Key Insights

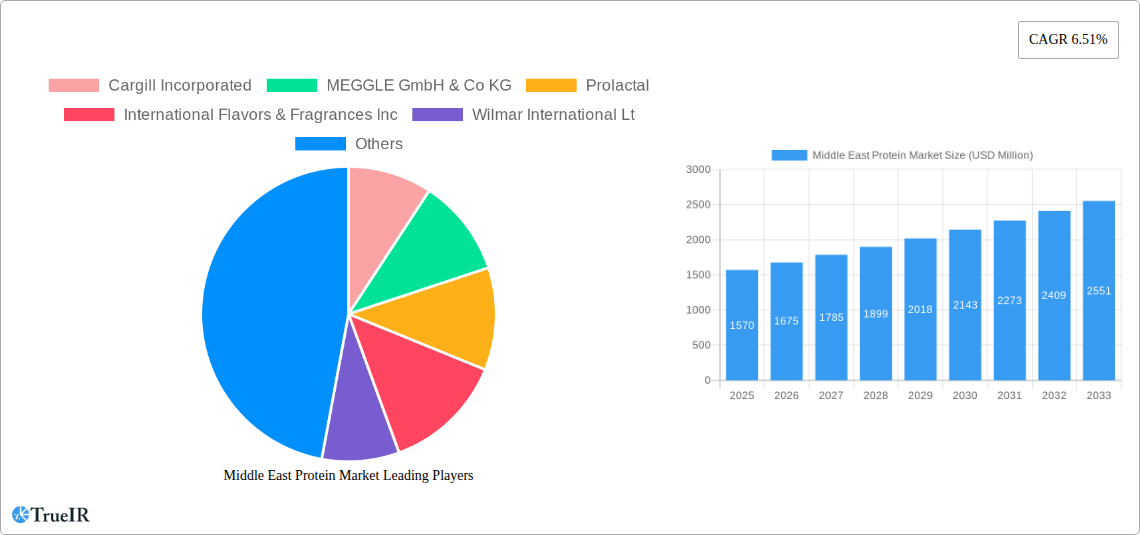

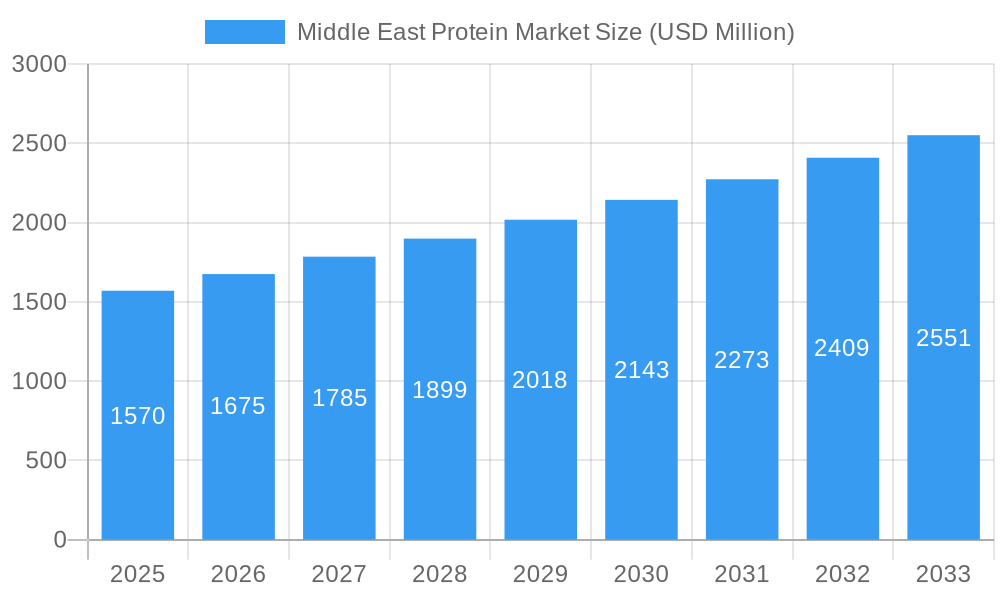

The Middle East protein market is poised for significant expansion, projected to reach an estimated $1.57 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.51%, indicating a sustained upward trajectory throughout the forecast period. This dynamic market is propelled by several key drivers, including the increasing consumer demand for healthier food options and specialized nutritional products, a growing awareness of the benefits of protein consumption for health and wellness, and the rising disposable incomes across the region. Furthermore, the expanding food and beverage industry, with a particular emphasis on convenience foods, fortified products, and meat alternatives, is a substantial contributor to this growth. The burgeoning sports nutrition sector and the increasing adoption of dietary supplements among health-conscious individuals are also playing a crucial role in shaping market demand.

Middle East Protein Market Market Size (In Billion)

The diversification of protein sources is a prominent trend in the Middle East protein market. While traditional animal proteins like whey and casein remain popular, there is a noticeable surge in the adoption of plant-based proteins such as pea and soy, driven by environmental concerns, ethical considerations, and the growing vegan and vegetarian populations. Microbial proteins, including algae and mycoprotein, are also emerging as innovative alternatives with high nutritional value and sustainable production methods. The animal feed sector is another significant end-user, reflecting the region's commitment to improving livestock health and productivity. However, the market faces certain restraints, including the fluctuating raw material prices, stringent regulatory frameworks for food and supplement products, and the established preference for certain traditional protein sources in some consumer segments. Despite these challenges, the overarching trends of health consciousness, innovation in protein sourcing, and an expanding food industry suggest a promising future for the Middle East protein market.

Middle East Protein Market Company Market Share

Middle East Protein Market Market Structure & Competitive Landscape

The Middle East protein market is characterized by a moderately concentrated landscape, with several global giants and regional players vying for market share. Innovation drivers stem from the increasing demand for high-quality protein sources across various applications, from animal feed to functional foods and supplements. Regulatory frameworks, while evolving, are increasingly supportive of food safety and quality standards, influencing product development and market entry. Product substitutes, particularly plant-based alternatives, are gaining traction, prompting established animal protein providers to innovate and diversify. End-user segmentation reveals a strong focus on the Food and Beverages sector, driven by evolving consumer preferences for healthier and protein-enriched products. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to enhance their product portfolios and expand their geographical reach. For instance, the merger of DuPont's Nutrition & Biosciences with IFF in February 2021 exemplifies this trend, creating a powerhouse in the ingredient space, including significant leadership in soy protein. While specific M&A volumes are dynamic, the trend indicates a strategic consolidation aimed at capturing a larger share of the growing protein market. The market concentration is estimated to be around 65% among the top 10 players, showcasing a competitive yet consolidated environment.

Middle East Protein Market Market Trends & Opportunities

The Middle East protein market is poised for significant growth, projected to reach several hundred billion dollars by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This expansion is fueled by a confluence of macro-economic factors, evolving consumer lifestyles, and a heightened awareness of health and wellness. The demand for protein is surging across its diverse applications, ranging from essential animal feed that underpins the region’s agricultural sector to specialized nutritional supplements catering to a growing health-conscious population. Technological advancements are playing a pivotal role, enabling the development of novel protein ingredients with enhanced functionality, bioavailability, and sustainability profiles. The burgeoning interest in plant-based proteins, driven by health, environmental, and ethical concerns, presents a substantial opportunity for market players to innovate and diversify their offerings. Similarly, the continuous innovation in animal protein processing, such as the development of high-purity whey isolates and specialized caseinates, is meeting the sophisticated demands of the food and beverage industry, particularly in bakery, dairy alternatives, and meat-mimicking products. Consumer preferences are shifting towards convenience and health, with a growing demand for ready-to-eat (RTE) and ready-to-cook (RTC) food products that are both nutritious and protein-rich. The sports nutrition segment, in particular, is witnessing a dramatic surge as physical fitness becomes a priority for a wider demographic across the Middle East. Furthermore, the increasing focus on infant and elderly nutrition highlights the vital role of protein in all life stages. The strategic mergers and acquisitions within the industry are consolidating market power and fostering innovation, creating a dynamic competitive landscape where companies like Cargill Incorporated, Kerry Group PLC, and Fonterra Co-operative Group Limited are at the forefront. The market penetration of specialized protein ingredients is expected to rise significantly as manufacturers increasingly incorporate these components to create value-added products. Opportunities also lie in leveraging sustainable sourcing and production methods, appealing to a market increasingly conscious of its environmental footprint. The exploration of untapped segments like insect protein, while nascent, holds potential for future diversification.

Dominant Markets & Segments in Middle East Protein Market

The Middle East Protein Market is experiencing robust growth driven by diverse segments, with Animal protein currently holding the dominant position, accounting for an estimated 60% of the market share. Within this segment, Whey Protein and Milk Protein are particularly significant due to their widespread application in the food and beverage industry and their established reputation for quality and efficacy. The growing demand for high-protein dairy products, including functional beverages and fortified food items, propels the growth of these sub-segments. The Food and Beverages end-user sector emerges as the largest contributor, driven by strong consumer demand for protein-enriched products across various sub-categories. Dairy and Dairy Alternative Products and Meat/Poultry/Seafood and Meat Alternative Products are key growth areas, reflecting both traditional consumption patterns and the rising popularity of plant-based alternatives. The Supplements segment is also experiencing remarkable expansion, especially Sport/Performance Nutrition and Baby Food and Infant Formula. The increasing health consciousness among the population, coupled with the rise of fitness culture, is significantly boosting the demand for sports nutrition products. Similarly, a growing emphasis on early childhood nutrition and a rising birth rate contribute to the growth of the infant formula market. Plant protein, though currently a smaller segment, is exhibiting the fastest growth rate, driven by increasing consumer preference for vegan and vegetarian diets, as well as growing concerns about the environmental impact of animal agriculture. Pea Protein and Soy Protein are leading the charge in this segment. The Animal Feed segment remains a cornerstone, essential for supporting the region's livestock industry and ensuring food security. Key growth drivers in this segment include government initiatives to boost agricultural production and improve livestock health.

Key Growth Drivers:

- Rising Health and Wellness Consciousness: Increased awareness of the health benefits of protein consumption across all age groups.

- Growing Popularity of Plant-Based Diets: A significant shift towards vegan and vegetarian lifestyles influencing demand for plant-derived proteins.

- Expansion of the Sports Nutrition Market: A surge in fitness activities and the demand for performance-enhancing supplements.

- Demand for Functional Foods and Beverages: Incorporation of protein into everyday food products to enhance nutritional value.

- Government Support for Agriculture and Food Security: Initiatives aimed at bolstering the livestock and food processing industries.

- Technological Advancements in Protein Extraction and Processing: Development of more efficient and sustainable methods for producing high-quality protein ingredients.

Middle East Protein Market Product Analysis

The Middle East protein market is witnessing an influx of innovative products designed to meet evolving consumer demands. Key innovations revolve around enhanced functionality, improved taste profiles, and increased sustainability. For instance, product launches like FrieslandCampina's Excellion Calcium Caseinate S address formulation challenges by enabling softer protein bars, while NZMP's new whey protein ingredient offers a higher protein concentration. Competitive advantages are being carved out through diversification into plant-based alternatives like pea and soy protein, catering to a growing vegan and vegetarian demographic. Companies are also focusing on creating protein ingredients with specific applications, such as those optimized for infant formula, medical nutrition, and sports performance, thereby securing niche market positions and commanding premium pricing.

Key Drivers, Barriers & Challenges in Middle East Protein Market

Key Drivers:

- Growing Health and Wellness Trend: Consumers are increasingly prioritizing protein intake for muscle building, weight management, and overall health, driving demand across all protein sources.

- Rising Demand for Plant-Based Proteins: Ethical, environmental, and health concerns are fueling the rapid adoption of plant-based protein alternatives, particularly pea and soy.

- Expansion of the Food and Beverage Industry: The continuous innovation in functional foods, dairy alternatives, and meat substitutes incorporates higher protein content.

- Government Initiatives: Support for agricultural development and food security policies encourage domestic protein production and processing.

- Technological Advancements: Improved extraction and processing techniques lead to higher quality, more versatile, and cost-effective protein ingredients.

Key Barriers and Challenges:

- Supply Chain Volatility: Dependence on global supply chains for certain raw materials and ingredients can lead to price fluctuations and availability issues.

- Regulatory Complexities: Navigating diverse and evolving food safety and labeling regulations across different Middle Eastern countries can be challenging.

- Competition from Established Players: The market is competitive, with large global companies holding significant market share, making it difficult for new entrants.

- Consumer Perception and Education: Overcoming traditional dietary habits and educating consumers about the benefits of newer protein sources, like insect protein, can be a hurdle.

- Cost of Production: Advanced processing and specialized ingredients can sometimes lead to higher production costs, impacting affordability.

Growth Drivers in the Middle East Protein Market Market

The Middle East protein market is propelled by several key drivers. Technologically, advancements in extraction and processing are yielding higher-quality, more functional, and cost-effective protein ingredients from both animal and plant sources. Economically, rising disposable incomes and a burgeoning middle class are translating into increased consumer spending on health-conscious products, including protein-enriched foods and supplements. Government initiatives focused on food security and the development of the agricultural sector also play a crucial role, encouraging investment in domestic protein production and processing capabilities. Furthermore, the growing prevalence of chronic diseases and a heightened awareness of preventative healthcare are spurring demand for nutrient-dense foods.

Challenges Impacting Middle East Protein Market Growth

Challenges impacting the Middle East protein market include navigating complex and often fragmented regulatory landscapes across different countries, which can hinder market access and increase compliance costs. Supply chain disruptions, influenced by global events and logistical hurdles, can lead to price volatility and affect the availability of key raw materials. Intense competitive pressures from established global players and the rapid emergence of new market entrants necessitate continuous innovation and strategic differentiation. Furthermore, a lack of widespread consumer awareness and acceptance of certain novel protein sources, such as insect protein, requires significant educational efforts and market development initiatives.

Key Players Shaping the Middle East Protein Market Market

Cargill Incorporated MEGGLE GmbH & Co KG Prolactal International Flavors & Fragrances Inc Wilmar International Lt Croda International Plc Lactoprot Deutschland GmbH Royal FrieslandCampina NV Kerry Group PLC Fonterra Co-operative Group Limited Hilmar Cheese Company Inc

Significant Middle East Protein Market Industry Milestones

- April 2021: FrieslandCampina Ingredients launched a new portfolio, including Excellion Calcium Caseinate S, to aid in the production of softer protein bars. Other products launched included Nutri Whey 800F, Nutri Whey Isolate, Biotis GOS, and Excellion EM9, as well as the new Excellion Textpro. The portfolio was made as a key solution to address the hardening problem that many formulators currently face.

- February 2021: NZMP, Fonterra's dairy ingredients business, launched a new protein ingredient that delivers 10% more protein than other standard whey protein offerings.

- February 2021: DuPont's Nutrition & Biosciences and the ingredient company IFF announced their merger in 2021. The combined company will continue to operate under the name IFF. The complementary portfolios give the company leadership positions within a range of ingredients, including soy protein.

Future Outlook for Middle East Protein Market Market

The future outlook for the Middle East protein market is exceptionally positive, projecting sustained growth driven by increasing health consciousness, a rising preference for plant-based diets, and significant advancements in product innovation. Strategic opportunities lie in the development of functional protein ingredients tailored for specific health needs, such as sports nutrition, medical foods, and infant formulas. The market will likely witness further consolidation through mergers and acquisitions as companies aim to expand their portfolios and global reach. Investments in sustainable sourcing and production methods will become increasingly crucial for competitive advantage. The growing demand for convenience foods will also fuel the incorporation of protein into ready-to-eat and ready-to-cook products. Exploration of novel protein sources and biotechnological solutions will unlock new market potential, ensuring a dynamic and evolving landscape for years to come.

Middle East Protein Market Segmentation

-

1. Source

-

1.1. Animal

-

1.1.1. By Protein Type

- 1.1.1.1. Casein and Caseinates

- 1.1.1.2. Collagen

- 1.1.1.3. Egg Protein

- 1.1.1.4. Gelatin

- 1.1.1.5. Insect Protein

- 1.1.1.6. Milk Protein

- 1.1.1.7. Whey Protein

- 1.1.1.8. Other Animal Protein

-

1.1.1. By Protein Type

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Middle East Protein Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Protein Market Regional Market Share

Geographic Coverage of Middle East Protein Market

Middle East Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative protein sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. By Protein Type

- 5.1.1.1.1. Casein and Caseinates

- 5.1.1.1.2. Collagen

- 5.1.1.1.3. Egg Protein

- 5.1.1.1.4. Gelatin

- 5.1.1.1.5. Insect Protein

- 5.1.1.1.6. Milk Protein

- 5.1.1.1.7. Whey Protein

- 5.1.1.1.8. Other Animal Protein

- 5.1.1.1. By Protein Type

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MEGGLE GmbH & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prolactal

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Flavors & Fragrances Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wilmar International Lt

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Croda International Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lactoprot Deutschland GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal FrieslandCampina NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Group PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fonterra Co-operative Group Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hilmar Cheese Company Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Middle East Protein Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Protein Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: Middle East Protein Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 3: Middle East Protein Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Middle East Protein Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 5: Middle East Protein Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Middle East Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Middle East Protein Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 8: Middle East Protein Market Volume K Tons Forecast, by Source 2020 & 2033

- Table 9: Middle East Protein Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Middle East Protein Market Volume K Tons Forecast, by End User 2020 & 2033

- Table 11: Middle East Protein Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Middle East Protein Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle East Protein Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle East Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Protein Market?

The projected CAGR is approximately 6.51%.

2. Which companies are prominent players in the Middle East Protein Market?

Key companies in the market include Cargill Incorporated, MEGGLE GmbH & Co KG, Prolactal, International Flavors & Fragrances Inc, Wilmar International Lt, Croda International Plc, Lactoprot Deutschland GmbH, Royal FrieslandCampina NV, Kerry Group PLC, Fonterra Co-operative Group Limited, Hilmar Cheese Company Inc.

3. What are the main segments of the Middle East Protein Market?

The market segments include Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Alternative protein sources.

8. Can you provide examples of recent developments in the market?

April 2021: FrieslandCampina Ingredients launched a new portfolio, including Excellion Calcium Caseinate S, to aid in the production of softer protein bars. Other products launched included Nutri Whey 800F, Nutri Whey Isolate, Biotis GOS, and Excellion EM9, as well as the new Excellion Textpro. The portfolio was made as a key solution to address the hardening problem that many formulators currently face.February 2021: NZMP, Fonterra's dairy ingredients business, launched a new protein ingredient that delivers 10% more protein than other standard whey protein offerings.February 2021: DuPont's Nutrition & Biosciences and the ingredient company IFF announced their merger in 2021. The combined company will continue to operate under the name IFF. The complementary portfolios give the company leadership positions within a range of ingredients, including soy protein.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Protein Market?

To stay informed about further developments, trends, and reports in the Middle East Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence