Key Insights

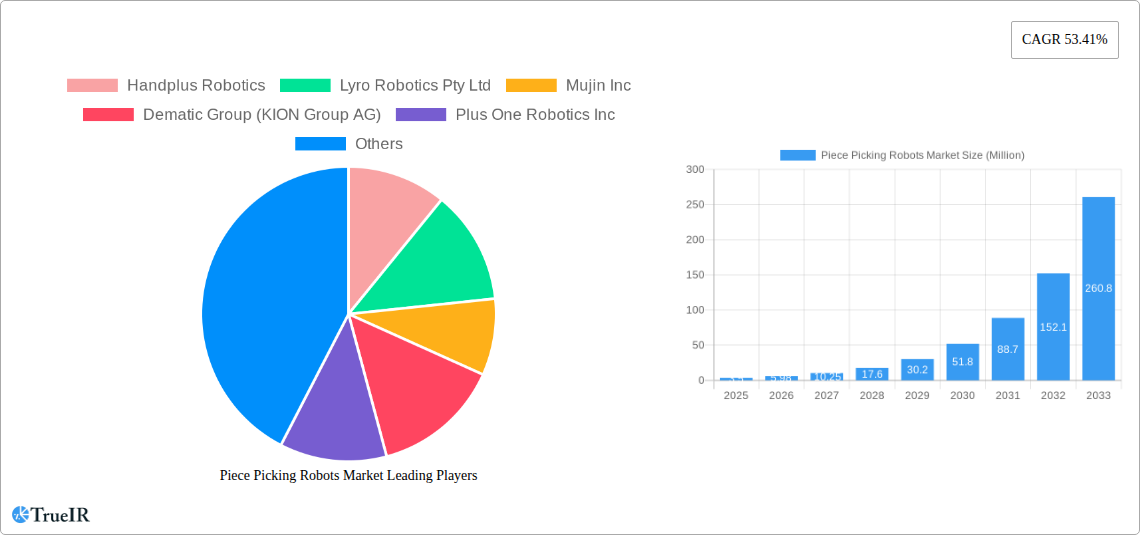

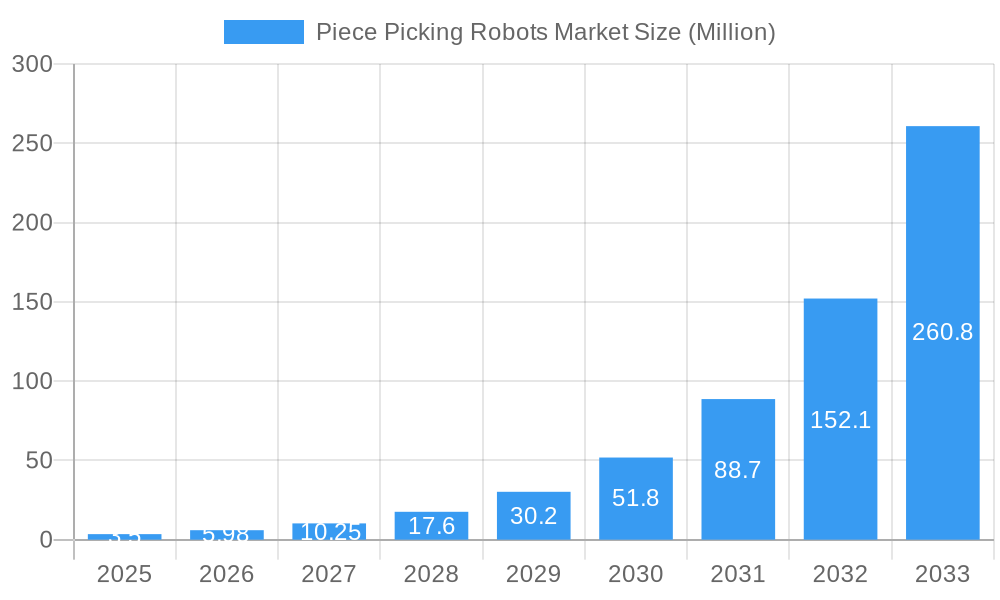

The global Piece Picking Robots Market is poised for explosive growth, with a current market size of 1.03 Million USD and a remarkable projected Compound Annual Growth Rate (CAGR) of 53.41%. This exceptional trajectory, spanning from 2019 to 2033, underscores a significant shift in automation adoption across various industries. The primary drivers fueling this surge include the relentless demand for increased operational efficiency, the need to mitigate labor shortages and rising labor costs, and the imperative for enhanced accuracy and speed in order fulfillment. The pharmaceutical sector is a key beneficiary, leveraging these robots for precise and sterile handling of sensitive materials, while the retail and e-commerce sectors are adopting them to streamline warehouse operations and meet the escalating expectations for faster delivery times. The continued evolution of artificial intelligence and machine learning is further accelerating advancements in robot capabilities, enabling more sophisticated and adaptable picking solutions.

Piece Picking Robots Market Market Size (In Million)

While the market is dominated by rapid expansion, certain restraints warrant attention. The initial high capital investment for advanced robotic systems can be a barrier for smaller enterprises. Additionally, the requirement for skilled personnel for installation, maintenance, and programming can pose a challenge. However, the increasing availability of more affordable and user-friendly solutions, coupled with growing rental and service models, is steadily mitigating these concerns. The market is segmented into collaborative robots, mobile robots, and other types, with collaborative robots gaining significant traction due to their ability to work safely alongside human operators. End-user applications are dominated by pharmaceuticals and retail/warehousing, with growing adoption in other diverse sectors seeking to optimize their picking processes. Leading companies like Universal Robots, Dematic Group, and Grey Orange are at the forefront of innovation, driving the market forward with their cutting-edge technologies and expanding portfolios.

Piece Picking Robots Market Company Market Share

Piece Picking Robots Market: Unlocking Efficiency in Warehousing Automation - Comprehensive Industry Report (2019-2033)

Gain unparalleled insights into the rapidly expanding Piece Picking Robots Market. This in-depth analysis covers market structure, trends, opportunities, dominant segments, and key players from 2019 through 2033, with a detailed focus on the 2025 base and estimated year. Discover how cutting-edge robotic solutions are revolutionizing pharmaceutical, retail, and other warehouse applications. Our report, meticulously researched, offers data-driven projections and strategic recommendations for stakeholders seeking to navigate this dynamic sector.

Piece Picking Robots Market Market Structure & Competitive Landscape

The Piece Picking Robots Market is characterized by a moderate to high degree of market concentration, with a significant portion of market share held by established automation providers and emerging innovators. This dynamic landscape is driven by continuous innovation, primarily in artificial intelligence (AI) for enhanced object recognition and manipulation, and advancements in robotic hardware for greater dexterity and speed. Regulatory impacts are becoming increasingly relevant, with evolving safety standards and data privacy concerns influencing robot deployment. Product substitutes exist, including semi-automated solutions and manual labor, but the cost-effectiveness and scalability of robotic picking are steadily eroding these alternatives. End-user segmentation is diverse, with the retail/e-commerce sector leading adoption, followed by pharmaceuticals and other industries demanding high-throughput, accuracy-driven operations. Mergers and acquisitions (M&A) are a notable trend, as larger players acquire specialized technology firms to bolster their product portfolios and expand market reach. For instance, the acquisition of companies with advanced AI picking capabilities by established industrial automation giants fuels this consolidation. We project that M&A activity will contribute approximately $500 Million to market growth over the forecast period, driven by the pursuit of synergistic technologies and market access.

Piece Picking Robots Market Market Trends & Opportunities

The global Piece Picking Robots Market is experiencing robust growth, projected to reach an estimated $8,500 Million by 2025, with a compound annual growth rate (CAGR) of 18.5% anticipated between 2025 and 2033. This surge is fueled by an escalating demand for enhanced operational efficiency and accuracy within warehouses and distribution centers. Technological shifts are at the forefront of this expansion, with advancements in AI, machine learning, and computer vision empowering robots to identify, grasp, and place a wider variety of items with unprecedented precision. The increasing complexity of SKUs and the rise of e-commerce have created a substantial market opportunity for automated piece-picking solutions capable of handling diverse product shapes, sizes, and materials. Consumer preferences for faster delivery times and personalized shopping experiences directly translate into a need for highly efficient order fulfillment processes, which piece-picking robots are uniquely positioned to provide. The competitive dynamics are intensifying, with both established industrial automation giants and nimble startups vying for market dominance. This competition is driving down costs and fostering innovation, making robotic solutions more accessible across a broader spectrum of businesses. Opportunities abound for companies that can offer integrated solutions, including software for inventory management and robotic fleet orchestration. The market penetration rate of piece-picking robots is expected to climb from xx% in 2025 to an estimated xx% by 2033, indicating significant room for expansion. The sheer volume of goods processed daily within global supply chains represents a colossal opportunity for automation. For example, the retail sector alone handles billions of orders annually, and the drive for same-day or next-day delivery necessitates scalable and error-free picking operations. Further opportunities lie in the development of specialized robotic end-effectors and grippers tailored for delicate or unusually shaped items, expanding the applicability of piece-picking robots into niche markets like the handling of perishable goods or highly specialized industrial components. The growing awareness of labor shortages and the rising costs associated with manual picking are also significant catalysts, pushing companies to invest in automation for long-term cost savings and improved worker safety.

Dominant Markets & Segments in Piece Picking Robots Market

The Retail/Warehouse segment stands as the dominant force within the Piece Picking Robots Market, driven by the exponential growth of e-commerce and the subsequent pressure on fulfillment centers to process orders with unprecedented speed and accuracy. The sheer volume of individual item picks required for online retail orders makes this sector a prime candidate for robotic automation. Key growth drivers in this segment include:

- Infrastructure: The widespread availability of sophisticated warehouse management systems (WMS) and the integration capabilities of robotic solutions with existing infrastructure.

- Policies: Evolving trade policies and the global push for supply chain resilience further encourage investment in domestic, automated fulfillment capabilities.

- Consumer Behavior: The increasing expectation for rapid delivery and a vast product selection online directly translates to a need for highly efficient and scalable picking operations.

The Mobile Robot sub-segment within the "Type of Robot" category is also exhibiting significant traction. Mobile piece-picking robots offer enhanced flexibility and scalability, allowing for dynamic reconfiguration of warehouse layouts and reduced reliance on fixed infrastructure. Their ability to navigate complex environments and collaborate with human workers makes them particularly attractive for evolving warehouse needs.

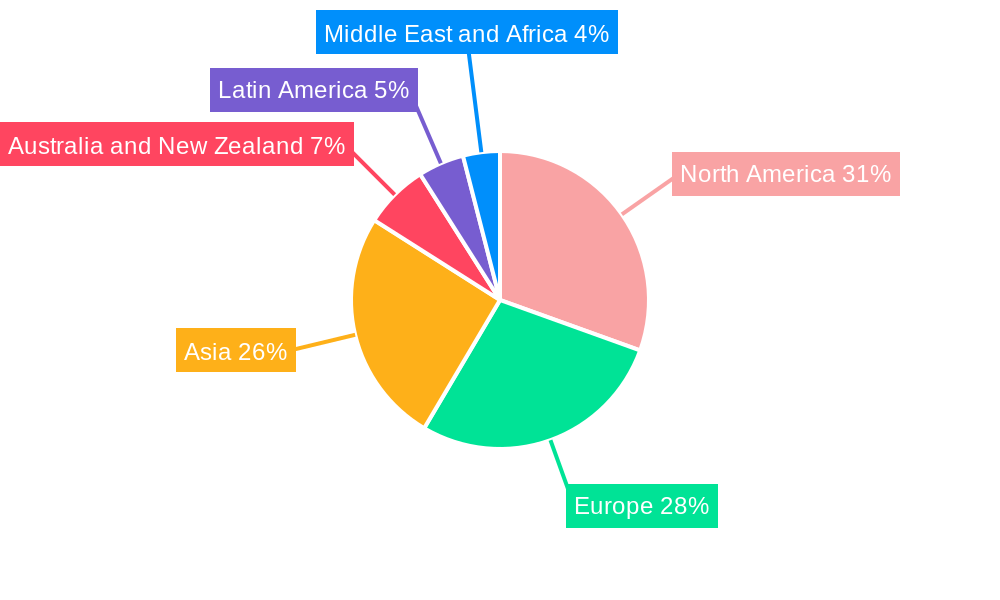

In terms of geographical dominance, North America and Europe currently lead the Piece Picking Robots Market. This leadership is attributed to:

- Advanced Technological Adoption: High rates of technology adoption and a mature industrial automation ecosystem.

- Government Initiatives: Supportive government policies and incentives aimed at boosting manufacturing and logistics efficiency.

- Labor Costs: Rising labor costs in these regions make robotic automation a more financially viable solution for businesses.

The Pharmaceutical end-user application, while currently smaller in market share compared to retail, is a rapidly growing segment. Stringent quality control requirements, the need for sterile environments, and the handling of high-value, sensitive products make robotic picking a logical and increasingly adopted solution. Opportunities here lie in the development of specialized robots capable of aseptic handling and precise dispensing. The "Others" end-user application category, encompassing sectors like 3PL (Third-Party Logistics), manufacturing, and food & beverage, also presents substantial growth potential. As these industries grapple with similar pressures for efficiency and accuracy, the adoption of piece-picking robots is expected to accelerate.

Piece Picking Robots Market Product Analysis

Piece picking robots are undergoing rapid product innovation, focusing on enhanced dexterity, speed, and intelligence. Advancements in gripper technology, including soft grippers and multi-finger dexterous hands, enable robots to handle a wider range of object shapes, sizes, and materials, from delicate electronics to soft goods. The integration of advanced AI algorithms for object recognition and path planning allows robots to identify and pick items with greater accuracy and adaptability, even in cluttered environments. Competitive advantages stem from robots that offer seamless integration with existing WMS, real-time performance analytics, and the ability to learn and adapt to new picking tasks. These innovations are directly addressing the market's need for increased throughput, reduced errors, and improved operational efficiency in diverse end-user applications.

Key Drivers, Barriers & Challenges in Piece Picking Robots Market

Key Drivers:

The Piece Picking Robots Market is propelled by several pivotal factors. Technological advancements in AI, machine learning, and robotics are central, enabling robots to perform increasingly complex picking tasks with human-like dexterity and accuracy. The economic imperative to reduce labor costs and improve operational efficiency, especially in the face of labor shortages, is a significant driver. Furthermore, policy support and government incentives aimed at modernizing industrial sectors and promoting automation are also contributing to market expansion. The e-commerce boom continues to be a primary catalyst, demanding faster and more accurate order fulfillment.

Barriers & Challenges:

Despite the promising outlook, the market faces barriers and challenges. The high initial investment cost of sophisticated robotic systems remains a hurdle for some businesses, particularly SMEs. Integration complexity with existing warehouse infrastructure and IT systems can also pose a significant challenge. Supply chain issues related to the availability of critical components and regulatory hurdles concerning safety standards and data privacy can slow down adoption. Competitive pressures from established manual processes and the need for specialized training for robot operation and maintenance are also critical considerations. The need for robust and adaptable gripping solutions for a wide variety of items, from fragile to deformable, also presents an ongoing engineering challenge.

Growth Drivers in the Piece Picking Robots Market Market

Several key growth drivers are fueling the Piece Picking Robots Market. The relentless surge in e-commerce volume necessitates highly efficient and accurate order fulfillment, directly benefiting piece-picking robots. Technological advancements, particularly in AI-powered vision systems and dexterous manipulation, are making robots more versatile and capable of handling a wider range of SKUs. Labor shortages and rising labor costs in many developed economies are creating a strong economic incentive for businesses to invest in automation as a long-term solution for consistent and cost-effective operations. Furthermore, government initiatives promoting industrial automation and supply chain resilience are providing a supportive environment for market growth. The increasing demand for faster delivery times from consumers is also a significant push factor for adopting solutions that can significantly speed up the picking process.

Challenges Impacting Piece Picking Robots Market Growth

While growth is robust, several challenges impact the Piece Picking Robots Market. The high upfront capital expenditure required for advanced robotic systems can be a significant barrier, especially for small and medium-sized enterprises (SMEs). Integration complexity with existing warehouse management systems (WMS) and legacy infrastructure can lead to implementation delays and increased costs. Supply chain disruptions affecting the availability of essential components, such as advanced sensors and robotic arms, can also hinder production and delivery timelines. Regulatory complexities surrounding industrial safety standards and the need for skilled personnel to operate and maintain these sophisticated systems present further hurdles. The limited adaptability of some current robotic solutions to highly diverse or exceptionally delicate items continues to be an area requiring ongoing development.

Key Players Shaping the Piece Picking Robots Market Market

- Handplus Robotics

- Lyro Robotics Pty Ltd

- Mujin Inc

- Dematic Group (KION Group AG)

- Plus One Robotics Inc

- Robomotive BV

- Karakuri Ltd

- Osaro Inc

- Nimble Robotics Inc

- SSI Schaefer Group

- XYZ Robotics Inc

- Grey Orange Pte Ltd

- Covariant

- Berkshire Grey Inc

- Universal Robots A/S

- Kindred Systems Inc

- Righthand Robotics Inc

- Nomagic Inc

- Knapp AG

- Swisslog Holding AG

- Fizyr B V

Significant Piece Picking Robots Market Industry Milestones

- September 2023: Movu Robotics launched the innovative Movu Eligo robot picking arm, enhancing warehouse automation solutions.

- May 2023: SSI SCHAEFER announced the launch of a fully automated piece-picking system featuring advanced AI for object recognition and gentle product handling, debuting at LogiMAT.

Future Outlook for Piece Picking Robots Market Market

The future outlook for the Piece Picking Robots Market is exceptionally bright, driven by an ongoing wave of technological innovation and increasing operational demands. Strategic opportunities lie in the development of more adaptable and cost-effective robotic solutions, particularly for SMEs. The continued integration of AI and machine learning will empower robots with enhanced learning capabilities and predictive maintenance, reducing downtime and optimizing performance. The market potential is vast, fueled by the persistent growth of e-commerce, the global drive for supply chain resilience, and the ever-present need for increased efficiency and reduced operational costs across various industries. We foresee a significant expansion in the adoption of collaborative robots working alongside humans, further enhancing warehouse productivity.

Piece Picking Robots Market Segmentation

-

1. Type of Robot

- 1.1. Collaborative

- 1.2. Mobile and others

-

2. End User Application

- 2.1. Pharmaceutical

- 2.2. Retail/W

- 2.3. Other End User Applications

Piece Picking Robots Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Piece Picking Robots Market Regional Market Share

Geographic Coverage of Piece Picking Robots Market

Piece Picking Robots Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 53.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. A Shift from Full-case or Pallet Picking to Piece Flow and Improved Technology Investments; Increasing Investments in Automation

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise to Maintain the Deployed System is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Collaborative Robots to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Piece Picking Robots Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Robot

- 5.1.1. Collaborative

- 5.1.2. Mobile and others

- 5.2. Market Analysis, Insights and Forecast - by End User Application

- 5.2.1. Pharmaceutical

- 5.2.2. Retail/W

- 5.2.3. Other End User Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Robot

- 6. North America Piece Picking Robots Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Robot

- 6.1.1. Collaborative

- 6.1.2. Mobile and others

- 6.2. Market Analysis, Insights and Forecast - by End User Application

- 6.2.1. Pharmaceutical

- 6.2.2. Retail/W

- 6.2.3. Other End User Applications

- 6.1. Market Analysis, Insights and Forecast - by Type of Robot

- 7. Europe Piece Picking Robots Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Robot

- 7.1.1. Collaborative

- 7.1.2. Mobile and others

- 7.2. Market Analysis, Insights and Forecast - by End User Application

- 7.2.1. Pharmaceutical

- 7.2.2. Retail/W

- 7.2.3. Other End User Applications

- 7.1. Market Analysis, Insights and Forecast - by Type of Robot

- 8. Asia Piece Picking Robots Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Robot

- 8.1.1. Collaborative

- 8.1.2. Mobile and others

- 8.2. Market Analysis, Insights and Forecast - by End User Application

- 8.2.1. Pharmaceutical

- 8.2.2. Retail/W

- 8.2.3. Other End User Applications

- 8.1. Market Analysis, Insights and Forecast - by Type of Robot

- 9. Australia and New Zealand Piece Picking Robots Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Robot

- 9.1.1. Collaborative

- 9.1.2. Mobile and others

- 9.2. Market Analysis, Insights and Forecast - by End User Application

- 9.2.1. Pharmaceutical

- 9.2.2. Retail/W

- 9.2.3. Other End User Applications

- 9.1. Market Analysis, Insights and Forecast - by Type of Robot

- 10. Latin America Piece Picking Robots Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Robot

- 10.1.1. Collaborative

- 10.1.2. Mobile and others

- 10.2. Market Analysis, Insights and Forecast - by End User Application

- 10.2.1. Pharmaceutical

- 10.2.2. Retail/W

- 10.2.3. Other End User Applications

- 10.1. Market Analysis, Insights and Forecast - by Type of Robot

- 11. Middle East and Africa Piece Picking Robots Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of Robot

- 11.1.1. Collaborative

- 11.1.2. Mobile and others

- 11.2. Market Analysis, Insights and Forecast - by End User Application

- 11.2.1. Pharmaceutical

- 11.2.2. Retail/W

- 11.2.3. Other End User Applications

- 11.1. Market Analysis, Insights and Forecast - by Type of Robot

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Handplus Robotics

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lyro Robotics Pty Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mujin Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dematic Group (KION Group AG)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Plus One Robotics Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Robomotive BV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Karakuri Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Osaro Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nimble Robotics Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SSI Schaefer Group*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 XYZ Robotics Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Grey Orange Pte Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Covariant

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Berkshire Grey Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Universal Robots A/S

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Kindred Systems Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Righthand Robotics Inc

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Nomagic Inc

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Knapp AG

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Swisslog Holding AG

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.21 Fizyr B V

- 12.2.21.1. Overview

- 12.2.21.2. Products

- 12.2.21.3. SWOT Analysis

- 12.2.21.4. Recent Developments

- 12.2.21.5. Financials (Based on Availability)

- 12.2.1 Handplus Robotics

List of Figures

- Figure 1: Global Piece Picking Robots Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Piece Picking Robots Market Revenue (Million), by Type of Robot 2025 & 2033

- Figure 3: North America Piece Picking Robots Market Revenue Share (%), by Type of Robot 2025 & 2033

- Figure 4: North America Piece Picking Robots Market Revenue (Million), by End User Application 2025 & 2033

- Figure 5: North America Piece Picking Robots Market Revenue Share (%), by End User Application 2025 & 2033

- Figure 6: North America Piece Picking Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Piece Picking Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Piece Picking Robots Market Revenue (Million), by Type of Robot 2025 & 2033

- Figure 9: Europe Piece Picking Robots Market Revenue Share (%), by Type of Robot 2025 & 2033

- Figure 10: Europe Piece Picking Robots Market Revenue (Million), by End User Application 2025 & 2033

- Figure 11: Europe Piece Picking Robots Market Revenue Share (%), by End User Application 2025 & 2033

- Figure 12: Europe Piece Picking Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Piece Picking Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Piece Picking Robots Market Revenue (Million), by Type of Robot 2025 & 2033

- Figure 15: Asia Piece Picking Robots Market Revenue Share (%), by Type of Robot 2025 & 2033

- Figure 16: Asia Piece Picking Robots Market Revenue (Million), by End User Application 2025 & 2033

- Figure 17: Asia Piece Picking Robots Market Revenue Share (%), by End User Application 2025 & 2033

- Figure 18: Asia Piece Picking Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Piece Picking Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Piece Picking Robots Market Revenue (Million), by Type of Robot 2025 & 2033

- Figure 21: Australia and New Zealand Piece Picking Robots Market Revenue Share (%), by Type of Robot 2025 & 2033

- Figure 22: Australia and New Zealand Piece Picking Robots Market Revenue (Million), by End User Application 2025 & 2033

- Figure 23: Australia and New Zealand Piece Picking Robots Market Revenue Share (%), by End User Application 2025 & 2033

- Figure 24: Australia and New Zealand Piece Picking Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Piece Picking Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Piece Picking Robots Market Revenue (Million), by Type of Robot 2025 & 2033

- Figure 27: Latin America Piece Picking Robots Market Revenue Share (%), by Type of Robot 2025 & 2033

- Figure 28: Latin America Piece Picking Robots Market Revenue (Million), by End User Application 2025 & 2033

- Figure 29: Latin America Piece Picking Robots Market Revenue Share (%), by End User Application 2025 & 2033

- Figure 30: Latin America Piece Picking Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Piece Picking Robots Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Piece Picking Robots Market Revenue (Million), by Type of Robot 2025 & 2033

- Figure 33: Middle East and Africa Piece Picking Robots Market Revenue Share (%), by Type of Robot 2025 & 2033

- Figure 34: Middle East and Africa Piece Picking Robots Market Revenue (Million), by End User Application 2025 & 2033

- Figure 35: Middle East and Africa Piece Picking Robots Market Revenue Share (%), by End User Application 2025 & 2033

- Figure 36: Middle East and Africa Piece Picking Robots Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Piece Picking Robots Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Piece Picking Robots Market Revenue Million Forecast, by Type of Robot 2020 & 2033

- Table 2: Global Piece Picking Robots Market Revenue Million Forecast, by End User Application 2020 & 2033

- Table 3: Global Piece Picking Robots Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Piece Picking Robots Market Revenue Million Forecast, by Type of Robot 2020 & 2033

- Table 5: Global Piece Picking Robots Market Revenue Million Forecast, by End User Application 2020 & 2033

- Table 6: Global Piece Picking Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Piece Picking Robots Market Revenue Million Forecast, by Type of Robot 2020 & 2033

- Table 8: Global Piece Picking Robots Market Revenue Million Forecast, by End User Application 2020 & 2033

- Table 9: Global Piece Picking Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Piece Picking Robots Market Revenue Million Forecast, by Type of Robot 2020 & 2033

- Table 11: Global Piece Picking Robots Market Revenue Million Forecast, by End User Application 2020 & 2033

- Table 12: Global Piece Picking Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Piece Picking Robots Market Revenue Million Forecast, by Type of Robot 2020 & 2033

- Table 14: Global Piece Picking Robots Market Revenue Million Forecast, by End User Application 2020 & 2033

- Table 15: Global Piece Picking Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Piece Picking Robots Market Revenue Million Forecast, by Type of Robot 2020 & 2033

- Table 17: Global Piece Picking Robots Market Revenue Million Forecast, by End User Application 2020 & 2033

- Table 18: Global Piece Picking Robots Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Piece Picking Robots Market Revenue Million Forecast, by Type of Robot 2020 & 2033

- Table 20: Global Piece Picking Robots Market Revenue Million Forecast, by End User Application 2020 & 2033

- Table 21: Global Piece Picking Robots Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Piece Picking Robots Market?

The projected CAGR is approximately 53.41%.

2. Which companies are prominent players in the Piece Picking Robots Market?

Key companies in the market include Handplus Robotics, Lyro Robotics Pty Ltd, Mujin Inc, Dematic Group (KION Group AG), Plus One Robotics Inc, Robomotive BV, Karakuri Ltd, Osaro Inc, Nimble Robotics Inc, SSI Schaefer Group*List Not Exhaustive, XYZ Robotics Inc, Grey Orange Pte Ltd, Covariant, Berkshire Grey Inc, Universal Robots A/S, Kindred Systems Inc, Righthand Robotics Inc, Nomagic Inc, Knapp AG, Swisslog Holding AG, Fizyr B V.

3. What are the main segments of the Piece Picking Robots Market?

The market segments include Type of Robot, End User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

A Shift from Full-case or Pallet Picking to Piece Flow and Improved Technology Investments; Increasing Investments in Automation.

6. What are the notable trends driving market growth?

Collaborative Robots to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Expertise to Maintain the Deployed System is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2023 - Movu Robotics, one of the leading suppliers for designing, developing, and implementing innovative and more accessible warehouse automation solutions, announced the launch of the innovative Movu Eligo robot picking arm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Piece Picking Robots Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Piece Picking Robots Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Piece Picking Robots Market?

To stay informed about further developments, trends, and reports in the Piece Picking Robots Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence