Key Insights

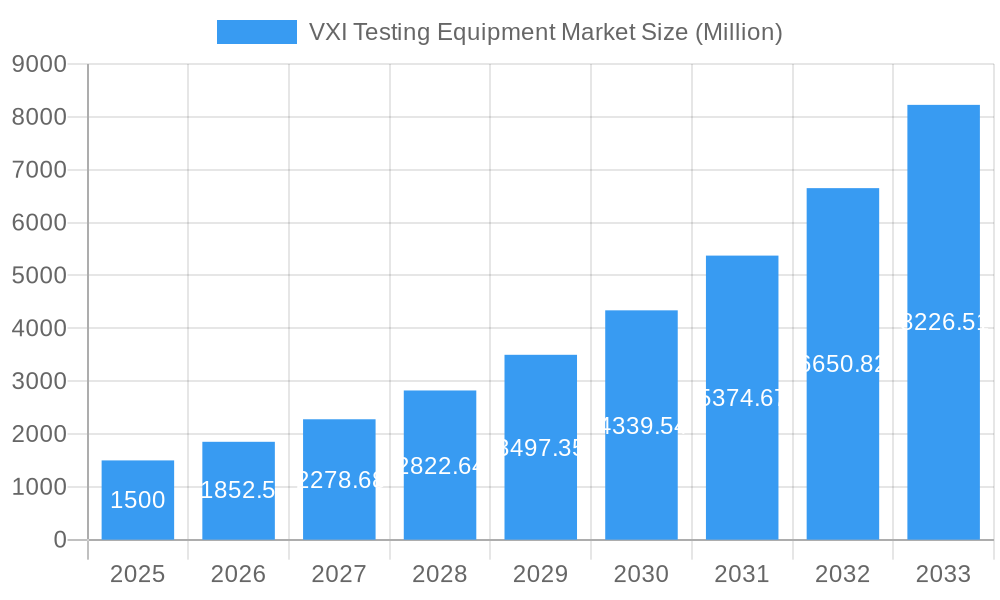

The VXI (VMEbus Extensions for Instrumentation) testing equipment market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of 7.27% from 2025 to 2033. This growth trajectory is propelled by the increasing complexity of electronic systems across industries such as consumer electronics, telecommunications, and aerospace & defense, demanding advanced testing solutions. The imperative for enhanced testing accuracy, accelerated test cycles, and greater automation in manufacturing operations are significant market drivers. The proliferation of technologies like 5G and the Internet of Things (IoT) is also augmenting the demand for dependable and efficient VXI testing equipment. Moreover, the trend towards device miniaturization and heightened integration necessitates precise and thorough testing methodologies, further stimulating market development.

VXI Testing Equipment Market Market Size (In Billion)

Despite this positive outlook, the market faces certain headwinds. Substantial upfront investment for VXI system acquisition and upkeep can present a barrier, especially for smaller enterprises. The emergence of alternative testing solutions and the risk of legacy VXI system obsolescence represent competitive challenges. However, continuous technological evolution within the VXI framework, including enhanced software capabilities and modular architectures, is actively addressing these concerns. The market is notably segmented by end-user applications, with consumer electronics and telecommunications emerging as the dominant sectors. Leading industry participants, including National Instruments and Agilent Technologies, are spearheading innovation and fostering market competition. The Asia-Pacific region is expected to exhibit robust growth, driven by expanding manufacturing capacities and rising adoption of electronic products. The global VXI testing equipment market was valued at approximately 5.77 billion in the base year 2025.

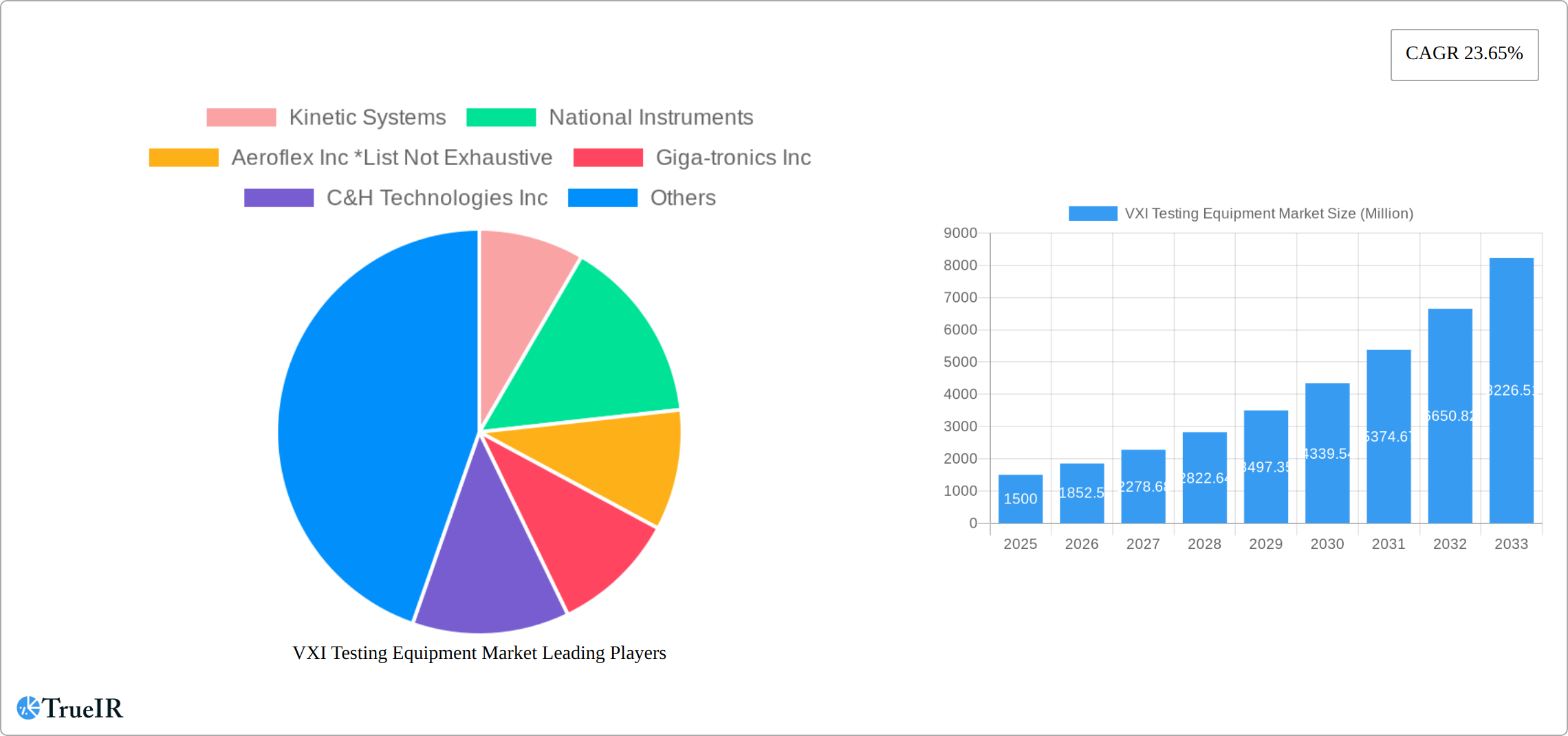

VXI Testing Equipment Market Company Market Share

VXI Testing Equipment Market: A Comprehensive Report (2019-2033)

This dynamic report provides a thorough analysis of the VXI Testing Equipment market, offering invaluable insights for stakeholders seeking to navigate this evolving landscape. Leveraging extensive market research and data analysis spanning the period 2019-2033 (with a base year of 2025 and a forecast period of 2025-2033), this report unveils key trends, growth drivers, and challenges impacting the market's trajectory. The report's detailed segmentation by product type (Oscilloscopes, Function Generators, Power Suppliers, Other Product Types) and end-user (Consumer Electronics, Communications, Aerospace, Military and Defense, Industrial Electronics, Other End Users) provides a granular understanding of market dynamics. The report also profiles key players like Kinetic Systems, National Instruments, Aeroflex Inc, Giga-tronics Inc, C&H Technologies Inc, Agilent Technologies, and Interface Technology Inc, offering a competitive analysis and future outlook. The estimated market size in 2025 is valued at XX Million, projected to reach YY Million by 2033, exhibiting a robust CAGR of ZZ%.

VXI Testing Equipment Market Structure & Competitive Landscape

The VXI Testing Equipment market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately concentrated market. This concentration is driven by high barriers to entry, including significant R&D investments, specialized expertise, and established distribution networks. Innovation plays a crucial role, with companies continuously striving to improve accuracy, speed, and functionality of their testing equipment. Regulatory compliance, particularly regarding safety and electromagnetic compatibility (EMC), significantly impacts market operations. Product substitutes, such as software-defined testing solutions, are emerging as potential disruptors. End-user segmentation reveals that the Aerospace & Defense and Communication sectors are currently the largest consumers of VXI testing equipment. The market has witnessed a moderate level of M&A activity in recent years, with approximately xx deals recorded between 2019 and 2024. This activity is expected to continue, driven by the need for companies to expand their product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with HHI estimated at xx in 2025.

- Innovation Drivers: Advancements in semiconductor technology, demand for higher testing accuracy, and the adoption of automated testing solutions.

- Regulatory Impacts: Compliance with safety and EMC standards significantly affects product development and market entry.

- Product Substitutes: Software-defined testing and other alternative technologies pose a potential threat.

- End-User Segmentation: Aerospace & Defense and Communications sectors dominate market demand.

- M&A Trends: Moderate M&A activity (approx. xx deals between 2019 and 2024).

VXI Testing Equipment Market Market Trends & Opportunities

The VXI (VMEbus Extensions for Instrumentation) Testing Equipment market is currently experiencing robust expansion, propelled by a confluence of dynamic market forces. A primary driver is the escalating demand for sophisticated and high-performance electronic systems across a diverse range of industries. Sectors such as consumer electronics, the rapidly evolving automotive landscape (particularly with the surge in electric vehicles and autonomous driving), and the critical realm of industrial automation are all contributing significantly to this growth. Furthermore, the global rollout of 5G technology and the continuous development of other advanced communication protocols are creating an imperative for high-speed, precise testing solutions, thereby boosting the adoption of VXI equipment.

Technological innovation is also playing a pivotal role. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into testing processes is revolutionizing efficiency and accuracy, enabling predictive maintenance, adaptive testing, and more sophisticated data analysis. This intelligent approach allows for faster identification of faults and optimization of testing procedures. The market has demonstrated significant growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 6-8% between 2019 and 2024 (please note: the exact CAGR should be replaced with current market research data). While developed regions exhibit high market penetration rates for VXI solutions, there is substantial untapped potential for growth in emerging economies that are rapidly industrializing and expanding their technological infrastructure.

This upward trajectory is projected to continue throughout the forecast period, fueled by ongoing technological advancements, the sustained demand from key end-user industries, and increased investment in Research and Development (R&D) by market participants. The competitive landscape is characterized by moderate intensity, with established players vying for market share through competitive pricing, superior performance, and continuous innovation. The emergence and increasing prominence of software-defined testing platforms present both exciting opportunities and strategic challenges for traditional VXI equipment manufacturers, necessitating adaptation and the development of integrated hardware-software solutions.

Dominant Markets & Segments in VXI Testing Equipment Market

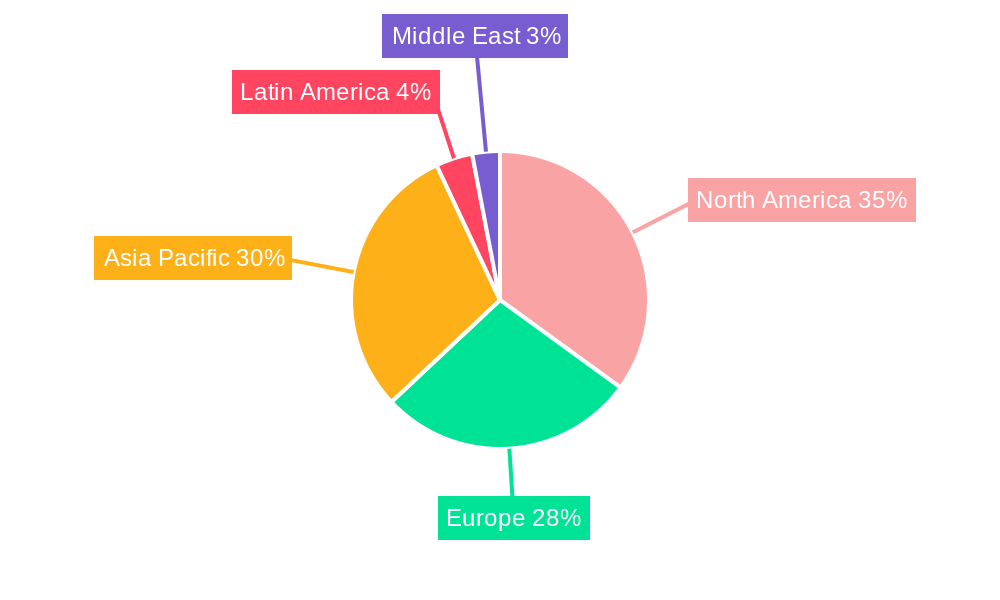

The North American region currently holds the largest market share in VXI testing equipment, followed by Europe and Asia-Pacific. Within product types, Oscilloscopes dominate the market due to their versatility and widespread use in various testing applications. In terms of end-users, the Aerospace & Defense and Communications sectors are the key drivers of market growth.

- Leading Region: North America

- Leading Product Type: Oscilloscopes

- Leading End-User: Aerospace & Defense and Communications

Key Growth Drivers:

- Aerospace & Defense: Stringent quality control requirements and the need for reliable testing equipment.

- Communications: Demand for high-speed testing solutions driven by 5G adoption and other advanced technologies.

- Industrial Electronics: Growth in automation and industrial IoT is increasing demand for testing equipment.

- Government Regulations: Stringent safety and quality standards driving adoption.

VXI Testing Equipment Market Product Analysis

Recent advancements in VXI testing equipment are fundamentally reshaping the capabilities and applications of these systems. A key focus for manufacturers has been on enhancing core performance metrics, leading to improvements in measurement accuracy, expanded bandwidth capabilities to support higher data rates, and significantly increased automation functionalities. Innovations are prominently featuring the development of software-defined instruments, which offer unparalleled flexibility and adaptability to evolving testing needs. Modular designs are increasingly prevalent, allowing users to customize their VXI systems by integrating specific instrument modules, thereby optimizing cost and performance for particular applications. Furthermore, the integration of robust remote access capabilities is greatly enhancing collaboration among geographically dispersed teams and improving overall operational efficiency.

These cutting-edge advancements empower manufacturers to deliver highly customized and application-specific solutions, providing them with a distinct competitive advantage in a demanding market. The trend towards integrating these advanced features ensures that VXI testing equipment remains at the forefront of complex electronic system validation and characterization.

Key Drivers, Barriers & Challenges in VXI Testing Equipment Market

Key Drivers:

- Growing demand from end-user industries (e.g., increasing adoption of 5G, expanding automation in manufacturing).

- Technological advancements (e.g., software-defined instruments, AI integration).

- Government regulations and standards (e.g., increased focus on product safety and reliability).

Key Challenges and Restraints:

- High initial investment costs, limiting adoption among smaller companies.

- Complexity of VXI systems, requiring specialized technical expertise.

- Competition from alternative testing methods (e.g., software-defined testing).

- Supply chain disruptions (e.g., impact of geopolitical events on component availability).

Growth Drivers in the VXI Testing Equipment Market Market

The market growth is significantly boosted by the increasing demand for high-performance electronics in various industries, technological advancements like the adoption of AI and machine learning, and stringent government regulations necessitating rigorous testing procedures. These factors are collectively driving the need for advanced and reliable VXI testing equipment.

Challenges Impacting VXI Testing Equipment Market Growth

Challenges include the high initial investment cost limiting smaller companies' adoption, the complexity demanding specialized expertise, and competition from alternative technologies. Furthermore, supply chain disruptions due to global events add pressure, limiting timely availability and impacting overall market growth.

Key Players Shaping the VXI Testing Equipment Market Market

- Kinetic Systems

- National Instruments

- Aeroflex Inc

- Giga-tronics Inc

- C&H Technologies Inc

- Agilent Technologies

- Interface Technology Inc

Significant VXI Testing Equipment Market Industry Milestones

- 2020: National Instruments, a leading innovator, launched a new generation of VXI modules, significantly enhancing performance capabilities and addressing the growing demands for higher speed and precision in testing.

- 2022: Aeroflex Inc strategically expanded its product portfolio and market reach through the acquisition of a prominent smaller VXI equipment manufacturer, reinforcing its position in the market.

- 2023: A wave of strategic partnerships emerged as several key players collaborated to integrate advanced AI capabilities into their VXI testing solutions, paving the way for more intelligent and automated testing environments.

- 2024: New and updated regulatory standards concerning Electromagnetic Compatibility (EMC) came into effect globally. These evolving standards have a direct impact on product design, manufacturing processes, and the required testing protocols for electronic equipment.

Future Outlook for VXI Testing Equipment Market Market

The VXI testing equipment market is poised for continued growth, fueled by the ongoing demand for advanced testing solutions across various sectors and the continued technological advancements in testing capabilities. Strategic partnerships, acquisitions, and product innovations will shape the competitive landscape. The rising adoption of AI and automation in testing processes presents significant opportunities for market expansion and revenue growth. The market's future outlook is promising, with considerable potential for further growth and development.

VXI Testing Equipment Market Segmentation

-

1. Product Type

- 1.1. Oscilloscopes

- 1.2. Function Generators

- 1.3. Power Suppliers

- 1.4. Other Product Types

-

2. End User

- 2.1. Consumer Electronics

- 2.2. Communications

- 2.3. Aerospace, Military and Defense

- 2.4. Industrial Electronics

- 2.5. Other End Users

VXI Testing Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

VXI Testing Equipment Market Regional Market Share

Geographic Coverage of VXI Testing Equipment Market

VXI Testing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Consumer Electronics Sale; Increased Focus on Sophisticated Testing Methods

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Testing Equipment; Fluctuations in the Semiconductor Industry

- 3.4. Market Trends

- 3.4.1. Growth of Consumer Electronics to Drive VXI Testing Equipment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Oscilloscopes

- 5.1.2. Function Generators

- 5.1.3. Power Suppliers

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Consumer Electronics

- 5.2.2. Communications

- 5.2.3. Aerospace, Military and Defense

- 5.2.4. Industrial Electronics

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Oscilloscopes

- 6.1.2. Function Generators

- 6.1.3. Power Suppliers

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Consumer Electronics

- 6.2.2. Communications

- 6.2.3. Aerospace, Military and Defense

- 6.2.4. Industrial Electronics

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Oscilloscopes

- 7.1.2. Function Generators

- 7.1.3. Power Suppliers

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Consumer Electronics

- 7.2.2. Communications

- 7.2.3. Aerospace, Military and Defense

- 7.2.4. Industrial Electronics

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Oscilloscopes

- 8.1.2. Function Generators

- 8.1.3. Power Suppliers

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Consumer Electronics

- 8.2.2. Communications

- 8.2.3. Aerospace, Military and Defense

- 8.2.4. Industrial Electronics

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Oscilloscopes

- 9.1.2. Function Generators

- 9.1.3. Power Suppliers

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Consumer Electronics

- 9.2.2. Communications

- 9.2.3. Aerospace, Military and Defense

- 9.2.4. Industrial Electronics

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East VXI Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Oscilloscopes

- 10.1.2. Function Generators

- 10.1.3. Power Suppliers

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Consumer Electronics

- 10.2.2. Communications

- 10.2.3. Aerospace, Military and Defense

- 10.2.4. Industrial Electronics

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kinetic Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 National Instruments

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aeroflex Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Giga-tronics Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 C&H Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Agilent Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Interface Technology Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Kinetic Systems

List of Figures

- Figure 1: Global VXI Testing Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Latin America VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Latin America VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East VXI Testing Equipment Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East VXI Testing Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East VXI Testing Equipment Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East VXI Testing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East VXI Testing Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East VXI Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global VXI Testing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global VXI Testing Equipment Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global VXI Testing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global VXI Testing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the VXI Testing Equipment Market?

The projected CAGR is approximately 7.27%.

2. Which companies are prominent players in the VXI Testing Equipment Market?

Key companies in the market include Kinetic Systems, National Instruments, Aeroflex Inc *List Not Exhaustive, Giga-tronics Inc, C&H Technologies Inc, Agilent Technologies, Interface Technology Inc.

3. What are the main segments of the VXI Testing Equipment Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.77 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Consumer Electronics Sale; Increased Focus on Sophisticated Testing Methods.

6. What are the notable trends driving market growth?

Growth of Consumer Electronics to Drive VXI Testing Equipment Market.

7. Are there any restraints impacting market growth?

; High Cost Associated with Testing Equipment; Fluctuations in the Semiconductor Industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "VXI Testing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the VXI Testing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the VXI Testing Equipment Market?

To stay informed about further developments, trends, and reports in the VXI Testing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence