Key Insights

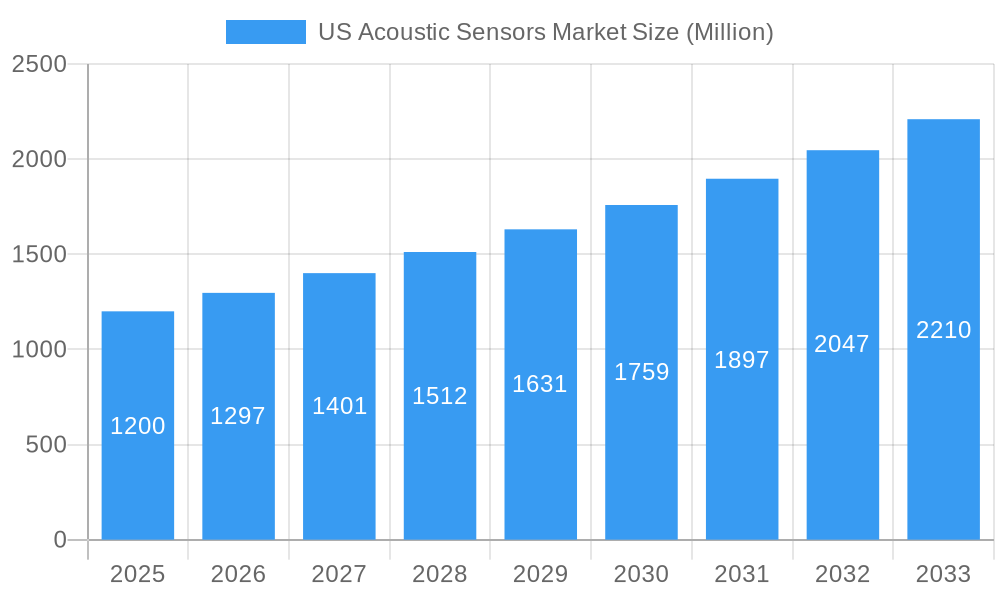

The US acoustic sensors market is projected for substantial growth, forecasted to reach $1.58 billion by 2029, expanding at a Compound Annual Growth Rate (CAGR) of 12.4%. This robust expansion is driven by rapid technological advancements and escalating demand across multiple industries. Key growth catalysts include the widespread integration of Advanced Driver-Assistance Systems (ADAS) in the automotive sector for enhanced object detection and collision avoidance, and the rising need for sophisticated monitoring and diagnostics in industrial automation, particularly for predictive maintenance and process optimization. The healthcare industry is also a significant contributor, utilizing acoustic sensors for non-invasive patient monitoring, advanced medical imaging, and diagnostic tools. Innovations in wireless acoustic sensing technologies are enhancing deployment flexibility, while advancements in surface and bulk wave technologies are improving precision and sensitivity for sensing parameters like temperature, pressure, and chemical vapors.

US Acoustic Sensors Market Market Size (In Billion)

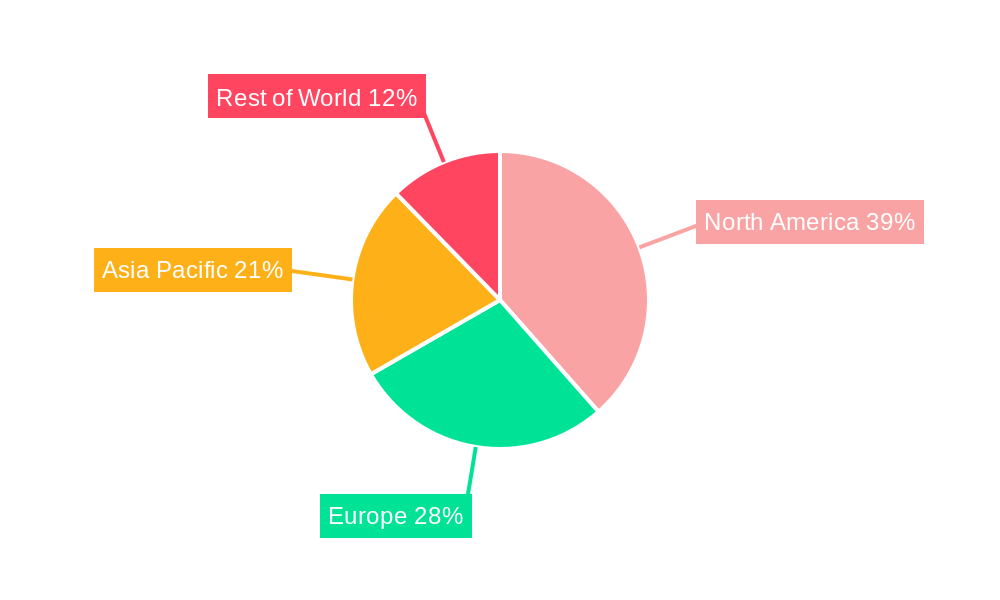

Market dynamics are further influenced by the miniaturization of acoustic sensor components, enabling integration into increasingly compact devices, notably in consumer electronics and wearable technology. Growing emphasis on environmental monitoring and industrial safety is also boosting demand for sensors capable of detecting subtle sound variations and vibrations. While significant opportunities exist, potential restraints such as the upfront investment for advanced acoustic sensor systems and the requirement for specialized installation and maintenance expertise may influence growth in specific segments. However, ongoing development of cost-effective solutions and increasing awareness of the benefits of acoustic sensing are expected to address these challenges. North America, led by the United States, is anticipated to retain its dominant market position, attributed to early adoption of cutting-edge technologies and substantial R&D investments in critical application areas like automotive and industrial sectors.

US Acoustic Sensors Market Company Market Share

Here is a dynamic, SEO-optimized report description for the US Acoustic Sensors Market, designed for immediate use:

US Acoustic Sensors Market: Comprehensive Market Analysis, Trends, and Forecast 2019–2033

This in-depth report provides a meticulous analysis of the US Acoustic Sensors Market, a vital sector underpinning advancements across numerous industries. Leveraging high-volume search terms and offering unparalleled insights, this report is essential for stakeholders seeking to understand market dynamics, competitive strategies, and future growth trajectories. We cover the US acoustic sensor industry, acoustic sensing technology, and advanced acoustic solutions within the United States, from 2019 to 2033, with a detailed focus on the 2025 base year and the 2025-2033 forecast period.

US Acoustic Sensors Market Market Structure & Competitive Landscape

The US Acoustic Sensors Market exhibits a moderately concentrated structure, characterized by a blend of established global players and specialized domestic manufacturers. Innovation remains a key driver, fueled by continuous research and development in miniaturization, increased sensitivity, and enhanced data processing capabilities. Regulatory frameworks, particularly those concerning safety and environmental monitoring, indirectly influence market adoption and product development. While direct product substitutes are limited for core acoustic sensing functions, advancements in alternative sensing modalities in specific niche applications present a nuanced competitive landscape. End-user segmentation reveals significant reliance on sectors like Aerospace and Defense, Automotive, and Industrial applications, each with distinct performance and reliability demands. Merger and Acquisition (M&A) activity, while not at peak levels, is anticipated to increase as companies seek to broaden their technological portfolios and market reach, with an estimated xx M&A deals recorded historically. The competitive landscape is shaped by the ability of companies to offer integrated solutions and adapt to evolving technological requirements and stringent application-specific standards.

US Acoustic Sensors Market Market Trends & Opportunities

The US Acoustic Sensors Market is poised for significant expansion, driven by escalating demand for sophisticated sensing solutions across a spectrum of industries. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period, reaching an estimated market size of USD xx Million by 2033. Technological advancements are at the forefront, with a notable shift towards wireless acoustic sensors offering enhanced deployment flexibility and reduced installation costs, particularly in large-scale industrial and infrastructure monitoring projects. The increasing integration of acoustic sensors with AI and machine learning algorithms is unlocking new opportunities for predictive maintenance, anomaly detection, and enhanced operational efficiency. Consumer preferences are also influencing the market, with a growing demand for acoustic sensing in smart home devices, wearable technology, and advanced audio systems.

The US acoustic sensor market trends are heavily influenced by national security imperatives, particularly within the Aerospace and Defense sector. Investments in advanced surveillance, anti-submarine warfare (ASW), and unmanned systems are creating substantial demand for high-performance acoustic sensors. The automotive industry is another major growth engine, with acoustic sensors playing a crucial role in advanced driver-assistance systems (ADAS), in-cabin monitoring, and noise cancellation technologies. The industrial sector is rapidly adopting acoustic sensors for condition monitoring of machinery, leak detection, and process optimization, leading to improved safety and reduced operational downtime.

Emerging opportunities lie in the healthcare sector, where acoustic sensors are finding applications in diagnostic tools, patient monitoring, and medical device development. The expanding Internet of Things (IoT) ecosystem is also a significant catalyst, as acoustic sensors are increasingly integrated into connected devices for environmental monitoring, security, and industrial automation. The push towards digitalization and smart infrastructure across the US is creating a fertile ground for acoustic sensor adoption, offering immense potential for market players to innovate and capture market share.

Dominant Markets & Segments in US Acoustic Sensors Market

The US Acoustic Sensors Market is characterized by distinct dominant segments across its various categories. In terms of Type, Wired acoustic sensors currently hold a significant market share due to their reliability and established infrastructure, particularly in critical industrial applications. However, Wireless acoustic sensors are experiencing a rapid growth trajectory, driven by their inherent flexibility, ease of deployment, and compatibility with evolving IoT architectures.

Analyzing Wave Type, Bulk Wave acoustic sensors remain prevalent due to their established performance characteristics in a wide range of applications. Nonetheless, Surface Wave acoustic sensors are gaining traction, particularly in specialized applications requiring high sensitivity and miniaturization.

Across Sensing Parameters, Pressure and Temperature sensors constitute the largest segments, reflecting their ubiquitous demand in industrial, automotive, and environmental monitoring. Torque and Mass sensing applications are also significant, particularly within industrial automation and automotive powertrain management. Emerging applications are witnessing growth in Chemical Vapor and Humidity sensing, driven by environmental regulations and process control needs.

The Application segment paints a clear picture of market dominance. The Aerospace and Defense sector stands out as a leading consumer, driven by the extensive use of acoustic sensors in naval applications, airborne surveillance, and unmanned systems. The Automotive sector follows closely, fueled by the increasing adoption of ADAS and in-cabin monitoring systems. Industrial applications represent another substantial segment, with acoustic sensors vital for machinery health monitoring, predictive maintenance, and process optimization. Consumer Electronics and Healthcare are emerging growth areas, poised for significant expansion in the coming years.

Key growth drivers in these dominant segments include:

- Infrastructure Development: Increased investment in national infrastructure, smart cities, and defense modernization projects directly fuels demand for robust acoustic sensing solutions.

- Technological Advancements: Continuous innovation in sensor materials, signal processing, and wireless communication enhances performance and expands application possibilities.

- Stringent Regulations: Evolving environmental and safety regulations necessitate more sophisticated monitoring capabilities, driving the adoption of advanced acoustic sensors.

- Cost-Effectiveness: The development of more affordable and efficient acoustic sensor technologies is making them accessible to a broader range of applications.

US Acoustic Sensors Market Product Analysis

The US acoustic sensor market is defined by continuous product innovation focused on enhancing performance, miniaturization, and integration capabilities. Key advancements include the development of highly sensitive piezoelectric and MEMS-based sensors, improved signal processing algorithms for clearer data interpretation, and the integration of wireless communication modules for seamless connectivity. These innovations translate into competitive advantages such as increased accuracy, reduced power consumption, and broader operational temperature ranges. Applications are expanding from traditional noise and vibration monitoring to sophisticated leak detection, structural health monitoring, and advanced diagnostic tools in healthcare and automotive sectors, demonstrating the growing versatility and market fit of these advanced acoustic sensing technologies.

Key Drivers, Barriers & Challenges in US Acoustic Sensors Market

The US Acoustic Sensors Market is propelled by several key drivers. Technological advancements in piezoelectric and MEMS technologies, leading to smaller, more sensitive, and energy-efficient sensors, are paramount. The growing adoption of IoT and Industry 4.0 initiatives, necessitating real-time data acquisition and analysis for predictive maintenance and process optimization, also acts as a significant catalyst. Furthermore, stringent regulatory mandates for environmental monitoring, safety compliance, and product quality control across sectors like automotive and aerospace are driving demand for reliable acoustic sensing solutions. Increased government spending on defense and homeland security further bolsters the market.

However, the market faces several barriers and challenges. High initial investment costs for certain advanced acoustic sensor systems and integration can be a restraint for smaller enterprises. The complexity of data interpretation and the need for specialized expertise for effective utilization of acoustic sensor data can also pose a challenge. Supply chain disruptions for critical raw materials and components, as experienced historically, can impact production volumes and lead times. Furthermore, the presence of mature, albeit less sophisticated, legacy sensing technologies in some applications presents a competitive hurdle. Cybersecurity concerns related to connected acoustic sensor networks also require careful consideration and robust solutions.

Growth Drivers in the US Acoustic Sensors Market Market

Key drivers fueling the growth of the US Acoustic Sensors Market are predominantly technological, economic, and regulatory. Technologically, the continuous miniaturization of acoustic sensors, coupled with enhanced sensitivity and extended frequency response, allows for their integration into increasingly compact and complex systems, such as within advanced driver-assistance systems (ADAS) and wearable medical devices. Economically, the burgeoning adoption of the Industrial Internet of Things (IIoT) and the pursuit of operational efficiency through predictive maintenance strategies create a substantial demand for acoustic sensors to monitor equipment health and detect anomalies before failures occur. Regulatory drivers, including stricter environmental noise pollution standards and enhanced safety protocols in industries like aerospace and defense, necessitate the deployment of sophisticated acoustic monitoring equipment. For instance, the recent naval contract for sonobuoys exemplifies the significant defense-driven growth.

Challenges Impacting US Acoustic Sensors Market Growth

Several challenges continue to impact the growth trajectory of the US Acoustic Sensors Market. Regulatory complexities, particularly the need for compliance with diverse industry-specific standards and certifications, can prolong product development cycles and increase R&D costs. Supply chain issues, including potential shortages of rare earth elements or specialized manufacturing components, pose a risk to production continuity and cost stability. Competitive pressures from both established players and emerging market entrants drive down profit margins and necessitate continuous innovation. Furthermore, the skilled workforce gap in advanced sensor design, data analytics, and signal processing can hinder the widespread adoption and effective utilization of cutting-edge acoustic sensor technologies. The significant initial investment required for some advanced systems remains a barrier for smaller businesses seeking to implement these solutions.

Key Players Shaping the US Acoustic Sensors Market Market

- ifm efector inc

- Dytran Instruments Inc

- Honeywell Sensing and Productivity Solutions

- Vectron International Inc (Microchip Technology Incorporated)

- Transense Technologies plc

- Siemens AG

- pro-micron GmbH

- Murata Manufacturing Co Ltd

- Campbell Scientific Inc

Significant US Acoustic Sensors Market Industry Milestones

- December 2021: Officials of the Naval Air Systems Command announced a USD 222.3 Million contract to ERAPSCO and Lockheed Martin Corp. for the production of AN/SSQ-125 multi-static sonobuoys, crucial acoustic sensors for airborne Anti-Submarine Warfare (ASW) operations. This development underscores the significant investment in advanced underwater acoustic sensing for defense applications, impacting market demand and innovation in specialized acoustic sensors.

- December 2021: Marine scientists at the University of South Florida successfully conducted field missions in Tampa Bay and the Gulf of Mexico, testing a novel approach to mapping vulnerable shallow coastal areas using an acoustic sensor mounted on an unmanned surface vehicle (USV), alongside laser-based and satellite sensors. This milestone highlights the expanding applications of acoustic sensing in environmental research, coastal management, and the development of remote sensing technologies, indicating growth potential in the environmental monitoring segment.

Future Outlook for US Acoustic Sensors Market Market

The future outlook for the US Acoustic Sensors Market is exceptionally promising, driven by relentless technological innovation and expanding application frontiers. The ongoing integration of artificial intelligence and machine learning with acoustic sensor data will unlock unprecedented capabilities in predictive analytics, anomaly detection, and autonomous systems, particularly in industrial automation and defense. The burgeoning growth of the IoT ecosystem will continue to fuel demand for connected acoustic sensing solutions across smart cities, smart homes, and industrial environments. Furthermore, increased focus on sustainability, environmental monitoring, and advanced healthcare diagnostics will create significant new market opportunities. Strategic partnerships, targeted research and development, and a proactive approach to emerging applications will be critical for stakeholders to capitalize on the substantial growth potential within this dynamic market. The market is projected to experience sustained growth, driven by these critical catalysts.

US Acoustic Sensors Market Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. Wave Type

- 2.1. Surface Wave

- 2.2. Bulk Wave

-

3. Sensing Parameter

- 3.1. Temperature

- 3.2. Pressure

- 3.3. Torque

- 3.4. Mass

- 3.5. Humidity

- 3.6. Viscosity

- 3.7. Chemical Vapor

-

4. Application

- 4.1. Automotive

- 4.2. Aerospace and Defense

- 4.3. Consumer Electronics

- 4.4. Healthcare

- 4.5. Industrial

- 4.6. Other Applications

US Acoustic Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Acoustic Sensors Market Regional Market Share

Geographic Coverage of US Acoustic Sensors Market

US Acoustic Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Telecommunications Market; Low Manufacturing Costs

- 3.3. Market Restrains

- 3.3.1. Technical Challenges Associated with Acoustic Sensors

- 3.4. Market Trends

- 3.4.1. Pressure Sensors to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Acoustic Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Wave Type

- 5.2.1. Surface Wave

- 5.2.2. Bulk Wave

- 5.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 5.3.1. Temperature

- 5.3.2. Pressure

- 5.3.3. Torque

- 5.3.4. Mass

- 5.3.5. Humidity

- 5.3.6. Viscosity

- 5.3.7. Chemical Vapor

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Automotive

- 5.4.2. Aerospace and Defense

- 5.4.3. Consumer Electronics

- 5.4.4. Healthcare

- 5.4.5. Industrial

- 5.4.6. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Acoustic Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Wave Type

- 6.2.1. Surface Wave

- 6.2.2. Bulk Wave

- 6.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 6.3.1. Temperature

- 6.3.2. Pressure

- 6.3.3. Torque

- 6.3.4. Mass

- 6.3.5. Humidity

- 6.3.6. Viscosity

- 6.3.7. Chemical Vapor

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Automotive

- 6.4.2. Aerospace and Defense

- 6.4.3. Consumer Electronics

- 6.4.4. Healthcare

- 6.4.5. Industrial

- 6.4.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Acoustic Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Wave Type

- 7.2.1. Surface Wave

- 7.2.2. Bulk Wave

- 7.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 7.3.1. Temperature

- 7.3.2. Pressure

- 7.3.3. Torque

- 7.3.4. Mass

- 7.3.5. Humidity

- 7.3.6. Viscosity

- 7.3.7. Chemical Vapor

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Automotive

- 7.4.2. Aerospace and Defense

- 7.4.3. Consumer Electronics

- 7.4.4. Healthcare

- 7.4.5. Industrial

- 7.4.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Acoustic Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Wave Type

- 8.2.1. Surface Wave

- 8.2.2. Bulk Wave

- 8.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 8.3.1. Temperature

- 8.3.2. Pressure

- 8.3.3. Torque

- 8.3.4. Mass

- 8.3.5. Humidity

- 8.3.6. Viscosity

- 8.3.7. Chemical Vapor

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Automotive

- 8.4.2. Aerospace and Defense

- 8.4.3. Consumer Electronics

- 8.4.4. Healthcare

- 8.4.5. Industrial

- 8.4.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Acoustic Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Wave Type

- 9.2.1. Surface Wave

- 9.2.2. Bulk Wave

- 9.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 9.3.1. Temperature

- 9.3.2. Pressure

- 9.3.3. Torque

- 9.3.4. Mass

- 9.3.5. Humidity

- 9.3.6. Viscosity

- 9.3.7. Chemical Vapor

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Automotive

- 9.4.2. Aerospace and Defense

- 9.4.3. Consumer Electronics

- 9.4.4. Healthcare

- 9.4.5. Industrial

- 9.4.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Acoustic Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Wave Type

- 10.2.1. Surface Wave

- 10.2.2. Bulk Wave

- 10.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 10.3.1. Temperature

- 10.3.2. Pressure

- 10.3.3. Torque

- 10.3.4. Mass

- 10.3.5. Humidity

- 10.3.6. Viscosity

- 10.3.7. Chemical Vapor

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Automotive

- 10.4.2. Aerospace and Defense

- 10.4.3. Consumer Electronics

- 10.4.4. Healthcare

- 10.4.5. Industrial

- 10.4.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ifm efector inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dytran Instruments Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell Sensing and Productivity Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vectron International Inc (Microchip technology Incorporated)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Transense Technologies plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 pro-micron GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Murata Manufacturing Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Campbell Scientific Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ifm efector inc

List of Figures

- Figure 1: Global US Acoustic Sensors Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Acoustic Sensors Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America US Acoustic Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Acoustic Sensors Market Revenue (billion), by Wave Type 2025 & 2033

- Figure 5: North America US Acoustic Sensors Market Revenue Share (%), by Wave Type 2025 & 2033

- Figure 6: North America US Acoustic Sensors Market Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 7: North America US Acoustic Sensors Market Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 8: North America US Acoustic Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 9: North America US Acoustic Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America US Acoustic Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America US Acoustic Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Acoustic Sensors Market Revenue (billion), by Type 2025 & 2033

- Figure 13: South America US Acoustic Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America US Acoustic Sensors Market Revenue (billion), by Wave Type 2025 & 2033

- Figure 15: South America US Acoustic Sensors Market Revenue Share (%), by Wave Type 2025 & 2033

- Figure 16: South America US Acoustic Sensors Market Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 17: South America US Acoustic Sensors Market Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 18: South America US Acoustic Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 19: South America US Acoustic Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: South America US Acoustic Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America US Acoustic Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US Acoustic Sensors Market Revenue (billion), by Type 2025 & 2033

- Figure 23: Europe US Acoustic Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe US Acoustic Sensors Market Revenue (billion), by Wave Type 2025 & 2033

- Figure 25: Europe US Acoustic Sensors Market Revenue Share (%), by Wave Type 2025 & 2033

- Figure 26: Europe US Acoustic Sensors Market Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 27: Europe US Acoustic Sensors Market Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 28: Europe US Acoustic Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Europe US Acoustic Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe US Acoustic Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe US Acoustic Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Acoustic Sensors Market Revenue (billion), by Type 2025 & 2033

- Figure 33: Middle East & Africa US Acoustic Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East & Africa US Acoustic Sensors Market Revenue (billion), by Wave Type 2025 & 2033

- Figure 35: Middle East & Africa US Acoustic Sensors Market Revenue Share (%), by Wave Type 2025 & 2033

- Figure 36: Middle East & Africa US Acoustic Sensors Market Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 37: Middle East & Africa US Acoustic Sensors Market Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 38: Middle East & Africa US Acoustic Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East & Africa US Acoustic Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East & Africa US Acoustic Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa US Acoustic Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Acoustic Sensors Market Revenue (billion), by Type 2025 & 2033

- Figure 43: Asia Pacific US Acoustic Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Asia Pacific US Acoustic Sensors Market Revenue (billion), by Wave Type 2025 & 2033

- Figure 45: Asia Pacific US Acoustic Sensors Market Revenue Share (%), by Wave Type 2025 & 2033

- Figure 46: Asia Pacific US Acoustic Sensors Market Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 47: Asia Pacific US Acoustic Sensors Market Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 48: Asia Pacific US Acoustic Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 49: Asia Pacific US Acoustic Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: Asia Pacific US Acoustic Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific US Acoustic Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Acoustic Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global US Acoustic Sensors Market Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 3: Global US Acoustic Sensors Market Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 4: Global US Acoustic Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global US Acoustic Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global US Acoustic Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global US Acoustic Sensors Market Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 8: Global US Acoustic Sensors Market Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 9: Global US Acoustic Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global US Acoustic Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global US Acoustic Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global US Acoustic Sensors Market Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 16: Global US Acoustic Sensors Market Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 17: Global US Acoustic Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global US Acoustic Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global US Acoustic Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global US Acoustic Sensors Market Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 24: Global US Acoustic Sensors Market Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 25: Global US Acoustic Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global US Acoustic Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global US Acoustic Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 37: Global US Acoustic Sensors Market Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 38: Global US Acoustic Sensors Market Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 39: Global US Acoustic Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global US Acoustic Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global US Acoustic Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global US Acoustic Sensors Market Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 49: Global US Acoustic Sensors Market Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 50: Global US Acoustic Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 51: Global US Acoustic Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US Acoustic Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Acoustic Sensors Market?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the US Acoustic Sensors Market?

Key companies in the market include ifm efector inc, Dytran Instruments Inc, Honeywell Sensing and Productivity Solutions, Vectron International Inc (Microchip technology Incorporated), Transense Technologies plc, Siemens AG, pro-micron GmbH, Murata Manufacturing Co Ltd, Campbell Scientific Inc.

3. What are the main segments of the US Acoustic Sensors Market?

The market segments include Type, Wave Type, Sensing Parameter, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of Telecommunications Market; Low Manufacturing Costs.

6. What are the notable trends driving market growth?

Pressure Sensors to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Technical Challenges Associated with Acoustic Sensors.

8. Can you provide examples of recent developments in the market?

December 2021 - Officials of the Naval Air Systems Command at Patuxent River Naval Air Station, Maryland, US, announced a USD 222.3 million contract last week to ERAPSCO in Columbia City, Ind., and to the Lockheed Martin Corp. Rotary and Mission Systems segment in Manassas, Va., to build as many as 18,000 AN/SSQ-125 multi-static sonobuoys for airborne ASW operations. The sonobuoy is a consumable electromechanical ASW acoustic sensor that can be launched in the air, designed to relay the underwater sounds of ships and submarines. Sonobuoys allow Navy ASW units to track potentially hostile submarines operating in open oceans and coastal areas that threaten naval aircraft carrier combat groups and other units. Information from these systems will help enable precision attacks by air-launch torpedoes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Acoustic Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Acoustic Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Acoustic Sensors Market?

To stay informed about further developments, trends, and reports in the US Acoustic Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence