Key Insights

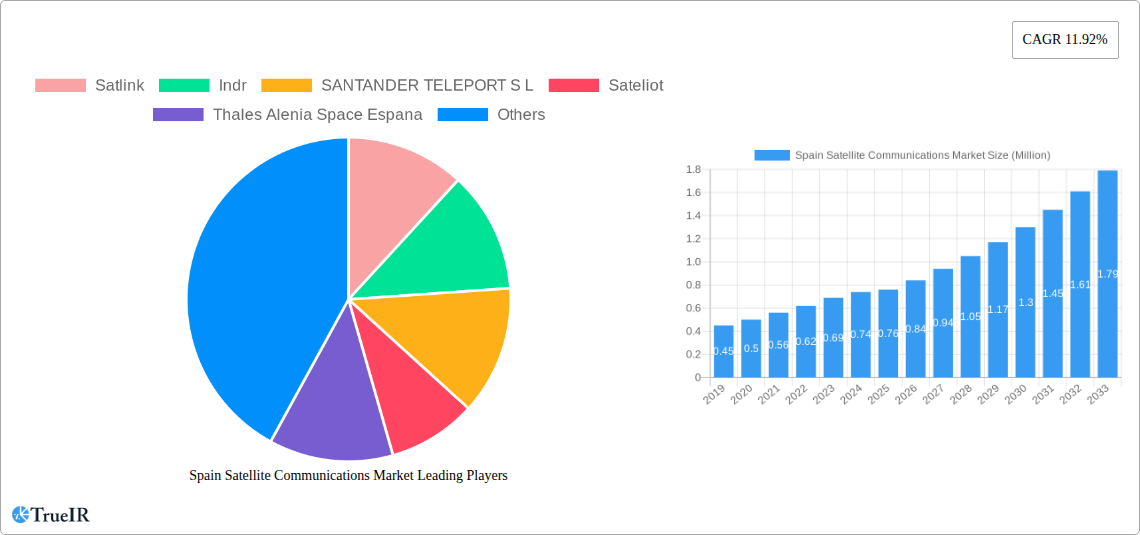

The Spanish satellite communications market is poised for significant expansion, projected to reach an estimated \$0.76 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 11.92%, indicating strong momentum in the sector. Key drivers for this upward trajectory include the increasing demand for high-bandwidth connectivity in remote and underserved areas, the proliferation of IoT devices requiring reliable communication infrastructure, and the growing adoption of satellite technology across various enterprise verticals. Furthermore, advancements in satellite technology, such as the development of more powerful and agile satellites and the expansion of ground equipment capabilities, are creating new opportunities and enhancing service delivery. The Spanish government's commitment to digital transformation and the expansion of broadband access further bolster the market’s potential, creating a favorable environment for both established players and emerging innovators.

Spain Satellite Communications Market Market Size (In Million)

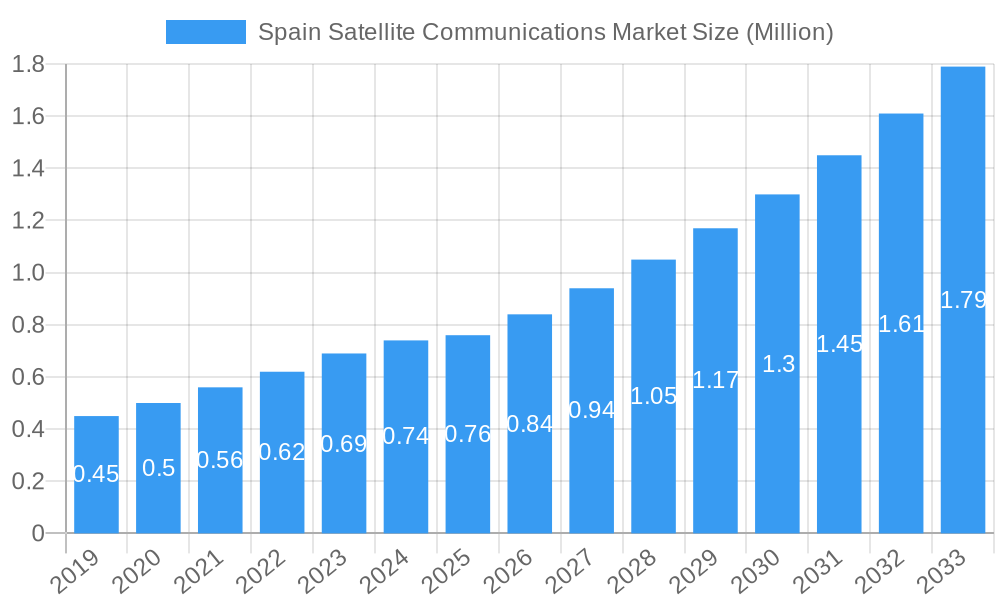

The market is segmented into Ground Equipment and Services, with a diverse range of platforms including Portable, Land, Maritime, and Airborne solutions. This broad applicability caters to a wide array of end-user verticals such as Maritime, Defense and Government, Enterprises, and Media and Entertainment. The "Other End-user Verticals" category suggests emerging applications that are likely to contribute to future growth. Spain’s strategic geographical location and its role as a hub for telecommunications in Southern Europe also play a crucial role in its market dynamics. Leading companies like Satlink, Hispasat, and Thales Alenia Space España are actively shaping the market through innovation and strategic investments, underscoring the competitive landscape and the readiness for advanced satellite solutions to address evolving connectivity needs across the nation and beyond.

Spain Satellite Communications Market Company Market Share

Here's the SEO-optimized report description for the Spain Satellite Communications Market, designed for immediate use without further modification.

This in-depth report provides a definitive analysis of the Spain Satellite Communications Market, offering unparalleled insights into its structure, dynamics, and future trajectory. Leveraging a robust methodology and extensive research, this report is an essential resource for stakeholders seeking to understand the intricate landscape of satellite communications in Spain. Covering a comprehensive Study Period of 2019–2033, with a Base Year of 2025, Estimated Year of 2025, Forecast Period of 2025–2033, and Historical Period of 2019–2024, this analysis delves deep into market segmentation, key trends, growth drivers, and the competitive environment. The report is meticulously structured to deliver actionable intelligence, enabling informed strategic decision-making for ground equipment manufacturers, satellite service providers, platform developers, and end-user verticals including Maritime, Defense and Government, Enterprises, Media and Entertainment, and Other End-user Verticals.

Spain Satellite Communications Market Market Structure & Competitive Landscape

The Spain Satellite Communications Market exhibits a moderately concentrated structure, characterized by the presence of established national players and expanding international service providers. Innovation is primarily driven by advancements in High Throughput Satellites (HTS), Low Earth Orbit (LEO) constellations, and sophisticated ground segment technologies. Regulatory frameworks, overseen by entities such as the Spanish Directorate-General for Telecommunications and Audiovisual Communication Services, play a crucial role in shaping market access and spectrum allocation, fostering a secure yet competitive environment. Product substitutes, including terrestrial fiber optics and 5G networks, pose a challenge, particularly in densely populated urban areas, but the unique reach and resilience of satellite communications maintain their critical importance for remote regions, specialized applications, and disaster recovery. End-user segmentation reveals a strong demand from the Defense and Government sector, driven by national security imperatives and the need for reliable, secure connectivity. The Maritime sector is also a significant contributor, demanding robust broadband solutions for vessel operations and crew welfare. Enterprise adoption is steadily increasing, fueled by digital transformation initiatives and the requirement for connectivity in underserved areas. Mergers and Acquisitions (M&A) activity is anticipated to increase as companies seek to consolidate market share, expand service portfolios, and leverage technological synergies, with an estimated M&A volume of XX Million EUR during the forecast period. Concentration ratios are currently estimated at XX% for the top three players.

Spain Satellite Communications Market Market Trends & Opportunities

The Spain Satellite Communications Market is poised for substantial growth, driven by increasing demand for high-speed, reliable connectivity across diverse sectors. Market size is projected to reach XX Billion EUR by 2033, expanding from an estimated XX Billion EUR in 2025. Technological shifts are central to this growth, with the proliferation of Low Earth Orbit (LEO) satellite constellations promising lower latency and more affordable services, complementing the established geostationary (GEO) satellite infrastructure. This technological evolution is significantly impacting consumer preferences, with a growing expectation for seamless connectivity akin to terrestrial broadband. The market penetration rate for satellite broadband services is expected to rise from XX% in 2025 to XX% by 2033. Competitive dynamics are intensifying, with a race to offer integrated solutions encompassing hardware, software, and managed services. Opportunities abound in developing specialized satellite solutions for niche markets, such as IoT connectivity for agriculture and industrial applications, enhanced maritime broadband for the cruise and cargo industries, and resilient communication networks for emergency services. The Spanish government's commitment to digital transformation and the "España Digital 2026" agenda further fuels market expansion by promoting the adoption of advanced digital technologies, including satellite communications. The increasing adoption of cloud-based services and the burgeoning data economy also present significant growth avenues, as satellite networks become integral to cloud connectivity strategies for businesses operating beyond the reach of traditional infrastructure. Furthermore, the development of resilient communication infrastructure for national security and public safety remains a paramount driver, creating consistent demand for advanced satellite solutions. The rise of remote work and the need for reliable connectivity in rural and island territories further amplify the market's expansion potential. The market is projected to experience a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

Dominant Markets & Segments in Spain Satellite Communications Market

The Maritime segment is a leading market within Spain's satellite communications landscape, driven by the country's extensive coastline and significant maritime trade. Key growth drivers include the mandatory implementation of broadband for crew welfare, enhanced operational efficiency through real-time data transmission for vessel management, and the increasing adoption of digitalization in the shipping industry. Policies supporting the modernization of the Spanish fleet and initiatives aimed at improving connectivity for offshore platforms further bolster this segment's dominance.

The Defense and Government segment is another dominant force, characterized by a consistent and substantial demand for secure, resilient, and high-bandwidth satellite communication solutions. Key growth drivers include national security mandates, the need for persistent surveillance and reconnaissance capabilities, interoperability across various military branches, and the deployment of secure communication networks for critical infrastructure protection. Government investment in advanced satellite programs, such as SPAINSAT NG, underscores the strategic importance of this sector.

In terms of platform, Land-based applications, including enterprise connectivity, rural broadband, and critical infrastructure communication, represent a significant and growing market. The need for reliable connectivity in remote areas, coupled with the expansion of enterprise digital transformation initiatives, fuels this segment's growth. Portable platforms, used by emergency services and field operations, also show robust growth due to their mobility and rapid deployment capabilities.

Within service types, Services are experiencing the most rapid growth, encompassing managed services, data analytics, and application-specific solutions, moving beyond basic connectivity provision. Ground Equipment remains crucial, with continuous innovation in user terminals, modems, and antennas to support evolving satellite technologies like LEO and MEO constellations.

Spain Satellite Communications Market Product Analysis

Product innovation in the Spain satellite communications market is primarily focused on delivering higher bandwidth, lower latency, and enhanced reliability. Key advancements include the development of smaller, more powerful user terminals for portable and maritime applications, and sophisticated ground station equipment designed to manage vast amounts of data from LEO constellations. Applications are diversifying, extending beyond traditional voice and data to encompass real-time video streaming, IoT connectivity for remote sensing and industrial automation, and secure data transmission for defense and government operations. Competitive advantages are being gained through integrated hardware and software solutions that offer end-to-end connectivity and value-added services, catering to the specific needs of verticals like maritime, defense, and enterprises. The emphasis is on creating robust, cost-effective, and user-friendly systems that can operate reliably in challenging environments.

Key Drivers, Barriers & Challenges in Spain Satellite Communications Market

Key Drivers:

- Technological Advancements: The deployment of LEO and MEO constellations, coupled with the evolution of HTS technology, is drastically improving speed, capacity, and reducing latency, opening up new application possibilities.

- Increasing Demand for Connectivity: A persistent need for reliable internet access in rural, remote, and underserved areas, alongside the growing demand for high-bandwidth services across all sectors, is a primary market catalyst.

- Government Initiatives & Investments: Support from the Spanish government for digital transformation, including investments in national satellite programs and policies promoting digital inclusion, significantly drives market growth.

- Digital Transformation Across Industries: Enterprises are increasingly adopting satellite communications for business continuity, IoT deployments, and remote operations, particularly in sectors like agriculture, energy, and logistics.

Barriers & Challenges:

- Regulatory Complexities: Navigating spectrum allocation, licensing, and compliance with national and international regulations can be a significant hurdle, potentially impacting deployment timelines and costs.

- Supply Chain Issues: Global supply chain disruptions and the reliance on specialized components can affect the availability and cost of satellite hardware, leading to potential delays and increased prices, impacting an estimated XX% of hardware procurement.

- Competitive Pressure: Intense competition from established terrestrial networks (fiber, 5G) in urban areas and from emerging LEO players requires continuous innovation and competitive pricing strategies to maintain market share.

- High Initial Investment: The upfront cost of satellite infrastructure, ground equipment, and service subscriptions can be a barrier for some smaller enterprises and end-users, particularly in cost-sensitive markets.

Growth Drivers in the Spain Satellite Communications Market Market

The Spain Satellite Communications Market is propelled by several key growth drivers. Technologically, the advent of LEO constellations is democratizing access to high-speed, low-latency internet, significantly expanding the addressable market. Economically, the increasing digitalization of businesses and the need for robust connectivity solutions for remote operations and IoT applications are creating sustained demand. Regulatory drivers, such as government initiatives focused on digital inclusion and the modernization of critical infrastructure, further stimulate growth by providing favorable frameworks and funding for satellite deployments. For instance, the "España Digital 2026" plan actively promotes the adoption of advanced communication technologies, including satellite services, to bridge the digital divide. The growing demand for reliable connectivity in the Maritime and Defense and Government sectors, driven by operational efficiency and national security needs, respectively, also acts as a potent growth catalyst.

Challenges Impacting Spain Satellite Communications Market Growth

Several challenges are impacting the Spain Satellite Communications Market growth. Regulatory complexities, including obtaining necessary licenses and navigating spectrum management, can lead to delays and increased operational costs. Supply chain issues, exacerbated by global geopolitical factors, continue to pose a threat to the timely availability and affordability of critical satellite components, impacting an estimated XX% of planned deployments. Competitive pressures from established terrestrial broadband providers and the rapid expansion of LEO constellations necessitate continuous innovation and strategic pricing. Furthermore, the high initial investment required for satellite terminal equipment and recurring service fees can be a barrier for some potential users, particularly small and medium-sized enterprises (SMEs) and individuals in less affluent regions.

Key Players Shaping the Spain Satellite Communications Market Market

- Satlink

- Indra

- SANTANDER TELEPORT S L

- Sateliot

- Thales Alenia Space Espana

- Hispasat

- Hisdesat Servicios EstratEgicos SA

- Telespazio S p A

- GMV

- Verasat Global SL

Significant Spain Satellite Communications Market Industry Milestones

- January 2023: GMV was awarded a contract by Hisdesat for the construction and development of the ground segment for the SPAINSAT NG project. This significant development will introduce two new satellites in 2024 and 2025, substantially enhancing the functionality of Spain's satellite communication capabilities.

- July 2022: Satlink secured a three-year contract to provide broadband satellite communication solutions to Spanish Civil Guard patrol vessels. This contract involves equipping 56 ships, building upon the company's existing narrowband (L-band) technology deployment.

Future Outlook for Spain Satellite Communications Market Market

The future outlook for the Spain Satellite Communications Market is exceptionally positive, driven by ongoing technological advancements and expanding market applications. The continued rollout of LEO satellite constellations is expected to significantly lower latency and increase bandwidth availability, making satellite communications a more competitive and attractive option for a wider range of users, including those in the Enterprises, Media and Entertainment, and Other End-user Verticals. Strategic opportunities lie in the development of integrated IoT solutions, the expansion of resilient communication networks for critical infrastructure, and the provision of enhanced broadband services to the Maritime sector. Government support for digital infrastructure development and national security initiatives will continue to be a major growth catalyst. The market is poised for sustained growth, with an increasing focus on value-added services and end-to-end solutions that leverage the unique capabilities of satellite technology.

Spain Satellite Communications Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Spain Satellite Communications Market Segmentation By Geography

- 1. Spain

Spain Satellite Communications Market Regional Market Share

Geographic Coverage of Spain Satellite Communications Market

Spain Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Transformation; Increasing Demand for Broadband Connectivity

- 3.3. Market Restrains

- 3.3.1. Interference in Transmission of Data; Regulatory and Spectrum Constraints

- 3.4. Market Trends

- 3.4.1. The media and entertainment segment is expected to hold a considerable market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Satlink

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Indr

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SANTANDER TELEPORT S L

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sateliot

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thales Alenia Space Espana

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hispasat

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hisdesat Servicios EstratEgicos SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telespazio S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GMV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Verasat Global SL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Satlink

List of Figures

- Figure 1: Spain Satellite Communications Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Satellite Communications Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Satellite Communications Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Spain Satellite Communications Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Spain Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Spain Satellite Communications Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Spain Satellite Communications Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Spain Satellite Communications Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 7: Spain Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Spain Satellite Communications Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Satellite Communications Market?

The projected CAGR is approximately 11.92%.

2. Which companies are prominent players in the Spain Satellite Communications Market?

Key companies in the market include Satlink, Indr, SANTANDER TELEPORT S L, Sateliot, Thales Alenia Space Espana, Hispasat, Hisdesat Servicios EstratEgicos SA, Telespazio S p A, GMV, Verasat Global SL.

3. What are the main segments of the Spain Satellite Communications Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Transformation; Increasing Demand for Broadband Connectivity.

6. What are the notable trends driving market growth?

The media and entertainment segment is expected to hold a considerable market share.

7. Are there any restraints impacting market growth?

Interference in Transmission of Data; Regulatory and Spectrum Constraints.

8. Can you provide examples of recent developments in the market?

January 2023: A contract for the construction and development of the ground segment of the SPAINSAT NG project satellites was provided to multinational GMV by the Spanish government satellite provider Hisdesat. These two additional satellites, whose launches are planned for 2024 and 2025, will succeed the operator's existing SpainSat and XTAR-EUR spacecraft and significantly improve their functionality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Spain Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence