Key Insights

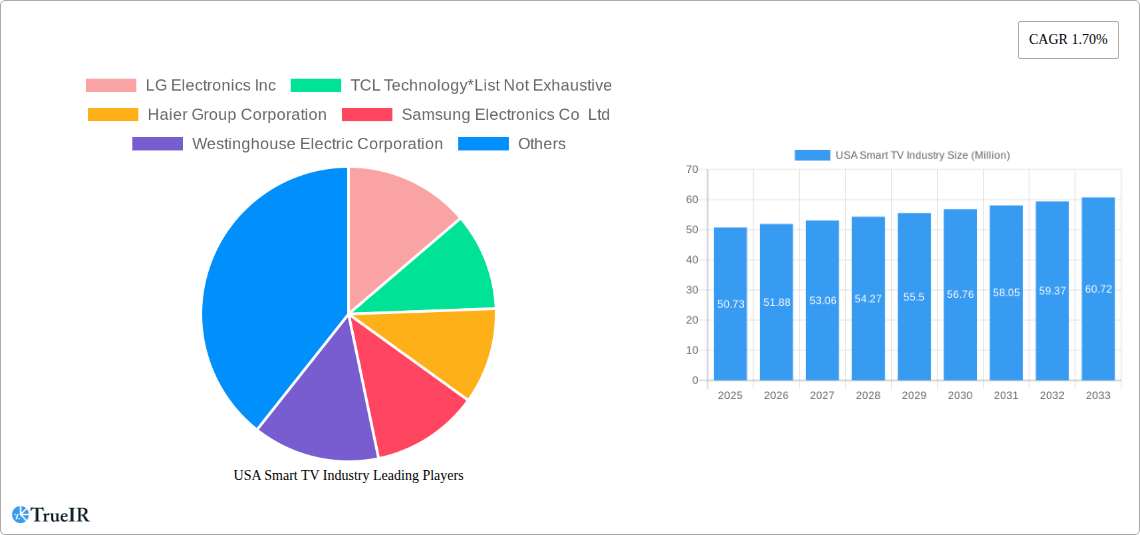

The US Smart TV market is projected to reach USD 50.73 million in 2025, exhibiting a steady CAGR of 2.29% through 2033. This growth is underpinned by an increasing consumer demand for enhanced home entertainment experiences, driven by the proliferation of streaming services and the growing adoption of advanced display technologies like OLED and QLED. The market is experiencing a significant shift towards larger screen sizes, with the "55 inches and above" segment dominating consumer preferences, reflecting a desire for more immersive viewing. Furthermore, the prevalence of 4K UHD resolution TVs is becoming the norm, offering unparalleled picture clarity. Manufacturers are actively innovating in panel technology, with OLED and QLED displays gaining considerable traction due to their superior contrast ratios and color reproduction capabilities. The under USD 1,000 price segment remains a key driver for mass adoption, while the mid-to-high-end segments cater to premium consumers seeking cutting-edge features. The dominance of Android, Tizen, and WebOS operating systems highlights the importance of a user-friendly and versatile interface for smart TV functionality.

USA Smart TV Industry Market Size (In Million)

The competitive landscape is characterized by the presence of major global players such as Samsung, LG Electronics, TCL, and Sony, who are continuously investing in research and development to introduce new features and improve existing ones. Emerging trends include the integration of artificial intelligence for personalized content recommendations and voice control, as well as advancements in connectivity for seamless smart home integration. Restraints to market growth may include the economic sensitivity of consumer electronics purchases, potential supply chain disruptions, and the increasing lifespan of durable goods. However, the continuous evolution of content consumption patterns, the increasing penetration of high-speed internet, and the strategic efforts by companies to offer diverse product portfolios across various price points are expected to propel the US Smart TV market forward, solidifying its position as a critical component of modern home entertainment.

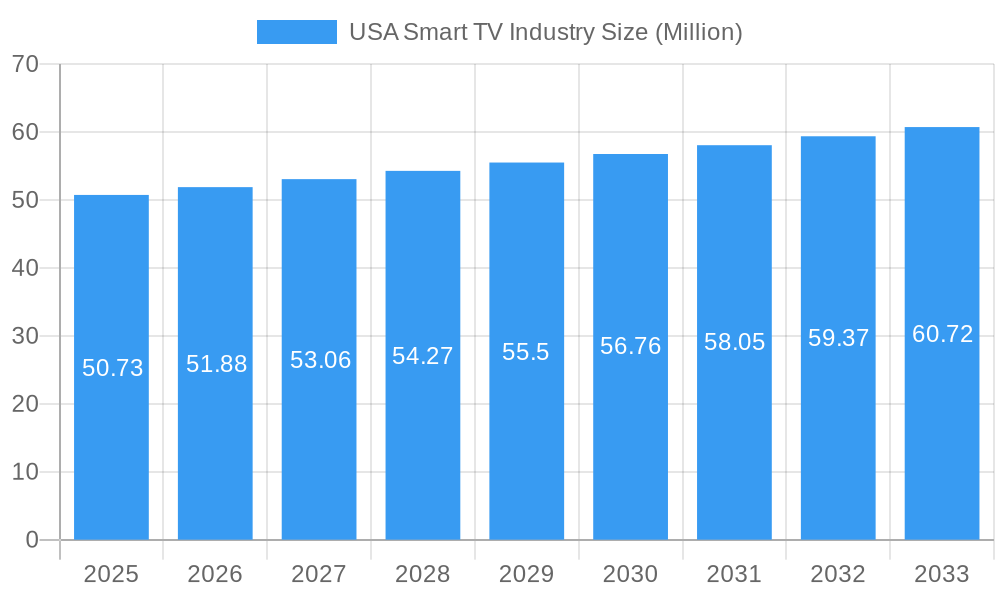

USA Smart TV Industry Company Market Share

This comprehensive report offers an in-depth analysis of the USA Smart TV industry, providing critical insights into market dynamics, competitive strategies, and future growth trajectories. Leveraging high-volume keywords like "smart TV market USA," "4K UHD TV," "OLED TV," "QLED TV," and "TV operating systems," this report is meticulously crafted for industry professionals, investors, and researchers seeking to understand the evolving landscape. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report delivers unparalleled foresight into this dynamic sector. The analysis covers extensive segments including screen sizes from 30-45 Inches to 55 Inches and above, resolution types like 4K UHD TV, and panel types such as LCD, LED, OLED, and QLED. Pricing ranges from under USD 1,000 to USD 3,000 and above, and operating systems encompass Android, Tizen, WebOS, Roku, and others, ensuring a granular understanding of market segmentation.

USA Smart TV Industry Market Structure & Competitive Landscape

The USA Smart TV industry is characterized by a moderately concentrated market, with a few dominant players holding significant market share. Innovation drivers are primarily focused on enhanced display technologies, seamless integration of smart features, and superior user experience. Regulatory impacts are generally minimal, with a focus on consumer protection and intellectual property rights. Product substitutes, such as traditional TVs with external streaming devices, exist but are increasingly being outpaced by the integrated capabilities of smart TVs. End-user segmentation reveals a strong preference for larger screen sizes and higher resolutions, driven by the growing adoption of streaming services and immersive content. Merger and acquisition (M&A) trends are present, though less frequent, often involving strategic partnerships to enhance technological capabilities or expand market reach. The industry's competitive intensity remains high, with continuous product development and aggressive marketing strategies from key players.

- Market Concentration: Dominated by a few key global manufacturers.

- Innovation Focus: Display quality (OLED, QLED), AI-powered features, and connectivity.

- Regulatory Landscape: Primarily focused on consumer safety and data privacy.

- Product Substitutes: External streaming devices, though their market share is declining.

- M&A Activity: Primarily strategic, aimed at technology acquisition or market consolidation.

USA Smart TV Industry Market Trends & Opportunities

The USA Smart TV industry is poised for substantial growth, driven by evolving consumer preferences and relentless technological advancements. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) during the forecast period, fueled by increasing disposable incomes and a growing demand for immersive home entertainment experiences. Technological shifts are rapidly moving towards higher resolution displays like 8K UHD, the proliferation of OLED and QLED panel technologies offering superior picture quality, and the integration of artificial intelligence for personalized content recommendations and smart home control. Consumer preferences are increasingly leaning towards larger screen sizes, advanced gaming features, and seamless connectivity with other smart devices. The competitive dynamics are intensifying, with established players investing heavily in research and development to maintain their market leadership and new entrants vying for a foothold. Opportunities abound in the integration of cloud gaming, the expansion of content streaming services, and the development of more intuitive and personalized user interfaces. The increasing penetration of high-speed internet across the nation further underpins the growth of this sector, enabling richer online content consumption and interactive experiences.

Dominant Markets & Segments in USA Smart TV Industry

The USA Smart TV industry exhibits clear dominance across several key segments, reflecting consumer demand and technological adoption. The 55 Inches and above screen size segment is a dominant force, driven by the desire for cinematic viewing experiences at home. Within resolution types, 4K UHD TV has become the de facto standard, offering superior clarity and detail for a wide range of content. In terms of panel technology, LED televisions continue to hold a significant market share due to their balance of performance and affordability, while OLED and QLED are rapidly gaining traction among premium consumers seeking the best picture quality. The Under USD 1,000 pricing range remains highly competitive and accessible, catering to a broad consumer base, although the USD 1,000 to USD 2,000 segment is experiencing significant growth as consumers invest in enhanced features and larger displays. Regarding operating systems, Roku commands a substantial market presence due to its user-friendly interface and extensive app support, alongside Android TV and Tizen, which are integral to the offerings of major manufacturers like Samsung.

- Screen Size (Diagonal): 55 Inches and above - High demand for immersive entertainment.

- Resolution Type: 4K UHD TV - The current industry standard for superior visual quality.

- Panel Type: LED - Dominant due to a balance of cost and performance; OLED & QLED are growing premium segments.

- Pricing Range: Under USD 1,000 - Broad accessibility; USD 1,000 to USD 2,000 - Growing segment for enhanced features.

- Operating Segment: Roku - Strong market presence; Android TV & Tizen - Key proprietary platforms.

USA Smart TV Industry Product Analysis

Product innovation in the USA Smart TV industry is rapidly advancing, with a focus on enhancing visual fidelity and user experience. Key advancements include the widespread adoption of Mini-LED and Micro-LED technologies offering unprecedented contrast ratios and brightness, alongside continuous improvements in OLED panel technology for perfect blacks and vibrant colors. Smart features are becoming more sophisticated, with AI-powered upscaling, personalized content curation through advanced Smart Hubs, and seamless integration with voice assistants. Gaming performance is a significant differentiator, with features like HDMI 2.1 support, Variable Refresh Rate (VRR), and Auto Low Latency Mode (ALLM) becoming standard on higher-end models. Competitive advantages are built upon superior picture quality, intuitive operating systems, robust app ecosystems, and increasingly, eco-friendly designs and energy efficiency.

Key Drivers, Barriers & Challenges in USA Smart TV Industry

Key Drivers:

- Technological Advancements: Continuous innovation in display technologies (OLED, QLED, Mini-LED) and smart features.

- Growing Demand for Home Entertainment: Increased spending on home entertainment systems, fueled by streaming services.

- Content Availability: Proliferation of high-quality 4K and HDR content across streaming platforms.

- Economic Growth: Rising disposable incomes supporting the purchase of premium smart TVs.

Barriers & Challenges:

- Supply Chain Disruptions: Global component shortages and logistics issues can impact availability and pricing.

- High Production Costs: Advanced technologies like OLED can lead to higher manufacturing expenses.

- Intense Competition: Price wars and aggressive marketing strategies can squeeze profit margins.

- Rapid Obsolescence: Short product lifecycles driven by continuous technological upgrades.

Growth Drivers in the USA Smart TV Industry Market

The USA Smart TV industry's growth is propelled by several key factors. Technological innovation remains a primary driver, with manufacturers consistently introducing superior display technologies like OLED and QLED, alongside advanced AI-driven features that enhance user experience. The insatiable demand for high-quality home entertainment, exacerbated by the growth of streaming services, encourages consumers to upgrade to larger, more capable smart TVs. Furthermore, economic stability and rising disposable incomes empower consumers to invest in premium smart TV models. Policy initiatives promoting digital infrastructure and broadband penetration indirectly support the smart TV market by ensuring access to robust online content and services.

Challenges Impacting USA Smart TV Industry Growth

Despite robust growth, the USA Smart TV industry faces significant challenges. Persistent global supply chain issues, particularly concerning semiconductor components, continue to impact production volumes and lead to price volatility. The high cost associated with cutting-edge display technologies can be a barrier for some consumer segments, while the rapid pace of technological innovation leads to frequent product obsolescence, pressuring manufacturers to constantly R&D and market new models. Intense competition among major players, both domestic and international, can lead to aggressive pricing strategies and reduced profit margins, necessitating efficient operational management and distinct product differentiation.

Key Players Shaping the USA Smart TV Industry Market

- LG Electronics Inc

- TCL Technology

- Haier Group Corporation

- Samsung Electronics Co Ltd

- Westinghouse Electric Corporation

- Hitachi Ltd

- Hisense Group Co Ltd

- Insignia Systems Inc

- Koninklijke Philips NV

- Sharp Corporation

- VIZIO Inc

- Panasonic Corporation

- Sony Corporation

Significant USA Smart TV Industry Industry Milestones

- April 2022: Panasonic launched its flagship OLED TV, the LZ2000, in 55-inch, 65-inch, and 77-inch sizes. This model was positioned as a gaming TV powerhouse, featuring new Game Control Board settings, automatic NVIDIA GPU detection, improved 60Hz latency, and HDMI 2.1 support, enhancing its appeal to a gaming-centric audience.

- January 2022: Samsung announced its 2022 smart TV lineup ahead of CES, including Micro LED, New QLED, and Lifestyle series, alongside a new soundbar lineup supporting Dolby Atmos. The unveiling of a new Smart Hub for its 2022 smart TVs was a key development, promising enhanced smart content curation, cloud gaming, video calls, on-screen multitasking, and NFT management. The integrated Gaming Hub offered streamlined access to various cloud gaming services, underscoring Samsung's focus on the growing gaming market.

Future Outlook for USA Smart TV Industry Market

The future outlook for the USA Smart TV industry is exceptionally bright, characterized by sustained growth and exciting technological advancements. Emerging opportunities lie in the further integration of AI for hyper-personalized user experiences, the expansion of cloud gaming services becoming a staple feature, and the development of more immersive augmented and virtual reality integration. The increasing demand for sustainability and energy-efficient products will also shape future product designs. As display technologies continue to evolve, offering even greater realism and interactive capabilities, the smart TV will solidify its position as the central hub of the connected home, driving strategic opportunities for market players focused on innovation, user experience, and content integration.

USA Smart TV Industry Segmentation

-

1. Screen Size (Diagonal)

- 1.1. 30-45 Inches

- 1.2. 45-55 Inches

- 1.3. 55 Inches and above

-

2. Resolution Type

- 2.1. 4K UHD TV

- 2.2. Full HD TV

- 2.3. HDTV

-

3. Panel Type

- 3.1. LCD

- 3.2. LED

- 3.3. OLED

- 3.4. QLED

-

4. Pricing Range

- 4.1. Under USD 1,000

- 4.2. USD 1,000 to USD 2,000

- 4.3. USD 2,000 to USD 3,000

- 4.4. USD 3,000 and Above

-

5. Operating Segment

- 5.1. Android

- 5.2. Tizen

- 5.3. WebOS

- 5.4. Roku

- 5.5. Other Operating Systems

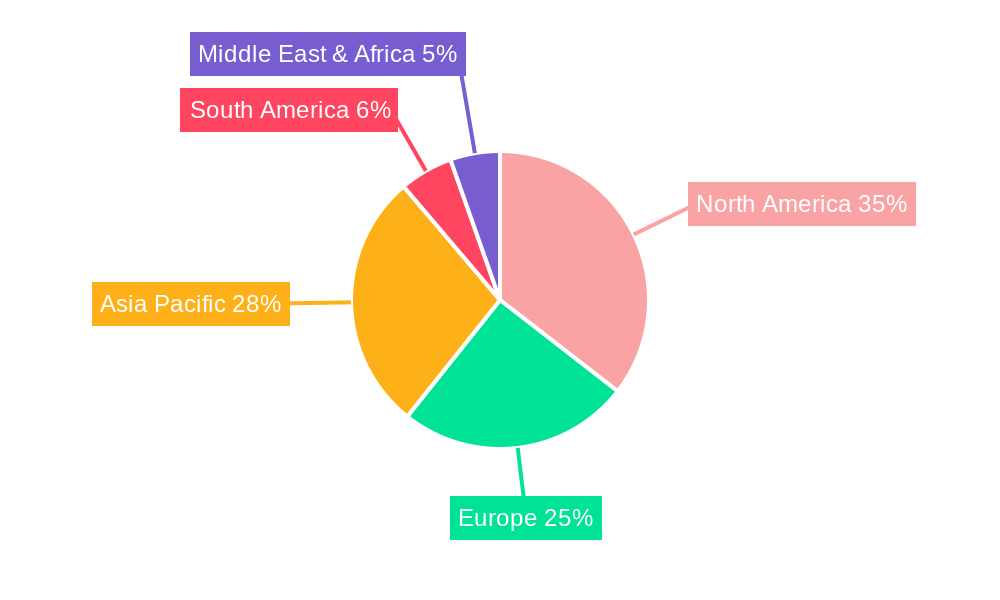

USA Smart TV Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Smart TV Industry Regional Market Share

Geographic Coverage of USA Smart TV Industry

USA Smart TV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Disposable Income across Emerging Economies; Rising Trend of Video-on-demand Service

- 3.3. Market Restrains

- 3.3.1. Slower Rate of Penetration of Telematics in Developing Regions; Delayed Regulatory Sanctions

- 3.4. Market Trends

- 3.4.1. Boosting Demand for 55 Inches and above Screen Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 5.1.1. 30-45 Inches

- 5.1.2. 45-55 Inches

- 5.1.3. 55 Inches and above

- 5.2. Market Analysis, Insights and Forecast - by Resolution Type

- 5.2.1. 4K UHD TV

- 5.2.2. Full HD TV

- 5.2.3. HDTV

- 5.3. Market Analysis, Insights and Forecast - by Panel Type

- 5.3.1. LCD

- 5.3.2. LED

- 5.3.3. OLED

- 5.3.4. QLED

- 5.4. Market Analysis, Insights and Forecast - by Pricing Range

- 5.4.1. Under USD 1,000

- 5.4.2. USD 1,000 to USD 2,000

- 5.4.3. USD 2,000 to USD 3,000

- 5.4.4. USD 3,000 and Above

- 5.5. Market Analysis, Insights and Forecast - by Operating Segment

- 5.5.1. Android

- 5.5.2. Tizen

- 5.5.3. WebOS

- 5.5.4. Roku

- 5.5.5. Other Operating Systems

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 6. North America USA Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 6.1.1. 30-45 Inches

- 6.1.2. 45-55 Inches

- 6.1.3. 55 Inches and above

- 6.2. Market Analysis, Insights and Forecast - by Resolution Type

- 6.2.1. 4K UHD TV

- 6.2.2. Full HD TV

- 6.2.3. HDTV

- 6.3. Market Analysis, Insights and Forecast - by Panel Type

- 6.3.1. LCD

- 6.3.2. LED

- 6.3.3. OLED

- 6.3.4. QLED

- 6.4. Market Analysis, Insights and Forecast - by Pricing Range

- 6.4.1. Under USD 1,000

- 6.4.2. USD 1,000 to USD 2,000

- 6.4.3. USD 2,000 to USD 3,000

- 6.4.4. USD 3,000 and Above

- 6.5. Market Analysis, Insights and Forecast - by Operating Segment

- 6.5.1. Android

- 6.5.2. Tizen

- 6.5.3. WebOS

- 6.5.4. Roku

- 6.5.5. Other Operating Systems

- 6.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 7. South America USA Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 7.1.1. 30-45 Inches

- 7.1.2. 45-55 Inches

- 7.1.3. 55 Inches and above

- 7.2. Market Analysis, Insights and Forecast - by Resolution Type

- 7.2.1. 4K UHD TV

- 7.2.2. Full HD TV

- 7.2.3. HDTV

- 7.3. Market Analysis, Insights and Forecast - by Panel Type

- 7.3.1. LCD

- 7.3.2. LED

- 7.3.3. OLED

- 7.3.4. QLED

- 7.4. Market Analysis, Insights and Forecast - by Pricing Range

- 7.4.1. Under USD 1,000

- 7.4.2. USD 1,000 to USD 2,000

- 7.4.3. USD 2,000 to USD 3,000

- 7.4.4. USD 3,000 and Above

- 7.5. Market Analysis, Insights and Forecast - by Operating Segment

- 7.5.1. Android

- 7.5.2. Tizen

- 7.5.3. WebOS

- 7.5.4. Roku

- 7.5.5. Other Operating Systems

- 7.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 8. Europe USA Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 8.1.1. 30-45 Inches

- 8.1.2. 45-55 Inches

- 8.1.3. 55 Inches and above

- 8.2. Market Analysis, Insights and Forecast - by Resolution Type

- 8.2.1. 4K UHD TV

- 8.2.2. Full HD TV

- 8.2.3. HDTV

- 8.3. Market Analysis, Insights and Forecast - by Panel Type

- 8.3.1. LCD

- 8.3.2. LED

- 8.3.3. OLED

- 8.3.4. QLED

- 8.4. Market Analysis, Insights and Forecast - by Pricing Range

- 8.4.1. Under USD 1,000

- 8.4.2. USD 1,000 to USD 2,000

- 8.4.3. USD 2,000 to USD 3,000

- 8.4.4. USD 3,000 and Above

- 8.5. Market Analysis, Insights and Forecast - by Operating Segment

- 8.5.1. Android

- 8.5.2. Tizen

- 8.5.3. WebOS

- 8.5.4. Roku

- 8.5.5. Other Operating Systems

- 8.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 9. Middle East & Africa USA Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 9.1.1. 30-45 Inches

- 9.1.2. 45-55 Inches

- 9.1.3. 55 Inches and above

- 9.2. Market Analysis, Insights and Forecast - by Resolution Type

- 9.2.1. 4K UHD TV

- 9.2.2. Full HD TV

- 9.2.3. HDTV

- 9.3. Market Analysis, Insights and Forecast - by Panel Type

- 9.3.1. LCD

- 9.3.2. LED

- 9.3.3. OLED

- 9.3.4. QLED

- 9.4. Market Analysis, Insights and Forecast - by Pricing Range

- 9.4.1. Under USD 1,000

- 9.4.2. USD 1,000 to USD 2,000

- 9.4.3. USD 2,000 to USD 3,000

- 9.4.4. USD 3,000 and Above

- 9.5. Market Analysis, Insights and Forecast - by Operating Segment

- 9.5.1. Android

- 9.5.2. Tizen

- 9.5.3. WebOS

- 9.5.4. Roku

- 9.5.5. Other Operating Systems

- 9.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 10. Asia Pacific USA Smart TV Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 10.1.1. 30-45 Inches

- 10.1.2. 45-55 Inches

- 10.1.3. 55 Inches and above

- 10.2. Market Analysis, Insights and Forecast - by Resolution Type

- 10.2.1. 4K UHD TV

- 10.2.2. Full HD TV

- 10.2.3. HDTV

- 10.3. Market Analysis, Insights and Forecast - by Panel Type

- 10.3.1. LCD

- 10.3.2. LED

- 10.3.3. OLED

- 10.3.4. QLED

- 10.4. Market Analysis, Insights and Forecast - by Pricing Range

- 10.4.1. Under USD 1,000

- 10.4.2. USD 1,000 to USD 2,000

- 10.4.3. USD 2,000 to USD 3,000

- 10.4.4. USD 3,000 and Above

- 10.5. Market Analysis, Insights and Forecast - by Operating Segment

- 10.5.1. Android

- 10.5.2. Tizen

- 10.5.3. WebOS

- 10.5.4. Roku

- 10.5.5. Other Operating Systems

- 10.1. Market Analysis, Insights and Forecast - by Screen Size (Diagonal)

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 LG Electronics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TCL Technology*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Haier Group Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung Electronics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Westinghouse Electric Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hitachi Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hisense Group Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Insignia Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sharp Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 VIZIO Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Panasonic Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sony Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 LG Electronics Inc

List of Figures

- Figure 1: Global USA Smart TV Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global USA Smart TV Industry Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America USA Smart TV Industry Revenue (undefined), by Screen Size (Diagonal) 2025 & 2033

- Figure 4: North America USA Smart TV Industry Volume (Million), by Screen Size (Diagonal) 2025 & 2033

- Figure 5: North America USA Smart TV Industry Revenue Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 6: North America USA Smart TV Industry Volume Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 7: North America USA Smart TV Industry Revenue (undefined), by Resolution Type 2025 & 2033

- Figure 8: North America USA Smart TV Industry Volume (Million), by Resolution Type 2025 & 2033

- Figure 9: North America USA Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 10: North America USA Smart TV Industry Volume Share (%), by Resolution Type 2025 & 2033

- Figure 11: North America USA Smart TV Industry Revenue (undefined), by Panel Type 2025 & 2033

- Figure 12: North America USA Smart TV Industry Volume (Million), by Panel Type 2025 & 2033

- Figure 13: North America USA Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 14: North America USA Smart TV Industry Volume Share (%), by Panel Type 2025 & 2033

- Figure 15: North America USA Smart TV Industry Revenue (undefined), by Pricing Range 2025 & 2033

- Figure 16: North America USA Smart TV Industry Volume (Million), by Pricing Range 2025 & 2033

- Figure 17: North America USA Smart TV Industry Revenue Share (%), by Pricing Range 2025 & 2033

- Figure 18: North America USA Smart TV Industry Volume Share (%), by Pricing Range 2025 & 2033

- Figure 19: North America USA Smart TV Industry Revenue (undefined), by Operating Segment 2025 & 2033

- Figure 20: North America USA Smart TV Industry Volume (Million), by Operating Segment 2025 & 2033

- Figure 21: North America USA Smart TV Industry Revenue Share (%), by Operating Segment 2025 & 2033

- Figure 22: North America USA Smart TV Industry Volume Share (%), by Operating Segment 2025 & 2033

- Figure 23: North America USA Smart TV Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: North America USA Smart TV Industry Volume (Million), by Country 2025 & 2033

- Figure 25: North America USA Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America USA Smart TV Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: South America USA Smart TV Industry Revenue (undefined), by Screen Size (Diagonal) 2025 & 2033

- Figure 28: South America USA Smart TV Industry Volume (Million), by Screen Size (Diagonal) 2025 & 2033

- Figure 29: South America USA Smart TV Industry Revenue Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 30: South America USA Smart TV Industry Volume Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 31: South America USA Smart TV Industry Revenue (undefined), by Resolution Type 2025 & 2033

- Figure 32: South America USA Smart TV Industry Volume (Million), by Resolution Type 2025 & 2033

- Figure 33: South America USA Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 34: South America USA Smart TV Industry Volume Share (%), by Resolution Type 2025 & 2033

- Figure 35: South America USA Smart TV Industry Revenue (undefined), by Panel Type 2025 & 2033

- Figure 36: South America USA Smart TV Industry Volume (Million), by Panel Type 2025 & 2033

- Figure 37: South America USA Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 38: South America USA Smart TV Industry Volume Share (%), by Panel Type 2025 & 2033

- Figure 39: South America USA Smart TV Industry Revenue (undefined), by Pricing Range 2025 & 2033

- Figure 40: South America USA Smart TV Industry Volume (Million), by Pricing Range 2025 & 2033

- Figure 41: South America USA Smart TV Industry Revenue Share (%), by Pricing Range 2025 & 2033

- Figure 42: South America USA Smart TV Industry Volume Share (%), by Pricing Range 2025 & 2033

- Figure 43: South America USA Smart TV Industry Revenue (undefined), by Operating Segment 2025 & 2033

- Figure 44: South America USA Smart TV Industry Volume (Million), by Operating Segment 2025 & 2033

- Figure 45: South America USA Smart TV Industry Revenue Share (%), by Operating Segment 2025 & 2033

- Figure 46: South America USA Smart TV Industry Volume Share (%), by Operating Segment 2025 & 2033

- Figure 47: South America USA Smart TV Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America USA Smart TV Industry Volume (Million), by Country 2025 & 2033

- Figure 49: South America USA Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America USA Smart TV Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Europe USA Smart TV Industry Revenue (undefined), by Screen Size (Diagonal) 2025 & 2033

- Figure 52: Europe USA Smart TV Industry Volume (Million), by Screen Size (Diagonal) 2025 & 2033

- Figure 53: Europe USA Smart TV Industry Revenue Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 54: Europe USA Smart TV Industry Volume Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 55: Europe USA Smart TV Industry Revenue (undefined), by Resolution Type 2025 & 2033

- Figure 56: Europe USA Smart TV Industry Volume (Million), by Resolution Type 2025 & 2033

- Figure 57: Europe USA Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 58: Europe USA Smart TV Industry Volume Share (%), by Resolution Type 2025 & 2033

- Figure 59: Europe USA Smart TV Industry Revenue (undefined), by Panel Type 2025 & 2033

- Figure 60: Europe USA Smart TV Industry Volume (Million), by Panel Type 2025 & 2033

- Figure 61: Europe USA Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 62: Europe USA Smart TV Industry Volume Share (%), by Panel Type 2025 & 2033

- Figure 63: Europe USA Smart TV Industry Revenue (undefined), by Pricing Range 2025 & 2033

- Figure 64: Europe USA Smart TV Industry Volume (Million), by Pricing Range 2025 & 2033

- Figure 65: Europe USA Smart TV Industry Revenue Share (%), by Pricing Range 2025 & 2033

- Figure 66: Europe USA Smart TV Industry Volume Share (%), by Pricing Range 2025 & 2033

- Figure 67: Europe USA Smart TV Industry Revenue (undefined), by Operating Segment 2025 & 2033

- Figure 68: Europe USA Smart TV Industry Volume (Million), by Operating Segment 2025 & 2033

- Figure 69: Europe USA Smart TV Industry Revenue Share (%), by Operating Segment 2025 & 2033

- Figure 70: Europe USA Smart TV Industry Volume Share (%), by Operating Segment 2025 & 2033

- Figure 71: Europe USA Smart TV Industry Revenue (undefined), by Country 2025 & 2033

- Figure 72: Europe USA Smart TV Industry Volume (Million), by Country 2025 & 2033

- Figure 73: Europe USA Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Europe USA Smart TV Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: Middle East & Africa USA Smart TV Industry Revenue (undefined), by Screen Size (Diagonal) 2025 & 2033

- Figure 76: Middle East & Africa USA Smart TV Industry Volume (Million), by Screen Size (Diagonal) 2025 & 2033

- Figure 77: Middle East & Africa USA Smart TV Industry Revenue Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 78: Middle East & Africa USA Smart TV Industry Volume Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 79: Middle East & Africa USA Smart TV Industry Revenue (undefined), by Resolution Type 2025 & 2033

- Figure 80: Middle East & Africa USA Smart TV Industry Volume (Million), by Resolution Type 2025 & 2033

- Figure 81: Middle East & Africa USA Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 82: Middle East & Africa USA Smart TV Industry Volume Share (%), by Resolution Type 2025 & 2033

- Figure 83: Middle East & Africa USA Smart TV Industry Revenue (undefined), by Panel Type 2025 & 2033

- Figure 84: Middle East & Africa USA Smart TV Industry Volume (Million), by Panel Type 2025 & 2033

- Figure 85: Middle East & Africa USA Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 86: Middle East & Africa USA Smart TV Industry Volume Share (%), by Panel Type 2025 & 2033

- Figure 87: Middle East & Africa USA Smart TV Industry Revenue (undefined), by Pricing Range 2025 & 2033

- Figure 88: Middle East & Africa USA Smart TV Industry Volume (Million), by Pricing Range 2025 & 2033

- Figure 89: Middle East & Africa USA Smart TV Industry Revenue Share (%), by Pricing Range 2025 & 2033

- Figure 90: Middle East & Africa USA Smart TV Industry Volume Share (%), by Pricing Range 2025 & 2033

- Figure 91: Middle East & Africa USA Smart TV Industry Revenue (undefined), by Operating Segment 2025 & 2033

- Figure 92: Middle East & Africa USA Smart TV Industry Volume (Million), by Operating Segment 2025 & 2033

- Figure 93: Middle East & Africa USA Smart TV Industry Revenue Share (%), by Operating Segment 2025 & 2033

- Figure 94: Middle East & Africa USA Smart TV Industry Volume Share (%), by Operating Segment 2025 & 2033

- Figure 95: Middle East & Africa USA Smart TV Industry Revenue (undefined), by Country 2025 & 2033

- Figure 96: Middle East & Africa USA Smart TV Industry Volume (Million), by Country 2025 & 2033

- Figure 97: Middle East & Africa USA Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East & Africa USA Smart TV Industry Volume Share (%), by Country 2025 & 2033

- Figure 99: Asia Pacific USA Smart TV Industry Revenue (undefined), by Screen Size (Diagonal) 2025 & 2033

- Figure 100: Asia Pacific USA Smart TV Industry Volume (Million), by Screen Size (Diagonal) 2025 & 2033

- Figure 101: Asia Pacific USA Smart TV Industry Revenue Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 102: Asia Pacific USA Smart TV Industry Volume Share (%), by Screen Size (Diagonal) 2025 & 2033

- Figure 103: Asia Pacific USA Smart TV Industry Revenue (undefined), by Resolution Type 2025 & 2033

- Figure 104: Asia Pacific USA Smart TV Industry Volume (Million), by Resolution Type 2025 & 2033

- Figure 105: Asia Pacific USA Smart TV Industry Revenue Share (%), by Resolution Type 2025 & 2033

- Figure 106: Asia Pacific USA Smart TV Industry Volume Share (%), by Resolution Type 2025 & 2033

- Figure 107: Asia Pacific USA Smart TV Industry Revenue (undefined), by Panel Type 2025 & 2033

- Figure 108: Asia Pacific USA Smart TV Industry Volume (Million), by Panel Type 2025 & 2033

- Figure 109: Asia Pacific USA Smart TV Industry Revenue Share (%), by Panel Type 2025 & 2033

- Figure 110: Asia Pacific USA Smart TV Industry Volume Share (%), by Panel Type 2025 & 2033

- Figure 111: Asia Pacific USA Smart TV Industry Revenue (undefined), by Pricing Range 2025 & 2033

- Figure 112: Asia Pacific USA Smart TV Industry Volume (Million), by Pricing Range 2025 & 2033

- Figure 113: Asia Pacific USA Smart TV Industry Revenue Share (%), by Pricing Range 2025 & 2033

- Figure 114: Asia Pacific USA Smart TV Industry Volume Share (%), by Pricing Range 2025 & 2033

- Figure 115: Asia Pacific USA Smart TV Industry Revenue (undefined), by Operating Segment 2025 & 2033

- Figure 116: Asia Pacific USA Smart TV Industry Volume (Million), by Operating Segment 2025 & 2033

- Figure 117: Asia Pacific USA Smart TV Industry Revenue Share (%), by Operating Segment 2025 & 2033

- Figure 118: Asia Pacific USA Smart TV Industry Volume Share (%), by Operating Segment 2025 & 2033

- Figure 119: Asia Pacific USA Smart TV Industry Revenue (undefined), by Country 2025 & 2033

- Figure 120: Asia Pacific USA Smart TV Industry Volume (Million), by Country 2025 & 2033

- Figure 121: Asia Pacific USA Smart TV Industry Revenue Share (%), by Country 2025 & 2033

- Figure 122: Asia Pacific USA Smart TV Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Smart TV Industry Revenue undefined Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 2: Global USA Smart TV Industry Volume Million Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 3: Global USA Smart TV Industry Revenue undefined Forecast, by Resolution Type 2020 & 2033

- Table 4: Global USA Smart TV Industry Volume Million Forecast, by Resolution Type 2020 & 2033

- Table 5: Global USA Smart TV Industry Revenue undefined Forecast, by Panel Type 2020 & 2033

- Table 6: Global USA Smart TV Industry Volume Million Forecast, by Panel Type 2020 & 2033

- Table 7: Global USA Smart TV Industry Revenue undefined Forecast, by Pricing Range 2020 & 2033

- Table 8: Global USA Smart TV Industry Volume Million Forecast, by Pricing Range 2020 & 2033

- Table 9: Global USA Smart TV Industry Revenue undefined Forecast, by Operating Segment 2020 & 2033

- Table 10: Global USA Smart TV Industry Volume Million Forecast, by Operating Segment 2020 & 2033

- Table 11: Global USA Smart TV Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: Global USA Smart TV Industry Volume Million Forecast, by Region 2020 & 2033

- Table 13: Global USA Smart TV Industry Revenue undefined Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 14: Global USA Smart TV Industry Volume Million Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 15: Global USA Smart TV Industry Revenue undefined Forecast, by Resolution Type 2020 & 2033

- Table 16: Global USA Smart TV Industry Volume Million Forecast, by Resolution Type 2020 & 2033

- Table 17: Global USA Smart TV Industry Revenue undefined Forecast, by Panel Type 2020 & 2033

- Table 18: Global USA Smart TV Industry Volume Million Forecast, by Panel Type 2020 & 2033

- Table 19: Global USA Smart TV Industry Revenue undefined Forecast, by Pricing Range 2020 & 2033

- Table 20: Global USA Smart TV Industry Volume Million Forecast, by Pricing Range 2020 & 2033

- Table 21: Global USA Smart TV Industry Revenue undefined Forecast, by Operating Segment 2020 & 2033

- Table 22: Global USA Smart TV Industry Volume Million Forecast, by Operating Segment 2020 & 2033

- Table 23: Global USA Smart TV Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global USA Smart TV Industry Volume Million Forecast, by Country 2020 & 2033

- Table 25: United States USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United States USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Canada USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Canada USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Mexico USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Global USA Smart TV Industry Revenue undefined Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 32: Global USA Smart TV Industry Volume Million Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 33: Global USA Smart TV Industry Revenue undefined Forecast, by Resolution Type 2020 & 2033

- Table 34: Global USA Smart TV Industry Volume Million Forecast, by Resolution Type 2020 & 2033

- Table 35: Global USA Smart TV Industry Revenue undefined Forecast, by Panel Type 2020 & 2033

- Table 36: Global USA Smart TV Industry Volume Million Forecast, by Panel Type 2020 & 2033

- Table 37: Global USA Smart TV Industry Revenue undefined Forecast, by Pricing Range 2020 & 2033

- Table 38: Global USA Smart TV Industry Volume Million Forecast, by Pricing Range 2020 & 2033

- Table 39: Global USA Smart TV Industry Revenue undefined Forecast, by Operating Segment 2020 & 2033

- Table 40: Global USA Smart TV Industry Volume Million Forecast, by Operating Segment 2020 & 2033

- Table 41: Global USA Smart TV Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global USA Smart TV Industry Volume Million Forecast, by Country 2020 & 2033

- Table 43: Brazil USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Brazil USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Argentina USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Argentina USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of South America USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Rest of South America USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Global USA Smart TV Industry Revenue undefined Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 50: Global USA Smart TV Industry Volume Million Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 51: Global USA Smart TV Industry Revenue undefined Forecast, by Resolution Type 2020 & 2033

- Table 52: Global USA Smart TV Industry Volume Million Forecast, by Resolution Type 2020 & 2033

- Table 53: Global USA Smart TV Industry Revenue undefined Forecast, by Panel Type 2020 & 2033

- Table 54: Global USA Smart TV Industry Volume Million Forecast, by Panel Type 2020 & 2033

- Table 55: Global USA Smart TV Industry Revenue undefined Forecast, by Pricing Range 2020 & 2033

- Table 56: Global USA Smart TV Industry Volume Million Forecast, by Pricing Range 2020 & 2033

- Table 57: Global USA Smart TV Industry Revenue undefined Forecast, by Operating Segment 2020 & 2033

- Table 58: Global USA Smart TV Industry Volume Million Forecast, by Operating Segment 2020 & 2033

- Table 59: Global USA Smart TV Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global USA Smart TV Industry Volume Million Forecast, by Country 2020 & 2033

- Table 61: United Kingdom USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: United Kingdom USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: Germany USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Germany USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 65: France USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: France USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 67: Italy USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: Italy USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 69: Spain USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: Spain USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 71: Russia USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Russia USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 73: Benelux USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Benelux USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 75: Nordics USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Nordics USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 77: Rest of Europe USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of Europe USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 79: Global USA Smart TV Industry Revenue undefined Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 80: Global USA Smart TV Industry Volume Million Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 81: Global USA Smart TV Industry Revenue undefined Forecast, by Resolution Type 2020 & 2033

- Table 82: Global USA Smart TV Industry Volume Million Forecast, by Resolution Type 2020 & 2033

- Table 83: Global USA Smart TV Industry Revenue undefined Forecast, by Panel Type 2020 & 2033

- Table 84: Global USA Smart TV Industry Volume Million Forecast, by Panel Type 2020 & 2033

- Table 85: Global USA Smart TV Industry Revenue undefined Forecast, by Pricing Range 2020 & 2033

- Table 86: Global USA Smart TV Industry Volume Million Forecast, by Pricing Range 2020 & 2033

- Table 87: Global USA Smart TV Industry Revenue undefined Forecast, by Operating Segment 2020 & 2033

- Table 88: Global USA Smart TV Industry Volume Million Forecast, by Operating Segment 2020 & 2033

- Table 89: Global USA Smart TV Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 90: Global USA Smart TV Industry Volume Million Forecast, by Country 2020 & 2033

- Table 91: Turkey USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Turkey USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 93: Israel USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: Israel USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 95: GCC USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 96: GCC USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 97: North Africa USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: North Africa USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 99: South Africa USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: South Africa USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 101: Rest of Middle East & Africa USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: Rest of Middle East & Africa USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 103: Global USA Smart TV Industry Revenue undefined Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 104: Global USA Smart TV Industry Volume Million Forecast, by Screen Size (Diagonal) 2020 & 2033

- Table 105: Global USA Smart TV Industry Revenue undefined Forecast, by Resolution Type 2020 & 2033

- Table 106: Global USA Smart TV Industry Volume Million Forecast, by Resolution Type 2020 & 2033

- Table 107: Global USA Smart TV Industry Revenue undefined Forecast, by Panel Type 2020 & 2033

- Table 108: Global USA Smart TV Industry Volume Million Forecast, by Panel Type 2020 & 2033

- Table 109: Global USA Smart TV Industry Revenue undefined Forecast, by Pricing Range 2020 & 2033

- Table 110: Global USA Smart TV Industry Volume Million Forecast, by Pricing Range 2020 & 2033

- Table 111: Global USA Smart TV Industry Revenue undefined Forecast, by Operating Segment 2020 & 2033

- Table 112: Global USA Smart TV Industry Volume Million Forecast, by Operating Segment 2020 & 2033

- Table 113: Global USA Smart TV Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 114: Global USA Smart TV Industry Volume Million Forecast, by Country 2020 & 2033

- Table 115: China USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 116: China USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 117: India USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 118: India USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 119: Japan USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 120: Japan USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 121: South Korea USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 122: South Korea USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 123: ASEAN USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 124: ASEAN USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 125: Oceania USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 126: Oceania USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 127: Rest of Asia Pacific USA Smart TV Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 128: Rest of Asia Pacific USA Smart TV Industry Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Smart TV Industry?

The projected CAGR is approximately 2.29%.

2. Which companies are prominent players in the USA Smart TV Industry?

Key companies in the market include LG Electronics Inc, TCL Technology*List Not Exhaustive, Haier Group Corporation, Samsung Electronics Co Ltd, Westinghouse Electric Corporation, Hitachi Ltd, Hisense Group Co Ltd, Insignia Systems Inc, Koninklijke Philips NV, Sharp Corporation, VIZIO Inc, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the USA Smart TV Industry?

The market segments include Screen Size (Diagonal), Resolution Type, Panel Type, Pricing Range, Operating Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Disposable Income across Emerging Economies; Rising Trend of Video-on-demand Service.

6. What are the notable trends driving market growth?

Boosting Demand for 55 Inches and above Screen Size.

7. Are there any restraints impacting market growth?

Slower Rate of Penetration of Telematics in Developing Regions; Delayed Regulatory Sanctions.

8. Can you provide examples of recent developments in the market?

April 2022 - Panasonic launched its flagship OLED TV, the LZ2000, in 55-inch, 65-inch, and, for the first time, 77-inch sizes. The LZ2000 is a gaming TV powerhouse with high-quality TV series, new Game Control Board settings, automatic NVIDIA GPU detection, improved 60Hz latency, and HDMI2.1 support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Smart TV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Smart TV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Smart TV Industry?

To stay informed about further developments, trends, and reports in the USA Smart TV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence