Key Insights

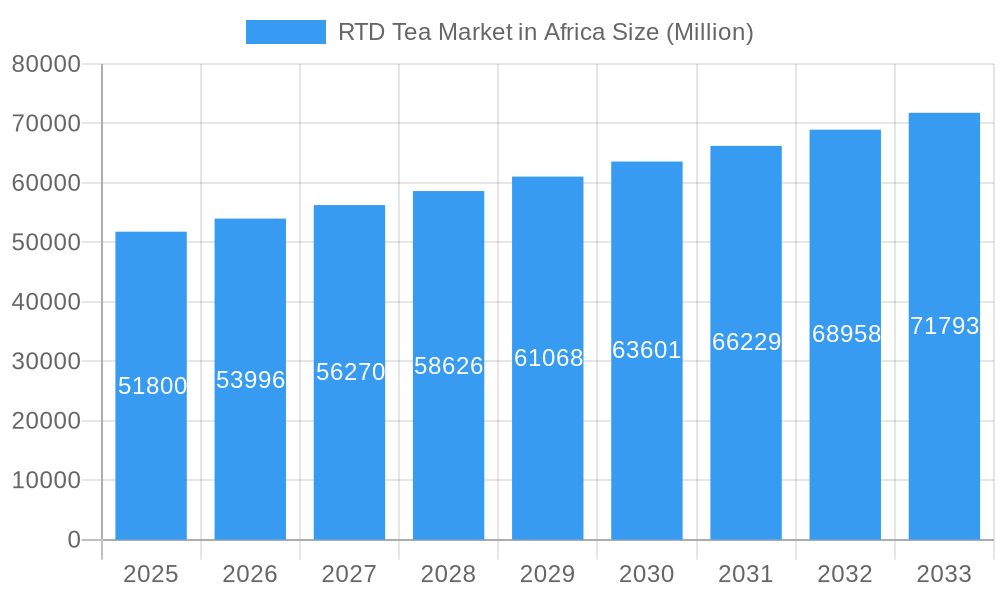

The Ready-to-Drink (RTD) tea market in Africa is poised for substantial growth, driven by evolving consumer preferences for convenient, healthy, and flavorful beverages. With an estimated market size of USD 51.8 billion in 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period of 2025-2033. This upward trajectory is fueled by a growing middle class with increasing disposable incomes, a heightened awareness of the health benefits associated with tea, and the rapid urbanization that favors on-the-go consumption. Emerging trends such as the demand for novel flavor profiles, organic and ethically sourced ingredients, and sugar-free or low-sugar options are significantly shaping product innovation and market penetration across the continent. Leading players are increasingly focusing on localized flavor offerings and expanding their distribution networks to reach a wider consumer base.

RTD Tea Market in Africa Market Size (In Billion)

Despite the optimistic outlook, the RTD tea market in Africa faces certain restraints that warrant strategic attention. The primary challenges include the underdeveloped cold chain infrastructure in many regions, which can impact product freshness and distribution efficiency, particularly for perishable varieties. Additionally, price sensitivity among a significant portion of the consumer base and the presence of strong local competition from traditional beverages and other RTD categories pose hurdles to market expansion. However, the strategic focus on expanding off-trade channels, especially online retail and convenience stores, coupled with innovative packaging solutions like aseptic packages and PET bottles designed for affordability and portability, is expected to mitigate these challenges. The diversification of RTD tea types, encompassing green tea, herbal tea, and iced tea, caters to a broader spectrum of consumer tastes, further bolstering market resilience and growth prospects.

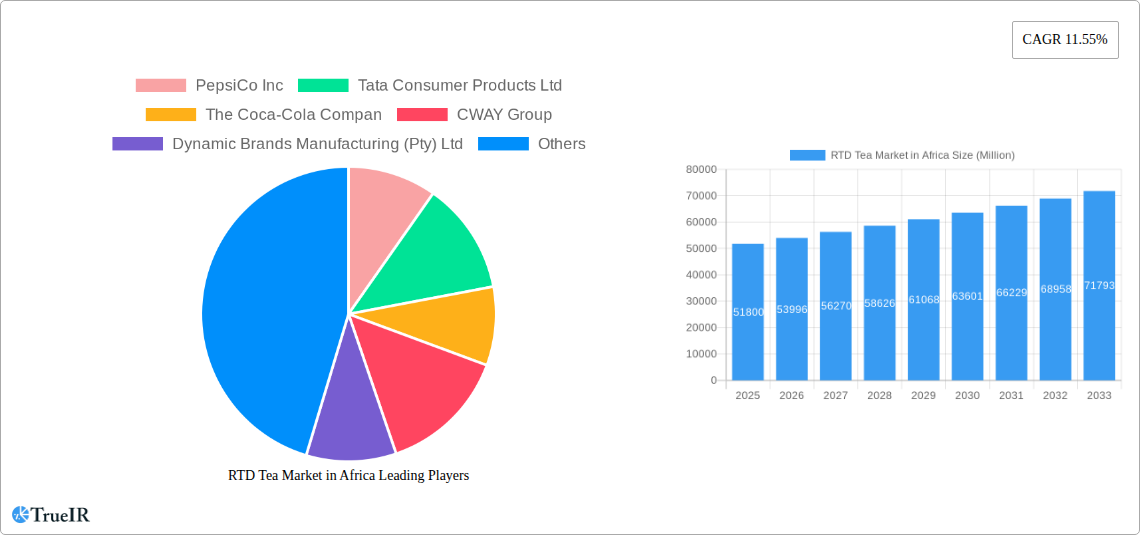

RTD Tea Market in Africa Company Market Share

This comprehensive report provides an in-depth analysis of the burgeoning Ready-to-Drink (RTD) Tea market in Africa, covering the historical period of 2019-2024, the base and estimated year of 2025, and a detailed forecast period from 2025-2033. With an estimated market size reaching billions of dollars, this study is an indispensable resource for stakeholders seeking to understand market dynamics, identify lucrative opportunities, and navigate the competitive landscape of this rapidly evolving sector.

Our analysis delves into critical aspects including market structure, key trends, dominant segments, product innovations, growth drivers, and challenges. We examine the strategic initiatives of leading players like PepsiCo Inc., Tata Consumer Products Ltd., The Coca-Cola Company, CWAY Group, Dynamic Brands Manufacturing (Pty) Ltd, Clover S A (Pty) Ltd, and BOS Brands (Pty) Ltd, offering actionable insights for strategic planning and market penetration.

RTD Tea Market in Africa Market Structure & Competitive Landscape

The African RTD Tea market is characterized by a moderate to high level of concentration, with key players like PepsiCo Inc., The Coca-Cola Company, and Tata Consumer Products Ltd. holding significant market shares. Innovation is a key driver, with companies continuously introducing new flavors, healthier formulations, and sustainable packaging options to cater to evolving consumer preferences. Regulatory impacts, while varying by country, generally focus on food safety standards and labeling requirements. Product substitutes, such as carbonated soft drinks and juices, pose a competitive threat, yet the perceived health benefits and diverse flavor profiles of RTD tea offer a distinct market advantage. End-user segmentation reveals a growing demand across urban and peri-urban demographics, with a rising interest from the younger population. Mergers and acquisitions (M&A) are anticipated to play a crucial role in market consolidation and expansion, with an estimated XX volume of M&A deals projected over the forecast period. Concentration ratios, estimated to be around XX% for the top three players, indicate a dynamic competitive environment.

RTD Tea Market in Africa Market Trends & Opportunities

The RTD Tea market in Africa is poised for substantial growth, driven by a confluence of favorable trends and emerging opportunities. Market size growth is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period, translating into billions of dollars in revenue by 2033. Technological shifts, including advancements in aseptic packaging and innovative brewing techniques, are enhancing product quality, shelf life, and consumer convenience. Consumer preferences are increasingly leaning towards healthier beverage options, with a growing demand for low-sugar, natural ingredient-based RTD teas, including green tea and herbal tea variants. The expanding middle class across the continent, coupled with increasing disposable incomes, is a significant catalyst for market penetration rates, which are expected to rise from XX% in the base year to XX% by 2033. Competitive dynamics are intensifying, with both global beverage giants and agile local players vying for market share. Opportunities lie in tapping into niche markets, developing region-specific flavors, and leveraging the burgeoning e-commerce landscape for wider distribution. The African RTD tea market presents a compelling investment landscape, offering significant returns for strategic market participants.

Dominant Markets & Segments in RTD Tea Market in Africa

Dominant Region and Key Markets: The Southern African region, particularly South Africa, is currently the dominant market for RTD tea in Africa. This dominance is attributed to well-established distribution networks, higher consumer disposable incomes, and a greater awareness of beverage trends. However, West African nations like Nigeria and East African economies such as Kenya and Ethiopia are showing rapid growth potential, driven by increasing urbanization and a growing young population.

Dominant Soft Drink Type:

- Iced Tea: Currently holds the largest market share due to its widespread appeal as a refreshing beverage. Its versatility in flavor profiles and association with popular global brands contribute to its dominance.

- Green Tea: Witnessing significant growth as consumers become more health-conscious, appreciating its perceived health benefits and antioxidants.

- Herbal Tea: Emerging as a niche but rapidly growing segment, driven by interest in functional beverages and traditional remedies.

- Other RTD Tea: Encompasses a range of specialized teas and blends, with potential for future expansion.

Dominant Packaging Type:

- PET Bottles: Lead the market due to their affordability, durability, and convenience for on-the-go consumption. The widespread availability of PET bottle recycling infrastructure in some markets also contributes to their appeal.

- Metal Cans: Gaining traction due to their premium perception, recyclability, and effective preservation of taste and freshness.

- Aseptic Packages: Increasingly adopted for their long shelf life and ability to maintain product integrity without refrigeration, particularly in remote areas.

- Glass Bottles: While offering a premium feel, their usage is more limited to specific on-trade or niche off-trade segments due to cost and fragility.

Dominant Distribution Channel:

- Off-trade:

- Supermarket/Hypermarket: Represents the largest distribution channel, offering a wide selection and catering to bulk purchases.

- Convenience Stores: Play a crucial role in providing immediate access to RTD teas, especially in urban areas.

- Online Retail: Experiencing exponential growth, providing convenience and wider product availability, especially in digitally connected urban centers.

- Others (Wholesalers, Kiosks): Contribute to broad market reach, particularly in less developed areas.

- On-trade (Restaurants, Cafes, Bars): Contributes to brand visibility and trial, offering RTD teas as part of a wider beverage offering.

Growth drivers include improving infrastructure, favorable government policies promoting beverage manufacturing, and increasing urbanization, which leads to higher demand for convenient and ready-to-consume products.

RTD Tea Market in Africa Product Analysis

Product innovations in the African RTD Tea market are largely driven by health and wellness trends. Companies are focusing on developing unsweetened or low-sugar variants, incorporating natural ingredients, and offering functional benefits. Examples include the launch of unsweetened iced teas with exotic fruit and floral infusions by BOS Brands and the introduction of Rooibos RTD Tea products with diverse flavors by Clover S.A. Competitive advantages are being built through unique flavor profiles, sustainable sourcing, and appealing packaging formats that cater to the on-the-go African consumer. Technological advancements in brewing and preservation are enabling a wider range of product formulations and extended shelf life.

Key Drivers, Barriers & Challenges in RTD Tea Market in Africa

Key Drivers: The RTD Tea market in Africa is propelled by several key drivers. The growing health consciousness among African consumers is a significant factor, driving demand for beverages perceived as healthier alternatives to traditional soft drinks. Increasing disposable incomes and a burgeoning middle class are boosting purchasing power, making premium and convenient beverages more accessible. Urbanization is leading to a faster-paced lifestyle, increasing the demand for ready-to-drink options. Furthermore, a young demographic with a growing exposure to global beverage trends and a penchant for exploring new flavors are significant growth catalysts. The expansion of modern retail formats and e-commerce platforms is also improving accessibility and distribution.

Barriers & Challenges: Despite its growth potential, the RTD Tea market in Africa faces several barriers and challenges. Supply chain issues, including underdeveloped logistics infrastructure and cold chain limitations in some regions, can hinder efficient distribution and increase costs. Regulatory complexities and varying standards across different African countries can pose challenges for market entry and product standardization. Intense competition from established soft drink brands and local beverage producers requires significant investment in marketing and brand building. Price sensitivity among a large segment of the population can limit the adoption of premium RTD tea products. Additionally, limited consumer awareness and education regarding the benefits and variety of RTD teas in some emerging markets can slow down adoption rates.

Growth Drivers in the RTD Tea Market in Africa Market

The RTD Tea market in Africa is experiencing robust growth driven by several key factors. Technological advancements in beverage production and packaging, such as aseptic filling and advanced filtration techniques, are enabling the creation of higher-quality, longer-shelf-life products. Economic growth and rising disposable incomes across the continent are empowering consumers to spend more on convenience and premium beverages. Government initiatives and favorable trade policies in certain countries are encouraging investment in the food and beverage sector. The increasing awareness of health and wellness among consumers is a paramount driver, pushing demand for beverages perceived as natural and healthy. Furthermore, youthful demographics and evolving lifestyle trends are creating a receptive market for innovative and convenient drink options.

Challenges Impacting RTD Tea Market in Africa Growth

Several challenges are impacting the growth of the RTD Tea market in Africa. Inadequate infrastructure, particularly in terms of logistics and cold chain facilities, leads to distribution inefficiencies and potential product spoilage. Complex and inconsistent regulatory frameworks across various nations can create hurdles for market entry and compliance. Intense competition from established players in the broader beverage industry, including carbonated soft drinks and juices, necessitates significant marketing expenditure. Price sensitivity, especially in lower-income segments, can limit the affordability of certain RTD tea products. Additionally, supply chain disruptions, stemming from political instability or natural disasters in some regions, pose a consistent risk.

Key Players Shaping the RTD Tea Market in Africa Market

- PepsiCo Inc.

- Tata Consumer Products Ltd.

- The Coca-Cola Company

- CWAY Group

- Dynamic Brands Manufacturing (Pty) Ltd

- Clover S A (Pty) Ltd

- BOS Brands (Pty) Ltd

Significant RTD Tea Market in Africa Industry Milestones

- February 2021: BOS Brands ramped up its direct-to-consumer offerings through a new subscription service, making BOS products available directly from the brand at a discounted rate for monthly orders.

- January 2021: Manhattan Ice Tea, a brand under Clover S.A., launched a new range of Rooibos RTD Tea products in Lemon and Mixed Berry flavors. These products contain mineral water, fructose, sugar, citric acid, rooibos tea extract, acidity regulators, flavoring, preservatives, colorants, and sweeteners.

- February 2019: BOS Brands (Pty) Ltd launched unsweetened iced tea in three flavors: blueberry and jasmine, white peach and elderflower, and pineapple and coconut.

Future Outlook for RTD Tea Market in Africa Market

The future outlook for the RTD Tea market in Africa is exceptionally positive, fueled by a growing consumer base, increasing disposable incomes, and a rising demand for convenient, healthier beverage options. Strategic opportunities lie in further product innovation, particularly in functional RTD teas and plant-based variants, catering to specific health needs and dietary preferences. Expanding distribution networks into rural and peri-urban areas, alongside leveraging the rapid growth of e-commerce, will be crucial for market penetration. Companies that can adapt to local tastes and preferences, offer competitive pricing, and invest in sustainable practices are poised to capture significant market share. The continuous development of new flavor profiles and healthier formulations will be key to retaining consumer interest and driving long-term market growth, projecting a market size in billions of dollars.

RTD Tea Market in Africa Segmentation

-

1. Soft Drink Type

- 1.1. Green Tea

- 1.2. Herbal Tea

- 1.3. Iced Tea

- 1.4. Other RTD Tea

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

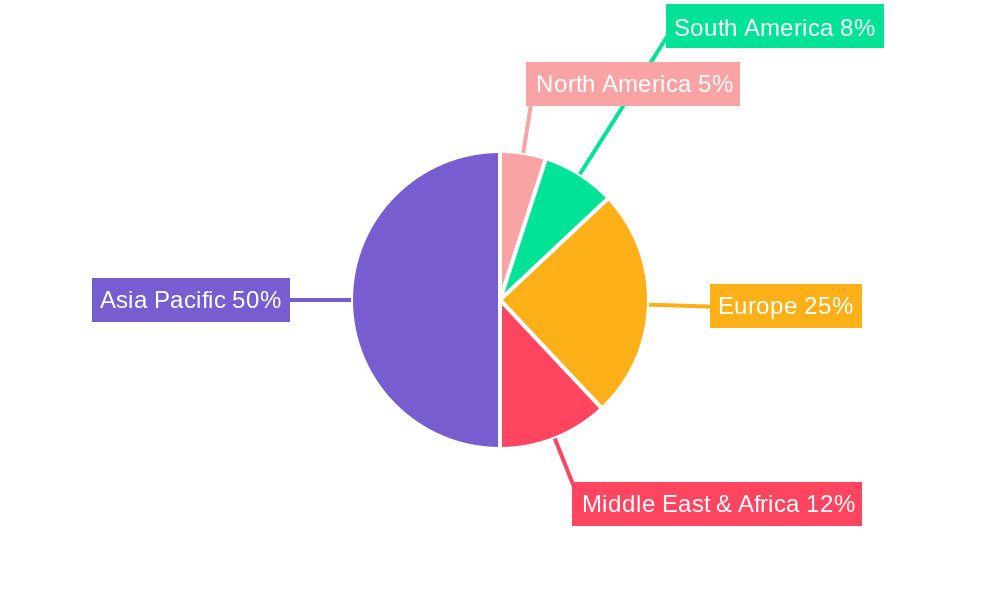

RTD Tea Market in Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

RTD Tea Market in Africa Regional Market Share

Geographic Coverage of RTD Tea Market in Africa

RTD Tea Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RTD Tea Market in Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Green Tea

- 5.1.2. Herbal Tea

- 5.1.3. Iced Tea

- 5.1.4. Other RTD Tea

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America RTD Tea Market in Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Green Tea

- 6.1.2. Herbal Tea

- 6.1.3. Iced Tea

- 6.1.4. Other RTD Tea

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Glass Bottles

- 6.2.3. Metal Can

- 6.2.4. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Retail

- 6.3.1.3. Supermarket/Hypermarket

- 6.3.1.4. Others

- 6.3.2. On-trade

- 6.3.1. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America RTD Tea Market in Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Green Tea

- 7.1.2. Herbal Tea

- 7.1.3. Iced Tea

- 7.1.4. Other RTD Tea

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Glass Bottles

- 7.2.3. Metal Can

- 7.2.4. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Retail

- 7.3.1.3. Supermarket/Hypermarket

- 7.3.1.4. Others

- 7.3.2. On-trade

- 7.3.1. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe RTD Tea Market in Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Green Tea

- 8.1.2. Herbal Tea

- 8.1.3. Iced Tea

- 8.1.4. Other RTD Tea

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Glass Bottles

- 8.2.3. Metal Can

- 8.2.4. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Retail

- 8.3.1.3. Supermarket/Hypermarket

- 8.3.1.4. Others

- 8.3.2. On-trade

- 8.3.1. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa RTD Tea Market in Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Green Tea

- 9.1.2. Herbal Tea

- 9.1.3. Iced Tea

- 9.1.4. Other RTD Tea

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Glass Bottles

- 9.2.3. Metal Can

- 9.2.4. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Retail

- 9.3.1.3. Supermarket/Hypermarket

- 9.3.1.4. Others

- 9.3.2. On-trade

- 9.3.1. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific RTD Tea Market in Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Green Tea

- 10.1.2. Herbal Tea

- 10.1.3. Iced Tea

- 10.1.4. Other RTD Tea

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Glass Bottles

- 10.2.3. Metal Can

- 10.2.4. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Retail

- 10.3.1.3. Supermarket/Hypermarket

- 10.3.1.4. Others

- 10.3.2. On-trade

- 10.3.1. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PepsiCo Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tata Consumer Products Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Coca-Cola Compan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CWAY Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dynamic Brands Manufacturing (Pty) Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Clover S A (Pty) Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BOS Brands (Pty) Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 PepsiCo Inc

List of Figures

- Figure 1: Global RTD Tea Market in Africa Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global RTD Tea Market in Africa Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America RTD Tea Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 4: North America RTD Tea Market in Africa Volume (K Tons), by Soft Drink Type 2025 & 2033

- Figure 5: North America RTD Tea Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 6: North America RTD Tea Market in Africa Volume Share (%), by Soft Drink Type 2025 & 2033

- Figure 7: North America RTD Tea Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 8: North America RTD Tea Market in Africa Volume (K Tons), by Packaging Type 2025 & 2033

- Figure 9: North America RTD Tea Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 10: North America RTD Tea Market in Africa Volume Share (%), by Packaging Type 2025 & 2033

- Figure 11: North America RTD Tea Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 12: North America RTD Tea Market in Africa Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 13: North America RTD Tea Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America RTD Tea Market in Africa Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America RTD Tea Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America RTD Tea Market in Africa Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America RTD Tea Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America RTD Tea Market in Africa Volume Share (%), by Country 2025 & 2033

- Figure 19: South America RTD Tea Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 20: South America RTD Tea Market in Africa Volume (K Tons), by Soft Drink Type 2025 & 2033

- Figure 21: South America RTD Tea Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 22: South America RTD Tea Market in Africa Volume Share (%), by Soft Drink Type 2025 & 2033

- Figure 23: South America RTD Tea Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 24: South America RTD Tea Market in Africa Volume (K Tons), by Packaging Type 2025 & 2033

- Figure 25: South America RTD Tea Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 26: South America RTD Tea Market in Africa Volume Share (%), by Packaging Type 2025 & 2033

- Figure 27: South America RTD Tea Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 28: South America RTD Tea Market in Africa Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 29: South America RTD Tea Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America RTD Tea Market in Africa Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America RTD Tea Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 32: South America RTD Tea Market in Africa Volume (K Tons), by Country 2025 & 2033

- Figure 33: South America RTD Tea Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America RTD Tea Market in Africa Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe RTD Tea Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 36: Europe RTD Tea Market in Africa Volume (K Tons), by Soft Drink Type 2025 & 2033

- Figure 37: Europe RTD Tea Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 38: Europe RTD Tea Market in Africa Volume Share (%), by Soft Drink Type 2025 & 2033

- Figure 39: Europe RTD Tea Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 40: Europe RTD Tea Market in Africa Volume (K Tons), by Packaging Type 2025 & 2033

- Figure 41: Europe RTD Tea Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 42: Europe RTD Tea Market in Africa Volume Share (%), by Packaging Type 2025 & 2033

- Figure 43: Europe RTD Tea Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 44: Europe RTD Tea Market in Africa Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 45: Europe RTD Tea Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe RTD Tea Market in Africa Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe RTD Tea Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 48: Europe RTD Tea Market in Africa Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe RTD Tea Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe RTD Tea Market in Africa Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa RTD Tea Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 52: Middle East & Africa RTD Tea Market in Africa Volume (K Tons), by Soft Drink Type 2025 & 2033

- Figure 53: Middle East & Africa RTD Tea Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 54: Middle East & Africa RTD Tea Market in Africa Volume Share (%), by Soft Drink Type 2025 & 2033

- Figure 55: Middle East & Africa RTD Tea Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 56: Middle East & Africa RTD Tea Market in Africa Volume (K Tons), by Packaging Type 2025 & 2033

- Figure 57: Middle East & Africa RTD Tea Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 58: Middle East & Africa RTD Tea Market in Africa Volume Share (%), by Packaging Type 2025 & 2033

- Figure 59: Middle East & Africa RTD Tea Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa RTD Tea Market in Africa Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa RTD Tea Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa RTD Tea Market in Africa Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa RTD Tea Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East & Africa RTD Tea Market in Africa Volume (K Tons), by Country 2025 & 2033

- Figure 65: Middle East & Africa RTD Tea Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa RTD Tea Market in Africa Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific RTD Tea Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 68: Asia Pacific RTD Tea Market in Africa Volume (K Tons), by Soft Drink Type 2025 & 2033

- Figure 69: Asia Pacific RTD Tea Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 70: Asia Pacific RTD Tea Market in Africa Volume Share (%), by Soft Drink Type 2025 & 2033

- Figure 71: Asia Pacific RTD Tea Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 72: Asia Pacific RTD Tea Market in Africa Volume (K Tons), by Packaging Type 2025 & 2033

- Figure 73: Asia Pacific RTD Tea Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 74: Asia Pacific RTD Tea Market in Africa Volume Share (%), by Packaging Type 2025 & 2033

- Figure 75: Asia Pacific RTD Tea Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific RTD Tea Market in Africa Volume (K Tons), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific RTD Tea Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific RTD Tea Market in Africa Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific RTD Tea Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 80: Asia Pacific RTD Tea Market in Africa Volume (K Tons), by Country 2025 & 2033

- Figure 81: Asia Pacific RTD Tea Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific RTD Tea Market in Africa Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global RTD Tea Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Global RTD Tea Market in Africa Volume K Tons Forecast, by Soft Drink Type 2020 & 2033

- Table 3: Global RTD Tea Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 4: Global RTD Tea Market in Africa Volume K Tons Forecast, by Packaging Type 2020 & 2033

- Table 5: Global RTD Tea Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global RTD Tea Market in Africa Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global RTD Tea Market in Africa Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global RTD Tea Market in Africa Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global RTD Tea Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 10: Global RTD Tea Market in Africa Volume K Tons Forecast, by Soft Drink Type 2020 & 2033

- Table 11: Global RTD Tea Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 12: Global RTD Tea Market in Africa Volume K Tons Forecast, by Packaging Type 2020 & 2033

- Table 13: Global RTD Tea Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global RTD Tea Market in Africa Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global RTD Tea Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global RTD Tea Market in Africa Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: United States RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Canada RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Mexico RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global RTD Tea Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 24: Global RTD Tea Market in Africa Volume K Tons Forecast, by Soft Drink Type 2020 & 2033

- Table 25: Global RTD Tea Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 26: Global RTD Tea Market in Africa Volume K Tons Forecast, by Packaging Type 2020 & 2033

- Table 27: Global RTD Tea Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global RTD Tea Market in Africa Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global RTD Tea Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global RTD Tea Market in Africa Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Brazil RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Brazil RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Argentina RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Global RTD Tea Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 38: Global RTD Tea Market in Africa Volume K Tons Forecast, by Soft Drink Type 2020 & 2033

- Table 39: Global RTD Tea Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 40: Global RTD Tea Market in Africa Volume K Tons Forecast, by Packaging Type 2020 & 2033

- Table 41: Global RTD Tea Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global RTD Tea Market in Africa Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global RTD Tea Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: Global RTD Tea Market in Africa Volume K Tons Forecast, by Country 2020 & 2033

- Table 45: United Kingdom RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Germany RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Germany RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: France RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: France RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Italy RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Italy RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Spain RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Spain RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Russia RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Russia RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Benelux RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Benelux RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Nordics RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Nordics RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global RTD Tea Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 64: Global RTD Tea Market in Africa Volume K Tons Forecast, by Soft Drink Type 2020 & 2033

- Table 65: Global RTD Tea Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 66: Global RTD Tea Market in Africa Volume K Tons Forecast, by Packaging Type 2020 & 2033

- Table 67: Global RTD Tea Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global RTD Tea Market in Africa Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global RTD Tea Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global RTD Tea Market in Africa Volume K Tons Forecast, by Country 2020 & 2033

- Table 71: Turkey RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Turkey RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Israel RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Israel RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: GCC RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: GCC RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 77: North Africa RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: North Africa RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 79: South Africa RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: South Africa RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: Global RTD Tea Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 84: Global RTD Tea Market in Africa Volume K Tons Forecast, by Soft Drink Type 2020 & 2033

- Table 85: Global RTD Tea Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 86: Global RTD Tea Market in Africa Volume K Tons Forecast, by Packaging Type 2020 & 2033

- Table 87: Global RTD Tea Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global RTD Tea Market in Africa Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global RTD Tea Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 90: Global RTD Tea Market in Africa Volume K Tons Forecast, by Country 2020 & 2033

- Table 91: China RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: China RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 93: India RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: India RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 95: Japan RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 96: Japan RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 97: South Korea RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: South Korea RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 99: ASEAN RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: ASEAN RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 101: Oceania RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: Oceania RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific RTD Tea Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific RTD Tea Market in Africa Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RTD Tea Market in Africa?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the RTD Tea Market in Africa?

Key companies in the market include PepsiCo Inc, Tata Consumer Products Ltd, The Coca-Cola Compan, CWAY Group, Dynamic Brands Manufacturing (Pty) Ltd, Clover S A (Pty) Ltd, BOS Brands (Pty) Ltd.

3. What are the main segments of the RTD Tea Market in Africa?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

February 2021: BOS Brands ramped up its direct-toconsumer offerings, through a new subscription service. This service makes BOS products available to consumers directly from the brand, and at a discounted rate for monthly orders.January 2021: Manhattan Ice Tea, a brand under Clover S.A. launched a new range of Rooibos RTD Tea products. This new range includes two new rooibos RTD Tea products, which are available in Lemon and Mixed Berry flavours.These products contain mineral water, fructose, sugar, citric acid, rooibos tea extract, acidity regulators, flavouring, preservatives, and colourants, as well sweeteners.February 2019: BOS Brands (Pty) Ltd launched unsweetened iced tea in three flavors such as blueberry and jasmine, white peach and elderflower, and pineapple and coconut.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RTD Tea Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RTD Tea Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RTD Tea Market in Africa?

To stay informed about further developments, trends, and reports in the RTD Tea Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence