Key Insights

The South America Automotive LED Lighting Market is projected for significant expansion, estimated to reach a market size of $4.08 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.53% through 2033. This growth is propelled by rising consumer demand for advanced vehicle safety features, increasing adoption of technologies like Daytime Running Lights (DRLs) and adaptive headlights, and stringent government regulations promoting enhanced visibility and energy efficiency. The inherent advantages of LED technology, including superior brightness, extended lifespan, and reduced power consumption, are key drivers. Furthermore, expanding automotive production in major South American economies, particularly Brazil and Argentina, directly fuels demand for automotive LED lighting solutions. Ongoing advancements in LED chip design and manufacturing are also improving cost-effectiveness and performance across various vehicle segments, including passenger cars, commercial vehicles, and two-wheelers.

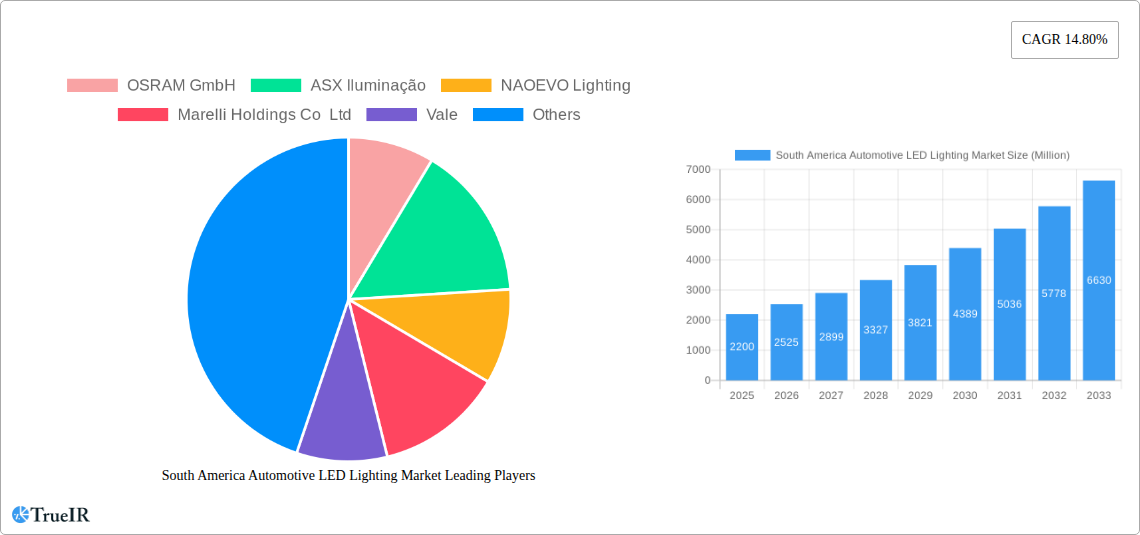

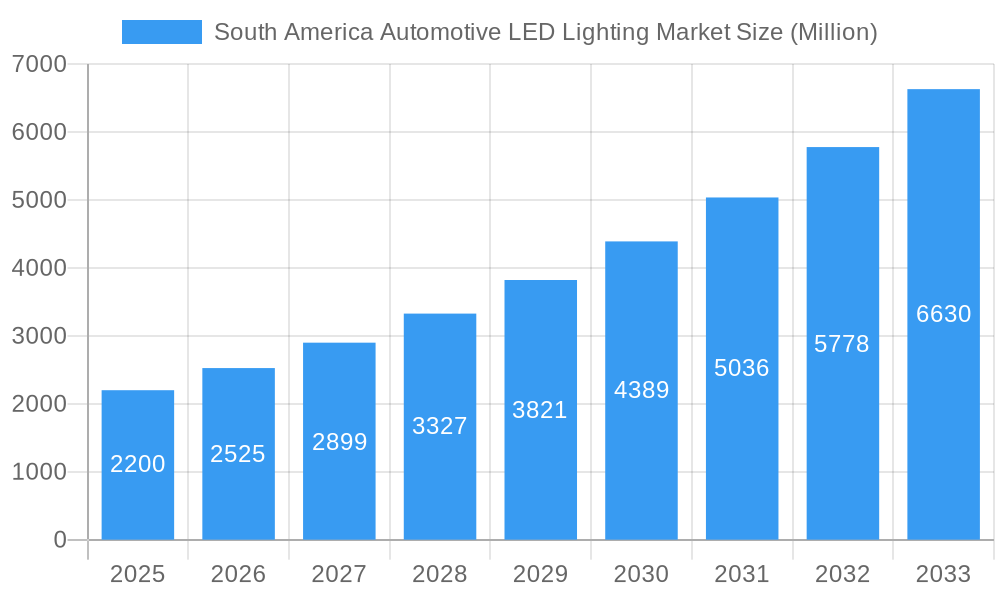

South America Automotive LED Lighting Market Market Size (In Billion)

The market is shaped by trends such as the integration of advanced lighting functionalities, including matrix LED headlights and animated turn signals, to improve both aesthetics and safety. The growing prevalence of electric vehicles (EVs) presents a significant opportunity, as their designs often feature innovative lighting elements for differentiation and aerodynamic optimization. Key market restraints include the initial higher cost of LED components compared to conventional lighting, potential supply chain disruptions, and the requirement for specialized technical expertise for installation and maintenance. Despite these challenges, the substantial safety, fuel efficiency, and design flexibility benefits of LED lighting are expected to sustain market momentum. Leading players, including OSRAM GmbH, KOITO MANUFACTURING CO LTD, and HYUNDAI MOBIS, are actively investing in research and development and expanding production to meet the evolving demands of the South American automotive sector.

South America Automotive LED Lighting Market Company Market Share

South America Automotive LED Lighting Market: Size, Trends, Opportunities, and Forecast (2025-2033)

This report provides comprehensive insights into the South America Automotive LED Lighting Market, detailing market size, growth drivers, competitive landscape, and future outlook. The market, encompassing both Automotive Utility Lighting and Automotive Vehicle Lighting, is set for substantial expansion driven by technological innovation, shifting consumer preferences, and regulatory mandates. Our analysis covers the historical period from 2019 to 2024 and forecasts growth through 2033, with a base year of 2025. Discover the intricate dynamics of this growing market and identify strategic opportunities for stakeholders.

South America Automotive LED Lighting Market Market Structure & Competitive Landscape

The South America Automotive LED Lighting Market exhibits a moderately consolidated structure with key players investing heavily in innovation and product development. The concentration ratio is influenced by the presence of established global automotive lighting giants alongside emerging local manufacturers. Innovation drivers are predominantly focused on enhanced energy efficiency, improved illumination performance, sophisticated design integration, and the incorporation of smart lighting functionalities. Regulatory impacts, particularly concerning road safety standards and emissions, are significant, compelling manufacturers to adopt advanced LED technologies. Product substitutes, while present in the form of traditional lighting systems, are increasingly being phased out due to the superior benefits offered by LEDs. End-user segmentation highlights a strong demand from the passenger car segment, followed by commercial vehicles and two-wheelers. Mergers and acquisitions (M&A) trends, though less pronounced than in mature markets, are present as companies seek to expand their market reach and technological capabilities. For instance, strategic partnerships and smaller acquisitions are observed to bolster product portfolios and geographical presence. The market is characterized by a competitive environment where technological prowess, cost-effectiveness, and compliance with evolving safety standards are paramount for sustained success.

South America Automotive LED Lighting Market Market Trends & Opportunities

The South America Automotive LED Lighting Market is experiencing robust growth, projected to reach an estimated market size of $550.6 Million by 2033, growing at a Compound Annual Growth Rate (CAGR) of 7.9% during the forecast period of 2025–2033. This expansion is propelled by a confluence of factors, including the increasing adoption of LED technology across all vehicle types due to its superior energy efficiency, longer lifespan, and enhanced safety features. Technological shifts are a primary trend, with a noticeable move towards advanced LED solutions such as adaptive front-lighting systems (AFS), matrix LED headlights, and integrated smart lighting functionalities that enhance driver visibility and vehicle aesthetics. Consumer preferences are increasingly leaning towards vehicles equipped with modern, energy-efficient lighting, driving demand for LED-equipped models. The automotive industry's focus on sustainability and reducing carbon footprints further accentuates the appeal of LED lighting, which consumes significantly less power than traditional incandescent or halogen bulbs.

Competitive dynamics are evolving, with intense competition among established players and newer entrants vying for market share. Companies are investing in research and development to introduce innovative lighting solutions that offer improved performance, reduced heat generation, and enhanced design flexibility. The growing demand for premium features in vehicles, even in emerging markets within South America, translates into a higher penetration rate for advanced LED lighting systems. Furthermore, the rising production of vehicles in South America, coupled with the increasing stringency of automotive safety regulations across countries like Brazil and Argentina, is creating a fertile ground for market growth. Opportunities abound for manufacturers to cater to the growing demand for customized and high-performance lighting solutions, particularly in segments like Daytime Running Lights (DRL), advanced headlight systems, and sophisticated tail light designs that contribute to vehicle brand identity. The trend towards vehicle electrification also plays a crucial role, as electric vehicles often prioritize energy efficiency, making LED lighting an ideal choice.

Dominant Markets & Segments in South America Automotive LED Lighting Market

The South America Automotive LED Lighting Market is characterized by the dominance of specific regions, countries, and vehicle segments, driven by distinct growth catalysts and market dynamics. Within the geographical landscape, Brazil and Argentina stand out as leading markets, owing to their significant automotive manufacturing hubs and substantial vehicle parc. These countries are witnessing increased investment in automotive production and are implementing stricter safety regulations that mandate the use of advanced lighting technologies.

- Leading Countries:

- Brazil: As the largest automotive market in South America, Brazil's robust manufacturing base and significant consumer demand for passenger cars and commercial vehicles make it a dominant force. Government initiatives promoting automotive sector growth and evolving road safety standards further bolster LED lighting adoption.

- Argentina: With a well-established automotive industry and a growing focus on technological upgrades in vehicles, Argentina represents another key market. Increasing vehicle exports and domestic sales contribute to the demand for advanced LED lighting solutions.

In terms of Automotive Vehicle Lighting, the Passenger Cars segment holds the largest market share. This dominance is attributed to the high volume of passenger car production and sales, coupled with a growing consumer preference for aesthetically appealing and technologically advanced vehicles. The integration of LED lighting in headlights, taillights, and interior lighting is becoming standard in new passenger car models.

The Automotive Utility Lighting segment sees strong performance from Headlights and Daytime Running Lights (DRL).

- Headlights: The demand for high-performance, energy-efficient headlights that offer superior visibility and adaptive capabilities is driving the adoption of LED technology. Regulatory requirements for enhanced road safety at night further fuel this demand.

- Daytime Running Lights (DRL): Increasingly mandated for new vehicle registrations in many South American countries, DRLs are crucial for enhancing vehicle visibility during daylight hours. LED technology offers the perfect solution due to its low power consumption and long lifespan.

The Commercial Vehicles segment is also exhibiting significant growth, driven by the need for durable, high-visibility lighting solutions that comply with stringent operational and safety standards. As logistics and transportation sectors expand, the demand for robust LED lighting for trucks, buses, and other commercial vehicles is on the rise.

While 2 Wheelers represent a smaller segment in terms of market value for LED lighting, their increasing adoption of LED technology, especially for headlights and taillights, contributes to overall market expansion. The focus here is on cost-effectiveness and energy efficiency.

South America Automotive LED Lighting Market Product Analysis

The South America Automotive LED Lighting Market is witnessing a surge in product innovation, driven by the pursuit of enhanced performance, safety, and design integration. Key product advancements include the development of highly efficient LED chips that offer superior luminosity with reduced power consumption, crucial for electric and hybrid vehicles. Innovative lighting solutions such as adaptive front-lighting systems (AFS) that adjust beam patterns based on driving conditions, and advanced matrix LED headlights providing intelligent illumination, are gaining traction. Furthermore, integrated LED lighting designs, seamlessly blended into vehicle bodywork, are transforming automotive aesthetics. The competitive advantage for manufacturers lies in their ability to offer reliable, durable, and feature-rich LED lighting solutions that meet evolving automotive safety standards and consumer demand for sophisticated vehicle features, thereby differentiating their offerings in a competitive market.

Key Drivers, Barriers & Challenges in South America Automotive LED Lighting Market

The South America Automotive LED Lighting Market is propelled by several key drivers, including increasing vehicle production and sales across the region, a growing emphasis on road safety and the subsequent adoption of stricter lighting regulations, and the inherent advantages of LED technology such as energy efficiency and extended lifespan. Technological advancements, leading to improved performance and reduced costs of LED components, also play a crucial role. Economic growth in key South American economies is directly contributing to increased consumer spending on vehicles equipped with modern features.

However, the market faces significant barriers and challenges. High initial investment costs for LED manufacturing and implementation can be a deterrent for some players. Supply chain disruptions, particularly for specialized electronic components, can impact production timelines and costs. Regulatory complexities and varying standards across different South American countries can create hurdles for market entry and product standardization. Intense price competition from both global and local manufacturers can put pressure on profit margins. Furthermore, the availability of counterfeit products and the need for robust intellectual property protection remain ongoing concerns.

Growth Drivers in the South America Automotive LED Lighting Market Market

The growth of the South America Automotive LED Lighting Market is significantly influenced by several pivotal factors. Technological advancements in LED semiconductor technology are continuously improving performance, reducing energy consumption, and lowering manufacturing costs. The increasing stringency of road safety regulations across countries like Brazil, Argentina, and Chile, which mandate improved visibility and advanced lighting features, is a major catalyst. The burgeoning automotive manufacturing sector in South America, coupled with rising vehicle sales, directly translates to higher demand for automotive lighting components. Furthermore, the global trend towards vehicle electrification necessitates energy-efficient solutions, making LED lighting a preferred choice for electric and hybrid vehicles. Consumer demand for modern vehicle aesthetics and advanced safety features also plays a crucial role in driving the adoption of LED lighting.

Challenges Impacting South America Automotive LED Lighting Market Growth

Several challenges are impacting the growth trajectory of the South America Automotive LED Lighting Market. The high upfront investment required for advanced LED manufacturing facilities and research and development can be a significant barrier, especially for smaller companies. Fluctuations in currency exchange rates and economic instability in some South American nations can impact vehicle sales and consumer purchasing power, subsequently affecting demand for automotive components. Supply chain vulnerabilities, particularly for semiconductor components and specialized materials, can lead to production delays and increased costs. Navigating the diverse and sometimes inconsistent regulatory frameworks across different countries within South America can also pose complexities for manufacturers. Furthermore, intense price competition from both established global players and emerging local manufacturers can squeeze profit margins and necessitate continuous cost optimization efforts.

Key Players Shaping the South America Automotive LED Lighting Market Market

- OSRAM GmbH

- ASX Iluminação

- NAOEVO Lighting

- Marelli Holdings Co Ltd

- Vale

- Stanley Electric Co Ltd

- KOITO MANUFACTURING CO LTD

- HYUNDAI MOBIS

- SHOCKLIGHT

- HELLA GmbH & Co KGaA

Significant South America Automotive LED Lighting Market Industry Milestones

- March 2023: HELLA expands Black Magic auxiliary headlamp series with 32 new lightbars. Range expansion includes 14 lightbars with ECE approval for on-road use and 18 light-bars for off-road applications.

- January 2023: HELLA brings FlatLight technology into series production as a daytime running light for the first time. The lighting concept is successfully transferred from the rear combination lamp to an application in the front area; series production starts in 2025.

- December 2022: HELLA further expands its market position in chip-based headlamp technologies (SSL | HD).

Future Outlook for South America Automotive LED Lighting Market Market

The future outlook for the South America Automotive LED Lighting Market is highly promising, with sustained growth projected through 2033. Key growth catalysts include the accelerating adoption of LED technology driven by its energy efficiency and safety benefits, especially in the burgeoning electric and hybrid vehicle segments. The continuous evolution of automotive design trends will further necessitate the integration of advanced and aesthetically pleasing LED lighting solutions. Government initiatives aimed at enhancing road safety and promoting the automotive industry will continue to be significant drivers. Strategic opportunities lie in catering to the increasing demand for smart lighting functionalities, such as adaptive headlights and integrated signaling systems, and in expanding market reach into countries with developing automotive sectors. Companies that focus on innovation, cost-effectiveness, and compliance with evolving regional and international standards will be well-positioned to capitalize on the significant market potential.

South America Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

South America Automotive LED Lighting Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Automotive LED Lighting Market Regional Market Share

Geographic Coverage of South America Automotive LED Lighting Market

South America Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region

- 3.3. Market Restrains

- 3.3.1. High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Automotive LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OSRAM GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ASX Iluminação

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NAOEVO Lighting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marelli Holdings Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vale

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stanley Electric Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KOITO MANUFACTURING CO LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HYUNDAI MOBIS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SHOCKLIGHT

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HELLA GmbH & Co KGaA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 OSRAM GmbH

List of Figures

- Figure 1: South America Automotive LED Lighting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Automotive LED Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: South America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 2: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 3: South America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 4: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 5: South America Automotive LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Automotive LED Lighting Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: South America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 8: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 9: South America Automotive LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 10: South America Automotive LED Lighting Market Volume K Unit Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 11: South America Automotive LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South America Automotive LED Lighting Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Brazil South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Argentina South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Argentina South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Chile South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Chile South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Colombia South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Colombia South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Peru South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Peru South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South America Automotive LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Automotive LED Lighting Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Automotive LED Lighting Market?

The projected CAGR is approximately 6.53%.

2. Which companies are prominent players in the South America Automotive LED Lighting Market?

Key companies in the market include OSRAM GmbH, ASX Iluminação, NAOEVO Lighting, Marelli Holdings Co Ltd, Vale, Stanley Electric Co Ltd, KOITO MANUFACTURING CO LTD, HYUNDAI MOBIS, SHOCKLIGHT, HELLA GmbH & Co KGaA.

3. What are the main segments of the South America Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.08 billion as of 2022.

5. What are some drivers contributing to market growth?

5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market.

8. Can you provide examples of recent developments in the market?

March 2023: HELLA expands Black Magic auxiliary headlamp series with 32 new lightbars. Range expansion includes 14 lightbars with ECE approval for on-road use and 18 light-bars for off-road applicationsJanuary 2023: HELLA brings FlatLight technology into series production as a daytime running light for the first time. The lighting concept is successfully transferred from the rear combination lamp to an application in the front area; series production starts in 2025.December 2022: HELLA further expands its market position in chip-based headlamp technologies(SSL | HD).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the South America Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence