Key Insights

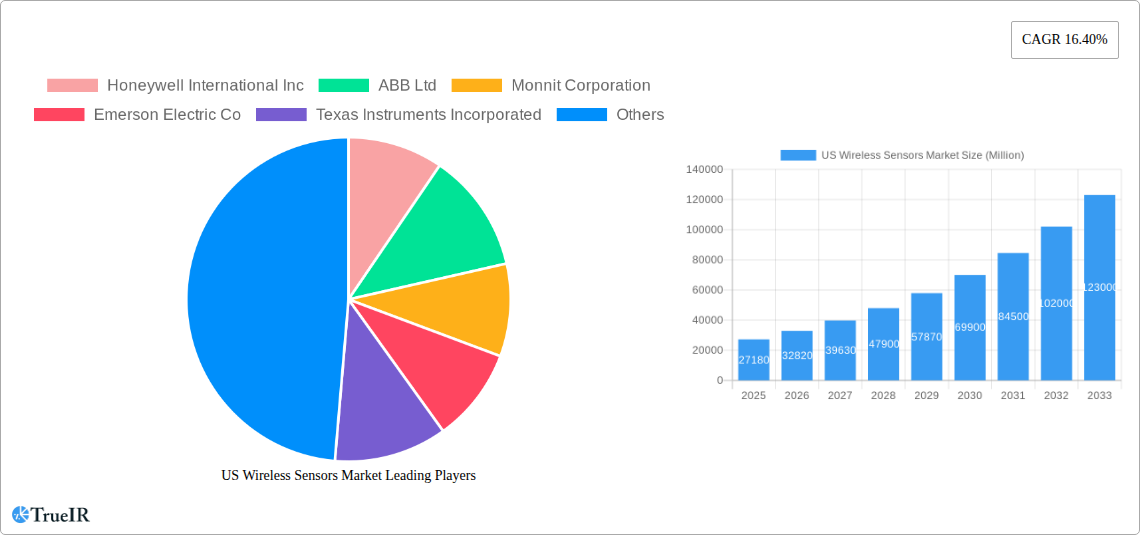

The US Wireless Sensors Market is poised for significant expansion, projected to reach $27.18 billion in 2025, driven by a robust CAGR of 20.6% through 2033. This impressive growth trajectory is fueled by the increasing demand for automation and real-time data across diverse industries. The automotive sector is a primary catalyst, integrating wireless sensors for advanced driver-assistance systems (ADAS), infotainment, and vehicle diagnostics. Simultaneously, the healthcare industry is witnessing a surge in adoption for remote patient monitoring, wearable devices, and smart hospital infrastructure, enhancing patient care and operational efficiency. The aerospace and defense sector also contributes substantially, leveraging these sensors for critical applications in surveillance, navigation, and structural health monitoring. Furthermore, the energy and power industry is deploying wireless sensors for smart grid management, predictive maintenance of infrastructure, and optimizing renewable energy sources.

US Wireless Sensors Market Market Size (In Billion)

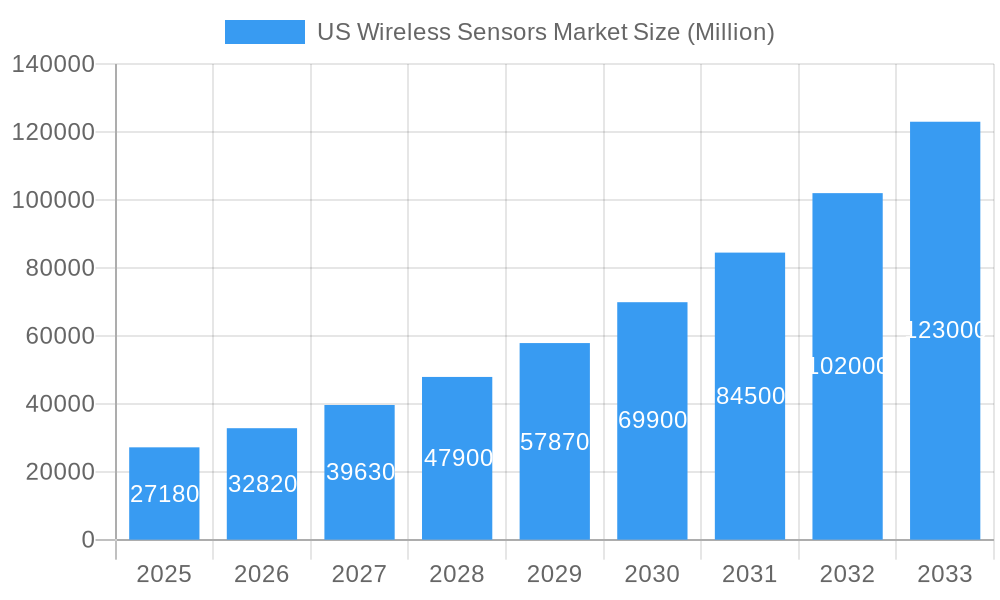

Emerging trends such as the proliferation of the Internet of Things (IoT) and the increasing adoption of 5G technology are further accelerating market penetration. These advancements enable seamless connectivity, faster data transmission, and the development of more sophisticated sensor networks. The market is segmented into various sensor types, including pressure, temperature, chemical and gas, and position and proximity sensors, each catering to specific industrial needs. While the market is characterized by immense growth opportunities, certain restraints, such as cybersecurity concerns and the initial implementation costs, need to be addressed to ensure sustained progress. Key players like Honeywell International Inc., ABB Ltd., and Emerson Electric Co. are at the forefront of innovation, introducing advanced wireless sensor solutions and expanding their market reach.

US Wireless Sensors Market Company Market Share

This comprehensive report delves into the dynamic US Wireless Sensors Market, providing in-depth analysis and actionable insights for industry stakeholders. Leveraging high-volume keywords such as "US wireless sensors," "IoT sensors," "industrial wireless sensors," "smart sensors," and "connected devices," this report is meticulously crafted to optimize search rankings and engage a broad spectrum of industry audiences.

The study encompasses a robust Study Period of 2019–2033, with a Base Year of 2025, an Estimated Year of 2025, and a detailed Forecast Period of 2025–2033, building upon the Historical Period of 2019–2024. The market valuation is projected to reach hundreds of billions of dollars by the end of the forecast period, driven by the exponential growth of the Internet of Things (IoT) and the increasing adoption of automation across various sectors.

Key players analyzed include Honeywell International Inc, ABB Ltd, Monnit Corporation, Emerson Electric Co, Texas Instruments Incorporated, Phoenix Sensors LLC, Pasco Scientific, and Schneider Electric, among others. The report segments the market by Type (Pressure Sensor, Temperature Sensor, Chemical and Gas Sensor, Position and Proximity Sensor, Other Types) and End-user Industry (Automotive, Healthcare, Aerospace and Defense, Energy and Power, Food and Beverage, Other End-user Industries).

US Wireless Sensors Market Market Structure & Competitive Landscape

The US wireless sensors market is characterized by a moderately concentrated structure, with a blend of established multinational corporations and nimble, specialized players. Innovation drivers are primarily fueled by advancements in miniaturization, power efficiency, data analytics, and the integration of artificial intelligence (AI) within sensor technologies. Regulatory impacts, while varied, often steer towards enhanced safety, environmental monitoring, and data security standards, influencing product development and market entry strategies. Product substitutes, though present in some niche applications, are increasingly being outpaced by the versatility, cost-effectiveness, and real-time data capabilities offered by wireless sensor solutions. End-user segmentation reveals a strong demand across diverse industries, each with unique requirements and adoption rates. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with larger players acquiring innovative startups to expand their product portfolios and market reach. For instance, the past few years have witnessed an average of xx M&A deals annually, indicating ongoing consolidation. Concentration ratios, particularly in the industrial segment, are estimated to be around xx% for the top five players, highlighting the competitive intensity.

US Wireless Sensors Market Market Trends & Opportunities

The US wireless sensors market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, reaching an estimated market size of hundreds of billions of dollars by 2033. This robust expansion is propelled by several transformative trends. The pervasive adoption of the Internet of Things (IoT) across consumer and industrial sectors is a paramount growth catalyst. Smart homes, smart cities, and industrial IoT (IIoT) initiatives are creating an insatiable demand for connected devices, with wireless sensors forming the foundational layer of these ecosystems. Technological shifts are continually enhancing sensor capabilities, leading to smaller, more energy-efficient, and highly accurate devices. The integration of AI and machine learning is enabling predictive maintenance, real-time anomaly detection, and sophisticated data analytics, adding significant value beyond mere data collection. Consumer preferences are increasingly gravitating towards convenience, automation, and data-driven insights, further fueling the adoption of wireless sensor-enabled products in sectors like smart home devices, wearable technology, and health monitoring. Competitive dynamics are intensifying, with companies differentiating themselves through specialized solutions, integrated platforms, and a focus on niche applications. The market penetration rate for wireless sensors in industrial automation is estimated to reach xx% by 2033, showcasing the significant opportunity for growth and innovation. Emerging opportunities lie in the development of advanced sensor fusion techniques, low-power wide-area network (LPWAN) technologies, and secure wireless communication protocols to address growing concerns about data privacy and cybersecurity.

Dominant Markets & Segments in US Wireless Sensors Market

The Energy and Power sector stands out as a dominant end-user industry within the US wireless sensors market. This dominance is driven by critical needs for real-time monitoring of grid infrastructure, predictive maintenance of power generation equipment, and enhanced safety protocols in hazardous environments. The imperative for efficient energy management and the integration of renewable energy sources further amplify the demand for sophisticated wireless sensing solutions. For instance, the deployment of smart grids and the increasing complexity of distributed energy resources necessitate accurate and reliable data from a vast network of sensors.

Key growth drivers in this segment include:

- Infrastructure Modernization: Significant investments in upgrading aging power grids and substations create a strong demand for wireless sensor networks for monitoring and control.

- Safety Regulations: Stringent safety regulations in power generation and transmission environments mandate continuous monitoring of critical parameters, pushing the adoption of wireless sensors.

- Predictive Maintenance: The high cost of downtime in the energy sector makes predictive maintenance a crucial strategy, with wireless sensors providing the necessary real-time data for early fault detection.

- Renewable Energy Integration: The growth of solar, wind, and other renewable energy sources requires robust monitoring and control systems, often relying on wireless sensor technology for seamless integration into the grid.

Within the Type segmentation, Temperature Sensors and Pressure Sensors consistently hold significant market share due to their ubiquitous application across numerous industries, from industrial process control to environmental monitoring and automotive systems. However, the rapid advancements in Chemical and Gas Sensors are creating substantial growth opportunities, particularly in areas like environmental compliance, industrial safety, and healthcare.

The Automotive industry is another major end-user, driven by the increasing integration of advanced driver-assistance systems (ADAS), infotainment, and powertrain efficiency management. The proliferation of connected vehicles and the pursuit of autonomous driving technologies are further accelerating the adoption of various wireless sensors.

US Wireless Sensors Market Product Analysis

Product innovation in the US wireless sensors market is characterized by a relentless pursuit of miniaturization, enhanced accuracy, and extended battery life. Advancements in MEMS (Micro-Electro-Mechanical Systems) technology have enabled the development of smaller and more cost-effective pressure, temperature, and inertial sensors. The integration of AI at the edge allows sensors to process data locally, reducing latency and bandwidth requirements for applications in industrial automation and smart cities. Furthermore, the development of low-power communication protocols like LoRaWAN and NB-IoT is extending the reach and applicability of wireless sensor networks in remote or challenging environments. These innovations are crucial for enabling predictive maintenance, optimizing resource utilization, and enhancing safety across diverse sectors.

Key Drivers, Barriers & Challenges in US Wireless Sensors Market

Key Drivers, Barriers & Challenges in US Wireless Sensors Market

Key Drivers:

- IoT Expansion: The burgeoning Internet of Things ecosystem across consumer, industrial, and commercial sectors is the primary growth engine, demanding ubiquitous sensor connectivity.

- Automation and Efficiency: Industries are increasingly adopting automation to boost productivity, reduce operational costs, and enhance safety, with wireless sensors being fundamental to these initiatives.

- Technological Advancements: Continuous innovation in sensor technology, including miniaturization, power efficiency, and AI integration, expands application possibilities.

- Data-Driven Decision Making: The growing reliance on real-time data for informed decision-making across all industries fuels demand for accurate and reliable sensor networks.

Barriers & Challenges:

- Cybersecurity Concerns: The interconnected nature of wireless sensors raises significant cybersecurity risks, necessitating robust security protocols and increasing implementation costs.

- Interoperability and Standardization: The lack of universal standards can create compatibility issues between different sensor systems and platforms, hindering widespread adoption.

- Initial Investment Costs: While costs are decreasing, the initial outlay for implementing comprehensive wireless sensor networks can be substantial for some organizations.

- Data Management and Analytics: The sheer volume of data generated by sensor networks requires sophisticated data management and analytics capabilities, which can be a challenge for many businesses.

Growth Drivers in the US Wireless Sensors Market Market

The US wireless sensors market is propelled by significant growth drivers. The relentless expansion of the Internet of Things (IoT) ecosystem is a foundational element, creating an unprecedented demand for connected devices. Furthermore, the pervasive drive towards automation across manufacturing, logistics, and other industries necessitates real-time data acquisition, which wireless sensors efficiently provide. Technological advancements, including the miniaturization of sensor components, improvements in power efficiency allowing for longer operational lifespans, and the integration of AI for edge computing, are continuously expanding the application scope. The increasing focus on data-driven decision-making across all sectors underscores the value proposition of wireless sensor networks in providing actionable insights. Economic incentives, such as increased operational efficiency and reduced downtime, further encourage investment in these technologies.

Challenges Impacting US Wireless Sensors Market Growth

Despite the robust growth potential, the US wireless sensors market faces several challenges. Cybersecurity remains a paramount concern, as the interconnected nature of these devices presents vulnerabilities to data breaches and unauthorized access. The absence of universally adopted standards can lead to interoperability issues between different vendor solutions, complicating integration efforts and potentially increasing implementation costs. While the cost of wireless sensors has been declining, the initial investment for deploying comprehensive networks, coupled with the ongoing expenses for data management and analytics infrastructure, can still pose a barrier for smaller enterprises. Regulatory complexities related to data privacy and compliance also add to the challenges, requiring careful navigation by market participants.

Key Players Shaping the US Wireless Sensors Market Market

- Honeywell International Inc

- ABB Ltd

- Monnit Corporation

- Emerson Electric Co

- Texas Instruments Incorporated

- Phoenix Sensors LLC

- Pasco Scientific

- Schneider Electric

Significant US Wireless Sensors Market Industry Milestones

- June 2021: Salunda launched a wireless sensor network for connectivity of critical production, operational, and safety systems in the oil and gas industry, such as Red Zone management. The Hawk wireless network can be retrofitted to existing infrastructure and rapidly commissioned while drilling activity continues, ensuring minimum downtime and disruption to productivity. The network can be integrated with third-party sensors and control systems to improve platform safety further, predict equipment failure, enhance production and operational efficiencies.

- March 2021: MIT researchers have developed a wireless sensing and AI system that could help improve patients' techniques with self-administered medications such as inhalers and insulin pens. The wireless sensors could detect errors in self-administered medication, ranging from swallowing pills and injecting insulin. According to MIT, users can install the system in their homes, and it can alert patients and caregivers to medication errors and potentially reduce unnecessary hospital visits.

Future Outlook for US Wireless Sensors Market Market

The future outlook for the US wireless sensors market is exceptionally promising, driven by continued technological innovation and expanding applications. The increasing integration of AI and machine learning at the edge will empower sensors with advanced analytical capabilities, leading to more sophisticated predictive maintenance and autonomous decision-making. The development of ultra-low-power sensors and energy harvesting technologies will further enhance their deployment in remote and inaccessible locations, expanding the reach of IoT networks. The growing demand for personalized healthcare and smart city solutions will create new avenues for sensor adoption. Strategic partnerships and M&A activities are expected to continue, fostering consolidation and driving the development of comprehensive, end-to-end wireless sensing solutions. The market is anticipated to witness significant growth, transforming industries and enhancing the quality of life through intelligent, connected environments.

US Wireless Sensors Market Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Chemical and Gas Sensor

- 1.4. Position and Proximity Sensor

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Energy and Power

- 2.5. Food and Beverage

- 2.6. Other End-user Industries

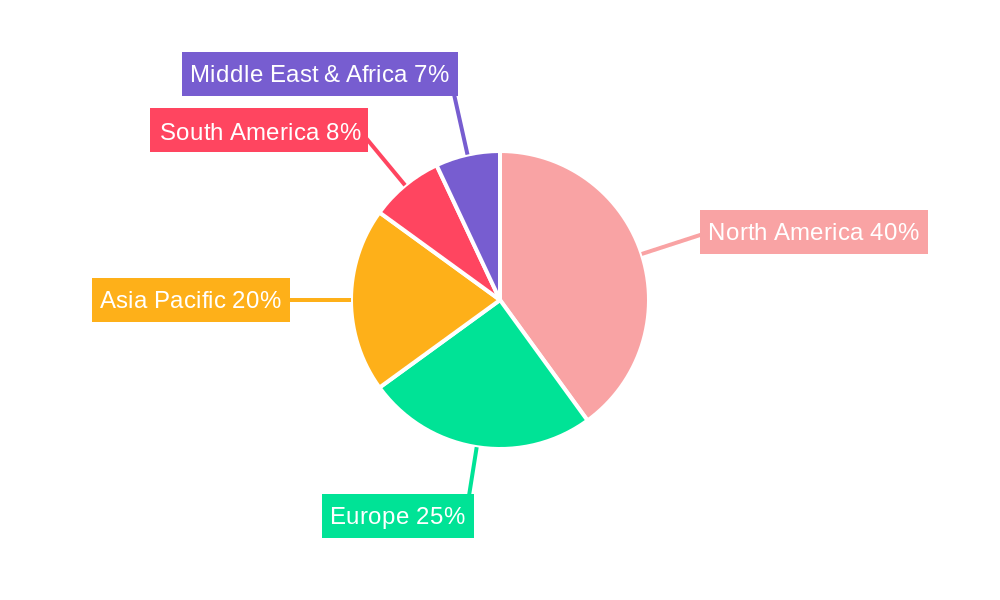

US Wireless Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Wireless Sensors Market Regional Market Share

Geographic Coverage of US Wireless Sensors Market

US Wireless Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation)

- 3.3. Market Restrains

- 3.3.1. False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 3.4. Market Trends

- 3.4.1. Position and proximity sensor is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Wireless Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Chemical and Gas Sensor

- 5.1.4. Position and Proximity Sensor

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy and Power

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Wireless Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pressure Sensor

- 6.1.2. Temperature Sensor

- 6.1.3. Chemical and Gas Sensor

- 6.1.4. Position and Proximity Sensor

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Healthcare

- 6.2.3. Aerospace and Defense

- 6.2.4. Energy and Power

- 6.2.5. Food and Beverage

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Wireless Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pressure Sensor

- 7.1.2. Temperature Sensor

- 7.1.3. Chemical and Gas Sensor

- 7.1.4. Position and Proximity Sensor

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Healthcare

- 7.2.3. Aerospace and Defense

- 7.2.4. Energy and Power

- 7.2.5. Food and Beverage

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Wireless Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pressure Sensor

- 8.1.2. Temperature Sensor

- 8.1.3. Chemical and Gas Sensor

- 8.1.4. Position and Proximity Sensor

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Healthcare

- 8.2.3. Aerospace and Defense

- 8.2.4. Energy and Power

- 8.2.5. Food and Beverage

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Wireless Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pressure Sensor

- 9.1.2. Temperature Sensor

- 9.1.3. Chemical and Gas Sensor

- 9.1.4. Position and Proximity Sensor

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Healthcare

- 9.2.3. Aerospace and Defense

- 9.2.4. Energy and Power

- 9.2.5. Food and Beverage

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Wireless Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pressure Sensor

- 10.1.2. Temperature Sensor

- 10.1.3. Chemical and Gas Sensor

- 10.1.4. Position and Proximity Sensor

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Healthcare

- 10.2.3. Aerospace and Defense

- 10.2.4. Energy and Power

- 10.2.5. Food and Beverage

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Monnit Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Emerson Electric Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Phoenix Sensors LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pasco Scientific

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global US Wireless Sensors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Wireless Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America US Wireless Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Wireless Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America US Wireless Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America US Wireless Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America US Wireless Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Wireless Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America US Wireless Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America US Wireless Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: South America US Wireless Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: South America US Wireless Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America US Wireless Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Wireless Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe US Wireless Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe US Wireless Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe US Wireless Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe US Wireless Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe US Wireless Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Wireless Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa US Wireless Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa US Wireless Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Middle East & Africa US Wireless Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Middle East & Africa US Wireless Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Wireless Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Wireless Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific US Wireless Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific US Wireless Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific US Wireless Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific US Wireless Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific US Wireless Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Wireless Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global US Wireless Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global US Wireless Sensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global US Wireless Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global US Wireless Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global US Wireless Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global US Wireless Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global US Wireless Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global US Wireless Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global US Wireless Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global US Wireless Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global US Wireless Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global US Wireless Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global US Wireless Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 30: Global US Wireless Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global US Wireless Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global US Wireless Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 39: Global US Wireless Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Wireless Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Wireless Sensors Market?

The projected CAGR is approximately 20.6%.

2. Which companies are prominent players in the US Wireless Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Monnit Corporation, Emerson Electric Co, Texas Instruments Incorporated, Phoenix Sensors LLC, Pasco Scientific, Schneider Electric*List Not Exhaustive.

3. What are the main segments of the US Wireless Sensors Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation).

6. What are the notable trends driving market growth?

Position and proximity sensor is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems.

8. Can you provide examples of recent developments in the market?

June 2021 - Salunda launched a wireless sensor network for connectivity of critical production, operational, and safety systems in the oil and gas industry, such as Red Zone management. The Hawk wireless network can be retrofitted to existing infrastructure and rapidly commissioned while drilling activity continues, ensuring minimum downtime and disruption to productivity. The network can be integrated with third-party sensors and control systems to improve platform safety further, predict equipment failure, enhance production and operational efficiencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Wireless Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Wireless Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Wireless Sensors Market?

To stay informed about further developments, trends, and reports in the US Wireless Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence