Key Insights

The Portugal Point-of-Sale (POS) terminals market is set for significant expansion, fueled by a growing digital payment landscape and widespread adoption across various industries. Projected to reach $32.33 billion in 2025, the market is expected to achieve a Compound Annual Growth Rate (CAGR) of 8.31% by 2033. Key growth drivers include government initiatives promoting cashless transactions, rising consumer demand for secure and convenient payment methods, and continuous POS technology innovation, particularly mobile and cloud-based solutions. While retail remains a core sector, substantial growth is also anticipated in hospitality and healthcare as these industries adopt digital transformation for operational efficiency and enhanced customer experiences.

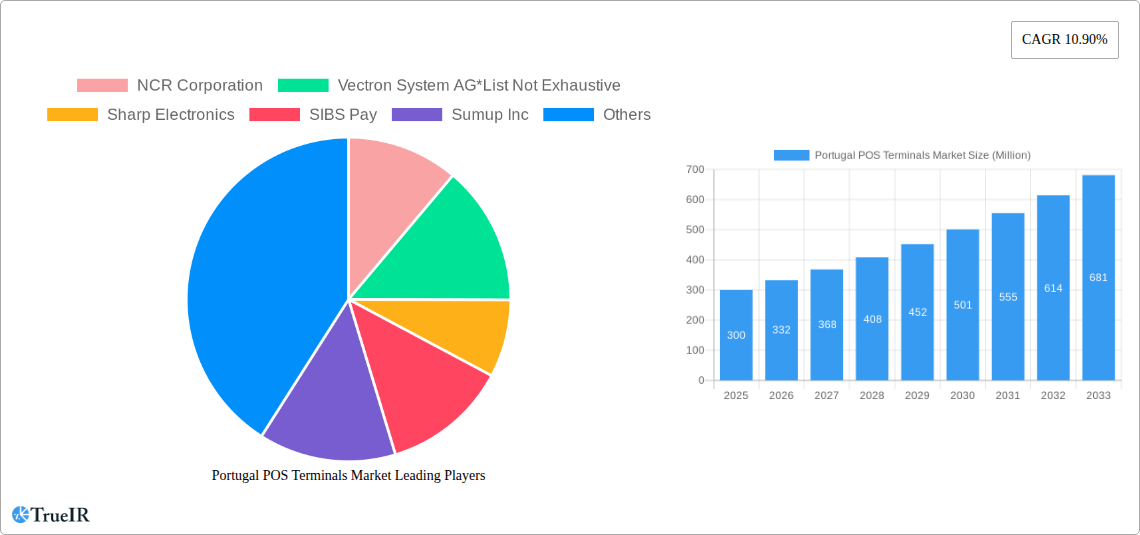

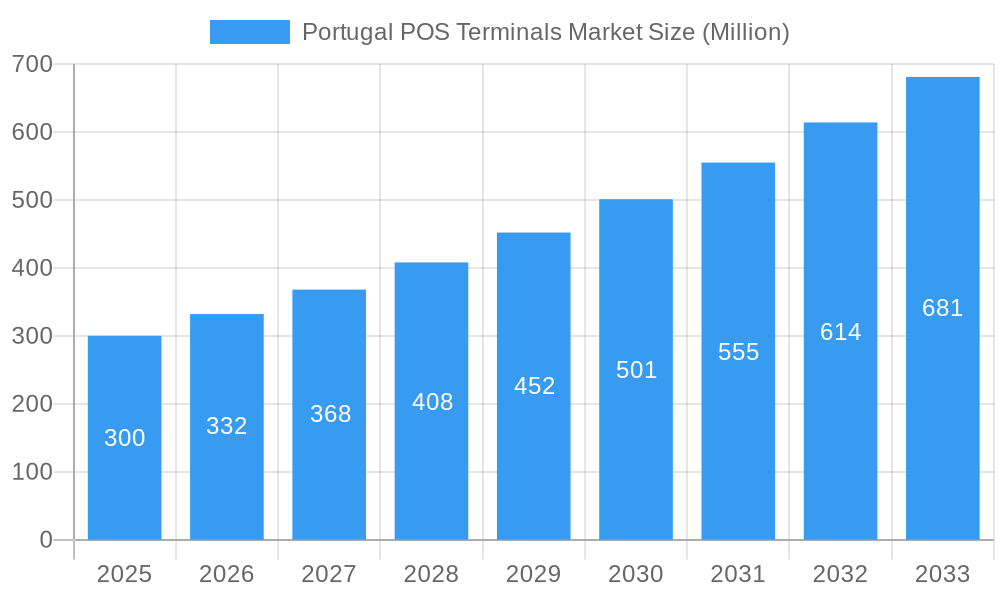

Portugal POS Terminals Market Market Size (In Billion)

Further market expansion is driven by the integration of advanced POS features such as inventory management, customer relationship management (CRM), and analytics, positioning POS systems as essential business tools. The rise of mobile POS (mPOS) systems offers crucial flexibility and affordability for small and medium-sized enterprises (SMEs) and startups. While the market exhibits strong positive momentum, potential challenges, including initial investment costs for advanced systems and the necessity for robust cybersecurity, require strategic consideration by market players. Nevertheless, the overall outlook indicates a dynamic and growing market, with key companies actively shaping its future through technological advancements and strategic collaborations.

Portugal POS Terminals Market Company Market Share

This comprehensive report offers a dynamic, SEO-optimized analysis of the Portugal POS terminals market, utilizing high-volume keywords to improve search visibility and engage industry stakeholders. The analysis covers the historical period 2019-2024, with 2025 as the base year and a forecast extending to 2033.

Portugal POS Terminals Market Market Structure & Competitive Landscape

The Portugal POS terminals market exhibits a dynamic competitive landscape characterized by a mix of established global players and emerging local providers, vying for market share amidst evolving technological demands. Market concentration is moderate, with the top five companies estimated to hold a significant XX% of the market by revenue in 2025. Innovation drivers are largely dictated by the increasing adoption of cloud-based solutions, mobile payment integration, and enhanced data analytics capabilities. Regulatory impacts, while present, are generally supportive of market growth, focusing on transaction security and consumer data protection. Product substitutes, primarily traditional cash registers and manual transaction methods, are steadily declining in relevance due to the superior efficiency and comprehensive features offered by modern POS terminals. End-user segmentation plays a crucial role, with distinct needs arising from the retail, healthcare, hospitality, and entertainment sectors. Merger and acquisition (M&A) trends are anticipated to remain active as larger entities seek to consolidate their market position and expand their service offerings, with an estimated XX M&A deals in the historical period.

Portugal POS Terminals Market Market Trends & Opportunities

The Portugal POS terminals market is poised for robust growth, driven by a confluence of technological advancements, shifting consumer preferences, and expanding end-user adoption. The market size is projected to reach approximately XX Million Euros by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fueled by the increasing demand for seamless and secure payment solutions across all commercial sectors. Technological shifts are prominently marked by the proliferation of mobile POS (mPOS) systems, enabling greater flexibility and mobility for businesses, particularly small and medium-sized enterprises (SMEs). The integration of NFC (Near Field Communication) and contactless payment technologies has become a standard expectation, significantly boosting transaction speeds and enhancing customer convenience. Furthermore, the growing emphasis on omnichannel commerce strategies necessitates integrated POS solutions that can manage online and in-store sales, inventory, and customer data effectively.

Consumer preferences are increasingly leaning towards faster, more convenient, and secure payment methods. The declining use of cash and the rising adoption of credit, debit, and digital wallets are directly impacting the demand for advanced POS terminals. Businesses are recognizing the imperative to invest in modern POS systems not just for payment processing but also for their capabilities in inventory management, customer relationship management (CRM), sales analytics, and loyalty programs. This trend creates significant opportunities for POS terminal providers offering value-added services and comprehensive business management solutions.

Competitive dynamics are intensifying, with companies focusing on differentiating through features such as advanced security protocols, user-friendly interfaces, cloud-based management platforms, and specialized industry solutions. The drive towards digitalization across Portuguese businesses, influenced by government initiatives promoting digital transformation and e-invoicing, further underpins the growth of the POS terminals market. Opportunities also lie in catering to the burgeoning e-commerce sector by providing integrated POS solutions that bridge the gap between online and offline retail experiences. The healthcare sector's adoption of digital patient management systems and the hospitality industry's need for streamlined booking and payment processes present lucrative avenues for market penetration. As businesses continue to prioritize operational efficiency and enhanced customer experiences, the demand for sophisticated and adaptable POS terminals is set to surge.

Dominant Markets & Segments in Portugal POS Terminals Market

The Portugal POS terminals market is segmented by type and end-user industry, with certain segments demonstrating exceptional dominance and growth potential.

By Type:

- Fixed Point-of-Sale Systems: Historically the dominant segment, fixed POS systems continue to hold a significant market share, particularly in larger retail establishments, restaurants, and healthcare facilities where stationary terminals are integral to operations. The reliability, extensive features, and robust processing capabilities of these systems make them a preferred choice for high-volume transaction environments. Infrastructure development and the need for sophisticated inventory and sales management within brick-and-mortar stores are key growth drivers for this segment.

- Mobile/Portable Point-of-Sale Systems: This segment is experiencing rapid expansion, driven by the increasing demand for flexibility and mobility. The proliferation of smartphones and tablets, coupled with advancements in wireless technology, has made mPOS solutions highly accessible and cost-effective. Small businesses, pop-up shops, and service-based industries that require payment processing on the go are major adopters. Policies promoting digital payments and the ease of deployment are significant accelerators for mPOS adoption. The ability to accept payments anywhere, anytime, empowers businesses to capture more sales and enhance customer service.

By End-user Industry:

- Retail: The retail sector remains the largest and most influential end-user industry for POS terminals in Portugal. This dominance is attributed to the sheer volume of transactions, the increasing adoption of self-checkout systems, and the growing need for integrated inventory and CRM functionalities to manage complex supply chains and customer loyalty programs. Government initiatives aimed at modernizing the retail sector and promoting e-commerce further fuel this segment's growth. Infrastructure development in terms of reliable internet connectivity across retail outlets is crucial for seamless POS operations.

- Hospitality: The hospitality sector, encompassing hotels, restaurants, and cafes, represents another significant market. The demand for efficient order taking, table management, billing, and payment processing makes POS systems indispensable. The growing trend of online ordering and delivery services further necessitates integrated POS solutions that can manage multiple sales channels. Technological advancements in contactless payment and mobile ordering platforms are key growth drivers.

- Healthcare: The healthcare industry is increasingly adopting POS terminals for patient billing, prescription payments, and managing various administrative tasks. The emphasis on digital health records and streamlined patient experiences is driving the adoption of secure and efficient payment solutions. Compliance with stringent data privacy regulations (e.g., GDPR) is a critical factor in this segment.

- Entertainment: Venues such as cinemas, event centers, and amusement parks utilize POS terminals for ticket sales, merchandise, and concession stands, benefiting from faster transaction processing and enhanced sales tracking.

- Other End-user Industries: This category includes diverse sectors like transportation, education, and government services, all of which are gradually integrating POS solutions for various payment and administrative needs.

The market dominance within these segments is influenced by factors such as the digital infrastructure available, government policies supporting technology adoption, and the economic viability for businesses to invest in advanced POS systems.

Portugal POS Terminals Market Product Analysis

Portugal's POS terminals market is characterized by continuous product innovation focused on enhancing transaction speed, security, and user experience. Innovations include the integration of advanced biometric authentication, AI-powered analytics for sales forecasting, and cloud-based platforms for remote management and updates. Competitive advantages are being built around secure, contactless payment capabilities, seamless integration with e-commerce platforms, and customizable software solutions tailored to specific industry needs. The market is witnessing a surge in feature-rich devices that go beyond basic payment processing, offering functionalities like inventory management, customer loyalty programs, and employee management, thus providing a comprehensive business management solution.

Key Drivers, Barriers & Challenges in Portugal POS Terminals Market

Key Drivers:

The Portugal POS terminals market is propelled by several key drivers. Technological advancements, particularly the widespread adoption of contactless and mobile payment solutions, are fundamentally reshaping transaction methods. The increasing penetration of smartphones and tablets facilitates the adoption of cost-effective mPOS systems, especially for SMEs. Government initiatives promoting digital transformation and e-invoicing further stimulate demand for integrated POS systems. Furthermore, the growing consumer preference for convenience and speed in transactions, coupled with businesses' need to enhance operational efficiency and customer experience, are significant growth catalysts.

Barriers & Challenges:

Despite the positive outlook, the market faces certain barriers and challenges. High initial investment costs for advanced POS hardware and software can be a restraint for some smaller businesses. Regulatory complexities and evolving data security standards necessitate continuous compliance efforts and investment. Supply chain disruptions and the global semiconductor shortage can impact the availability and pricing of POS terminals. Intense competition among vendors, leading to price pressures, also poses a challenge. Lastly, the resistance to change and the learning curve associated with adopting new technologies can hinder adoption rates in certain segments of the market.

Growth Drivers in the Portugal POS Terminals Market Market

Several key factors are driving the growth of the Portugal POS terminals market. The pervasive shift towards digital and contactless payments, driven by both consumer preference and merchant adoption, is a primary catalyst. Technological advancements, including the miniaturization of hardware and the expansion of cloud-based POS solutions, have made sophisticated payment systems more accessible and affordable. Government policies aimed at fostering a digital economy, such as incentives for e-invoicing and digital transaction reporting, directly boost the demand for compliant POS terminals. Economic factors, including the overall health of the Portuguese economy and increased consumer spending, indirectly contribute to higher transaction volumes, thus increasing the need for efficient POS systems.

Challenges Impacting Portugal POS Terminals Market Growth

The growth of the Portugal POS terminals market is impacted by several challenges. Regulatory complexities, particularly concerning data privacy and transaction security, require ongoing adaptation and investment from POS providers and users. Supply chain issues, exacerbated by global manufacturing and logistics challenges, can lead to delays and increased costs for hardware. Competitive pressures from a crowded market can lead to price wars, potentially impacting profit margins for vendors. Furthermore, the digital divide and varying levels of technological literacy among different business segments can create a barrier to adoption for more advanced POS solutions. The interoperability of different payment systems and POS devices also remains a concern for seamless integration.

Key Players Shaping the Portugal POS Terminals Market Market

- NCR Corporation

- Vectron System AG

- Sharp Electronics

- SIBS Pay

- Sumup Inc

- NEC Corporation

- myPOS World Ltd

- Mastercard Inc

- Ingenico Group (Worldline)

- Verifone Inc

Significant Portugal POS Terminals Market Industry Milestones

- March 2022: Norauto, an automotive repair and maintenance services provider, announced the deployment of Openbravo's POS solution to strengthen its business and adopt omnichannel commerce in its auto centers. The company chose Openbravo POS, a key component of the Openbravo Commerce Cloud platform, for its completely web-based point-of-sale solution.

Future Outlook for Portugal POS Terminals Market Market

The future outlook for the Portugal POS terminals market is exceptionally bright, fueled by ongoing digitalization trends and evolving business needs. Strategic opportunities lie in the continued development and adoption of AI-powered POS solutions that offer predictive analytics and personalized customer experiences. The integration of IoT devices and blockchain technology for enhanced security and supply chain transparency presents further avenues for innovation. As businesses increasingly embrace omnichannel strategies and seek to optimize operational efficiency, the demand for versatile, cloud-connected POS terminals will continue to surge. The market is expected to witness further consolidation and strategic partnerships as companies aim to offer end-to-end solutions, encompassing payment processing, inventory management, and customer engagement.

Portugal POS Terminals Market Segmentation

-

1. BY Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-user Industry

- 2.1. Retail

- 2.2. Healthcare

- 2.3. Hospitality

- 2.4. Entertainment

- 2.5. Other End-user Industries

Portugal POS Terminals Market Segmentation By Geography

- 1. Portugal

Portugal POS Terminals Market Regional Market Share

Geographic Coverage of Portugal POS Terminals Market

Portugal POS Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas

- 3.4. Market Trends

- 3.4.1. Retail Industry Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Portugal POS Terminals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Healthcare

- 5.2.3. Hospitality

- 5.2.4. Entertainment

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Portugal

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NCR Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vectron System AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sharp Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SIBS Pay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sumup Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NEC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 myPOS World Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mastercard Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ingenico Group (Worldline)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Verifone Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NCR Corporation

List of Figures

- Figure 1: Portugal POS Terminals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Portugal POS Terminals Market Share (%) by Company 2025

List of Tables

- Table 1: Portugal POS Terminals Market Revenue billion Forecast, by BY Type 2020 & 2033

- Table 2: Portugal POS Terminals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Portugal POS Terminals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Portugal POS Terminals Market Revenue billion Forecast, by BY Type 2020 & 2033

- Table 5: Portugal POS Terminals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Portugal POS Terminals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portugal POS Terminals Market?

The projected CAGR is approximately 8.31%.

2. Which companies are prominent players in the Portugal POS Terminals Market?

Key companies in the market include NCR Corporation, Vectron System AG*List Not Exhaustive, Sharp Electronics, SIBS Pay, Sumup Inc, NEC Corporation, myPOS World Ltd, Mastercard Inc, Ingenico Group (Worldline), Verifone Inc.

3. What are the main segments of the Portugal POS Terminals Market?

The market segments include BY Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Retail Industry Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas.

8. Can you provide examples of recent developments in the market?

March 2022: Norauto, automotive repair and maintenance services provider, announced the deployment of Openbravo's POS solution to strengthen its business and adopt omnichannel commerce in its auto centers. The company chose Openbravo POS, a key component of the Openbravo Commerce Cloud platform, for its completely web-based point-of-sale solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portugal POS Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portugal POS Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portugal POS Terminals Market?

To stay informed about further developments, trends, and reports in the Portugal POS Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence