Key Insights

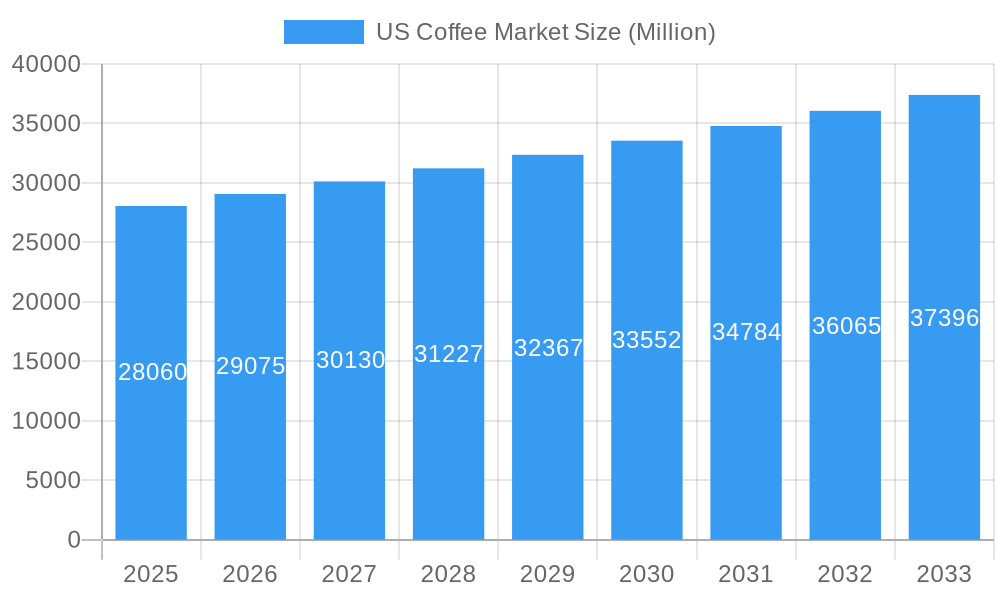

The US coffee market is poised for sustained growth, with a current market size of approximately USD 28.06 billion in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.69% through 2033. This robust expansion is underpinned by several key drivers. Evolving consumer preferences are fueling demand for premium and specialty coffee products, including single-origin beans and ethically sourced options. The proliferation of innovative brewing methods and the convenience offered by ready-to-drink (RTD) coffee and single-serve pods and capsules are also significantly contributing to market dynamism. Furthermore, the increasing integration of coffee consumption into daily routines, alongside the influence of social media trends and a growing appreciation for coffee culture, are solidifying its position as a staple beverage. The expansion of online retail channels has also enhanced accessibility, allowing consumers to easily discover and purchase a wider array of coffee products from the comfort of their homes.

US Coffee Market Market Size (In Billion)

Despite the optimistic outlook, the market faces certain restraints that could temper its growth trajectory. Rising raw material costs, particularly for coffee beans due to climate change impacts and geopolitical instability in major producing regions, present a significant challenge. Fluctuations in global coffee bean prices can directly affect profit margins for manufacturers and ultimately influence consumer pricing. Additionally, intense competition among established brands and emerging players, coupled with the need for continuous innovation to capture consumer attention, necessitates substantial investment. However, the overarching trend towards health-conscious choices and the growing demand for plant-based milk alternatives as coffee additions are creating new avenues for product development and market penetration, indicating a resilient and adaptable industry.

US Coffee Market Company Market Share

This comprehensive report delves into the dynamic US coffee market, providing an exhaustive analysis of its structure, trends, opportunities, and competitive landscape. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this study offers actionable insights for stakeholders seeking to navigate and capitalize on this multi-billion dollar industry. With a projected market size expected to reach over 100 Billion USD by 2025, the US coffee market is a significant contributor to the nation's economy, driven by evolving consumer preferences and technological advancements.

US Coffee Market Market Structure & Competitive Landscape

The US coffee market is characterized by a moderate to high degree of market concentration, with a few dominant players holding significant market share, estimated at over 70% by major players. Innovation remains a key differentiator, with companies heavily investing in new product development, particularly in the ready-to-drink (RTD) and plant-based milk alternatives segments, which are experiencing double-digit growth. Regulatory impacts, while generally supportive of food and beverage safety, can influence ingredient sourcing and labeling. Product substitutes, such as tea and energy drinks, present a constant competitive force, though coffee's entrenched consumer habit provides a strong defense. End-user segmentation is increasingly nuanced, with distinct preferences emerging among millennials, Gen Z, and health-conscious consumers. Mergers and acquisitions (M&A) activity, while not at peak levels, remains a strategic tool for market consolidation and expansion, with an estimated 5-10 significant M&A deals annually in the broader beverage sector impacting coffee.

- Market Concentration: Dominated by a mix of large multinational corporations and a growing number of specialty roasters.

- Innovation Drivers: Focus on sustainability, convenience, health and wellness, and premiumization.

- Regulatory Impacts: FDA regulations on labeling, food safety standards, and evolving environmental regulations impacting packaging.

- Product Substitutes: Tea, energy drinks, other caffeinated beverages.

- End-User Segmentation: Home brewing, office consumption, on-the-go, specialty coffee shops.

- M&A Trends: Strategic acquisitions to broaden product portfolios, gain market access, and enhance distribution capabilities.

US Coffee Market Market Trends & Opportunities

The US coffee market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of over 5% projected throughout the forecast period (2025–2033). This upward trajectory is fueled by a confluence of evolving consumer preferences, technological advancements, and an expanding array of product offerings. The increasing demand for premium and specialty coffee experiences continues to drive market penetration, with consumers willing to pay a premium for ethically sourced, single-origin, and expertly roasted beans. Ready-to-drink (RTD) coffee beverages, particularly those offering unique flavor profiles and functional benefits like added vitamins or adaptogens, are experiencing remarkable growth, contributing significantly to overall market expansion. The convenience factor associated with RTD and single-serve formats (e.g., coffee pods and capsules) further enhances their appeal to busy consumers.

Technological shifts are profoundly reshaping the coffee landscape. Advancements in brewing technology, from sophisticated home espresso machines to innovative cold brew makers, are empowering consumers to replicate café-quality coffee at home. Furthermore, the integration of e-commerce platforms has revolutionized coffee accessibility, allowing for direct-to-consumer sales and the proliferation of subscription services, offering unprecedented convenience and customization. The burgeoning interest in plant-based diets has also spurred significant innovation in coffee creamers and milk alternatives, creating a lucrative sub-segment within the broader coffee market. Opportunities abound for companies that can effectively leverage these trends, focusing on sustainable sourcing, unique flavor profiles, health-conscious formulations, and seamless digital consumer experiences. The market penetration for specialty coffee, in particular, is expected to continue its upward climb as consumers become more discerning and adventurous with their coffee choices.

Dominant Markets & Segments in US Coffee Market

The US coffee market exhibits significant dominance across various product types and distribution channels, reflecting a mature yet dynamic consumer base. Whole Bean coffee continues to hold a substantial market share, driven by the growing popularity of home brewing and the desire for fresh, high-quality coffee experiences. Consumers are increasingly investing in grinders and brewing equipment, further solidifying the demand for whole beans. Ground coffee remains a perennial favorite due to its convenience and affordability, catering to a broad segment of the population.

In terms of distribution channels, Supermarkets/Hypermarkets remain the largest and most dominant channel for coffee sales in the US. Their extensive reach, diverse product selection, and frequent promotional activities make them a primary destination for most coffee purchases. However, Online Retail is rapidly emerging as a formidable force, experiencing significant growth. This channel offers unparalleled convenience, a vast array of niche and specialty brands, and direct-to-consumer subscription models, appealing to a growing segment of digitally savvy consumers. Convenience/Grocery Stores also play a crucial role, especially for on-the-go purchases and impulse buys.

The Coffee Pods and Capsules segment is experiencing robust growth, propelled by the widespread adoption of single-serve brewing systems in homes and offices. The convenience, speed, and variety of flavors offered by these formats are key drivers.

- Dominant Product Type: Whole Bean Coffee

- Growth Drivers: Home brewing enthusiasts, demand for premium and specialty coffee, increasing investment in grinding and brewing equipment.

- Market Dominance: Appeals to consumers seeking the freshest flavor and customization options.

- Dominant Distribution Channel: Supermarkets/Hypermarkets

- Growth Drivers: Extensive store networks, wide product variety, competitive pricing, established consumer shopping habits.

- Market Dominance: Offers accessibility and convenience for everyday coffee purchases.

- Emerging Distribution Channel: Online Retail

- Growth Drivers: Direct-to-consumer sales, subscription services, vast product selection, convenience, niche market access.

- Market Dominance: Rapidly gaining market share, especially among younger demographics and specialty coffee buyers.

- Growing Product Segment: Coffee Pods and Capsules

- Growth Drivers: Convenience of single-serve brewing, speed, variety of flavors, increasing adoption of compatible machines.

- Market Dominance: Appeals to consumers prioritizing ease of use and quick preparation.

US Coffee Market Product Analysis

Product innovation in the US coffee market is predominantly focused on enhancing convenience, catering to health-conscious consumers, and delivering premium experiences. The rise of plant-based coffee creamers and milk alternatives, alongside the continued development of ready-to-drink (RTD) coffee beverages with functional ingredients like antioxidants and adaptogens, highlights a strong market trend. Technological advancements in coffee pod and capsule technology, such as the introduction of home compostable options by Nestlé's Nespresso, demonstrate a commitment to sustainability without compromising taste. The competitive advantage for brands lies in their ability to offer unique flavor profiles, ethically sourced beans, and eco-friendly packaging, meeting the evolving demands of a discerning consumer base.

Key Drivers, Barriers & Challenges in US Coffee Market

The US coffee market is propelled by several key drivers, including increasing disposable incomes, a deeply ingrained coffee culture, and a growing preference for premium and specialty coffee. Technological advancements in brewing equipment and online retail platforms are further expanding accessibility and consumer choice. Economic factors such as stable commodity prices and efficient supply chains also support market growth.

However, the market faces significant challenges and restraints. Fluctuations in the global coffee bean supply due to climate change and geopolitical instability can lead to price volatility and supply chain disruptions. Regulatory hurdles related to labeling, food safety, and sustainability standards can also impact operational costs and product development. Intense competition from established brands and emerging niche players, coupled with the rising cost of raw materials and labor, presents ongoing pressures.

Growth Drivers in the US Coffee Market Market

The US coffee market is experiencing robust growth driven by several interconnected factors. A significant driver is the evolving consumer preference for premium and specialty coffee, with consumers demonstrating a willingness to pay more for high-quality, ethically sourced, and single-origin beans. This trend is amplified by the increasing adoption of home brewing equipment, empowering consumers to replicate café experiences in their own kitchens. Technological innovation plays a crucial role, with advancements in brewing machines and the expansion of online retail platforms, including direct-to-consumer sales and subscription models, enhancing accessibility and convenience. Furthermore, the burgeoning demand for ready-to-drink (RTD) coffee beverages, particularly those offering functional benefits and unique flavor profiles, represents a substantial growth opportunity. The growing influence of health and wellness trends is also spurring the development of plant-based coffee creamers and milk alternatives, broadening the appeal of coffee beverages to a wider audience.

Challenges Impacting US Coffee Market Growth

Despite its strong growth trajectory, the US coffee market is not without its challenges. Supply chain volatility, driven by climate change impacts on coffee-growing regions, political instability, and global logistics issues, poses a significant threat to consistent supply and can lead to price fluctuations. Rising raw material costs, including the price of coffee beans, energy, and packaging, directly impact profit margins and can necessitate price increases for consumers. Intense competition from a crowded marketplace, encompassing both large established corporations and agile specialty coffee brands, requires continuous innovation and strategic differentiation. Furthermore, regulatory complexities, encompassing evolving food safety standards, labeling requirements, and sustainability mandates, can add to operational costs and compliance burdens. Consumer price sensitivity, particularly in the face of economic uncertainty, also presents a restraint, forcing brands to balance premiumization with affordability.

Key Players Shaping the US Coffee Market Market

- Fresh Roasted Coffee LLC

- Califia Farms LLC

- Monster Beverage Corporation

- The J M Smucker Co

- Kraft Heinz Co

- Keurig Dr Pepper Inc

- Starbucks Corporation

- White Wave Food Co

- Eight O' Clock Coffee Company

- Nestlé S A

Significant US Coffee Market Industry Milestones

- November 2022: Nestlé's Nespresso brand launched plant-based home compostable coffee capsules, offering premium quality coffee compatible with Nespresso Original machines, emphasizing taste and sustainability.

- June 2022: Keurig Dr. Pepper Inc. and Intelligentsia Coffee collaborated to launch Intelligentsia K-Cup Pods for the Keurig brewing system, marking the first time this super-premium coffee brand was available in this format.

- August 2022: Tim Hortons introduced four new varieties of espresso capsules compatible with Nespresso machines: classic, bright, bold, and decaf, expanding consumer choice for at-home espresso preparation.

Future Outlook for US Coffee Market Market

The future outlook for the US coffee market remains exceptionally bright, driven by sustained innovation and evolving consumer demands. The continued emphasis on premiumization, ethical sourcing, and unique flavor profiles will fuel growth in the specialty coffee segment. The ready-to-drink (RTD) coffee category is expected to see further expansion, with a focus on functional benefits and novel ingredient combinations. Sustainability will remain a critical differentiator, with consumers increasingly favoring brands that demonstrate environmental responsibility through their packaging and sourcing practices. The online retail channel will continue to gain prominence, offering personalized experiences and subscription models that cater to convenience-seeking consumers. Strategic opportunities lie in developing innovative plant-based offerings, leveraging advanced brewing technologies, and expanding into underserved demographic segments, ensuring continued market penetration and revenue growth.

US Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail

- 2.4. Other Distribution Channels

US Coffee Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

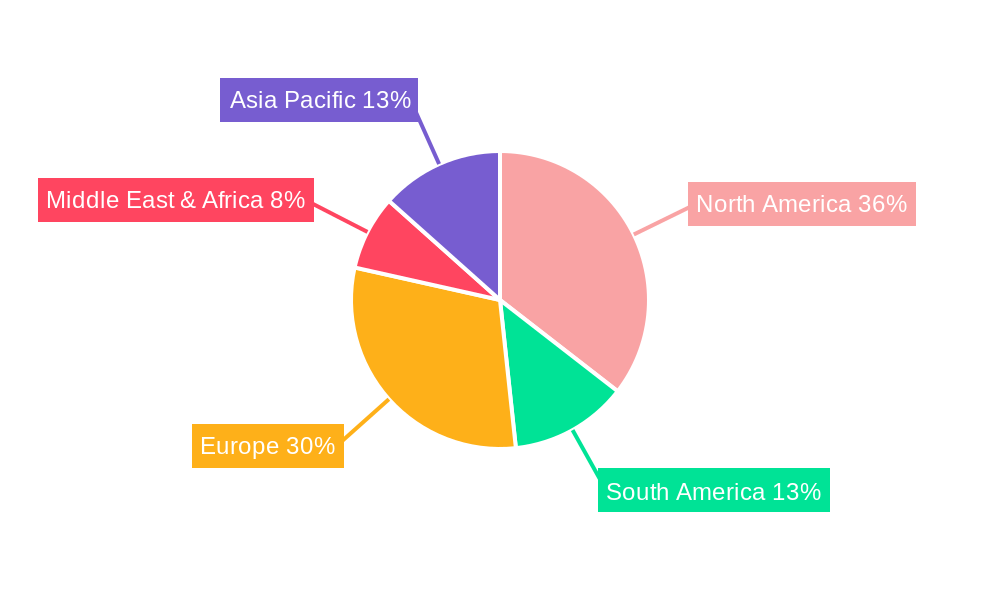

US Coffee Market Regional Market Share

Geographic Coverage of US Coffee Market

US Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Specialty Coffee; Popularity of Clean Labeled Products

- 3.3. Market Restrains

- 3.3.1. Emergence of Tea as a Healthier Alternative

- 3.4. Market Trends

- 3.4.1. Working Youth Population Boosting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America US Coffee Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whole Bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffee

- 6.1.4. Coffee Pods and Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Online Retail

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America US Coffee Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whole Bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffee

- 7.1.4. Coffee Pods and Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Online Retail

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe US Coffee Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whole Bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffee

- 8.1.4. Coffee Pods and Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Online Retail

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa US Coffee Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whole Bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffee

- 9.1.4. Coffee Pods and Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience/Grocery Stores

- 9.2.3. Online Retail

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific US Coffee Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Whole Bean

- 10.1.2. Ground Coffee

- 10.1.3. Instant Coffee

- 10.1.4. Coffee Pods and Capsules

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience/Grocery Stores

- 10.2.3. Online Retail

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Fresh Roasted Coffee LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Califia Farms LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Monster Beverage Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The J M Smucker Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kraft Heinz Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Keurig Dr Pepper Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Starbucks Corporation*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 White Wave Food Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eight O' Clock Coffee Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nestlé S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Fresh Roasted Coffee LLC

List of Figures

- Figure 1: Global US Coffee Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Coffee Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America US Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America US Coffee Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America US Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America US Coffee Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Coffee Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: South America US Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America US Coffee Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America US Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America US Coffee Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Coffee Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe US Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe US Coffee Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe US Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe US Coffee Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Coffee Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa US Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa US Coffee Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa US Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa US Coffee Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Coffee Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Coffee Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific US Coffee Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific US Coffee Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific US Coffee Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific US Coffee Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Coffee Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global US Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global US Coffee Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global US Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global US Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global US Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global US Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global US Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global US Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global US Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global US Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Coffee Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global US Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global US Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Coffee Market?

The projected CAGR is approximately 3.69%.

2. Which companies are prominent players in the US Coffee Market?

Key companies in the market include Fresh Roasted Coffee LLC, Califia Farms LLC, Monster Beverage Corporation, The J M Smucker Co, Kraft Heinz Co, Keurig Dr Pepper Inc, Starbucks Corporation*List Not Exhaustive, White Wave Food Co, Eight O' Clock Coffee Company, Nestlé S A.

3. What are the main segments of the US Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Specialty Coffee; Popularity of Clean Labeled Products.

6. What are the notable trends driving market growth?

Working Youth Population Boosting the Market Growth.

7. Are there any restraints impacting market growth?

Emergence of Tea as a Healthier Alternative.

8. Can you provide examples of recent developments in the market?

November 2022: The Nestlé brand Nespresso launched plant-based home compostable coffee capsules. It offers premium quality coffee without compromising the taste. The capsules are made compatible with Nespresso Original machines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Coffee Market?

To stay informed about further developments, trends, and reports in the US Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence