Key Insights

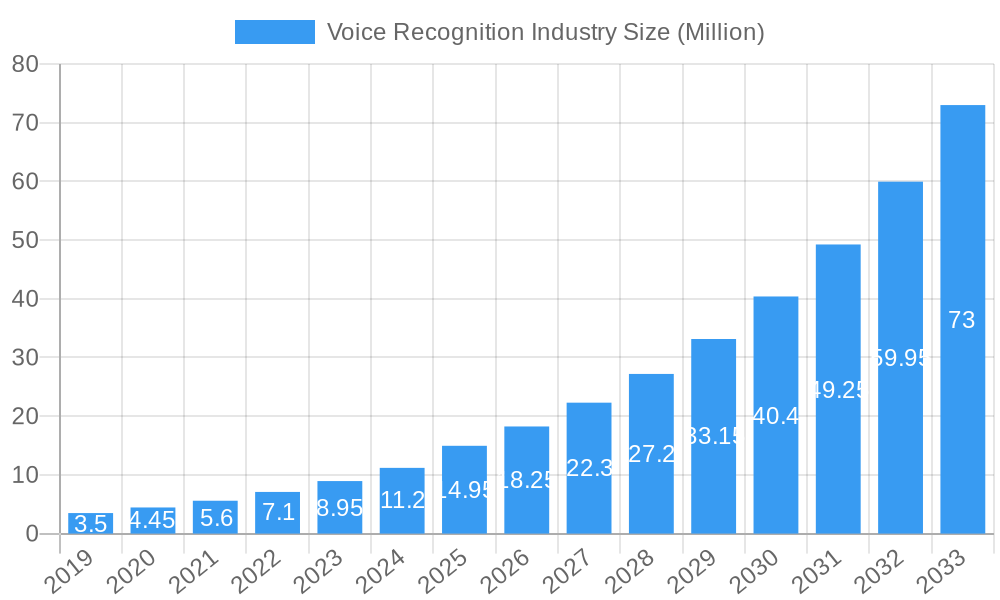

The global Voice Recognition Market is poised for explosive growth, projected to reach a substantial USD 14.95 billion by 2025, fueled by an impressive Compound Annual Growth Rate (CAGR) of 22.98%. This surge is primarily driven by the increasing adoption of voice assistants across consumer electronics, the burgeoning demand for hands-free interaction in automotive systems, and the critical need for enhanced security through voice biometrics in the banking and healthcare sectors. The ongoing digital transformation and the proliferation of smart devices are creating a fertile ground for voice recognition technologies to become an indispensable part of our daily lives. Furthermore, the continuous advancements in artificial intelligence and natural language processing are enhancing the accuracy and capabilities of voice recognition systems, making them more intuitive and reliable for a wider range of applications. The market's trajectory indicates a strong shift towards cloud-based deployment models, offering scalability, flexibility, and cost-effectiveness for businesses of all sizes.

Voice Recognition Industry Market Size (In Million)

While the market benefits from robust growth drivers, certain restraints, such as concerns surrounding data privacy and security, along with the need for robust infrastructure to support widespread adoption, will require strategic attention. However, the widespread integration of voice recognition into diverse end-user industries including telecommunications, government, and consumer applications, alongside the innovative efforts of key players like Alphabet Inc., Microsoft Corporation, and Amazon.com Inc., is expected to significantly mitigate these challenges. The ongoing innovation in areas like natural language understanding, accent recognition, and speaker identification is paving the way for more sophisticated and user-friendly voice recognition solutions. This robust ecosystem of technological advancement and market demand solidifies the voice recognition industry's position as a high-growth sector with substantial future potential.

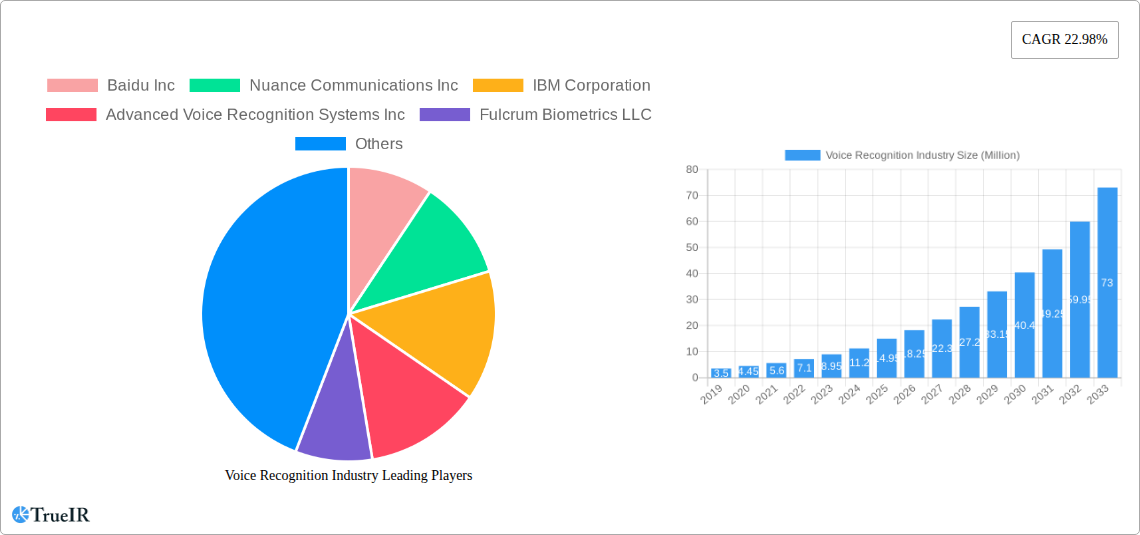

Voice Recognition Industry Company Market Share

This in-depth Voice Recognition Industry Market Report offers a comprehensive analysis of the global voice recognition market, providing critical insights for stakeholders navigating this rapidly evolving sector. Covering the historical period of 2019–2024, the base year of 2025, and a detailed forecast period spanning 2025–2033, this report leverages high-volume SEO keywords to ensure maximum visibility and accessibility for industry professionals. Explore market dynamics, competitive landscapes, technological advancements, and future growth opportunities within the multi-million dollar voice recognition ecosystem.

Voice Recognition Industry Market Structure & Competitive Landscape

The voice recognition industry exhibits a dynamic market structure characterized by a moderate to high level of concentration, driven by significant investments in research and development and ongoing technological innovation. Key innovation drivers include advancements in Natural Language Processing (NLP), Artificial Intelligence (AI), and machine learning algorithms, enabling more accurate and nuanced voice interactions. Regulatory impacts, while nascent in some regions, are beginning to shape data privacy and security standards, influencing deployment strategies. Product substitutes, such as advanced touch interfaces and gesture recognition, are present but have yet to fully displace the growing adoption of voice as a primary input method.

The end-user segmentation of the voice recognition market is diverse and expanding, with significant contributions from:

- Automotive: In-car infotainment and control systems.

- Banking: Fraud detection and customer service automation.

- Telecommunication: Customer support and device interaction.

- Healthcare: Dictation, patient monitoring, and administrative tasks.

- Government: Public safety and administrative efficiency.

- Consumer Applications: Smart assistants, wearables, and home automation.

- Other End Users: Including education, retail, and industrial sectors.

Mergers and acquisitions (M&A) trends are a notable feature, with larger technology firms acquiring specialized voice recognition startups to enhance their product portfolios and market reach. For instance, substantial M&A activity has been observed in the past few years, with an estimated volume of over $500 million in disclosed deals, reflecting the strategic importance of voice capabilities. Concentration ratios, particularly among the top five players, indicate a strong market share held by established technology giants, though a vibrant ecosystem of niche players continues to drive specialized innovation.

Voice Recognition Industry Market Trends & Opportunities

The global voice recognition market is experiencing substantial growth, projected to reach multi-million dollar valuations by the end of the forecast period. This expansion is fueled by a confluence of technological advancements, shifting consumer preferences, and increasing industry adoption. The market size has grown from approximately $2,000 million in 2019 to an estimated $3,500 million in 2024, with an anticipated Compound Annual Growth Rate (CAGR) of over 15% through 2033.

Technological shifts are at the forefront of this growth. The refinement of deep learning algorithms has led to dramatic improvements in speech recognition accuracy, even in noisy environments and with diverse accents. The development of natural language understanding (NLU) capabilities allows for more conversational and context-aware interactions, moving beyond simple command recognition to genuine dialogue. Furthermore, the integration of voice recognition with other AI technologies, such as sentiment analysis and predictive analytics, is unlocking new applications and enhancing user experiences. The proliferation of voice-enabled devices, from smartphones and smart speakers to automotive infotainment systems and wearable technology, is a significant driver of market penetration.

Consumer preferences are increasingly leaning towards hands-free and intuitive interfaces. The convenience and efficiency offered by voice assistants and voice control are highly valued, particularly in scenarios where users are multitasking or have limited mobility. This preference is evident across various demographics and is driving demand for voice-enabled products and services in both consumer and enterprise settings.

Competitive dynamics within the voice recognition industry are intense. Established technology giants like Alphabet Inc., Amazon com Inc., Apple Inc., and Microsoft Corporation are investing heavily in proprietary voice technologies and integrated ecosystems. However, there is also significant opportunity for specialized companies focusing on niche applications or advanced technological solutions. The increasing demand for secure voice biometrics for authentication and identification purposes presents a substantial market opportunity, as does the growing need for multilingual voice recognition capabilities to cater to a global user base. The healthcare sector, with its critical need for efficient data entry and patient engagement, continues to be a fertile ground for voice recognition adoption, as do the automotive and telecommunications industries, where voice control is becoming a standard feature. The ongoing evolution of AI-powered voice technology promises to further democratize access and expand the utility of voice interactions across all facets of life.

Dominant Markets & Segments in Voice Recognition Industry

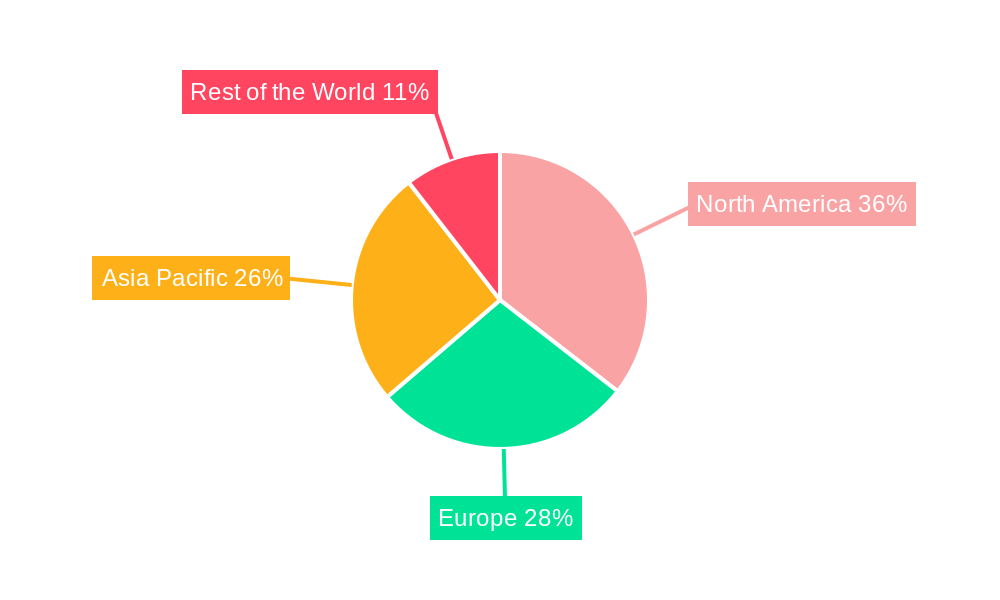

The voice recognition industry's dominance is currently observed across several key regions and user segments, propelled by robust technological infrastructure, supportive government policies, and substantial market demand. North America, particularly the United States, remains a leading market due to its early adoption of voice technologies, significant R&D investments, and a large consumer base for smart devices and AI-powered services. Europe, driven by Germany, the UK, and France, also represents a significant market, with increasing adoption in the automotive and healthcare sectors. The Asia-Pacific region, led by China and Japan, is emerging as a rapidly growing market, fueled by a burgeoning tech-savvy population and increasing government initiatives supporting digital transformation.

Among the deployment segments, Cloud-based voice recognition is currently dominating, accounting for an estimated 70% of the market share. This dominance is attributed to its scalability, cost-effectiveness, and the ability to process complex AI algorithms without requiring high-end local hardware. Cloud platforms offer continuous updates and access to the latest AI models, making them highly attractive for businesses of all sizes. On-premise solutions, while still significant, particularly for highly sensitive data environments like government and certain healthcare applications, are seeing slower growth compared to cloud deployments.

In terms of end-user segments, several sectors are driving significant market growth:

- Automotive: The integration of advanced voice control systems for infotainment, navigation, and vehicle operations is a major growth driver. This segment is characterized by increasing demand for hands-free operation, enhancing driver safety and convenience.

- Healthcare: Voice recognition is revolutionizing healthcare by improving clinical documentation accuracy, streamlining administrative tasks, and enhancing patient engagement. The adoption of medical speech recognition software is on the rise, enabling faster and more efficient record-keeping.

- Consumer Applications: This segment, encompassing smart speakers, smartphones, and wearable devices, continues to be a powerhouse. The widespread adoption of voice assistants for everyday tasks, entertainment, and home automation fuels continuous demand.

- Banking & Financial Services: Voice biometrics are increasingly being used for customer authentication, fraud prevention, and personalized customer service, leading to enhanced security and improved customer experience.

The Telecommunication sector is also a key player, leveraging voice recognition for customer service automation and interactive voice response (IVR) systems. Government applications are growing, with voice technology being explored for public safety, defense, and citizen services. The “Other End Users” category, including education, retail, and industrial applications, presents significant untapped potential for future growth as these sectors increasingly recognize the benefits of voice-enabled solutions. The continued investment in infrastructure, coupled with policies encouraging digital adoption, will further solidify the dominance of these key markets and segments in the coming years.

Voice Recognition Industry Product Analysis

The voice recognition industry is witnessing a continuous stream of product innovations driven by advancements in AI and machine learning. Key product developments include the refinement of wake-word detection for always-on voice assistants, enabling more responsive and energy-efficient activation. Innovations in speaker identification and voice biometrics are enhancing security and personalization across various applications, from device unlocking to financial transactions. Furthermore, the development of natural language understanding (NLU) engines is enabling more sophisticated conversational AI, allowing devices to understand context, intent, and even emotion. These advancements are creating a richer and more intuitive user experience, making voice an increasingly viable and preferred mode of interaction across a wide spectrum of devices and services. The competitive advantage lies in the accuracy, speed, and naturalness of the voice interaction, as well as the ability to integrate seamlessly with existing ecosystems.

Key Drivers, Barriers & Challenges in Voice Recognition Industry

The voice recognition industry is propelled by several key drivers, primarily technological advancements in AI and machine learning, leading to enhanced accuracy and natural language processing capabilities. The growing adoption of smart devices, including smartphones, smart speakers, and wearables, fuels demand for voice interfaces. Furthermore, the increasing need for hands-free operation in environments like automotive and healthcare, coupled with government initiatives promoting digital transformation, acts as a significant catalyst. The convenience and efficiency offered by voice commands are also major drivers, improving user experience across diverse applications. The market size for voice recognition is projected to reach multi-million dollar figures, underscoring its economic importance.

However, the industry faces notable barriers and challenges. Privacy concerns and data security remain paramount, as voice data can be highly sensitive. Regulatory hurdles related to data handling and consent, particularly in regions like Europe with GDPR, can impede widespread adoption. Accuracy limitations in noisy environments or with diverse accents and dialects, although improving, still present challenges for seamless user experience. The high cost of development and integration for complex enterprise-level voice solutions can be a barrier for smaller businesses. Supply chain issues related to specialized hardware components for voice processing, although less prominent than in other tech sectors, can occasionally impact production timelines. Competitive pressures from established tech giants with vast resources also create a challenging landscape for smaller innovators. Overcoming these challenges will be crucial for sustained growth in the multi-million dollar voice recognition market.

Growth Drivers in the Voice Recognition Industry Market

The voice recognition industry market is experiencing robust growth driven by several key factors. Technologically, the continuous advancements in Artificial Intelligence (AI), particularly deep learning and Natural Language Processing (NLP), are leading to unprecedented improvements in speech recognition accuracy and understanding. This enhanced capability makes voice interfaces more reliable and user-friendly. Economically, the increasing affordability and proliferation of voice-enabled devices, from smart speakers and smartphones to automotive systems and wearables, are expanding the potential user base exponentially. Government initiatives in various countries promoting digital transformation and smart city development are also acting as significant growth catalysts, encouraging the integration of voice technology into public services and infrastructure. The growing demand for hands-free operation in sectors like automotive and healthcare, coupled with the convenience and efficiency benefits offered by voice interactions, further fuels market expansion in this multi-million dollar industry.

Challenges Impacting Voice Recognition Industry Growth

Several challenges are impacting the growth of the voice recognition industry. Foremost among these are the complexities surrounding data privacy and security concerns. The collection and processing of sensitive voice data raise significant ethical and regulatory questions, with stringent data protection laws like GDPR in Europe creating compliance hurdles. Accuracy limitations in diverse and challenging acoustic environments, such as noisy public spaces or with users exhibiting non-standard speech patterns, continue to be a restraint, though significant progress is being made. The high cost of developing and implementing sophisticated, enterprise-grade voice recognition solutions can be a barrier for smaller businesses, limiting market penetration in certain segments. Furthermore, supply chain disruptions for specialized voice processing hardware, while less pervasive, can occasionally affect the timely delivery of advanced voice-enabled products. Intense competitive pressures from dominant tech players also create a challenging environment for smaller, innovative companies vying for market share in this multi-million dollar industry.

Key Players Shaping the Voice Recognition Industry Market

- Baidu Inc

- Nuance Communications Inc

- IBM Corporation

- Advanced Voice Recognition Systems Inc

- Fulcrum Biometrics LLC

- Alphabet Inc

- Brainasoft

- Microsoft Corporation

- Amazon com Inc

- Sensory Inc

- Apple Inc

- Neurotechnology

- Auraya Systems Pty Ltd

Significant Voice Recognition Industry Industry Milestones

- June 2022: ArkX Laboratories announced the release of EveryWord Voice Control, incorporating the Sensory TrulyHandsfree SDK software stack. This integration allows OEMs to create tailored wake-words, control sets (21 dialects), and speech validation designs for voice interfaces.

- April 2022: A Yorkshire hospital's trust launched speech recognition technology developed by an NHS healthcare technology professional, implemented by the Health Informatics Service (THIS) to aid the Calderdale and Huddersfield NHS Foundation Trust (CHFT).

- April 2022: Imagine Learning collaborated with SoapBox Labs, a Dublin-based voice recognition startup, to drive enhanced learning and playing experiences for millions of children in the United States.

Future Outlook for Voice Recognition Industry Market

The future outlook for the voice recognition industry market is exceptionally promising, characterized by sustained and accelerated growth. Key growth catalysts include the ongoing convergence of AI, machine learning, and NLP, which will continue to drive remarkable improvements in the accuracy, naturalness, and contextual understanding of voice interactions. The expanding ecosystem of voice-enabled devices, coupled with increasing consumer demand for intuitive, hands-free interfaces, will solidify voice as a primary mode of human-computer interaction. Strategic opportunities lie in the further penetration of voice biometrics for enhanced security and personalization, the development of more sophisticated conversational AI for enterprise applications, and the expansion of voice solutions into emerging markets and underserved sectors like education and industrial automation. The multi-million dollar market is poised for continued innovation and widespread adoption, making it a critical area for future technological development and investment.

Voice Recognition Industry Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-premise

-

2. End User

- 2.1. Automotive

- 2.2. Banking

- 2.3. Telecommunication

- 2.4. Healthcare

- 2.5. Government

- 2.6. Consumer Applications

- 2.7. Other End Users

Voice Recognition Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Voice Recognition Industry Regional Market Share

Geographic Coverage of Voice Recognition Industry

Voice Recognition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Authentication Market; Increase in Voice-based Searches; Demand for Connected Devices

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Involved

- 3.4. Market Trends

- 3.4.1. Growing Security Concerns Drive the Market for Voice Recognition

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Voice Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Banking

- 5.2.3. Telecommunication

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Consumer Applications

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Voice Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Automotive

- 6.2.2. Banking

- 6.2.3. Telecommunication

- 6.2.4. Healthcare

- 6.2.5. Government

- 6.2.6. Consumer Applications

- 6.2.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Voice Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Automotive

- 7.2.2. Banking

- 7.2.3. Telecommunication

- 7.2.4. Healthcare

- 7.2.5. Government

- 7.2.6. Consumer Applications

- 7.2.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Voice Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Automotive

- 8.2.2. Banking

- 8.2.3. Telecommunication

- 8.2.4. Healthcare

- 8.2.5. Government

- 8.2.6. Consumer Applications

- 8.2.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Rest of the World Voice Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Automotive

- 9.2.2. Banking

- 9.2.3. Telecommunication

- 9.2.4. Healthcare

- 9.2.5. Government

- 9.2.6. Consumer Applications

- 9.2.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Baidu Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nuance Communications Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Advanced Voice Recognition Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fulcrum Biometrics LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Alphabet Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Brainasoft*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Microsoft Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Amazon com Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sensory Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Apple Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Neurotechnology

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Auraya Systems Pty Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Baidu Inc

List of Figures

- Figure 1: Global Voice Recognition Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Voice Recognition Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Voice Recognition Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Voice Recognition Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Voice Recognition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Voice Recognition Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Voice Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Voice Recognition Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 9: Europe Voice Recognition Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Voice Recognition Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Voice Recognition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Voice Recognition Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Voice Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Voice Recognition Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Asia Pacific Voice Recognition Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific Voice Recognition Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Voice Recognition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Voice Recognition Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Voice Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Voice Recognition Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Rest of the World Voice Recognition Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Rest of the World Voice Recognition Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World Voice Recognition Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Voice Recognition Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Voice Recognition Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Voice Recognition Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Voice Recognition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Voice Recognition Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Voice Recognition Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 5: Global Voice Recognition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Voice Recognition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Voice Recognition Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Voice Recognition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Voice Recognition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Voice Recognition Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Global Voice Recognition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Voice Recognition Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Voice Recognition Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Voice Recognition Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Voice Recognition Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Voice Recognition Industry?

The projected CAGR is approximately 22.98%.

2. Which companies are prominent players in the Voice Recognition Industry?

Key companies in the market include Baidu Inc, Nuance Communications Inc, IBM Corporation, Advanced Voice Recognition Systems Inc, Fulcrum Biometrics LLC, Alphabet Inc, Brainasoft*List Not Exhaustive, Microsoft Corporation, Amazon com Inc, Sensory Inc, Apple Inc, Neurotechnology, Auraya Systems Pty Ltd.

3. What are the main segments of the Voice Recognition Industry?

The market segments include Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Authentication Market; Increase in Voice-based Searches; Demand for Connected Devices.

6. What are the notable trends driving market growth?

Growing Security Concerns Drive the Market for Voice Recognition.

7. Are there any restraints impacting market growth?

High Initial Cost Involved.

8. Can you provide examples of recent developments in the market?

June 2022: ArkX Laboratories announced the release of EveryWord Voice Control, which incorporates the Sensory TrulyHandsfree SDK software stack. When combined with the manufacturing EveryWord Audio Front End (AFE) or Voice Component, the two companies' innovative far-field voice acquisition and speech recognition innovations facilitate OEMs to create tailored wake-words, small to moderate control sets (21 dialects), and speech validation designs for voice interfaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Voice Recognition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Voice Recognition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Voice Recognition Industry?

To stay informed about further developments, trends, and reports in the Voice Recognition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence