Key Insights

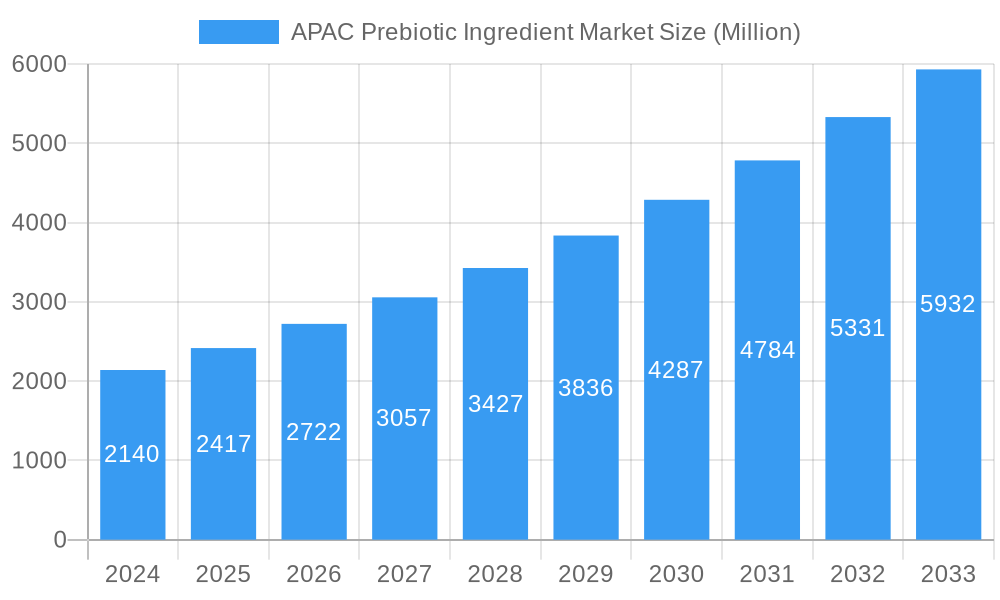

The Asia Pacific (APAC) Prebiotic Ingredient Market is poised for substantial growth, projected to reach USD 2.14 billion in 2024. This expansion is driven by a remarkable CAGR of 11.77%, indicating a dynamic and rapidly evolving industry landscape. The market's robust performance is fueled by increasing consumer awareness regarding gut health and the numerous benefits of prebiotics, such as improved digestion, enhanced nutrient absorption, and a strengthened immune system. This heightened consumer demand is directly influencing product innovation and the broader adoption of prebiotic-fortified foods and beverages across the region. The rising prevalence of lifestyle diseases and a growing emphasis on preventive healthcare further bolster the demand for prebiotic ingredients, positioning them as a crucial component in functional foods and dietary supplements.

APAC Prebiotic Ingredient Market Market Size (In Billion)

Key segments like Inulin, Fructo-oligosaccharides (FOS), and Galacto-oligosaccharides (GOS) are witnessing significant traction, catering to diverse applications ranging from infant formula and fortified food and beverages to dietary supplements and animal feed. The burgeoning middle class and increasing disposable incomes in countries like China, India, and other emerging economies within APAC are key contributors to this market expansion. Furthermore, evolving regulatory frameworks and a growing acceptance of functional ingredients by manufacturers are creating a favorable environment for market players. While robust growth is evident, potential challenges may include the cost-effectiveness of certain high-purity prebiotic ingredients and ensuring consistent supply chains to meet escalating demand across the diverse APAC region.

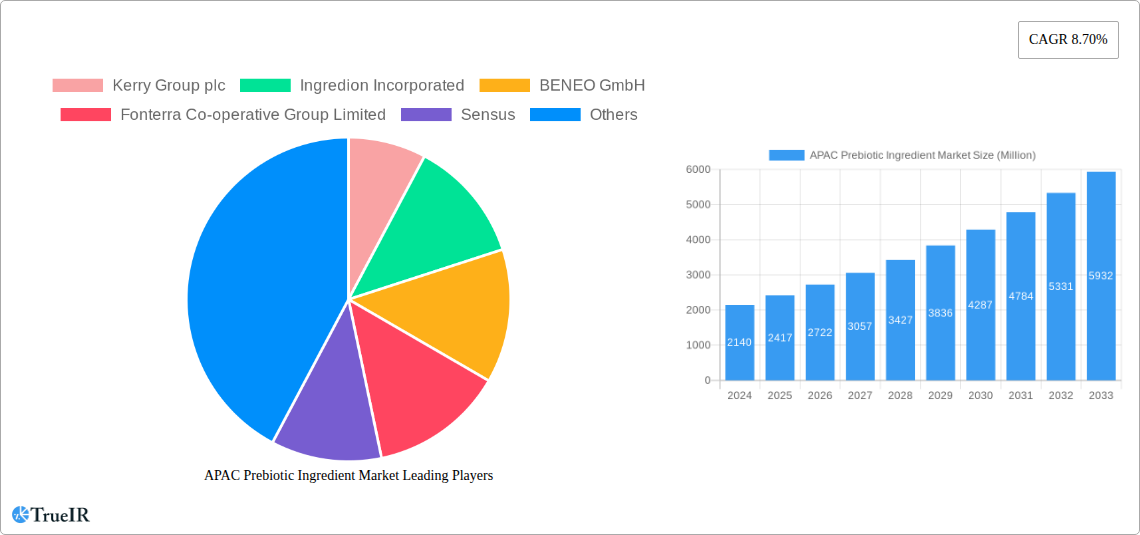

APAC Prebiotic Ingredient Market Company Market Share

Here's a dynamic, SEO-optimized report description for the APAC Prebiotic Ingredient Market, incorporating your specifications:

APAC Prebiotic Ingredient Market: Dominant Growth & Innovation Unveiled (2019–2033)

Explore the surging APAC Prebiotic Ingredient Market, projected to reach US$5.2 Billion by 2033, exhibiting a robust CAGR of 8.5% from 2025 to 2033. This comprehensive report delves into the intricate dynamics of the Asia Pacific prebiotic market, dissecting key trends, opportunities, and challenges that are shaping its trajectory. With a focus on high-volume search terms like "prebiotic ingredients Asia Pacific," "inulin market China," "FOS market India," and "dietary supplements Asia," this analysis offers unparalleled insights for stakeholders seeking to capitalize on this burgeoning sector.

APAC Prebiotic Ingredient Market Market Structure & Competitive Landscape

The APAC Prebiotic Ingredient Market is characterized by a moderately concentrated structure, with leading players like Kerry Group plc, Ingredion Incorporated, BENEO GmbH, and Fonterra Co-operative Group Limited holding significant market shares. Innovation serves as a primary driver, fueled by extensive research and development in novel prebiotic sources and enhanced bioavailability. Regulatory frameworks, particularly concerning health claims and ingredient safety, are increasingly influencing market entry and product development across key geographies like China and Japan. While direct product substitutes are limited, the market faces indirect competition from other functional ingredients and a growing consumer awareness of gut health alternatives. End-user segmentation reveals a strong demand from Infant Formula and Fortified Food and Beverage sectors, closely followed by Dietary Supplements. Mergers and Acquisitions (M&A) activity, though nascent, is expected to intensify as larger players seek to consolidate their market position and expand their product portfolios. For instance, recent M&A volumes are estimated at US$XXX Million, reflecting strategic consolidation efforts.

APAC Prebiotic Ingredient Market Market Trends & Opportunities

The APAC Prebiotic Ingredient Market is experiencing an unprecedented surge driven by escalating consumer awareness of gut health, the microbiome's role in overall well-being, and the proactive management of chronic diseases. This heightened consciousness translates into a substantial market size growth, with the market estimated at US$3.1 Billion in the base year 2025, expanding significantly through the forecast period. Technological shifts are pivotal, with advancements in fermentation processes, enzyme technologies, and extraction methods leading to the development of more effective and diverse prebiotic ingredients. The market penetration rate for prebiotics in functional foods and beverages is rapidly increasing, exceeding XX% in developed APAC economies. Consumer preferences are leaning towards naturally derived prebiotics and those offering scientifically backed health benefits, such as improved digestion, enhanced immunity, and better nutrient absorption. Competitive dynamics are evolving, with established global players expanding their presence and local manufacturers innovating to cater to specific regional tastes and dietary needs. The CAGR of 8.5% underscores the sustained upward momentum. Opportunities abound in developing tailored prebiotic solutions for specific life stages, such as aging populations and specific dietary requirements, and in fortifying mainstream food products to reach a broader consumer base. The integration of prebiotics into personalized nutrition plans and the growing e-commerce channel for dietary supplements are also key avenues for market expansion. The increasing demand for plant-based and sustainable prebiotic sources further presents a significant growth catalyst, aligning with global sustainability trends.

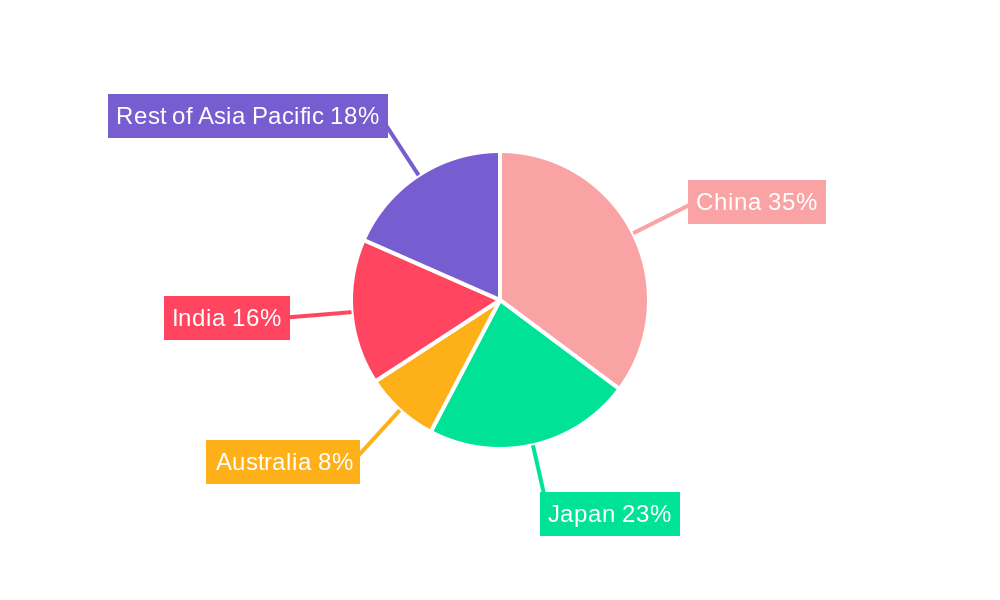

Dominant Markets & Segments in APAC Prebiotic Ingredient Market

China stands as the dominant market within the APAC Prebiotic Ingredient landscape, propelled by its vast population, increasing disposable income, and a rapidly growing awareness of health and wellness. The country's proactive government policies supporting the food and beverage industry, coupled with robust infrastructure for production and distribution, further solidify its leadership position. Among the product segments, Inulin and Fructo-oligosaccharide (FOS) collectively command the largest market share, driven by their widespread application and proven efficacy in promoting gut health. The Infant Formula segment continues to be a primary revenue generator, reflecting the high demand for specialized nutrition for infants and young children. Fortified Food and Beverage is another significant segment, witnessing substantial growth as manufacturers increasingly incorporate prebiotics into everyday food products to enhance their nutritional value.

Dominant Geography: China

- Key Growth Drivers: High population density, rising middle-class income, government support for food fortification, extensive manufacturing capabilities, and a rapidly evolving consumer consciousness regarding health benefits.

- Detailed Analysis: China's market dominance is further amplified by its extensive research and development in novel prebiotic applications and its role as a major manufacturing hub for these ingredients. The sheer volume of consumption, coupled with increasing urbanization and a desire for healthier lifestyles, creates an insatiable demand.

Dominant Segment (Type): Inulin & FOS

- Key Growth Drivers: Versatility in application across food, beverage, and supplement industries; cost-effectiveness of production; established scientific evidence supporting their health benefits; and broad consumer familiarity.

- Detailed Analysis: Inulin and FOS are the workhorses of the prebiotic market. Their ability to withstand processing conditions in various food matrices makes them ideal for fortification. The extensive body of scientific literature validating their prebiotic effects instills consumer confidence and drives their adoption.

Dominant Segment (Application): Infant Formula

- Key Growth Drivers: Critical role of prebiotics in infant gut development and immunity, stringent quality standards driving demand for proven ingredients, and a high birth rate in many APAC nations.

- Detailed Analysis: The infant formula segment is non-negotiable in terms of ingredient safety and efficacy. Prebiotics are recognized as essential components for mimicking the beneficial bacteria found in breast milk, making them a cornerstone of infant nutrition products.

APAC Prebiotic Ingredient Market Product Analysis

The APAC Prebiotic Ingredient Market is characterized by continuous product innovation, focusing on enhancing efficacy, taste, and functionality. Key advancements include the development of novel prebiotic fibers with superior gut-modulating properties and improved solubility for diverse applications. The integration of prebiotics into a wider array of food and beverage products, from dairy alternatives to baked goods, showcases their versatility. Competitive advantages are being built on scientifically validated health claims, sustainable sourcing, and tailored formulations addressing specific health needs, such as immune support and digestive wellness.

Key Drivers, Barriers & Challenges in APAC Prebiotic Ingredient Market

Key Drivers:

- Growing Health & Wellness Consciousness: Increasing consumer awareness of gut health and its impact on overall well-being is a primary growth catalyst.

- Technological Advancements: Innovations in extraction, fermentation, and formulation technologies are leading to more effective and diverse prebiotic ingredients.

- Government Initiatives: Supportive policies and regulations promoting functional foods and dietary supplements in countries like China and India are driving market growth.

- Rising Disposable Incomes: Increased purchasing power in emerging economies allows consumers to opt for premium, health-focused products.

Key Barriers & Challenges:

- Regulatory Hurdles: Varying regulations across different APAC countries regarding health claims and ingredient approvals can pose significant challenges.

- Supply Chain Volatility: Ensuring consistent quality and availability of raw materials, particularly for natural sources, can be affected by agricultural factors and geopolitical influences.

- Consumer Education: Despite growing awareness, a segment of the population still requires further education on the specific benefits and proper usage of prebiotics.

- Cost Sensitivities: In price-sensitive markets, the cost of premium prebiotic ingredients can be a barrier to widespread adoption in mainstream food products.

Growth Drivers in the APAC Prebiotic Ingredient Market Market

The APAC Prebiotic Ingredient Market is propelled by a confluence of technological advancements, evolving economic landscapes, and increasingly health-conscious consumer demographics. Technological innovations in fermentation and extraction are yielding higher-quality, more efficacious prebiotic ingredients, such as specialized oligosaccharides and resistant starches. Economically, rising disposable incomes across the Asia Pacific region are empowering consumers to invest in functional foods and dietary supplements that offer tangible health benefits, including improved gut health and enhanced immunity. Furthermore, supportive government policies in key markets like China, promoting food fortification and the use of scientifically validated health ingredients, are creating a fertile ground for market expansion. The growing prevalence of lifestyle-related diseases also acts as a significant driver, encouraging proactive health management strategies where prebiotics play a crucial role.

Challenges Impacting APAC Prebiotic Ingredient Market Growth

Despite its robust growth trajectory, the APAC Prebiotic Ingredient Market faces several significant challenges. Regulatory complexities, including varying standards for health claims and ingredient approvals across different nations, can hinder market penetration and product innovation. Supply chain vulnerabilities, stemming from reliance on agricultural raw materials susceptible to climate fluctuations and global trade dynamics, can lead to price volatility and availability issues. Intense competitive pressures from both established global players and emerging local manufacturers necessitate continuous innovation and cost optimization. Moreover, consumer education remains an ongoing challenge; while awareness is growing, a deeper understanding of specific prebiotic benefits and optimal consumption patterns is still required to maximize market potential and prevent misperceptions.

Key Players Shaping the APAC Prebiotic Ingredient Market Market

- Kerry Group plc

- Ingredion Incorporated

- BENEO GmbH

- Fonterra Co-operative Group Limited

- Sensus

- Nexira SAS

- Royal FrieslandCampina

- Shandong Bailong Group Co

- Baolingbao Biology Co Ltd

Significant APAC Prebiotic Ingredient Market Industry Milestones

- 2023: Launch of novel prebiotic fibers from plant-based sources, enhancing sustainability claims.

- 2022: Increased R&D investment in microbiome research and personalized nutrition applications.

- 2021: Expansion of manufacturing capacities by key players to meet rising demand in India and Southeast Asia.

- 2020: Regulatory approvals for new health claims related to prebiotic benefits in Japan and South Korea.

- 2019: Growing consumer preference for natural and clean-label prebiotic ingredients observed across the region.

Future Outlook for APAC Prebiotic Ingredient Market Market

The future outlook for the APAC Prebiotic Ingredient Market is exceptionally promising, driven by sustained consumer interest in preventative health and the expanding applications of prebiotics. Strategic opportunities lie in the development of synergistic prebiotic formulations, the integration of prebiotics into the rapidly growing plant-based food sector, and the exploration of novel sources derived from underutilized agricultural by-products. The increasing adoption of personalized nutrition platforms will further fuel demand for tailored prebiotic solutions. As research into the gut microbiome continues to unveil new health benefits, the market is poised for continued innovation and significant expansion, solidifying its position as a vital component of the global functional ingredients landscape.

APAC Prebiotic Ingredient Market Segmentation

-

1. Type

- 1.1. Inulin

- 1.2. FOS (Fructo-oligosaccharide)

- 1.3. GOS (Galacto-oligosaccharide)

- 1.4. Other In

-

2. Application

- 2.1. Infant Formula

- 2.2. Fortified Food and Beverage

- 2.3. Dietary Supplements

- 2.4. Animal Feed

- 2.5. Other Applications

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Rest of Asia Pacific

APAC Prebiotic Ingredient Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. Australia

- 4. India

- 5. Rest of Asia Pacific

APAC Prebiotic Ingredient Market Regional Market Share

Geographic Coverage of APAC Prebiotic Ingredient Market

APAC Prebiotic Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Prebiotics for Fortifying Food & Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inulin

- 5.1.2. FOS (Fructo-oligosaccharide)

- 5.1.3. GOS (Galacto-oligosaccharide)

- 5.1.4. Other In

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Fortified Food and Beverage

- 5.2.3. Dietary Supplements

- 5.2.4. Animal Feed

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. Australia

- 5.3.4. India

- 5.3.5. Rest of Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. Australia

- 5.4.4. India

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inulin

- 6.1.2. FOS (Fructo-oligosaccharide)

- 6.1.3. GOS (Galacto-oligosaccharide)

- 6.1.4. Other In

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Fortified Food and Beverage

- 6.2.3. Dietary Supplements

- 6.2.4. Animal Feed

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. Australia

- 6.3.4. India

- 6.3.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inulin

- 7.1.2. FOS (Fructo-oligosaccharide)

- 7.1.3. GOS (Galacto-oligosaccharide)

- 7.1.4. Other In

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Fortified Food and Beverage

- 7.2.3. Dietary Supplements

- 7.2.4. Animal Feed

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. Australia

- 7.3.4. India

- 7.3.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Australia APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inulin

- 8.1.2. FOS (Fructo-oligosaccharide)

- 8.1.3. GOS (Galacto-oligosaccharide)

- 8.1.4. Other In

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Fortified Food and Beverage

- 8.2.3. Dietary Supplements

- 8.2.4. Animal Feed

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. Australia

- 8.3.4. India

- 8.3.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. India APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inulin

- 9.1.2. FOS (Fructo-oligosaccharide)

- 9.1.3. GOS (Galacto-oligosaccharide)

- 9.1.4. Other In

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Infant Formula

- 9.2.2. Fortified Food and Beverage

- 9.2.3. Dietary Supplements

- 9.2.4. Animal Feed

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. Australia

- 9.3.4. India

- 9.3.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific APAC Prebiotic Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inulin

- 10.1.2. FOS (Fructo-oligosaccharide)

- 10.1.3. GOS (Galacto-oligosaccharide)

- 10.1.4. Other In

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Infant Formula

- 10.2.2. Fortified Food and Beverage

- 10.2.3. Dietary Supplements

- 10.2.4. Animal Feed

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. Australia

- 10.3.4. India

- 10.3.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kerry Group plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ingredion Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BENEO GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fonterra Co-operative Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sensus

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nexira SAS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Royal FrieslandCampina

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shandong Bailong Group Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baolingbao Biology Co Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kerry Group plc

List of Figures

- Figure 1: APAC Prebiotic Ingredient Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: APAC Prebiotic Ingredient Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: APAC Prebiotic Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Prebiotic Ingredient Market?

The projected CAGR is approximately 11.77%.

2. Which companies are prominent players in the APAC Prebiotic Ingredient Market?

Key companies in the market include Kerry Group plc, Ingredion Incorporated, BENEO GmbH, Fonterra Co-operative Group Limited, Sensus, Nexira SAS, Royal FrieslandCampina, Shandong Bailong Group Co, Baolingbao Biology Co Ltd *List Not Exhaustive.

3. What are the main segments of the APAC Prebiotic Ingredient Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Acquisitive Demand of Prebiotics for Fortifying Food & Beverages.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Prebiotic Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Prebiotic Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Prebiotic Ingredient Market?

To stay informed about further developments, trends, and reports in the APAC Prebiotic Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence