Key Insights

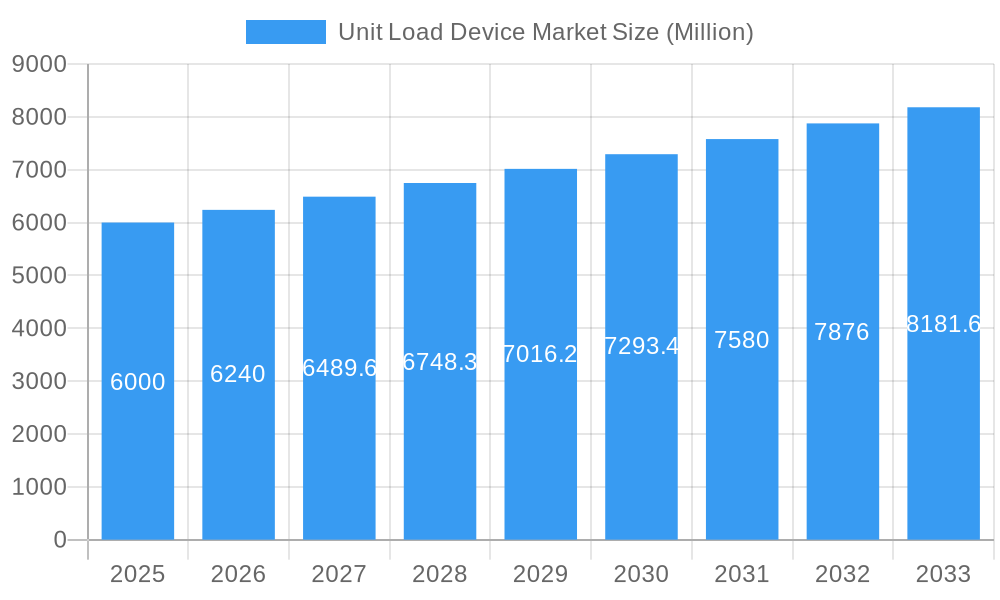

The Unit Load Device (ULD) market is poised for significant expansion, driven by the robust growth of the air freight industry and the escalating demand for efficient cargo handling solutions. Projecting a Compound Annual Growth Rate (CAGR) of 6%, the market, valued at $2.39 billion in the base year 2025, is set to experience substantial development throughout the forecast period (2025-2033). Key growth accelerators include the burgeoning e-commerce sector, which fuels air freight volumes, the increasing requirement for standardized and secure cargo transportation, and continuous technological advancements in ULD design, such as the integration of lighter, more durable materials and enhanced tracking capabilities. Market segmentation reveals strong demand for various ULD types, including containers and pallets, across commercial and cargo applications.

Unit Load Device Market Market Size (In Billion)

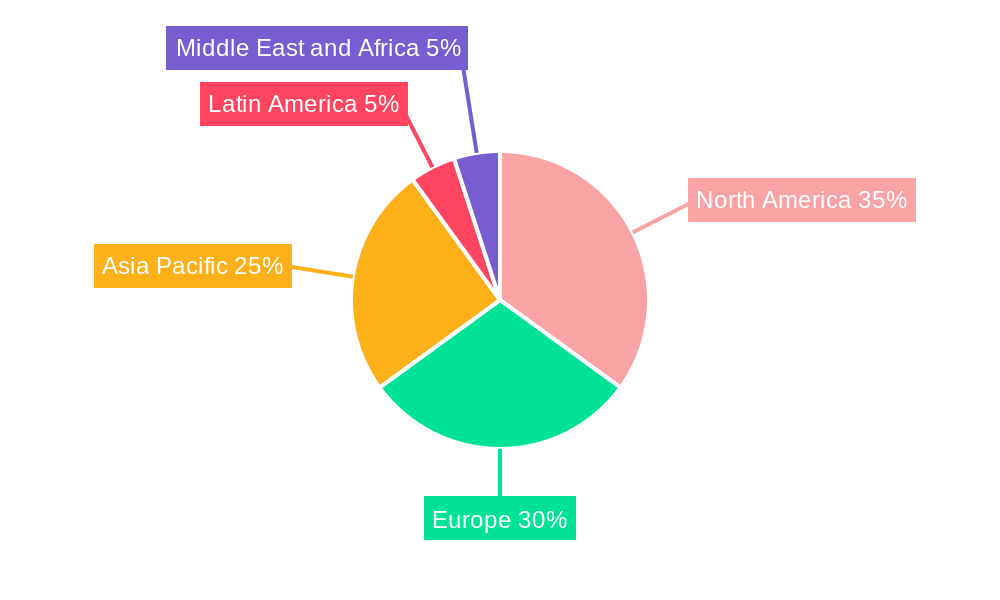

Regional analysis indicates a dynamic market landscape. North America and Europe maintain substantial market shares, supported by established air freight infrastructure and strong economic conditions. However, the Asia-Pacific region is anticipated to demonstrate the highest growth trajectory, fueled by rapid economic expansion and the flourishing manufacturing and e-commerce industries in key economies such as China and India. While market restraints like volatile fuel prices and global economic uncertainties exist, the overall outlook remains highly positive, underpinned by sustained growth in air freight demand and the persistent need for reliable and efficient ULD solutions. Furthermore, the increasing adoption of sustainable and eco-friendly ULDs will contribute to market expansion, aligning with global sustainability initiatives in logistics.

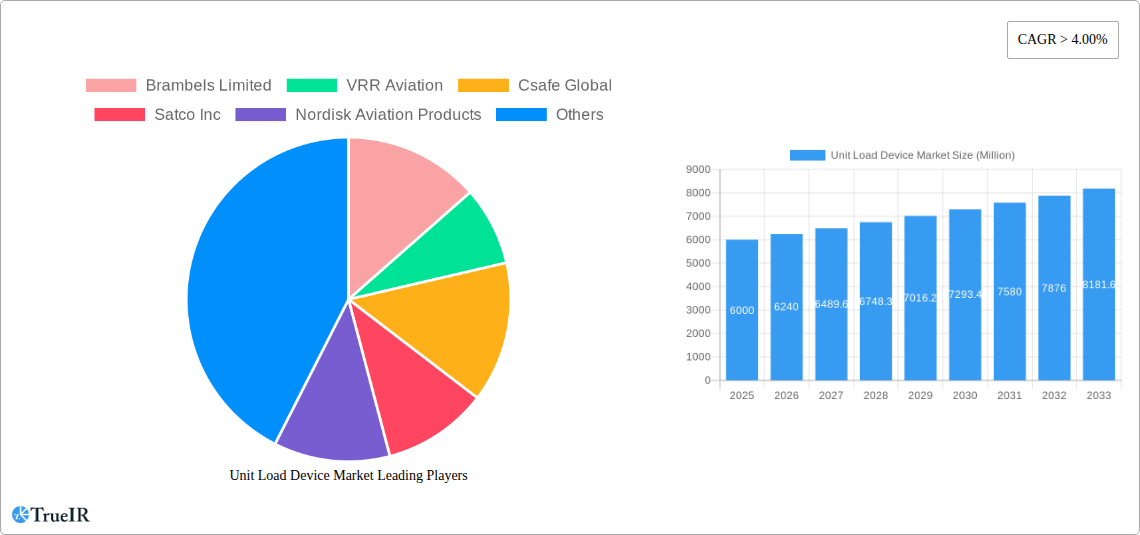

Unit Load Device Market Company Market Share

Unit Load Device (ULD) Market Analysis: Global Size, Growth, and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the global Unit Load Device (ULD) market, providing critical insights for industry stakeholders. Covering the period from 2025 to 2033, with 2025 as the base year, this study meticulously examines market structure, competitive dynamics, growth drivers, and future projections. The report employs extensive quantitative and qualitative data to forecast market trends and identify lucrative opportunities within the ULD sector.

Unit Load Device Market Market Structure & Competitive Landscape

The Unit Load Device market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Several key players dominate the market, leveraging their established infrastructure, technological expertise, and strong customer relationships. The market is characterized by ongoing innovation, driven by the need for lighter, stronger, and more technologically advanced ULDs to optimize air cargo efficiency and reduce operational costs. Stringent safety regulations and environmental concerns significantly impact market dynamics, necessitating compliance with international standards and fostering the development of sustainable ULD solutions. Product substitution is limited, primarily due to the specialized nature of ULDs and their integration with existing airline logistics. The end-user segment is primarily comprised of airlines, cargo carriers, and freight forwarders, with varying demands based on specific operational requirements and cargo types. Mergers and acquisitions (M&A) activity in the ULD sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on consolidation and technological advancements. This suggests an ongoing effort by key players to enhance their market share and product offerings.

Unit Load Device Market Market Trends & Opportunities

The global Unit Load Device market is poised for substantial growth during the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by the expanding global air cargo industry, rising e-commerce activities, and increasing demand for efficient and reliable air freight solutions. Technological advancements, such as the integration of smart sensors and IoT devices into ULDs, are enhancing cargo tracking, security, and overall supply chain visibility. Consumer preferences for faster and more reliable delivery services are driving the demand for sophisticated ULD management systems and technologically enhanced containers. The competitive landscape is characterized by both established industry giants and emerging players, leading to intense rivalry, innovation, and strategic partnerships. Market penetration rates for advanced ULD technologies are steadily increasing, with xx% market share estimated for smart ULDs in 2025. This ongoing technological integration is expected to unlock further efficiency gains and improve customer satisfaction across the air cargo value chain.

Dominant Markets & Segments in Unit Load Device Market

The North American region currently dominates the global ULD market, holding a xx% market share in 2025. This dominance is attributed to the robust air cargo infrastructure, the presence of major airlines and cargo carriers, and strong economic activity. Within the ULD types, containers represent a larger market segment compared to pallets (xx% and xx% respectively), driven by the versatility and high payload capacity of containers. The commercial application segment holds the largest share (xx%), supported by the extensive use of ULDs in passenger aircraft for baggage and cargo transport.

Key Growth Drivers in North America:

- Well-developed air cargo infrastructure.

- Presence of major airlines and logistics hubs.

- High level of e-commerce activity.

- Favorable government regulations.

Key Growth Drivers in Europe:

- Growing air cargo traffic volume.

- Expansion of e-commerce market.

- Technological advancements in ULD design and management.

Key Growth Drivers in Asia-Pacific:

- Rapid economic growth and increasing industrialization.

- Surge in air freight demand due to rising e-commerce penetration.

- Infrastructure development in emerging economies.

The Cargo application segment is also witnessing robust growth, driven by increasing global trade and the expansion of express delivery services. This is significantly boosting the market for specialized ULDs optimized for various cargo types.

Unit Load Device Market Product Analysis

Recent innovations in ULD technology focus on lightweight yet durable materials, improved temperature control systems, and integrated tracking devices. These advancements aim to enhance operational efficiency, reduce fuel consumption, and improve security. Products like reusable and recyclable containers with enhanced features are gaining traction. This shift addresses environmental concerns and reduces the overall lifecycle costs for operators. Competitive advantages primarily stem from superior design, advanced features, and robust after-sales support, all influencing customer choice and fostering long-term partnerships.

Key Drivers, Barriers & Challenges in Unit Load Device Market

Key Drivers: The growth of e-commerce, globalization, and the expanding air cargo industry are major drivers. Technological advancements like IoT-enabled ULDs, lighter materials, and improved temperature control are also key. Government initiatives promoting efficient air cargo logistics further contribute to growth.

Challenges: Supply chain disruptions and fluctuating raw material prices pose significant threats. Strict safety and environmental regulations impose compliance costs, and intense competition from established players creates pressure on pricing and margins. These factors combined create dynamic and complex challenges for market players.

Growth Drivers in the Unit Load Device Market Market

The burgeoning e-commerce sector and the consequent increase in air freight demand are pivotal drivers. Technological improvements like lightweight and durable materials, better temperature control, and RFID tracking systems enhance efficiency and reduce costs. Supportive government policies and investments in air cargo infrastructure also play a crucial role. These intertwined factors contribute to a positive outlook for market expansion.

Challenges Impacting Unit Load Device Market Growth

Supply chain disruptions due to geopolitical instability or unforeseen events can significantly impact production and delivery. Rising raw material costs increase production expenses, potentially reducing profit margins. Stiff competition, particularly from established players with large market shares, pressures prices and necessitates continuous innovation. Regulatory hurdles and stringent safety standards require significant investment in compliance.

Key Players Shaping the Unit Load Device Market Market

- Brambels Limited

- VRR Aviation

- Csafe Global

- Satco Inc

- Nordisk Aviation Products

- ACL Airshop

- Jettainer GmbH

- Envirotaine

- AEROTUF

- DoKaSch GmbH

Significant Unit Load Device Market Industry Milestones

- June 2022: Jettainer renewed its contract with Etihad Cargo for five years, encompassing the digitalization of Etihad Cargo's ULD fleet and integration of BLE tags. This highlights the increasing demand for advanced ULD management systems.

- August 2022: Jettainer secured a contract with Norse Atlantic Airways to provide ULD management services, showcasing Jettainer's expansion into new markets and its ability to provide tailored solutions to emerging airlines.

Future Outlook for Unit Load Device Market Market

The ULD market is projected to experience continued growth, driven by the expanding air cargo industry, technological advancements, and favorable government policies. Strategic opportunities exist in developing sustainable and technologically advanced ULDs, optimizing supply chains, and strengthening customer relationships. The market presents significant potential for companies that can adapt to the dynamic market trends and offer innovative solutions.

Unit Load Device Market Segmentation

-

1. Type

- 1.1. Containers

- 1.2. Pallets

-

2. Application

- 2.1. Commercial

- 2.2. Cargo

Unit Load Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Unit Load Device Market Regional Market Share

Geographic Coverage of Unit Load Device Market

Unit Load Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Segment is Expected to Show Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Unit Load Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Containers

- 5.1.2. Pallets

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Unit Load Device Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Containers

- 6.1.2. Pallets

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Cargo

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Unit Load Device Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Containers

- 7.1.2. Pallets

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Cargo

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Unit Load Device Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Containers

- 8.1.2. Pallets

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Cargo

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Unit Load Device Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Containers

- 9.1.2. Pallets

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial

- 9.2.2. Cargo

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Unit Load Device Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Containers

- 10.1.2. Pallets

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial

- 10.2.2. Cargo

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Brambels Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 VRR Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Csafe Global

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Satco Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nordisk Aviation Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ACL Airshop

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jettainer GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Envirotaine

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AEROTUF

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DoKaSch GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Brambels Limited

List of Figures

- Figure 1: Global Unit Load Device Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Unit Load Device Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Unit Load Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Unit Load Device Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Unit Load Device Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Unit Load Device Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Unit Load Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Unit Load Device Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Unit Load Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Unit Load Device Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Unit Load Device Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Unit Load Device Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Unit Load Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Unit Load Device Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Unit Load Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Unit Load Device Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Unit Load Device Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Unit Load Device Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Unit Load Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Unit Load Device Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Unit Load Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Unit Load Device Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Unit Load Device Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Unit Load Device Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Unit Load Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Unit Load Device Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Unit Load Device Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Unit Load Device Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Unit Load Device Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Unit Load Device Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Unit Load Device Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Unit Load Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Unit Load Device Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Unit Load Device Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Unit Load Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Unit Load Device Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Unit Load Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Unit Load Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Unit Load Device Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Unit Load Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Unit Load Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Unit Load Device Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Unit Load Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Unit Load Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Unit Load Device Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Unit Load Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Unit Load Device Market Revenue billion Forecast, by Type 2020 & 2033

- Table 31: Global Unit Load Device Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Unit Load Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Unit Load Device Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Unit Load Device Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Unit Load Device Market?

Key companies in the market include Brambels Limited, VRR Aviation, Csafe Global, Satco Inc, Nordisk Aviation Products, ACL Airshop, Jettainer GmbH, Envirotaine, AEROTUF, DoKaSch GmbH.

3. What are the main segments of the Unit Load Device Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Segment is Expected to Show Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: Jettainer was awarded a contract from Norse Atlantic Airways, a new Norwegian airline, to provide ULD management services. Jettainer has supplied the airline with a tailored and dedicated fleet of pallets and containers since its inaugural flight in June 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Unit Load Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Unit Load Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Unit Load Device Market?

To stay informed about further developments, trends, and reports in the Unit Load Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence