Key Insights

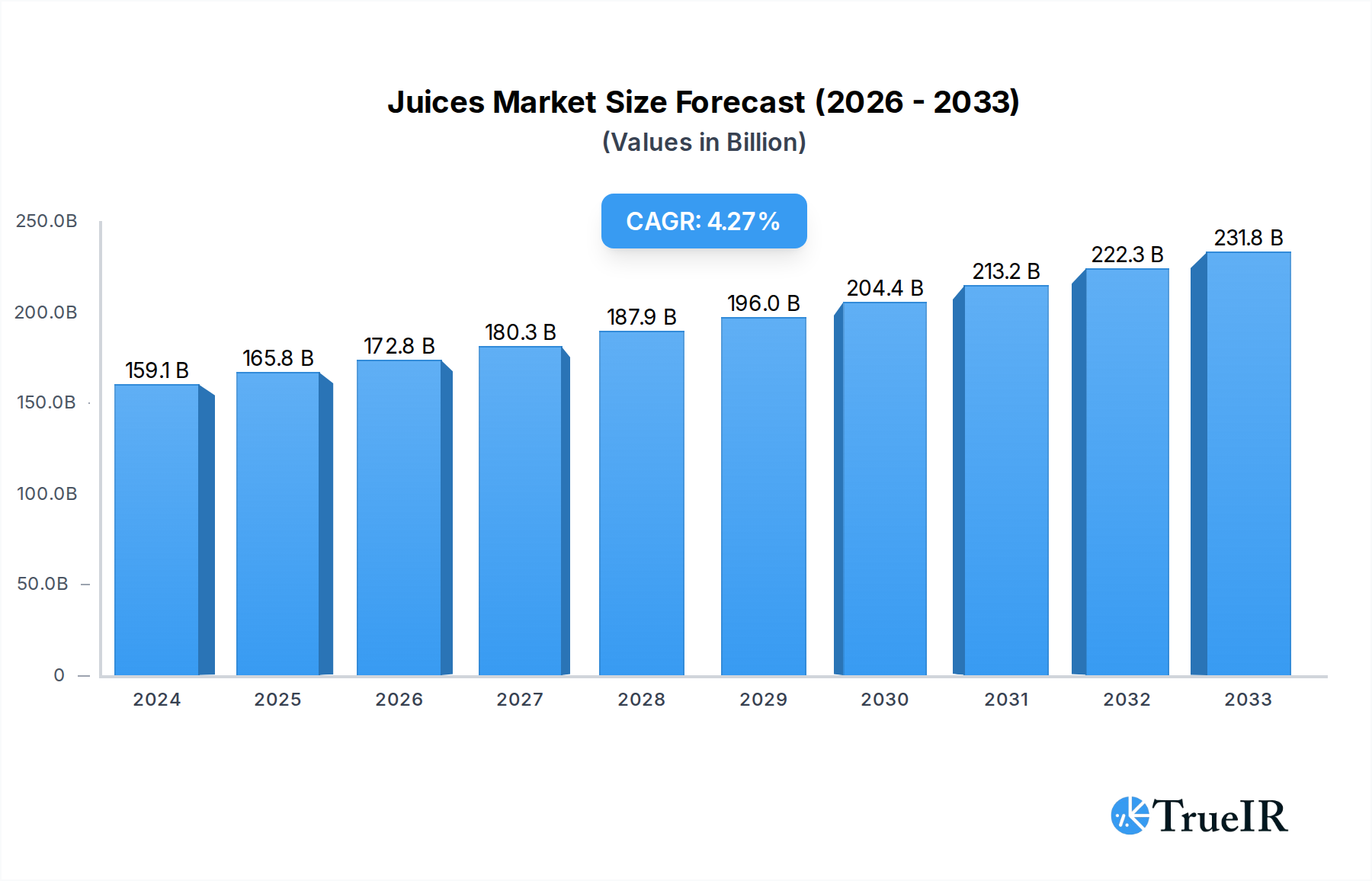

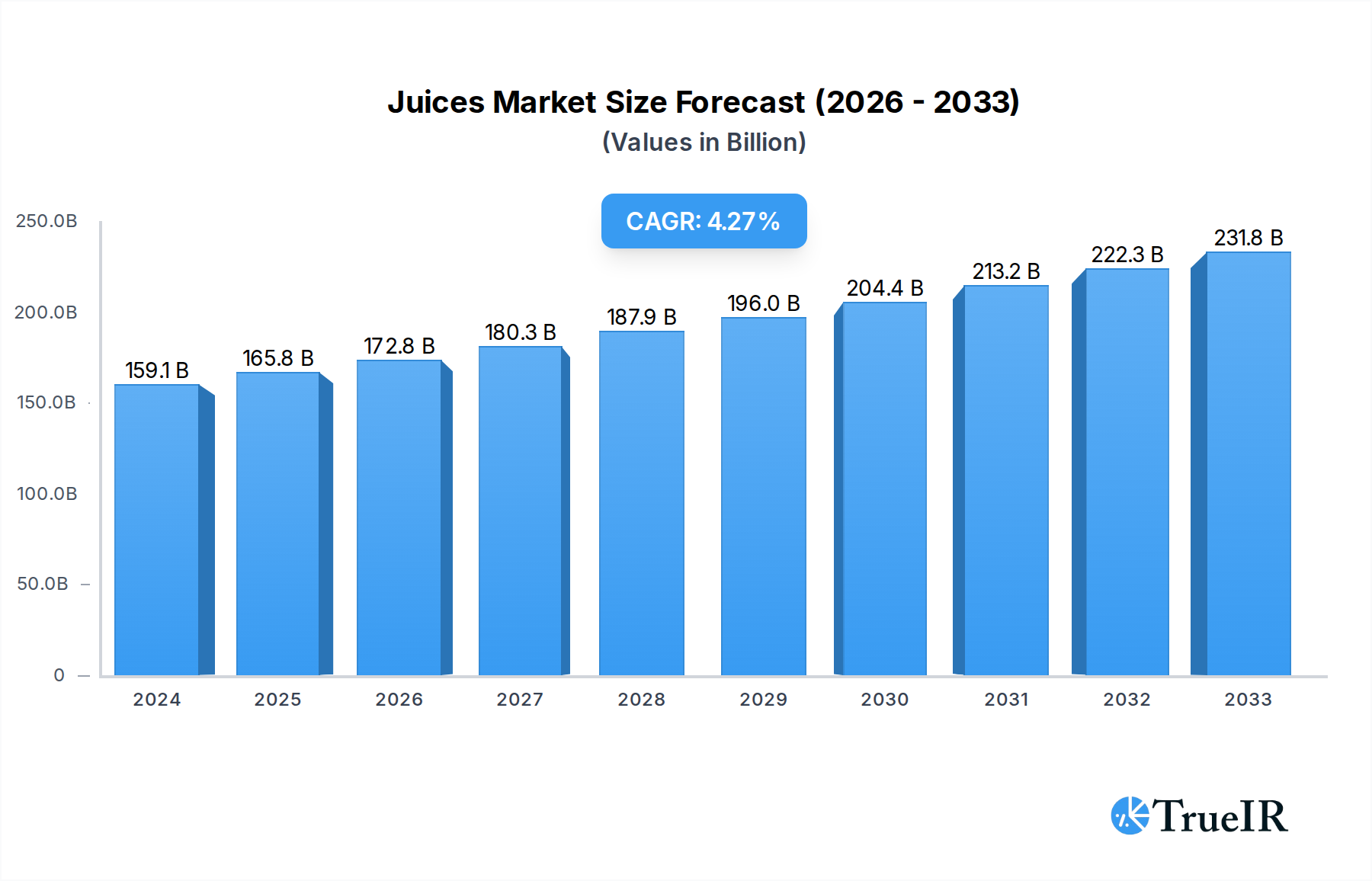

The global juices market is poised for robust growth, projected to reach a substantial USD 159.1 billion in 2024, expanding at a Compound Annual Growth Rate (CAGR) of 4.31% through 2033. This impressive trajectory is fueled by a confluence of factors, primarily driven by a growing consumer consciousness towards healthier beverage options and an increasing demand for natural and functional juices. The rising disposable incomes across emerging economies further bolster this demand, as consumers are willing to spend more on premium and health-oriented products. Furthermore, innovations in packaging, such as aseptic cartons and PET bottles, have enhanced convenience and shelf life, making juices more accessible to a wider demographic. The market is also witnessing a surge in demand for 100% juices and those fortified with vitamins and natural ingredients, catering to the health and wellness trends.

Juices Market Market Size (In Billion)

The competitive landscape is characterized by the presence of major global players alongside regional powerhouses, all vying for market share through product innovation, strategic partnerships, and expanding distribution networks. While the market exhibits strong growth potential, certain restraints, such as fluctuating raw material prices and increasing competition from other beverage categories like functional drinks and plant-based milk, could pose challenges. However, the persistent shift towards healthy lifestyles and the increasing adoption of on-the-go consumption patterns are expected to largely offset these restraints, ensuring sustained market expansion. The Asia Pacific region, particularly China and India, is anticipated to be a significant growth engine due to its large population, increasing urbanization, and rising health awareness.

Juices Market Company Market Share

Unlock unparalleled insights into the global juices market with this comprehensive, SEO-optimized report. Covering the period 2019–2033, with a base and estimated year of 2025, this analysis delves into a dynamic industry valued in the billions, driven by evolving consumer preferences and robust innovation. Our research leverages high-volume keywords like "fruit juice market," "nectar market," "juice drinks market," and "beverage industry trends" to ensure maximum search visibility and engagement for industry professionals, investors, and market strategists.

Juices Market Market Structure & Competitive Landscape

The global juices market, projected to reach billions, exhibits a moderately concentrated structure. Key players like PepsiCo Inc., Nongfu Spring Co Ltd., Rauch Fruchtsäfte GmbH & Co OG, Suntory Holdings Limited, Keurig Dr Pepper Inc., The Kraft Heinz Company, Tingyi (Cayman Islands) Holding Corporation, The Coca-Cola Company, Uni-President Enterprises Corp, Britvic PLC, Tropicana Brands Group, Thai Beverages PCL, and Eckes-Granini Group GmbH, dominate significant market shares. Innovation is a critical driver, with companies continuously introducing new flavors, functional benefits, and healthier options. Regulatory impacts, such as labeling requirements and sugar content restrictions, shape product development and market access. Product substitutes, including ready-to-drink teas, flavored water, and dairy-based beverages, exert competitive pressure. End-user segmentation reveals distinct preferences across age groups and health-conscious consumers. Mergers and acquisitions (M&A) activity, though not at extremely high volumes, plays a strategic role in market consolidation and expansion. The market is characterized by a strong focus on product differentiation and premiumization.

- Market Concentration: Moderately concentrated with a few dominant global players.

- Innovation Drivers: Health and wellness trends, novel flavors, functional ingredients.

- Regulatory Impacts: Sugar taxes, clear labeling, fortification mandates.

- Product Substitutes: Ready-to-drink teas, flavored waters, dairy alternatives.

- End-User Segmentation: Health-conscious consumers, families, on-the-go individuals.

- M&A Trends: Strategic acquisitions for market share expansion and portfolio diversification.

Juices Market Market Trends & Opportunities

The global juices market is experiencing robust growth, with market size expansion driven by a confluence of factors spanning economic development, evolving consumer lifestyles, and technological advancements. The forecast period (2025–2033) anticipates a significant upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) of xx%, contributing billions to the global beverage sector. Consumers worldwide are increasingly prioritizing health and wellness, leading to a heightened demand for 100% juices and juice drinks with reduced sugar content and added nutritional benefits like vitamins and antioxidants. This shift in consumer preferences presents substantial opportunities for manufacturers to innovate and cater to this burgeoning segment. Technological shifts, particularly in aseptic packaging and advanced processing techniques, are enhancing product shelf life, preserving nutritional value, and reducing waste, thereby enabling wider market reach and greater product accessibility. The rise of online retail channels has further democratized market access, allowing smaller players to compete and consumers to access a broader array of products. Competitive dynamics are intensifying, with established giants and emerging brands vying for market share through product differentiation, strategic marketing campaigns, and partnerships. The market penetration rates for juices are steadily increasing across both developed and developing economies, fueled by rising disposable incomes and greater awareness of the health benefits associated with fruit consumption. Opportunities lie in tapping into emerging markets with growing middle classes and introducing novel product formulations that align with the "free-from" trends (e.g., no added sugar, no artificial flavors).

Dominant Markets & Segments in Juices Market

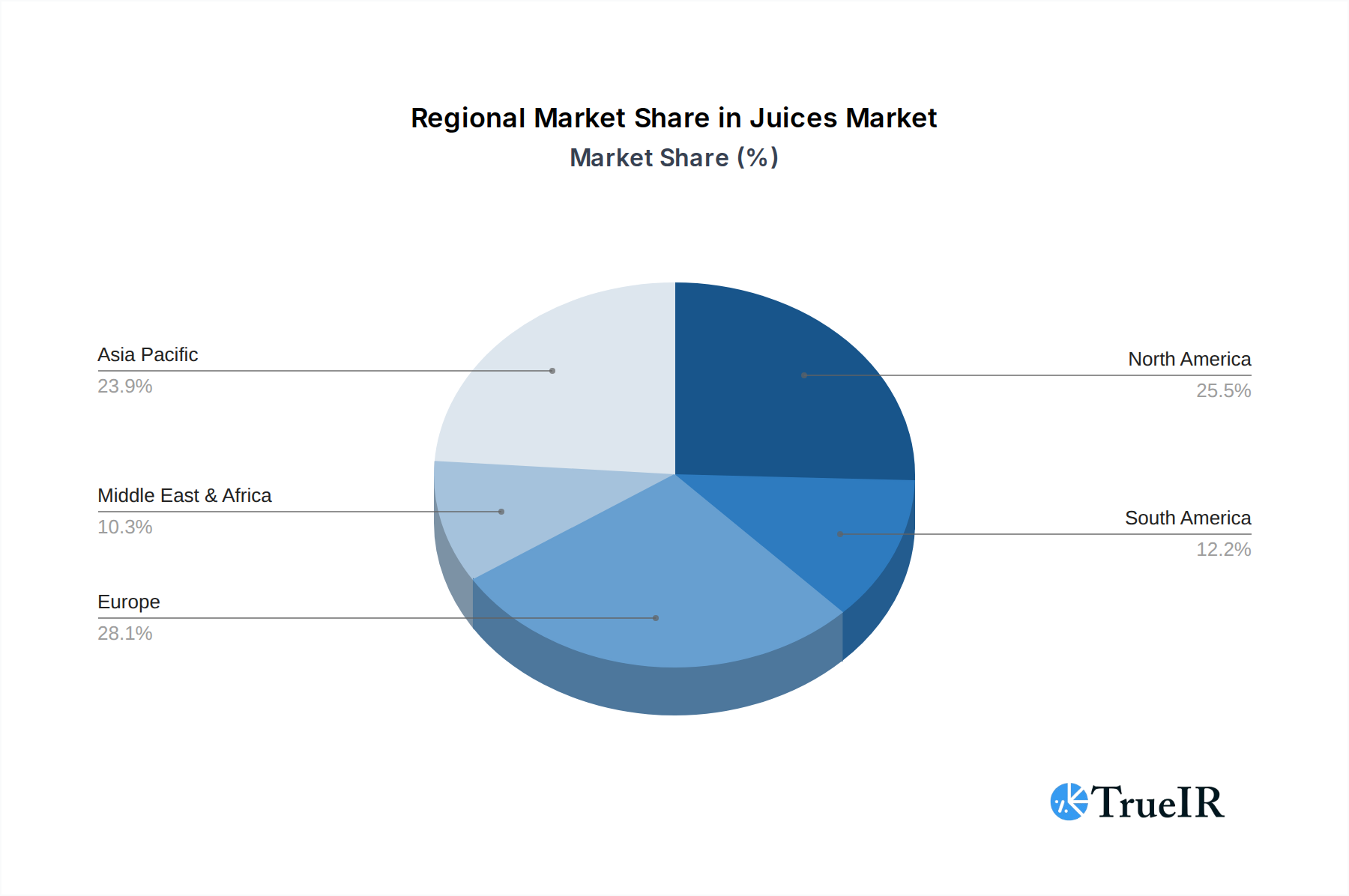

The global juices market exhibits significant regional dominance, with North America and Europe currently leading in terms of market value and consumption. However, the Asia Pacific region, driven by rapidly growing economies and an increasing health-conscious population, is poised for substantial growth. Within this dynamic market, the 100% Juice segment consistently commands a significant share due to its perceived health benefits and natural appeal. Growth drivers for this segment include increased consumer awareness of the nutritional value of pure fruit juices, particularly orange, apple, and exotic fruit varieties.

Packaging plays a crucial role in market accessibility and consumer convenience. PET Bottles and Aseptic packages are dominant due to their portability, recyclability, and shelf-stability, respectively. Supermarkets/hypermarkets continue to be the primary off-trade distribution channel, offering wider product selection and competitive pricing. However, the burgeoning Online Retail segment is rapidly gaining traction, offering convenience and access to niche and premium products.

- Leading Region: North America and Europe currently lead, with Asia Pacific showing the highest growth potential.

- Growth Drivers (Asia Pacific): Rising disposable incomes, increasing health consciousness, urbanization, robust distribution networks.

- Dominant Soft Drink Type: 100% Juice leads due to its perceived health benefits.

- Key Growth Drivers: Demand for natural ingredients, fortification with vitamins and minerals, clean label trends.

- Dominant Packaging Type: PET Bottles and Aseptic packages are favored.

- Growth Drivers (PET Bottles): Portability, convenience for on-the-go consumption, recyclability.

- Growth Drivers (Aseptic Packages): Extended shelf life, preservation of nutrients, reduced need for preservatives.

- Dominant Distribution Channel: Off-trade, particularly Supermarket/Hypermarket.

- Growth Drivers (Online Retail): E-commerce penetration, convenience, wider product availability, targeted promotions.

- Nectar Segment Growth: Nectars, with their balanced sweetness and flavor profile, are experiencing steady growth, appealing to a broader consumer base seeking taste and value.

- Juice Drinks Segment Potential: Juice drinks (up to 24% Juice) offer an affordable and accessible option, particularly in emerging markets, catering to daily hydration needs.

Juices Market Product Analysis

Product innovation in the juices market is characterized by a focus on health-oriented formulations, exotic flavors, and functional benefits. Manufacturers are increasingly leveraging technological advancements to enhance nutritional profiles, reduce added sugar, and improve shelf stability. Competitive advantages are being built through unique ingredient sourcing, such as the integration of superfruits and botanicals, and by offering plant-based or organic options. The market fit is expanding as juices are positioned not just as beverages but as part of a healthy lifestyle.

Key Drivers, Barriers & Challenges in Juices Market

Key Drivers:

- Health and Wellness Trends: Growing consumer demand for natural, nutritious beverages with functional benefits.

- Disposable Income Growth: Rising incomes in emerging economies drive premium product consumption.

- Product Innovation: Introduction of new flavors, functional ingredients, and reduced sugar options.

- E-commerce Expansion: Increased accessibility through online retail channels.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in raw material availability and pricing (e.g., citrus, berries).

- Regulatory Hurdles: Stringent labeling requirements, sugar taxes, and import/export regulations.

- Intense Competition: Saturation in certain markets and pressure from substitute beverages.

- Consumer Price Sensitivity: Balancing premium ingredients with affordable pricing.

Growth Drivers in the Juices Market Market

The juices market is propelled by a confluence of dynamic forces. Technologically, advancements in processing and packaging preserve nutrient integrity and extend shelf life, making juices more accessible globally. Economically, rising disposable incomes in emerging markets are fueling demand for healthier and premium beverage options. Regulatory frameworks, while sometimes presenting challenges, can also incentivize innovation towards healthier formulations, such as reduced sugar content. Consumer preferences are undeniably a pivotal driver, with a persistent global trend towards natural, functional, and less processed food and beverage choices. The increasing awareness of the health benefits associated with fruit consumption, coupled with the desire for convenient, on-the-go refreshment, solidifies the growth trajectory of this sector.

Challenges Impacting Juices Market Growth

The juices market faces several significant challenges. Supply chain disruptions, including adverse weather conditions impacting fruit yields and geopolitical instability, can lead to raw material price volatility and availability issues. Regulatory complexities, such as evolving sugar content guidelines and labeling mandates across different regions, require constant adaptation and investment. Competitive pressures from a wide array of beverage categories, including functional waters, teas, and dairy alternatives, necessitate continuous product differentiation and marketing efforts to maintain market share. Furthermore, consumer price sensitivity in some markets can limit the adoption of premium or niche juice products.

Key Players Shaping the Juices Market Market

- PepsiCo Inc.

- Nongfu Spring Co Ltd.

- Rauch Fruchtsäfte GmbH & Co OG

- Suntory Holdings Limited

- Keurig Dr Pepper Inc.

- The Kraft Heinz Company

- Tingyi (Cayman Islands) Holding Corporation

- The Coca-Cola Company

- Uni-President Enterprises Corp

- Britvic PLC

- Tropicana Brands Group

- Thai Beverages PCL

- Eckes-Granini Group GmbH

Significant Juices Market Industry Milestones

- June 2023: Capri-Sun launched its new Jungle Drink, available in six flavors including Guava, Pineapple, Passionfruit, Orange & Lemon, catering to evolving taste preferences.

- February 2023: Capri Sun announced its strategic takeover of sales and distribution for pouch fruit juice drinks from Coca-Cola in several European countries, including France, Monaco, Great Britain, Netherlands, Belgium, Luxemburg, Sweden, Spain, and Portugal, by 2024. This move signifies a shift in market control and distribution strategies.

- July 2022: Capri Sun made a significant health-conscious product reformulation by reducing added sugar content by 40% using monk fruit juice, decreasing sugar from 8gm to 5gm per pouch. This highlights a strong industry move towards healthier options.

Future Outlook for Juices Market Market

The future outlook for the global juices market is highly promising, driven by persistent consumer demand for healthy and natural beverages. Strategic opportunities lie in the expansion of functional juice categories, incorporating adaptogens, probiotics, and enhanced vitamin fortification. Emerging markets, with their rapidly growing middle classes and increasing health consciousness, represent significant untapped potential. The continued growth of e-commerce channels will further democratize market access and facilitate the introduction of niche and premium products. Innovation in sustainable packaging and sourcing practices will also play a crucial role in shaping brand perception and consumer loyalty. Overall, the market is poised for sustained growth, with a strong emphasis on health, convenience, and ethical production.

Juices Market Segmentation

-

1. Soft Drink Type

- 1.1. 100% Juice

- 1.2. Juice Drinks (up to 24% Juice)

- 1.3. Juice concentrates

- 1.4. Nectars (25-99% Juice)

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Disposable Cups

- 2.3. Glass Bottles

- 2.4. Metal Can

- 2.5. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

Juices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Juices Market Regional Market Share

Geographic Coverage of Juices Market

Juices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Juices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. 100% Juice

- 5.1.2. Juice Drinks (up to 24% Juice)

- 5.1.3. Juice concentrates

- 5.1.4. Nectars (25-99% Juice)

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Disposable Cups

- 5.2.3. Glass Bottles

- 5.2.4. Metal Can

- 5.2.5. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America Juices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. 100% Juice

- 6.1.2. Juice Drinks (up to 24% Juice)

- 6.1.3. Juice concentrates

- 6.1.4. Nectars (25-99% Juice)

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Disposable Cups

- 6.2.3. Glass Bottles

- 6.2.4. Metal Can

- 6.2.5. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Retail

- 6.3.1.3. Supermarket/Hypermarket

- 6.3.1.4. Others

- 6.3.2. On-trade

- 6.3.1. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America Juices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. 100% Juice

- 7.1.2. Juice Drinks (up to 24% Juice)

- 7.1.3. Juice concentrates

- 7.1.4. Nectars (25-99% Juice)

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Disposable Cups

- 7.2.3. Glass Bottles

- 7.2.4. Metal Can

- 7.2.5. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Retail

- 7.3.1.3. Supermarket/Hypermarket

- 7.3.1.4. Others

- 7.3.2. On-trade

- 7.3.1. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe Juices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. 100% Juice

- 8.1.2. Juice Drinks (up to 24% Juice)

- 8.1.3. Juice concentrates

- 8.1.4. Nectars (25-99% Juice)

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Disposable Cups

- 8.2.3. Glass Bottles

- 8.2.4. Metal Can

- 8.2.5. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Retail

- 8.3.1.3. Supermarket/Hypermarket

- 8.3.1.4. Others

- 8.3.2. On-trade

- 8.3.1. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa Juices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. 100% Juice

- 9.1.2. Juice Drinks (up to 24% Juice)

- 9.1.3. Juice concentrates

- 9.1.4. Nectars (25-99% Juice)

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Disposable Cups

- 9.2.3. Glass Bottles

- 9.2.4. Metal Can

- 9.2.5. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Retail

- 9.3.1.3. Supermarket/Hypermarket

- 9.3.1.4. Others

- 9.3.2. On-trade

- 9.3.1. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific Juices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. 100% Juice

- 10.1.2. Juice Drinks (up to 24% Juice)

- 10.1.3. Juice concentrates

- 10.1.4. Nectars (25-99% Juice)

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Disposable Cups

- 10.2.3. Glass Bottles

- 10.2.4. Metal Can

- 10.2.5. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Retail

- 10.3.1.3. Supermarket/Hypermarket

- 10.3.1.4. Others

- 10.3.2. On-trade

- 10.3.1. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PepsiCo Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nongfu Spring Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rauch Fruchtsäfte GmbH & Co OG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Suntory Holdings Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Keurig Dr Pepper Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Kraft Heinz Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tingyi (Cayman Islands) Holding Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Coca-Cola Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Uni-President Enterprises Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Britvic PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tropicana Brands Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Thai Beverages PCL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eckes-Granini Group GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 PepsiCo Inc

List of Figures

- Figure 1: Global Juices Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Juices Market Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 3: North America Juices Market Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 4: North America Juices Market Revenue (billion), by Packaging Type 2025 & 2033

- Figure 5: North America Juices Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Juices Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Juices Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Juices Market Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 11: South America Juices Market Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 12: South America Juices Market Revenue (billion), by Packaging Type 2025 & 2033

- Figure 13: South America Juices Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: South America Juices Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: South America Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Juices Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Juices Market Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 19: Europe Juices Market Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 20: Europe Juices Market Revenue (billion), by Packaging Type 2025 & 2033

- Figure 21: Europe Juices Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Europe Juices Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Europe Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Juices Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Juices Market Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 27: Middle East & Africa Juices Market Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 28: Middle East & Africa Juices Market Revenue (billion), by Packaging Type 2025 & 2033

- Figure 29: Middle East & Africa Juices Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: Middle East & Africa Juices Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Juices Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Juices Market Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 35: Asia Pacific Juices Market Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 36: Asia Pacific Juices Market Revenue (billion), by Packaging Type 2025 & 2033

- Figure 37: Asia Pacific Juices Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Asia Pacific Juices Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Juices Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Juices Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Juices Market Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Global Juices Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Juices Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Juices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Juices Market Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Global Juices Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Juices Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Juices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Juices Market Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 13: Global Juices Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 14: Global Juices Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Juices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Juices Market Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 20: Global Juices Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 21: Global Juices Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Juices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Juices Market Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 33: Global Juices Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 34: Global Juices Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Juices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Juices Market Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 43: Global Juices Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 44: Global Juices Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Juices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Juices Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Juices Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Juices Market?

Key companies in the market include PepsiCo Inc, Nongfu Spring Co Ltd, Rauch Fruchtsäfte GmbH & Co OG, Suntory Holdings Limited, Keurig Dr Pepper Inc, The Kraft Heinz Company, Tingyi (Cayman Islands) Holding Corporation, The Coca-Cola Company, Uni-President Enterprises Corp, Britvic PLC, Tropicana Brands Group, Thai Beverages PCL, Eckes-Granini Group GmbH.

3. What are the main segments of the Juices Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 159.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

June 2023: Capri-Sun launched new Jungle Drink in 6 flavours including Guava, Pineapple, Passionfruit, Orange & Lemon.February 2023: Capri Sun announced to takeover their sales and distribution of pouch fruit juice drinks from Coca Cola in France, Monaco, Great Britain, Netherlands, Belgium, Luxemburg, Sweden, Spain, and Portugal by 2024.July 2022: Capri Sun has reduced the addedsugar content by 40% using monk fruit juice. They have reduced 8gm sugar to 5gm in each pouch.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Juices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Juices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Juices Market?

To stay informed about further developments, trends, and reports in the Juices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence