Key Insights

The Saudi Arabia Point-of-Sale (POS) Terminal market is projected to reach a size of $487 million by 2024, exhibiting a robust Compound Annual Growth Rate (CAGR) of 11.5%. This significant expansion is propelled by Saudi Arabia's dynamic economic growth and the transformative Vision 2030. Key growth catalysts include the accelerating adoption of digital payments, the rapid expansion of the retail and hospitality sectors, and the burgeoning e-commerce landscape. Government-led initiatives promoting a cashless economy and enhancing business operational efficiency are further stimulating demand for sophisticated POS systems. The market prioritizes innovation, with businesses seeking integrated solutions that offer enhanced security, streamlined workflows, and superior customer experiences. While fixed POS systems remain prevalent in larger retail environments, mobile and portable POS solutions are gaining rapid traction due to their inherent flexibility and suitability for small businesses and mobile transactions.

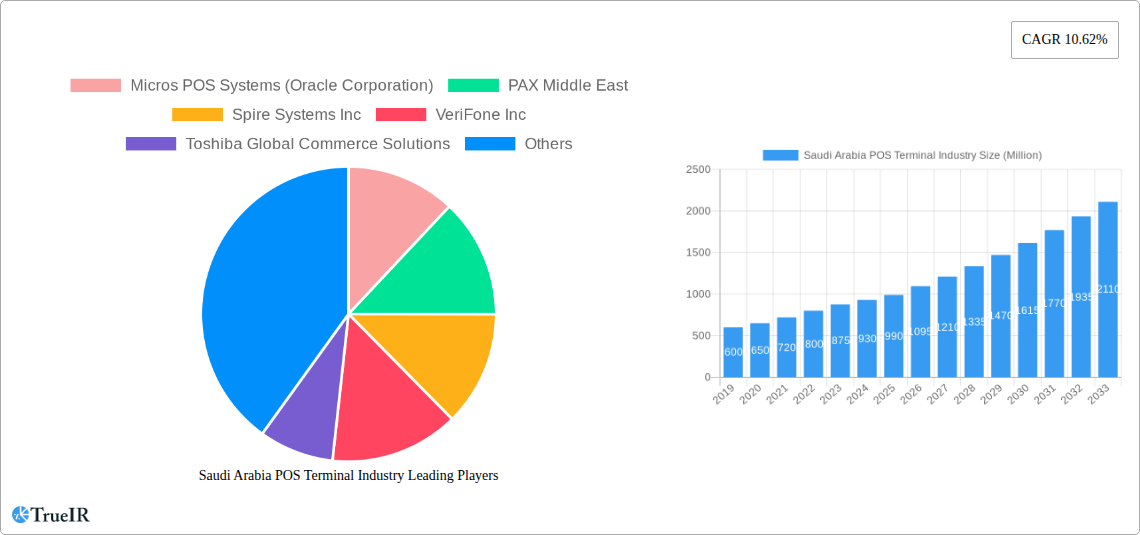

Saudi Arabia POS Terminal Industry Market Size (In Million)

Technological advancements and evolving consumer preferences are reshaping the Saudi Arabian POS terminal industry. Prominent trends encompass the integration of advanced analytics, the proliferation of cloud-based POS solutions, and a heightened emphasis on omnichannel retail strategies. The healthcare sector is also emerging as a substantial end-user, leveraging POS terminals for efficient billing and patient management. Potential challenges include initial investment costs for smaller businesses and the requirement for continuous technical support. Nevertheless, the market outlook remains overwhelmingly positive, with leading global players like Oracle, PAX, VeriFone, and Ingenico actively competing and innovating within the region. The ongoing introduction of new technologies and the government's unwavering commitment to digital transformation are expected to foster a highly competitive yet highly rewarding market for POS terminals in Saudi Arabia throughout the forecast period.

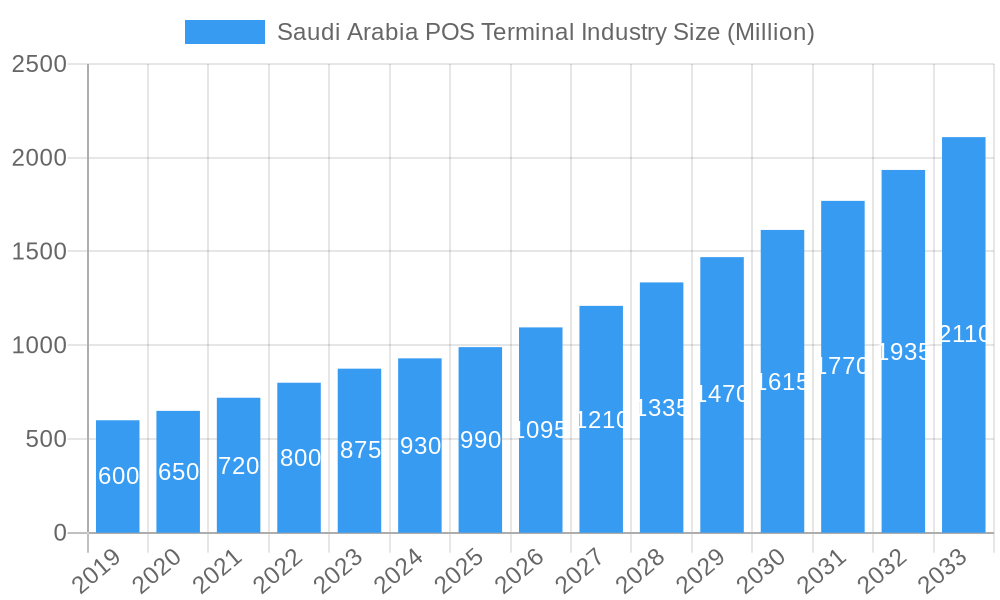

Saudi Arabia POS Terminal Industry Company Market Share

Saudi Arabia POS Terminal Industry Market Report: Comprehensive Analysis 2019-2033

This in-depth market research report provides a detailed analysis of the Saudi Arabia POS Terminal Industry, covering the historical period (2019–2024), base year (2025), and an extensive forecast period (2025–2033). With a focus on high-volume keywords and SEO optimization, this report is designed to offer unparalleled insights for industry stakeholders, investors, and decision-makers. We delve into market structure, competitive landscape, emerging trends, opportunities, dominant segments, product innovations, key drivers, barriers, challenges, and the strategic moves of key players shaping the future of POS technology in the Kingdom.

Saudi Arabia POS Terminal Industry Market Structure & Competitive Landscape

The Saudi Arabia POS terminal market is characterized by a dynamic and evolving competitive landscape, exhibiting moderate concentration. Innovation drivers are largely propelled by the push for digital transformation, enhanced customer experience, and the government's vision for a cashless economy. Regulatory impacts, particularly from the Saudi Central Bank (SAMA), are significant, fostering a secure and interoperable payment ecosystem. Product substitutes, such as mobile payment apps and e-commerce platforms, are increasingly influencing market dynamics, pushing POS providers to innovate and integrate diverse payment functionalities. End-user segmentation reveals a strong demand across retail, hospitality, and healthcare sectors, with each segment presenting unique requirements and growth potentials. Mergers and acquisitions (M&A) trends, while not fully exhaustive, are indicative of strategic consolidation and expansion efforts by key players aiming to capture larger market shares. For instance, the integration of advanced payment solutions and cloud-based POS systems by companies like Geidea Signals a shift towards more comprehensive service offerings. The market's growth is also influenced by initiatives aimed at supporting Small and Medium Enterprises (SMEs) with accessible and efficient payment solutions, further intensifying competition. The overall market structure reflects a growing maturity, with a clear emphasis on value-added services and technological differentiation.

Saudi Arabia POS Terminal Industry Market Trends & Opportunities

The Saudi Arabia POS terminal industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and strategic government initiatives. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period (2025–2033), reaching an estimated value of over 500 Million SAR by 2033. This expansion is fueled by the increasing adoption of digital payments, the proliferation of e-commerce, and the ongoing digital transformation across various business sectors in the Kingdom. Technological shifts are prominently marked by the rise of mobile POS (mPOS) systems, cloud-based solutions, and the integration of artificial intelligence (AI) and machine learning (ML) for enhanced data analytics and personalized customer experiences. Consumer preferences are increasingly leaning towards seamless, fast, and secure payment options, with a growing demand for contactless transactions and integrated loyalty programs. The competitive dynamics are intensifying, with both established global players and agile local providers vying for market dominance. This competition spurs innovation in areas such as biometric authentication, advanced security features, and omnichannel integration. The "Saudi Vision 2030" initiative plays a pivotal role, encouraging businesses to embrace digital solutions and reducing reliance on cash. This creates significant opportunities for POS terminal providers to offer tailored solutions that meet the specific needs of diverse industries, from large retail chains to small food trucks. The expansion of the tourism sector and the growth of the hospitality industry further amplify the demand for efficient and user-friendly POS systems. The increasing penetration of smartphones and the widespread availability of high-speed internet connectivity are also crucial enablers for the adoption of mPOS and cloud-based solutions. Furthermore, the focus on financial inclusion and the support for SMEs by the Saudi government present a fertile ground for innovative and affordable POS solutions. The development of integrated payment ecosystems, where POS terminals seamlessly communicate with other business management software, represents another significant trend and a lucrative opportunity for market players. The Saudi Arabia POS terminal market is a landscape of continuous innovation, offering immense potential for growth and market leadership for companies that can adapt to these rapidly evolving trends.

Dominant Markets & Segments in Saudi Arabia POS Terminal Industry

The Saudi Arabia POS Terminal Industry is experiencing robust growth across its various segments, with a clear dominance projected for certain categories.

Type: Mobile/Portable Point-of-Sale Systems are emerging as a significant growth driver, outpacing their fixed counterparts. This surge is attributed to:

- Increased Agility for Businesses: Mobile POS solutions offer unparalleled flexibility, allowing businesses to conduct transactions anywhere, from pop-up shops and food trucks to customer tables in restaurants, enhancing customer service and operational efficiency.

- Lower Initial Investment: Compared to traditional fixed POS systems, mPOS devices often have a lower upfront cost, making them more accessible for SMEs and startups.

- Technological Advancements: The widespread adoption of smartphones and tablets as the core of mPOS devices, coupled with advancements in wireless connectivity and secure payment processing, has made these systems highly reliable and user-friendly.

- Government Support for Digital Payments: Initiatives promoting cashless transactions and digital inclusivity further boost the adoption of mobile payment solutions.

End-user Industry: Retail continues to be the largest and most dominant segment within the Saudi Arabia POS Terminal Industry. Key factors contributing to this dominance include:

- High Transaction Volume: The retail sector, encompassing supermarkets, fashion stores, electronics outlets, and convenience stores, generates the highest volume of daily transactions, necessitating efficient and reliable POS systems.

- E-commerce Integration: The growing trend of omnichannel retail, where online and offline sales channels are integrated, requires POS systems capable of managing inventory, customer data, and sales across multiple platforms.

- Customer Experience Enhancement: Retailers are investing in advanced POS solutions to offer personalized shopping experiences, loyalty programs, and faster checkout processes, which are crucial for customer retention and satisfaction.

- Digital Transformation Initiatives: The retail industry is actively participating in Saudi Arabia's digital transformation drive, with POS systems being a cornerstone of modernizing operations.

End-user Industry: Hospitality is another substantial and rapidly growing segment. The demand for POS systems in this sector is driven by:

- Table-side Ordering and Payment: Mobile POS devices are revolutionizing restaurant operations by enabling staff to take orders and process payments directly at the table, reducing wait times and improving service.

- Inventory and Kitchen Management: Integrated POS systems offer advanced features for managing inventory, tracking food costs, and streamlining kitchen operations, leading to greater efficiency and reduced waste.

- Growth in Food & Beverage: The vibrant food and beverage scene in Saudi Arabia, including cafes, full-service restaurants, and quick-service outlets, fuels the demand for specialized POS solutions catering to their unique needs.

- Tourism and Entertainment Growth: The expansion of tourism and entertainment venues creates a consistent demand for POS systems capable of handling high volumes of transactions in fast-paced environments.

While Healthcare and Other End-user Industries are also significant and growing, the current market dominance lies with mobile/portable systems and the retail and hospitality sectors, reflecting the ongoing shift towards digital transactions and enhanced customer convenience.

Saudi Arabia POS Terminal Industry Product Analysis

The Saudi Arabia POS terminal market is witnessing a surge in product innovation, characterized by the development of sophisticated, multi-functional devices. Key product advancements include the integration of contactless payment technologies (NFC, QR codes), enhanced security features like EMV chip readers and tokenization, and cloud-based architecture for seamless data synchronization and remote management. Many new-generation POS systems are offering advanced analytics capabilities, enabling businesses to gain insights into sales trends, customer behavior, and inventory management. The competitive advantage for manufacturers lies in developing robust, reliable, and user-friendly terminals that support a wide range of payment methods, integrate with existing business software, and provide a superior customer experience.

Key Drivers, Barriers & Challenges in Saudi Arabia POS Terminal Industry

Key Drivers: The Saudi Arabia POS Terminal Industry is propelled by several significant drivers. The government's strong commitment to digital transformation and a cashless economy, as outlined in "Saudi Vision 2030," is a primary catalyst. This is further supported by increasing consumer adoption of digital payments and a growing preference for convenience and speed. Technological advancements, particularly in mPOS and cloud-based solutions, are making POS systems more accessible and versatile. The expansion of the retail and hospitality sectors, fueled by tourism and economic diversification, also creates substantial demand.

Barriers & Challenges: Despite the growth, the industry faces certain barriers and challenges. Ensuring data security and privacy in an increasingly digital environment is paramount and requires continuous investment in robust security protocols, posing a significant challenge for both providers and users. The initial cost of advanced POS systems can still be a hurdle for some smaller businesses, despite the availability of more affordable mPOS options. Fierce competition among a growing number of players can lead to price pressures and necessitate significant investment in research and development to maintain a competitive edge. Supply chain disruptions, though less pronounced, can still impact the availability of components and finished products. Regulatory compliance with evolving financial regulations also demands ongoing adaptation and investment.

Growth Drivers in the Saudi Arabia POS Terminal Industry Market

The growth of the Saudi Arabia POS Terminal Industry is significantly driven by the nation's ambitious digital transformation agenda, aiming to create a robust cashless economy. The increasing disposable income and evolving consumer habits are leading to a greater preference for digital and contactless payment methods, directly boosting the demand for POS terminals. Technological advancements, such as the proliferation of mPOS devices, cloud-based solutions, and the integration of AI for data analytics, are making POS systems more efficient, affordable, and user-friendly for businesses of all sizes. Furthermore, the expansion of the tourism and hospitality sectors, coupled with government support for SMEs, provides fertile ground for increased POS adoption.

Challenges Impacting Saudi Arabia POS Terminal Industry Growth

The growth of the Saudi Arabia POS Terminal Industry is not without its challenges. Ensuring robust cybersecurity measures to protect sensitive transaction data remains a constant concern and requires ongoing investment and vigilance. While adoption is rising, the initial investment cost for some advanced POS solutions can still be a deterrent for micro and small enterprises. Intense competition within the market can lead to price wars and pressure profit margins, necessitating a focus on value-added services and differentiation. Adapting to and complying with ever-evolving financial regulations and payment standards also presents an ongoing challenge for POS providers.

Key Players Shaping the Saudi Arabia POS Terminal Industry Market

- Micros POS Systems (Oracle Corporation)

- PAX Middle East

- Spire Systems Inc

- VeriFone Inc

- Toshiba Global Commerce Solutions

- Urovo Technology Corporation Limited

- DATECS Ltd

- Castles Technology

- Ingenico (Worldline)

- Geidea Solutions

Significant Saudi Arabia POS Terminal Industry Industry Milestones

- November 2022: Geidea announced the launch of an integrated point-of-sales solution in Saudi Arabia, designed to revolutionize payment and business processes for food & beverage operations. This fully integrated, new-generation, cloud-based POS system is available for cafes, full dining establishments, food trucks, quick service restaurants, and cloud kitchens, and is compatible with all of Geidea's payment solutions.

- August 2022: The Saudi Central Bank (SAMA) announced the launch of a point of sale (POS) service connecting the Saudi payments network (Mada) and Qatar's National ATM and POS Switch (NAPS). This development, following successful technical trials, enables Mada and NAPS cardholders to conduct POS transactions in both countries through the Gulf Payments Network (GCCNET).

Future Outlook for Saudi Arabia POS Terminal Industry Market

The future outlook for the Saudi Arabia POS Terminal Industry is exceptionally bright, driven by sustained digital transformation efforts and an increasingly cashless economy. Strategic opportunities lie in the continued expansion of mPOS solutions, the adoption of AI-powered analytics for personalized customer experiences, and the integration of POS systems with broader business management platforms. The growing e-commerce landscape and the expansion of the gig economy will further fuel demand for flexible and portable POS terminals. The government's ongoing support for SMEs and the development of smart city initiatives will also act as significant catalysts, ensuring continued market growth and innovation.

Saudi Arabia POS Terminal Industry Segmentation

-

1. Type

- 1.1. Fixed Point-of-Sale Systems

- 1.2. Mobile/Portable Point-of-Sale Systems

-

2. End-user Industry

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Other End-user Industries

Saudi Arabia POS Terminal Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia POS Terminal Industry Regional Market Share

Geographic Coverage of Saudi Arabia POS Terminal Industry

Saudi Arabia POS Terminal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Payments from NFC-Compatible Smartphones and Smart Cards; Retail Sector Adopting the NFC POS Solutions Considerably; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions

- 3.4. Market Trends

- 3.4.1. Increased Payments from NFC-Compatible Smartphones and Smart Cards

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia POS Terminal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-Sale Systems

- 5.1.2. Mobile/Portable Point-of-Sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Micros POS Systems (Oracle Corporation)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PAX Middle East

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spire Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 VeriFone Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toshiba Global Commerce Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Urovo technology Corporation Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DATECS Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Castles Technology*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ingenico (Worldline)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Geidea Solutions

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Micros POS Systems (Oracle Corporation)

List of Figures

- Figure 1: Saudi Arabia POS Terminal Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia POS Terminal Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia POS Terminal Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia POS Terminal Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Saudi Arabia POS Terminal Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia POS Terminal Industry Revenue million Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia POS Terminal Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Saudi Arabia POS Terminal Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia POS Terminal Industry?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Saudi Arabia POS Terminal Industry?

Key companies in the market include Micros POS Systems (Oracle Corporation), PAX Middle East, Spire Systems Inc, VeriFone Inc, Toshiba Global Commerce Solutions, Urovo technology Corporation Limited, DATECS Ltd, Castles Technology*List Not Exhaustive, Ingenico (Worldline), Geidea Solutions.

3. What are the main segments of the Saudi Arabia POS Terminal Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 487 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Payments from NFC-Compatible Smartphones and Smart Cards; Retail Sector Adopting the NFC POS Solutions Considerably; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Increased Payments from NFC-Compatible Smartphones and Smart Cards.

7. Are there any restraints impacting market growth?

Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions.

8. Can you provide examples of recent developments in the market?

November 2022: Geidea announced the launch of an integrated point-of-sales solution in Saudi Arabia to revolutionize payment and business processes for food & beverage operations. The fully integrated, new-generation, cloud-based POS system can respond to ever-evolving customer needs and dynamic market conditions. It is available for cafes, full dining, food trucks, quick service, and cloud kitchens and is compatible with all of Geidea's payment solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia POS Terminal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia POS Terminal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia POS Terminal Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia POS Terminal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence