Key Insights

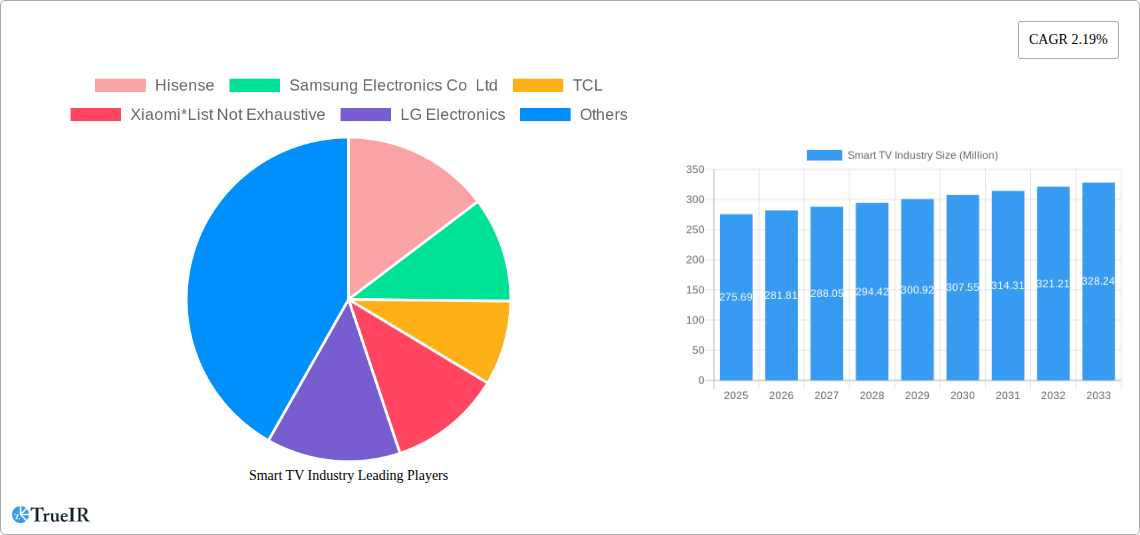

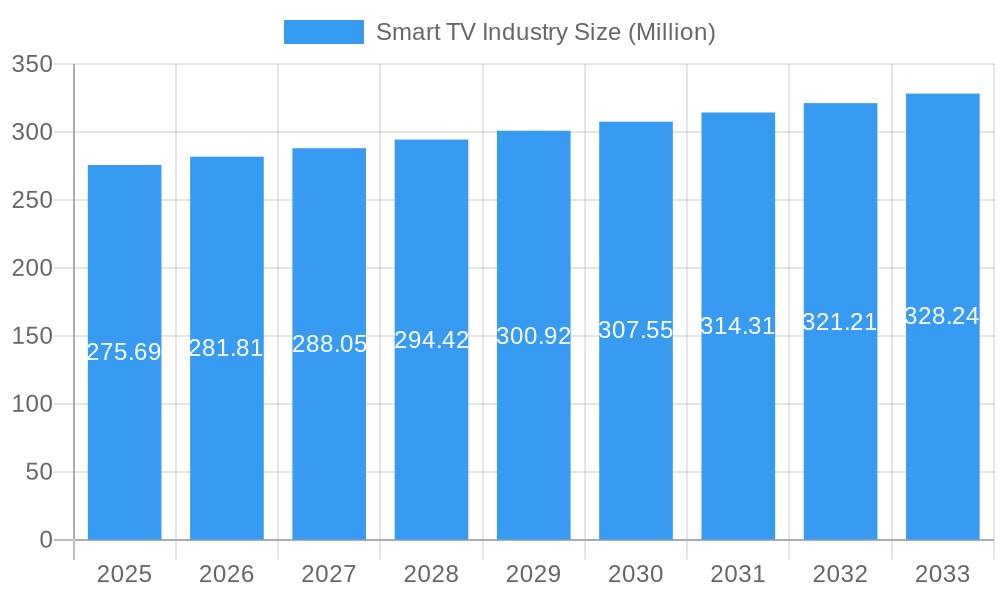

The global Smart TV market is projected to reach an estimated value of $275.69 million by 2025, exhibiting a modest Compound Annual Growth Rate (CAGR) of 2.19% during the forecast period of 2025-2033. This steady growth is primarily fueled by the increasing consumer demand for enhanced viewing experiences, driven by advancements in display technologies and the ever-expanding ecosystem of streaming services and smart functionalities. The penetration of higher resolution panels, particularly 4K and the emerging 8K, is a significant trend, catering to consumers seeking unparalleled visual fidelity. Furthermore, the proliferation of larger screen sizes, especially those exceeding 55 inches, continues to be a dominant factor, offering more immersive entertainment. The market is characterized by intense competition among key players like Samsung Electronics, LG Electronics, Hisense, and TCL, who are continuously innovating to introduce more sophisticated features and competitively priced models, thereby expanding the market's overall reach.

Smart TV Industry Market Size (In Million)

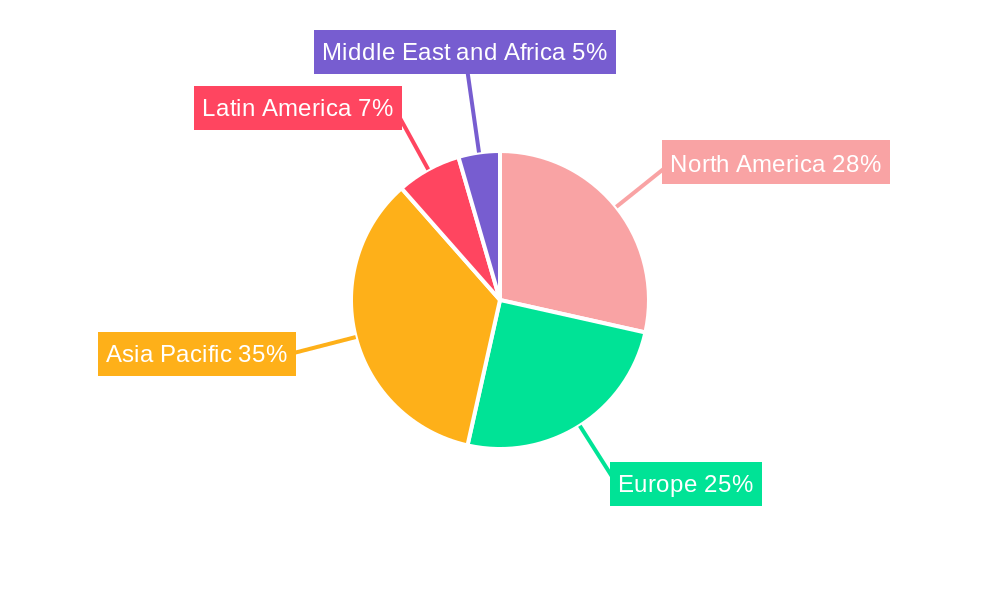

The industry is witnessing a dynamic shift in panel technology, with OLED and QLED gaining considerable traction alongside traditional LCD panels, offering superior contrast ratios and color reproduction. While the market exhibits consistent growth, it is not without its challenges. The high cost associated with premium display technologies, coupled with increasing screen sizes, can present a restraint for a segment of consumers. Additionally, the rapid pace of technological obsolescence necessitates continuous investment in research and development, which can impact profit margins. Geographically, the Asia Pacific region, particularly India and Southeast Asia, is anticipated to be a significant growth engine due to a burgeoning middle class and increasing disposable incomes, driving demand for advanced consumer electronics. North America and Europe are expected to maintain their strong market positions, driven by early adoption of new technologies and a mature entertainment consumption culture.

Smart TV Industry Company Market Share

Smart TV Industry Market Size, Share, Trends, and Forecast 2019-2033

This comprehensive report offers an in-depth analysis of the global Smart TV market, covering market structure, competitive landscape, key trends, opportunities, and future outlook. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report provides actionable insights for stakeholders seeking to navigate this dynamic industry. Leveraging high-volume keywords and detailed segment analysis, this report is meticulously designed for SEO optimization and industry-wide engagement.

Smart TV Industry Market Structure & Competitive Landscape

The Smart TV industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share. Innovation drivers are primarily technological advancements in display technology (e.g., OLED, QLED, 8K resolution) and the integration of advanced smart features like AI-powered assistants and enhanced connectivity. Regulatory impacts are mainly related to energy efficiency standards, content licensing, and data privacy concerns, influencing product development and market entry strategies. Product substitutes include traditional TVs, projectors, and smart displays, though the seamless integration of entertainment and connectivity in smart TVs provides a competitive edge. End-user segmentation is driven by income levels, technological adoption rates, and regional preferences. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market access, and consolidate their positions. For instance, strategic acquisitions of smaller tech companies by larger manufacturers aim to bolster R&D capabilities in areas like AI and content delivery. The industry's evolving landscape is characterized by continuous product differentiation and strategic alliances to capture a larger share of the growing global smart TV market, estimated to be worth tens of millions of dollars.

Smart TV Industry Market Trends & Opportunities

The global Smart TV market is experiencing robust growth, propelled by increasing consumer demand for integrated entertainment solutions and the accelerating adoption of high-resolution displays. Market size is projected to expand significantly, with an anticipated Compound Annual Growth Rate (CAGR) of over XX% during the forecast period (2025-2033). Technological shifts are central to this growth, with the widespread adoption of 4K resolution becoming standard, and 8K technology gaining traction among early adopters seeking premium viewing experiences. The increasing affordability of larger screen sizes, coupled with advancements in panel technologies like OLED and QLED, is driving consumer upgrades. Consumer preferences are evolving towards immersive viewing, seamless connectivity with other smart home devices, and intuitive user interfaces, such as personalized content recommendation engines. The competitive dynamics are intensifying, with established players like Samsung Electronics Co Ltd, LG Electronics, and TCL investing heavily in R&D to maintain their market leadership, while emerging players like Hisense and Xiaomi are rapidly gaining market share through innovative product offerings and aggressive pricing strategies. The proliferation of streaming services and on-demand content further fuels the demand for advanced smart TV functionalities. Opportunities abound for companies that can effectively leverage AI for enhanced user experience, develop energy-efficient display solutions, and integrate augmented and virtual reality capabilities into future smart TV platforms, further solidifying the market's trajectory towards an estimated several hundred million units sold annually.

Dominant Markets & Segments in Smart TV Industry

The Smart TV industry is characterized by dominant markets and segments that are shaping its overall trajectory. In terms of Resolution Type, 4K displays currently hold the largest market share and are projected to continue their dominance throughout the forecast period, driven by their balance of image quality and affordability. 8K resolution is an emerging segment with significant growth potential, targeting high-end consumers seeking unparalleled visual fidelity. HD/FHD resolutions are still prevalent in budget-conscious markets but are gradually being phased out by higher-resolution alternatives. Regarding Size (in inches), screens greater than 32 inches represent the vast majority of the market, with a pronounced trend towards larger displays, particularly in the 55-60 inch and less than 65-inch categories. Consumer preference for immersive cinematic experiences at home is a key growth driver. Panel Type segmentation sees LCD technology retaining a significant market share due to its cost-effectiveness and widespread availability. However, OLED and QLED technologies are experiencing rapid growth, offering superior contrast ratios, color accuracy, and brightness, thus capturing a growing segment of the premium market. Key growth drivers across these segments include increasing disposable incomes, the proliferation of high-definition content, government initiatives promoting digital infrastructure, and the growing adoption of smart home ecosystems. For instance, regions with a strong presence of online streaming platforms and high internet penetration rates exhibit higher demand for advanced smart TV features and larger screen sizes, often exceeding millions in sales volume per region annually.

Smart TV Industry Product Analysis

Smart TV product innovations are heavily focused on enhancing the viewing experience and expanding functionality beyond traditional broadcasting. Key advancements include the widespread adoption of AI for personalized content recommendations, voice control integration with virtual assistants, and improved picture processing for greater realism. Applications are diverse, ranging from immersive entertainment and gaming to smart home control hubs and even professional use cases like digital signage. Competitive advantages are derived from superior display technologies (e.g., advanced OLED and QLED panels offering exceptional contrast and color), seamless operating system integration, robust app ecosystems, and energy-efficient designs. For example, Hisense's TriChroma Laser TV, with its purer colors and enhanced brightness, exemplifies a significant technological leap, while Xiaomi's Mi TV 5X series highlights the integration of premium features like Dolby Vision and Google Assistant at competitive price points, demonstrating effective market fit.

Key Drivers, Barriers & Challenges in Smart TV Industry

The Smart TV industry is propelled by several key drivers, including rapid technological advancements in display technology such as the increasing adoption of OLED and QLED panels, and the growing demand for ultra-high definition content (4K and 8K). The expansion of streaming services and the increasing penetration of high-speed internet infrastructure globally are also significant catalysts. Economically, rising disposable incomes in emerging markets contribute to higher consumer spending on premium electronics. Policy-driven factors, such as government initiatives promoting digital transformation and smart city development, further bolster the market.

Conversely, the industry faces several barriers and challenges. Supply chain disruptions, exacerbated by global events, can impact production volumes and lead to price volatility, affecting the cost of components and finished products. Regulatory hurdles, including evolving energy efficiency standards and content localization requirements in different regions, add complexity to market entry and product development. Competitive pressures from established manufacturers and emerging players lead to intense price wars and a constant need for innovation, potentially impacting profit margins. For example, the reliance on a limited number of semiconductor suppliers can create significant vulnerabilities.

Growth Drivers in the Smart TV Industry Market

The Smart TV industry's growth is primarily fueled by accelerating technological innovation. The relentless pursuit of superior visual experiences, evidenced by the widespread adoption of 4K and the emerging prominence of 8K resolutions, is a major draw for consumers. Enhancements in panel technology, such as the vibrant colors and deep blacks offered by OLED and QLED displays, are creating aspirational product segments. Economically, rising global disposable incomes, particularly in emerging economies, are translating into increased consumer spending on high-value electronics. Furthermore, the proliferation of streaming services and the growing demand for on-demand content are creating a sustained need for advanced, connected television sets. Policy-driven factors, including government support for digital infrastructure development and initiatives promoting smart home integration, also provide a favorable environment for market expansion.

Challenges Impacting Smart TV Industry Growth

Several factors present significant challenges to the continued growth of the Smart TV industry. Supply chain vulnerabilities, including shortages of critical components like microchips and display panels, can lead to production delays and increased manufacturing costs, impacting product availability and pricing. Regulatory complexities, such as varied regional content licensing laws, data privacy regulations, and evolving energy efficiency mandates, can complicate product development and market entry strategies. Competitive pressures are intense, with both global giants and regional players vying for market share, often leading to price erosion and demanding constant innovation. For instance, geopolitical tensions can disrupt established supply routes and affect the cost of raw materials, further impacting the industry's delicate balance.

Key Players Shaping the Smart TV Industry Market

- Hisense

- Samsung Electronics Co Ltd

- TCL

- Xiaomi

- LG Electronics

Significant Smart TV Industry Industry Milestones

- January 2021: Hisense launched its TriChroma Laser TV product line, featuring cutting-edge display technology for purer colors and a 20% brightness enhancement at the pixel level, offering 430-nit picture brightness and screen sizes from 75-inch to 100-inch. This launch highlighted advanced display technology and expanded offerings to include customized solutions, home fitness screens, and professional options.

- August 2021: Xiaomi introduced the Mi TV 5X series in India, comprising 43-inch, 50-inch, and 55-inch models with 4K resolution displays. Key features included HDR 10, Dolby Vision, adaptive brightness, Patchwall interface, and Google Assistant integration, reinforcing Xiaomi's strategy to strengthen its market presence in the region through feature-rich products at competitive price points.

Future Outlook for Smart TV Industry Market

The future outlook for the Smart TV industry is exceptionally promising, driven by continuous innovation and evolving consumer behaviors. Growth catalysts include the further integration of artificial intelligence for truly personalized viewing experiences, the expansion of augmented and virtual reality applications accessible through smart TVs, and the development of more sustainable and energy-efficient display technologies. Strategic opportunities lie in expanding into developing markets with increasing disposable incomes, forging partnerships with content providers to offer exclusive integrated services, and developing robust smart home ecosystems where the TV acts as a central control hub. The market potential is immense, with ongoing advancements in display resolution and panel quality set to drive upgrade cycles and attract new consumer segments, solidifying the smart TV's position as an indispensable centerpiece of the modern connected home, with unit sales projected to reach several hundred million annually.

Smart TV Industry Segmentation

-

1. Resolution Type

- 1.1. HD/FHD

- 1.2. 4K

- 1.3. 8K

-

2. Size (in inches)

- 2.1. Greater than 32

- 2.2. 39-43

- 2.3. 48-50

- 2.4. 55-60

- 2.5. Less than 65

-

3. Panel Type

- 3.1. LCD

- 3.2. OLED

- 3.3. QLED

Smart TV Industry Segmentation By Geography

- 1. North America

- 2. Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. Southeast Asia

- 4. Latin America

- 5. Middle East and Africa

Smart TV Industry Regional Market Share

Geographic Coverage of Smart TV Industry

Smart TV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Disposable Income Across Emerging Economies; Rising Trend of Video-on-Demand Service

- 3.3. Market Restrains

- 3.3.1. The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution

- 3.4. Market Trends

- 3.4.1. QLED is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resolution Type

- 5.1.1. HD/FHD

- 5.1.2. 4K

- 5.1.3. 8K

- 5.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 5.2.1. Greater than 32

- 5.2.2. 39-43

- 5.2.3. 48-50

- 5.2.4. 55-60

- 5.2.5. Less than 65

- 5.3. Market Analysis, Insights and Forecast - by Panel Type

- 5.3.1. LCD

- 5.3.2. OLED

- 5.3.3. QLED

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resolution Type

- 6. North America Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resolution Type

- 6.1.1. HD/FHD

- 6.1.2. 4K

- 6.1.3. 8K

- 6.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 6.2.1. Greater than 32

- 6.2.2. 39-43

- 6.2.3. 48-50

- 6.2.4. 55-60

- 6.2.5. Less than 65

- 6.3. Market Analysis, Insights and Forecast - by Panel Type

- 6.3.1. LCD

- 6.3.2. OLED

- 6.3.3. QLED

- 6.1. Market Analysis, Insights and Forecast - by Resolution Type

- 7. Europe Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resolution Type

- 7.1.1. HD/FHD

- 7.1.2. 4K

- 7.1.3. 8K

- 7.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 7.2.1. Greater than 32

- 7.2.2. 39-43

- 7.2.3. 48-50

- 7.2.4. 55-60

- 7.2.5. Less than 65

- 7.3. Market Analysis, Insights and Forecast - by Panel Type

- 7.3.1. LCD

- 7.3.2. OLED

- 7.3.3. QLED

- 7.1. Market Analysis, Insights and Forecast - by Resolution Type

- 8. Asia Pacific Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resolution Type

- 8.1.1. HD/FHD

- 8.1.2. 4K

- 8.1.3. 8K

- 8.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 8.2.1. Greater than 32

- 8.2.2. 39-43

- 8.2.3. 48-50

- 8.2.4. 55-60

- 8.2.5. Less than 65

- 8.3. Market Analysis, Insights and Forecast - by Panel Type

- 8.3.1. LCD

- 8.3.2. OLED

- 8.3.3. QLED

- 8.1. Market Analysis, Insights and Forecast - by Resolution Type

- 9. Latin America Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resolution Type

- 9.1.1. HD/FHD

- 9.1.2. 4K

- 9.1.3. 8K

- 9.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 9.2.1. Greater than 32

- 9.2.2. 39-43

- 9.2.3. 48-50

- 9.2.4. 55-60

- 9.2.5. Less than 65

- 9.3. Market Analysis, Insights and Forecast - by Panel Type

- 9.3.1. LCD

- 9.3.2. OLED

- 9.3.3. QLED

- 9.1. Market Analysis, Insights and Forecast - by Resolution Type

- 10. Middle East and Africa Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resolution Type

- 10.1.1. HD/FHD

- 10.1.2. 4K

- 10.1.3. 8K

- 10.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 10.2.1. Greater than 32

- 10.2.2. 39-43

- 10.2.3. 48-50

- 10.2.4. 55-60

- 10.2.5. Less than 65

- 10.3. Market Analysis, Insights and Forecast - by Panel Type

- 10.3.1. LCD

- 10.3.2. OLED

- 10.3.3. QLED

- 10.1. Market Analysis, Insights and Forecast - by Resolution Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hisense

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung Electronics Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TCL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xiaomi*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LG Electronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Hisense

List of Figures

- Figure 1: Global Smart TV Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart TV Industry Revenue (Million), by Resolution Type 2025 & 2033

- Figure 3: North America Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 4: North America Smart TV Industry Revenue (Million), by Size (in inches) 2025 & 2033

- Figure 5: North America Smart TV Industry Revenue Share (%), by Size (in inches) 2025 & 2033

- Figure 6: North America Smart TV Industry Revenue (Million), by Panel Type 2025 & 2033

- Figure 7: North America Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 8: North America Smart TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Smart TV Industry Revenue (Million), by Resolution Type 2025 & 2033

- Figure 11: Europe Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 12: Europe Smart TV Industry Revenue (Million), by Size (in inches) 2025 & 2033

- Figure 13: Europe Smart TV Industry Revenue Share (%), by Size (in inches) 2025 & 2033

- Figure 14: Europe Smart TV Industry Revenue (Million), by Panel Type 2025 & 2033

- Figure 15: Europe Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 16: Europe Smart TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Smart TV Industry Revenue (Million), by Resolution Type 2025 & 2033

- Figure 19: Asia Pacific Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 20: Asia Pacific Smart TV Industry Revenue (Million), by Size (in inches) 2025 & 2033

- Figure 21: Asia Pacific Smart TV Industry Revenue Share (%), by Size (in inches) 2025 & 2033

- Figure 22: Asia Pacific Smart TV Industry Revenue (Million), by Panel Type 2025 & 2033

- Figure 23: Asia Pacific Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 24: Asia Pacific Smart TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Smart TV Industry Revenue (Million), by Resolution Type 2025 & 2033

- Figure 27: Latin America Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 28: Latin America Smart TV Industry Revenue (Million), by Size (in inches) 2025 & 2033

- Figure 29: Latin America Smart TV Industry Revenue Share (%), by Size (in inches) 2025 & 2033

- Figure 30: Latin America Smart TV Industry Revenue (Million), by Panel Type 2025 & 2033

- Figure 31: Latin America Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 32: Latin America Smart TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Smart TV Industry Revenue (Million), by Resolution Type 2025 & 2033

- Figure 35: Middle East and Africa Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 36: Middle East and Africa Smart TV Industry Revenue (Million), by Size (in inches) 2025 & 2033

- Figure 37: Middle East and Africa Smart TV Industry Revenue Share (%), by Size (in inches) 2025 & 2033

- Figure 38: Middle East and Africa Smart TV Industry Revenue (Million), by Panel Type 2025 & 2033

- Figure 39: Middle East and Africa Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 40: Middle East and Africa Smart TV Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Smart TV Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2020 & 2033

- Table 2: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2020 & 2033

- Table 3: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2020 & 2033

- Table 4: Global Smart TV Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2020 & 2033

- Table 6: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2020 & 2033

- Table 7: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2020 & 2033

- Table 8: Global Smart TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2020 & 2033

- Table 10: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2020 & 2033

- Table 11: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2020 & 2033

- Table 12: Global Smart TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2020 & 2033

- Table 14: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2020 & 2033

- Table 15: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2020 & 2033

- Table 16: Global Smart TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: India Smart TV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Southeast Asia Smart TV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2020 & 2033

- Table 20: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2020 & 2033

- Table 21: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2020 & 2033

- Table 22: Global Smart TV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2020 & 2033

- Table 24: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2020 & 2033

- Table 25: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2020 & 2033

- Table 26: Global Smart TV Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart TV Industry?

The projected CAGR is approximately 2.19%.

2. Which companies are prominent players in the Smart TV Industry?

Key companies in the market include Hisense, Samsung Electronics Co Ltd, TCL, Xiaomi*List Not Exhaustive, LG Electronics.

3. What are the main segments of the Smart TV Industry?

The market segments include Resolution Type, Size (in inches), Panel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 275.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Disposable Income Across Emerging Economies; Rising Trend of Video-on-Demand Service.

6. What are the notable trends driving market growth?

QLED is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution.

8. Can you provide examples of recent developments in the market?

January 2021 - Hisense launched a new product line of laser TV, TriChroma Laser TV, using its cutting-edge display technology. The laser TV will control and package separate lasers to get purer colors for display. TriChroma will have 20% brightness enhancement at the pixel level with a 430-nit picture brightness. The new TV product line will be offered in various screen sizes, including 75-inch to 100-inch giant screens. The company also aims to provide its customers with customized solutions, home fitness screens, and various professional options for different industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart TV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart TV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart TV Industry?

To stay informed about further developments, trends, and reports in the Smart TV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence