Key Insights

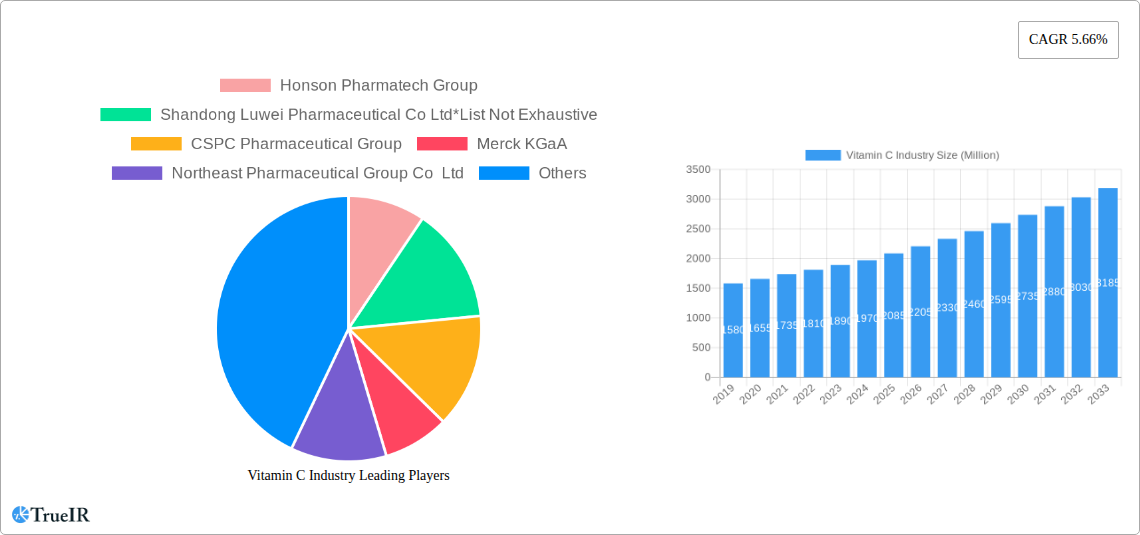

The global Vitamin C market is experiencing robust growth, projected to reach USD 1.97 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.66% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing consumer awareness regarding the health benefits of Vitamin C, its vital role in immune system support, and its widespread application across diverse industries. The food and beverage sector continues to be a dominant consumer, leveraging Vitamin C as an antioxidant, preservative, and nutritional enhancer. Furthermore, the growing demand for dietary supplements and fortified foods, driven by health-conscious populations globally, significantly contributes to market expansion. The pharmaceutical and healthcare industries also represent substantial drivers, utilizing Vitamin C in various therapeutic applications and as a crucial ingredient in medications.

Vitamin C Industry Market Size (In Billion)

Emerging trends indicate a strong shift towards natural and organic Vitamin C sources, driven by consumer preferences for clean-label products. Innovations in extraction and purification technologies are enabling more efficient and sustainable production methods. However, the market faces certain restraints, including price volatility of raw materials, stringent regulatory compliance for pharmaceutical-grade Vitamin C, and potential oversupply from key manufacturing regions. Despite these challenges, the market is poised for sustained growth, propelled by advancements in production, expanding applications, and a growing understanding of Vitamin C's multifaceted health benefits. Key players like Honson Pharmatech Group, Shandong Luwei Pharmaceutical Co Ltd, and BASF SE are actively investing in research and development to capture market share and introduce innovative products.

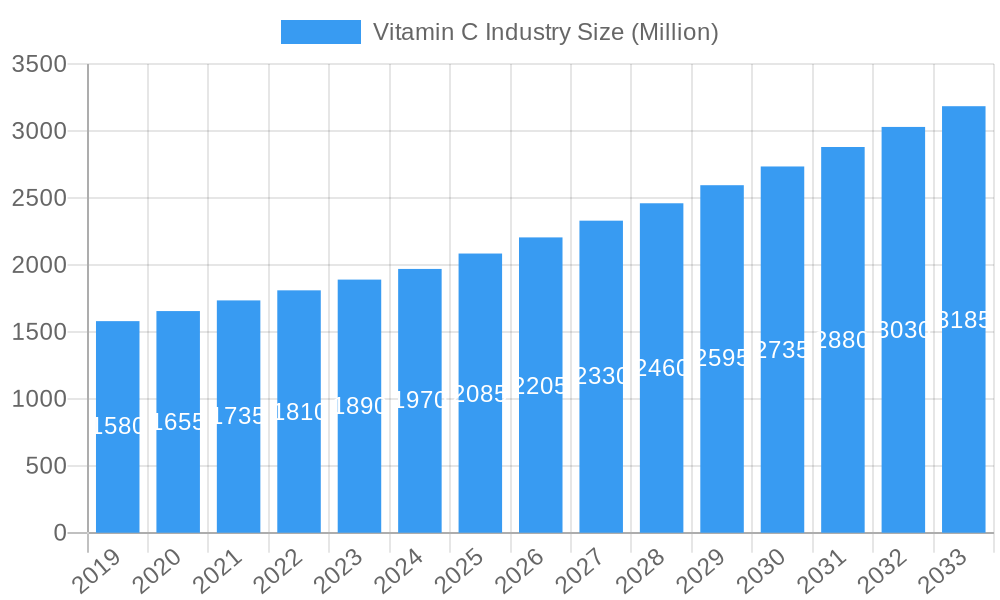

Vitamin C Industry Company Market Share

Unveiling the Global Vitamin C Market: Growth, Innovations, and Competitive Dynamics (2019–2033)

This comprehensive report dives deep into the dynamic Vitamin C industry, offering unparalleled insights into market structure, trends, opportunities, and the competitive landscape from 2019 to 2033. Leveraging high-volume keywords such as "Vitamin C market size," "ascorbic acid applications," "nutraceutical ingredients," and "pharmaceutical raw materials," this analysis is meticulously crafted for industry professionals seeking to navigate and capitalize on the evolving global Vitamin C market.

Vitamin C Industry Market Structure & Competitive Landscape

The global Vitamin C market is characterized by a moderate to high concentration, with a few key players dominating production and supply. Innovation drivers are primarily centered on cost-effective manufacturing processes, product purity, and the development of novel delivery systems for enhanced bioavailability. Regulatory frameworks, particularly concerning food fortification, pharmaceutical standards, and cosmetic ingredient safety, significantly influence market entry and product development. While direct product substitutes for Vitamin C are limited due to its essential biological functions, alternative antioxidants and nutrient blends can pose indirect competitive challenges. The end-user segmentation reveals a strong reliance on the food and beverage, pharmaceuticals, and beauty and personal care sectors. Mergers and acquisitions (M&A) play a crucial role in market consolidation and expansion. For instance, M&A activity in the last five years has seen a volume of approximately xx Billion USD, with key deals aimed at expanding geographical reach and product portfolios. Concentration ratios indicate that the top five players hold an estimated xx% of the global market share.

Vitamin C Industry Market Trends & Opportunities

The global Vitamin C market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025–2033. This expansion is fueled by escalating consumer awareness regarding health and wellness, leading to increased demand for Vitamin C as a dietary supplement and functional ingredient. Technological shifts are evident in advanced manufacturing techniques that improve production efficiency and reduce environmental impact, alongside innovative encapsulation technologies that enhance the stability and efficacy of Vitamin C in various applications. Consumer preferences are increasingly leaning towards natural and organic ingredients, creating opportunities for manufacturers focusing on sustainable sourcing and production. The competitive dynamics are intensifying, with established players and emerging companies vying for market share through product differentiation, strategic partnerships, and aggressive marketing strategies. Market penetration rates for Vitamin C in emerging economies are steadily rising, driven by improving healthcare infrastructure and increased disposable incomes. The overall market size, estimated at approximately xx Billion USD in the base year of 2025, is expected to reach xx Billion USD by 2033. Emerging trends include the growing use of Vitamin C in preventive healthcare and its recognized benefits in boosting immunity, further solidifying its position in the nutraceutical and pharmaceutical sectors.

Dominant Markets & Segments in Vitamin C Industry

The Pharmaceuticals and Healthcare segment stands as the dominant force within the global Vitamin C market, driven by its indispensable role in pharmaceutical formulations, dietary supplements, and medical treatments. The Food and Beverage sector follows closely, utilizing Vitamin C as an antioxidant, preservative, and fortifying agent. The Beauty and Personal Care segment is also experiencing significant growth, leveraging Vitamin C's anti-aging and skin-brightening properties. The Animal Feed segment, while smaller, contributes consistently to overall demand.

- Pharmaceuticals and Healthcare:

- Key Growth Drivers: Increasing prevalence of chronic diseases, rising demand for immune-boosting supplements, and the growing elderly population requiring nutritional support. Government initiatives promoting public health and the availability of over-the-counter Vitamin C products further bolster this segment.

- Food and Beverage:

- Key Growth Drivers: Consumer demand for healthier food options, stringent regulations on food preservation, and the trend of food fortification to combat micronutrient deficiencies. The growing processed food industry also contributes to consistent demand for Vitamin C as an additive.

- Beauty and Personal Care:

- Key Growth Drivers: Growing awareness of Vitamin C's dermatological benefits, particularly its antioxidant and collagen-boosting properties. The expansion of the global cosmetics market and the rising popularity of anti-aging skincare products are significant catalysts.

- Animal Feed:

- Key Growth Drivers: The need to enhance animal immunity and productivity in the livestock and aquaculture industries. The increasing focus on animal welfare and the demand for high-quality animal protein are also contributing factors.

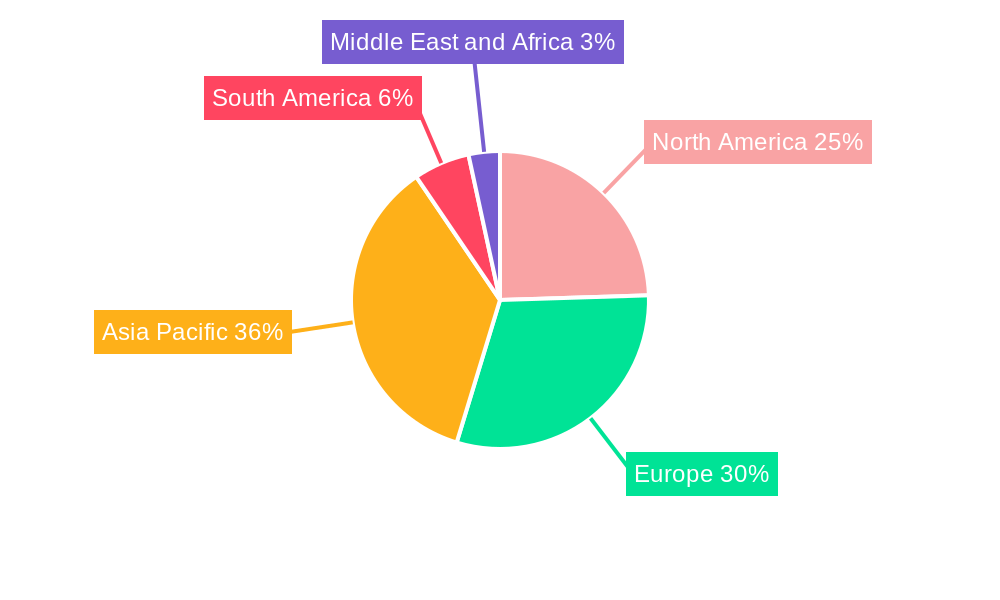

Geographically, North America and Europe currently represent the largest markets due to established healthcare systems, high disposable incomes, and a mature consumer base with strong health consciousness. However, the Asia-Pacific region is emerging as a high-growth market, driven by rapid industrialization, increasing population, rising healthcare expenditure, and a growing middle class with greater access to health and wellness products. Policies promoting domestic manufacturing and import-export trade agreements in this region are also facilitating market expansion.

Vitamin C Industry Product Analysis

Product innovation in the Vitamin C industry focuses on enhancing stability, bioavailability, and targeted delivery. Ascorbic acid, the most common form, is continuously being optimized through various salt forms and esterifications. Emerging applications leverage Vitamin C's potent antioxidant and anti-inflammatory properties in advanced pharmaceutical formulations for chronic disease management and in high-performance cosmetic products targeting skin rejuvenation. Competitive advantages are gained through superior purity, specialized formulations catering to niche applications (e.g., liposomal Vitamin C for enhanced skin penetration), and sustainable production methods.

Key Drivers, Barriers & Challenges in Vitamin C Industry

Key Drivers:

- Rising Health and Wellness Consciousness: Growing consumer awareness about Vitamin C's immune-boosting and antioxidant benefits.

- Expanding Nutraceutical and Pharmaceutical Sectors: Increased demand for Vitamin C as a key ingredient in dietary supplements and drug formulations.

- Technological Advancements: Improved manufacturing processes leading to higher purity and cost-effectiveness.

- Food Fortification Initiatives: Government policies and consumer demand for fortified food products.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in the cost of agricultural inputs can impact production costs.

- Regulatory Hurdles: Stringent regulations across different regions for food, pharmaceutical, and cosmetic applications.

- Intense Competition: A mature market with numerous players leading to price pressures.

- Supply Chain Disruptions: Global events can impact the availability and logistics of raw materials and finished products. The estimated impact of supply chain disruptions on market growth is approximately xx% in the last two years.

Growth Drivers in the Vitamin C Industry Market

Key growth drivers for the Vitamin C industry include the escalating global focus on preventive healthcare and the widespread recognition of Vitamin C's immune-supportive properties. Economically, rising disposable incomes in emerging markets are fueling demand for dietary supplements and fortified foods. Technologically, advancements in biomanufacturing and fermentation processes are enhancing production efficiency and sustainability. Regulatory factors, such as mandates for food fortification and approvals for new pharmaceutical applications, also contribute significantly to market expansion.

Challenges Impacting Vitamin C Industry Growth

Challenges impacting Vitamin C industry growth include the inherent price volatility of key agricultural raw materials, which can squeeze profit margins for manufacturers. Regulatory complexities across diverse geographical markets, particularly concerning purity standards and permissible usage levels in food and cosmetics, present ongoing hurdles. Intense competitive pressures, characterized by a saturated market and the presence of both large multinational corporations and smaller regional players, often lead to price wars and necessitate continuous innovation to maintain market share. Supply chain vulnerabilities, as witnessed during recent global disruptions, can lead to significant delays and increased costs.

Key Players Shaping the Vitamin C Industry Market

- Honson Pharmatech Group

- Shandong Luwei Pharmaceutical Co Ltd

- CSPC Pharmaceutical Group

- Merck KGaA

- Northeast Pharmaceutical Group Co Ltd

- BASF SE

- Freshine Chem

- Koninklijke DSM NV

- Foodchem International Corporation

- MC Biotec Inc

Significant Vitamin C Industry Industry Milestones

- December 2022: Merck KGaA and Mersana Therapeutics announced a joint partnership to create novel immunostimulatory antibody-drug conjugates. This collaboration strengthens the internal expertise and internal ADC strategy of Merck KGaA, Darmstadt, Germany.

- May 2022: Royal DSM merged with Firmenich. DSM-Firmenich has four business units such as perfumery and beauty, food and beverage, health and nutrition, and animal nutrition with combined sales of approximately EUR 11.5 billion.

Future Outlook for Vitamin C Industry Market

The future outlook for the Vitamin C industry remains exceptionally promising, driven by persistent global health trends and expanding applications. Strategic opportunities lie in the development of novel delivery systems that enhance efficacy and target specific health outcomes, such as improved cardiovascular health and cognitive function. The growing demand for clean-label and sustainably sourced ingredients will create a competitive advantage for eco-conscious manufacturers. Furthermore, increased investment in research and development for new therapeutic applications of Vitamin C, particularly in areas like oncology and immune modulation, will unlock substantial market potential. The market is projected to witness sustained growth, driven by innovation and evolving consumer needs.

Vitamin C Industry Segmentation

-

1. Application

- 1.1. Food and Beverage

- 1.2. Pharmaceuticals and Healthcare

- 1.3. Beauty and Personal Care

- 1.4. Animal Feed

Vitamin C Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Vitamin C Industry Regional Market Share

Geographic Coverage of Vitamin C Industry

Vitamin C Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Fortified/Functional Food and Beverage Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverage

- 5.1.2. Pharmaceuticals and Healthcare

- 5.1.3. Beauty and Personal Care

- 5.1.4. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverage

- 6.1.2. Pharmaceuticals and Healthcare

- 6.1.3. Beauty and Personal Care

- 6.1.4. Animal Feed

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverage

- 7.1.2. Pharmaceuticals and Healthcare

- 7.1.3. Beauty and Personal Care

- 7.1.4. Animal Feed

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverage

- 8.1.2. Pharmaceuticals and Healthcare

- 8.1.3. Beauty and Personal Care

- 8.1.4. Animal Feed

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverage

- 9.1.2. Pharmaceuticals and Healthcare

- 9.1.3. Beauty and Personal Care

- 9.1.4. Animal Feed

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Vitamin C Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food and Beverage

- 10.1.2. Pharmaceuticals and Healthcare

- 10.1.3. Beauty and Personal Care

- 10.1.4. Animal Feed

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honson Pharmatech Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shandong Luwei Pharmaceutical Co Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CSPC Pharmaceutical Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Northeast Pharmaceutical Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Freshine Chem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke DSM NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Foodchem International Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MC Biotec Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honson Pharmatech Group

List of Figures

- Figure 1: Global Vitamin C Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Vitamin C Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Vitamin C Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Vitamin C Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Vitamin C Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Vitamin C Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Spain Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Australia Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Vitamin C Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Vitamin C Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: South Africa Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Vitamin C Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vitamin C Industry?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Vitamin C Industry?

Key companies in the market include Honson Pharmatech Group, Shandong Luwei Pharmaceutical Co Ltd*List Not Exhaustive, CSPC Pharmaceutical Group, Merck KGaA, Northeast Pharmaceutical Group Co Ltd, BASF SE, Freshine Chem, Koninklijke DSM NV, Foodchem International Corporation, MC Biotec Inc.

3. What are the main segments of the Vitamin C Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Increasing Demand from Fortified/Functional Food and Beverage Application.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

In December 2022, Merck KGaA and Mersana Therapeutics announced a joint partnership to create novel immunostimulatory antibody-drug conjugates. This collaboration strengthens the internal expertise and internal ADC strategy of Merck KGaA, Darmstadt, Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vitamin C Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vitamin C Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vitamin C Industry?

To stay informed about further developments, trends, and reports in the Vitamin C Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence