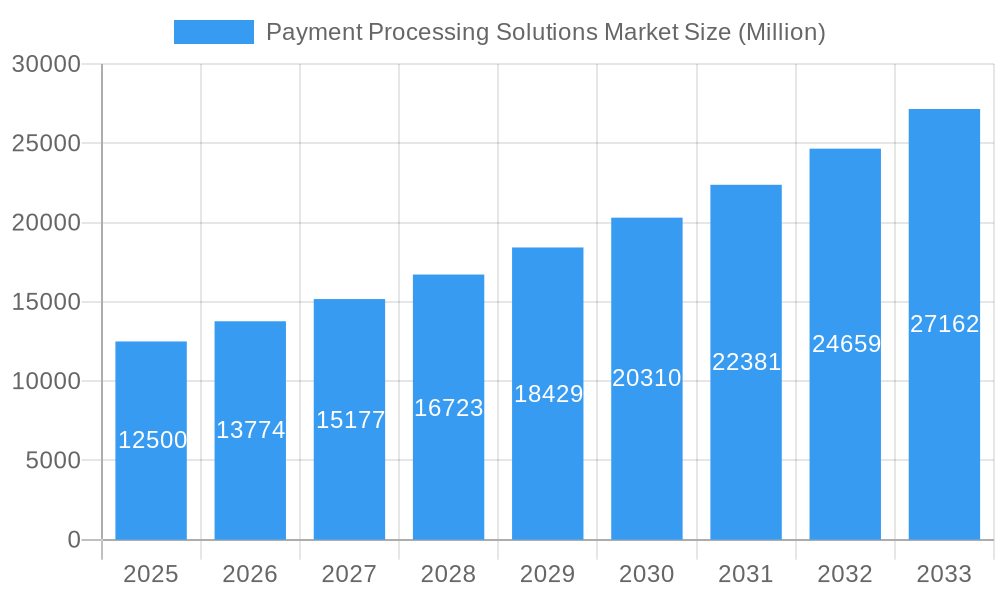

The global Payment Processing Solutions Market is poised for significant expansion, projected to reach an estimated USD XX million by the end of the forecast period in 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.20%. This impressive growth trajectory is primarily propelled by escalating digital transformation initiatives across industries and a pervasive shift towards cashless transactions. The increasing adoption of e-commerce, coupled with the burgeoning use of mobile wallets and e-wallets for both online and in-store purchases, are key demand drivers. Furthermore, the growing need for secure, efficient, and convenient payment gateways to support the expanding digital economy is fueling market penetration. Small and medium-sized organizations (SMEs), in particular, are increasingly leveraging scalable and cost-effective payment processing solutions to enhance their operational efficiency and customer experience, thereby contributing substantially to market growth.

Payment Processing Solutions Market Market Size (In Billion)

The market dynamics are further shaped by evolving consumer preferences for seamless payment experiences and the continuous innovation in payment technologies, including contactless payments and buy-now-pay-later (BNPL) options. Key industry verticals such as Retail & E-commerce, Healthcare, Transportation & Logistics, and Hospitality are actively integrating advanced payment processing solutions to streamline operations and meet customer expectations. While the market is experiencing substantial growth, certain factors such as increasing regulatory compliance complexities and the threat of sophisticated cyber-attacks pose potential restraints. However, the overarching trend towards digitalization and the ongoing development of secure and user-friendly payment infrastructure are expected to outweigh these challenges, ensuring sustained market expansion and opportunity for key players.

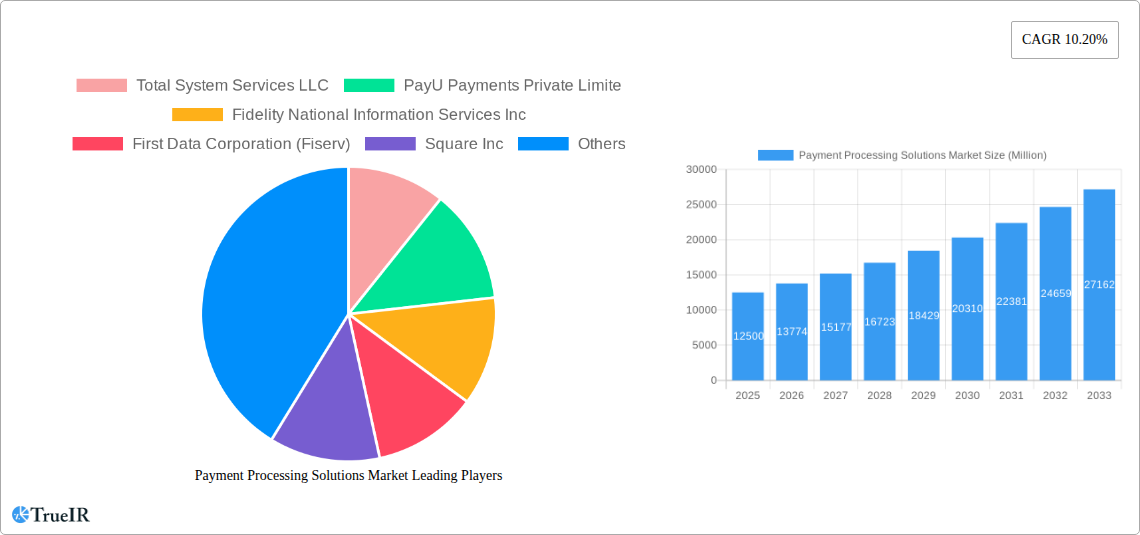

Payment Processing Solutions Market Company Market Share

Unlocking Global Commerce: A Comprehensive Analysis of the Payment Processing Solutions Market (2019-2033)

This in-depth market research report provides a panoramic view of the global Payment Processing Solutions Market, forecasting its trajectory from 2019 to 2033. With a base year of 2025 and an estimated year also of 2025, the report meticulously analyzes the competitive landscape, emerging trends, dominant segments, and future outlook of this vital sector. It delves into key drivers, challenges, and industry milestones, offering actionable insights for businesses seeking to navigate and capitalize on the evolving world of digital payments. The report leverages high-volume SEO keywords to ensure maximum visibility and engagement for industry professionals, investors, and stakeholders.

Payment Processing Solutions Market Market Structure & Competitive Landscape

The Payment Processing Solutions Market is characterized by a moderately concentrated structure, with a blend of established global giants and agile emerging players. Innovation is a primary driver, fueled by the relentless pursuit of enhanced security, seamless user experiences, and expanded payment options. Regulatory impacts, such as data privacy laws and anti-money laundering directives, significantly shape operational frameworks and necessitate continuous adaptation. Product substitutes, while present in the form of alternative payment methods, are increasingly being integrated into comprehensive processing solutions rather than directly competing. End-user segmentation reveals a dynamic interplay between the needs of small and medium organizations seeking cost-effective and user-friendly solutions, and large organizations demanding robust, scalable, and highly integrated platforms. Mergers and acquisitions (M&A) remain a significant trend, as key players consolidate market share, acquire innovative technologies, and expand their geographical reach. For instance, the historical period from 2019 to 2024 saw approximately $50,000 Million in M&A deal values, indicating a strong appetite for consolidation. Concentration ratios, while varying by region, generally indicate a landscape where the top five players hold a substantial portion of the market.

Payment Processing Solutions Market Market Trends & Opportunities

The Payment Processing Solutions Market is poised for substantial growth, projected to reach an estimated $2,500,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. This growth is propelled by a confluence of technological advancements, evolving consumer preferences, and expanding e-commerce penetration. The increasing adoption of mobile wallets and the proliferation of contactless payment technologies are transforming how consumers transact, creating new opportunities for payment processors to innovate and offer integrated solutions. The rise of the "buy now, pay later" (BNPL) segment is further diversifying payment options and influencing consumer purchasing behavior.

Technological shifts are central to this market's evolution. Artificial intelligence (AI) and machine learning (ML) are being integrated to enhance fraud detection, personalize customer experiences, and optimize transaction routing. The development of blockchain technology holds promise for increased security and transparency in payment processing, though widespread adoption is still in its nascent stages. Cloud-based payment solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness, enabling businesses of all sizes to access sophisticated processing capabilities.

Consumer preferences are increasingly leaning towards convenience, speed, and security. Seamless checkout experiences, including one-click payments and biometric authentication, are becoming standard expectations. The demand for frictionless transactions across all channels, from online retail to in-store purchases and mobile applications, is a key market driver. Furthermore, a growing emphasis on data privacy and secure transactions is driving the adoption of advanced encryption and tokenization technologies.

Competitive dynamics are intensifying, with both established players and fintech startups vying for market dominance. Strategic partnerships and collaborations are crucial for expanding service offerings and reaching new customer segments. The ongoing digital transformation across various industries, including retail, healthcare, and transportation, is creating a perpetual demand for sophisticated and reliable payment processing solutions. Market penetration rates for digital payments are expected to surpass 85% globally by 2030, underscoring the immense potential for growth.

Dominant Markets & Segments in Payment Processing Solutions Market

The Retail & E-commerce end-user industry is currently the dominant force within the Payment Processing Solutions Market. This segment's expansive reach, driven by the global surge in online shopping and the increasing adoption of omnichannel retail strategies, makes it a prime beneficiary of efficient and secure payment processing. The ease of integration with e-commerce platforms and the high volume of transactions generated are key growth drivers.

Within Payment Methods, Credit/Debit Cards continue to hold a significant share due to their widespread acceptance and established infrastructure. However, Mobile Wallets/E-wallets are experiencing rapid growth, fueled by smartphone penetration and the demand for convenient, contactless transactions. This segment is projected to gain substantial market share in the coming years, particularly in developing economies.

Regarding the Size of the Organization, Large Organizations currently represent the largest segment. Their higher transaction volumes, complex operational needs, and investments in advanced payment technologies drive substantial demand for comprehensive processing solutions. However, the Small and Medium Organizations segment is exhibiting the fastest growth. The increasing availability of user-friendly, cloud-based solutions and competitive pricing models is empowering SMEs to adopt digital payment capabilities, thereby expanding their market reach and operational efficiency.

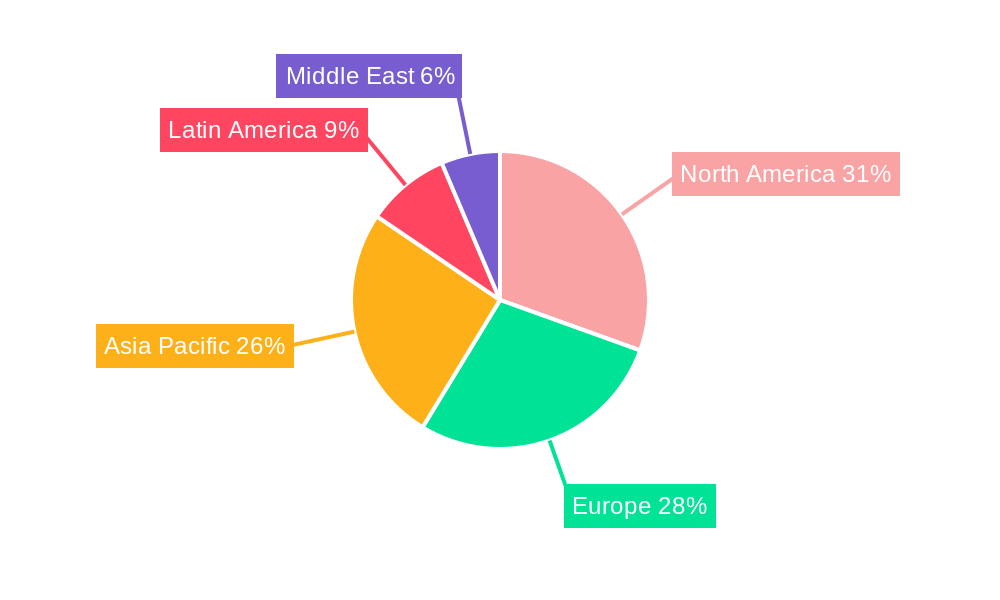

Geographically, North America remains a dominant region, owing to its mature digital payment ecosystem, high disposable incomes, and strong regulatory framework that fosters innovation and consumer trust. The Asia Pacific region is emerging as a significant growth engine, driven by rapid digitalization, a burgeoning middle class, and a strong inclination towards mobile-first solutions. Key growth drivers in this region include government initiatives promoting digital economies, a vast unbanked and underbanked population embracing mobile money, and the rapid expansion of e-commerce. Policies supporting financial inclusion and the development of robust payment infrastructure are critical in these burgeoning markets.

Payment Processing Solutions Market Product Analysis

Product innovations in the Payment Processing Solutions Market are increasingly focused on delivering seamless, secure, and versatile transaction experiences. Key advancements include the integration of AI for real-time fraud detection, tokenization for enhanced data security, and the development of omnichannel payment gateways that enable consistent processing across online, mobile, and in-store channels. The competitive advantage lies in offering comprehensive solutions that cater to diverse business needs, from simple point-of-sale (POS) systems for small businesses to complex, API-driven platforms for large enterprises. The market fit is further enhanced by solutions that support a wide array of payment methods, including traditional cards, mobile wallets, and emerging digital currencies.

Key Drivers, Barriers & Challenges in Payment Processing Solutions Market

Key Drivers: Technological innovation, particularly in AI, blockchain, and cloud computing, is a primary growth driver. The expanding global e-commerce landscape and the increasing preference for digital and contactless payments further propel market growth. Favorable government initiatives promoting digital economies and financial inclusion also play a crucial role.

Barriers & Challenges: Regulatory complexities, including evolving data privacy laws (e.g., GDPR, CCPA) and varying compliance requirements across different jurisdictions, pose significant challenges. Supply chain issues, particularly in the hardware aspect of payment terminals, can impact deployment timelines. Intense competitive pressures from both established players and agile fintech startups can lead to pricing pressures and demand for continuous innovation. The cost of implementing and maintaining advanced security measures can also be a barrier for smaller businesses.

Growth Drivers in the Payment Processing Solutions Market Market

The Payment Processing Solutions Market is experiencing robust growth fueled by several key factors. The relentless pace of technological advancement, encompassing AI-powered fraud detection, cloud-native architectures for scalability, and the growing exploration of blockchain for enhanced security and transparency, is paramount. The global surge in e-commerce, accelerated by changing consumer behavior and digital transformation initiatives across industries, creates an insatiable demand for efficient payment gateways. Furthermore, increasing consumer preference for convenient, contactless, and mobile payment options, driven by smartphone penetration and the desire for frictionless transactions, is a significant catalyst. Supportive government policies aimed at promoting financial inclusion and digitizing economies, especially in emerging markets, also play a crucial role in expanding the market's reach.

Challenges Impacting Payment Processing Solutions Market Growth

Despite the upward trajectory, the Payment Processing Solutions Market faces several impediments. The ever-evolving landscape of cybersecurity threats necessitates continuous investment in advanced security protocols and compliance measures, which can be costly. Stringent and fragmented regulatory frameworks across different regions, including varying data protection laws and licensing requirements, create complexity and compliance burdens for global payment processors. Intense competition among a multitude of players, from established financial institutions to agile fintech startups, leads to pricing pressures and necessitates constant innovation to maintain market share. Furthermore, the potential for global economic downturns or geopolitical instability could impact consumer spending and, consequently, transaction volumes, presenting a macroeconomic challenge to growth.

Key Players Shaping the Payment Processing Solutions Market Market

- Total System Services LLC

- PayU Payments Private Limite

- Fidelity National Information Services Inc

- First Data Corporation (Fiserv)

- Square Inc

- PayPal (Braintree)

- BluePay Processing LLC

- Paysafe Financial Services Limited

- Mastercard Inc

- Elavon Inc

- CCBill LLC

Significant Payment Processing Solutions Market Industry Milestones

- 2020 February: Fiserv acquires First Data, creating a powerhouse in payment processing.

- 2021 April: Square Inc. announces its intention to acquire Afterpay, a leading buy now, pay later (BNPL) service provider.

- 2022 July: Mastercard Inc. launches its new fraud prevention suite, leveraging AI and machine learning.

- 2023 March: PayPal (Braintree) expands its services to include cryptocurrency processing for merchants.

- 2023 September: Paysafe Financial Services Limited announces strategic partnerships to enhance its B2B payment solutions.

- 2024 January: Total System Services LLC (TSYS) integrates advanced biometric authentication into its payment processing platform.

Future Outlook for Payment Processing Solutions Market Market

The future outlook for the Payment Processing Solutions Market is exceptionally bright, driven by continued technological innovation and evolving consumer behavior. The integration of AI for hyper-personalization and advanced fraud mitigation will become standard. The expansion of real-time payment networks and the continued growth of mobile wallets will redefine transaction speed and convenience. Opportunities lie in serving the burgeoning SME sector with tailored, affordable solutions and in facilitating cross-border e-commerce with seamless currency conversion and compliance. Emerging markets represent significant growth potential as digital payment adoption accelerates. The focus will remain on providing secure, user-friendly, and integrated payment experiences that cater to the dynamic needs of a digitally connected global economy.

Payment Processing Solutions Market Segmentation

-

1. Payment Method

- 1.1. Credit/Debit Cards

- 1.2. Mobile Wallets/E-wallets

-

2. Size of the Organization

- 2.1. Small and Medium Organizations

- 2.2. Large Organizations

-

3. End-user Industry

- 3.1. Retail & E-commerce

- 3.2. Healthcare

- 3.3. Transportation & Logistics

- 3.4. Hospitality

- 3.5. Other En

Payment Processing Solutions Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Payment Processing Solutions Market Regional Market Share

Geographic Coverage of Payment Processing Solutions Market

Payment Processing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Adoption of Mobile/Digital Payment Solutions; Massive Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations in the Payments Industry

- 3.4. Market Trends

- 3.4.1. Retail & E-commerce Industry is Expected to Gain Maximum Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Payment Processing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Payment Method

- 5.1.1. Credit/Debit Cards

- 5.1.2. Mobile Wallets/E-wallets

- 5.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 5.2.1. Small and Medium Organizations

- 5.2.2. Large Organizations

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Retail & E-commerce

- 5.3.2. Healthcare

- 5.3.3. Transportation & Logistics

- 5.3.4. Hospitality

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Payment Method

- 6. North America Payment Processing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Payment Method

- 6.1.1. Credit/Debit Cards

- 6.1.2. Mobile Wallets/E-wallets

- 6.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 6.2.1. Small and Medium Organizations

- 6.2.2. Large Organizations

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Retail & E-commerce

- 6.3.2. Healthcare

- 6.3.3. Transportation & Logistics

- 6.3.4. Hospitality

- 6.3.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Payment Method

- 7. Europe Payment Processing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Payment Method

- 7.1.1. Credit/Debit Cards

- 7.1.2. Mobile Wallets/E-wallets

- 7.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 7.2.1. Small and Medium Organizations

- 7.2.2. Large Organizations

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Retail & E-commerce

- 7.3.2. Healthcare

- 7.3.3. Transportation & Logistics

- 7.3.4. Hospitality

- 7.3.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Payment Method

- 8. Asia Pacific Payment Processing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Payment Method

- 8.1.1. Credit/Debit Cards

- 8.1.2. Mobile Wallets/E-wallets

- 8.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 8.2.1. Small and Medium Organizations

- 8.2.2. Large Organizations

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Retail & E-commerce

- 8.3.2. Healthcare

- 8.3.3. Transportation & Logistics

- 8.3.4. Hospitality

- 8.3.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Payment Method

- 9. Latin America Payment Processing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Payment Method

- 9.1.1. Credit/Debit Cards

- 9.1.2. Mobile Wallets/E-wallets

- 9.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 9.2.1. Small and Medium Organizations

- 9.2.2. Large Organizations

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Retail & E-commerce

- 9.3.2. Healthcare

- 9.3.3. Transportation & Logistics

- 9.3.4. Hospitality

- 9.3.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Payment Method

- 10. Middle East Payment Processing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Payment Method

- 10.1.1. Credit/Debit Cards

- 10.1.2. Mobile Wallets/E-wallets

- 10.2. Market Analysis, Insights and Forecast - by Size of the Organization

- 10.2.1. Small and Medium Organizations

- 10.2.2. Large Organizations

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Retail & E-commerce

- 10.3.2. Healthcare

- 10.3.3. Transportation & Logistics

- 10.3.4. Hospitality

- 10.3.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Payment Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Total System Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PayU Payments Private Limite

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fidelity National Information Services Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 First Data Corporation (Fiserv)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Square Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PayPal (Braintree)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BluePay Processing LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Paysafe Financial Services Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mastercard Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Elavon Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CCBill LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Total System Services LLC

List of Figures

- Figure 1: Global Payment Processing Solutions Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Payment Processing Solutions Market Revenue (undefined), by Payment Method 2025 & 2033

- Figure 3: North America Payment Processing Solutions Market Revenue Share (%), by Payment Method 2025 & 2033

- Figure 4: North America Payment Processing Solutions Market Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 5: North America Payment Processing Solutions Market Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 6: North America Payment Processing Solutions Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America Payment Processing Solutions Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Payment Processing Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Payment Processing Solutions Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Payment Processing Solutions Market Revenue (undefined), by Payment Method 2025 & 2033

- Figure 11: Europe Payment Processing Solutions Market Revenue Share (%), by Payment Method 2025 & 2033

- Figure 12: Europe Payment Processing Solutions Market Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 13: Europe Payment Processing Solutions Market Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 14: Europe Payment Processing Solutions Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Europe Payment Processing Solutions Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Payment Processing Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Payment Processing Solutions Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Payment Processing Solutions Market Revenue (undefined), by Payment Method 2025 & 2033

- Figure 19: Asia Pacific Payment Processing Solutions Market Revenue Share (%), by Payment Method 2025 & 2033

- Figure 20: Asia Pacific Payment Processing Solutions Market Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 21: Asia Pacific Payment Processing Solutions Market Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 22: Asia Pacific Payment Processing Solutions Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Payment Processing Solutions Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Payment Processing Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Payment Processing Solutions Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Payment Processing Solutions Market Revenue (undefined), by Payment Method 2025 & 2033

- Figure 27: Latin America Payment Processing Solutions Market Revenue Share (%), by Payment Method 2025 & 2033

- Figure 28: Latin America Payment Processing Solutions Market Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 29: Latin America Payment Processing Solutions Market Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 30: Latin America Payment Processing Solutions Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Latin America Payment Processing Solutions Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Payment Processing Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Payment Processing Solutions Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Payment Processing Solutions Market Revenue (undefined), by Payment Method 2025 & 2033

- Figure 35: Middle East Payment Processing Solutions Market Revenue Share (%), by Payment Method 2025 & 2033

- Figure 36: Middle East Payment Processing Solutions Market Revenue (undefined), by Size of the Organization 2025 & 2033

- Figure 37: Middle East Payment Processing Solutions Market Revenue Share (%), by Size of the Organization 2025 & 2033

- Figure 38: Middle East Payment Processing Solutions Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Middle East Payment Processing Solutions Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East Payment Processing Solutions Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East Payment Processing Solutions Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Payment Processing Solutions Market Revenue undefined Forecast, by Payment Method 2020 & 2033

- Table 2: Global Payment Processing Solutions Market Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 3: Global Payment Processing Solutions Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Payment Processing Solutions Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Payment Processing Solutions Market Revenue undefined Forecast, by Payment Method 2020 & 2033

- Table 6: Global Payment Processing Solutions Market Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 7: Global Payment Processing Solutions Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Payment Processing Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Payment Processing Solutions Market Revenue undefined Forecast, by Payment Method 2020 & 2033

- Table 10: Global Payment Processing Solutions Market Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 11: Global Payment Processing Solutions Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Payment Processing Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Payment Processing Solutions Market Revenue undefined Forecast, by Payment Method 2020 & 2033

- Table 14: Global Payment Processing Solutions Market Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 15: Global Payment Processing Solutions Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Payment Processing Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Payment Processing Solutions Market Revenue undefined Forecast, by Payment Method 2020 & 2033

- Table 18: Global Payment Processing Solutions Market Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 19: Global Payment Processing Solutions Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Payment Processing Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Payment Processing Solutions Market Revenue undefined Forecast, by Payment Method 2020 & 2033

- Table 22: Global Payment Processing Solutions Market Revenue undefined Forecast, by Size of the Organization 2020 & 2033

- Table 23: Global Payment Processing Solutions Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Payment Processing Solutions Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Payment Processing Solutions Market?

The projected CAGR is approximately 17.5%.

2. Which companies are prominent players in the Payment Processing Solutions Market?

Key companies in the market include Total System Services LLC, PayU Payments Private Limite, Fidelity National Information Services Inc, First Data Corporation (Fiserv), Square Inc, PayPal (Braintree), BluePay Processing LLC, Paysafe Financial Services Limited, Mastercard Inc, Elavon Inc, CCBill LLC.

3. What are the main segments of the Payment Processing Solutions Market?

The market segments include Payment Method, Size of the Organization, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Adoption of Mobile/Digital Payment Solutions; Massive Growth of E-commerce.

6. What are the notable trends driving market growth?

Retail & E-commerce Industry is Expected to Gain Maximum Adoption.

7. Are there any restraints impacting market growth?

; Stringent Regulations in the Payments Industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Payment Processing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Payment Processing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Payment Processing Solutions Market?

To stay informed about further developments, trends, and reports in the Payment Processing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence