Key Insights

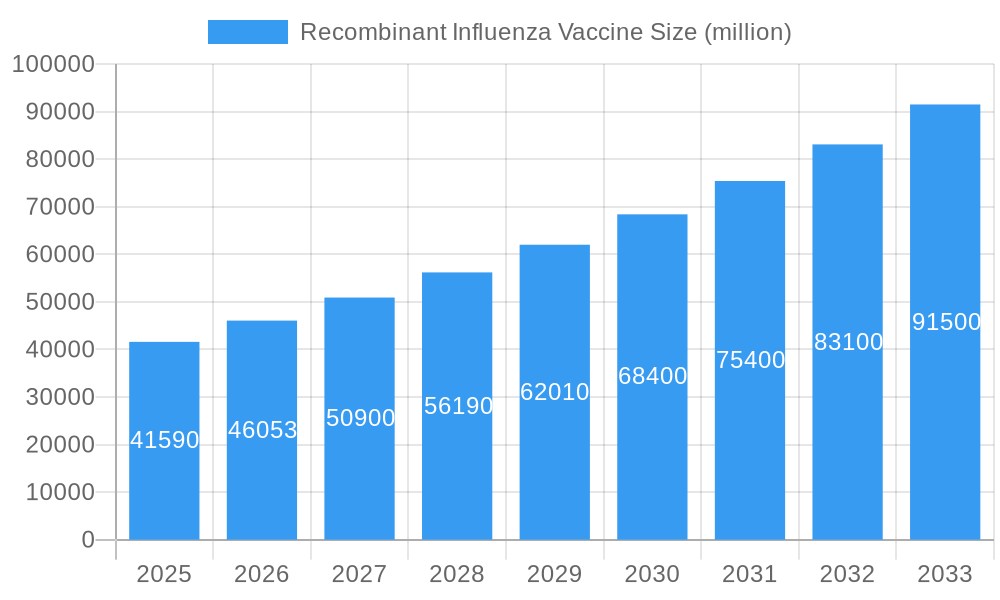

The global Recombinant Influenza Vaccine market is poised for significant expansion, with a projected market size of USD 41.59 billion in 2025. This growth trajectory is underpinned by an impressive Compound Annual Growth Rate (CAGR) of 10.62%, indicating a robust and sustained upward trend. The market is driven by a confluence of factors, chief among them the escalating prevalence of influenza strains and the growing global emphasis on preventative healthcare measures. The inherent advantages of recombinant vaccines, such as improved safety profiles, faster production times, and the elimination of egg-based cultivation, are increasingly recognized, fueling their adoption across public and private healthcare sectors. Furthermore, the continuous advancements in biotechnology and vaccine development technologies are paving the way for more effective and targeted influenza protection.

Recombinant Influenza Vaccine Market Size (In Billion)

The market's positive outlook is further bolstered by emerging trends like the development of universal influenza vaccines, which aim to provide broader and longer-lasting protection against a wider range of influenza viruses. The increasing demand for pre-filled syringe formats, offering enhanced convenience and reduced administration errors, is also contributing to market growth. While the market is characterized by strong growth drivers, certain restraints, such as the high cost of research and development and stringent regulatory approvals, are also present. However, the proactive efforts by key players, including Sanofi, to invest in innovation and expand manufacturing capabilities are expected to mitigate these challenges, ensuring the continued accessibility and efficacy of recombinant influenza vaccines in safeguarding public health.

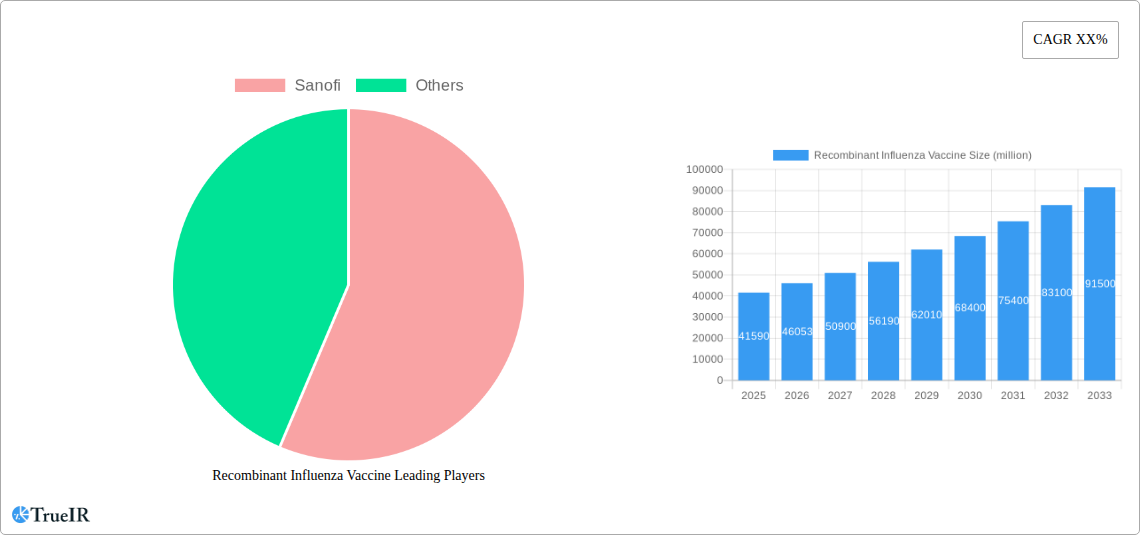

Recombinant Influenza Vaccine Company Market Share

Recombinant Influenza Vaccine Market: In-Depth Analysis & Future Forecast (2019–2033)

This comprehensive report delves into the dynamic Recombinant Influenza Vaccine market, providing a detailed analysis of its structure, trends, key players, and future outlook. Leveraging extensive historical data from 2019 to 2024 and projecting growth through 2033, this report is an indispensable resource for industry stakeholders seeking to navigate this rapidly evolving sector. The study encompasses a market size valued in the billions, driven by increasing public health awareness and advancements in vaccine technology.

Recombinant Influenza Vaccine Market Structure & Competitive Landscape

The global Recombinant Influenza Vaccine market exhibits a moderate concentration ratio, estimated at xx%, indicating a blend of established players and emerging innovators. Key companies like Sanofi are at the forefront, investing heavily in research and development to drive product innovation and expand market reach. The competitive landscape is shaped by several critical factors. Innovation drivers are primarily centered on enhancing vaccine efficacy, broadening strain coverage, and developing alternative delivery methods beyond traditional injections. Regulatory bodies play a pivotal role, with stringent approval processes acting as both a barrier to entry for new manufacturers and a driver of quality assurance for existing ones. The market is also influenced by the availability of product substitutes, including traditional cell-culture and egg-based influenza vaccines, though recombinant technology offers distinct advantages in terms of production speed and reduced allergenicity. End-user segmentation into Public Sector and Private Sector reveals differing procurement patterns and price sensitivities. M&A trends, with an estimated xx billion in deal values between 2021 and 2024, indicate a strategic consolidation of capabilities and market access as companies aim to secure a larger share of the burgeoning influenza vaccine market.

Recombinant Influenza Vaccine Market Trends & Opportunities

The Recombinant Influenza Vaccine market is poised for significant expansion, with projected market sizes reaching billions by the end of the forecast period. The Compound Annual Growth Rate (CAGR) is estimated at xx% between 2025 and 2033, a testament to the increasing demand for advanced influenza prevention solutions. This growth is fueled by a confluence of evolving consumer preferences and robust technological shifts. Consumers are increasingly seeking vaccines that offer improved safety profiles and reduced side effects, advantages that recombinant technologies inherently possess due to their non-avian origins. Technologically, advancements in genetic engineering and protein expression have enabled faster and more efficient production of vaccine antigens, leading to quicker responses to emerging influenza strains. The market penetration rate for recombinant influenza vaccines, while still lower than traditional methods, is steadily increasing as awareness and accessibility improve. Competitive dynamics are intensifying, with ongoing efforts by leading manufacturers to optimize production processes, secure intellectual property, and forge strategic partnerships to capture market share. Opportunities abound for companies that can demonstrate cost-effectiveness without compromising on quality and efficacy. The development of novel formulations and combination vaccines targeting multiple respiratory pathogens alongside influenza also presents a substantial avenue for growth. Furthermore, the increasing global emphasis on pandemic preparedness and the development of broad-spectrum influenza vaccines will continue to drive innovation and investment in this sector. The integration of artificial intelligence and machine learning in vaccine design and manufacturing is another emerging trend that promises to accelerate development cycles and improve vaccine specificity, further solidifying the market's growth trajectory.

Dominant Markets & Segments in Recombinant Influenza Vaccine

The Public Sector application segment is projected to remain a dominant force in the Recombinant Influenza Vaccine market, driven by government-backed vaccination programs and national health initiatives aimed at bolstering population immunity. These programs often involve large-scale procurement contracts, providing a stable and substantial revenue stream for manufacturers. Key growth drivers in this segment include strong government funding for public health, established vaccination infrastructure in developed and developing nations, and ongoing public health campaigns that emphasize the importance of seasonal influenza immunization.

- Public Sector Growth Drivers:

- National immunization programs and mandates.

- Government procurement contracts for public health.

- Increased funding for pandemic preparedness.

- Focus on preventing widespread outbreaks in schools and healthcare facilities.

The Private Sector, while currently smaller, presents a significant growth opportunity. This segment is characterized by individual healthcare provider recommendations, employer-sponsored wellness programs, and out-of-pocket purchases by health-conscious consumers. The growth in this segment is propelled by increasing individual healthcare expenditure, a rising awareness of the economic and personal costs of influenza, and the preference for advanced vaccine technologies offering enhanced safety and efficacy.

- Private Sector Growth Drivers:

- Growing personal healthcare spending.

- Employer-sponsored health and wellness initiatives.

- Consumer demand for advanced and well-tolerated vaccines.

- Increased accessibility through private clinics and pharmacies.

In terms of vaccine Types, the Prefilled syringe segment is demonstrating exceptional growth and is expected to lead the market. Prefilled syringes offer significant advantages in terms of convenience, reduced dosing errors, and improved administration efficiency, particularly in large-scale vaccination campaigns.

- Prefilled Syringe Growth Drivers:

- Enhanced convenience for healthcare providers and patients.

- Reduced risk of needlestick injuries and contamination.

- Improved accuracy in dosage delivery.

- Streamlined administration in mass vaccination settings.

The Vial format, while established, will continue to play a crucial role, especially in settings where multi-dose preparations are preferred for cost-effectiveness and inventory management. However, the shift towards unit-dose delivery via prefilled syringes is a discernible trend across the globe.

Recombinant Influenza Vaccine Product Analysis

Recombinant influenza vaccines represent a significant leap forward in immunization technology. These vaccines are produced using recombinant DNA technology, enabling the production of specific influenza virus antigens without the need for live viruses, eggs, or cell cultures. This innovation translates into several competitive advantages, including faster production times, the ability to rapidly respond to novel influenza strains, and a reduced risk of allergic reactions due to the absence of egg proteins. Product innovations are focused on expanding strain coverage, enhancing immunogenicity, and developing formulations suitable for different age groups and patient populations. The market fit for these vaccines is strong, addressing growing demand for safe, effective, and rapidly deployable influenza prevention solutions.

Key Drivers, Barriers & Challenges in Recombinant Influenza Vaccine

Key Drivers: The Recombinant Influenza Vaccine market is propelled by several powerful forces. Technological advancements in biotechnology and genetic engineering are enabling more efficient and cost-effective production. Increasing global health awareness and government initiatives promoting influenza vaccination are driving demand. The growing incidence of influenza outbreaks and the threat of pandemics further underscore the need for rapid vaccine development and deployment.

Barriers & Challenges: Despite the promising outlook, the market faces significant challenges. High research and development costs associated with novel vaccine technologies can be a substantial barrier. Stringent regulatory approval processes, while essential for safety, can prolong time-to-market. The established market presence and lower cost of traditional vaccines create competitive pressures. Furthermore, supply chain complexities and the need for specialized manufacturing infrastructure can impact scalability and accessibility. Ensuring broad-based vaccine uptake across diverse socioeconomic populations also remains a persistent challenge.

Growth Drivers in the Recombinant Influenza Vaccine Market

The growth of the Recombinant Influenza Vaccine market is primarily driven by a combination of factors. Technological advancements, particularly in bioprocessing and genetic sequencing, are enabling faster and more scalable production of vaccine antigens. Economic factors, such as increased healthcare expenditure and the rising burden of influenza-related illnesses, are stimulating demand for effective preventative measures. Regulatory support and government initiatives aimed at improving influenza immunization rates globally are also crucial. The increasing prevalence of chronic diseases and aging populations, who are more susceptible to influenza complications, further fuels market expansion.

Challenges Impacting Recombinant Influenza Vaccine Growth

Several hurdles impact the growth trajectory of the Recombinant Influenza Vaccine market. Regulatory complexities and the lengthy approval pathways for new vaccines can create significant delays and increase development costs. Supply chain issues, including the sourcing of raw materials and the establishment of robust distribution networks, can pose challenges to widespread availability. Competitive pressures from established, lower-cost traditional vaccines necessitate a strong focus on demonstrating the value proposition of recombinant technologies. Furthermore, public perception and vaccine hesitancy, although less pronounced with recombinant vaccines, can still affect uptake rates.

Key Players Shaping the Recombinant Influenza Vaccine Market

- Sanofi

- Seqirus

- GSK

- Novavax

- Emergent BioSolutions

Significant Recombinant Influenza Vaccine Industry Milestones

- 2020: Approval of new recombinant influenza vaccine formulations for broader age group coverage.

- 2021: Significant investment in expanding manufacturing capacity for recombinant vaccines in response to global health needs.

- 2022: Advances in strain selection algorithms for recombinant vaccines leading to improved efficacy predictions.

- 2023: Strategic partnerships formed to accelerate the development of universal influenza vaccines leveraging recombinant platforms.

- 2024: Increased adoption of recombinant influenza vaccines in national immunization programs of key countries.

Future Outlook for Recombinant Influenza Vaccine Market

The future outlook for the Recombinant Influenza Vaccine market is exceptionally promising, with continued growth driven by ongoing technological innovation and increasing global health priorities. Strategic opportunities lie in the development of quadrivalent vaccines with broader strain coverage, and the pursuit of universal influenza vaccines that can provide long-lasting immunity against multiple influenza strains. The market is expected to witness further consolidation through mergers and acquisitions as companies seek to strengthen their product portfolios and market presence. Increased investment in research and development for novel delivery systems and combination vaccines will also be a key growth catalyst. The projected expansion of manufacturing capabilities and the growing recognition of the advantages of recombinant technology will solidify its position as a cornerstone of future influenza prevention strategies, reaching market values in the billions.

Recombinant Influenza Vaccine Segmentation

-

1. Application

- 1.1. Public Sector

- 1.2. Private Sector

-

2. Types

- 2.1. Vial

- 2.2. Prefilled

Recombinant Influenza Vaccine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

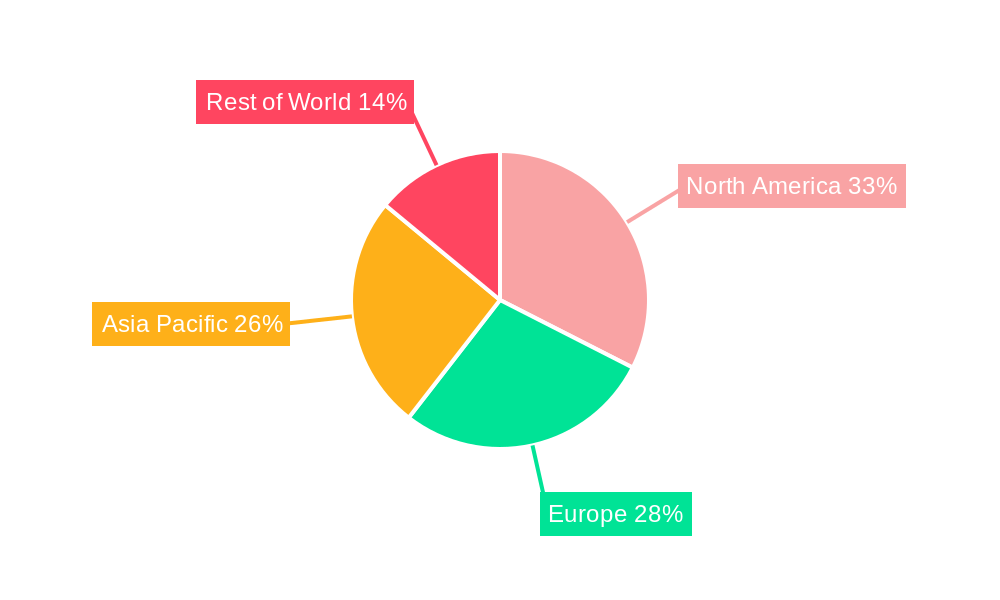

Recombinant Influenza Vaccine Regional Market Share

Geographic Coverage of Recombinant Influenza Vaccine

Recombinant Influenza Vaccine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recombinant Influenza Vaccine Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Public Sector

- 5.1.2. Private Sector

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Vial

- 5.2.2. Prefilled

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Recombinant Influenza Vaccine Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Public Sector

- 6.1.2. Private Sector

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Vial

- 6.2.2. Prefilled

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Recombinant Influenza Vaccine Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Public Sector

- 7.1.2. Private Sector

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Vial

- 7.2.2. Prefilled

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Recombinant Influenza Vaccine Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Public Sector

- 8.1.2. Private Sector

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Vial

- 8.2.2. Prefilled

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Recombinant Influenza Vaccine Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Public Sector

- 9.1.2. Private Sector

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Vial

- 9.2.2. Prefilled

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Recombinant Influenza Vaccine Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Public Sector

- 10.1.2. Private Sector

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Vial

- 10.2.2. Prefilled

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1. Sanofi

List of Figures

- Figure 1: Global Recombinant Influenza Vaccine Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Recombinant Influenza Vaccine Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Recombinant Influenza Vaccine Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Recombinant Influenza Vaccine Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Recombinant Influenza Vaccine Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Recombinant Influenza Vaccine Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Recombinant Influenza Vaccine Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Recombinant Influenza Vaccine Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Recombinant Influenza Vaccine Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Recombinant Influenza Vaccine Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Recombinant Influenza Vaccine Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Recombinant Influenza Vaccine Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Recombinant Influenza Vaccine Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Recombinant Influenza Vaccine Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Recombinant Influenza Vaccine Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Recombinant Influenza Vaccine Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Recombinant Influenza Vaccine Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Recombinant Influenza Vaccine Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Recombinant Influenza Vaccine Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Recombinant Influenza Vaccine Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Recombinant Influenza Vaccine Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Recombinant Influenza Vaccine Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Recombinant Influenza Vaccine Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Recombinant Influenza Vaccine Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Recombinant Influenza Vaccine Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Recombinant Influenza Vaccine Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Recombinant Influenza Vaccine Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Recombinant Influenza Vaccine Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Recombinant Influenza Vaccine Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Recombinant Influenza Vaccine Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Recombinant Influenza Vaccine Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Recombinant Influenza Vaccine Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Recombinant Influenza Vaccine Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recombinant Influenza Vaccine?

The projected CAGR is approximately 10.62%.

2. Which companies are prominent players in the Recombinant Influenza Vaccine?

Key companies in the market include Sanofi.

3. What are the main segments of the Recombinant Influenza Vaccine?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recombinant Influenza Vaccine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recombinant Influenza Vaccine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recombinant Influenza Vaccine?

To stay informed about further developments, trends, and reports in the Recombinant Influenza Vaccine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence