Key Insights

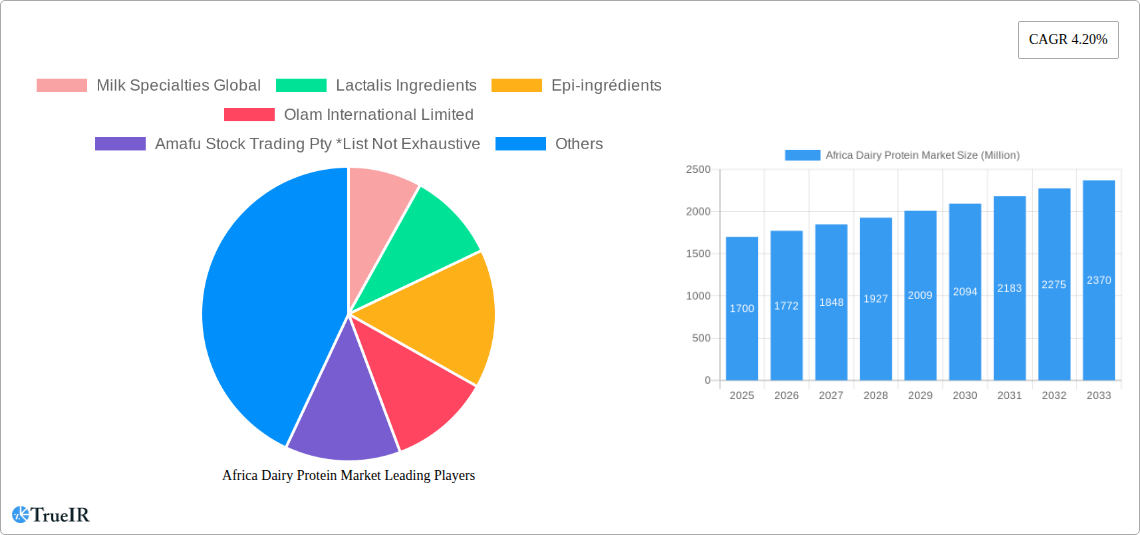

The Africa Dairy Protein Market is poised for significant expansion, projected to reach approximately $1,700 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.20%. This growth is fueled by a confluence of factors, primarily driven by the escalating demand for high-quality protein sources across various applications, from infant nutrition and dairy-based foods to burgeoning sports nutrition segments. Increasing health consciousness among African populations, coupled with a growing middle class with higher disposable incomes, is accelerating the adoption of dairy protein-rich products. Furthermore, the expanding food and beverage processing industry across the continent is creating substantial opportunities for dairy protein ingredients. Emerging economies within Africa, such as Nigeria, South Africa, and Egypt, are leading this surge due to their large populations and developing infrastructure, which supports both production and consumption of dairy protein.

Africa Dairy Protein Market Market Size (In Billion)

The market's segmentation reveals a dynamic landscape. Whey Protein Concentrates (WPCs) and Milk Protein Concentrates (MPCs) are expected to dominate, owing to their versatility and cost-effectiveness in food and beverage applications. However, the increasing demand for specialized and higher-purity products is driving the growth of Whey Protein Isolates (WPIs) and Milk Protein Isolates (MPIs), particularly in sports nutrition and functional foods. While the market is characterized by strong growth drivers, potential restraints such as fluctuating raw milk prices and supply chain complexities in certain regions need to be navigated. Nonetheless, the overall trajectory indicates a highly promising market, with continuous innovation in product development and processing technologies set to further shape its evolution. The personal care and animal feed sectors, though smaller, also represent emerging avenues for dairy protein utilization, indicating a broad spectrum of growth potential.

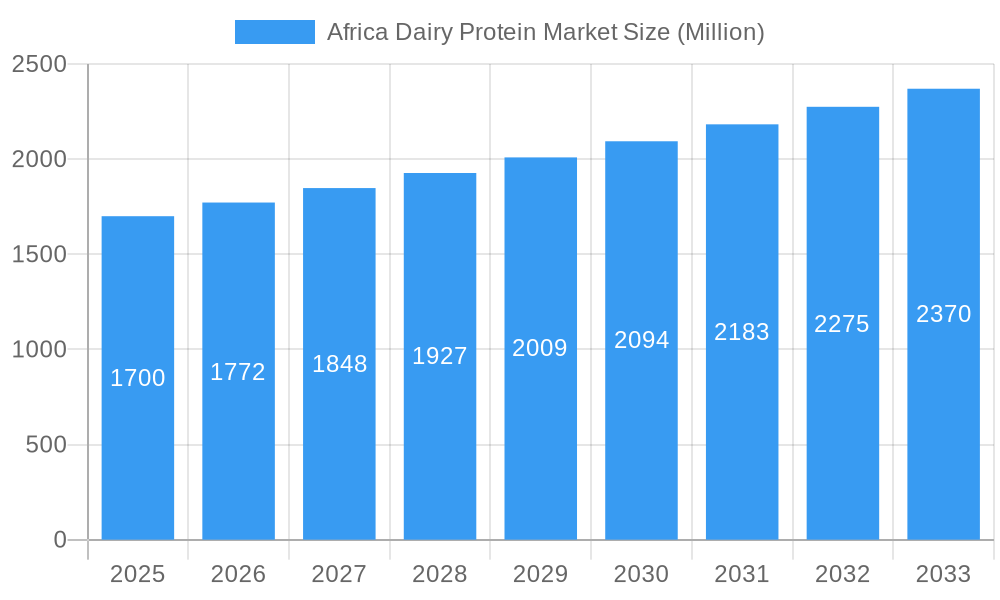

Africa Dairy Protein Market Company Market Share

Africa Dairy Protein Market: Comprehensive Insights and Future Projections (2019-2033)

Unlock the immense potential of the Africa Dairy Protein Market with our in-depth report. This comprehensive analysis delves into market dynamics, trends, opportunities, and competitive landscapes, providing actionable insights for stakeholders. We cover a study period from 2019 to 2033, with a base and estimated year of 2025, and a robust forecast period from 2025 to 2033. Our historical analysis spans from 2019 to 2024. This report is meticulously crafted to be SEO-optimized, leveraging high-volume keywords such as "Africa dairy protein," "whey protein Africa," "milk protein market," "dairy ingredients Africa," and "protein supplements Africa" to enhance search rankings and attract industry professionals.

Africa Dairy Protein Market Market Structure & Competitive Landscape

The Africa dairy protein market exhibits a moderately concentrated structure, with key players like Lactalis Ingredients, Olam International Limited, and Milk Specialties Global holding significant market share. Innovation is primarily driven by the growing demand for fortified food and beverages, coupled with advancements in processing technologies that enhance protein extraction and functionality. Regulatory impacts, while evolving across different African nations, are largely focused on food safety standards and labeling requirements, influencing product development and market entry strategies. Product substitutes, including plant-based proteins, pose a growing challenge, necessitating a focus on the inherent nutritional and functional benefits of dairy proteins. End-user segmentation reveals a strong reliance on the Food sector, particularly Infant Nutrition and Dairy Based Food, followed by the Beverage industry. Merger and acquisition (M&A) activities are expected to increase as larger players seek to consolidate their market presence and expand their product portfolios across the continent. While precise M&A volumes are dynamic, the trend indicates strategic consolidation for market access and scale. Concentration ratios are estimated to be in the range of 40-55% for the top 5-10 players, highlighting a degree of market consolidation.

Africa Dairy Protein Market Market Trends & Opportunities

The Africa dairy protein market is poised for substantial growth, with an estimated market size expansion of over 7% CAGR during the forecast period. This growth is fueled by a confluence of demographic shifts, increasing health consciousness, and evolving dietary patterns across the continent. As urbanization accelerates and disposable incomes rise, consumers are becoming more aware of the nutritional benefits of protein, driving demand for dairy protein ingredients in a wide array of applications. Technological advancements in dairy processing are enabling more efficient extraction of high-quality milk protein concentrates (MPCs) and whey protein concentrates (WPCs), as well as the development of specialized ingredients like milk protein isolates (MPIs) and whey protein isolates (WPIs) with enhanced functional properties. This has opened up new avenues for product development, particularly in the sports nutrition and functional foods segments. The expanding middle class is increasingly seeking convenient and health-promoting food and beverage options, creating significant opportunities for dairy protein fortification. Furthermore, the growing infant population across Africa necessitates a robust supply of protein-rich infant formula, a key application area for dairy proteins. The rising popularity of sports and fitness activities is also a significant growth catalyst, bolstering the demand for whey protein products. Opportunities also lie in leveraging local dairy resources more effectively and developing cost-efficient production methods to cater to price-sensitive markets. The penetration rate of dairy protein in mainstream food and beverage products is still relatively low, indicating substantial room for market expansion and product innovation. The development of novel dairy protein-based ingredients with improved solubility, emulsification, and gelling properties will be crucial for capturing new market segments and expanding existing ones. The increasing emphasis on clean labels and natural ingredients presents an opportunity for dairy proteins, which are often perceived as natural and wholesome.

Dominant Markets & Segments in Africa Dairy Protein Market

The African continent presents a dynamic landscape for dairy protein, with certain regions and segments exhibiting particularly strong growth potential. South Africa currently stands as a dominant market, driven by its more developed dairy infrastructure, established food processing industry, and higher consumer awareness regarding health and nutrition. However, East African nations like Kenya and Uganda, along with North African markets such as Egypt, are demonstrating rapid growth due to increasing disposable incomes, expanding populations, and a burgeoning middle class with a growing appetite for protein-rich foods and beverages.

From an Ingredients Type perspective, Whey Protein Concentrates (WPCs) are leading the market due to their versatility, cost-effectiveness, and widespread use in various applications, particularly in sports nutrition and general food fortification. Milk Protein Concentrates (MPCs) follow closely, offering a broader spectrum of amino acids and finding extensive use in infant nutrition and dairy-based products. Milk Protein Isolates (MPIs) and Whey Protein Isolates (WPIs) are gaining traction, albeit from a smaller base, driven by demand for higher protein content and lower fat/lactose formulations in specialized nutritional products. Casein and Caseinates, known for their slow digestion properties, are crucial for specific applications like medical nutrition and certain bakery products.

In terms of Application, the Food segment is the largest and fastest-growing, with Infant Nutrition being a primary driver due to the region's high birth rates and increasing investment in fortified infant foods. Dairy Based Food applications, including yogurts, cheeses, and milk-based desserts, also represent a significant market, benefiting from established consumer preferences. The Beverage sector, encompassing protein drinks, fortified juices, and functional beverages, is another area of substantial growth, catering to health-conscious consumers. The Sports and Performance Nutrition segment, though currently smaller than other food applications, is experiencing rapid expansion, fueled by increased participation in fitness and sports activities. The Personal Care & Cosmetics segment, utilizing dairy proteins for their moisturizing and skin-conditioning properties, represents a niche but growing application area, while Animal Feed applications are also important, especially in livestock development. Key growth drivers across these segments include supportive government policies for agriculture and food processing, investments in cold chain infrastructure, increasing consumer spending on health and wellness products, and the growing demand for processed and convenience foods.

Africa Dairy Protein Market Product Analysis

Product innovation in the Africa dairy protein market is largely focused on enhancing functional properties and catering to specific dietary needs. Advancements in ultrafiltration and microfiltration technologies are yielding higher purity protein isolates with improved solubility, emulsification, and gelation capabilities, making them ideal for a wider range of food and beverage formulations. The development of specialized protein blends tailored for infant nutrition, sports performance, and medical foods is a key competitive advantage, addressing distinct consumer demands for targeted nutritional benefits. Furthermore, efforts are underway to improve the cost-effectiveness of protein extraction and processing, making these valuable ingredients more accessible in price-sensitive African markets.

Key Drivers, Barriers & Challenges in Africa Dairy Protein Market

Key Drivers:

- Growing Health Consciousness: Increasing consumer awareness regarding the importance of protein for overall health and well-being is a major propeller.

- Rising Disposable Incomes: Improved economic conditions in several African nations are leading to higher spending on premium and health-focused food products.

- Expanding Infant Population: The high birth rate across Africa fuels significant demand for protein-rich infant nutrition products.

- Technological Advancements: Innovations in dairy processing are improving efficiency and product quality, making dairy proteins more versatile.

- Government Support: Policies promoting agricultural development and food processing can foster market growth.

Barriers & Challenges:

- Supply Chain Infrastructure: Inadequate cold chain logistics and transportation networks can lead to significant product spoilage and increased costs.

- Regulatory Complexities: Varying food safety regulations and import/export policies across different African countries create hurdles for market access and standardization.

- Price Sensitivity: A large portion of the African population is price-sensitive, making premium dairy protein ingredients a luxury for many.

- Competition from Plant-Based Alternatives: The increasing availability and marketing of plant-based protein sources pose a competitive threat.

- Limited Local Production Capacity: Reliance on imports for certain high-value dairy protein ingredients can impact availability and cost.

Growth Drivers in the Africa Dairy Protein Market Market

The Africa dairy protein market is propelled by a strong interplay of factors. Economically, rising disposable incomes and a growing middle class are translating into increased demand for nutrient-dense foods and beverages. Technologically, advancements in dairy processing, such as sophisticated membrane filtration, are enabling the production of higher-purity protein ingredients with enhanced functionalities, opening doors for their use in specialized applications like sports nutrition and medical foods. From a policy perspective, governments across the continent are increasingly prioritizing food security and agricultural development, which can include initiatives to boost local dairy production and processing capabilities. Furthermore, the sheer demographic growth, particularly the expanding youth and infant population, creates an intrinsic demand for protein-rich products, especially in the infant nutrition sector. The ongoing urbanization trend also contributes by increasing access to diverse food products and promoting adoption of Western dietary patterns that often emphasize protein intake.

Challenges Impacting Africa Dairy Protein Market Growth

Several significant challenges impede the growth trajectory of the Africa dairy protein market. Regulatory complexities, with divergent food safety standards and labeling requirements across numerous African countries, create a fragmented market and increase compliance costs for manufacturers. Supply chain inefficiencies, particularly the lack of robust cold chain infrastructure and reliable transportation networks in many regions, lead to product spoilage, increased waste, and higher logistical expenses, impacting the availability and affordability of dairy protein products. Competitive pressures are also mounting, not only from other dairy protein producers but increasingly from the rising availability and consumer acceptance of plant-based protein alternatives, which are often perceived as more sustainable or ethically sourced. Moreover, price sensitivity remains a major barrier, as the cost of certain high-value dairy protein ingredients can be prohibitive for a substantial segment of the African population. Limited local production capacity for specialized dairy proteins necessitates reliance on imports, exposing the market to currency fluctuations and global supply-demand dynamics.

Key Players Shaping the Africa Dairy Protein Market Market

- Milk Specialties Global

- Lactalis Ingredients

- Epi-ingrédients

- Olam International Limited

- Amafu Stock Trading Pty

Significant Africa Dairy Protein Market Industry Milestones

- 2019: Increased investment in dairy processing facilities in East Africa, focusing on whey and casein production to meet growing local demand.

- 2020: Launch of new fortified dairy-based beverages targeting the sports nutrition segment in South Africa, reflecting growing consumer interest.

- 2021: Several African countries introduce updated food safety regulations, emphasizing protein content and fortification standards, prompting product reformulation.

- 2022: Expansion of infant nutrition product lines by major food manufacturers across North and West Africa, heavily relying on milk protein concentrates.

- 2023: Growing partnerships between dairy cooperatives and international ingredient suppliers to improve the quality and consistency of raw milk for protein extraction.

- 2024: Introduction of innovative dairy protein-based snacks and bars catering to the convenience food trend in urban African centers.

Future Outlook for Africa Dairy Protein Market Market

The future outlook for the Africa dairy protein market is exceptionally bright, characterized by sustained growth and evolving opportunities. Key growth catalysts include the persistent rise in health and wellness awareness across diverse consumer demographics, coupled with a burgeoning youth population and significant demand in the infant nutrition segment. The increasing adoption of sports and fitness trends will continue to fuel the demand for whey protein and other performance-enhancing dairy ingredients. Strategic investments in local dairy processing infrastructure and technology will be crucial for reducing import dependency and improving cost-effectiveness. Furthermore, the ongoing diversification of product applications beyond traditional food and beverages into areas like personal care and animal feed presents untapped market potential. We project the market to continue its upward trajectory, driven by innovation in product development and a deepening understanding of African consumer needs, leading to increased market penetration of dairy protein ingredients in everyday food and beverage products.

Africa Dairy Protein Market Segmentation

-

1. Ingredients Type

- 1.1. Milk Protein Concentrates (MPCs)

- 1.2. Whey Protein Concentrates (WPCs)

- 1.3. Milk Protein Isolates (MPIs)

- 1.4. Whey Protein Isolates (WPIs)

- 1.5. Casein and Caseinates

- 1.6. Others

-

2. Application

-

2.1. Food

- 2.1.1. Infant Nutrition

- 2.1.2. Dairy Based Food

- 2.1.3. Bakery, Confectionary and Frozen Desserts

- 2.1.4. Sports and Performance Nutrition

- 2.1.5. Others

- 2.2. Beverage

- 2.3. Personal Care & Cosmetics

- 2.4. Animal Feed

-

2.1. Food

Africa Dairy Protein Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Dairy Protein Market Regional Market Share

Geographic Coverage of Africa Dairy Protein Market

Africa Dairy Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Rising Demand for Whey Protein Isolate& Concentrates in Various Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Dairy Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients Type

- 5.1.1. Milk Protein Concentrates (MPCs)

- 5.1.2. Whey Protein Concentrates (WPCs)

- 5.1.3. Milk Protein Isolates (MPIs)

- 5.1.4. Whey Protein Isolates (WPIs)

- 5.1.5. Casein and Caseinates

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food

- 5.2.1.1. Infant Nutrition

- 5.2.1.2. Dairy Based Food

- 5.2.1.3. Bakery, Confectionary and Frozen Desserts

- 5.2.1.4. Sports and Performance Nutrition

- 5.2.1.5. Others

- 5.2.2. Beverage

- 5.2.3. Personal Care & Cosmetics

- 5.2.4. Animal Feed

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredients Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Milk Specialties Global

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lactalis Ingredients

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Epi-ingrédients

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Olam International Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amafu Stock Trading Pty *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Milk Specialties Global

List of Figures

- Figure 1: Africa Dairy Protein Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Dairy Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Dairy Protein Market Revenue undefined Forecast, by Ingredients Type 2020 & 2033

- Table 2: Africa Dairy Protein Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Africa Dairy Protein Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Africa Dairy Protein Market Revenue undefined Forecast, by Ingredients Type 2020 & 2033

- Table 5: Africa Dairy Protein Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Africa Dairy Protein Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Dairy Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Dairy Protein Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Africa Dairy Protein Market?

Key companies in the market include Milk Specialties Global, Lactalis Ingredients, Epi-ingrédients, Olam International Limited, Amafu Stock Trading Pty *List Not Exhaustive.

3. What are the main segments of the Africa Dairy Protein Market?

The market segments include Ingredients Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Rising Demand for Whey Protein Isolate& Concentrates in Various Industries.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Dairy Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Dairy Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Dairy Protein Market?

To stay informed about further developments, trends, and reports in the Africa Dairy Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence