Key Insights

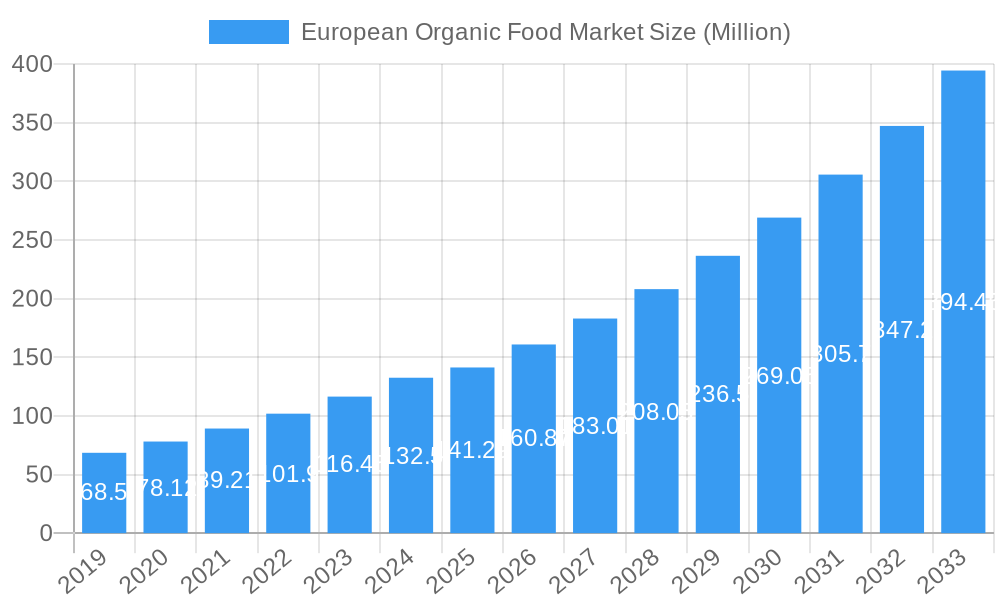

The European Organic Food Market is experiencing robust growth, projected to reach a substantial $141.29 billion by 2025. This expansion is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 14.15% throughout the forecast period of 2025-2033. A significant driver of this surge is the increasing consumer consciousness regarding health and wellness, leading to a heightened demand for products free from pesticides, synthetic fertilizers, and genetically modified organisms. The growing awareness of the environmental benefits associated with organic farming, such as improved soil health and reduced pollution, further bolsters market momentum. Consumers are actively seeking out transparent and sustainable food options, pushing manufacturers to adopt more ethical and eco-friendly practices across their supply chains. This shift in consumer preference is not limited to a single product category but is permeating across a diverse range of organic offerings, from staple produce to processed goods and beverages.

European Organic Food Market Market Size (In Million)

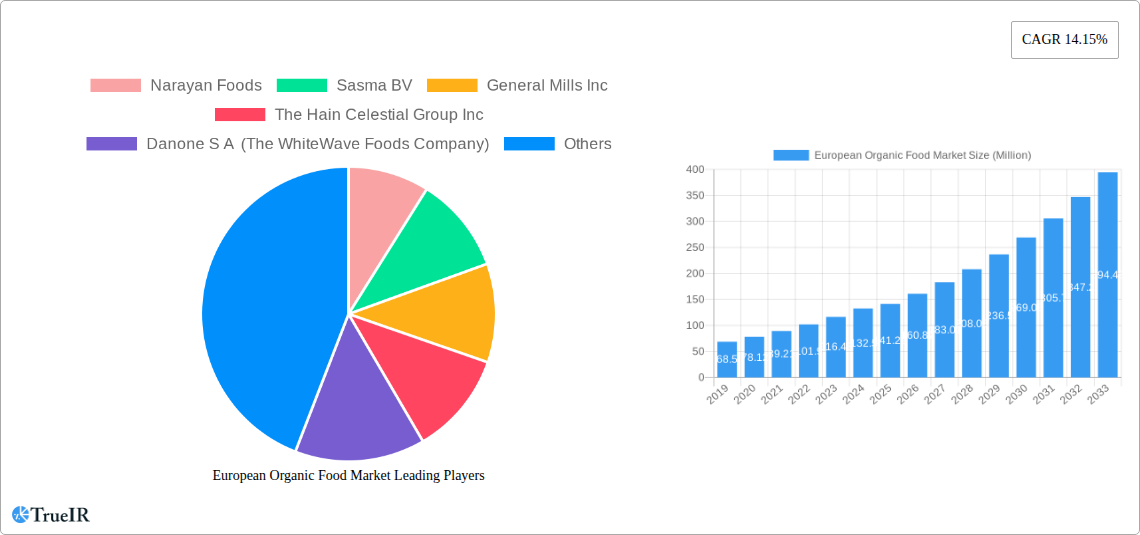

The market's dynamism is further evident in its segmented structure. Within the organic food sector, fruit & vegetables and meat, fish & poultry are leading segments due to their direct health implications. Dairy products and frozen & processed foods are also witnessing significant traction as consumers seek convenient yet healthy organic options. The organic beverage segment is equally vibrant, with strong performances in both alcoholic and non-alcoholic categories, particularly fruit and vegetable juices, dairy beverages, and specialty teas. Distribution channels are also evolving, with online retailing emerging as a significant growth avenue alongside traditional supermarkets/hypermarkets and specialist stores. Major players like Danone S.A., Nestlé S.A., and The Hain Celestial Group Inc. are actively investing in this market, driving innovation and expanding their product portfolios to cater to the discerning European consumer. Restraints such as higher production costs and limited availability in certain regions are being addressed through technological advancements and strategic expansion initiatives, ensuring sustained market vitality.

European Organic Food Market Company Market Share

European Organic Food Market: Comprehensive Market Analysis & Growth Forecast (2019–2033)

Dive deep into the burgeoning European Organic Food Market with this in-depth report. Spanning the historical period of 2019-2024 and projecting growth through 2033, with a strong focus on the 2025 base and estimated year, this analysis is your definitive guide to understanding market dynamics, key players, and future opportunities. Leveraging high-volume SEO keywords such as "organic food Europe," "sustainable agriculture," "European organic market trends," and "organic beverage market share," this report is engineered to capture the attention of industry leaders, investors, and decision-makers. Explore market size, segmentation, competitive landscapes, and pivotal industry developments.

European Organic Food Market Market Structure & Competitive Landscape

The European organic food market is characterized by a dynamic and evolving competitive landscape, exhibiting moderate to high market concentration across various segments. Innovation drivers are primarily fueled by increasing consumer demand for healthier and sustainably produced food, coupled with supportive government regulations and certifications that foster trust and transparency. The market is witnessing a surge in new product development, particularly in plant-based alternatives and functional organic foods, driven by a heightened awareness of health and environmental concerns among European consumers. Regulatory frameworks, such as the EU Organic Regulation, play a crucial role in standardizing production and labeling, thereby enhancing consumer confidence. Product substitutes, while present in conventional food markets, are increasingly challenged by the premium perceived value and health benefits associated with organic offerings. End-user segmentation highlights a growing influence of younger demographics and health-conscious millennials and Gen Z consumers. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with larger food corporations acquiring smaller, niche organic brands to expand their portfolios and market reach. For instance, acquisitions of innovative startups and established organic producers by multinational corporations are evident, signaling a maturing market. The market concentration ratio is estimated to be around 65-70% for the top 10 players within specific product categories, with M&A activities representing approximately 10-15% of the total market value annually over the historical period.

European Organic Food Market Market Trends & Opportunities

The European organic food market is on a robust growth trajectory, propelled by a confluence of factors including escalating consumer awareness regarding health and environmental sustainability, increasing disposable incomes, and supportive governmental policies promoting organic agriculture. Over the forecast period of 2025–2033, the market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% to 10%. This growth is underpinned by shifting consumer preferences, with a significant rise in demand for organic fruits and vegetables, dairy products, and plant-based alternatives. The market penetration rate for organic food products across the European Union is estimated to have reached 12% in 2025 and is expected to climb steadily. Technological advancements are playing a pivotal role, from precision farming techniques enhancing organic crop yields to innovative packaging solutions that reduce environmental impact. The rise of online retailing, accelerated by recent global events, presents a significant opportunity for organic food brands to reach a wider consumer base. Furthermore, the increasing focus on ethical sourcing, animal welfare, and reduced chemical usage in food production aligns perfectly with the core tenets of the organic movement, creating a fertile ground for market expansion. Opportunities also lie in the development of fortified and functional organic foods, catering to niche dietary requirements and wellness trends. The demand for organic beverages, including wine, beer, and non-alcoholic options like fruit juices and teas, is also experiencing substantial growth, driven by consumers seeking healthier and more natural beverage choices. The expansion of specialist organic stores and the increasing availability of organic options in mainstream supermarkets further contribute to market accessibility and growth.

Dominant Markets & Segments in European Organic Food Market

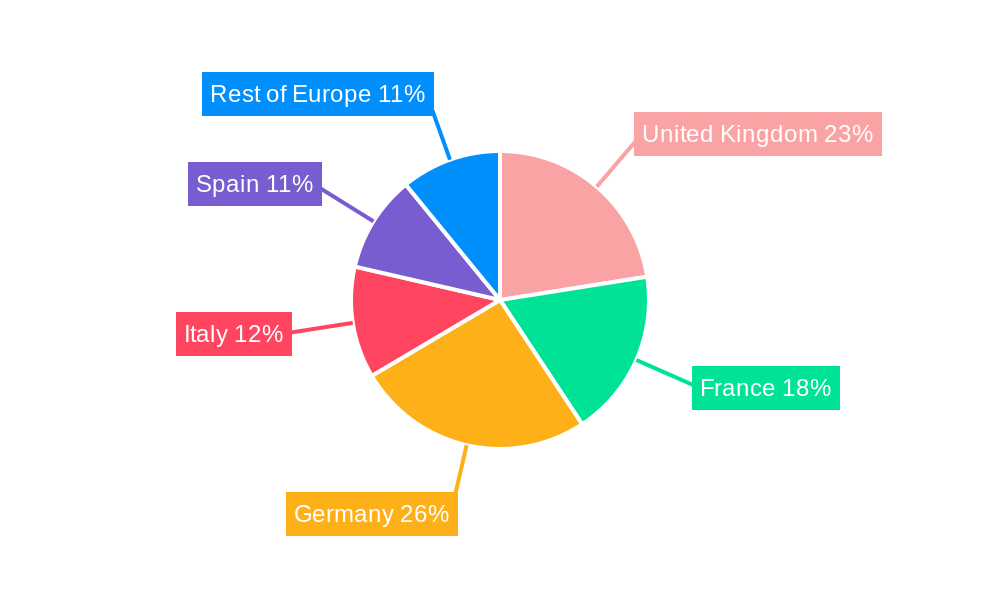

The European organic food market exhibits significant dominance within specific regions and product categories, driven by a complex interplay of consumer demographics, regulatory support, and distribution infrastructure. Germany, France, and the United Kingdom consistently emerge as the leading markets in terms of organic food consumption and sales, accounting for over 55% of the total European market value. This dominance is attributed to long-standing consumer awareness campaigns, robust organic certification schemes, and widespread availability of organic products.

Dominant Product Segments:

- Organic Foods: This segment holds the largest share, with Fruit & Vegetables leading due to their perceived health benefits and widespread appeal. Dairy Products and Frozen & Processed Foods are also substantial contributors, reflecting the growing demand for convenient yet healthy organic options.

- Organic Beverages: Non-alcoholic beverages, particularly Fruit and Vegetable Juices and Coffee & Tea, are experiencing accelerated growth. The demand for healthier, additive-free alternatives to conventional beverages is a key driver. Within Alcoholic Beverages, organic Wine commands a significant share, driven by growing consumer interest in sustainable viticulture.

Dominant Distribution Channels:

- Supermarkets/Hypermarkets: These remain the primary distribution channel, offering convenience and a wide selection of organic products, representing approximately 45% of total sales.

- Online Retailing: This channel is witnessing rapid expansion, driven by e-commerce growth and direct-to-consumer models, expected to capture over 20% of the market share by 2025.

- Specialist Stores: While smaller in volume, these stores cater to a dedicated consumer base and play a crucial role in brand building and product discovery.

Key Growth Drivers (by Segment/Channel):

- Product Type (Organic Foods): Increased consumer consciousness about health and wellness, rising concerns about pesticide use, and growing availability of diverse organic product ranges. For Fruit & Vegetables, the direct link to healthy eating is a primary driver.

- Product Type (Organic Beverages): Demand for natural ingredients, avoidance of artificial additives, and the trend towards mindful consumption, especially in non-alcoholic categories. Organic wine benefits from its association with premium quality and sustainable farming practices.

- Distribution Channel (Online Retailing): Convenience, wider product selection, home delivery services, and the ability to compare prices easily. The pandemic significantly accelerated adoption, creating lasting consumer habits.

- Distribution Channel (Supermarkets/Hypermarkets): Accessibility, one-stop shopping convenience, and the increasing integration of organic sections within conventional retail spaces.

The dominance of these markets and segments is further bolstered by governmental incentives for organic farming, such as subsidies and research funding, as well as consumer education initiatives that highlight the benefits of organic produce. The evolving retail landscape, with a greater emphasis on sustainability and transparency, also favors the growth of organic products.

European Organic Food Market Product Analysis

Product innovation within the European organic food market is driven by consumer demand for health, convenience, and sustainability. Key advancements include the development of plant-based organic alternatives across all food categories, from dairy and meat substitutes to snacks and ready-to-eat meals. Functional organic foods, enriched with specific vitamins, minerals, or probiotics, are gaining traction, catering to health-conscious consumers seeking targeted nutritional benefits. The market is also seeing innovations in organic beverage formulations, including cold-brew coffees, functional teas, and naturally flavored organic juices. Competitive advantages are being carved out through transparent sourcing, ethical production practices, and eco-friendly packaging solutions. Brands are emphasizing non-GMO ingredients, reduced processing, and the absence of artificial additives, aligning with the core values of the organic consumer. The integration of advanced agricultural technologies, such as vertical farming and precision agriculture, is also contributing to the efficiency and scalability of organic product offerings, enhancing their market fit.

Key Drivers, Barriers & Challenges in European Organic Food Market

Key Drivers: The European organic food market is propelled by several interconnected forces. Technological advancements in organic farming, including precision agriculture and biopesticides, are enhancing yields and reducing production costs. Growing consumer awareness of health benefits, environmental sustainability, and ethical food production practices is a primary demand driver. Supportive government policies, subsidies for organic farming, and robust certification schemes build consumer trust and encourage production. The economic factor of rising disposable incomes allows consumers to opt for premium organic products. Specific examples include EU initiatives promoting organic farming and labeling, leading to increased market penetration.

Barriers & Challenges: Supply chain complexities and inefficiencies, particularly for perishable organic goods, pose a significant challenge. Regulatory hurdles and the cost of organic certification can deter smaller producers. Price sensitivity among consumers, with organic products often being more expensive than conventional alternatives, remains a restraint. Intense competition from both established organic brands and conventional food manufacturers introducing their own organic lines also presents a challenge. For instance, a study indicated that supply chain losses for organic produce can be up to 15% higher than conventional due to shorter shelf lives and specialized handling requirements. Furthermore, ensuring consistent quality and availability across the diverse European landscape adds to the operational complexities.

Growth Drivers in the European Organic Food Market Market

The European organic food market's growth is predominantly fueled by an escalating consumer consciousness regarding health and wellness. Consumers are increasingly seeking out products free from synthetic pesticides, herbicides, and genetically modified organisms (GMOs), driving demand for organic fruits, vegetables, dairy, and meat. Environmental sustainability is another powerful driver; the organic farming method's emphasis on soil health, biodiversity, and reduced pollution resonates strongly with environmentally aware populations. Government support through subsidies, research funding for organic agriculture, and robust certification frameworks like the EU organic logo builds consumer confidence and encourages wider adoption. Technological innovations in organic farming, such as advanced composting techniques and biological pest control, are also improving efficiency and scalability, making organic products more accessible.

Challenges Impacting European Organic Food Market Growth

Despite the positive growth trajectory, the European organic food market faces several significant challenges. Regulatory complexities surrounding organic certification across different member states can create a fragmented market and increase compliance costs for businesses operating internationally. Supply chain issues, including the shorter shelf-life of many organic products and the need for specialized transportation and storage, can lead to increased waste and higher operational expenses. Price sensitivity remains a considerable barrier; organic products often carry a premium price tag compared to conventional alternatives, which can limit their appeal to budget-conscious consumers, especially during economic downturns. Intense competition from both established organic players and conventional food manufacturers launching their own organic lines necessitates continuous innovation and effective marketing strategies. Furthermore, ensuring a consistent and reliable supply of high-quality organic ingredients across the vast European continent can be challenging.

Key Players Shaping the European Organic Food Market Market

- Narayan Foods

- Sasma BV

- General Mills Inc

- The Hain Celestial Group Inc

- Danone S A (The WhiteWave Foods Company)

- Clipper Teas

- Amy's Kitchen Inc

- Starbucks Corporation

- PureOrganic Drinks Limited

- Nestlé S A

Significant European Organic Food Market Industry Milestones

- November 2022: MeliBio, in partnership with Narayan Foods, announced an additional USD 2.2 million in funding to sell its bee-free honey in 75,000 European stores. Narayan Foods plans to market MeliBio's plant-based honey under the Better Foodie brand starting in early 2023.

- November 2022: Ocado and Planet Organic became the first supermarkets to offer the plant-based meal brand allplants, featuring products like Protein Powder Buddha Bowl and Sticky Teriyaki Udon Noodles.

- July 2021: The Hain Celestial Group, Inc. introduced new innovations, including Celestial Seasonings Cold Brew Iced Tea and Garden Veggie Puffs, made with non-GMO ingredients and reduced fat content, made available in the European market.

Future Outlook for European Organic Food Market Market

The future outlook for the European organic food market remains exceptionally positive, driven by persistent consumer demand for healthier, sustainable, and ethically produced food. Strategic opportunities lie in the continued expansion of plant-based organic alternatives, catering to evolving dietary trends and environmental concerns. The growth of online retailing and direct-to-consumer models will offer new avenues for market penetration and brand building. Innovations in functional organic foods and beverages, addressing specific wellness needs, are expected to capture significant market share. Furthermore, increased investment in organic agriculture technology and infrastructure will likely improve supply chain efficiency and affordability. The ongoing commitment from governments to promote sustainable farming practices and the increasing corporate focus on sustainability will continue to provide a supportive environment for growth. The market is poised for sustained expansion, driven by a convergence of consumer values and industry innovation, with an estimated market value to reach well over €60 Billion by 2033.

European Organic Food Market Segmentation

-

1. Product Type

-

1.1. Organic Foods

- 1.1.1. Fruit & Vegetables

- 1.1.2. Meat, Fish & Poultry

- 1.1.3. Dairy Products

- 1.1.4. Frozen & Processed Foods

- 1.1.5. Other Product Types

-

1.2. Organic Beverages

-

1.2.1. Alcoholic

- 1.2.1.1. Wine

- 1.2.1.2. Beer

- 1.2.1.3. Spirits

-

1.2.2. Non-alcoholic

- 1.2.2.1. Fruit and Vegetable Juices

- 1.2.2.2. Dairy Beverages

- 1.2.2.3. Coffee

- 1.2.2.4. Tea

- 1.2.2.5. Carbonated Beverages

- 1.2.2.6. Other Non-alcoholic Beverages

-

1.2.1. Alcoholic

-

1.1. Organic Foods

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailing

- 2.5. Other Distribution Channels

European Organic Food Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

European Organic Food Market Regional Market Share

Geographic Coverage of European Organic Food Market

European Organic Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products

- 3.3. Market Restrains

- 3.3.1. Availability of Cheaper Snacking Options

- 3.4. Market Trends

- 3.4.1. Growing Demand for Clean-label Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Organic Foods

- 5.1.1.1. Fruit & Vegetables

- 5.1.1.2. Meat, Fish & Poultry

- 5.1.1.3. Dairy Products

- 5.1.1.4. Frozen & Processed Foods

- 5.1.1.5. Other Product Types

- 5.1.2. Organic Beverages

- 5.1.2.1. Alcoholic

- 5.1.2.1.1. Wine

- 5.1.2.1.2. Beer

- 5.1.2.1.3. Spirits

- 5.1.2.2. Non-alcoholic

- 5.1.2.2.1. Fruit and Vegetable Juices

- 5.1.2.2.2. Dairy Beverages

- 5.1.2.2.3. Coffee

- 5.1.2.2.4. Tea

- 5.1.2.2.5. Carbonated Beverages

- 5.1.2.2.6. Other Non-alcoholic Beverages

- 5.1.2.1. Alcoholic

- 5.1.1. Organic Foods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailing

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Organic Foods

- 6.1.1.1. Fruit & Vegetables

- 6.1.1.2. Meat, Fish & Poultry

- 6.1.1.3. Dairy Products

- 6.1.1.4. Frozen & Processed Foods

- 6.1.1.5. Other Product Types

- 6.1.2. Organic Beverages

- 6.1.2.1. Alcoholic

- 6.1.2.1.1. Wine

- 6.1.2.1.2. Beer

- 6.1.2.1.3. Spirits

- 6.1.2.2. Non-alcoholic

- 6.1.2.2.1. Fruit and Vegetable Juices

- 6.1.2.2.2. Dairy Beverages

- 6.1.2.2.3. Coffee

- 6.1.2.2.4. Tea

- 6.1.2.2.5. Carbonated Beverages

- 6.1.2.2.6. Other Non-alcoholic Beverages

- 6.1.2.1. Alcoholic

- 6.1.1. Organic Foods

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Stores

- 6.2.4. Online Retailing

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Organic Foods

- 7.1.1.1. Fruit & Vegetables

- 7.1.1.2. Meat, Fish & Poultry

- 7.1.1.3. Dairy Products

- 7.1.1.4. Frozen & Processed Foods

- 7.1.1.5. Other Product Types

- 7.1.2. Organic Beverages

- 7.1.2.1. Alcoholic

- 7.1.2.1.1. Wine

- 7.1.2.1.2. Beer

- 7.1.2.1.3. Spirits

- 7.1.2.2. Non-alcoholic

- 7.1.2.2.1. Fruit and Vegetable Juices

- 7.1.2.2.2. Dairy Beverages

- 7.1.2.2.3. Coffee

- 7.1.2.2.4. Tea

- 7.1.2.2.5. Carbonated Beverages

- 7.1.2.2.6. Other Non-alcoholic Beverages

- 7.1.2.1. Alcoholic

- 7.1.1. Organic Foods

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Stores

- 7.2.4. Online Retailing

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Organic Foods

- 8.1.1.1. Fruit & Vegetables

- 8.1.1.2. Meat, Fish & Poultry

- 8.1.1.3. Dairy Products

- 8.1.1.4. Frozen & Processed Foods

- 8.1.1.5. Other Product Types

- 8.1.2. Organic Beverages

- 8.1.2.1. Alcoholic

- 8.1.2.1.1. Wine

- 8.1.2.1.2. Beer

- 8.1.2.1.3. Spirits

- 8.1.2.2. Non-alcoholic

- 8.1.2.2.1. Fruit and Vegetable Juices

- 8.1.2.2.2. Dairy Beverages

- 8.1.2.2.3. Coffee

- 8.1.2.2.4. Tea

- 8.1.2.2.5. Carbonated Beverages

- 8.1.2.2.6. Other Non-alcoholic Beverages

- 8.1.2.1. Alcoholic

- 8.1.1. Organic Foods

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Stores

- 8.2.4. Online Retailing

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Organic Foods

- 9.1.1.1. Fruit & Vegetables

- 9.1.1.2. Meat, Fish & Poultry

- 9.1.1.3. Dairy Products

- 9.1.1.4. Frozen & Processed Foods

- 9.1.1.5. Other Product Types

- 9.1.2. Organic Beverages

- 9.1.2.1. Alcoholic

- 9.1.2.1.1. Wine

- 9.1.2.1.2. Beer

- 9.1.2.1.3. Spirits

- 9.1.2.2. Non-alcoholic

- 9.1.2.2.1. Fruit and Vegetable Juices

- 9.1.2.2.2. Dairy Beverages

- 9.1.2.2.3. Coffee

- 9.1.2.2.4. Tea

- 9.1.2.2.5. Carbonated Beverages

- 9.1.2.2.6. Other Non-alcoholic Beverages

- 9.1.2.1. Alcoholic

- 9.1.1. Organic Foods

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Stores

- 9.2.4. Online Retailing

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Organic Foods

- 10.1.1.1. Fruit & Vegetables

- 10.1.1.2. Meat, Fish & Poultry

- 10.1.1.3. Dairy Products

- 10.1.1.4. Frozen & Processed Foods

- 10.1.1.5. Other Product Types

- 10.1.2. Organic Beverages

- 10.1.2.1. Alcoholic

- 10.1.2.1.1. Wine

- 10.1.2.1.2. Beer

- 10.1.2.1.3. Spirits

- 10.1.2.2. Non-alcoholic

- 10.1.2.2.1. Fruit and Vegetable Juices

- 10.1.2.2.2. Dairy Beverages

- 10.1.2.2.3. Coffee

- 10.1.2.2.4. Tea

- 10.1.2.2.5. Carbonated Beverages

- 10.1.2.2.6. Other Non-alcoholic Beverages

- 10.1.2.1. Alcoholic

- 10.1.1. Organic Foods

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialist Stores

- 10.2.4. Online Retailing

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Organic Foods

- 11.1.1.1. Fruit & Vegetables

- 11.1.1.2. Meat, Fish & Poultry

- 11.1.1.3. Dairy Products

- 11.1.1.4. Frozen & Processed Foods

- 11.1.1.5. Other Product Types

- 11.1.2. Organic Beverages

- 11.1.2.1. Alcoholic

- 11.1.2.1.1. Wine

- 11.1.2.1.2. Beer

- 11.1.2.1.3. Spirits

- 11.1.2.2. Non-alcoholic

- 11.1.2.2.1. Fruit and Vegetable Juices

- 11.1.2.2.2. Dairy Beverages

- 11.1.2.2.3. Coffee

- 11.1.2.2.4. Tea

- 11.1.2.2.5. Carbonated Beverages

- 11.1.2.2.6. Other Non-alcoholic Beverages

- 11.1.2.1. Alcoholic

- 11.1.1. Organic Foods

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Specialist Stores

- 11.2.4. Online Retailing

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Organic Food Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Organic Foods

- 12.1.1.1. Fruit & Vegetables

- 12.1.1.2. Meat, Fish & Poultry

- 12.1.1.3. Dairy Products

- 12.1.1.4. Frozen & Processed Foods

- 12.1.1.5. Other Product Types

- 12.1.2. Organic Beverages

- 12.1.2.1. Alcoholic

- 12.1.2.1.1. Wine

- 12.1.2.1.2. Beer

- 12.1.2.1.3. Spirits

- 12.1.2.2. Non-alcoholic

- 12.1.2.2.1. Fruit and Vegetable Juices

- 12.1.2.2.2. Dairy Beverages

- 12.1.2.2.3. Coffee

- 12.1.2.2.4. Tea

- 12.1.2.2.5. Carbonated Beverages

- 12.1.2.2.6. Other Non-alcoholic Beverages

- 12.1.2.1. Alcoholic

- 12.1.1. Organic Foods

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Convenience Stores

- 12.2.3. Specialist Stores

- 12.2.4. Online Retailing

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Narayan Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sasma BV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Mills Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hain Celestial Group Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Danone S A (The WhiteWave Foods Company)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Clipper Teas

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Amy's Kitchen Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Starbucks Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 PureOrganic Drinks Limited*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nestlé S A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Narayan Foods

List of Figures

- Figure 1: European Organic Food Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Organic Food Market Share (%) by Company 2025

List of Tables

- Table 1: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 3: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: European Organic Food Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: European Organic Food Market Volume Tons Forecast, by Region 2020 & 2033

- Table 7: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 9: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 13: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 15: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 17: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 19: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 21: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 23: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 25: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 27: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 31: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 33: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 35: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 37: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 39: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 40: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 41: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

- Table 43: European Organic Food Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: European Organic Food Market Volume Tons Forecast, by Product Type 2020 & 2033

- Table 45: European Organic Food Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: European Organic Food Market Volume Tons Forecast, by Distribution Channel 2020 & 2033

- Table 47: European Organic Food Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: European Organic Food Market Volume Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Organic Food Market?

The projected CAGR is approximately 14.15%.

2. Which companies are prominent players in the European Organic Food Market?

Key companies in the market include Narayan Foods, Sasma BV, General Mills Inc, The Hain Celestial Group Inc, Danone S A (The WhiteWave Foods Company), Clipper Teas, Amy's Kitchen Inc, Starbucks Corporation, PureOrganic Drinks Limited*List Not Exhaustive, Nestlé S A.

3. What are the main segments of the European Organic Food Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 141.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products.

6. What are the notable trends driving market growth?

Growing Demand for Clean-label Products.

7. Are there any restraints impacting market growth?

Availability of Cheaper Snacking Options.

8. Can you provide examples of recent developments in the market?

In November 2022, in a partnership with Narayan Foods, a renowned player in organic foods, MeliBio, the first company that claims to produce real honey without bees, announced that it raised an extra USD 2.2 million in funding and planned to sell its products in 75,000 European stores. Through the partnership, Narayan Foods announced its plans to market MeliBio's plant-based honey under the Better Foodie brand, starting in early 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Organic Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Organic Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Organic Food Market?

To stay informed about further developments, trends, and reports in the European Organic Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence