Key Insights

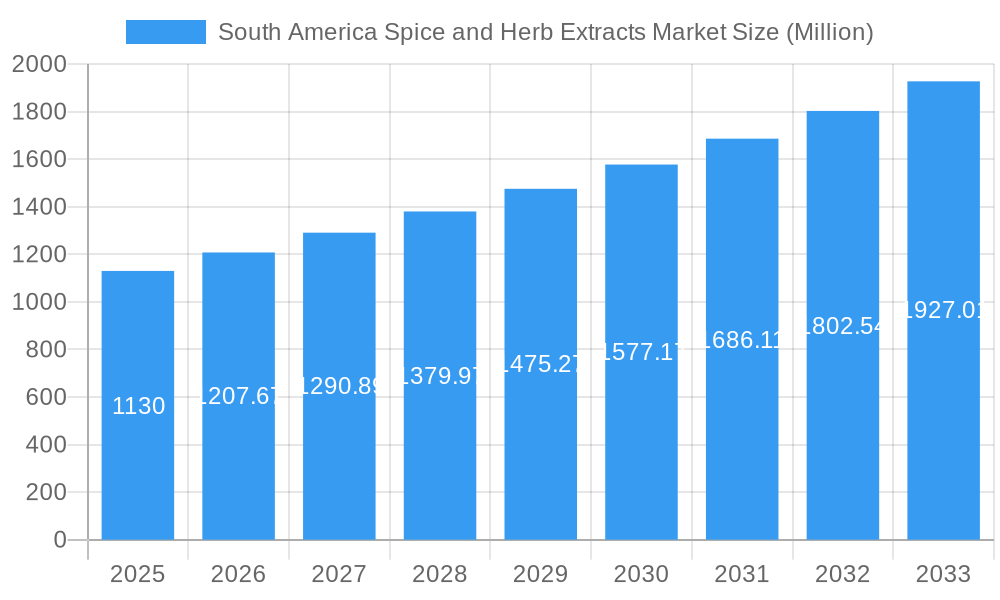

The South America Spice and Herb Extracts Market is poised for significant expansion, projected to reach a valuation of USD 1.13 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.9% throughout the forecast period of 2019-2033, with a strong emphasis on the 2025-2033 trajectory. The increasing consumer demand for natural and functional ingredients in food and beverages is a primary catalyst, driving the adoption of spice and herb extracts for their flavor-enhancing, preservative, and perceived health benefits. Key product segments like Cinnamon, Cumin, Chili, and Coriander are witnessing heightened demand due to their widespread use in culinary applications across the region. Furthermore, the growing pharmaceutical industry's interest in botanical extracts for drug development and nutraceuticals is contributing to market momentum.

South America Spice and Herb Extracts Market Market Size (In Billion)

Emerging trends such as the rise of clean-label products and a greater focus on sustainable sourcing are shaping the market landscape. Consumers are actively seeking products with recognizable and natural ingredients, which directly benefits the spice and herb extracts sector. While the market benefits from robust demand, certain restraints, including stringent regulatory frameworks for food additives and the potential volatility in raw material prices due to agricultural factors, require strategic navigation by market players. Nonetheless, the burgeoning food processing industry, coupled with expanding export opportunities for South American spice and herb derivatives, paints a promising picture for sustained market development. Key companies like Givaudan, Firmenich, and Synthite Industries Ltd are actively investing in innovation and expanding their presence to capitalize on these growth avenues.

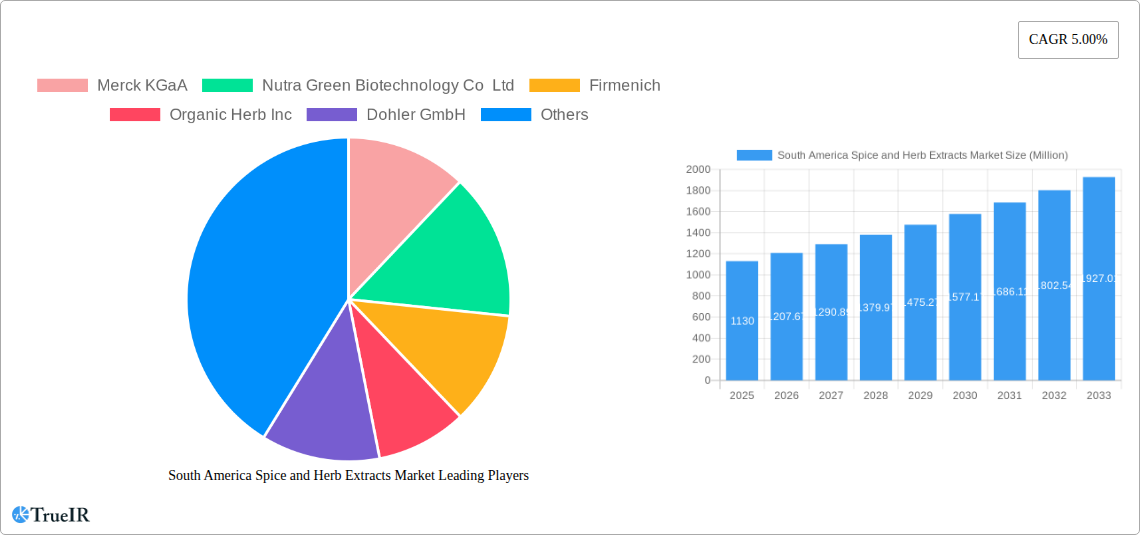

South America Spice and Herb Extracts Market Company Market Share

This in-depth report provides a detailed analysis of the South America Spice and Herb Extracts Market, a rapidly expanding sector driven by burgeoning demand for natural ingredients and functional foods. Explore market dynamics, key players, growth drivers, and future projections within this dynamic landscape.

South America Spice and Herb Extracts Market Market Structure & Competitive Landscape

The South America Spice and Herb Extracts Market exhibits a moderately concentrated structure, with a blend of established global players and emerging regional manufacturers vying for market share. Innovation remains a critical driver, fueled by advancements in extraction technologies and a growing consumer preference for natural and organic ingredients. Regulatory frameworks across South America, while evolving, are increasingly focusing on food safety and labeling standards, influencing product development and market entry strategies. Product substitutes, primarily in the form of whole spices and herbs, pose a competitive challenge, though the convenience and concentrated flavor profiles of extracts offer distinct advantages. End-user segmentation reveals a dominant presence of the food and beverage industry, followed by pharmaceuticals, with emerging applications in the nutraceutical sector. Mergers and acquisitions (M&A) activity, while not at peak levels, are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, in the historical period 2019-2024, approximately xx M&A deals were recorded, indicating strategic consolidation. The market concentration ratio (CR4) is estimated to be around xx%, highlighting the influence of the top four players.

South America Spice and Herb Extracts Market Market Trends & Opportunities

The South America Spice and Herb Extracts Market is poised for significant growth, projected to expand from an estimated market size of $xx billion in 2025 to a substantial $xx billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This upward trajectory is propelled by a confluence of factors, including the escalating consumer consciousness regarding health and wellness, which translates into a heightened demand for natural, clean-label ingredients in food and beverage products. The inherent therapeutic and functional properties attributed to various spices and herbs are increasingly being recognized and leveraged by the pharmaceutical and nutraceutical industries, creating new avenues for market penetration.

Technological advancements in extraction methodologies, such as supercritical fluid extraction and enzyme-assisted extraction, are enabling the production of higher-purity, more potent, and cost-effective spice and herb extracts. These innovations not only enhance product quality but also contribute to more sustainable manufacturing processes, aligning with the growing environmental concerns of consumers and businesses alike. The expanding middle-class population across South America, coupled with rising disposable incomes, is fueling a greater appetite for premium and diverse food and beverage options, thereby boosting the demand for a wider array of spice and herb extracts that offer unique flavor profiles and health benefits.

Furthermore, the increasing adoption of plant-based diets and the surge in demand for ethnic and exotic cuisines are creating substantial opportunities for manufacturers of specialized spice and herb extracts. The convenience factor associated with extracts, offering consistent flavor intensity and ease of incorporation into various formulations, further solidifies their position in the market. Competitive dynamics are evolving, with companies focusing on product differentiation through organic certifications, specialized ingredient sourcing, and the development of value-added products. Strategic partnerships and collaborations between ingredient suppliers and food and beverage manufacturers are also becoming more prevalent, fostering innovation and expanding market reach. The penetration rate of spice and herb extracts in the South American food and beverage industry is estimated to be xx%, indicating significant room for growth.

Dominant Markets & Segments in South America Spice and Herb Extracts Market

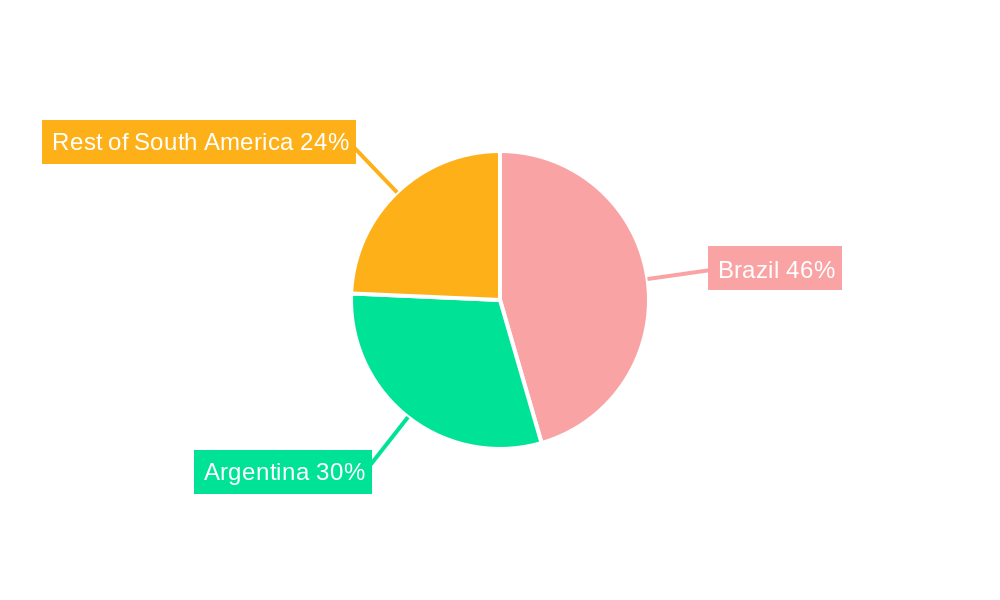

The South America Spice and Herb Extracts Market is characterized by distinct regional and segment-specific dominance. Geographically, Brazil stands out as the leading market, driven by its vast agricultural production of various spices and herbs, a large and growing population with increasing disposable income, and a well-established food and beverage manufacturing sector. Argentina also holds significant market influence due to its agricultural prowess and burgeoning food processing industry. The Rest of South America, while fragmented, presents a mosaic of growing markets with increasing demand for natural ingredients.

Within product types, Chili extracts are a dominant force, owing to their widespread use in cuisines across the continent and their growing application in functional foods for their capsaicin content. Ginger and Cinnamon extracts also command substantial market share due to their global appeal and perceived health benefits. Pepper and Coriander extracts are also significant contributors to the market’s overall value. The demand for these core spices is consistently high, supported by their integral role in both traditional and modern culinary practices.

In terms of applications, Food Applications represent the largest and most influential segment. The versatility of spice and herb extracts in enhancing flavor, aroma, and color in a wide range of food products, from savory dishes to confectionery and baked goods, underpins this dominance. The growing trend of convenience foods and processed snacks further amplifies the demand for these extracts. The Beverage Applications segment is experiencing robust growth, fueled by the increasing popularity of functional beverages, natural flavorings in juices and soft drinks, and the incorporation of spice and herb infusions in alcoholic beverages. The Pharmaceuticals segment, while smaller in comparison, is a high-value market for spice and herb extracts, driven by their medicinal properties and their use in over-the-counter remedies and prescription drugs, particularly for digestive health, anti-inflammatory properties, and antioxidant benefits.

Key growth drivers in Brazil include supportive government policies for agricultural exports and food processing, coupled with significant investment in R&D for value-added agricultural products. In the Rest of South America, growing urbanization and a rising middle class are contributing to increased consumption of processed foods and beverages, thereby boosting the demand for spice and herb extracts. Infrastructure development, particularly in logistics and cold chain management, is crucial for ensuring the efficient supply and distribution of these sensitive extracts across the continent, further influencing market dominance.

South America Spice and Herb Extracts Market Product Analysis

Product innovations in the South America Spice and Herb Extracts Market are largely centered around enhancing the purity, potency, and bioavailability of active compounds. Advanced extraction techniques like supercritical CO2 extraction and microwave-assisted extraction are gaining traction for their ability to yield high-quality extracts with minimal degradation of natural compounds. The market is also witnessing a rise in demand for organic and non-GMO certified extracts, catering to the growing consumer preference for clean-label products. Applications are expanding beyond traditional food flavoring, with an increasing focus on functional benefits in pharmaceuticals and nutraceuticals, such as antioxidant, anti-inflammatory, and digestive support. Competitive advantages are being built on the back of unique sourcing, proprietary extraction processes, and a strong emphasis on research and development to unlock novel applications and benefits of various spice and herb extracts.

Key Drivers, Barriers & Challenges in South America Spice and Herb Extracts Market

Key Drivers:

- Rising Consumer Demand for Natural and Clean-Label Products: Increasing health consciousness and a preference for minimally processed ingredients are fueling demand for natural spice and herb extracts.

- Growing Popularity of Functional Foods and Beverages: The perceived health benefits associated with various spices and herbs are driving their incorporation into functional food and beverage formulations.

- Advancements in Extraction Technology: Innovations in extraction methods are leading to higher purity, increased potency, and cost-effectiveness of spice and herb extracts.

- Expanding Food and Beverage Industry: The robust growth of the food and beverage processing sector across South America directly translates into higher demand for flavoring and functional ingredients.

Barriers & Challenges:

- Supply Chain Volatility and Sourcing Challenges: Fluctuations in agricultural yields due to climate change, geopolitical instability, and pest outbreaks can impact the availability and pricing of raw materials, leading to supply chain disruptions.

- Regulatory Complexities and Standardization: Navigating diverse regulatory landscapes across different South American countries can be challenging for manufacturers, particularly regarding food safety, labeling, and import/export requirements.

- Competition from Whole Spices and Herbs: While extracts offer convenience and concentrated flavor, whole spices and herbs remain a viable and often preferred alternative for certain applications.

- Price Sensitivity of Consumers: In some market segments, the price of premium or specialized spice and herb extracts can be a limiting factor for widespread adoption.

Growth Drivers in the South America Spice and Herb Extracts Market Market

The South America Spice and Herb Extracts Market is propelled by several key growth drivers. Technologically, advancements in sustainable extraction methods, such as solvent-free extraction, are enhancing product appeal and reducing environmental impact. Economically, rising disposable incomes across the continent are leading to increased consumer spending on processed foods and beverages, where spice and herb extracts are crucial flavoring and functional ingredients. Policy-driven factors, including government initiatives promoting the agricultural sector and trade agreements fostering regional commerce, are also contributing to market expansion. For instance, investments in agricultural research and development for indigenous spices are opening new avenues for product innovation.

Challenges Impacting South America Spice and Herb Extracts Market Growth

Several challenges are impacting the growth of the South America Spice and Herb Extracts Market. Regulatory complexities, with varying standards for food additives and natural ingredients across different nations, can create hurdles for market entry and product harmonization. Supply chain issues, including potential disruptions due to climate variability affecting raw material yields and the need for robust cold chain logistics, present ongoing concerns. Furthermore, intense competitive pressures from both established global players and agile local manufacturers necessitate continuous innovation and cost-efficiency. The price sensitivity of certain consumer segments also acts as a restraint, particularly for premium or specialty extracts, requiring manufacturers to carefully balance quality with affordability.

Key Players Shaping the South America Spice and Herb Extracts Market Market

- Merck KGaA

- Nutra Green Biotechnology Co Ltd

- Firmenich

- Organic Herb Inc

- Dohler GmbH

- Givaudan (Naturex SA)

- Synthite Industries Ltd

- Indena S p A

Significant South America Spice and Herb Extracts Market Industry Milestones

- 2019: Increased investment in R&D for novel spice and herb extract applications in nutraceuticals.

- 2020: Growing adoption of sustainable sourcing practices by leading extract manufacturers.

- 2021: Emergence of new players focusing on indigenous South American botanicals.

- 2022: Enhanced regulatory scrutiny on natural ingredient labeling and claims.

- 2023: Significant partnerships between extract suppliers and major food and beverage manufacturers for product innovation.

- 2024: Expansion of production capacities to meet rising demand for chili and ginger extracts.

Future Outlook for South America Spice and Herb Extracts Market Market

The future outlook for the South America Spice and Herb Extracts Market is exceptionally bright, driven by sustained consumer preference for natural, healthy, and flavorful ingredients. Continued technological advancements in extraction and processing will unlock new applications and improve product quality, further solidifying the market's growth. The burgeoning demand in functional foods, beverages, and pharmaceuticals presents significant strategic opportunities. Expansion into emerging markets within South America, coupled with a focus on sustainable and ethical sourcing, will be critical for long-term success, positioning the market for continued robust expansion and innovation in the coming years.

South America Spice and Herb Extracts Market Segmentation

-

1. Product Type

- 1.1. Cinnamon

- 1.2. Cumin

- 1.3. Chili

- 1.4. Coriander

- 1.5. Cardamom

- 1.6. Oregano

- 1.7. Pepper

- 1.8. Ginger

- 1.9. Other Product Types

-

2. Application

- 2.1. Food Applications

- 2.2. Beverage Applications

- 2.3. Pharmaceuticals

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Spice and Herb Extracts Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Spice and Herb Extracts Market Regional Market Share

Geographic Coverage of South America Spice and Herb Extracts Market

South America Spice and Herb Extracts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Growing Demand for Processed Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Spice and Herb Extracts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cinnamon

- 5.1.2. Cumin

- 5.1.3. Chili

- 5.1.4. Coriander

- 5.1.5. Cardamom

- 5.1.6. Oregano

- 5.1.7. Pepper

- 5.1.8. Ginger

- 5.1.9. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food Applications

- 5.2.2. Beverage Applications

- 5.2.3. Pharmaceuticals

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Spice and Herb Extracts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cinnamon

- 6.1.2. Cumin

- 6.1.3. Chili

- 6.1.4. Coriander

- 6.1.5. Cardamom

- 6.1.6. Oregano

- 6.1.7. Pepper

- 6.1.8. Ginger

- 6.1.9. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food Applications

- 6.2.2. Beverage Applications

- 6.2.3. Pharmaceuticals

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Spice and Herb Extracts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cinnamon

- 7.1.2. Cumin

- 7.1.3. Chili

- 7.1.4. Coriander

- 7.1.5. Cardamom

- 7.1.6. Oregano

- 7.1.7. Pepper

- 7.1.8. Ginger

- 7.1.9. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food Applications

- 7.2.2. Beverage Applications

- 7.2.3. Pharmaceuticals

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Spice and Herb Extracts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cinnamon

- 8.1.2. Cumin

- 8.1.3. Chili

- 8.1.4. Coriander

- 8.1.5. Cardamom

- 8.1.6. Oregano

- 8.1.7. Pepper

- 8.1.8. Ginger

- 8.1.9. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food Applications

- 8.2.2. Beverage Applications

- 8.2.3. Pharmaceuticals

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Merck KGaA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nutra Green Biotechnology Co Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Firmenich

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Organic Herb Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Dohler GmbH

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Givaudan (Naturex SA)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Synthite Industries Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Indena S p A*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Merck KGaA

List of Figures

- Figure 1: South America Spice and Herb Extracts Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Spice and Herb Extracts Market Share (%) by Company 2025

List of Tables

- Table 1: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Spice and Herb Extracts Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Spice and Herb Extracts Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the South America Spice and Herb Extracts Market?

Key companies in the market include Merck KGaA, Nutra Green Biotechnology Co Ltd, Firmenich, Organic Herb Inc, Dohler GmbH, Givaudan (Naturex SA), Synthite Industries Ltd, Indena S p A*List Not Exhaustive.

3. What are the main segments of the South America Spice and Herb Extracts Market?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Growing Demand for Processed Food.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Spice and Herb Extracts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Spice and Herb Extracts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Spice and Herb Extracts Market?

To stay informed about further developments, trends, and reports in the South America Spice and Herb Extracts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence