Key Insights

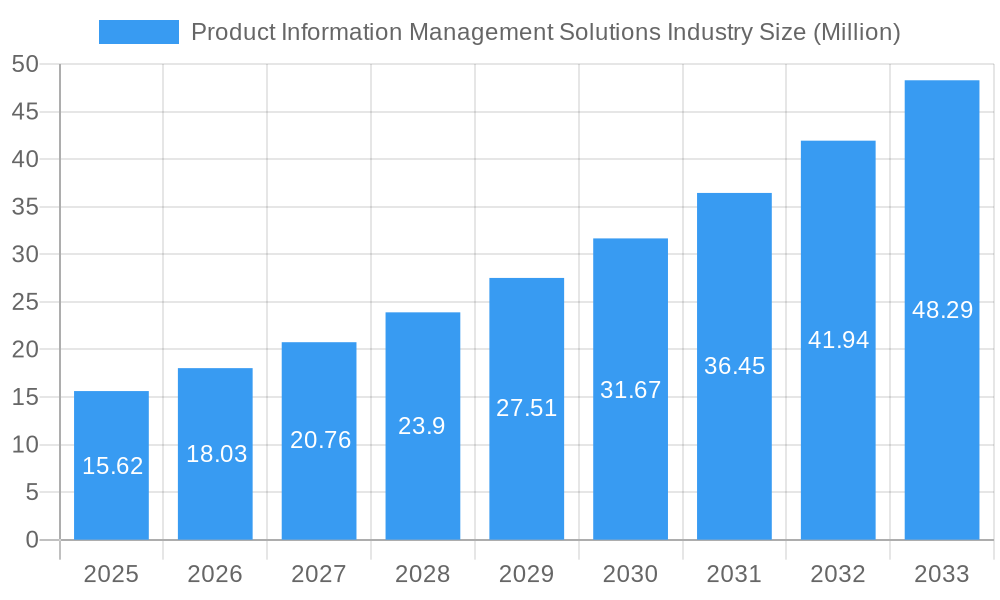

The Product Information Management (PIM) Solutions market is poised for robust expansion, projected to reach an impressive $15.62 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 15.41% between 2025 and 2033. This significant growth is fueled by an increasing demand for centralized, accurate, and consistent product data across diverse customer touchpoints. Businesses are recognizing the critical role of PIM in enhancing customer experience, driving sales, and optimizing operational efficiency, especially as e-commerce continues its upward trajectory and product catalogs become increasingly complex. The need to manage rich content, streamline product launches, and ensure compliance across global markets are key drivers propelling PIM adoption. Furthermore, the rise of digital transformation initiatives across industries underscores the necessity of a well-managed product information backbone.

Product Information Management Solutions Industry Market Size (In Million)

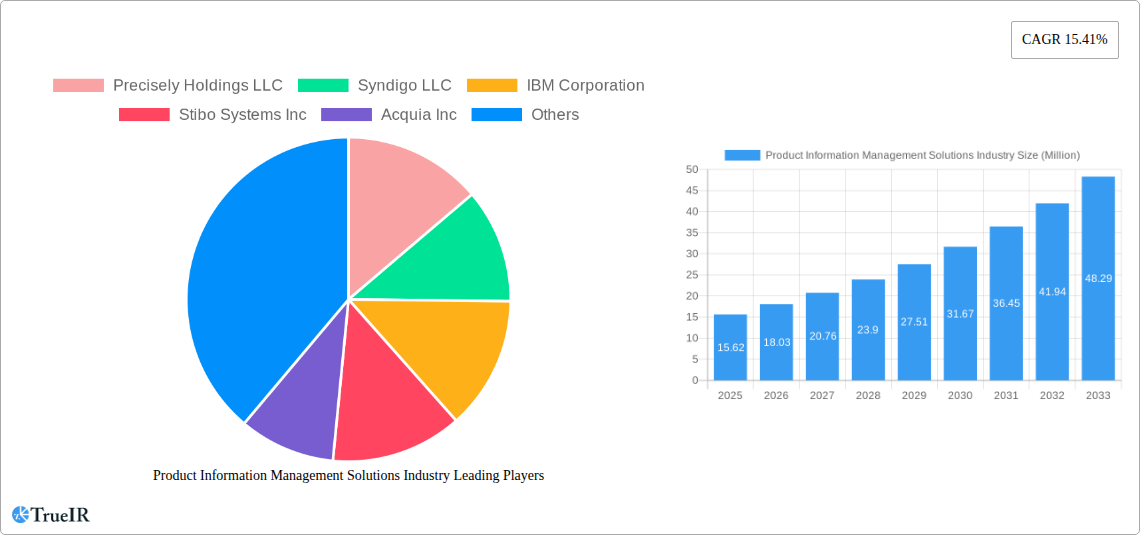

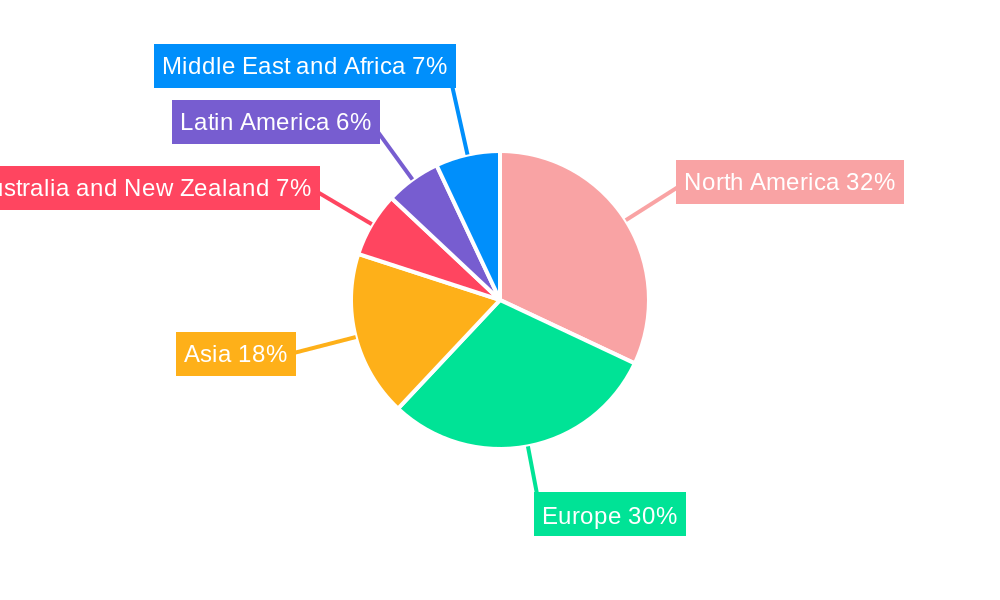

The PIM Solutions market is characterized by a dynamic segmentation. In terms of deployment, both Cloud and On-premise solutions are witnessing adoption, with cloud-based offerings gaining traction due to their scalability, flexibility, and reduced infrastructure costs. Offering-wise, the market is bifurcated into Solutions and Services, with a growing emphasis on comprehensive service packages that include implementation, customization, and ongoing support. The BFSI, Media and Entertainment, Retail, Energy and Utilities, Healthcare, IT and Telecommunications, and Transportation and Logistics sectors are prominent end-users, each leveraging PIM to manage their unique product portfolios and customer engagement strategies. Key industry players, including Precisely Holdings LLC, Syndigo LLC, IBM Corporation, Stibo Systems Inc, Acquia Inc, Pimcore GMBH, Salsify Inc, Akeneo SAS, InRiver AB, Informatica LLC, Plytix Limited, and SAP SE, are actively innovating and expanding their offerings to cater to these evolving market demands. The PIM market is global, with North America and Europe currently leading in adoption, but Asia is demonstrating significant growth potential.

Product Information Management Solutions Industry Company Market Share

Product Information Management Solutions Industry Market Report: Unlocking Product Data Excellence (2019-2033)

Gain unparalleled insights into the global Product Information Management (PIM) Solutions Industry. This comprehensive report, spanning 2019-2033 with a base year of 2025, delivers a deep dive into market dynamics, growth trajectories, competitive landscapes, and future opportunities. Leveraging high-volume keywords such as "Product Information Management," "PIM software," "product data management," "enterprise PIM," "digital product catalog," "product experience management (PXM)," and "data governance solutions," this report is meticulously crafted for industry professionals, IT decision-makers, marketing leaders, and strategic planners seeking to optimize their product data strategies and enhance their competitive edge.

Product Information Management Solutions Industry Market Structure & Competitive Landscape

The Product Information Management (PIM) Solutions Industry exhibits a moderately concentrated market structure, driven by significant investment in digital transformation and the increasing demand for consistent, accurate product data across multiple channels. Innovation is a key differentiator, with leading players continuously enhancing their platforms with AI-powered enrichment, advanced analytics, and seamless integration capabilities. Regulatory impacts, particularly around data privacy and product compliance, are shaping product development and demanding robust data governance features. Product substitutes, while present in the form of basic spreadsheets or disparate internal systems, are rapidly becoming inadequate for meeting the complexities of modern e-commerce and omnichannel retail. The end-user segmentation reveals a strong reliance on the Retail sector, followed by IT and Telecommunications, and Media and Entertainment, all seeking to leverage PIM for enhanced customer experiences and operational efficiency. Mergers and acquisitions (M&A) are a notable trend, with strategic consolidations aiming to expand market reach, acquire specialized technologies, and offer more comprehensive PIM and Product Experience Management (PXM) solutions. Concentration ratios are estimated to be around 40-50%, indicating a healthy mix of large established vendors and agile innovators. The volume of M&A activities is projected to remain steady, with an estimated xx deals per year within the forecast period.

Product Information Management Solutions Industry Market Trends & Opportunities

The global Product Information Management (PIM) Solutions Industry is poised for substantial growth, driven by the imperative for businesses to deliver exceptional product experiences across an ever-expanding digital ecosystem. The market size is projected to reach XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This robust expansion is fueled by a confluence of technological shifts and evolving consumer preferences. The rapid adoption of e-commerce and omnichannel strategies has elevated the importance of accurate, enriched, and consistent product information. Consumers expect detailed product descriptions, high-quality imagery, rich media content, and real-time availability updates, irrespective of the channel they use to interact with a brand. PIM solutions are central to meeting these demands, enabling businesses to centralize, enrich, and distribute product data efficiently.

Technological advancements are playing a pivotal role. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing PIM capabilities, enabling automated data cleansing, intelligent product categorization, personalized product recommendations, and predictive analytics for inventory management. The rise of headless commerce architectures also necessitates sophisticated PIM solutions that can seamlessly deliver product content to any digital touchpoint. Furthermore, the increasing complexity of global supply chains and the growing emphasis on product sustainability and ethical sourcing are creating new demands for transparent and traceable product information, further solidifying the role of PIM.

Competitive dynamics are intensifying, with vendors focusing on differentiation through specialized industry solutions, enhanced user experience, and expanded PXM capabilities. Opportunities abound for PIM providers to offer end-to-end product content lifecycle management, encompassing content creation, enrichment, syndication, and analytics. The market penetration rate for PIM solutions is currently around XX%, offering significant room for growth as more businesses recognize the strategic value of mastering their product data. The increasing adoption of cloud-based PIM solutions is democratizing access to advanced capabilities for small and medium-sized businesses (SMBs), further accelerating market expansion.

Dominant Markets & Segments in Product Information Management Solutions Industry

The Product Information Management (PIM) Solutions Industry is experiencing significant regional and segment-specific dominance, driven by distinct market needs and technological adoption rates.

Deployment Segment Dominance: Cloud PIM Solutions Lead the Charge

- Cloud Deployment: The Cloud deployment model is emerging as the dominant force within the PIM market. This supremacy is underpinned by several key growth drivers:

- Scalability and Flexibility: Cloud-based PIM solutions offer unparalleled scalability, allowing businesses to easily adjust resources up or down based on demand, a critical advantage in dynamic market conditions.

- Reduced IT Overhead: Businesses can significantly reduce upfront infrastructure costs and ongoing maintenance burdens by opting for cloud deployments, making advanced PIM accessible to a wider range of organizations.

- Faster Time-to-Market: Cloud solutions facilitate quicker deployment and implementation, enabling businesses to realize the benefits of PIM sooner.

- Enhanced Accessibility and Collaboration: Cloud platforms enable seamless access for distributed teams and external partners, fostering better collaboration in product data management.

- Automatic Updates and Innovation: Cloud vendors regularly push updates and new features, ensuring users are always on the latest version and benefiting from continuous innovation.

- On-premise Deployment: While still relevant for organizations with stringent data security requirements or existing complex IT infrastructures, On-premise deployments are seeing a slower growth rate compared to cloud. This segment is largely driven by highly regulated industries like BFSI and certain governmental organizations where data sovereignty is paramount.

Offering Segment Dominance: Integrated Solutions Drive Value

- Solution Offering: The Solution offering segment is demonstrating strong market leadership. This encompasses comprehensive PIM platforms that provide a suite of integrated functionalities for data onboarding, enrichment, governance, and syndication.

- End-to-End Product Data Management: Businesses are increasingly seeking unified platforms that can manage the entire product data lifecycle, from initial creation to final distribution across all channels.

- Advanced Data Modeling and Governance: Robust data modeling capabilities and stringent data governance features are critical for ensuring data accuracy, consistency, and compliance.

- Workflow Automation: Automated workflows for data approval and enrichment streamline operations and reduce manual errors, enhancing efficiency.

- Services Offering: While Services are an integral part of any PIM implementation, the focus is shifting towards value-added services that complement the core solution. This includes implementation, integration, data migration, consulting, and ongoing support. The growth in this segment is directly proportional to the adoption of PIM solutions.

End-User Industry Dominance: Retail Leads the Pack

- Retail: The Retail sector continues to be the largest and fastest-growing end-user industry for PIM solutions. The intense competition in online and offline retail environments, coupled with the evolving expectations of digital-savvy consumers, makes effective product information management a critical success factor.

- E-commerce Growth: The exponential growth of e-commerce platforms demands a constant stream of accurate and engaging product content to drive sales.

- Omnichannel Consistency: Retailers must ensure a seamless and consistent brand experience across their websites, mobile apps, social media, and physical stores, all reliant on unified product data.

- Product Assortment Expansion: Retailers are continuously expanding their product assortments, requiring robust systems to manage vast product catalogs efficiently.

- IT and Telecommunications: This sector is a significant adopter, driven by the need to manage complex technical specifications, product variations, and rapid product lifecycle changes for a wide array of electronics and service offerings.

- Media and Entertainment: This industry leverages PIM for managing rich media assets, metadata for content discovery, and accurate information for licensing and distribution.

- BFSI: While often more risk-averse, the BFSI sector is increasingly adopting PIM for managing financial product information, regulatory disclosures, and customer-facing product details with a strong emphasis on security and compliance.

- Healthcare: PIM is crucial for managing pharmaceutical product information, medical device specifications, and patient-facing product details, with a strong focus on regulatory compliance and safety.

- Energy and Utilities: This sector utilizes PIM for managing complex equipment specifications, service offerings, and safety information related to their infrastructure and operations.

- Transportation and Logistics: PIM helps in managing detailed information about vehicles, equipment, and service offerings, improving operational efficiency and customer communication.

Product Information Management Solutions Industry Product Analysis

Product innovation in the PIM Solutions Industry is rapidly evolving, with a strong emphasis on artificial intelligence (AI) and machine learning (ML) to automate data enrichment, categorization, and anomaly detection. Key advancements include enterprise-grade data modeling for complex product structures, robust workflow automation for data governance and collaboration, and seamless integration capabilities with e-commerce platforms, ERP systems, and CRM solutions. Competitive advantages are being carved out through enhanced user experience, advanced analytics for product performance insights, and specialized functionalities catering to specific end-user industries. The market is witnessing a trend towards Product Experience Management (PXM) platforms, which extend PIM capabilities to manage the entire customer journey around product information, including marketing content, digital assets, and personalized experiences.

Key Drivers, Barriers & Challenges in Product Information Management Solutions Industry

The Product Information Management (PIM) Solutions Industry is propelled by several key drivers, including the accelerating digital transformation across all sectors, the escalating demand for consistent and accurate product data in omnichannel retail environments, and the growing recognition of PIM's role in enhancing customer experience and driving sales. Technological advancements, such as AI and ML integration for automated data enrichment and analytics, further bolster market growth. Economic factors, including the pursuit of operational efficiency and the desire to reduce time-to-market for new products, also play a significant role.

However, the industry faces several barriers and challenges. Data quality and legacy systems often present significant hurdles, requiring substantial investment in data migration and cleansing. The complexity of integrating PIM solutions with existing enterprise systems can also be a deterrent. Regulatory compliance, particularly concerning data privacy and product safety, adds another layer of complexity. Competitive pressures are intense, with vendors constantly innovating to stay ahead. Supply chain disruptions can indirectly impact PIM adoption by affecting product launch timelines and the availability of product information. Quantifiable impacts of these challenges include extended implementation cycles, higher project costs, and potential data inconsistencies if not managed effectively.

Growth Drivers in the Product Information Management Solutions Industry Market

Key growth drivers in the Product Information Management Solutions Industry include the persistent surge in e-commerce penetration globally, compelling businesses to present rich and accurate product catalogs online. The increasing adoption of omnichannel retail strategies, where consistent product information across all touchpoints is paramount for customer satisfaction and brand loyalty, is another significant catalyst. Technological advancements, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated data enrichment, validation, and personalization, are driving innovation and efficiency within PIM solutions. Furthermore, the growing emphasis on data governance and regulatory compliance, particularly around product safety and sustainability, is necessitating robust PIM systems to ensure adherence and transparency.

Challenges Impacting Product Information Management Solutions Industry Growth

Challenges impacting Product Information Management Solutions Industry growth include the inherent complexity of integrating PIM platforms with diverse existing enterprise systems, such as ERP, CRM, and e-commerce platforms, leading to extended implementation timelines. Overcoming data silos and ensuring data quality from disparate sources requires significant effort and investment in data cleansing and standardization processes. The stringent regulatory landscape across various industries, with evolving data privacy laws and product safety standards, necessitates continuous adaptation and robust compliance features within PIM solutions. Intense competitive pressures among PIM vendors drive rapid innovation but can also lead to market fragmentation and customer confusion. Supply chain disruptions, while not directly a PIM issue, can indirectly impact the urgency and scale of PIM implementations by affecting product launch cycles and the availability of source data.

Key Players Shaping the Product Information Management Solutions Industry Market

- Precisely Holdings LLC

- Syndigo LLC

- IBM Corporation

- Stibo Systems Inc

- Acquia Inc

- Pimcore GMBH

- Salsify Inc

- Akeneo SAS

- InRiver AB

- Informatica LLC

- Plytix Limited

- SAP SE

- Insight Software

Significant Product Information Management Solutions Industry Industry Milestones

- March 2024: Akeneo announced it had launched the Akeneo PIM App for Salesforce on Salesforce AppExchange. This integration empowers customers to leverage complete, compelling, and consistent product information to unlock the full potential of Salesforce. Akeneo’s Product Cloud enables businesses to ingest, normalize, enrich, and centralize product information through enterprise-grade data modeling, governance, and workflows, significantly enhancing their PXM capabilities.

- February 2024: Salsify announced the general availability of Salsify PXM Advance, a new version of the Salsify platform. This release is designed to raise the business value customers can achieve from their product experience management operations by offering enhanced features for content optimization and channel syndication.

Future Outlook for Product Information Management Solutions Industry Market

The future outlook for the Product Information Management (PIM) Solutions Industry is exceptionally bright, driven by the relentless digital transformation and the increasing criticality of exceptional product experiences. Strategic opportunities lie in the continued integration of AI and ML for predictive analytics, hyper-personalization of product content, and automated data governance. The convergence of PIM with Product Experience Management (PXM) will create more holistic solutions, empowering businesses to manage the entire customer journey around their products. The growing demand for sustainability and supply chain transparency will further necessitate robust PIM capabilities for accurate and traceable product information. The market is poised for continued expansion, with cloud-based solutions and specialized industry offerings leading the charge, promising significant market potential for vendors and enhanced operational efficiency and customer engagement for businesses.

Product Information Management Solutions Industry Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. Offering

- 2.1. Solution

- 2.2. Services

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Media and Entertainment

- 3.3. Retail

- 3.4. Energy and Utilities

- 3.5. Healthcare

- 3.6. IT and Telecommunications

- 3.7. Transportation and Logistics

- 3.8. Other End-user Industries

Product Information Management Solutions Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Product Information Management Solutions Industry Regional Market Share

Geographic Coverage of Product Information Management Solutions Industry

Product Information Management Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Better Customer Service; Growing Demand for Centralized Data Management Tools

- 3.3. Market Restrains

- 3.3.1. Increasing Data Breaching Cases

- 3.4. Market Trends

- 3.4.1. Retail Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Product Information Management Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by Offering

- 5.2.1. Solution

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Media and Entertainment

- 5.3.3. Retail

- 5.3.4. Energy and Utilities

- 5.3.5. Healthcare

- 5.3.6. IT and Telecommunications

- 5.3.7. Transportation and Logistics

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Product Information Management Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by Offering

- 6.2.1. Solution

- 6.2.2. Services

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Media and Entertainment

- 6.3.3. Retail

- 6.3.4. Energy and Utilities

- 6.3.5. Healthcare

- 6.3.6. IT and Telecommunications

- 6.3.7. Transportation and Logistics

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Product Information Management Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by Offering

- 7.2.1. Solution

- 7.2.2. Services

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Media and Entertainment

- 7.3.3. Retail

- 7.3.4. Energy and Utilities

- 7.3.5. Healthcare

- 7.3.6. IT and Telecommunications

- 7.3.7. Transportation and Logistics

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Product Information Management Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by Offering

- 8.2.1. Solution

- 8.2.2. Services

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Media and Entertainment

- 8.3.3. Retail

- 8.3.4. Energy and Utilities

- 8.3.5. Healthcare

- 8.3.6. IT and Telecommunications

- 8.3.7. Transportation and Logistics

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Australia and New Zealand Product Information Management Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by Offering

- 9.2.1. Solution

- 9.2.2. Services

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Media and Entertainment

- 9.3.3. Retail

- 9.3.4. Energy and Utilities

- 9.3.5. Healthcare

- 9.3.6. IT and Telecommunications

- 9.3.7. Transportation and Logistics

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Latin America Product Information Management Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by Offering

- 10.2.1. Solution

- 10.2.2. Services

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. Media and Entertainment

- 10.3.3. Retail

- 10.3.4. Energy and Utilities

- 10.3.5. Healthcare

- 10.3.6. IT and Telecommunications

- 10.3.7. Transportation and Logistics

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Middle East and Africa Product Information Management Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 11.1.1. Cloud

- 11.1.2. On-premise

- 11.2. Market Analysis, Insights and Forecast - by Offering

- 11.2.1. Solution

- 11.2.2. Services

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. BFSI

- 11.3.2. Media and Entertainment

- 11.3.3. Retail

- 11.3.4. Energy and Utilities

- 11.3.5. Healthcare

- 11.3.6. IT and Telecommunications

- 11.3.7. Transportation and Logistics

- 11.3.8. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Precisely Holdings LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Syndigo LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Stibo Systems Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Acquia Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pimcore GMBH

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Salsify Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Akeneo SAS

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 InRiver AB

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Informatica LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Plytix Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 SAP SE

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Insight Software

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Precisely Holdings LLC

List of Figures

- Figure 1: Global Product Information Management Solutions Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Product Information Management Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Product Information Management Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Product Information Management Solutions Industry Revenue (Million), by Offering 2025 & 2033

- Figure 5: North America Product Information Management Solutions Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 6: North America Product Information Management Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Product Information Management Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Product Information Management Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Product Information Management Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Product Information Management Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Product Information Management Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Product Information Management Solutions Industry Revenue (Million), by Offering 2025 & 2033

- Figure 13: Europe Product Information Management Solutions Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 14: Europe Product Information Management Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Product Information Management Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Product Information Management Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Product Information Management Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Product Information Management Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Product Information Management Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Product Information Management Solutions Industry Revenue (Million), by Offering 2025 & 2033

- Figure 21: Asia Product Information Management Solutions Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Asia Product Information Management Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Product Information Management Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Product Information Management Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Product Information Management Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Product Information Management Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Australia and New Zealand Product Information Management Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Australia and New Zealand Product Information Management Solutions Industry Revenue (Million), by Offering 2025 & 2033

- Figure 29: Australia and New Zealand Product Information Management Solutions Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 30: Australia and New Zealand Product Information Management Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Australia and New Zealand Product Information Management Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Australia and New Zealand Product Information Management Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Product Information Management Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Product Information Management Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Latin America Product Information Management Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Latin America Product Information Management Solutions Industry Revenue (Million), by Offering 2025 & 2033

- Figure 37: Latin America Product Information Management Solutions Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 38: Latin America Product Information Management Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Latin America Product Information Management Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Product Information Management Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Product Information Management Solutions Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Product Information Management Solutions Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 43: Middle East and Africa Product Information Management Solutions Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 44: Middle East and Africa Product Information Management Solutions Industry Revenue (Million), by Offering 2025 & 2033

- Figure 45: Middle East and Africa Product Information Management Solutions Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 46: Middle East and Africa Product Information Management Solutions Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 47: Middle East and Africa Product Information Management Solutions Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Middle East and Africa Product Information Management Solutions Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Product Information Management Solutions Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Product Information Management Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Product Information Management Solutions Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 3: Global Product Information Management Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Product Information Management Solutions Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Product Information Management Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Product Information Management Solutions Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: Global Product Information Management Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Product Information Management Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Product Information Management Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Product Information Management Solutions Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 11: Global Product Information Management Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Product Information Management Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Product Information Management Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Product Information Management Solutions Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 15: Global Product Information Management Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Product Information Management Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Product Information Management Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Product Information Management Solutions Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 19: Global Product Information Management Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Product Information Management Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Product Information Management Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Product Information Management Solutions Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 23: Global Product Information Management Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Product Information Management Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Product Information Management Solutions Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 26: Global Product Information Management Solutions Industry Revenue Million Forecast, by Offering 2020 & 2033

- Table 27: Global Product Information Management Solutions Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Product Information Management Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Product Information Management Solutions Industry?

The projected CAGR is approximately 15.41%.

2. Which companies are prominent players in the Product Information Management Solutions Industry?

Key companies in the market include Precisely Holdings LLC, Syndigo LLC, IBM Corporation, Stibo Systems Inc, Acquia Inc, Pimcore GMBH, Salsify Inc, Akeneo SAS, InRiver AB, Informatica LLC, Plytix Limited, SAP SE, Insight Software.

3. What are the main segments of the Product Information Management Solutions Industry?

The market segments include Deployment, Offering, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Better Customer Service; Growing Demand for Centralized Data Management Tools.

6. What are the notable trends driving market growth?

Retail Sector to Witness Growth.

7. Are there any restraints impacting market growth?

Increasing Data Breaching Cases.

8. Can you provide examples of recent developments in the market?

March 2024 - Akeneo announced it had launched the Akeneo PIM App for Salesforce on Salesforce AppExchange, an enterprise marketplace for partner apps and experts. The Akeneo App for Salesforce empowers customers to leverage complete, compelling, and consistent product information to unlock the full potential of Salesforce. Akeneo’s Product Cloud enables businesses to ingest, normalize, enrich, and centralize product information through enterprise-grade data modeling, governance, and workflows.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Product Information Management Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Product Information Management Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Product Information Management Solutions Industry?

To stay informed about further developments, trends, and reports in the Product Information Management Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence