Key Insights

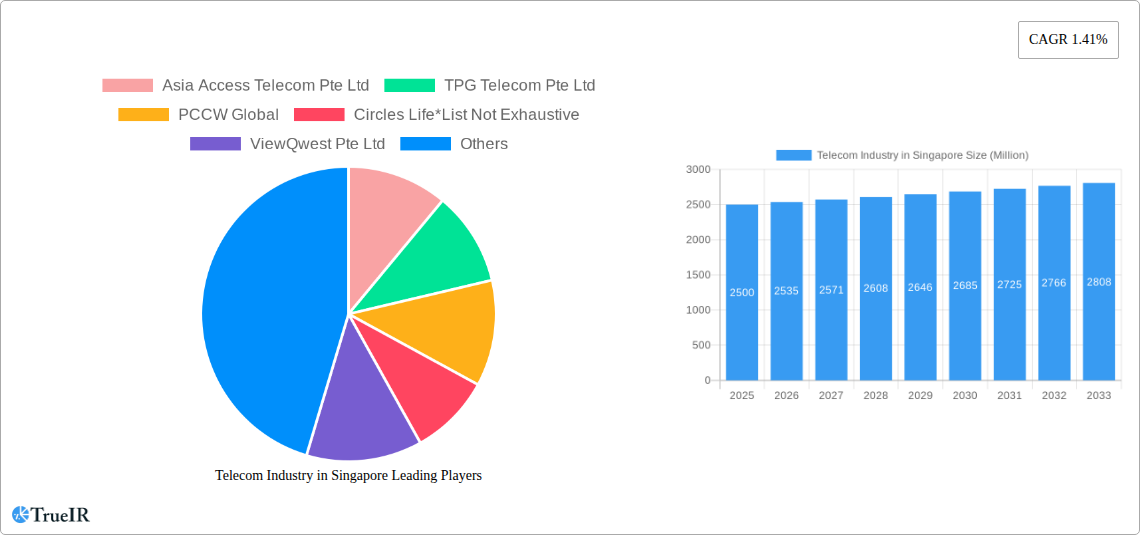

The Singaporean telecommunications market, valued at approximately $2.84 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.78% from 2025 to 2033. This growth is propelled by escalating demand for high-speed data, driven by widespread smartphone adoption and the increasing integration of digital services across all societal sectors. The expansion of Over-the-Top (OTT) platforms and Pay-TV services further fuels this trend, necessitating enhanced bandwidth and advanced network infrastructure. While traditional voice services persist, their revenue share is diminishing, reflecting a global shift towards data-centric communication. Intense competition among established providers like Singapore Telecommunications Limited, StarHub Limited, and M1 Limited, alongside emerging players such as Circles.Life and ViewQwest, stimulates innovation and price reductions, benefiting consumers. Regulatory policies significantly influence market dynamics, affecting pricing, infrastructure deployment, and overall sector competitiveness.

Telecom Industry in Singapore Market Size (In Billion)

However, the market faces challenges including mobile market saturation and heightened broadband competition. Maintaining superior network quality and security amidst burgeoning data demand presents a considerable hurdle. Significant capital expenditure is required for infrastructure upgrades to support 5G and next-generation technologies, potentially impacting operator profitability. Evolving consumer preferences and disruptive innovations also continuously reshape established business models. Key market segments—wireless data and messaging, OTT/Pay-TV, and voice services—exhibit varied growth patterns, requiring strategic market understanding for effective business planning. Future success will hinge on delivering high-value bundled services, investing in network modernization, and utilizing data analytics for personalized customer experiences.

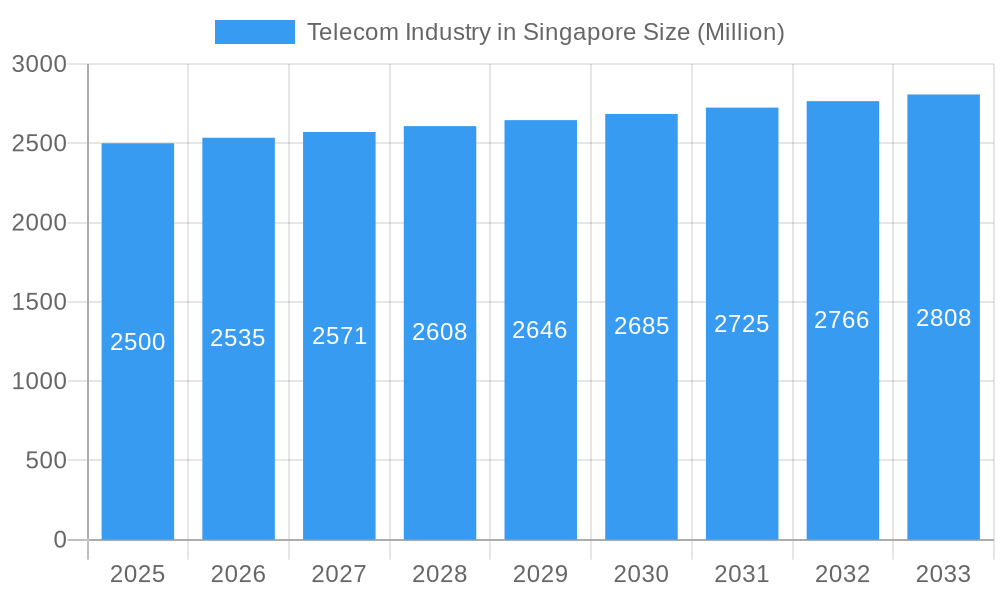

Telecom Industry in Singapore Company Market Share

Singapore Telecom Market Analysis: 2025-2033

This comprehensive report provides an in-depth analysis of the Singapore telecommunications industry, detailing market structure, competitive landscape, key trends, opportunities, and future projections from 2025 to 2033. This essential resource, based on extensive data and insights, is designed for industry professionals, investors, and strategists navigating this dynamic sector. The report scrutinizes core segments including wireless data, messaging, OTT, Pay-TV, and voice services, offering critical market sizing, forecasts, and trend analysis, with a particular focus on Average Revenue Per User (ARPU).

Telecom Industry in Singapore Market Structure & Competitive Landscape

The Singapore telecom market exhibits a moderately concentrated structure, with several major players dominating various segments. The market is characterized by intense competition, driving innovation and impacting pricing strategies. Regulatory frameworks, including those from the Infocomm Media Development Authority (IMDA), significantly influence market dynamics. The availability of robust fiber optic infrastructure and advancements in 5G technology are key innovation drivers. Product substitution is a factor, with Over-the-Top (OTT) services increasingly competing with traditional telecom offerings. The end-user segment is diverse, encompassing residential, business, and government users with varying needs and consumption patterns. M&A activity has been relatively modest in recent years, with a total estimated value of xx Million in the period 2019-2024, indicating a focus on organic growth.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a moderately concentrated market.

- Innovation Drivers: 5G deployment, fiber optic infrastructure expansion, advancements in cloud technologies.

- Regulatory Impacts: IMDA regulations influence licensing, spectrum allocation, and consumer protection.

- Product Substitutes: OTT services (e.g., WhatsApp, Netflix) pose a competitive threat to traditional voice and video services.

- End-User Segmentation: Residential, SME, Enterprise, Government.

- M&A Trends: Relatively low M&A activity in recent years, with an estimated xx Million in deal value from 2019-2024.

Telecom Industry in Singapore Market Trends & Opportunities

The Singapore telecom market is experiencing robust growth, driven by increasing smartphone penetration, rising data consumption, and the expanding adoption of digital services. The market size is estimated at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological shifts, such as the widespread adoption of 5G, are transforming service offerings and business models. Consumer preferences are evolving towards greater data allowances, bundled packages, and value-added services. Intense competition is forcing players to enhance network infrastructure, innovate service offerings, and optimize operational efficiency. Market penetration rates for 5G are increasing rapidly, anticipated to reach xx% by 2033. Opportunities exist in the expanding IoT sector, the growth of cloud services, and the emergence of new digital applications.

Dominant Markets & Segments in Telecom Industry in Singapore

The wireless data and messaging segment represents the dominant market segment in Singapore's telecom sector, fueled by high smartphone penetration and rising internet usage. OTT and Pay-TV services are also experiencing significant growth, with increasing consumer adoption of streaming platforms. The voice services market is experiencing a decline in traditional voice calls due to the increasing use of messaging and OTT applications.

- Wireless: Data and Messaging Services:

- Market size (2025): xx Million

- CAGR (2025-2033): xx%

- Key Growth Drivers: Rising smartphone penetration, increasing data consumption, 5G rollout.

- OTT and Pay-TV Services:

- Market size (2025): xx Million

- CAGR (2025-2033): xx%

- Key Growth Drivers: Increased consumer preference for streaming, affordable data packages, wider content library.

- Voice Services:

- ARPU (2025): xx

- Market size (2025): xx Million

- CAGR (2025-2033): -xx%

- Key Trends: Decline in traditional calls, shift towards OTT communication platforms.

Telecom Industry in Singapore Product Analysis

Product innovation is focused on enhancing network speeds and capacity, improving customer experience, and offering a wider range of value-added services. The market is seeing the introduction of advanced 5G technologies, enhanced data packages, bundled offerings, and innovative solutions for the IoT sector. These advancements are improving network performance, expanding service capabilities, and adapting to evolving consumer needs. The competitive advantage lies in offering superior network coverage, reliable service, and attractive pricing strategies.

Key Drivers, Barriers & Challenges in Telecom Industry in Singapore

Key Drivers: The Singapore government's emphasis on digitalization, advancements in 5G and fiber optic infrastructure, and increasing demand for data services are key drivers. Investment in digital infrastructure projects and regulatory support for innovation are boosting industry growth.

Challenges: Intense competition, rising operational costs, the need for ongoing investments in network infrastructure, and potential regulatory hurdles are major challenges. Maintaining high service quality and security, whilst managing cybersecurity risks and complying with stringent data privacy regulations present further hurdles. The impact of these challenges is seen in slower ARPU growth and tighter margins for some providers.

Growth Drivers in the Telecom Industry in Singapore Market

Government initiatives promoting digitalization, the expansion of 5G networks, and increasing demand for high-speed internet are significant growth drivers. The growing adoption of IoT devices and the expansion of cloud computing infrastructure also contribute to market expansion. Furthermore, the rising adoption of OTT and streaming services presents a significant opportunity for growth.

Challenges Impacting Telecom Industry in Singapore Growth

Intense competition among established players and the emergence of new entrants pose a significant challenge. Maintaining high service quality and network security against evolving cyber threats is crucial. Regulatory compliance and managing rising operational costs also present challenges to sustainable industry growth.

Key Players Shaping the Telecom Industry in Singapore Market

- Asia Access Telecom Pte Ltd

- TPG Telecom Pte Ltd

- PCCW Global

- Circles Life

- ViewQwest Pte Ltd

- Nexwave Telecoms Pte Ltd

- Singapore Telecommunications Limited

- StarHub Limited

- Thuraya Telecommunications Company

- M1 Limited

- Nera Telecommunications Ltd

Significant Telecom Industry in Singapore Industry Milestones

- September 2022: M1 Limited partnered with Gardens by the Bay and ESPL to offer high-speed 5G connectivity and immersive metaverse experiences. This showcased the potential of 5G for enhanced user experiences and new revenue streams.

- June 2023: Singapore's SGD10 million (USD 7.45 million) commitment to the ITU P2C Digital Coalition underscores the country's dedication to digital inclusion and global digital economy development, impacting the broader industry landscape.

Future Outlook for Telecom Industry in Singapore Market

The Singapore telecom industry is poised for continued growth, driven by technological advancements, increasing data consumption, and government support for digitalization. Strategic opportunities exist in expanding 5G coverage, developing innovative IoT solutions, and providing advanced cloud services. The market's potential is significant, with substantial growth anticipated in the coming years, particularly in areas such as 5G adoption and the evolution of digital services.

Telecom Industry in Singapore Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging

- 1.3. OTT and PayTV

-

1.1. Voice Services

Telecom Industry in Singapore Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Telecom Industry in Singapore Regional Market Share

Geographic Coverage of Telecom Industry in Singapore

Telecom Industry in Singapore REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust 5G Network; Increased Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Fragmented Nature of the Market and Growing Incidence of Data Breaches and Lack of Supporting Infrastructure; Lack of Cybersecurity Professionals

- 3.4. Market Trends

- 3.4.1. Robust 5G Framework

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Industry in Singapore Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging

- 5.1.3. OTT and PayTV

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Telecom Industry in Singapore Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and Messaging

- 6.1.3. OTT and PayTV

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America Telecom Industry in Singapore Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and Messaging

- 7.1.3. OTT and PayTV

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Telecom Industry in Singapore Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and Messaging

- 8.1.3. OTT and PayTV

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa Telecom Industry in Singapore Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and Messaging

- 9.1.3. OTT and PayTV

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific Telecom Industry in Singapore Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and Messaging

- 10.1.3. OTT and PayTV

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Asia Access Telecom Pte Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TPG Telecom Pte Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PCCW Global

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Circles Life*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ViewQwest Pte Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nexwave Telecoms Pte Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Singapore Telecommunications Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 StarHub Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thuraya Telecommunications Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 M1 Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nera Telecommunications Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Asia Access Telecom Pte Ltd

List of Figures

- Figure 1: Global Telecom Industry in Singapore Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Telecom Industry in Singapore Revenue (billion), by Services 2025 & 2033

- Figure 3: North America Telecom Industry in Singapore Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Telecom Industry in Singapore Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Telecom Industry in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Telecom Industry in Singapore Revenue (billion), by Services 2025 & 2033

- Figure 7: South America Telecom Industry in Singapore Revenue Share (%), by Services 2025 & 2033

- Figure 8: South America Telecom Industry in Singapore Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Telecom Industry in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Telecom Industry in Singapore Revenue (billion), by Services 2025 & 2033

- Figure 11: Europe Telecom Industry in Singapore Revenue Share (%), by Services 2025 & 2033

- Figure 12: Europe Telecom Industry in Singapore Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Telecom Industry in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Telecom Industry in Singapore Revenue (billion), by Services 2025 & 2033

- Figure 15: Middle East & Africa Telecom Industry in Singapore Revenue Share (%), by Services 2025 & 2033

- Figure 16: Middle East & Africa Telecom Industry in Singapore Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Telecom Industry in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Telecom Industry in Singapore Revenue (billion), by Services 2025 & 2033

- Figure 19: Asia Pacific Telecom Industry in Singapore Revenue Share (%), by Services 2025 & 2033

- Figure 20: Asia Pacific Telecom Industry in Singapore Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Telecom Industry in Singapore Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Telecom Industry in Singapore Revenue billion Forecast, by Services 2020 & 2033

- Table 2: Global Telecom Industry in Singapore Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Telecom Industry in Singapore Revenue billion Forecast, by Services 2020 & 2033

- Table 4: Global Telecom Industry in Singapore Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Telecom Industry in Singapore Revenue billion Forecast, by Services 2020 & 2033

- Table 9: Global Telecom Industry in Singapore Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Telecom Industry in Singapore Revenue billion Forecast, by Services 2020 & 2033

- Table 14: Global Telecom Industry in Singapore Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Telecom Industry in Singapore Revenue billion Forecast, by Services 2020 & 2033

- Table 25: Global Telecom Industry in Singapore Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Telecom Industry in Singapore Revenue billion Forecast, by Services 2020 & 2033

- Table 33: Global Telecom Industry in Singapore Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Telecom Industry in Singapore Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Industry in Singapore?

The projected CAGR is approximately 3.78%.

2. Which companies are prominent players in the Telecom Industry in Singapore?

Key companies in the market include Asia Access Telecom Pte Ltd, TPG Telecom Pte Ltd, PCCW Global, Circles Life*List Not Exhaustive, ViewQwest Pte Ltd, Nexwave Telecoms Pte Ltd, Singapore Telecommunications Limited, StarHub Limited, Thuraya Telecommunications Company, M1 Limited, Nera Telecommunications Ltd.

3. What are the main segments of the Telecom Industry in Singapore?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.84 billion as of 2022.

5. What are some drivers contributing to market growth?

Robust 5G Network; Increased Smartphone Usage.

6. What are the notable trends driving market growth?

Robust 5G Framework.

7. Are there any restraints impacting market growth?

Fragmented Nature of the Market and Growing Incidence of Data Breaches and Lack of Supporting Infrastructure; Lack of Cybersecurity Professionals.

8. Can you provide examples of recent developments in the market?

June 2023: Recognizing the importance of guaranteeing that all nations can benefit from and participate in the development of the global digital economy, Singapore is committing SGD10 million (USD 7.45 million) to the International Telecommunication Union (ITU) P2C Digital Coalition to assist the international organization in harnessing the complete potential of digital technologies in line with the UN Sustainable Development Goals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Industry in Singapore," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Industry in Singapore report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Industry in Singapore?

To stay informed about further developments, trends, and reports in the Telecom Industry in Singapore, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence