Key Insights

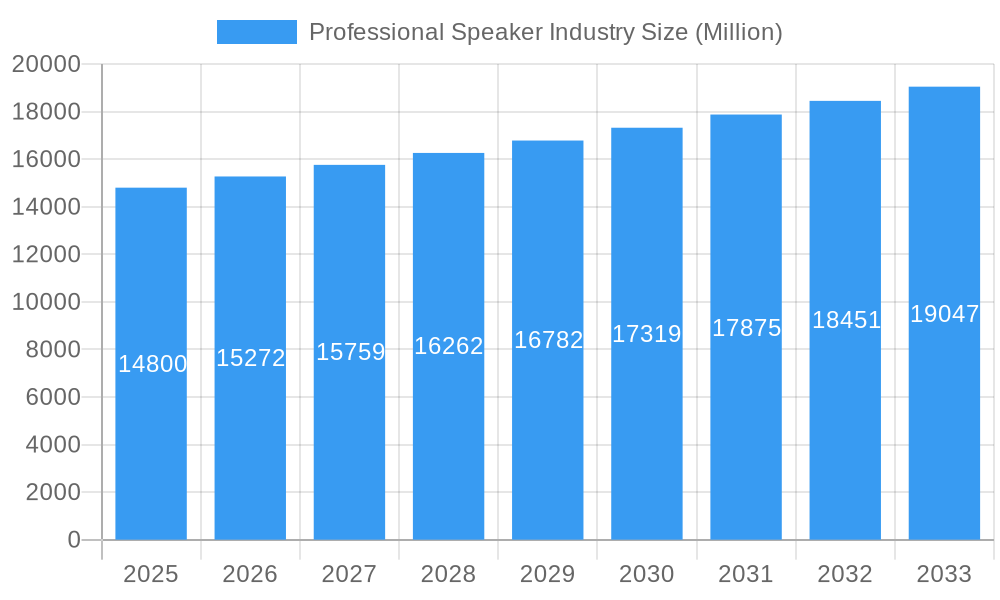

The global professional speaker market is projected for significant expansion, anticipated to reach a valuation of $6.1 billion by 2025. Driven by a compound annual growth rate (CAGR) of 7.3%, the market is expected to reach an estimated $14.8 billion by 2033. This robust growth is fueled by increasing demand for high-fidelity audio solutions across diverse applications, including large-scale events, corporate conferences, educational institutions, and broadcasting. Advancements in audio technology and evolving sound reinforcement needs in entertainment and professional settings are primary catalysts. Infrastructure development for venues and the adoption of advanced audio systems in commercial spaces, such as hospitality, further contribute to market traction. The surge in live performances and the demand for exceptional audio experiences in cinemas, theaters, and corporate presentations ensure sustained demand for innovative professional speaker systems.

Professional Speaker Industry Market Size (In Billion)

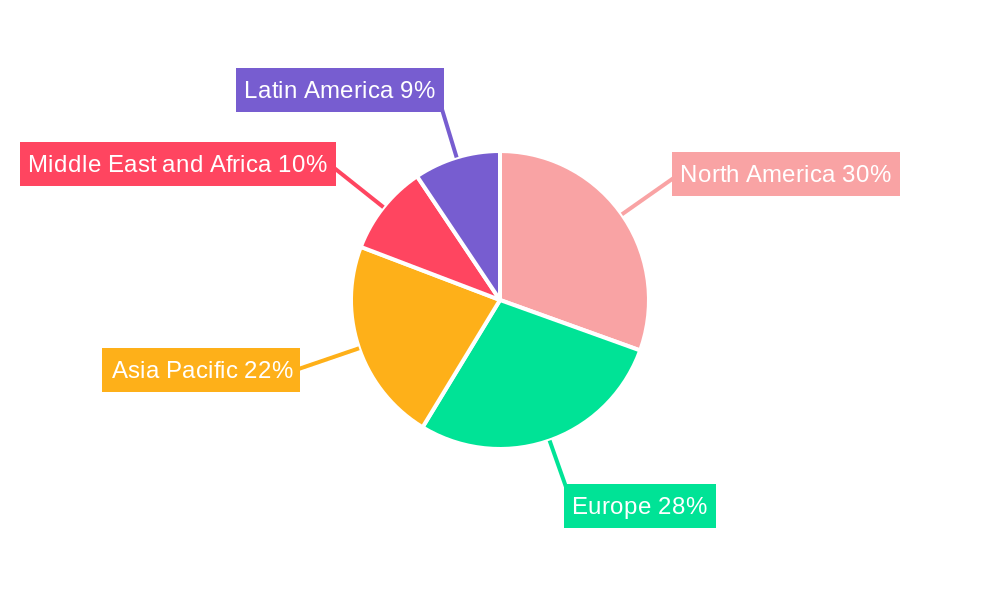

Key market drivers include the pursuit of superior audio quality and immersive sound experiences, propelled by technological advancements in speaker design and amplification. The growing deployment of line array speaker systems and sophisticated subwoofers for enhanced coverage and precise sound projection, particularly in large venues, is a notable trend. Amplification methods are also evolving, with a preference for powered speaker systems for their ease of integration and superior performance. North America and Europe are expected to remain dominant markets, supported by established entertainment industries and a high concentration of professional audio users. However, the Asia Pacific region presents substantial growth opportunities, driven by rapid economic development, increased investment in entertainment infrastructure, and a burgeoning market for live events and broadcasting. Potential restraints include high initial investment costs for premium systems and the availability of counterfeit products in certain markets, but the overarching trend of audio technology innovation and its critical role in modern communication and entertainment is expected to overcome these challenges.

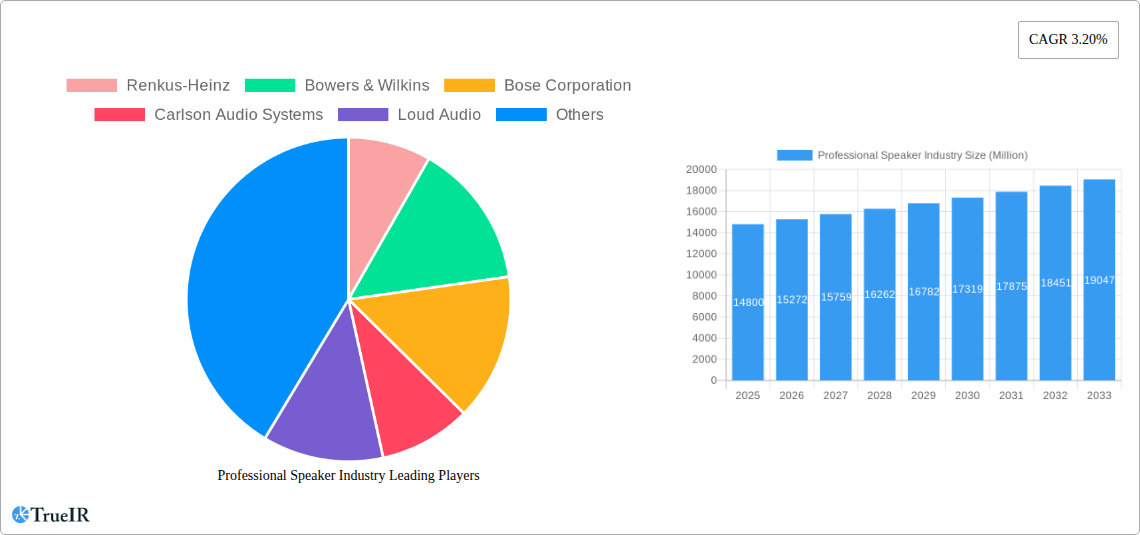

Professional Speaker Industry Company Market Share

This comprehensive report provides a detailed examination of the global Professional Speaker Industry, offering critical insights for stakeholders, manufacturers, and investors. Spanning a study period from 2019 to 2033, with a base year of 2025, this report leverages high-volume keywords for optimal SEO performance. We delve into market dynamics, competitive landscapes, emerging trends, and future projections, equipping you with the knowledge to navigate this dynamic sector.

Professional Speaker Industry Market Structure & Competitive Landscape

The Professional Speaker Industry exhibits a moderately concentrated market structure, with a blend of established global players and emerging regional manufacturers. Innovation drivers are primarily fueled by advancements in acoustic engineering, digital signal processing, and materials science, leading to enhanced audio fidelity, portability, and energy efficiency. Regulatory impacts, though generally minimal, can influence product standards and safety certifications. Product substitutes, such as integrated audio solutions or alternative sound reinforcement technologies, are present but often fail to replicate the nuanced performance of dedicated professional speaker systems. End-user segmentation reveals a diverse customer base, with Corporates and Large Venues & Events representing significant market shares due to ongoing investments in audio-visual infrastructure. M&A trends, while not as pervasive as in some tech sectors, are observed as larger entities seek to consolidate market presence or acquire specialized technological expertise.

- Market Concentration: Dominated by a few key global players, but with room for niche specialists.

- Innovation Drivers: Advancements in DSP, acoustic design, lightweight materials, and wireless connectivity.

- Regulatory Impact: Focus on safety standards, electromagnetic compatibility (EMC), and environmental compliance.

- Product Substitutes: Integrated PA systems, portable Bluetooth speakers for smaller applications.

- End-User Segmentation: High reliance on Corporates, Large Venues & Events, and Educational Institutions.

- M&A Trends: Strategic acquisitions to broaden product portfolios and technological capabilities.

Professional Speaker Industry Market Trends & Opportunities

The global Professional Speaker Industry is poised for significant expansion, driven by an estimated market size growth that will see revenues ascend to multiple billions of dollars by 2033. The market is characterized by robust technological shifts, including the increasing integration of digital signal processing (DSP) for advanced sound customization and control, the proliferation of network audio protocols for seamless integration into complex AV systems, and the development of more efficient and lighter-weight driver technologies. Consumer preferences are evolving towards more versatile, user-friendly, and scalable audio solutions capable of delivering pristine sound quality across a wide range of applications, from intimate corporate presentations to massive outdoor music festivals. Competitive dynamics are intensifying, with manufacturers focusing on product differentiation through superior audio performance, innovative features, and strategic pricing. The burgeoning demand for immersive audio experiences in live events and entertainment venues is creating substantial opportunities for advanced line array speaker systems and high-performance subwoofers. Furthermore, the ongoing digital transformation across various sectors, including education and broadcasting, necessitates continuous upgrades and investments in professional audio equipment, further stimulating market growth. The industry is also witnessing a trend towards sustainable manufacturing practices and longer product lifecycles, appealing to environmentally conscious clients.

This dynamic evolution presents lucrative opportunities for companies that can innovate and adapt to these changing landscapes. The integration of artificial intelligence (AI) in audio management systems, for instance, is an emerging trend that could redefine user interaction and performance optimization. The continued growth of the live event industry, coupled with the demand for superior sound in virtual and hybrid events, ensures a sustained need for high-quality professional loudspeakers. As the market matures, a greater emphasis on system integration and cloud-based management solutions is expected, allowing for remote diagnostics and control, which can be a significant competitive advantage.

Dominant Markets & Segments in Professional Speaker Industry

The Professional Speaker Industry is segmented across various product types, amplification methods, end-users, and distribution channels, with certain segments exhibiting notable dominance.

Product Type Dominance:

- Line Array Speaker Systems: These are expected to continue their reign as the dominant product type, driven by their superior sound dispersion capabilities for large-scale events, concerts, and conferences. Their ability to provide consistent coverage across wide areas and variable audience sizes makes them indispensable for professional audio installations in large venues. The demand for sophisticated acoustic control and phased array technology further solidifies their market leadership.

- Subwoofers: Crucial for delivering powerful low-frequency audio, subwoofers are a consistently strong segment, essential for full-range sound reproduction in music venues, cinemas, and large event spaces. Advancements in driver technology and enclosure design are leading to more compact yet potent subwoofer solutions.

Amplification Method Dominance:

- Powered Speaker Systems: This segment is experiencing significant growth due to their ease of deployment, integrated amplification, and simplified signal routing. The all-in-one nature of powered speakers reduces setup time and complexity, making them attractive for a wide range of applications, from smaller corporate events to touring sound reinforcement.

End-User Dominance:

- Large Venues & Events: This segment remains the primary consumer of professional speaker systems. The continuous demand for live entertainment, corporate gatherings, sports events, and festivals necessitates sophisticated and high-capacity audio solutions. Ongoing infrastructure development in entertainment hubs and the resurgence of large-scale events post-pandemic are key growth drivers.

- Corporates: The increasing focus on engaging presentations, hybrid meetings, and immersive corporate communication is driving investments in high-quality audio systems for boardrooms, conference centers, and auditoriums.

Distribution Channel Dominance:

- Manufacturing, Production, & Distribution: This represents the core of the industry's value chain. Direct sales and established distribution networks remain vital for reaching professional end-users. The development of robust B2B sales channels and direct-to-enterprise solutions are critical for market penetration.

Professional Speaker Industry Product Analysis

Product innovations in the Professional Speaker Industry are centered on enhancing audio fidelity, increasing power efficiency, and improving system integration. Key advancements include the development of advanced driver materials for lighter weight and greater durability, sophisticated digital signal processing (DSP) for precise acoustic control and room correction, and the adoption of network audio protocols like Dante for seamless multi-channel audio transmission. Competitive advantages stem from superior sound reproduction, robust build quality for demanding environments, and user-friendly interfaces that facilitate complex audio setups. Applications span live sound reinforcement, installed sound systems in venues, broadcast studios, and high-fidelity audio monitoring.

Key Drivers, Barriers & Challenges in Professional Speaker Industry

Key Drivers, Barriers & Challenges in Professional Speaker Industry

Technological advancements are the primary growth drivers, with innovations in acoustics, digital signal processing (DSP), and materials science enabling more powerful, efficient, and versatile speaker systems. The global resurgence of live events and entertainment post-pandemic is a significant economic catalyst, boosting demand across various segments. Favorable government policies supporting cultural events and infrastructure development also contribute to market expansion. For example, investments in smart city initiatives often include upgrades to public address systems.

However, significant challenges restrain growth. Supply chain disruptions, particularly for specialized electronic components, can lead to production delays and increased costs. Evolving regulatory landscapes concerning acoustics and environmental impact can impose compliance burdens. Intense competitive pressures among a multitude of manufacturers, both established and emerging, drive down profit margins in certain market segments. The high initial investment cost for advanced professional audio systems can also be a barrier for smaller organizations or educational institutions with limited budgets.

Growth Drivers in the Professional Speaker Industry Market

Key growth drivers in the Professional Speaker Industry market are multifaceted. Technological innovation remains paramount, with ongoing research and development in areas like advanced acoustic design, more efficient power amplification, and integrated digital signal processing (DSP) capabilities. The economic recovery and sustained demand for live events, concerts, and conferences globally are a major catalyst. Furthermore, the increasing adoption of immersive audio experiences in entertainment and corporate settings fuels the need for sophisticated loudspeaker systems. Government initiatives to support the arts, culture, and public infrastructure also indirectly boost demand for professional audio solutions.

Challenges Impacting Professional Speaker Industry Growth

Challenges impacting Professional Speaker Industry growth include the inherent complexity of supply chains for specialized electronic components, leading to potential lead time extensions and cost volatility. Evolving environmental regulations and acoustic compliance standards in various regions can necessitate product redesigns and increase manufacturing overhead. Intense competition among a large number of manufacturers, ranging from global conglomerates to niche specialists, creates significant pricing pressures and can impact profitability. The high upfront capital investment required for cutting-edge professional audio equipment can also pose a barrier to entry for smaller businesses and organizations.

Key Players Shaping the Professional Speaker Industry Market

- B&C Speakers

- Bose Corporation

- Bowers & Wilkins

- Carlson Audio Systems

- D&B Audiotechnik

- Harman International (Samsung)

- K-Array

- L-Acoustics

- Loud Audio

- Meyer Sound Laboratories

- Music Group (Music Tribe)

- Nady Systems

- Renkus-Heinz

- Sony Corporation

- Yamaha Corporation

- AEB Industriale (DB Technologies)

Significant Professional Speaker Industry Industry Milestones

- 2019: Launch of advanced line array systems with improved rigging and DSP integration.

- 2020: Increased focus on wireless audio solutions and networkable speakers for remote collaboration.

- 2021: Resurgence of live events leads to significant demand for touring-grade professional loudspeakers.

- 2022: Introduction of more compact and energy-efficient powered speaker systems.

- 2023: Growing emphasis on sustainability in manufacturing and product lifecycles.

- 2024: Further integration of AI and machine learning in audio processing and system management.

Future Outlook for Professional Speaker Industry Market

The future outlook for the Professional Speaker Industry market is exceptionally bright, driven by continued technological innovation and a sustained demand for high-quality audio experiences. Strategic opportunities lie in the development of intelligent audio systems that offer predictive maintenance and remote diagnostics, enhancing user convenience and operational efficiency. The burgeoning market for immersive audio technologies, including spatial audio, presents a significant growth avenue. Furthermore, the increasing adoption of professional audio solutions in emerging sectors like virtual reality (VR) and augmented reality (AR) applications will unlock new revenue streams. Companies that can offer scalable, integrated, and user-friendly solutions tailored to specific industry needs are well-positioned for substantial growth and market leadership in the coming years.

Professional Speaker Industry Segmentation

-

1. Product Type

- 1.1. Point Source Speaker System

- 1.2. Line Array Speaker Systems

- 1.3. Subwoofers

- 1.4. Others

-

2. Amplification Method

- 2.1. Passive Pro Speaker Systems

- 2.2. Powered Speaker Systems

-

3. End-User

- 3.1. Corporates

- 3.2. Large Venues & Events

- 3.3. Educational Institutions

- 3.4. Government & Military

- 3.5. Studio & Broadcasting

- 3.6. Hospitality

- 3.7. Other Sectors

-

4. Distribution Channel

- 4.1. Manufacturing, Production, & Distribution

- 4.2. Distribution Through Retail Stores

- 4.3. Distribution Through Online Websites

Professional Speaker Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Professional Speaker Industry Regional Market Share

Geographic Coverage of Professional Speaker Industry

Professional Speaker Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increased Demand from Corporate

- 3.2.2 Governments

- 3.2.3 and Institutions; Expansion of Live Music Industry; Growth in Music Production and Recording Equipment Market

- 3.3. Market Restrains

- 3.3.1. ; Volatility in Raw Material Costs; Acoustical Challenges

- 3.4. Market Trends

- 3.4.1. Music Production and Recording Equipment to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Professional Speaker Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Point Source Speaker System

- 5.1.2. Line Array Speaker Systems

- 5.1.3. Subwoofers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Amplification Method

- 5.2.1. Passive Pro Speaker Systems

- 5.2.2. Powered Speaker Systems

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Corporates

- 5.3.2. Large Venues & Events

- 5.3.3. Educational Institutions

- 5.3.4. Government & Military

- 5.3.5. Studio & Broadcasting

- 5.3.6. Hospitality

- 5.3.7. Other Sectors

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Manufacturing, Production, & Distribution

- 5.4.2. Distribution Through Retail Stores

- 5.4.3. Distribution Through Online Websites

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Professional Speaker Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Point Source Speaker System

- 6.1.2. Line Array Speaker Systems

- 6.1.3. Subwoofers

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Amplification Method

- 6.2.1. Passive Pro Speaker Systems

- 6.2.2. Powered Speaker Systems

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Corporates

- 6.3.2. Large Venues & Events

- 6.3.3. Educational Institutions

- 6.3.4. Government & Military

- 6.3.5. Studio & Broadcasting

- 6.3.6. Hospitality

- 6.3.7. Other Sectors

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Manufacturing, Production, & Distribution

- 6.4.2. Distribution Through Retail Stores

- 6.4.3. Distribution Through Online Websites

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Professional Speaker Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Point Source Speaker System

- 7.1.2. Line Array Speaker Systems

- 7.1.3. Subwoofers

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Amplification Method

- 7.2.1. Passive Pro Speaker Systems

- 7.2.2. Powered Speaker Systems

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Corporates

- 7.3.2. Large Venues & Events

- 7.3.3. Educational Institutions

- 7.3.4. Government & Military

- 7.3.5. Studio & Broadcasting

- 7.3.6. Hospitality

- 7.3.7. Other Sectors

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Manufacturing, Production, & Distribution

- 7.4.2. Distribution Through Retail Stores

- 7.4.3. Distribution Through Online Websites

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Professional Speaker Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Point Source Speaker System

- 8.1.2. Line Array Speaker Systems

- 8.1.3. Subwoofers

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Amplification Method

- 8.2.1. Passive Pro Speaker Systems

- 8.2.2. Powered Speaker Systems

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Corporates

- 8.3.2. Large Venues & Events

- 8.3.3. Educational Institutions

- 8.3.4. Government & Military

- 8.3.5. Studio & Broadcasting

- 8.3.6. Hospitality

- 8.3.7. Other Sectors

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Manufacturing, Production, & Distribution

- 8.4.2. Distribution Through Retail Stores

- 8.4.3. Distribution Through Online Websites

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Professional Speaker Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Point Source Speaker System

- 9.1.2. Line Array Speaker Systems

- 9.1.3. Subwoofers

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Amplification Method

- 9.2.1. Passive Pro Speaker Systems

- 9.2.2. Powered Speaker Systems

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Corporates

- 9.3.2. Large Venues & Events

- 9.3.3. Educational Institutions

- 9.3.4. Government & Military

- 9.3.5. Studio & Broadcasting

- 9.3.6. Hospitality

- 9.3.7. Other Sectors

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Manufacturing, Production, & Distribution

- 9.4.2. Distribution Through Retail Stores

- 9.4.3. Distribution Through Online Websites

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Professional Speaker Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Point Source Speaker System

- 10.1.2. Line Array Speaker Systems

- 10.1.3. Subwoofers

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Amplification Method

- 10.2.1. Passive Pro Speaker Systems

- 10.2.2. Powered Speaker Systems

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Corporates

- 10.3.2. Large Venues & Events

- 10.3.3. Educational Institutions

- 10.3.4. Government & Military

- 10.3.5. Studio & Broadcasting

- 10.3.6. Hospitality

- 10.3.7. Other Sectors

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Manufacturing, Production, & Distribution

- 10.4.2. Distribution Through Retail Stores

- 10.4.3. Distribution Through Online Websites

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Renkus-Heinz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bowers & Wilkins

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bose Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Carlson Audio Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Loud Audio

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 L-Acoustics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 D&B Audiotechnik

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Harman International (Samsung)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yamaha Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Music Group (Music Tribe)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sony Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 B&C Speakers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 K-Array

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Meyer Sound Laboratories

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Nady Systems

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AEB Industriale (DB Technologies)

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Renkus-Heinz

List of Figures

- Figure 1: Global Professional Speaker Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Professional Speaker Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Professional Speaker Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Professional Speaker Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Professional Speaker Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Professional Speaker Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Professional Speaker Industry Revenue (billion), by Amplification Method 2025 & 2033

- Figure 8: North America Professional Speaker Industry Volume (K Unit), by Amplification Method 2025 & 2033

- Figure 9: North America Professional Speaker Industry Revenue Share (%), by Amplification Method 2025 & 2033

- Figure 10: North America Professional Speaker Industry Volume Share (%), by Amplification Method 2025 & 2033

- Figure 11: North America Professional Speaker Industry Revenue (billion), by End-User 2025 & 2033

- Figure 12: North America Professional Speaker Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 13: North America Professional Speaker Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Professional Speaker Industry Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America Professional Speaker Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 16: North America Professional Speaker Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 17: North America Professional Speaker Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: North America Professional Speaker Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 19: North America Professional Speaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 20: North America Professional Speaker Industry Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Professional Speaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Professional Speaker Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Professional Speaker Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 24: Europe Professional Speaker Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 25: Europe Professional Speaker Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Professional Speaker Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 27: Europe Professional Speaker Industry Revenue (billion), by Amplification Method 2025 & 2033

- Figure 28: Europe Professional Speaker Industry Volume (K Unit), by Amplification Method 2025 & 2033

- Figure 29: Europe Professional Speaker Industry Revenue Share (%), by Amplification Method 2025 & 2033

- Figure 30: Europe Professional Speaker Industry Volume Share (%), by Amplification Method 2025 & 2033

- Figure 31: Europe Professional Speaker Industry Revenue (billion), by End-User 2025 & 2033

- Figure 32: Europe Professional Speaker Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 33: Europe Professional Speaker Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 34: Europe Professional Speaker Industry Volume Share (%), by End-User 2025 & 2033

- Figure 35: Europe Professional Speaker Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 36: Europe Professional Speaker Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 37: Europe Professional Speaker Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Europe Professional Speaker Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 39: Europe Professional Speaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 40: Europe Professional Speaker Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Professional Speaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Professional Speaker Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Professional Speaker Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 44: Asia Pacific Professional Speaker Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 45: Asia Pacific Professional Speaker Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Asia Pacific Professional Speaker Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 47: Asia Pacific Professional Speaker Industry Revenue (billion), by Amplification Method 2025 & 2033

- Figure 48: Asia Pacific Professional Speaker Industry Volume (K Unit), by Amplification Method 2025 & 2033

- Figure 49: Asia Pacific Professional Speaker Industry Revenue Share (%), by Amplification Method 2025 & 2033

- Figure 50: Asia Pacific Professional Speaker Industry Volume Share (%), by Amplification Method 2025 & 2033

- Figure 51: Asia Pacific Professional Speaker Industry Revenue (billion), by End-User 2025 & 2033

- Figure 52: Asia Pacific Professional Speaker Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 53: Asia Pacific Professional Speaker Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 54: Asia Pacific Professional Speaker Industry Volume Share (%), by End-User 2025 & 2033

- Figure 55: Asia Pacific Professional Speaker Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Professional Speaker Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Professional Speaker Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Professional Speaker Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Professional Speaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Professional Speaker Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Professional Speaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Professional Speaker Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Professional Speaker Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 64: Middle East and Africa Professional Speaker Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 65: Middle East and Africa Professional Speaker Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 66: Middle East and Africa Professional Speaker Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 67: Middle East and Africa Professional Speaker Industry Revenue (billion), by Amplification Method 2025 & 2033

- Figure 68: Middle East and Africa Professional Speaker Industry Volume (K Unit), by Amplification Method 2025 & 2033

- Figure 69: Middle East and Africa Professional Speaker Industry Revenue Share (%), by Amplification Method 2025 & 2033

- Figure 70: Middle East and Africa Professional Speaker Industry Volume Share (%), by Amplification Method 2025 & 2033

- Figure 71: Middle East and Africa Professional Speaker Industry Revenue (billion), by End-User 2025 & 2033

- Figure 72: Middle East and Africa Professional Speaker Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 73: Middle East and Africa Professional Speaker Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 74: Middle East and Africa Professional Speaker Industry Volume Share (%), by End-User 2025 & 2033

- Figure 75: Middle East and Africa Professional Speaker Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 76: Middle East and Africa Professional Speaker Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 77: Middle East and Africa Professional Speaker Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Middle East and Africa Professional Speaker Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Middle East and Africa Professional Speaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Professional Speaker Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Professional Speaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Professional Speaker Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Latin America Professional Speaker Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 84: Latin America Professional Speaker Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 85: Latin America Professional Speaker Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 86: Latin America Professional Speaker Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 87: Latin America Professional Speaker Industry Revenue (billion), by Amplification Method 2025 & 2033

- Figure 88: Latin America Professional Speaker Industry Volume (K Unit), by Amplification Method 2025 & 2033

- Figure 89: Latin America Professional Speaker Industry Revenue Share (%), by Amplification Method 2025 & 2033

- Figure 90: Latin America Professional Speaker Industry Volume Share (%), by Amplification Method 2025 & 2033

- Figure 91: Latin America Professional Speaker Industry Revenue (billion), by End-User 2025 & 2033

- Figure 92: Latin America Professional Speaker Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 93: Latin America Professional Speaker Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 94: Latin America Professional Speaker Industry Volume Share (%), by End-User 2025 & 2033

- Figure 95: Latin America Professional Speaker Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 96: Latin America Professional Speaker Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 97: Latin America Professional Speaker Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 98: Latin America Professional Speaker Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 99: Latin America Professional Speaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 100: Latin America Professional Speaker Industry Volume (K Unit), by Country 2025 & 2033

- Figure 101: Latin America Professional Speaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 102: Latin America Professional Speaker Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Professional Speaker Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Professional Speaker Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Professional Speaker Industry Revenue billion Forecast, by Amplification Method 2020 & 2033

- Table 4: Global Professional Speaker Industry Volume K Unit Forecast, by Amplification Method 2020 & 2033

- Table 5: Global Professional Speaker Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Professional Speaker Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Global Professional Speaker Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Professional Speaker Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global Professional Speaker Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Global Professional Speaker Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Professional Speaker Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Professional Speaker Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 13: Global Professional Speaker Industry Revenue billion Forecast, by Amplification Method 2020 & 2033

- Table 14: Global Professional Speaker Industry Volume K Unit Forecast, by Amplification Method 2020 & 2033

- Table 15: Global Professional Speaker Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 16: Global Professional Speaker Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 17: Global Professional Speaker Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Professional Speaker Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Professional Speaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Professional Speaker Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Professional Speaker Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Professional Speaker Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 23: Global Professional Speaker Industry Revenue billion Forecast, by Amplification Method 2020 & 2033

- Table 24: Global Professional Speaker Industry Volume K Unit Forecast, by Amplification Method 2020 & 2033

- Table 25: Global Professional Speaker Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global Professional Speaker Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Global Professional Speaker Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global Professional Speaker Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Professional Speaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Professional Speaker Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Professional Speaker Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Global Professional Speaker Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 33: Global Professional Speaker Industry Revenue billion Forecast, by Amplification Method 2020 & 2033

- Table 34: Global Professional Speaker Industry Volume K Unit Forecast, by Amplification Method 2020 & 2033

- Table 35: Global Professional Speaker Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Global Professional Speaker Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 37: Global Professional Speaker Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 38: Global Professional Speaker Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Professional Speaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global Professional Speaker Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Professional Speaker Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Global Professional Speaker Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 43: Global Professional Speaker Industry Revenue billion Forecast, by Amplification Method 2020 & 2033

- Table 44: Global Professional Speaker Industry Volume K Unit Forecast, by Amplification Method 2020 & 2033

- Table 45: Global Professional Speaker Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 46: Global Professional Speaker Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 47: Global Professional Speaker Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 48: Global Professional Speaker Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 49: Global Professional Speaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Professional Speaker Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Global Professional Speaker Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 52: Global Professional Speaker Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 53: Global Professional Speaker Industry Revenue billion Forecast, by Amplification Method 2020 & 2033

- Table 54: Global Professional Speaker Industry Volume K Unit Forecast, by Amplification Method 2020 & 2033

- Table 55: Global Professional Speaker Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 56: Global Professional Speaker Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 57: Global Professional Speaker Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Professional Speaker Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Professional Speaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Professional Speaker Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Professional Speaker Industry?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the Professional Speaker Industry?

Key companies in the market include Renkus-Heinz, Bowers & Wilkins, Bose Corporation, Carlson Audio Systems, Loud Audio, L-Acoustics, D&B Audiotechnik, Harman International (Samsung), Yamaha Corporation, Music Group (Music Tribe), Sony Corporation, B&C Speakers, K-Array, Meyer Sound Laboratories, Nady Systems, AEB Industriale (DB Technologies).

3. What are the main segments of the Professional Speaker Industry?

The market segments include Product Type, Amplification Method, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Demand from Corporate. Governments. and Institutions; Expansion of Live Music Industry; Growth in Music Production and Recording Equipment Market.

6. What are the notable trends driving market growth?

Music Production and Recording Equipment to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

; Volatility in Raw Material Costs; Acoustical Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Professional Speaker Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Professional Speaker Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Professional Speaker Industry?

To stay informed about further developments, trends, and reports in the Professional Speaker Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence