Key Insights

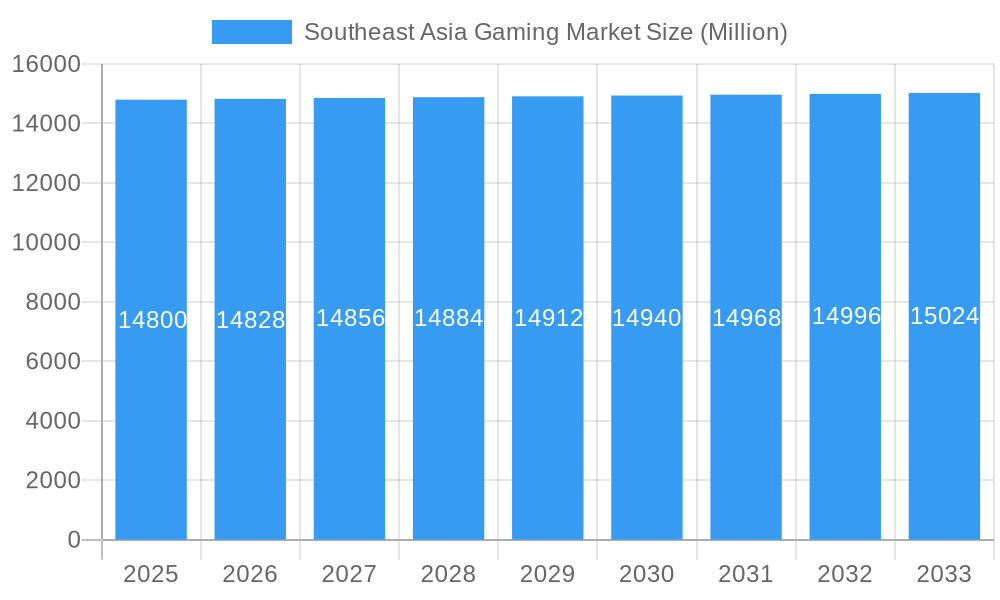

The Southeast Asia gaming market, valued at $14.80 billion in 2025, exhibits a modest but consistent growth trajectory, projected to expand steadily over the forecast period (2025-2033) with a Compound Annual Growth Rate (CAGR) of 0.19%. This relatively low CAGR suggests a market approaching maturity, yet significant potential remains untapped. Key drivers include the increasing smartphone penetration and affordability across the region, coupled with rising internet access and a burgeoning young population eager to engage with interactive entertainment. Popular gaming platforms like mobile, PC, and consoles contribute to this market's strength. Growth is further fueled by the escalating popularity of esports and the rise of mobile-first gaming experiences tailored to local preferences. However, challenges exist, including regulatory hurdles in certain markets, concerns about gaming addiction, and the need for robust infrastructure development in some areas to fully realize the market's potential. Competition amongst established industry giants like Tencent, Netmarble, and Sony, alongside smaller regional players, is fierce, driving innovation and pushing the boundaries of gaming experiences. The diversity of gaming preferences across the different countries within Southeast Asia – from the highly developed markets of Japan and South Korea to the rapidly expanding markets of Indonesia and Vietnam – creates both opportunities and complexities for market players.

Southeast Asia Gaming Market Market Size (In Billion)

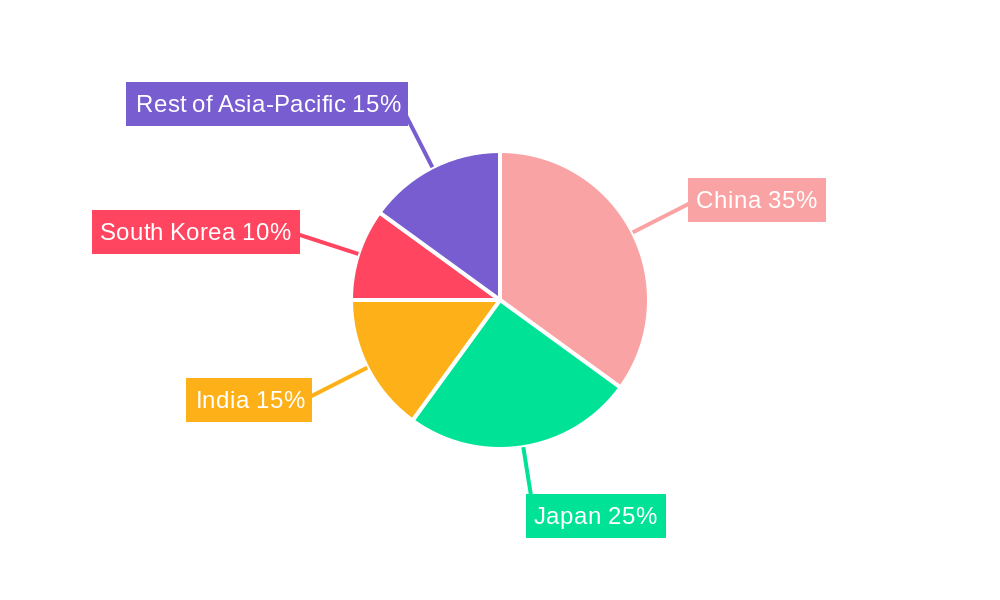

The regional distribution of market share within Southeast Asia reflects the economic disparities and digital adoption rates across the region. China, Japan, South Korea, and India are likely to constitute the largest segments, driven by their sizable populations and established gaming cultures. However, countries like Vietnam, Indonesia, and the Philippines are experiencing rapid growth and are poised to become increasingly important contributors to the overall market size in the coming years. This dynamic landscape presents significant opportunities for companies that can effectively tailor their strategies to meet the diverse needs and preferences of consumers across different countries within Southeast Asia. Focusing on localized content, supporting multiple languages, and understanding the specific cultural nuances are key success factors for businesses looking to capitalize on this growth.

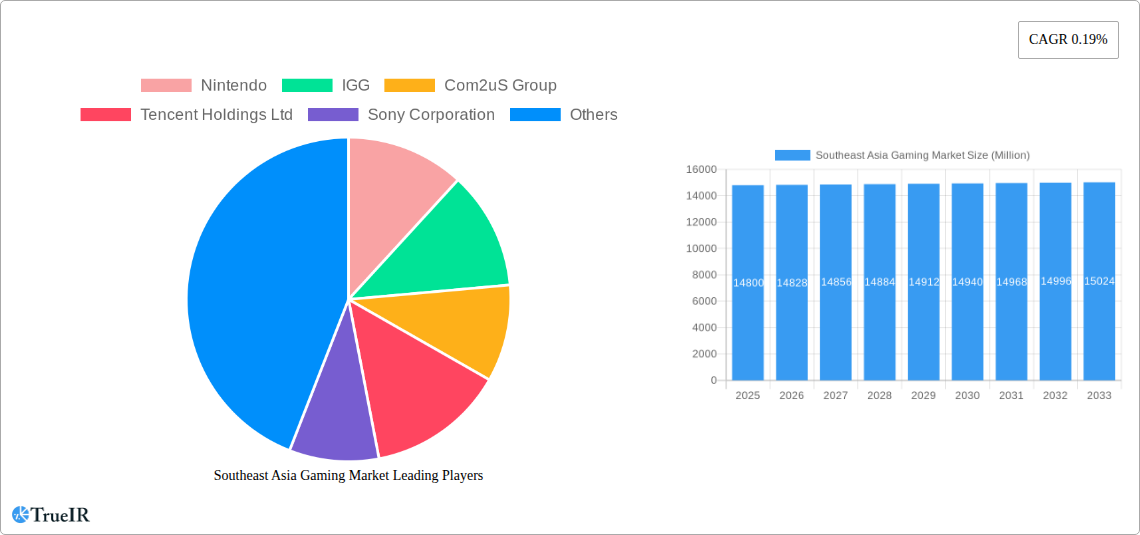

Southeast Asia Gaming Market Company Market Share

Southeast Asia Gaming Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the booming Southeast Asia gaming market, offering invaluable insights for investors, industry professionals, and strategists. With a comprehensive analysis spanning the period 2019-2033, including a detailed forecast from 2025-2033, this report leverages extensive data and expert analysis to illuminate the region's gaming landscape. The base year for this analysis is 2025, with an estimated market size of xx Million. This report covers key segments, market trends, competitive dynamics, and future outlook, making it an essential resource for navigating this rapidly evolving market.

Southeast Asia Gaming Market Market Structure & Competitive Landscape

The Southeast Asia gaming market exhibits a moderately concentrated structure, with a few major players holding significant market share, but also a vibrant ecosystem of smaller developers and publishers. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive environment. Key innovation drivers include the rise of mobile gaming, esports, and the increasing adoption of cloud gaming technologies. Regulatory landscapes vary across the region, impacting market entry and operations. Product substitutes include other forms of entertainment, such as streaming services and social media, while the increasing popularity of esports creates new revenue streams. End-user segmentation primarily focuses on age demographics, with significant penetration across all age groups. M&A activity has been significant in the past five years, with approximately xx Million in deals concluded. This trend is expected to continue.

- Market Concentration: Moderately concentrated, with an estimated HHI of xx in 2024.

- Innovation Drivers: Mobile gaming, esports, cloud gaming.

- Regulatory Impacts: Vary across Southeast Asian nations, influencing market entry and operations.

- Product Substitutes: Streaming services, social media.

- End-User Segmentation: Primarily based on age demographics.

- M&A Trends: Significant activity in recent years, with approximately xx Million in deals.

Southeast Asia Gaming Market Market Trends & Opportunities

The Southeast Asia gaming market has experienced remarkable growth, with a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024. This robust expansion is driven by several factors, including increasing smartphone penetration, rising internet accessibility, a growing young population, and the increasing popularity of esports. Technological advancements, such as the introduction of 5G networks and improved mobile processing power, further fuel this expansion. Consumer preferences are shifting towards mobile and online gaming experiences, with a significant surge in casual and mobile esports titles. This presents opportunities for companies focusing on mobile game development and esports infrastructure. Competitive dynamics are intensifying, with both local and international players vying for market share. Market penetration rates, particularly in mobile gaming, remain high and are expected to continue growing. This is fuelled by mobile payment systems and the ease of access provided by mobile devices.

Dominant Markets & Segments in Southeast Asia Gaming Market

The mobile gaming segment dominates the Southeast Asia gaming market, accounting for approximately xx% of total revenue in 2024. This dominance is propelled by factors such as high smartphone penetration, affordable data plans, and the convenience of mobile gaming. Indonesia, followed by the Philippines and Vietnam are the leading markets within the region.

Key Growth Drivers in Mobile Gaming:

- High smartphone penetration rates.

- Affordable data plans.

- Wide availability of mobile payment systems.

- Growing popularity of mobile esports.

Market Dominance Analysis: The mobile segment's leadership stems from its accessibility, affordability, and suitability to the region's demographics. Indonesia's large population and growing middle class contribute significantly to its leading position.

Southeast Asia Gaming Market Product Analysis

The Southeast Asia gaming market witnesses continuous product innovation, with a focus on mobile games, casual titles, and esports-focused experiences. Advancements in game design, graphics, and user experience are enhancing the overall gaming experience and attracting a wider audience. The integration of social features and in-app purchases creates lucrative revenue streams. The market is characterized by a diverse range of game genres, catering to varying player preferences and demographics, maximizing market reach and ensuring that there is a high level of user engagement.

Key Drivers, Barriers & Challenges in Southeast Asia Gaming Market

Key Drivers:

- Increasing smartphone penetration and internet accessibility.

- Growing young population with high disposable income.

- Rising popularity of esports and competitive gaming.

- Favorable regulatory environments in some countries.

Challenges:

- Intense competition from both domestic and international players.

- Piracy remains a significant challenge affecting revenue streams.

- Regulatory inconsistencies across the region create hurdles for market entry and expansion. The impact of these inconsistencies is estimated to decrease growth by approximately xx% annually.

Growth Drivers in the Southeast Asia Gaming Market Market

The Southeast Asian gaming market's growth is propelled by rising smartphone penetration, affordable data plans, a young and tech-savvy population, and the burgeoning esports scene. Government support for the digital economy in some countries, such as through tax incentives, further bolsters expansion. The increasing adoption of cloud gaming technology also presents a significant growth opportunity.

Challenges Impacting Southeast Asia Gaming Market Growth

Challenges include regulatory inconsistencies across the region, inconsistent infrastructure in different areas that impedes internet access and game accessibility, high rates of game piracy, and fierce competition amongst global and local game developers. These factors can impede market expansion and profitability.

Key Players Shaping the Southeast Asia Gaming Market Market

- Nintendo

- IGG

- Com2uS Group

- Tencent Holdings Ltd

- Sony Corporation

- Asiasoft Corporation Public Company Limited

- Sherman Chin

- Netmarble Corp

- Sea Limited

- Bandai Namco Entertainment Asia Pte Ltd

Significant Southeast Asia Gaming Market Industry Milestones

- September 2022: GRAVITY Co. Ltd. launched Ragnarok Tactics II in Thailand, expanding the tactical SRPG market.

- March 2022: Microsoft launched PC Game Pass in Thailand, Malaysia, Indonesia, the Philippines, and Vietnam, boosting PC gaming accessibility.

Future Outlook for Southeast Asia Gaming Market Market

The Southeast Asia gaming market is poised for continued robust growth, driven by technological advancements, increasing internet and smartphone penetration, and a burgeoning esports ecosystem. Strategic partnerships, investments in infrastructure, and the development of innovative game experiences will further fuel this expansion. The market's potential remains immense, with significant opportunities for both established players and new entrants.

Southeast Asia Gaming Market Segmentation

-

1. Platform

- 1.1. PC

- 1.2. Console

- 1.3. Mobile

-

2. Geography

- 2.1. Indonesia

- 2.2. Malaysia

- 2.3. Singapore

- 2.4. Thailand

- 2.5. Rest of Southeast Asia

Southeast Asia Gaming Market Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Singapore

- 4. Thailand

- 5. Rest of Southeast Asia

Southeast Asia Gaming Market Regional Market Share

Geographic Coverage of Southeast Asia Gaming Market

Southeast Asia Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration to Boost the Market Growth; The rising popularity of smartphones and 5G technology is expected to boost market growth.

- 3.3. Market Restrains

- 3.3.1. Users' devices with limited game support may act as a market restraint.

- 3.4. Market Trends

- 3.4.1. Mobile Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. PC

- 5.1.2. Console

- 5.1.3. Mobile

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Indonesia

- 5.2.2. Malaysia

- 5.2.3. Singapore

- 5.2.4. Thailand

- 5.2.5. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.3.2. Malaysia

- 5.3.3. Singapore

- 5.3.4. Thailand

- 5.3.5. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Indonesia Southeast Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. PC

- 6.1.2. Console

- 6.1.3. Mobile

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Indonesia

- 6.2.2. Malaysia

- 6.2.3. Singapore

- 6.2.4. Thailand

- 6.2.5. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Malaysia Southeast Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. PC

- 7.1.2. Console

- 7.1.3. Mobile

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Indonesia

- 7.2.2. Malaysia

- 7.2.3. Singapore

- 7.2.4. Thailand

- 7.2.5. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Singapore Southeast Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. PC

- 8.1.2. Console

- 8.1.3. Mobile

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Indonesia

- 8.2.2. Malaysia

- 8.2.3. Singapore

- 8.2.4. Thailand

- 8.2.5. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Thailand Southeast Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. PC

- 9.1.2. Console

- 9.1.3. Mobile

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Indonesia

- 9.2.2. Malaysia

- 9.2.3. Singapore

- 9.2.4. Thailand

- 9.2.5. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Rest of Southeast Asia Southeast Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. PC

- 10.1.2. Console

- 10.1.3. Mobile

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Indonesia

- 10.2.2. Malaysia

- 10.2.3. Singapore

- 10.2.4. Thailand

- 10.2.5. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nintendo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IGG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Com2uS Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tencent Holdings Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sony Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Asiasoft Corporation Public Company Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sherman Chin

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Netmarble Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sea Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bandai Namco Entertainment Asia Pte Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nintendo

List of Figures

- Figure 1: Southeast Asia Gaming Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Gaming Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Southeast Asia Gaming Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 3: Southeast Asia Gaming Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Southeast Asia Gaming Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Southeast Asia Gaming Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Southeast Asia Gaming Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Southeast Asia Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Southeast Asia Gaming Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 9: Southeast Asia Gaming Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Southeast Asia Gaming Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Southeast Asia Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Southeast Asia Gaming Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 14: Southeast Asia Gaming Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 15: Southeast Asia Gaming Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Southeast Asia Gaming Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Southeast Asia Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Southeast Asia Gaming Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 20: Southeast Asia Gaming Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 21: Southeast Asia Gaming Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Southeast Asia Gaming Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Southeast Asia Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Southeast Asia Gaming Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Southeast Asia Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 26: Southeast Asia Gaming Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 27: Southeast Asia Gaming Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Southeast Asia Gaming Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Southeast Asia Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Southeast Asia Gaming Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Southeast Asia Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 32: Southeast Asia Gaming Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 33: Southeast Asia Gaming Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Southeast Asia Gaming Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 35: Southeast Asia Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Southeast Asia Gaming Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Gaming Market?

The projected CAGR is approximately 0.19%.

2. Which companies are prominent players in the Southeast Asia Gaming Market?

Key companies in the market include Nintendo, IGG, Com2uS Group, Tencent Holdings Ltd, Sony Corporation, Asiasoft Corporation Public Company Limited, Sherman Chin, Netmarble Corp, Sea Limited, Bandai Namco Entertainment Asia Pte Ltd.

3. What are the main segments of the Southeast Asia Gaming Market?

The market segments include Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration to Boost the Market Growth; The rising popularity of smartphones and 5G technology is expected to boost market growth..

6. What are the notable trends driving market growth?

Mobile Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Users' devices with limited game support may act as a market restraint..

8. Can you provide examples of recent developments in the market?

September 2022- GRAVITY Co. Ltd, a producer, and publisher of online and mobile games, announced that Ragnarok Tactics II, a wholly-owned subsidiary, was successfully launched in Thailand. Ragnarok Tactics II is a tactical SRPG in which players level up their characters by gathering monsters. In the game, players fight with their characters and creatures. Aside from the character's progress, the battle's outcome is determined by how the monsters and characters are positioned in the conflict.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Gaming Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence