Key Insights

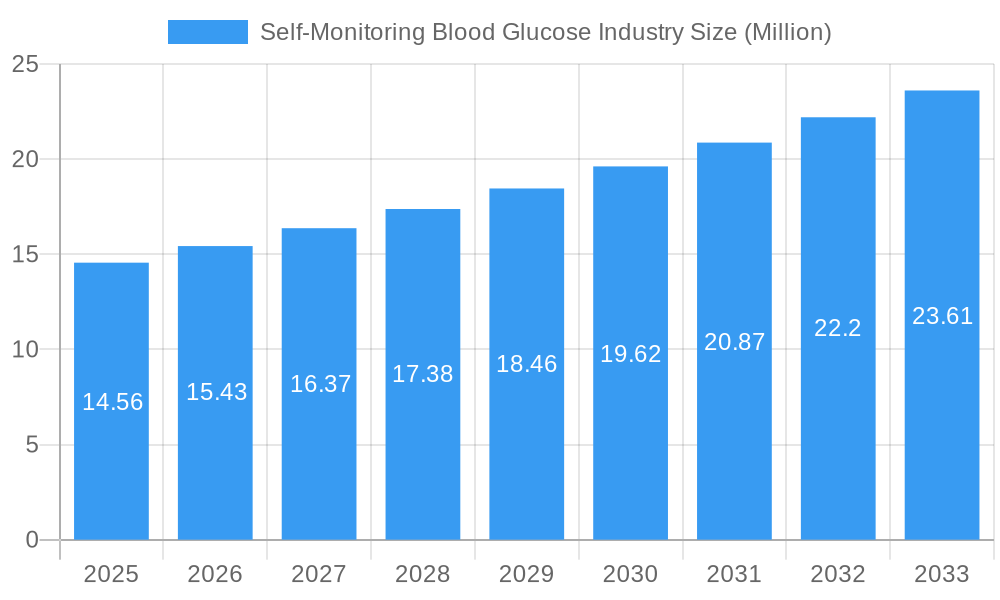

The global Self-Monitoring Blood Glucose (SMBG) market is poised for significant expansion, projected to reach an estimated \$14.56 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.23% expected through 2033. This sustained growth is primarily fueled by the escalating prevalence of diabetes worldwide, particularly Type 2 diabetes, driven by factors such as unhealthy lifestyles, rising obesity rates, and an aging global population. Increased awareness among patients regarding the importance of regular blood glucose monitoring for effective diabetes management, coupled with advancements in SMBG device technology, including the development of more user-friendly, accurate, and connected glucometers, further propels market demand. The growing adoption of these devices for personal and home use, supported by expanding healthcare infrastructure and increasing disposable incomes in emerging economies, also plays a crucial role in shaping the market landscape.

Self-Monitoring Blood Glucose Industry Market Size (In Million)

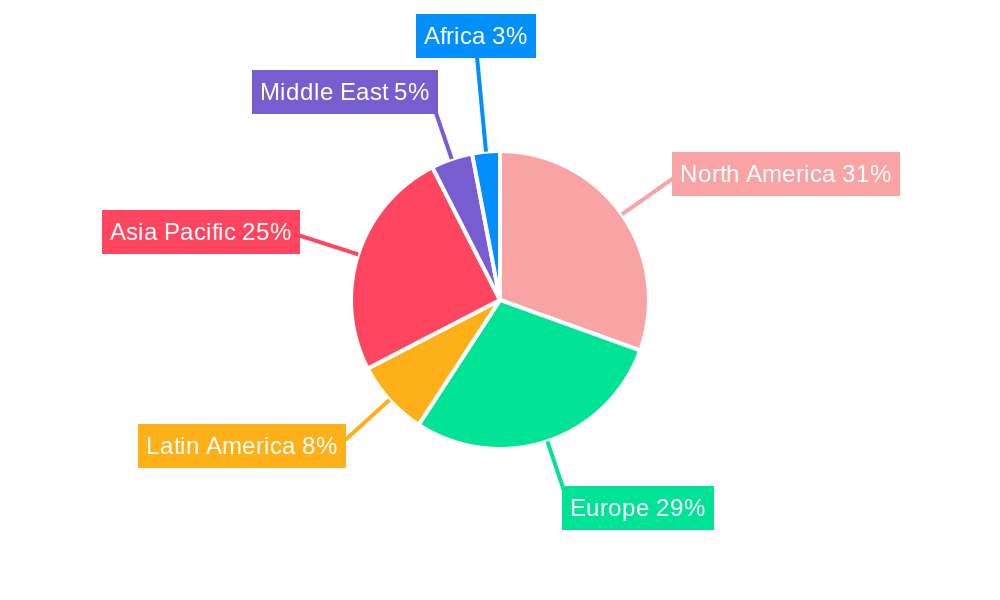

The market is segmented into key components like glucometer devices, test strips, and lancets, with each segment experiencing its own growth trajectory influenced by technological innovations and replacement cycles. End-users are predominantly categorized into hospitals/clinics and personal/home settings, with the latter showing accelerated growth due to enhanced patient self-care initiatives and the convenience offered by modern SMBG solutions. Geographically, North America and Europe currently dominate the market, driven by well-established healthcare systems and high diabetes prevalence. However, the Asia Pacific region is anticipated to emerge as the fastest-growing market, propelled by a large and growing diabetic population, improving healthcare access, and increasing adoption of advanced SMBG technologies. Key industry players are focusing on product innovation, strategic partnerships, and expanding their distribution networks to capitalize on these growth opportunities and address the evolving needs of individuals managing diabetes.

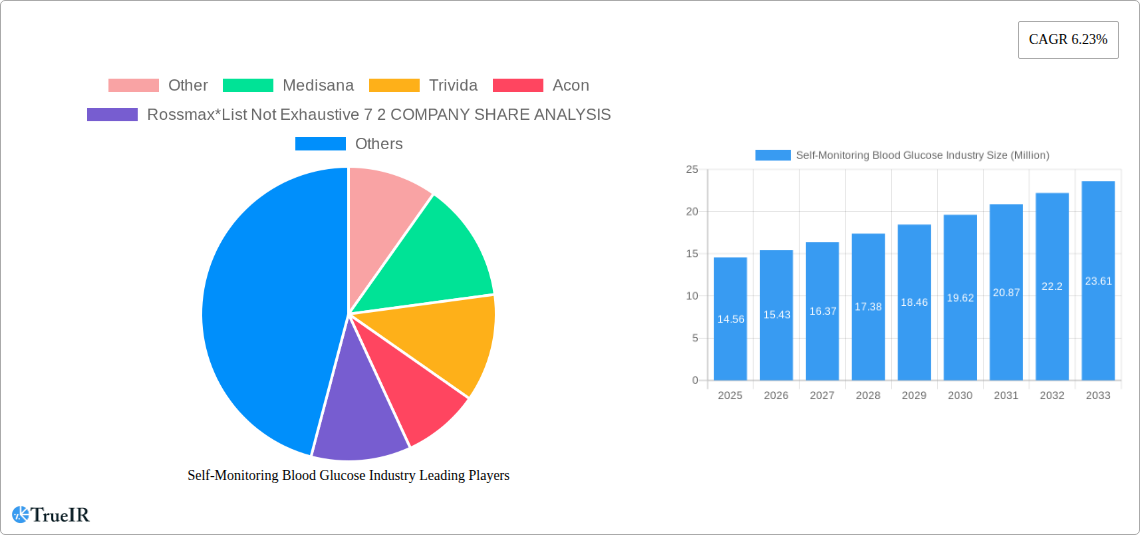

Self-Monitoring Blood Glucose Industry Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the global Self-Monitoring Blood Glucose (SMBG) industry. Leveraging high-volume keywords and incorporating detailed quantitative and qualitative insights, this report is designed to engage industry professionals and enhance search rankings. The study encompasses a comprehensive historical period (2019–2024), a base year of 2025, and a detailed forecast period from 2025–2033.

Self-Monitoring Blood Glucose Industry Market Structure & Competitive Landscape

The Self-Monitoring Blood Glucose (SMBG) industry is characterized by a moderately consolidated market structure, driven by continuous innovation and evolving regulatory landscapes. Key players are strategically focused on developing advanced technologies to cater to the growing diabetic population worldwide. The market is influenced by several factors including:

- Market Concentration: The industry exhibits a moderate concentration, with a few dominant players holding significant market share. The top 5 companies are estimated to command approximately 65% of the market. Concentration ratios are closely monitored due to ongoing mergers and acquisitions aimed at expanding product portfolios and geographical reach.

- Innovation Drivers: Technological advancements, such as the development of connected glucometers, continuous glucose monitoring (CGM) integration, and user-friendly mobile applications, are pivotal. The demand for minimally invasive and highly accurate devices continues to fuel research and development.

- Regulatory Impacts: Stringent regulatory approvals from bodies like the FDA and EMA are critical for market entry and product commercialization. These regulations ensure product safety, efficacy, and data privacy, impacting product development timelines and market access strategies.

- Product Substitutes: While traditional SMBG devices remain prevalent, advanced diabetes management solutions, including CGMs and artificial pancreas systems, are emerging as potential substitutes, albeit at a higher price point. The value proposition of SMBG lies in its cost-effectiveness and established user base.

- End-User Segmentation: The market is segmented by end-users, with Personal/Home use representing the largest share, followed by Hospital/Clinics. The increasing prevalence of diabetes and the growing awareness of self-management are driving the growth in home-use devices.

- M&A Trends: Mergers and acquisitions are prevalent as companies seek to enhance their competitive edge through technological integration, market expansion, and diversification. For instance, several acquisitions in the past five years have focused on integrating AI-powered analytics with SMBG data.

Self-Monitoring Blood Glucose Industry Market Trends & Opportunities

The global Self-Monitoring Blood Glucose (SMBG) market is poised for substantial growth and transformation over the forecast period (2025–2033). This expansion is fueled by a confluence of escalating diabetes prevalence, rapid technological advancements, and increasing healthcare consciousness among individuals worldwide. The market size, estimated to be in the billions of dollars in the base year of 2025, is projected to witness a significant compound annual growth rate (CAGR) of approximately 7.5% during the forecast period. This growth trajectory is underpinned by several critical trends and emerging opportunities that are reshaping the competitive landscape and consumer preferences.

A primary driver is the increasing global prevalence of diabetes. With millions of new diagnoses annually, the demand for effective diabetes management tools, including SMBG devices, continues to rise. This demographic shift, particularly in developing economies, presents a vast untapped market. Coupled with this is the growing awareness among individuals regarding proactive health management. Consumers are increasingly opting for self-care solutions, leading to a higher adoption rate of home-use SMBG devices. This trend is further amplified by the convenience and empowerment these devices offer in managing chronic conditions like diabetes.

Technologically, the market is experiencing a shift towards connected and smart devices. The integration of Bluetooth connectivity, mobile applications, and cloud-based data management systems is revolutionizing SMBG. These features enable seamless data syncing, personalized insights, remote patient monitoring, and better communication between patients and healthcare providers. Innovations in sensor technology are leading to more accurate, faster, and less painful blood glucose testing. For example, the development of non-invasive or minimally invasive testing methods, while still in early stages, represents a significant future opportunity. The demand for user-friendly and integrated solutions is also a major trend. Devices that offer simpler operation, larger displays, and features like meal logging and activity tracking are gaining popularity. The inclusion of advanced algorithms for trend analysis and predictive alerts enhances the value proposition for users, aiding in better glycemic control.

Competitive dynamics are evolving with increased investment in research and development by key players. Companies are focusing on differentiating their products through superior accuracy, enhanced connectivity, improved user experience, and competitive pricing. The market also presents opportunities for partnerships and collaborations between device manufacturers, software developers, and healthcare providers to offer comprehensive diabetes management ecosystems. Furthermore, the growing demand for cost-effective solutions in emerging markets opens avenues for market penetration through affordable and reliable SMBG products. The rise of telehealth and remote patient monitoring programs further bolsters the market by emphasizing the need for reliable self-monitoring tools that can transmit data to healthcare professionals remotely. The development of specialized SMBG devices for specific patient populations, such as pediatric or gestational diabetes, also represents a niche but growing opportunity.

Dominant Markets & Segments in Self-Monitoring Blood Glucose Industry

The global Self-Monitoring Blood Glucose (SMBG) industry's market dominance is shaped by distinct regional strengths and segment preferences. Analyzing these dominant markets and segments provides critical insights into growth drivers and strategic opportunities for stakeholders.

Dominant Regions & Countries:

- North America: This region consistently holds a leading position in the SMBG market.

- Key Growth Drivers:

- High prevalence of diabetes and obesity.

- Advanced healthcare infrastructure and widespread adoption of technology.

- Strong reimbursement policies and insurance coverage for diabetes management devices.

- High consumer awareness and proactive approach to personal health management.

- Presence of major research and development centers and key market players.

- Government initiatives promoting diabetes awareness and management.

- Market Analysis: The United States, in particular, is a powerhouse due to its large diabetic population and high per capita healthcare spending. The adoption of connected devices and demand for innovative features are significant drivers.

- Key Growth Drivers:

- Europe: A close second, Europe exhibits robust growth driven by a similar set of factors as North America, with significant variations across countries.

- Key Growth Drivers:

- Aging population and increasing incidence of type 2 diabetes.

- Well-established healthcare systems and emphasis on preventive care.

- Stringent quality standards and regulatory approvals (e.g., CE marking) driving product innovation.

- Growing adoption of digital health solutions and telemedicine.

- Market Analysis: Countries like Germany, the UK, and France are major contributors. The focus on integrated diabetes care and government support for chronic disease management are key.

- Key Growth Drivers:

- Asia Pacific: This region presents the fastest-growing market for SMBG devices.

- Key Growth Drivers:

- Rapidly increasing diabetic population, especially in countries like China and India.

- Growing disposable incomes and increasing affordability of healthcare products.

- Rising awareness about diabetes management and self-care.

- Government initiatives to improve healthcare access and quality.

- Emergence of local manufacturers offering cost-effective solutions.

- Market Analysis: The sheer volume of the population and the escalating diabetes rates make Asia Pacific a critical growth frontier. The adoption of technology is accelerating, driven by a younger, tech-savvy demographic.

- Key Growth Drivers:

Dominant Segments:

- Component: Test Strips: This segment continues to dominate the SMBG market in terms of revenue.

- Key Growth Drivers:

- High consumption rates due to the need for frequent testing.

- Essentiality for the functioning of glucometer devices.

- Continuous innovation leading to improved accuracy and faster results.

- Strategic importance for market players in terms of recurring revenue.

- Market Analysis: The high volume of tests required for effective diabetes management ensures a sustained demand for test strips. Competition focuses on improving strip technology, reducing costs, and ensuring compatibility with a wide range of glucometers.

- Key Growth Drivers:

- Component: Glucometer Devices: This segment is also a significant revenue generator and is experiencing rapid innovation.

- Key Growth Drivers:

- Advancements in device technology, including connectivity, accuracy, and ease of use.

- Development of smart and connected glucometers that integrate with mobile apps.

- Increasing demand for user-friendly and portable devices.

- Innovation in sensor technology leading to more accurate readings.

- Market Analysis: The evolution of glucometers towards digital integration is a key trend, enhancing their value proposition beyond simple glucose measurement.

- Key Growth Drivers:

- End User: Personal/Home: This segment represents the largest and fastest-growing end-user segment.

- Key Growth Drivers:

- Rising prevalence of diabetes and increasing self-management practices.

- Convenience and comfort of testing at home.

- Growing awareness of the importance of regular monitoring for glycemic control.

- Technological advancements making devices more accessible and user-friendly for home use.

- Shift towards preventative healthcare and personal health tracking.

- Market Analysis: The empowerment of individuals to manage their health effectively at home is a major catalyst. This segment benefits from the increasing availability of affordable and sophisticated SMBG devices.

- Key Growth Drivers:

- End User: Hospital/Clinics: While smaller than the personal/home segment, this sector is crucial for point-of-care testing and clinical decision-making.

- Key Growth Drivers:

- Need for rapid and accurate glucose readings for patient diagnosis and treatment in acute care settings.

- Development of specialized point-of-care devices for healthcare professionals.

- Integration with hospital information systems for efficient data management.

- Market Analysis: This segment is characterized by demand for high-throughput, accurate, and integrated testing solutions that can provide immediate actionable data for patient care.

- Key Growth Drivers:

Self-Monitoring Blood Glucose Industry Product Analysis

The Self-Monitoring Blood Glucose (SMBG) industry is witnessing remarkable product innovation, driven by the relentless pursuit of accuracy, convenience, and connectivity. Key advancements focus on integrating sophisticated sensor technologies for faster and more precise readings, often with less discomfort. Modern glucometers are increasingly designed as smart devices, featuring Bluetooth connectivity to sync seamlessly with mobile applications. These apps offer advanced data analysis, trend tracking, personalized insights, and direct communication channels with healthcare providers, transforming SMBG from mere measurement into proactive diabetes management. Competitive advantages are being carved out through enhanced user experience, such as larger displays, simpler interfaces, and reduced calibration requirements. Furthermore, developments in disposable test strips aim for greater efficiency and cost-effectiveness.

Key Drivers, Barriers & Challenges in Self-Monitoring Blood Glucose Industry

Key Drivers:

- Rising Global Diabetes Prevalence: The escalating number of individuals diagnosed with diabetes worldwide is the primary catalyst for SMBG market growth. This demographic trend directly correlates with the increasing demand for reliable glucose monitoring tools for effective disease management.

- Technological Advancements: Continuous innovation in sensor technology, smart device integration (Bluetooth, Wi-Fi), and sophisticated mobile applications are enhancing accuracy, user-friendliness, and data insights, driving adoption.

- Increased Health Awareness & Self-Care: Growing global awareness about the importance of proactive health management and self-care empowers individuals to adopt SMBG devices for better control over their chronic conditions.

- Government Initiatives and Reimbursement Policies: Supportive government policies promoting diabetes awareness, management programs, and favorable reimbursement schemes in various countries further propel market expansion.

Barriers & Challenges:

- Regulatory Hurdles: Navigating complex and stringent regulatory approval processes across different geographies can be time-consuming and costly, impacting time-to-market for new products.

- High Cost of Advanced Devices: While basic SMBG devices are affordable, the higher price point of advanced connected glucometers and emerging technologies like continuous glucose monitors can be a barrier to widespread adoption, particularly in low-income regions.

- Data Security and Privacy Concerns: The increasing reliance on connected devices and cloud-based data management raises concerns about data security and patient privacy, requiring robust cybersecurity measures.

- Competition from Emerging Technologies: The rapid development and increasing adoption of Continuous Glucose Monitoring (CGM) systems present a significant competitive challenge to traditional SMBG devices, especially for individuals seeking more comprehensive and real-time insights.

Growth Drivers in the Self-Monitoring Blood Glucose Industry Market

The Self-Monitoring Blood Glucose (SMBG) industry is propelled by several key growth drivers. Technologically, the ongoing innovation in miniaturized sensors, improved accuracy, and faster testing times is a significant factor. The integration of Bluetooth and Wi-Fi capabilities into glucometers, enabling seamless data syncing with smartphone applications, is revolutionizing patient engagement and remote monitoring. Economically, the escalating global prevalence of diabetes, particularly type 2, creates an ever-expanding market for glucose monitoring solutions. Furthermore, increasing disposable incomes in emerging economies are making these devices more accessible. Regulatory-wise, government initiatives focused on chronic disease management and reimbursement policies supporting diabetes care are crucial catalysts for market expansion and product adoption.

Challenges Impacting Self-Monitoring Blood Glucose Industry Growth

Several challenges impact the growth of the Self-Monitoring Blood Glucose Industry. Regulatory complexities in obtaining approvals across diverse international markets can lead to significant delays and increased costs for manufacturers. Supply chain disruptions, as witnessed in recent global events, can affect the availability and pricing of essential components like test strips and electronics. Competitive pressures are intense, not only from traditional SMBG players but increasingly from emerging technologies like Continuous Glucose Monitoring (CGM) systems, which offer continuous data streams and advanced analytics, potentially cannibalizing the market for frequent finger-prick testing. Ensuring data security and patient privacy with connected devices is also a paramount concern, requiring substantial investment in cybersecurity infrastructure.

Key Players Shaping the Self-Monitoring Blood Glucose Industry Market

- Agamatrix Inc

- F Hoffmann-La Roche AG

- Abbott

- Bionime Corporation

- Arkray

- LifeScan

- Ascensia

- Medisana

- Trivida

- Acon

- Rossmax

- Other

Significant Self-Monitoring Blood Glucose Industry Industry Milestones

- June 2022: LifeScan announced the publication of Real World Evidence in Diabetes Technology and Therapeutics (DTT) demonstrating improved glycemic control in people with diabetes using a Bluetooth-connected Blood Glucose Meter (OneTouch Verio Reflect) with the OneTouch Reveal mobile app, highlighting the impact of connected devices on diabetes management.

- January 2022: Roche launched its new point-of-care blood glucose monitor, Cobas pulse, designed for hospital professionals. This device, featuring a touchscreen interface, automated test strip reader, and camera, aims to support patient care across all ages, including neonates and those in intensive care, indicating a focus on sophisticated clinical settings and integrated diagnostics.

Future Outlook for Self-Monitoring Blood Glucose Industry Market

The future outlook for the Self-Monitoring Blood Glucose (SMBG) industry is exceptionally promising, driven by sustained growth catalysts and expanding market potential. The increasing global diabetes epidemic, coupled with rising health consciousness and proactive self-care trends, will continue to fuel demand for SMBG solutions. Technological advancements, particularly in miniaturization, connectivity, and AI-powered analytics, will lead to smarter, more intuitive, and personalized diabetes management tools. Strategic opportunities lie in the expansion into emerging markets with tailored, cost-effective solutions and the integration of SMBG data into broader digital health ecosystems and telehealth platforms. The development of hybrid systems, combining the affordability of SMBG with the insights of continuous monitoring, also presents a significant area for future innovation and market penetration.

Self-Monitoring Blood Glucose Industry Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

-

2. End User

- 2.1. Hospital/Clinics

- 2.2. Personal/Home

Self-Monitoring Blood Glucose Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Italy

- 2.4. Spain

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Latin America

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Rest of Latin America

-

4. Asia Pacific

- 4.1. Japan

- 4.2. South Korea

- 4.3. China

- 4.4. India

- 4.5. Australia

- 4.6. Vietnam

- 4.7. Malaysia

- 4.8. Indonesia

- 4.9. Philippines

- 4.10. Thailand

- 4.11. Rest of Asia Pacific

- 5. Middle East

-

6. Saudi Arabia

- 6.1. Iran

- 6.2. Egypt

- 6.3. Oman

- 6.4. South Africa

- 6.5. Rest of Middle East

Self-Monitoring Blood Glucose Industry Regional Market Share

Geographic Coverage of Self-Monitoring Blood Glucose Industry

Self-Monitoring Blood Glucose Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. The Glucometer Devices Segment is Expected to Witness the Highest CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinics

- 5.2.2. Personal/Home

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Latin America

- 5.3.4. Asia Pacific

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinics

- 6.2.2. Personal/Home

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinics

- 7.2.2. Personal/Home

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Latin America Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinics

- 8.2.2. Personal/Home

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Asia Pacific Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Glucometer Devices

- 9.1.2. Test Strips

- 9.1.3. Lancets

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospital/Clinics

- 9.2.2. Personal/Home

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Glucometer Devices

- 10.1.2. Test Strips

- 10.1.3. Lancets

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospital/Clinics

- 10.2.2. Personal/Home

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Saudi Arabia Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Glucometer Devices

- 11.1.2. Test Strips

- 11.1.3. Lancets

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Hospital/Clinics

- 11.2.2. Personal/Home

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. MEA Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2025

- 17.2. Company Profiles

- 17.2.1 Other

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Medisana

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Trivida

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Acon

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Rossmax*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Agamatrix Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 F Hoffmann-La Roche AG

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Abbott

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Bionime Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Arkray

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 LifeScan

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Ascensia

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Other

List of Figures

- Figure 1: Global Self-Monitoring Blood Glucose Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: MEA Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: MEA Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 13: North America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 14: North America Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: North America Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: North America Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Europe Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Europe Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 21: Europe Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 23: Europe Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 24: Latin America Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 25: Latin America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 26: Latin America Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 27: Latin America Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 28: Latin America Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Latin America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 31: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 32: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 33: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 35: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 36: Middle East Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 37: Middle East Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 38: Middle East Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 43: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 44: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 45: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 47: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Mexico Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Belgium Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Netherland Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Nordics Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Southeast Asia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Indonesia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Phillipes Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Singapore Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Thailandc Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Peru Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Chile Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Colombia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Ecuador Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Venezuela Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: United Arab Emirates Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Africa Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 47: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 49: United States Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Canada Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of North America Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 53: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 54: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 55: France Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Germany Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Italy Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Spain Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: United Kingdom Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Russia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 63: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 64: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 65: Mexico Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Brazil Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: Rest of Latin America Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 69: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 70: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 71: Japan Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Korea Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 73: China Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: India Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 75: Australia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Vietnam Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 77: Malaysia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Indonesia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 79: Philippines Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Thailand Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 81: Rest of Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 83: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 84: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 85: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 86: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 87: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 88: Iran Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 89: Egypt Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oman Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 91: South Africa Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Middle East Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Monitoring Blood Glucose Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Self-Monitoring Blood Glucose Industry?

Key companies in the market include Other, Medisana, Trivida, Acon, Rossmax*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS, Agamatrix Inc, F Hoffmann-La Roche AG, Abbott, Bionime Corporation, Arkray, LifeScan, Ascensia.

3. What are the main segments of the Self-Monitoring Blood Glucose Industry?

The market segments include Component, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

The Glucometer Devices Segment is Expected to Witness the Highest CAGR.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) published Real World Evidence of Improved Glycemic Control in People with Diabetes using a Bluetooth-connected Blood Glucose Meter with Mobile Diabetes Management Application using the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter which can be synced via the Bluetooth wireless technology. It could support improved glycemic control for people with diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Monitoring Blood Glucose Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Monitoring Blood Glucose Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Monitoring Blood Glucose Industry?

To stay informed about further developments, trends, and reports in the Self-Monitoring Blood Glucose Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence