Key Insights

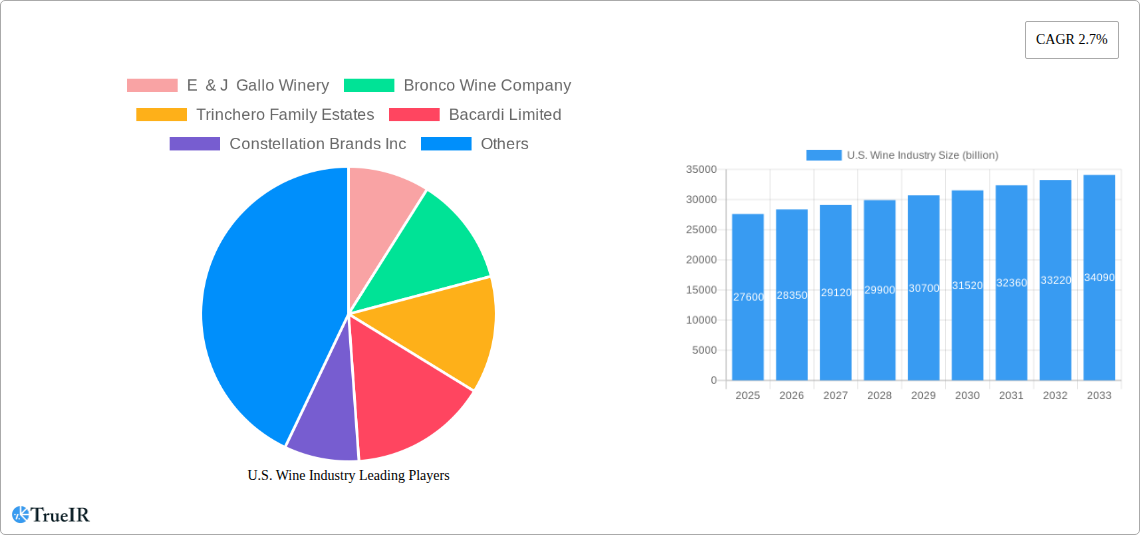

The U.S. wine industry is poised for steady growth, with an estimated market size of $27.6 billion in 2025. This expansion is anticipated to continue at a Compound Annual Growth Rate (CAGR) of 2.7% through 2033. This consistent growth trajectory is driven by several key factors. Evolving consumer preferences are leaning towards premiumization, with a growing demand for artisanal, organic, and sustainably produced wines. Furthermore, an increasing interest in wine education and appreciation, fueled by social media and accessible online content, is broadening the consumer base. The on-trade channel, encompassing restaurants and bars, continues to be a significant contributor, as is the robust off-trade segment, particularly the rapidly expanding online retail channels, which offer convenience and wider selection. The diversification of product offerings, including the rise of rosé and sparkling wines, also plays a crucial role in attracting new and existing consumers.

U.S. Wine Industry Market Size (In Billion)

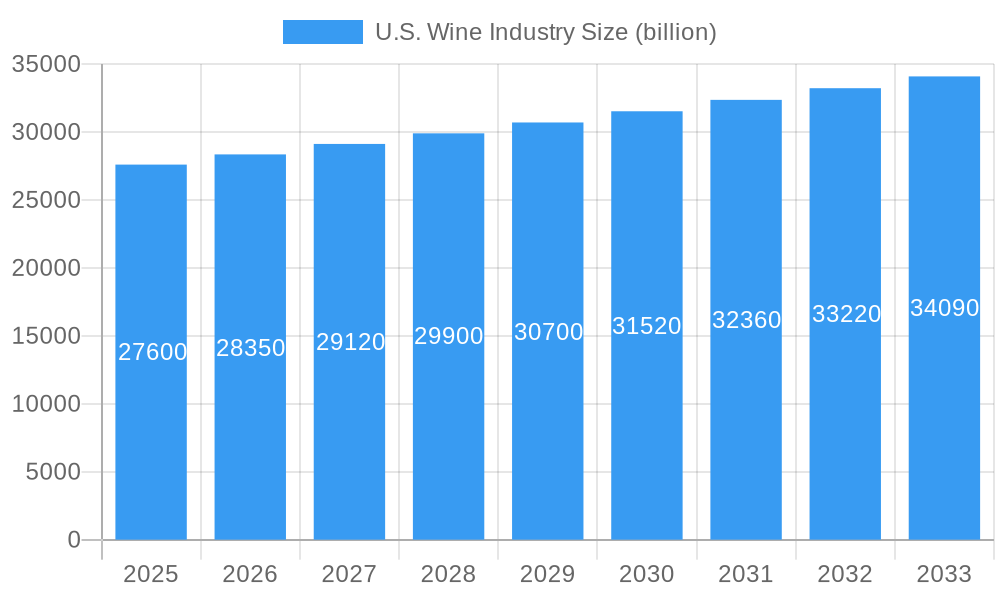

Despite the positive outlook, the U.S. wine market faces certain restraints that could temper its growth. Rising production costs, including agricultural inputs and labor, present a persistent challenge for wineries. Evolving regulatory landscapes and potential increases in excise taxes could also impact profitability and consumer pricing. Moreover, intense competition from other alcoholic beverages, such as craft beers and spirits, necessitates continuous innovation and marketing efforts to maintain market share. Nevertheless, the industry's adaptability, exemplified by the strategic focus on direct-to-consumer (DTC) sales and the exploration of new varietals and flavor profiles, positions it well to navigate these headwinds. The dominance of major players like E & J Gallo Winery and Constellation Brands Inc. underscores the consolidated nature of the market, yet opportunities remain for niche producers and innovative brands to carve out significant market presence.

U.S. Wine Industry Company Market Share

U.S. Wine Industry Market Structure & Competitive Landscape

The U.S. wine industry exhibits a dynamic market structure characterized by significant competition and evolving innovation drivers. The market features a mix of large, consolidated players and numerous smaller, artisanal wineries, leading to a moderate to high concentration ratio, estimated at approximately 70% for the top 10 companies. Regulatory impacts, primarily at the state level concerning alcohol sales and distribution, significantly influence market access and operational strategies. Product substitutes, including beer, spirits, and non-alcoholic beverages, exert constant pressure, driving the need for product differentiation and premiumization. End-user segmentation is broad, encompassing consumers seeking value, premium experiences, and health-conscious options. Merger and acquisition (M&A) trends continue to shape the landscape, with an estimated value of over $1 billion in M&A activity annually over the historical period (2019-2024), indicating consolidation and strategic expansion by key industry participants.

U.S. Wine Industry Market Trends & Opportunities

The U.S. wine market is poised for sustained growth, projected to reach a valuation of over $100 billion by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period (2025–2033). This expansion is fueled by a confluence of shifting consumer preferences, technological advancements, and evolving distribution channels. Health and wellness trends are increasingly influencing purchasing decisions, leading to a growing demand for lower-calorie, organic, and sustainably produced wines. Consumers are also demonstrating a greater appreciation for premium and super-premium wines, driven by an increased focus on provenance, craftsmanship, and unique flavor profiles. Digitalization and online retail channels are revolutionizing how consumers discover and purchase wine, with online sales penetration expected to exceed 20% by 2033. Technological shifts are impacting every facet of the industry, from vineyard management and winemaking processes to sophisticated marketing and direct-to-consumer (DTC) strategies. Innovations in bottling, packaging, and delivery are enhancing convenience and sustainability. The competitive landscape is intensifying, with both established giants and agile startups vying for market share. Emerging opportunities lie in leveraging data analytics to understand consumer behavior, expanding into niche markets such as natural and biodynamic wines, and investing in sustainable practices to appeal to an increasingly environmentally conscious consumer base. The market penetration of imported wines remains significant, presenting both a competitive challenge and an opportunity for domestic producers to highlight their unique terroirs and value propositions.

Dominant Markets & Segments in U.S. Wine Industry

The U.S. wine industry's dominance is multifaceted, with Still Wine holding the largest market share, accounting for over 85% of the total market value. Within this category, Red Wine is the most popular color segment, driven by its broad appeal and diverse range of varietals, followed closely by White Wine. Sparkling Wine is experiencing robust growth, particularly driven by premiumization and the increasing popularity of Prosecco and Champagne-style wines for celebrations and everyday enjoyment. The Off-trade distribution channel is the dominant force, with Supermarkets/Hypermarkets representing the largest sub-segment due to their convenience and broad accessibility, followed by Online Retail Channels, which are rapidly gaining traction.

- Still Wine: Remains the bedrock of the U.S. wine market.

- Red Wine: Dominates due to established consumer preferences and a wide array of varietals like Cabernet Sauvignon, Merlot, and Pinot Noir.

- White Wine: Holds significant market share, with Chardonnay, Sauvignon Blanc, and Pinot Grigio being perennial favorites.

- Sparkling Wine: Exhibits strong growth potential, fueled by premiumization trends and increased occasion-based consumption.

- Distribution Channels:

- Off-trade: The primary revenue generator.

- Supermarkets/Hypermarkets: Leverages high foot traffic and bulk purchasing.

- Online Retail Channels: Experiencing exponential growth due to convenience, wider selection, and direct-to-consumer capabilities.

- Specialty Stores: Cater to connoisseurs and offer curated selections.

- On-trade: Important for brand building and consumer experience, but less dominant in volume.

- Off-trade: The primary revenue generator.

Key growth drivers include the expanding middle class with increased disposable income, a growing appreciation for wine culture and education, and innovative marketing strategies by wineries to engage consumers across various platforms. Government policies, while presenting some complexities, generally support the growth of the agricultural and beverage sectors.

U.S. Wine Industry Product Analysis

Product innovation in the U.S. wine industry is focused on catering to evolving consumer tastes and demands. Key advancements include the development of lower-calorie and low-alcohol wines, organic and biodynamic options, and wines with unique flavor profiles, as exemplified by Meiomi Wines' Red Blend launch. Technological integration in winemaking, from precision fermentation to advanced aging techniques, enhances quality and consistency. Competitive advantages are increasingly derived from sustainable sourcing, unique terroir expression, and effective brand storytelling that resonates with targeted consumer segments. The application of data analytics in understanding consumer preferences is also driving product development for better market fit.

Key Drivers, Barriers & Challenges in U.S. Wine Industry

Key drivers propelling the U.S. wine industry include a growing appreciation for wine culture and premiumization trends, leading to increased consumer spending on higher-quality wines. Economic factors, such as rising disposable incomes and a robust economy, contribute to market expansion. Technological advancements in vineyard management and winemaking, alongside innovative marketing and direct-to-consumer (DTC) strategies, are also significant growth catalysts. Favorable trade policies and a strong domestic agricultural base support the industry's growth.

Key challenges and restraints facing the U.S. wine industry include intense competition from both domestic and international producers, impacting market share and pricing. Regulatory complexities at federal and state levels, particularly concerning alcohol distribution and sales, create hurdles for market entry and expansion. Supply chain disruptions, exacerbated by global events, can affect the availability of raw materials and finished goods, leading to increased costs. Shifting consumer preferences and the rise of alternative beverage categories also pose a competitive threat. The estimated impact of these restraints can lead to a reduction in projected market growth by up to 15% if not effectively managed.

Growth Drivers in the U.S. Wine Industry Market

Key drivers for the U.S. wine industry market include the persistent trend of premiumization, with consumers increasingly willing to invest in higher-quality wines that offer unique experiences and provenance. Economic prosperity and rising disposable incomes in key demographics further fuel this demand. Technological innovations in viticulture and oenology are enhancing wine quality and sustainability, appealing to environmentally conscious consumers. Regulatory shifts that promote innovation and market access, alongside effective marketing campaigns that educate and engage consumers about wine culture, are also significant growth catalysts.

Challenges Impacting U.S. Wine Industry Growth

Challenges impacting U.S. wine industry growth are primarily centered on intense competition from a diverse range of domestic and international wine producers, as well as alternative beverage categories. Regulatory complexities, particularly regarding interstate commerce and distribution laws, can hinder market reach and increase operational costs. Persistent supply chain issues, including labor shortages and logistical bottlenecks, can disrupt production and delivery, leading to increased expenses. Furthermore, evolving consumer preferences and the demand for healthier or more sustainable options require continuous adaptation and investment from wineries.

Key Players Shaping the U.S. Wine Industry Market

- E & J Gallo Winery

- Bronco Wine Company

- Trinchero Family Estates

- Bacardi Limited

- Constellation Brands Inc

- The Brown Forman Corporation

- Treasury Wine Estates

- The Wine Group

- Andrew Peller Limited

- Diageo plc

- Truett Hurst Inc

Significant U.S. Wine Industry Industry Milestones

- March 2022: Meiomi Wines announced the release of the Red Blend, adding another flavor sourced from Meiomi's signature California regions. The company claims the product has the same premium taste that customers expect but with new, bold flavors and more options.

- February 2022: Ventessa by Mezzacorona launched a new wine brand for those seeking a naturally low-calorie wine option, thus, appealing to health-conscious consumers.

- May 2021: Treasury Wine Estates announced that the company had entered a long-term distribution agreement with Republic National Distributing Company (RNDC). The agreement will cover distribution in multiple markets in California with other states, including Texas, Louisiana, Oklahoma, Kentucky, Mississippi, Utah, Wyoming, and Nebraska.

Future Outlook for U.S. Wine Industry Market

The future outlook for the U.S. wine industry is exceptionally promising, driven by sustained consumer interest in premiumization and the exploration of diverse wine varietals. Strategic opportunities lie in leveraging the burgeoning online retail sector for expanded reach and direct-to-consumer engagement, alongside innovations in sustainable and health-conscious wine production. The market potential is further amplified by an increasing appreciation for unique terroirs and artisanal winemaking practices. Continued investment in data analytics to understand evolving consumer preferences will be crucial for capitalizing on this growth trajectory.

U.S. Wine Industry Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Other Product Types

-

2. Color

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

- 2.4. Other Colors

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Online Retail Channels

- 3.2.4. Other Distribution Channels

U.S. Wine Industry Segmentation By Geography

- 1. U.S.

U.S. Wine Industry Regional Market Share

Geographic Coverage of U.S. Wine Industry

U.S. Wine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Extensive Vineyard Area Anticipated to Strengthen the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Wine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.2.4. Other Colors

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online Retail Channels

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 E & J Gallo Winery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bronco Wine Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trinchero Family Estates

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bacardi Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Constellation Brands Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Brown Forman Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Treasury Wine Estates

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Wine Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Andrew Peller Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Diageo plc*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Truett Hurst Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 E & J Gallo Winery

List of Figures

- Figure 1: U.S. Wine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: U.S. Wine Industry Share (%) by Company 2025

List of Tables

- Table 1: U.S. Wine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: U.S. Wine Industry Revenue billion Forecast, by Color 2020 & 2033

- Table 3: U.S. Wine Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: U.S. Wine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: U.S. Wine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: U.S. Wine Industry Revenue billion Forecast, by Color 2020 & 2033

- Table 7: U.S. Wine Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: U.S. Wine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Wine Industry?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the U.S. Wine Industry?

Key companies in the market include E & J Gallo Winery, Bronco Wine Company, Trinchero Family Estates, Bacardi Limited, Constellation Brands Inc, The Brown Forman Corporation, Treasury Wine Estates, The Wine Group, Andrew Peller Limited, Diageo plc*List Not Exhaustive, Truett Hurst Inc.

3. What are the main segments of the U.S. Wine Industry?

The market segments include Product Type, Color, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Extensive Vineyard Area Anticipated to Strengthen the Market.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

March 2022: Meiomi Wines announced the release of the Red Blend, adding another flavor sourced from Meiomi's signature California regions. The company claims the product has the same premium taste that customers expect but with new, bold flavors and more options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Wine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Wine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Wine Industry?

To stay informed about further developments, trends, and reports in the U.S. Wine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence