Key Insights

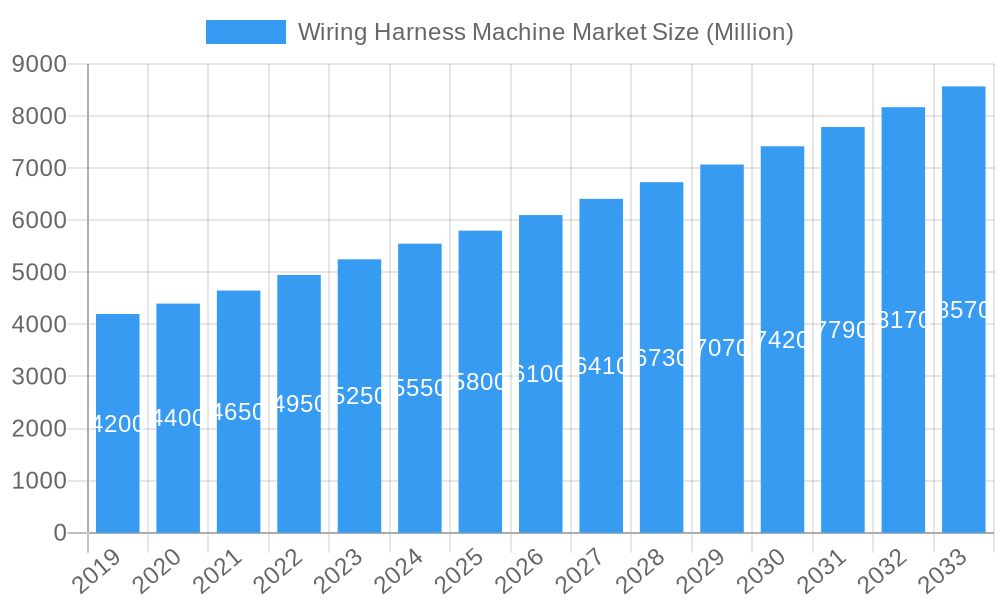

The global wiring harness machine market is projected for significant growth, anticipated to reach an estimated USD 5,800 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.00%. This expansion is primarily fueled by the increasing demand for advanced automotive electronics, including ADAS, infotainment systems, and vehicle electrification. The growing complexity of vehicle electrical systems necessitates automated solutions for wiring harness production. Enhanced manufacturing efficiency, precision, and adherence to stringent quality standards within the automotive industry also drive the adoption of advanced wiring harness machines to ensure reliability and reduce costs. The burgeoning production of electric vehicles (EVs), requiring specialized high-voltage wiring harnesses, further stimulates demand for these machines.

Wiring Harness Machine Market Market Size (In Billion)

The market's growth is further supported by the integration of Industry 4.0 technologies, such as IoT, AI, and automation, in wiring harness production, improving efficiency, traceability, and predictive maintenance. Emerging applications in commercial vehicles, aerospace, and industrial machinery also contribute to market diversification. Restraints include the high initial investment for advanced machinery and potential skilled labor shortages. However, continuous innovation in wire processing technologies and a growing global automotive production base, particularly in the Asia Pacific region, are expected to sustain strong market momentum. Key industry players are investing in R&D to develop versatile and intelligent machines that meet evolving industry needs.

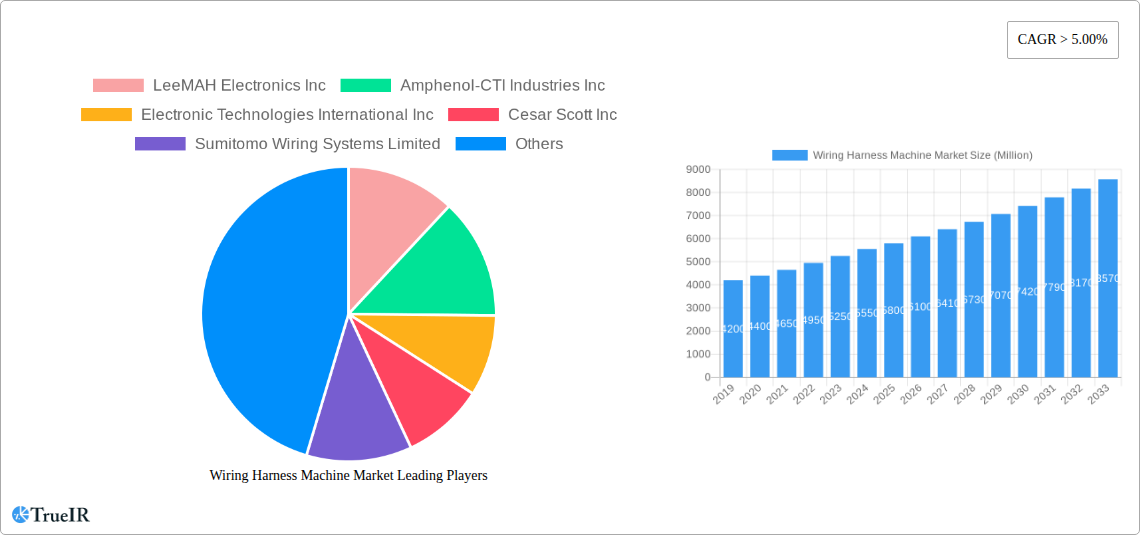

Wiring Harness Machine Market Company Market Share

Wiring Harness Machine Market Market Structure & Competitive Landscape

The global Wiring Harness Machine Market exhibits a moderately concentrated structure, with leading players vying for market share through technological innovation and strategic expansions. The market concentration is driven by significant capital investments required for advanced manufacturing technologies and R&D. Innovation in automated processing, high-speed winding, and intelligent inspection systems are key differentiators. Regulatory impacts, particularly evolving automotive safety and emissions standards, directly influence the demand for sophisticated wiring harness machines capable of producing compliant solutions. Product substitutes are limited, as specialized wiring harness machines are crucial for efficient and accurate production; however, advancements in integrated electronic systems could indirectly impact future demand. End-user segmentation is heavily dominated by the automotive industry, followed by industrial machinery, aerospace, and telecommunications. Mergers and acquisitions (M&A) are active, with approximately 5-10 major M&A deals annually in the past five years, totaling over $500 Million, indicating a trend towards consolidation and portfolio expansion. Key companies like Sumitomo Wiring Systems Limited, Leoni AG, and Motherson Sumi Systems Limited are actively involved in both manufacturing wiring harnesses and influencing the demand for advanced wiring harness machinery.

Wiring Harness Machine Market Market Trends & Opportunities

The Wiring Harness Machine Market is poised for substantial growth, driven by a confluence of technological advancements, evolving industry demands, and increasing automation across key end-use sectors. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033, reaching an estimated market size of over $5.2 Billion by 2033. This robust growth trajectory is underpinned by the escalating complexity of automotive electrical systems, propelled by the proliferation of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and sophisticated infotainment technologies. These trends necessitate increasingly intricate and reliable wiring harnesses, thereby boosting the demand for high-precision, automated wiring harness machines.

Technological shifts are at the forefront of market evolution. The integration of Industry 4.0 principles, including IoT, AI, and robotics, into wiring harness manufacturing is revolutionizing production efficiency, quality control, and data analytics. Smart machines equipped with real-time monitoring, predictive maintenance capabilities, and adaptive processing algorithms are becoming indispensable for manufacturers seeking to optimize their operations. The increasing adoption of modular wiring harness designs, driven by the need for flexibility and faster assembly in vehicle manufacturing, also presents significant opportunities for machine manufacturers to develop versatile and reconfigurable solutions.

Consumer preferences, particularly in the automotive sector, are increasingly leaning towards enhanced safety, comfort, and convenience features, all of which rely heavily on sophisticated electrical architectures. The surge in demand for premium automotive segments, featuring advanced lighting systems, connectivity solutions, and augmented reality interfaces, directly translates into a higher requirement for specialized wiring harnesses and, consequently, the machinery used to produce them. Furthermore, the growing emphasis on vehicle weight reduction and fuel efficiency is driving the adoption of lighter materials like aluminum for wiring, creating a demand for machines capable of efficiently processing these alternatives to traditional copper wires.

Competitive dynamics within the Wiring Harness Machine Market are characterized by intense innovation and a focus on offering integrated solutions that encompass design, manufacturing, and testing. Machine manufacturers are investing heavily in R&D to develop machines that can handle a wider range of wire types, connectors, and complex assembly procedures with greater speed and accuracy. The market penetration rate for highly automated wiring harness machines is steadily increasing, especially among Tier 1 automotive suppliers and large-scale contract manufacturers who recognize the long-term cost savings and quality improvements associated with advanced automation. The global push towards sustainable manufacturing practices also presents an opportunity for manufacturers to develop energy-efficient machines and those that minimize material waste.

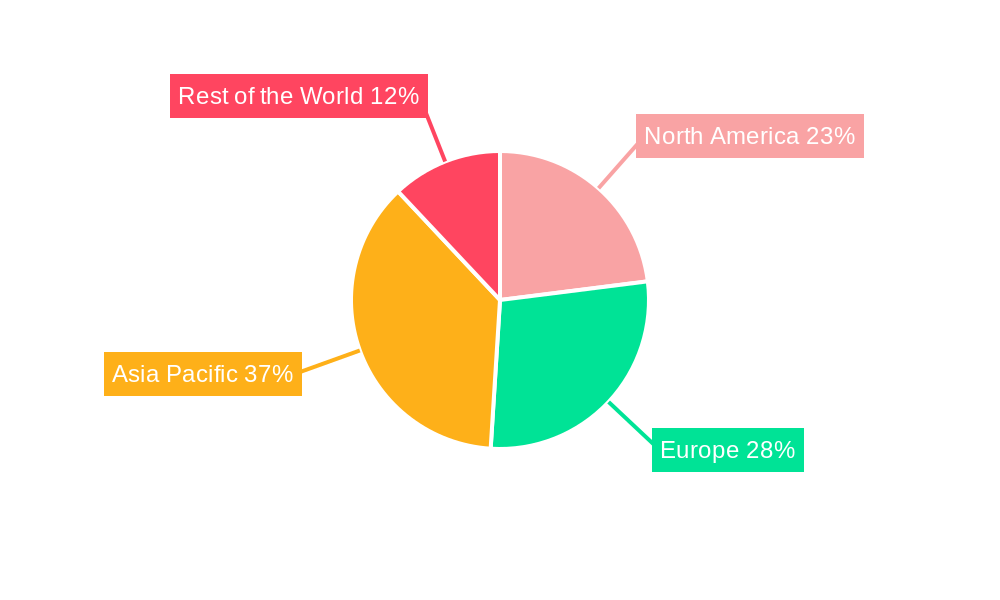

Dominant Markets & Segments in Wiring Harness Machine Market

The Wiring Harness Machine Market is experiencing robust growth and significant regional dominance, primarily driven by the automotive industry's insatiable demand for increasingly complex electrical systems.

Dominant Region: Asia-Pacific currently holds the dominant position in the global Wiring Harness Machine Market and is projected to maintain its lead throughout the forecast period.

- Key Growth Drivers in Asia-Pacific:

- Massive Automotive Production Hubs: Countries like China, Japan, South Korea, and India are the world's largest automotive manufacturing centers, producing millions of vehicles annually. This sheer volume directly translates into a colossal demand for wiring harness machines.

- Growing EV Adoption: The accelerated adoption of electric vehicles (EVs) in the region, supported by government incentives and increasing consumer interest, necessitates more sophisticated and high-voltage wiring harnesses, driving demand for specialized machinery.

- Favorable Manufacturing Policies: Governments in several Asia-Pacific nations offer incentives and policies that encourage foreign investment and domestic manufacturing, creating a conducive environment for the growth of the wiring harness machine industry.

- Expanding Industrial Base: Beyond automotive, the growing industrial machinery, telecommunications, and consumer electronics sectors in Asia-Pacific also contribute to the demand for wiring harness machines.

Dominant Wire Type: Copper remains the dominant wire type in terms of volume and value within the Wiring Harness Machine Market.

- Detailed Analysis of Copper Dominance:

- Electrical Conductivity: Copper's superior electrical conductivity and reliability make it the preferred material for the vast majority of wiring harness applications, especially in high-performance automotive systems.

- Maturity of Technology: The manufacturing processes and machinery for copper wire processing are well-established and highly optimized, offering efficiency and cost-effectiveness for mass production.

- Ubiquitous in Existing Applications: Traditional internal combustion engine vehicles and a significant portion of existing electrical infrastructure rely heavily on copper wiring, ensuring continued demand.

Dominant Component: Connectors represent a significant segment within the Wiring Harness Machine Market.

- Detailed Analysis of Connector Dominance:

- Critical Junction Points: Connectors are vital for establishing reliable electrical connections between various components, ensuring the integrity and functionality of the entire wiring harness.

- Technological Advancements: The evolution of automotive electronics has led to the development of highly specialized and miniaturized connectors, requiring advanced and precise wiring harness machines for their termination and assembly.

- Increased Number of Connectors: Modern vehicles, with their proliferation of sensors, ECUs, and infotainment systems, utilize a substantially higher number of connectors compared to older models.

Dominant Application: Powertrain applications continue to be a primary driver for Wiring Harness Machine Market growth.

- Detailed Analysis of Powertrain Dominance:

- Core Functionality: The powertrain of a vehicle encompasses all components that generate power and transmit it to the road, including the engine, transmission, and increasingly, the battery and electric motor in EVs.

- High-Voltage and High-Current Requirements: Powertrain systems, especially in EVs, involve high-voltage and high-current applications, demanding robust and precisely manufactured wiring harnesses designed to handle these demanding conditions.

- Safety and Reliability: The critical nature of powertrain systems necessitates the highest standards of safety and reliability, making the precision and quality of wiring harness production paramount.

While Powertrain leads, Safety and Security applications are rapidly gaining prominence. The increasing integration of ADAS, active safety systems, and advanced sensor networks in vehicles significantly expands the complexity and length of safety and security-related wiring harnesses, creating substantial demand for specialized machinery.

Wiring Harness Machine Market Product Analysis

The Wiring Harness Machine Market is characterized by continuous product innovation aimed at enhancing speed, accuracy, and automation in harness production. Leading manufacturers are introducing intelligent machines equipped with advanced vision systems for defect detection, robotic arms for intricate assembly, and integrated data analytics for real-time process optimization. These technological advancements enable the efficient processing of diverse wire types, including copper and aluminum, and the precise termination of various components like connectors and terminals. The competitive advantage lies in offering flexible solutions that can adapt to evolving vehicle architectures and emerging technologies, such as advanced driver-assistance systems (ADAS) and electric vehicle powertrains, thereby meeting stringent industry requirements for reliability and performance.

Key Drivers, Barriers & Challenges in Wiring Harness Machine Market

Key Drivers: The Wiring Harness Machine Market is propelled by the escalating complexity of automotive electrical systems, driven by the rapid adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). This technological evolution necessitates more intricate and robust wiring harnesses, increasing the demand for sophisticated, automated machinery. Furthermore, global trends towards vehicle electrification and stricter emissions regulations are creating a sustained need for high-precision manufacturing solutions. The expansion of manufacturing bases in emerging economies, particularly in the automotive sector, also serves as a significant growth catalyst.

Key Barriers & Challenges: The primary challenge for wiring harness machine manufacturers lies in the high capital expenditure required for advanced automation and R&D. Fluctuations in raw material prices, particularly for copper, can impact production costs. Supply chain disruptions, as witnessed in recent years, can affect the availability of critical components for machine assembly. Moreover, the evolving nature of automotive technologies demands continuous adaptation and innovation from machine manufacturers, posing a challenge to keep pace with rapid advancements.

Growth Drivers in the Wiring Harness Machine Market Market

The Wiring Harness Machine Market is experiencing robust growth fueled by several key factors. The accelerating global shift towards electric vehicles (EVs) is a paramount driver, as EVs feature significantly more complex and higher-voltage wiring harnesses compared to their internal combustion engine counterparts, demanding specialized, high-precision machinery. The widespread adoption of advanced driver-assistance systems (ADAS) and the increasing integration of sophisticated electronic features in vehicles, such as infotainment systems and connectivity solutions, also contribute substantially. Furthermore, stringent automotive safety and emissions regulations worldwide are pushing manufacturers to adopt more reliable and efficient wiring harness solutions, thereby increasing the demand for cutting-edge manufacturing equipment. Government initiatives and incentives promoting local manufacturing and technological upgrades in automotive hubs also play a crucial role in market expansion.

Challenges Impacting Wiring Harness Machine Market Growth

Despite the positive growth trajectory, the Wiring Harness Machine Market faces several significant challenges. The high initial investment required for advanced, automated machinery acts as a considerable barrier for smaller manufacturers. Fluctuations in the prices of essential raw materials, particularly copper, can directly impact the cost-effectiveness of production and the profitability of machine manufacturers. Evolving technological landscapes, especially the rapid advancements in automotive electronics and the emergence of new vehicle architectures, necessitate continuous and substantial investment in research and development to stay competitive, posing a significant R&D challenge. Supply chain vulnerabilities and the potential for disruptions in the availability of critical machine components can also hinder production timelines and impact market delivery capabilities.

Key Players Shaping the Wiring Harness Machine Market Market

- LeeMAH Electronics Inc

- Amphenol-CTI Industries Inc

- Electronic Technologies International Inc

- Cesar Scott Inc

- Sumitomo Wiring Systems Limited

- Leoni AG

- Furukawa Electric Co ltd

- KRA International (Patrick Industries Inc )

- Motherson Sumi Systems Limited

- AME Systems Proprietary Limited

Significant Wiring Harness Machine Market Industry Milestones

- 2020: Introduction of AI-powered quality control systems for wiring harness inspection, enhancing defect detection accuracy.

- 2021: Development of high-speed automated crimping machines capable of processing aluminum wires, catering to lightweighting trends.

- 2022: Launch of modular wiring harness assembly machines designed for flexible production lines, adaptable to various vehicle models.

- 2023: Increased adoption of IoT connectivity in wiring harness machines for real-time data monitoring and predictive maintenance.

- 2024: Focus on energy-efficient machine designs and sustainable manufacturing practices within the industry.

Future Outlook for Wiring Harness Machine Market Market

The future outlook for the Wiring Harness Machine Market is exceptionally bright, driven by the relentless evolution of the automotive industry and the increasing electrification of transport. The sustained growth in electric vehicles (EVs) will continue to be a primary catalyst, demanding increasingly sophisticated and high-voltage wiring harness solutions. The ongoing integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies will further amplify the complexity of vehicle electrical architectures, necessitating more advanced and precise manufacturing machinery. Opportunities abound for manufacturers who can offer innovative, AI-driven, and highly automated solutions that enhance production efficiency, ensure superior quality, and adapt to future technological paradigms. The market is poised for continued expansion, with a strong emphasis on smart manufacturing and integrated solutions.

Wiring Harness Machine Market Segmentation

-

1. Wire Type

- 1.1. Copper

- 1.2. Aluminum

-

2. Components

- 2.1. Wires

- 2.2. Terminals

- 2.3. Relays

- 2.4. Fuses

- 2.5. Connectors

- 2.6. Others

-

3. Application

- 3.1. Powertrain

- 3.2. Comfort and Convenience

- 3.3. Safety and Security

- 3.4. Body Wiring

- 3.5. Others

Wiring Harness Machine Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. UAE

- 4.3. Other Countries

Wiring Harness Machine Market Regional Market Share

Geographic Coverage of Wiring Harness Machine Market

Wiring Harness Machine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission Regulations are Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Electrification of Construction Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wiring Harness Machine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Wire Type

- 5.1.1. Copper

- 5.1.2. Aluminum

- 5.2. Market Analysis, Insights and Forecast - by Components

- 5.2.1. Wires

- 5.2.2. Terminals

- 5.2.3. Relays

- 5.2.4. Fuses

- 5.2.5. Connectors

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Powertrain

- 5.3.2. Comfort and Convenience

- 5.3.3. Safety and Security

- 5.3.4. Body Wiring

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Wire Type

- 6. North America Wiring Harness Machine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Wire Type

- 6.1.1. Copper

- 6.1.2. Aluminum

- 6.2. Market Analysis, Insights and Forecast - by Components

- 6.2.1. Wires

- 6.2.2. Terminals

- 6.2.3. Relays

- 6.2.4. Fuses

- 6.2.5. Connectors

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Powertrain

- 6.3.2. Comfort and Convenience

- 6.3.3. Safety and Security

- 6.3.4. Body Wiring

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Wire Type

- 7. Europe Wiring Harness Machine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Wire Type

- 7.1.1. Copper

- 7.1.2. Aluminum

- 7.2. Market Analysis, Insights and Forecast - by Components

- 7.2.1. Wires

- 7.2.2. Terminals

- 7.2.3. Relays

- 7.2.4. Fuses

- 7.2.5. Connectors

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Powertrain

- 7.3.2. Comfort and Convenience

- 7.3.3. Safety and Security

- 7.3.4. Body Wiring

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Wire Type

- 8. Asia Pacific Wiring Harness Machine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Wire Type

- 8.1.1. Copper

- 8.1.2. Aluminum

- 8.2. Market Analysis, Insights and Forecast - by Components

- 8.2.1. Wires

- 8.2.2. Terminals

- 8.2.3. Relays

- 8.2.4. Fuses

- 8.2.5. Connectors

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Powertrain

- 8.3.2. Comfort and Convenience

- 8.3.3. Safety and Security

- 8.3.4. Body Wiring

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Wire Type

- 9. Rest of the World Wiring Harness Machine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Wire Type

- 9.1.1. Copper

- 9.1.2. Aluminum

- 9.2. Market Analysis, Insights and Forecast - by Components

- 9.2.1. Wires

- 9.2.2. Terminals

- 9.2.3. Relays

- 9.2.4. Fuses

- 9.2.5. Connectors

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Powertrain

- 9.3.2. Comfort and Convenience

- 9.3.3. Safety and Security

- 9.3.4. Body Wiring

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Wire Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 LeeMAH Electronics Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amphenol-CTI Industries Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Electronic Technologies International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cesar Scott Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sumitomo Wiring Systems Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Leoni AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Furukawa Electric Co ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KRA International (Patrick Industries Inc )

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Motherson Sumi Systems Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AME Systems Proprietary Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 LeeMAH Electronics Inc

List of Figures

- Figure 1: Global Wiring Harness Machine Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Wiring Harness Machine Market Revenue (billion), by Wire Type 2025 & 2033

- Figure 3: North America Wiring Harness Machine Market Revenue Share (%), by Wire Type 2025 & 2033

- Figure 4: North America Wiring Harness Machine Market Revenue (billion), by Components 2025 & 2033

- Figure 5: North America Wiring Harness Machine Market Revenue Share (%), by Components 2025 & 2033

- Figure 6: North America Wiring Harness Machine Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Wiring Harness Machine Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Wiring Harness Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Wiring Harness Machine Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Wiring Harness Machine Market Revenue (billion), by Wire Type 2025 & 2033

- Figure 11: Europe Wiring Harness Machine Market Revenue Share (%), by Wire Type 2025 & 2033

- Figure 12: Europe Wiring Harness Machine Market Revenue (billion), by Components 2025 & 2033

- Figure 13: Europe Wiring Harness Machine Market Revenue Share (%), by Components 2025 & 2033

- Figure 14: Europe Wiring Harness Machine Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Wiring Harness Machine Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Wiring Harness Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Wiring Harness Machine Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Wiring Harness Machine Market Revenue (billion), by Wire Type 2025 & 2033

- Figure 19: Asia Pacific Wiring Harness Machine Market Revenue Share (%), by Wire Type 2025 & 2033

- Figure 20: Asia Pacific Wiring Harness Machine Market Revenue (billion), by Components 2025 & 2033

- Figure 21: Asia Pacific Wiring Harness Machine Market Revenue Share (%), by Components 2025 & 2033

- Figure 22: Asia Pacific Wiring Harness Machine Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Wiring Harness Machine Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Wiring Harness Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Wiring Harness Machine Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Wiring Harness Machine Market Revenue (billion), by Wire Type 2025 & 2033

- Figure 27: Rest of the World Wiring Harness Machine Market Revenue Share (%), by Wire Type 2025 & 2033

- Figure 28: Rest of the World Wiring Harness Machine Market Revenue (billion), by Components 2025 & 2033

- Figure 29: Rest of the World Wiring Harness Machine Market Revenue Share (%), by Components 2025 & 2033

- Figure 30: Rest of the World Wiring Harness Machine Market Revenue (billion), by Application 2025 & 2033

- Figure 31: Rest of the World Wiring Harness Machine Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Wiring Harness Machine Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Wiring Harness Machine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wiring Harness Machine Market Revenue billion Forecast, by Wire Type 2020 & 2033

- Table 2: Global Wiring Harness Machine Market Revenue billion Forecast, by Components 2020 & 2033

- Table 3: Global Wiring Harness Machine Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Wiring Harness Machine Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Wiring Harness Machine Market Revenue billion Forecast, by Wire Type 2020 & 2033

- Table 6: Global Wiring Harness Machine Market Revenue billion Forecast, by Components 2020 & 2033

- Table 7: Global Wiring Harness Machine Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Wiring Harness Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: US Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Wiring Harness Machine Market Revenue billion Forecast, by Wire Type 2020 & 2033

- Table 12: Global Wiring Harness Machine Market Revenue billion Forecast, by Components 2020 & 2033

- Table 13: Global Wiring Harness Machine Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Wiring Harness Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Germany Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: UK Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Wiring Harness Machine Market Revenue billion Forecast, by Wire Type 2020 & 2033

- Table 20: Global Wiring Harness Machine Market Revenue billion Forecast, by Components 2020 & 2033

- Table 21: Global Wiring Harness Machine Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Wiring Harness Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: India Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: China Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Wiring Harness Machine Market Revenue billion Forecast, by Wire Type 2020 & 2033

- Table 28: Global Wiring Harness Machine Market Revenue billion Forecast, by Components 2020 & 2033

- Table 29: Global Wiring Harness Machine Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Wiring Harness Machine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: UAE Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Other Countries Wiring Harness Machine Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wiring Harness Machine Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Wiring Harness Machine Market?

Key companies in the market include LeeMAH Electronics Inc, Amphenol-CTI Industries Inc, Electronic Technologies International Inc, Cesar Scott Inc, Sumitomo Wiring Systems Limited, Leoni AG, Furukawa Electric Co ltd, KRA International (Patrick Industries Inc ), Motherson Sumi Systems Limited, AME Systems Proprietary Limited.

3. What are the main segments of the Wiring Harness Machine Market?

The market segments include Wire Type, Components, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 102.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission Regulations are Fueling the Market Growth.

6. What are the notable trends driving market growth?

Electrification of Construction Equipment.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wiring Harness Machine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wiring Harness Machine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wiring Harness Machine Market?

To stay informed about further developments, trends, and reports in the Wiring Harness Machine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence