Key Insights

The global Automotive Smart Antenna Market is projected for substantial growth, driven by the increasing demand for advanced vehicle connectivity and integrated antenna systems. With an estimated market size of 3.38 billion and a Compound Annual Growth Rate (CAGR) of 11.15%, the market is set for significant expansion between 2025 and 2033. Key growth catalysts include the widespread adoption of connected car technologies, such as Advanced Driver-Assistance Systems (ADAS), sophisticated infotainment, and Vehicle-to-Everything (V2X) communication, all of which require high-performance antenna solutions. The integration of 5G technology in automotive applications further accelerates this trend, necessitating multi-band, high-frequency antennas for seamless data transmission. Additionally, evolving safety regulations and the push towards autonomous driving are compelling automakers to deploy more antennas for enhanced sensing and communication capabilities.

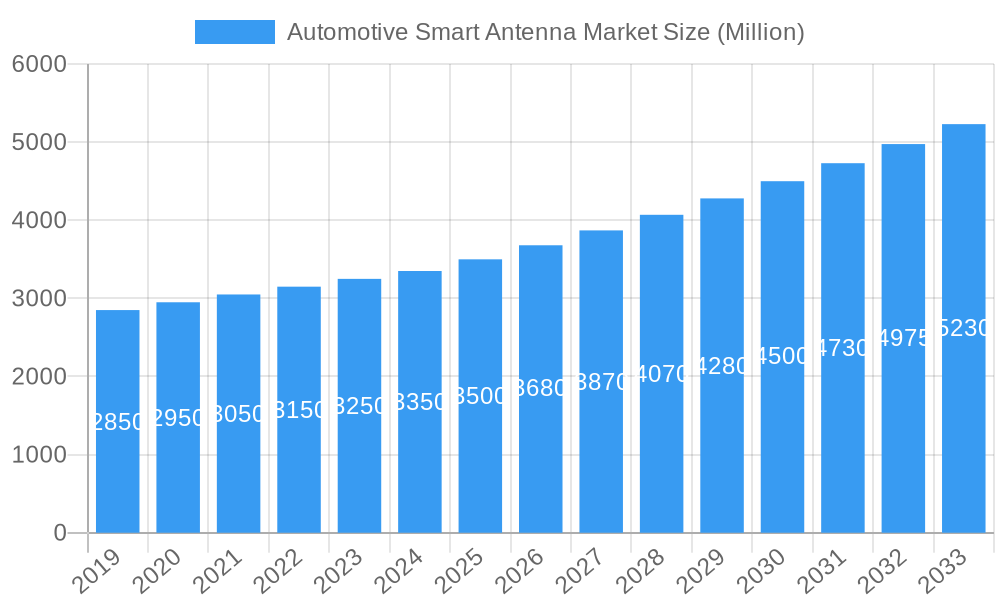

Automotive Smart Antenna Market Market Size (In Billion)

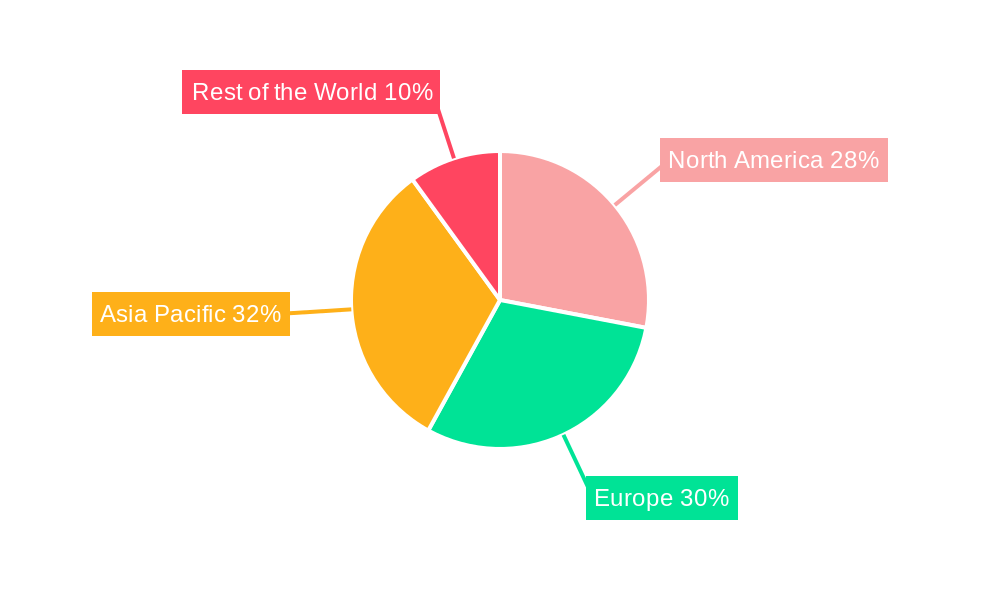

Market segmentation reveals diverse applications and technologies within the automotive smart antenna sector. Antenna types, including shark-fin and fixed mast designs, cater to specific vehicle requirements. Demand spans High Frequency (HF), Very High Frequency (VHF), and Ultra-High Frequency (UHF) spectrums, supporting a range of communication needs from navigation and satellite radio to cellular and Wi-Fi. Both passenger cars and commercial vehicles are significant segments, driven by consumer demand for enhanced in-car experiences and safety, and by the need for efficient fleet management and telematics, respectively. North America and Europe are expected to lead market development due to early adoption of connected car technologies and stringent regulatory environments. However, the Asia Pacific region, particularly China and India, is poised for the fastest growth, supported by a rapidly expanding automotive industry and rising disposable incomes. Potential restraints, such as the cost of integrated antenna solutions and electromagnetic interference (EMI) management, may slightly temper growth but are largely offset by the robust demand for advanced automotive electronics.

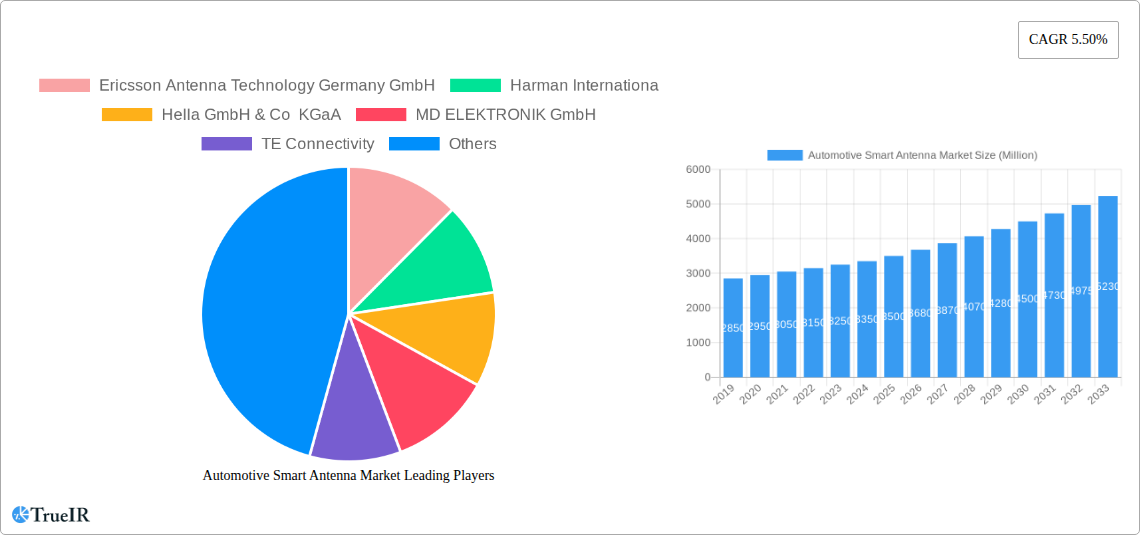

Automotive Smart Antenna Market Company Market Share

This comprehensive report offers a definitive analysis of the global Automotive Smart Antenna Market, detailing its structure, competitive landscape, historical performance, current trends, and future projections. Utilizing extensive data and expert insights, this study is an essential resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and develop effective strategies in the rapidly evolving automotive technology sector. Our analysis covers the historical period of 2019–2024, with a base year of 2025 and a forecast extending to 2033.

Automotive Smart Antenna Market Market Structure & Competitive Landscape

The Automotive Smart Antenna Market is characterized by a moderately concentrated structure, with key players investing heavily in research and development to drive innovation. The market's competitive intensity is fueled by continuous technological advancements, stringent regulatory frameworks governing automotive connectivity, and the increasing demand for integrated antenna solutions. Product substitutes, while present in the form of separate antenna components, are increasingly being displaced by the convenience and performance benefits of smart antenna systems. End-user segmentation reveals a strong preference for passenger cars, driven by the proliferation of advanced driver-assistance systems (ADAS) and in-car infotainment. Merger and acquisition (M&A) trends indicate a strategic consolidation within the industry as larger players aim to expand their product portfolios and market reach. For instance, the acquisition of Laird Connectivity by TE Connectivity in September 2021 exemplifies this trend, aimed at bolstering capabilities in wireless modules and IoT devices. Concentration ratios are estimated to be around xx% for the top 5 players in the forecast period. M&A activities are projected to see a volume of approximately xx million transactions annually between 2025-2033.

Automotive Smart Antenna Market Market Trends & Opportunities

The Automotive Smart Antenna Market is poised for significant expansion, driven by the relentless pursuit of enhanced vehicle connectivity and autonomous driving capabilities. The market size is projected to reach an estimated value of xx Billion USD by 2033, exhibiting a compound annual growth rate (CAGR) of xx% from the base year of 2025. Technological shifts are at the forefront of this growth, with the increasing integration of 5G technology, vehicle-to-everything (V2X) communication, and advanced antenna designs revolutionizing in-car connectivity and external communication. Consumer preferences are increasingly leaning towards seamless digital experiences within vehicles, demanding robust and reliable wireless performance for navigation, entertainment, and communication systems. This surge in demand for advanced in-car connectivity is a primary market penetration driver. Competitive dynamics are intensifying as established automotive component manufacturers and emerging technology firms vie for market share. Strategic partnerships and product innovations are key to navigating this landscape. For example, Harman International's introduction of the 5G TCU with Smart Conformal Antenna in January 2021 underscores the industry's focus on integrating multiple functionalities into single, efficient modules. The global market penetration rate for smart antennas in new vehicle production is expected to rise from xx% in 2025 to xx% by 2033. The market size is estimated to be xx Billion USD in 2025.

Dominant Markets & Segments in Automotive Smart Antenna Market

The global Automotive Smart Antenna Market exhibits distinct regional dominance and segment preferences. North America is a leading region, primarily driven by early adoption of advanced automotive technologies, robust infrastructure for V2X communication, and supportive government policies promoting connected vehicles. Within North America, the United States stands out as a dominant country due to its large automotive manufacturing base and high consumer spending on technologically advanced vehicles.

Analyzing by Antenna Type, the Shark-fin Antenna segment holds a significant market share. Its aerodynamic design, ability to house multiple antennas, and aesthetic appeal make it a preferred choice for passenger cars, especially in modern vehicle designs. However, the "Others" category, encompassing Pillar and Element antennas, is expected to witness substantial growth, driven by innovation in conformal and integrated antenna designs for specific vehicle architectures.

In terms of Frequency, the Ultra-High Frequency (UHF) segment is experiencing the most rapid expansion. This is directly linked to the growing deployment of 5G networks, advanced GPS systems, and burgeoning V2X communication protocols that operate within these frequency bands. The increasing demand for high-speed data transmission and real-time communication between vehicles and infrastructure fuels this dominance.

The Vehicle Type segment is overwhelmingly dominated by Passenger Cars. This is attributable to the sheer volume of passenger vehicle production globally and the escalating integration of smart antenna systems for diverse applications, including telematics, infotainment, navigation, and advanced driver-assistance systems (ADAS). While commercial vehicles are also adopting these technologies, their current market penetration remains lower compared to passenger cars.

Key growth drivers for these dominant segments include:

- Infrastructure Development: Expansion of 5G networks and intelligent transportation systems (ITS).

- Regulatory Support: Government mandates and incentives for vehicle connectivity and safety features.

- Technological Advancements: Miniaturization, integration capabilities, and improved performance of smart antennas.

- Consumer Demand: Growing preference for connected car features and enhanced in-car digital experiences.

Automotive Smart Antenna Market Product Analysis

Product innovations in the Automotive Smart Antenna Market are centered on enhancing functionality, miniaturization, and seamless integration. Smart conformal antennas, designed to blend into the vehicle's body surface, offer a significant competitive advantage by optimizing space and aesthetics. These advanced solutions combine multiple antennas for various communication needs, such as 5G, Wi-Fi, GPS, and cellular, within a single unit. This integration leads to improved signal reception, reduced electromagnetic interference, and simplified vehicle assembly. The primary applications include telematics, infotainment, ADAS, and V2X communication, all crucial for the future of automotive technology.

Key Drivers, Barriers & Challenges in Automotive Smart Antenna Market

Key Drivers:

- Increasing Demand for Connected Cars: Proliferation of infotainment, telematics, and ADAS features.

- Advancement in 5G and V2X Technologies: Requirement for sophisticated antennas to support these communication protocols.

- Stricter Safety Regulations: Mandates for emergency calling (eCall) and advanced safety systems.

- Technological Innovations: Development of multi-functional, compact, and energy-efficient smart antennas.

Barriers & Challenges:

- High Development and Integration Costs: Complexity of designing and integrating smart antenna systems.

- Electromagnetic Compatibility (EMC) Issues: Ensuring optimal performance without interference in a complex vehicle environment.

- Supply Chain Disruptions: Vulnerability to global supply chain issues affecting electronic components.

- Standardization and Interoperability: Establishing universal standards for antenna performance and communication protocols.

Growth Drivers in the Automotive Smart Antenna Market Market

The Automotive Smart Antenna Market is propelled by several interconnected growth drivers. The pervasive adoption of connected car technologies, including advanced infotainment systems, real-time navigation, and over-the-air (OTA) updates, necessitates high-performance antenna solutions. The rapid rollout and adoption of 5G networks globally are creating a significant demand for smart antennas capable of supporting these high-bandwidth, low-latency communication channels, essential for autonomous driving and enhanced V2X capabilities. Furthermore, increasing governmental focus on vehicle safety and the implementation of stringent regulations mandating features like eCall systems directly stimulate the market. The continuous innovation by key industry players in developing smaller, more efficient, and multi-functional smart antennas, such as those integrating cellular, Wi-Fi, and GPS capabilities, also acts as a major growth catalyst, offering greater design flexibility to automotive manufacturers.

Challenges Impacting Automotive Smart Antenna Market Growth

Despite the robust growth prospects, the Automotive Smart Antenna Market faces several critical challenges. The high cost associated with research, development, and the integration of sophisticated smart antenna systems into vehicle architectures can be a significant barrier, particularly for mass-market vehicles. Ensuring electromagnetic compatibility (EMC) within the complex electronic environment of a modern vehicle remains a persistent technical hurdle, requiring meticulous design and testing to prevent signal interference. The automotive industry's reliance on a global supply chain for critical electronic components, including those for smart antennas, makes it susceptible to disruptions caused by geopolitical events, natural disasters, or manufacturing issues, leading to potential production delays and increased costs. Moreover, the ongoing development of industry standards for V2X communication and antenna performance can lead to fragmentation and interoperability challenges, necessitating continuous adaptation and investment from manufacturers.

Key Players Shaping the Automotive Smart Antenna Market Market

- Ericsson Antenna Technology Germany GmbH

- Harman International

- Hella GmbH & Co KGaA

- MD ELEKTRONIK GmbH

- TE Connectivity

- Continental AG

- Huf Huelsbeck & Fuerst GmbH & Co KG

- Robert Bosch GmbH

- Ficosa Group

Significant Automotive Smart Antenna Market Industry Milestones

- January 2022: MGV, a firm specializing in electromagnetic wave visualization and precise antenna and wireless connectivity testing, announced its partnership to supply automotive antenna measurement tools to SGS, a leading testing and certification firm. This collaboration is expected to enhance the accuracy and efficiency of antenna testing in the automotive sector.

- September 2021: TE Connectivity, a global leader in sensors, antennas, and connectivity equipment, strategically acquired Laird Connectivity. This acquisition aims to strengthen TE Connectivity's position in wireless modules, IoT devices, and antennas, further expanding its comprehensive connectivity solutions for the automotive industry.

- January 2021: Harman International introduced its innovative 5G TCU with Smart Conformal Antenna. This groundbreaking solution is designed to overcome integration challenges by consolidating multiple antennas into a single module that can be seamlessly mounted on a vehicle's body surface and concealed with a waterproof, non-conductive cover, representing a significant leap in antenna design and functionality.

Future Outlook for Automotive Smart Antenna Market Market

The future outlook for the Automotive Smart Antenna Market is exceptionally promising, fueled by the accelerating pace of automotive innovation and the increasing demand for seamless connectivity. Growth catalysts are deeply rooted in the expansion of autonomous driving technology, which relies heavily on robust and reliable antenna performance for V2X communication, sensor fusion, and high-definition mapping. The continued global rollout of 5G infrastructure will further drive the adoption of advanced smart antennas capable of leveraging higher frequencies and data throughputs. Opportunities lie in the development of highly integrated, multi-functional antenna systems that contribute to vehicle lightweighting and improved aerodynamics. The market is also expected to witness further consolidation through strategic partnerships and acquisitions as companies aim to expand their technological capabilities and market reach, ensuring they are well-positioned to capitalize on the evolving landscape of the connected and intelligent automotive future.

Automotive Smart Antenna Market Segmentation

-

1. Antenna Type

- 1.1. Shark-fin Antenna

- 1.2. Fixed Mast Antenna

- 1.3. Others (Pillar, Element, etc.)

-

2. Frequency

- 2.1. High Frequency

- 2.2. Very High Frequency

- 2.3. Ultra-High Frequency

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial vehicles

Automotive Smart Antenna Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Smart Antenna Market Regional Market Share

Geographic Coverage of Automotive Smart Antenna Market

Automotive Smart Antenna Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus On Safety

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1. Increase in Development of New Smart Antennas

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Smart Antenna Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Antenna Type

- 5.1.1. Shark-fin Antenna

- 5.1.2. Fixed Mast Antenna

- 5.1.3. Others (Pillar, Element, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Frequency

- 5.2.1. High Frequency

- 5.2.2. Very High Frequency

- 5.2.3. Ultra-High Frequency

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Antenna Type

- 6. North America Automotive Smart Antenna Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Antenna Type

- 6.1.1. Shark-fin Antenna

- 6.1.2. Fixed Mast Antenna

- 6.1.3. Others (Pillar, Element, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Frequency

- 6.2.1. High Frequency

- 6.2.2. Very High Frequency

- 6.2.3. Ultra-High Frequency

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial vehicles

- 6.1. Market Analysis, Insights and Forecast - by Antenna Type

- 7. Europe Automotive Smart Antenna Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Antenna Type

- 7.1.1. Shark-fin Antenna

- 7.1.2. Fixed Mast Antenna

- 7.1.3. Others (Pillar, Element, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Frequency

- 7.2.1. High Frequency

- 7.2.2. Very High Frequency

- 7.2.3. Ultra-High Frequency

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial vehicles

- 7.1. Market Analysis, Insights and Forecast - by Antenna Type

- 8. Asia Pacific Automotive Smart Antenna Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Antenna Type

- 8.1.1. Shark-fin Antenna

- 8.1.2. Fixed Mast Antenna

- 8.1.3. Others (Pillar, Element, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Frequency

- 8.2.1. High Frequency

- 8.2.2. Very High Frequency

- 8.2.3. Ultra-High Frequency

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial vehicles

- 8.1. Market Analysis, Insights and Forecast - by Antenna Type

- 9. Rest of the World Automotive Smart Antenna Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Antenna Type

- 9.1.1. Shark-fin Antenna

- 9.1.2. Fixed Mast Antenna

- 9.1.3. Others (Pillar, Element, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Frequency

- 9.2.1. High Frequency

- 9.2.2. Very High Frequency

- 9.2.3. Ultra-High Frequency

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial vehicles

- 9.1. Market Analysis, Insights and Forecast - by Antenna Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ericsson Antenna Technology Germany GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Harman Internationa

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hella GmbH & Co KGaA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MD ELEKTRONIK GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 TE Connectivity

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Huf Huelsbeck & Fuerst GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Robert Bosch GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ficosa Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Ericsson Antenna Technology Germany GmbH

List of Figures

- Figure 1: Global Automotive Smart Antenna Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Smart Antenna Market Revenue (billion), by Antenna Type 2025 & 2033

- Figure 3: North America Automotive Smart Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 4: North America Automotive Smart Antenna Market Revenue (billion), by Frequency 2025 & 2033

- Figure 5: North America Automotive Smart Antenna Market Revenue Share (%), by Frequency 2025 & 2033

- Figure 6: North America Automotive Smart Antenna Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Smart Antenna Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Smart Antenna Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive Smart Antenna Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Smart Antenna Market Revenue (billion), by Antenna Type 2025 & 2033

- Figure 11: Europe Automotive Smart Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 12: Europe Automotive Smart Antenna Market Revenue (billion), by Frequency 2025 & 2033

- Figure 13: Europe Automotive Smart Antenna Market Revenue Share (%), by Frequency 2025 & 2033

- Figure 14: Europe Automotive Smart Antenna Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Smart Antenna Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Smart Antenna Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Smart Antenna Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Smart Antenna Market Revenue (billion), by Antenna Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Smart Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Smart Antenna Market Revenue (billion), by Frequency 2025 & 2033

- Figure 21: Asia Pacific Automotive Smart Antenna Market Revenue Share (%), by Frequency 2025 & 2033

- Figure 22: Asia Pacific Automotive Smart Antenna Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Smart Antenna Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Smart Antenna Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Smart Antenna Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Smart Antenna Market Revenue (billion), by Antenna Type 2025 & 2033

- Figure 27: Rest of the World Automotive Smart Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 28: Rest of the World Automotive Smart Antenna Market Revenue (billion), by Frequency 2025 & 2033

- Figure 29: Rest of the World Automotive Smart Antenna Market Revenue Share (%), by Frequency 2025 & 2033

- Figure 30: Rest of the World Automotive Smart Antenna Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Smart Antenna Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Smart Antenna Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Smart Antenna Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Smart Antenna Market Revenue billion Forecast, by Antenna Type 2020 & 2033

- Table 2: Global Automotive Smart Antenna Market Revenue billion Forecast, by Frequency 2020 & 2033

- Table 3: Global Automotive Smart Antenna Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Smart Antenna Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Smart Antenna Market Revenue billion Forecast, by Antenna Type 2020 & 2033

- Table 6: Global Automotive Smart Antenna Market Revenue billion Forecast, by Frequency 2020 & 2033

- Table 7: Global Automotive Smart Antenna Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Smart Antenna Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Smart Antenna Market Revenue billion Forecast, by Antenna Type 2020 & 2033

- Table 13: Global Automotive Smart Antenna Market Revenue billion Forecast, by Frequency 2020 & 2033

- Table 14: Global Automotive Smart Antenna Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Smart Antenna Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Smart Antenna Market Revenue billion Forecast, by Antenna Type 2020 & 2033

- Table 23: Global Automotive Smart Antenna Market Revenue billion Forecast, by Frequency 2020 & 2033

- Table 24: Global Automotive Smart Antenna Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global Automotive Smart Antenna Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: South Korea Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Smart Antenna Market Revenue billion Forecast, by Antenna Type 2020 & 2033

- Table 32: Global Automotive Smart Antenna Market Revenue billion Forecast, by Frequency 2020 & 2033

- Table 33: Global Automotive Smart Antenna Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global Automotive Smart Antenna Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: South America Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Automotive Smart Antenna Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Smart Antenna Market?

The projected CAGR is approximately 11.15%.

2. Which companies are prominent players in the Automotive Smart Antenna Market?

Key companies in the market include Ericsson Antenna Technology Germany GmbH, Harman Internationa, Hella GmbH & Co KGaA, MD ELEKTRONIK GmbH, TE Connectivity, Continental AG, Huf Huelsbeck & Fuerst GmbH & Co KG, Robert Bosch GmbH, Ficosa Group.

3. What are the main segments of the Automotive Smart Antenna Market?

The market segments include Antenna Type, Frequency, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus On Safety.

6. What are the notable trends driving market growth?

Increase in Development of New Smart Antennas.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

January 2022: MGV, a firm that does visualization of electromagnetic waves, and realization of precise and performs tests of antennas and wireless connectivity, announced that it would supply automotive antenna measurement tools to SGS, a testing, and certification firm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Smart Antenna Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Smart Antenna Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Smart Antenna Market?

To stay informed about further developments, trends, and reports in the Automotive Smart Antenna Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence