Key Insights

The United States oat milk market is experiencing robust expansion, projected to reach approximately $1.9 billion in 2024, driven by a compelling CAGR of 14.8% over the forecast period. This significant growth is fueled by a confluence of factors, including increasing consumer demand for dairy alternatives due to rising lactose intolerance, allergies, and a growing preference for plant-based diets driven by health and environmental consciousness. The convenience and versatile nature of oat milk, suitable for a variety of culinary applications from coffee creamers to baking, further propels its adoption. Key players are investing in product innovation, expanding distribution networks, and launching targeted marketing campaigns to capture market share. The off-trade segment, particularly online retail and supermarkets/hypermarkets, is witnessing substantial growth as consumers prioritize accessibility and a wider product selection.

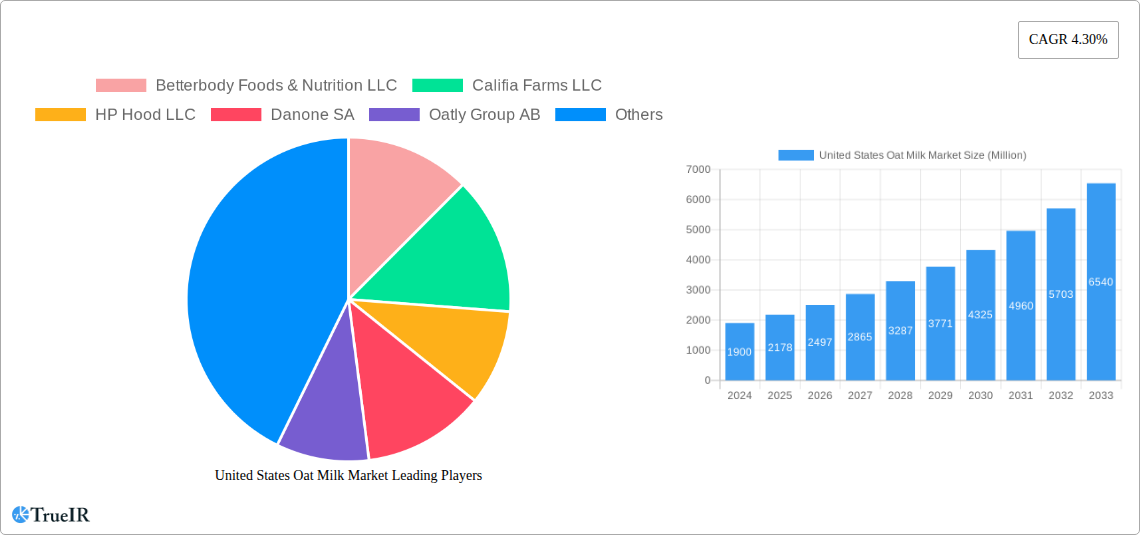

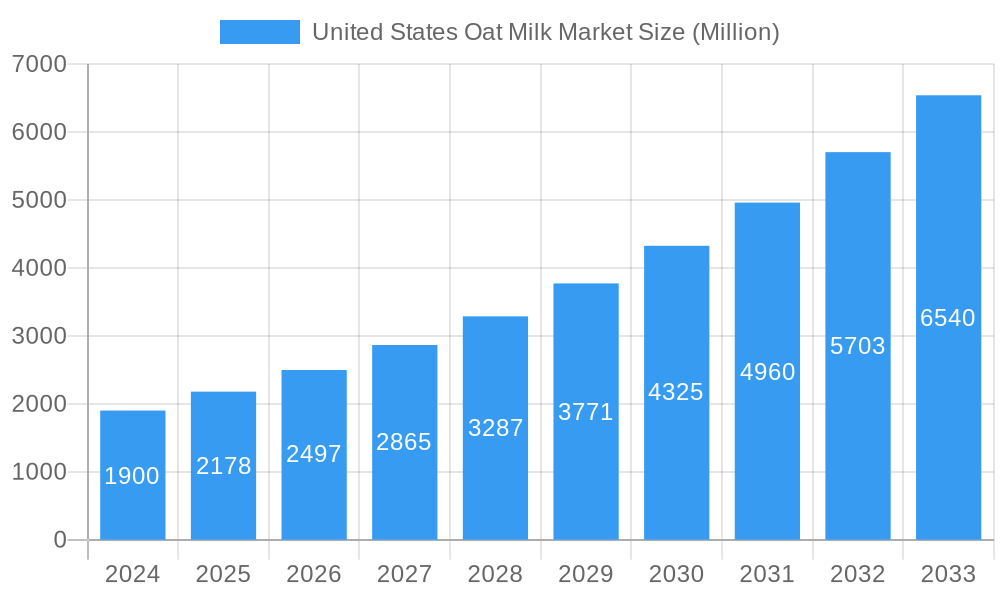

United States Oat Milk Market Market Size (In Billion)

The oat milk industry in the United States is poised for sustained dynamism, with evolving consumer preferences and technological advancements shaping its trajectory. Emerging trends include the development of specialized oat milk formulations catering to specific dietary needs (e.g., low-sugar, protein-fortified) and the increasing availability of oat milk in ready-to-drink formats. While the market is largely driven by positive consumer sentiment, potential restraints could emerge from fluctuations in raw material costs (oats), increased competition from other plant-based milk alternatives like almond and soy milk, and evolving regulatory landscapes concerning labeling and production. Nevertheless, the established momentum and ongoing innovation suggest a promising outlook for the U.S. oat milk market, with opportunities for further penetration across various consumer segments and distribution channels.

United States Oat Milk Market Company Market Share

Here's a dynamic, SEO-optimized report description for the United States Oat Milk Market, designed for industry audiences and to enhance search rankings:

United States Oat Milk Market: Growth, Trends, and Forecast 2025-2033

Dive deep into the booming United States oat milk market with our comprehensive report, meticulously analyzing its structure, competitive landscape, and future trajectory. This report provides an unparalleled understanding of market dynamics, from emerging trends and opportunities to dominant segments and key players. Leveraging high-volume keywords such as "oat milk market," "plant-based milk," "dairy alternatives," "vegan milk," and "oat milk sales," this analysis is crucial for manufacturers, distributors, investors, and industry stakeholders seeking to capitalize on the robust growth of this sector. Covering the study period from 2019 to 2033, with a deep dive into the base year 2025 and an extensive forecast period of 2025-2033, this report offers actionable insights and data-driven predictions.

United States Oat Milk Market Market Structure & Competitive Landscape

The United States oat milk market is characterized by a dynamic and evolving competitive landscape, marked by increasing market concentration yet driven by continuous innovation. Key players are fiercely competing to capture market share, leading to a vibrant ecosystem of established giants and agile disruptors. Innovation drivers are primarily centered around product formulation, nutritional enhancements, and sustainable sourcing, responding to growing consumer demand for healthier and environmentally friendly options. Regulatory impacts, while generally supportive of the plant-based sector, can influence ingredient sourcing and labeling practices. The presence of readily available product substitutes, including almond milk, soy milk, and other plant-based beverages, necessitates continuous differentiation and value proposition refinement. End-user segmentation reveals a strong inclination towards health-conscious consumers, vegans, lactose-intolerant individuals, and environmentally aware shoppers. Merger and acquisition (M&A) trends are expected to shape the market further, with larger entities seeking to expand their plant-based portfolios and smaller innovative companies aiming for wider distribution and scalability. The market is projected to see significant M&A activity in the coming years as consolidation becomes a strategic imperative.

United States Oat Milk Market Market Trends & Opportunities

The United States oat milk market is experiencing phenomenal growth, projected to reach a valuation exceeding $7 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of approximately 12% from 2025 to 2033. This robust expansion is fueled by a confluence of transformative trends and emerging opportunities that are reshaping the beverage industry. A primary trend is the escalating consumer preference for plant-based alternatives, driven by health consciousness, ethical considerations, and environmental concerns. Oat milk, in particular, has emerged as a leading dairy alternative due to its creamy texture, neutral flavor profile, and perceived health benefits, including its suitability for lactose-intolerant individuals and its lower allergenic potential compared to some other plant-based milks. Technological advancements in processing and formulation are enabling manufacturers to produce oat milk with enhanced nutritional profiles, improved taste, and extended shelf life, further driving market penetration. The rise of "flexitarianism" and the growing adoption of vegan and vegetarian diets across a broader demographic segment are significantly contributing to oat milk's market penetration, which is expected to surpass 30% of the total milk market by the end of the forecast period.

The competitive dynamics are intense, with both established dairy producers and dedicated plant-based companies vying for dominance. This competition fosters innovation in product development, leading to a proliferation of flavored oat milk varieties, barista-edition formulations, and functional oat milk products fortified with vitamins and minerals. The convenience sector is also a significant growth area, with oat milk becoming a staple in coffee shops and a popular choice for home consumption. Opportunities lie in expanding into underserved regions, developing novel applications for oat milk beyond beverages (e.g., in baking, cooking, and as an ingredient in packaged foods), and investing in sustainable packaging solutions to appeal to the environmentally conscious consumer. The increasing demand for clean-label products, with minimal artificial ingredients and transparent sourcing, presents a crucial opportunity for brands that can authentically deliver on these expectations. Furthermore, strategic partnerships with food service providers and grocery retailers are vital for expanding distribution and capturing a larger customer base. The market also presents opportunities in the premiumization segment, with consumers willing to pay a premium for high-quality, ethically produced, and nutritionally superior oat milk products. The integration of oat milk into ready-to-drink (RTD) beverages and its growing presence in school and hospital cafeterias also signifies expanding market horizons. The forecast period is expected to witness continued investment in research and development to unlock new functionalities and appeal to an even wider consumer base.

Dominant Markets & Segments in United States Oat Milk Market

The United States oat milk market exhibits distinct dominance across various distribution channels and geographical segments, reflecting evolving consumer purchasing habits and market accessibility. The Off-Trade distribution channel is overwhelmingly dominant, accounting for an estimated 85% of the total market revenue. Within this channel, Supermarkets and Hypermarkets represent the largest segment, capturing an estimated 40% of off-trade sales. These large retail formats offer broad product selection, competitive pricing, and convenience, making them the primary destination for household oat milk purchases. The Online Retail segment is experiencing the most rapid growth, projected to account for 25% of off-trade sales by 2033, driven by the convenience of home delivery and the increasing preference for e-commerce for grocery shopping.

Supermarkets and Hypermarkets:

- Key Growth Drivers: Wide product availability, price competitiveness, established supply chains, and strategic shelf placement.

- Market Dominance: These retailers serve as the primary gateway for mainstream consumers to access oat milk, benefiting from high foot traffic and established brand loyalty.

Online Retail:

- Key Growth Drivers: Convenience, subscription services, wider product assortment than physical stores, and targeted marketing capabilities.

- Market Dominance: The rapid expansion of e-commerce platforms and direct-to-consumer (DTC) models is significantly enhancing market penetration, especially in urban and suburban areas.

Convenience Stores:

- Key Growth Drivers: Impulse purchases, on-the-go consumption, and increasing demand for ready-to-drink plant-based options.

- Market Dominance: While smaller in volume, convenience stores play a crucial role in capturing impulse buys and serving consumers seeking immediate consumption needs.

Specialist Retailers:

- Key Growth Drivers: Niche product offerings, focus on organic and premium brands, and catering to specific dietary needs and preferences.

- Market Dominance: These retailers serve a dedicated segment of consumers willing to seek out specialized and artisanal oat milk products.

The On-Trade channel, encompassing coffee shops, restaurants, and food service establishments, represents the remaining 15% of the market but is a significant driver of brand awareness and trial. The integration of oat milk into popular coffee beverages has propelled its acceptance and demand. Geographically, the Northeastern and Western United States are the dominant regions, driven by a higher concentration of health-conscious consumers, greater adoption of vegan and vegetarian diets, and a robust presence of specialty food stores and cafes. Policies supporting plant-based initiatives and a higher disposable income in these regions also contribute to their market leadership.

United States Oat Milk Market Product Analysis

The United States oat milk market is characterized by relentless product innovation, focusing on enhanced nutritional value, diverse flavor profiles, and specialized applications. Manufacturers are developing reformulated versions with increased calcium, healthy fats, and essential minerals, directly addressing consumer demand for fortified and wholesome plant-based options. The competitive advantage lies in creating oat milk that mimics the texture and taste of dairy milk, particularly for barista-grade applications in coffee beverages. Innovations in product formats, such as single-serve cartons and larger family-sized containers, cater to varied consumer needs. The application spectrum is expanding beyond direct consumption to include its use in baking, cooking, and as a key ingredient in dairy-free yogurts and ice creams, further solidifying oat milk's versatility and market fit.

Key Drivers, Barriers & Challenges in United States Oat Milk Market

The United States oat milk market is propelled by several key drivers, primarily the escalating consumer demand for healthier, sustainable, and plant-based food options. Technological advancements in processing and ingredient formulation have enabled the creation of superior-tasting and nutritionally enhanced oat milk, appealing to a broader demographic. Growing awareness of the environmental impact of dairy farming and the ethical concerns associated with animal agriculture also significantly boost market growth. Favorable government policies supporting the growth of the plant-based food sector and increasing investment from major food corporations further catalyze market expansion.

However, the market faces several barriers and challenges. Supply chain volatility and the fluctuating cost of oats, a primary raw material, can impact pricing and profitability. Regulatory hurdles related to labeling and ingredient standards, although generally supportive, can sometimes create complexities. Intense competition from established dairy brands and other plant-based milk alternatives necessitates continuous innovation and effective marketing strategies. Consumer perception regarding the taste and texture compared to traditional dairy milk, while improving, can still be a barrier for some segments.

Growth Drivers in the United States Oat Milk Market Market

The United States oat milk market is experiencing robust growth, propelled by a multifaceted set of drivers. A primary catalyst is the rising health consciousness among American consumers, who are actively seeking alternatives to traditional dairy milk due to concerns about lactose intolerance, allergies, and overall wellness. The growing adoption of vegan and flexitarian diets is another significant driver, expanding the consumer base for plant-based beverages. Furthermore, environmental sustainability concerns are increasingly influencing purchasing decisions, with oat milk often perceived as a more eco-friendly option compared to dairy. Technological advancements in food processing have led to the development of oat milk with improved taste, texture, and nutritional profiles, making it a more attractive substitute for dairy. Increasing availability and distribution channels, including supermarkets, online retailers, and food service outlets, have also made oat milk more accessible to consumers nationwide.

Challenges Impacting United States Oat Milk Market Growth

Despite its rapid expansion, the United States oat milk market encounters several significant challenges. Supply chain disruptions and the price volatility of oats can impact production costs and profit margins for manufacturers. Intense competition from both established dairy milk producers introducing their own plant-based lines and a proliferation of other dairy alternatives (almond, soy, coconut) necessitates continuous innovation and strong brand differentiation. Regulatory complexities and evolving labeling standards can create compliance burdens for companies. Furthermore, while consumer acceptance is growing, some segments of the population still harbor perceptions regarding taste and texture compared to dairy milk, requiring ongoing efforts in product refinement and consumer education. Economic downturns or shifts in consumer spending priorities could also potentially impact the demand for premium plant-based products.

Key Players Shaping the United States Oat Milk Market Market

- Betterbody Foods & Nutrition LLC

- Califia Farms LLC

- HP Hood LLC

- Danone SA

- Oatly Group AB

- Elmhurst Milked LLC

- Campbell Soup Company

- Ripple Foods Pbc

- The Rise Brewing Co

- Green Grass Foods Inc (Nutpods)

Significant United States Oat Milk Market Industry Milestones

- September 2022: Elmhurst launched its reformulated unsweetened Oat Milk with enhanced nutritional benefits, including more calcium, healthy fat, and potassium.

- June 2022: Elmhurst 1925 announced the launch of three new products, including Chocolate Milked Oats and Unsweetened Milked Oats, across all Whole Foods Market chain locations.

- May 2022: Oatly Group launched its one-hour delivery service for its popular oat-based products, including oat milk and frozen non-dairy desserts, in Los Angeles and New York City via food delivery apps.

Future Outlook for United States Oat Milk Market Market

The future outlook for the United States oat milk market is exceptionally bright, projected for sustained and robust growth. Key growth catalysts include the deepening consumer preference for healthy and sustainable food choices, further technological advancements in product development leading to even more appealing and functional oat milk varieties, and the continued expansion of distribution networks across all channels. Strategic opportunities lie in product innovation, such as the development of oat milk-based infant formulas and specialized functional beverages, as well as expansion into untapped geographical markets and food service sectors. The market potential is vast, with increasing investments from major food conglomerates and a growing number of startups vying to capture market share, promising a dynamic and competitive landscape for years to come.

United States Oat Milk Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Retail

- 1.1.3. Specialist Retailers

- 1.1.4. Supermarkets and Hypermarkets

- 1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 1.2. On-Trade

-

1.1. Off-Trade

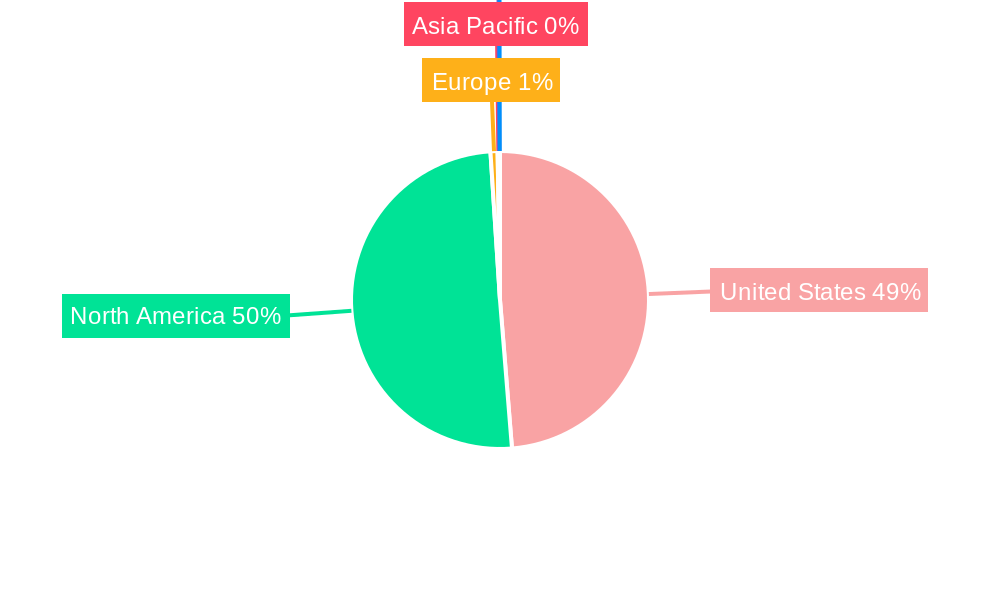

United States Oat Milk Market Segmentation By Geography

- 1. United States

United States Oat Milk Market Regional Market Share

Geographic Coverage of United States Oat Milk Market

United States Oat Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Oat Milk Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Retail

- 5.1.1.3. Specialist Retailers

- 5.1.1.4. Supermarkets and Hypermarkets

- 5.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Betterbody Foods & Nutrition LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Califia Farms LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HP Hood LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oatly Group AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elmhurst Milked LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Campbell Soup Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ripple Foods Pbc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Rise Brewing Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Green Grass Foods Inc (Nutpods)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Betterbody Foods & Nutrition LLC

List of Figures

- Figure 1: United States Oat Milk Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Oat Milk Market Share (%) by Company 2025

List of Tables

- Table 1: United States Oat Milk Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 2: United States Oat Milk Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: United States Oat Milk Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Oat Milk Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Oat Milk Market?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the United States Oat Milk Market?

Key companies in the market include Betterbody Foods & Nutrition LLC, Califia Farms LLC, HP Hood LLC, Danone SA, Oatly Group AB, Elmhurst Milked LLC, Campbell Soup Company, Ripple Foods Pbc, The Rise Brewing Co, Green Grass Foods Inc (Nutpods).

3. What are the main segments of the United States Oat Milk Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

September 2022: Elmhurst launched its reformulated unsweetened Oat Milk with enhanced nutritional benefits. The new formula includes more calcium, healthy fat, and potassium than the prior Elmhurst Oat Milk.June 2022: Elmhurst 1925 announced the launch of three products, including Chocolate Milked Oats and Unsweetened Milked Oats, across all Whole Foods Market chain locations.May 2022: Oatly Group launched its one-hour delivery for its bestselling oat-based products, including oat milk, and frozen non-dairy dessert pints and novelties in Los Angeles and New York City through popular food delivery apps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Oat Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Oat Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Oat Milk Market?

To stay informed about further developments, trends, and reports in the United States Oat Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence