Key Insights

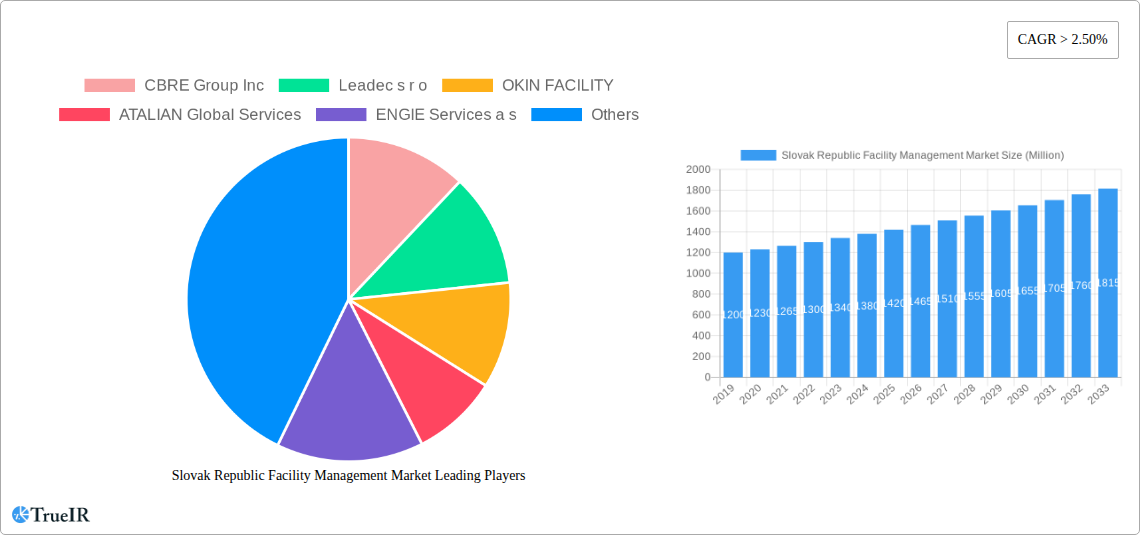

The Slovak Republic's facility management market is projected for substantial growth, driven by the increasing demand for efficient operational support across diverse sectors. With an estimated Compound Annual Growth Rate (CAGR) of 9.4%, the market is set to expand significantly, reaching a market size of $1.44 billion by 2024. This expansion is fueled by the trend of outsourcing non-core business functions, the imperative to optimize operational costs, and a heightened focus on workplace safety and regulatory compliance. The adoption of smart building technologies and sustainable facility management practices further stimulates growth, as businesses prioritize energy efficiency, reduced environmental impact, and enhanced occupant experiences. Evolving regulatory landscapes and the increasing complexity of managing varied facility types also contribute to the market's dynamic nature.

Slovak Republic Facility Management Market Market Size (In Billion)

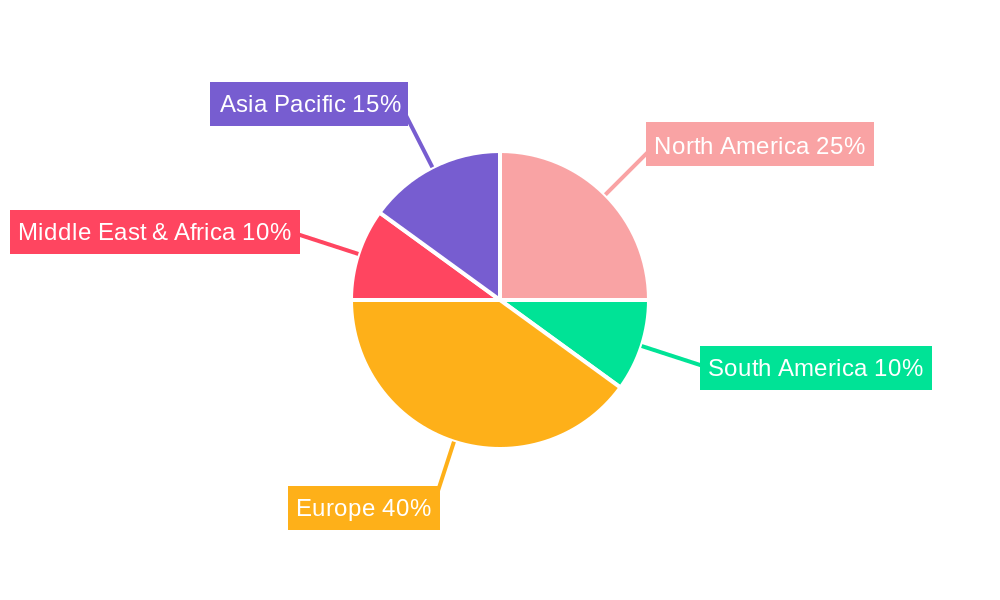

Market segmentation highlights a strong preference for outsourced facility management services, with integrated FM solutions gaining traction. This trend is particularly prominent in the commercial and industrial sectors, necessitating specialized expertise in both hard FM (building maintenance) and soft FM (support services). Leading entities are actively shaping the market through strategic investments and innovative service development. Geographically, Europe is expected to lead, with countries like Germany and the United Kingdom being significant contributors. The Slovak Republic, with its strategic location and expanding economy, is ideally positioned to leverage these regional trends and emerge as a key hub for facility management services.

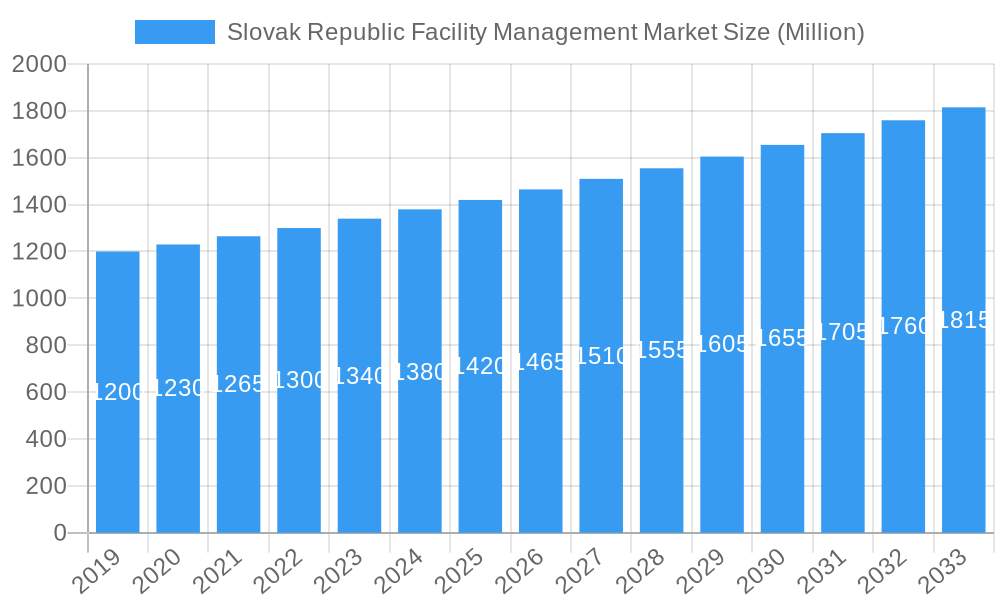

Slovak Republic Facility Management Market Company Market Share

This comprehensive report offers a dynamic analysis of the Slovak Republic Facility Management Market. Covering the period from 2019 to 2033, with a base year of 2024, this study investigates market structure, trends, opportunities, and the competitive landscape. Designed to engage industry professionals and improve search visibility, the report explores dominant segments, product innovations, key drivers, barriers, and the major players influencing the future of facility management in Slovakia.

Slovak Republic Facility Management Market Market Structure & Competitive Landscape

The Slovak Republic's facility management (FM) market is characterized by a dynamic and evolving competitive landscape, with a moderate level of market concentration. Key players are increasingly focusing on innovation and service diversification to capture market share. Regulatory impacts, while present, primarily focus on standardization and safety, creating a relatively stable operating environment. The presence of product substitutes, such as in-house management of certain FM functions, remains a factor, yet the clear advantages of professional outsourced services continue to drive adoption. End-user segmentation reveals a strong demand from the commercial and industrial sectors, with significant growth potential in the public/infrastructure and institutional segments. Mergers and acquisitions (M&A) are a recurring theme, indicating a trend towards consolidation and expansion of service portfolios. For instance, the acquisition of Inwemer by B+N Referencia Zrt. in February 2022 exemplifies this, strengthening B+N's presence across Central Europe and influencing competitive dynamics within Slovakia. The market is witnessing a growing number of integrated FM solutions, appealing to clients seeking a single point of contact for a comprehensive range of services. The average M&A deal value is estimated at XX Million, with approximately XX deals projected within the forecast period. Concentration ratios suggest that the top 5 players hold approximately 45-55% of the market share.

Slovak Republic Facility Management Market Market Trends & Opportunities

The Slovak Republic facility management market is poised for substantial growth, driven by a confluence of economic development, technological advancements, and evolving business needs. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 7-9% during the forecast period. This expansion is fueled by an increasing recognition among businesses of all sizes regarding the strategic importance of effective facility management in optimizing operational efficiency, reducing costs, and enhancing employee productivity and well-being. Technological shifts are profoundly impacting the sector, with the adoption of Building Information Modeling (BIM), the Internet of Things (IoT) for predictive maintenance, and advanced energy management systems becoming mainstream. These innovations are not only improving service delivery but also creating new opportunities for specialized FM providers. Consumer preferences are leaning towards integrated and bundled FM services, where clients can outsource a wider spectrum of responsibilities to a single provider. This simplifies procurement and management, allowing businesses to focus on their core competencies. The demand for smart building technologies and sustainable FM practices is also on the rise, reflecting a growing environmental consciousness and a desire for cost savings through energy efficiency. Market penetration rates for outsourced facility management are expected to climb from XX% in the historical period to an estimated XX% by 2033. The competitive dynamics are intensifying, with established international players and a growing number of domestic companies vying for market share. Differentiation through specialized services, technological integration, and a strong focus on client satisfaction will be crucial for success. Opportunities abound in the green building sector, as well as in the provision of cybersecurity for smart facilities and data management services. The industrial sector, with its complex operational requirements, presents a significant opportunity for specialized hard FM services. Furthermore, the increasing trend of digitalization across industries necessitates robust IT infrastructure management, a growing area for FM providers. The ongoing development of commercial real estate and logistics hubs across Slovakia also underpins the sustained demand for comprehensive facility management solutions.

Dominant Markets & Segments in Slovak Republic Facility Management Market

The Slovak Republic Facility Management Market is exhibiting dominance across several key segments, driven by evolving industry demands and strategic investments.

Type of Facility Management

Outsourced Facility Management: This segment is experiencing the most robust growth and is projected to capture the largest market share. The trend towards core business focus among companies in Slovakia is a primary driver, leading them to delegate non-core facility operations to expert providers.

- Integrated FM: This sub-segment is rapidly gaining traction. Clients increasingly prefer a single, strategic partner capable of managing a comprehensive suite of services, from hard to soft FM. This approach offers significant cost savings through economies of scale and streamlined communication. The market for Integrated FM is estimated to reach XX Million by 2033.

- Bundled FM: This offering, which combines multiple but not all facility services, is also a significant growth area. It appeals to businesses looking for more tailored outsourcing solutions than fully integrated models.

- Single FM: While still a part of the market, the growth in single service provision is slower compared to bundled and integrated offerings, as clients seek more holistic solutions.

In-house Facility Management: While some organizations, particularly larger enterprises with specific operational needs or stringent control requirements, maintain in-house FM capabilities, the overall trend indicates a gradual shift towards outsourcing.

Offering Type

- Soft FM: This category, encompassing services like cleaning, security, catering, and reception, consistently holds a significant market share. The continuous need for these essential services across all end-user sectors ensures sustained demand. The Soft FM market is expected to grow at a CAGR of approximately 6.5-8.5%.

- Hard FM: Services such as building maintenance, HVAC, electrical systems, and plumbing are crucial for operational continuity, especially in industrial and commercial facilities. The increasing complexity of building infrastructure and the focus on energy efficiency are driving the demand for advanced Hard FM solutions, including predictive maintenance. This segment is anticipated to grow at a CAGR of 7-9%.

End-User

- Commercial: This remains the dominant end-user segment. The expansion of office spaces, retail outlets, and hospitality venues in Slovakia directly translates to a high demand for professional facility management services to ensure smooth operations and appealing environments. The commercial sector's contribution to the market is estimated to be around 40-45%.

- Industrial: With Slovakia's strong manufacturing and industrial base, this segment represents another major consumer of FM services. The need for specialized technical maintenance, safety compliance, and efficient operational support makes industrial facilities key clients. This segment is expected to contribute 25-30% to the market.

- Public/Infrastructure: This segment, including government buildings, transportation hubs, and utilities, presents substantial long-term growth potential, particularly with ongoing government investments in infrastructure modernization. The demand for reliable and cost-effective FM solutions in this sector is steadily increasing.

- Institutional: This includes educational institutions, healthcare facilities, and non-profit organizations. The unique operational and regulatory requirements of these entities create a specialized demand for tailored FM services, focusing on hygiene, safety, and operational efficiency.

- Others End-Users: This category encompasses a diverse range of smaller or niche sectors, which collectively contribute to the overall market.

Slovak Republic Facility Management Market Product Analysis

The Slovak Republic Facility Management market is characterized by a growing emphasis on technological integration and sustainable practices within its service offerings. Innovations are primarily focused on enhancing efficiency, reducing operational costs, and improving the user experience within managed facilities. Key product advancements include the widespread adoption of IoT sensors for real-time monitoring of building systems, enabling predictive maintenance and energy optimization. Furthermore, advanced FM software platforms are being developed to offer comprehensive management dashboards, streamlining workflows, and providing data-driven insights for clients. The application of AI and machine learning in areas like space utilization optimization and resource allocation is emerging as a competitive advantage. These technological advancements are transforming traditional FM services into intelligent, data-informed solutions, fitting perfectly with the increasing demand for smart building functionalities and greater operational transparency.

Key Drivers, Barriers & Challenges in Slovak Republic Facility Management Market

Key Drivers:

- Economic Growth and Business Expansion: A growing Slovak economy fuels business expansion, leading to increased demand for facility management services to support new and existing operations.

- Technological Advancements: The integration of IoT, AI, and automation in facility management enhances efficiency, reduces costs, and improves service quality, driving adoption.

- Focus on Core Competencies: Businesses are increasingly outsourcing non-core functions, including facility management, to concentrate on their primary business objectives.

- Cost Optimization: Outsourced FM often provides cost efficiencies through economies of scale and specialized expertise.

- Regulatory Compliance: The need to adhere to evolving health, safety, and environmental regulations drives the adoption of professional FM services.

Barriers & Challenges:

- Talent Shortage: A scarcity of skilled FM professionals, particularly those with technical expertise, poses a significant challenge.

- Price Sensitivity: Some clients remain highly price-sensitive, potentially opting for lower-cost, less comprehensive solutions.

- Resistance to Change: In certain traditional organizations, there can be resistance to adopting new technologies or outsourcing established in-house functions.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of essential maintenance materials and equipment.

- Cybersecurity Threats: As facilities become more connected, the risk of cyberattacks on integrated FM systems presents a growing concern.

Growth Drivers in the Slovak Republic Facility Management Market Market

The growth of the Slovak Republic Facility Management market is significantly propelled by the increasing adoption of smart technologies, such as IoT and AI, which enable predictive maintenance and energy efficiency improvements, thereby reducing operational costs for clients. Economically, the steady expansion of the commercial real estate sector and the robust industrial manufacturing base are creating a sustained demand for outsourced FM solutions. Furthermore, government initiatives aimed at modernizing public infrastructure and promoting sustainable building practices are opening up new avenues for FM service providers. The growing awareness among businesses about the strategic benefits of facility management, including enhanced employee productivity and a focus on core competencies, also acts as a key growth catalyst.

Challenges Impacting Slovak Republic Facility Management Market Growth

Despite the positive growth trajectory, the Slovak Republic Facility Management market faces several challenges. Regulatory complexities, particularly concerning labor laws and safety standards across different service types, can create administrative burdens for providers. Supply chain issues, including delays and increased costs for materials and equipment, can impact project timelines and profitability. Moreover, intense competitive pressures from both established international players and emerging local companies can lead to price wars, squeezing profit margins. The ongoing shortage of skilled labor in specialized FM areas, such as technical maintenance and advanced technology implementation, also presents a significant constraint on the market's ability to scale effectively.

Key Players Shaping the Slovak Republic Facility Management Market Market

- CBRE Group Inc

- Leadec s r o

- OKIN FACILITY

- ATALIAN Global Services

- ENGIE Services a s

- Simacek Facility Management Group Gesellschaft m b H

- Reiwag Facility Services GmbH

- Apleona HSG s r o

Significant Slovak Republic Facility Management Market Industry Milestones

- February 2022: B+N Referencia Zrt. acquired Poland-based facility management operator Inwemer, significantly expanding its reach and service portfolio across the Central European region. This strategic move is expected to influence competitive dynamics and service offerings within Slovakia.

Future Outlook for Slovak Republic Facility Management Market Market

The future outlook for the Slovak Republic Facility Management market is exceptionally promising, driven by an increasing demand for integrated, technology-driven, and sustainable solutions. Strategic opportunities lie in the continued expansion of outsourcing trends across commercial, industrial, and institutional sectors. The ongoing digitalization of businesses will necessitate advanced FM support for IT infrastructure and smart building management. Furthermore, government investments in public infrastructure and the growing emphasis on green building certifications will create substantial growth potential. Companies that can effectively leverage technological innovations, offer comprehensive service portfolios, and adapt to evolving client needs will be well-positioned to capitalize on the market's robust growth trajectory, estimated to reach XX Million by 2033.

Slovak Republic Facility Management Market Segmentation

-

1. Type of Facility Management

- 1.1. In-house Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others End-Users

Slovak Republic Facility Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Slovak Republic Facility Management Market Regional Market Share

Geographic Coverage of Slovak Republic Facility Management Market

Slovak Republic Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand of Commercial Office Spaces; Growing Investment in Commercial Sector

- 3.3. Market Restrains

- 3.3.1. Lack of Managerial Awareness

- 3.4. Market Trends

- 3.4.1. Growth in demand of Office and Building Spaces and Leasing Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Slovak Republic Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. In-house Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. North America Slovak Republic Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6.1.1. In-house Facility Management

- 6.1.2. Outsourced Facility Management

- 6.1.2.1. Single FM

- 6.1.2.2. Bundled FM

- 6.1.2.3. Integrated FM

- 6.2. Market Analysis, Insights and Forecast - by Offering Type

- 6.2.1. Hard FM

- 6.2.2. Soft FM

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Commercial

- 6.3.2. Institutional

- 6.3.3. Public/Infrastructure

- 6.3.4. Industrial

- 6.3.5. Others End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 7. South America Slovak Republic Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 7.1.1. In-house Facility Management

- 7.1.2. Outsourced Facility Management

- 7.1.2.1. Single FM

- 7.1.2.2. Bundled FM

- 7.1.2.3. Integrated FM

- 7.2. Market Analysis, Insights and Forecast - by Offering Type

- 7.2.1. Hard FM

- 7.2.2. Soft FM

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Commercial

- 7.3.2. Institutional

- 7.3.3. Public/Infrastructure

- 7.3.4. Industrial

- 7.3.5. Others End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 8. Europe Slovak Republic Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 8.1.1. In-house Facility Management

- 8.1.2. Outsourced Facility Management

- 8.1.2.1. Single FM

- 8.1.2.2. Bundled FM

- 8.1.2.3. Integrated FM

- 8.2. Market Analysis, Insights and Forecast - by Offering Type

- 8.2.1. Hard FM

- 8.2.2. Soft FM

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Commercial

- 8.3.2. Institutional

- 8.3.3. Public/Infrastructure

- 8.3.4. Industrial

- 8.3.5. Others End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 9. Middle East & Africa Slovak Republic Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 9.1.1. In-house Facility Management

- 9.1.2. Outsourced Facility Management

- 9.1.2.1. Single FM

- 9.1.2.2. Bundled FM

- 9.1.2.3. Integrated FM

- 9.2. Market Analysis, Insights and Forecast - by Offering Type

- 9.2.1. Hard FM

- 9.2.2. Soft FM

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Commercial

- 9.3.2. Institutional

- 9.3.3. Public/Infrastructure

- 9.3.4. Industrial

- 9.3.5. Others End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 10. Asia Pacific Slovak Republic Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 10.1.1. In-house Facility Management

- 10.1.2. Outsourced Facility Management

- 10.1.2.1. Single FM

- 10.1.2.2. Bundled FM

- 10.1.2.3. Integrated FM

- 10.2. Market Analysis, Insights and Forecast - by Offering Type

- 10.2.1. Hard FM

- 10.2.2. Soft FM

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Commercial

- 10.3.2. Institutional

- 10.3.3. Public/Infrastructure

- 10.3.4. Industrial

- 10.3.5. Others End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CBRE Group Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leadec s r o

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OKIN FACILITY

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ATALIAN Global Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ENGIE Services a s

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Simacek Facility Management Group Gesellschaft m b H

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Reiwag Facility Services GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apleona HSG s r o

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 CBRE Group Inc

List of Figures

- Figure 1: Global Slovak Republic Facility Management Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Slovak Republic Facility Management Market Revenue (billion), by Type of Facility Management 2025 & 2033

- Figure 3: North America Slovak Republic Facility Management Market Revenue Share (%), by Type of Facility Management 2025 & 2033

- Figure 4: North America Slovak Republic Facility Management Market Revenue (billion), by Offering Type 2025 & 2033

- Figure 5: North America Slovak Republic Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 6: North America Slovak Republic Facility Management Market Revenue (billion), by End-User 2025 & 2033

- Figure 7: North America Slovak Republic Facility Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Slovak Republic Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Slovak Republic Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Slovak Republic Facility Management Market Revenue (billion), by Type of Facility Management 2025 & 2033

- Figure 11: South America Slovak Republic Facility Management Market Revenue Share (%), by Type of Facility Management 2025 & 2033

- Figure 12: South America Slovak Republic Facility Management Market Revenue (billion), by Offering Type 2025 & 2033

- Figure 13: South America Slovak Republic Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 14: South America Slovak Republic Facility Management Market Revenue (billion), by End-User 2025 & 2033

- Figure 15: South America Slovak Republic Facility Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America Slovak Republic Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Slovak Republic Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Slovak Republic Facility Management Market Revenue (billion), by Type of Facility Management 2025 & 2033

- Figure 19: Europe Slovak Republic Facility Management Market Revenue Share (%), by Type of Facility Management 2025 & 2033

- Figure 20: Europe Slovak Republic Facility Management Market Revenue (billion), by Offering Type 2025 & 2033

- Figure 21: Europe Slovak Republic Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 22: Europe Slovak Republic Facility Management Market Revenue (billion), by End-User 2025 & 2033

- Figure 23: Europe Slovak Republic Facility Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Europe Slovak Republic Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Slovak Republic Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Slovak Republic Facility Management Market Revenue (billion), by Type of Facility Management 2025 & 2033

- Figure 27: Middle East & Africa Slovak Republic Facility Management Market Revenue Share (%), by Type of Facility Management 2025 & 2033

- Figure 28: Middle East & Africa Slovak Republic Facility Management Market Revenue (billion), by Offering Type 2025 & 2033

- Figure 29: Middle East & Africa Slovak Republic Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 30: Middle East & Africa Slovak Republic Facility Management Market Revenue (billion), by End-User 2025 & 2033

- Figure 31: Middle East & Africa Slovak Republic Facility Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa Slovak Republic Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Slovak Republic Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Slovak Republic Facility Management Market Revenue (billion), by Type of Facility Management 2025 & 2033

- Figure 35: Asia Pacific Slovak Republic Facility Management Market Revenue Share (%), by Type of Facility Management 2025 & 2033

- Figure 36: Asia Pacific Slovak Republic Facility Management Market Revenue (billion), by Offering Type 2025 & 2033

- Figure 37: Asia Pacific Slovak Republic Facility Management Market Revenue Share (%), by Offering Type 2025 & 2033

- Figure 38: Asia Pacific Slovak Republic Facility Management Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: Asia Pacific Slovak Republic Facility Management Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Asia Pacific Slovak Republic Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Slovak Republic Facility Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 2: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 3: Global Slovak Republic Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 6: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 7: Global Slovak Republic Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 13: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 14: Global Slovak Republic Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 20: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 21: Global Slovak Republic Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 22: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 33: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 34: Global Slovak Republic Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 35: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 43: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 44: Global Slovak Republic Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 45: Global Slovak Republic Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Slovak Republic Facility Management Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Slovak Republic Facility Management Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Slovak Republic Facility Management Market?

Key companies in the market include CBRE Group Inc, Leadec s r o, OKIN FACILITY, ATALIAN Global Services, ENGIE Services a s, Simacek Facility Management Group Gesellschaft m b H, Reiwag Facility Services GmbH, Apleona HSG s r o.

3. What are the main segments of the Slovak Republic Facility Management Market?

The market segments include Type of Facility Management, Offering Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand of Commercial Office Spaces; Growing Investment in Commercial Sector.

6. What are the notable trends driving market growth?

Growth in demand of Office and Building Spaces and Leasing Activities.

7. Are there any restraints impacting market growth?

Lack of Managerial Awareness.

8. Can you provide examples of recent developments in the market?

February 2022 - B+N Referencia Zrt. has taken over Poland-based facility management operator Inwemer. With this new acquisition, B+N Referencia Zrt. will cover the Central European region with its highly extensive service portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Slovak Republic Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Slovak Republic Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Slovak Republic Facility Management Market?

To stay informed about further developments, trends, and reports in the Slovak Republic Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence