Key Insights

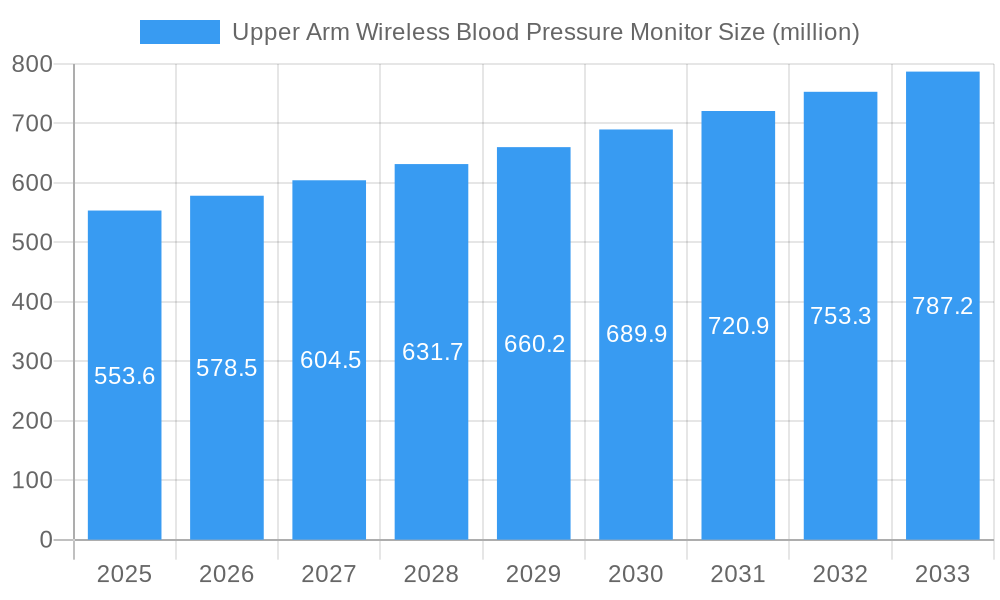

The Upper Arm Wireless Blood Pressure Monitor market is poised for significant expansion, projecting a market size of $553.6 million in 2025 with a robust CAGR of 4.5%. This growth is underpinned by a confluence of favorable factors, most notably the escalating global prevalence of hypertension and cardiovascular diseases. As healthcare awareness intensifies, consumers are increasingly seeking convenient and accurate home-monitoring solutions, driving demand for wireless blood pressure monitors. The ease of use and data-syncing capabilities offered by wireless devices appeal to a broad demographic, from tech-savvy individuals to the elderly, fostering wider adoption. Furthermore, technological advancements are continuously enhancing the precision, portability, and user-friendliness of these devices, making them indispensable tools for proactive health management.

Upper Arm Wireless Blood Pressure Monitor Market Size (In Million)

The market's upward trajectory is further fueled by the growing preference for at-home healthcare solutions, a trend accelerated by recent global health events. This shift empowers individuals to take greater control of their health, leading to increased investment in personal medical devices like wireless upper arm blood pressure monitors. The expanding availability of these devices through both online and offline sales channels ensures accessibility for diverse consumer segments. Leading companies are investing heavily in research and development, focusing on innovative features such as cloud connectivity, integration with health apps, and advanced diagnostic capabilities. While the market benefits from strong drivers, potential challenges such as stringent regulatory approvals and the need for consumer education on accurate usage will be crucial areas to address for sustained growth. The market is segmented into Fully Automatic and Semi-automatic types, with a strong inclination towards the fully automatic segment due to its user convenience.

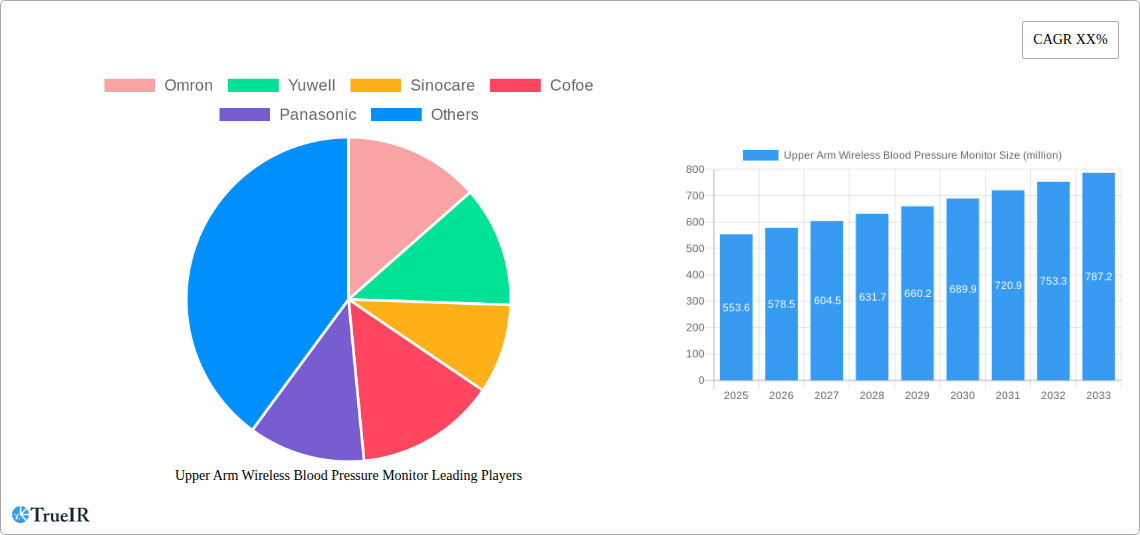

Upper Arm Wireless Blood Pressure Monitor Company Market Share

This comprehensive report delivers in-depth analysis of the global Upper Arm Wireless Blood Pressure Monitor market, encompassing market structure, trends, competitive landscape, and future outlook. Leveraging extensive data from the Study Period: 2019–2033, with Base Year: 2025 and Estimated Year: 2025, this report offers actionable insights for stakeholders across the healthcare technology industry.

Upper Arm Wireless Blood Pressure Monitor Market Structure & Competitive Landscape

The global Upper Arm Wireless Blood Pressure Monitor market exhibits a moderately fragmented structure, with a few dominant players coexisting alongside a significant number of emerging innovators. Market concentration is estimated at approximately 35% for the top five companies. Innovation is primarily driven by advancements in sensor technology, connectivity features (Bluetooth, Wi-Fi), and user-friendly interfaces. Regulatory impacts, particularly from health authorities like the FDA and EMA, are crucial, ensuring product safety and efficacy. The threat of product substitutes, while present from wrist-based monitors and traditional devices, is mitigated by the superior accuracy and ease of use of upper arm wireless models for home monitoring. End-user segmentation spans individuals managing hypertension, seniors, fitness enthusiasts, and healthcare providers. Mergers and Acquisitions (M&A) activity is moderate, with an estimated xx million in M&A volumes recorded between 2021-2024, primarily focused on acquiring innovative technologies and expanding market reach.

Upper Arm Wireless Blood Pressure Monitor Market Trends & Opportunities

The global Upper Arm Wireless Blood Pressure Monitor market is poised for substantial growth, projected to reach a market size of over xx million by 2033. The Forecast Period: 2025–2033 is expected to witness a robust Compound Annual Growth Rate (CAGR) of xx.x%. This expansion is fueled by a confluence of evolving consumer preferences and significant technological advancements. The increasing awareness and prevalence of cardiovascular diseases worldwide are primary drivers, prompting a greater demand for convenient and accurate home-based health monitoring solutions. The shift towards telehealth and remote patient monitoring further bolsters the market, as wireless blood pressure monitors seamlessly integrate into digital health ecosystems.

Technological innovation is a cornerstone of market evolution. The integration of Bluetooth and Wi-Fi connectivity enables effortless data synchronization with smartphones and cloud platforms, facilitating progress tracking and sharing with healthcare professionals. Advanced sensor technologies are enhancing accuracy and reliability, minimizing user error. Furthermore, the development of AI-powered insights and personalized health recommendations is emerging as a significant differentiator.

Consumer preferences are increasingly leaning towards user-friendly, portable, and data-driven devices. Patients managing chronic conditions like hypertension are seeking devices that empower them with actionable insights into their health. The convenience of wireless technology eliminates cumbersome cables and simplifies the measurement process, appealing to a broad demographic, including the elderly. Market penetration rates for wireless upper arm blood pressure monitors are steadily climbing, especially in developed economies, as healthcare providers increasingly recommend these devices for proactive health management. The growing acceptance of self-care and preventative healthcare strategies is a strong underlying trend.

Competitive dynamics are characterized by a drive for product differentiation through enhanced features, improved accuracy, and seamless app integration. Companies are investing heavily in R&D to develop next-generation devices that offer a superior user experience and more comprehensive health data. The market is also witnessing the rise of digital health platforms that leverage data from these devices to offer personalized health coaching and chronic disease management programs.

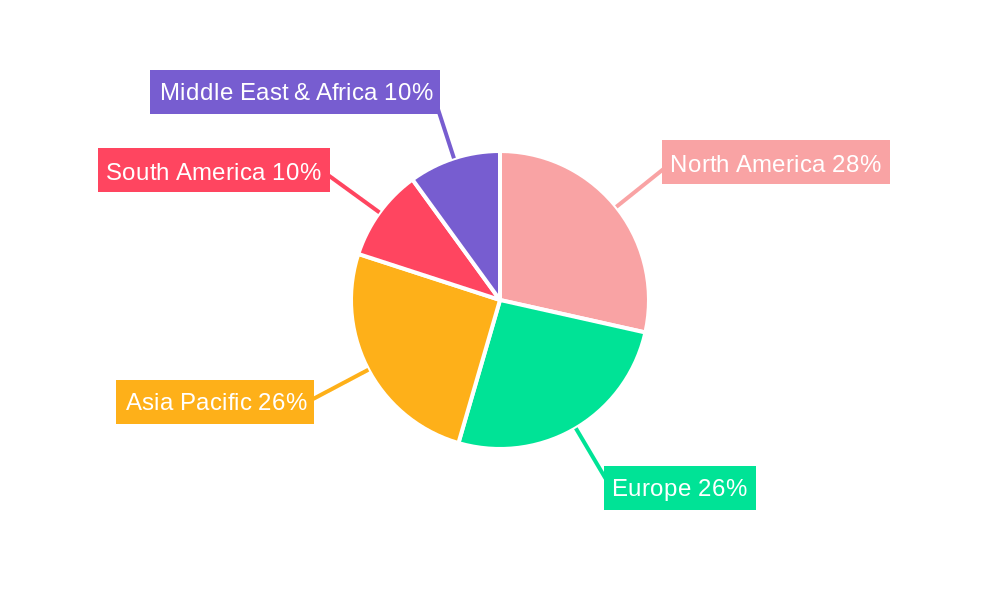

Dominant Markets & Segments in Upper Arm Wireless Blood Pressure Monitor

The Upper Arm Wireless Blood Pressure Monitor market showcases distinct regional and segment dominance. Online Sales are emerging as the leading application segment, projected to account for over xx% of the market by 2033. This growth is propelled by the convenience, wider product selection, and competitive pricing typically offered by e-commerce platforms. Key growth drivers include the expanding internet penetration, the increasing comfort of consumers with online purchases of health devices, and the targeted marketing strategies employed by manufacturers and retailers.

Within the Types segment, Fully Automatic blood pressure monitors are dominant, expected to capture over xx% of the market share in the forecast period. Their ease of use, requiring minimal user intervention and providing rapid results, makes them highly appealing to a broad consumer base, including the elderly and those with limited technical proficiency. The technological advancements in cuff inflation and deflation mechanisms have significantly improved the accuracy and user experience of fully automatic devices.

Geographically, North America and Europe currently lead the market, driven by factors such as high disposable incomes, a well-established healthcare infrastructure, a greater prevalence of lifestyle diseases, and strong government initiatives promoting digital health. The United States and Germany are particularly significant markets within these regions. In the United States, the increasing adoption of telehealth services and a proactive approach to chronic disease management contribute to robust demand. In Germany, stringent quality standards and a well-insured population further boost the market.

Asia Pacific is the fastest-growing region, fueled by a burgeoning middle class, increasing healthcare expenditure, a rising awareness of cardiovascular health, and a growing elderly population. Countries like China and India are witnessing rapid market expansion due to the increasing availability of affordable yet technologically advanced devices and government efforts to improve healthcare access.

The dominance of these segments and regions underscores the market's trajectory towards greater accessibility, user-friendliness, and digital integration in blood pressure monitoring.

Upper Arm Wireless Blood Pressure Monitor Product Analysis

Product innovations in the Upper Arm Wireless Blood Pressure Monitor market are primarily focused on enhanced accuracy, user convenience, and seamless data integration. Advanced cuff designs offer improved comfort and better fit for a wider range of arm circumferences. Connectivity features like Bluetooth and Wi-Fi are standard, enabling effortless syncing with companion mobile applications that provide trend analysis, personalized insights, and secure data sharing with healthcare providers. Some models incorporate irregular heartbeat detection and atrial fibrillation (AFib) alerts, adding significant value for users concerned about cardiac health. The competitive advantage lies in intuitive app interfaces, long battery life, and compact, portable designs that promote consistent monitoring.

Key Drivers, Barriers & Challenges in Upper Arm Wireless Blood Pressure Monitor

Key Drivers:

- Rising Prevalence of Cardiovascular Diseases: Increasing global rates of hypertension and other heart-related conditions drive demand for continuous monitoring.

- Technological Advancements: Innovations in sensor accuracy, wireless connectivity (Bluetooth, Wi-Fi), and user-friendly apps enhance device appeal.

- Growth of Telehealth and Remote Patient Monitoring: Wireless blood pressure monitors are integral to these growing healthcare models.

- Growing Health Consciousness and Preventive Healthcare: Consumers are proactively managing their health, leading to increased adoption of home monitoring devices.

- Aging Population: A larger elderly demographic requires more frequent and accessible health monitoring.

Barriers & Challenges:

- Regulatory Hurdles: Obtaining approvals from health authorities (FDA, CE) can be time-consuming and costly.

- Data Security and Privacy Concerns: Ensuring the secure handling of sensitive health data is paramount and can be a complex challenge.

- Price Sensitivity: While demand is high, cost remains a barrier for some consumers, especially in developing economies.

- Competition from Lower-Priced Alternatives: Traditional or less feature-rich devices can still be attractive due to their lower price point.

- Accuracy Concerns and User Error: Despite advancements, ensuring consistent accuracy and minimizing user error during measurement remains an ongoing challenge for manufacturers.

- Supply Chain Disruptions: Global events can impact the availability of components and the timely delivery of finished products.

Growth Drivers in the Upper Arm Wireless Blood Pressure Monitor Market

The Upper Arm Wireless Blood Pressure Monitor market is propelled by several key factors. Technologically, the integration of sophisticated algorithms for more accurate readings and the development of AI-driven insights that offer personalized health advice are significant growth catalysts. Economically, increasing disposable incomes in emerging markets and the growing focus on value-based healthcare, where preventative monitoring is encouraged, are driving adoption. Policy-wise, government initiatives promoting digital health and telehealth services create a supportive environment for wireless monitoring devices. For instance, programs encouraging home-based chronic disease management directly benefit the market.

Challenges Impacting Upper Arm Wireless Blood Pressure Monitor Growth

Several challenges can impact the growth trajectory of the Upper Arm Wireless Blood Pressure Monitor market. Regulatory complexities, including the need for ongoing compliance with evolving medical device standards across different regions, can slow down product launches and market entry. Supply chain vulnerabilities, highlighted by recent global events, pose a risk to consistent production and availability. Competitive pressures are intense, with a constant need for innovation to stay ahead, and the threat of commoditization in certain market segments exists. Furthermore, ensuring consistent user adoption and addressing potential accuracy issues that could lead to distrust in the technology are ongoing challenges that require significant consumer education and robust quality control.

Key Players Shaping the Upper Arm Wireless Blood Pressure Monitor Market

- Omron

- Yuwell

- Sinocare

- Cofoe

- Panasonic

- Andon

- Microlife

- A&D

- Rossmax

- Qardio

- Medline

- Beurer

- Kinetik Medical Devices

- Paul Hartmann

Significant Upper Arm Wireless Blood Pressure Monitor Industry Milestones

- 2019: Increased integration of Bluetooth Low Energy (BLE) for seamless smartphone connectivity.

- 2020: Surge in demand driven by the COVID-19 pandemic, emphasizing home health monitoring.

- 2021: Introduction of advanced AI algorithms for more precise readings and personalized health insights.

- 2022: Growing adoption of Wi-Fi connectivity for direct cloud-based data storage and accessibility.

- 2023: Expansion of FDA-cleared devices with atrial fibrillation (AFib) detection capabilities.

- 2024: Greater focus on eco-friendly materials and sustainable manufacturing practices in new product releases.

Future Outlook for Upper Arm Wireless Blood Pressure Monitor Market

The future outlook for the Upper Arm Wireless Blood Pressure Monitor market is exceptionally bright, driven by continued technological innovation and an increasing global emphasis on preventative healthcare. Strategic opportunities lie in further integrating these devices with comprehensive digital health platforms, offering predictive analytics, and personalizing health management plans. The market potential is significant, especially in expanding its reach into underserved regions and developing more affordable yet advanced monitoring solutions. The growing acceptance of remote patient monitoring by healthcare systems worldwide will act as a major catalyst for sustained growth in the coming years.

Upper Arm Wireless Blood Pressure Monitor Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Fully Automatic

- 2.2. Semi-automatic

Upper Arm Wireless Blood Pressure Monitor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Upper Arm Wireless Blood Pressure Monitor Regional Market Share

Geographic Coverage of Upper Arm Wireless Blood Pressure Monitor

Upper Arm Wireless Blood Pressure Monitor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Upper Arm Wireless Blood Pressure Monitor Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fully Automatic

- 5.2.2. Semi-automatic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Upper Arm Wireless Blood Pressure Monitor Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fully Automatic

- 6.2.2. Semi-automatic

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Upper Arm Wireless Blood Pressure Monitor Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fully Automatic

- 7.2.2. Semi-automatic

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Upper Arm Wireless Blood Pressure Monitor Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fully Automatic

- 8.2.2. Semi-automatic

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fully Automatic

- 9.2.2. Semi-automatic

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Upper Arm Wireless Blood Pressure Monitor Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fully Automatic

- 10.2.2. Semi-automatic

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Omron

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yuwell

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sinocare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cofoe

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Panasonic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Andon

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microlife

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 A&D

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rossmax

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qardio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Medline

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Beurer

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Kinetik Medical Devices

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Paul Hartmann

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Omron

List of Figures

- Figure 1: Global Upper Arm Wireless Blood Pressure Monitor Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Upper Arm Wireless Blood Pressure Monitor Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Upper Arm Wireless Blood Pressure Monitor Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Upper Arm Wireless Blood Pressure Monitor Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Upper Arm Wireless Blood Pressure Monitor Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Upper Arm Wireless Blood Pressure Monitor?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Upper Arm Wireless Blood Pressure Monitor?

Key companies in the market include Omron, Yuwell, Sinocare, Cofoe, Panasonic, Andon, Microlife, A&D, Rossmax, Qardio, Medline, Beurer, Kinetik Medical Devices, Paul Hartmann.

3. What are the main segments of the Upper Arm Wireless Blood Pressure Monitor?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Upper Arm Wireless Blood Pressure Monitor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Upper Arm Wireless Blood Pressure Monitor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Upper Arm Wireless Blood Pressure Monitor?

To stay informed about further developments, trends, and reports in the Upper Arm Wireless Blood Pressure Monitor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence