Key Insights

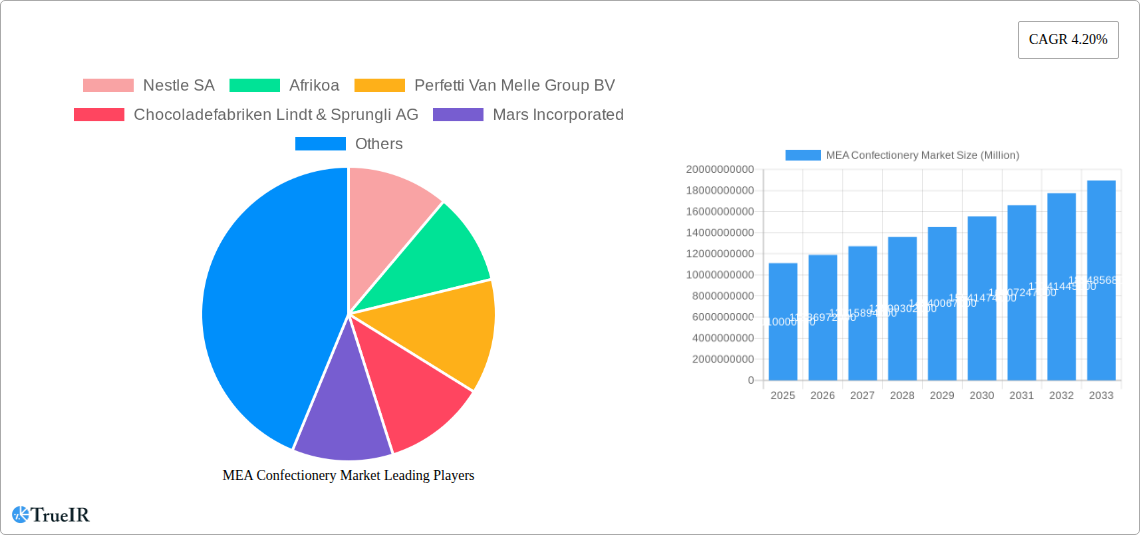

The Middle East & Africa (MEA) confectionery market is poised for significant expansion, driven by a growing young population, increasing disposable incomes, and a burgeoning demand for both indulgent and functional treats. The market is estimated to be valued at USD 11.11 billion in 2025, demonstrating robust growth with a projected Compound Annual Growth Rate (CAGR) of 6.92% from 2019 to 2033. This upward trajectory is fueled by evolving consumer preferences, with a notable shift towards premium and artisanal chocolates, as well as a rising interest in healthier confectionery options like snack bars that incorporate functional ingredients. Urbanization and improved retail infrastructure, particularly the expanding presence of supermarkets/hypermarkets and the rapid growth of online retail, are also critical enablers, ensuring wider accessibility and catering to convenience-seeking consumers across the region.

MEA Confectionery Market Market Size (In Billion)

However, the MEA confectionery market faces certain headwinds. Rising raw material costs, especially for cocoa and sugar, can exert pressure on profit margins and potentially impact pricing strategies, affecting affordability for a significant segment of the population. Geopolitical instability in certain sub-regions can also disrupt supply chains and affect consumer spending power. Despite these challenges, the fundamental drivers of market growth remain strong. The diversification of product offerings, including sugar-free and low-calorie options, alongside innovative flavor profiles and appealing packaging, will be crucial for sustained success. Key players like Nestle SA, Mars Incorporated, and The Hershey Company are actively investing in product innovation and market penetration strategies to capitalize on the immense potential within this dynamic region. The market's segmentation is diverse, with chocolates, sugar confectionery, and snack bars each carving out significant shares, and distribution channels are evolving to meet modern consumer habits.

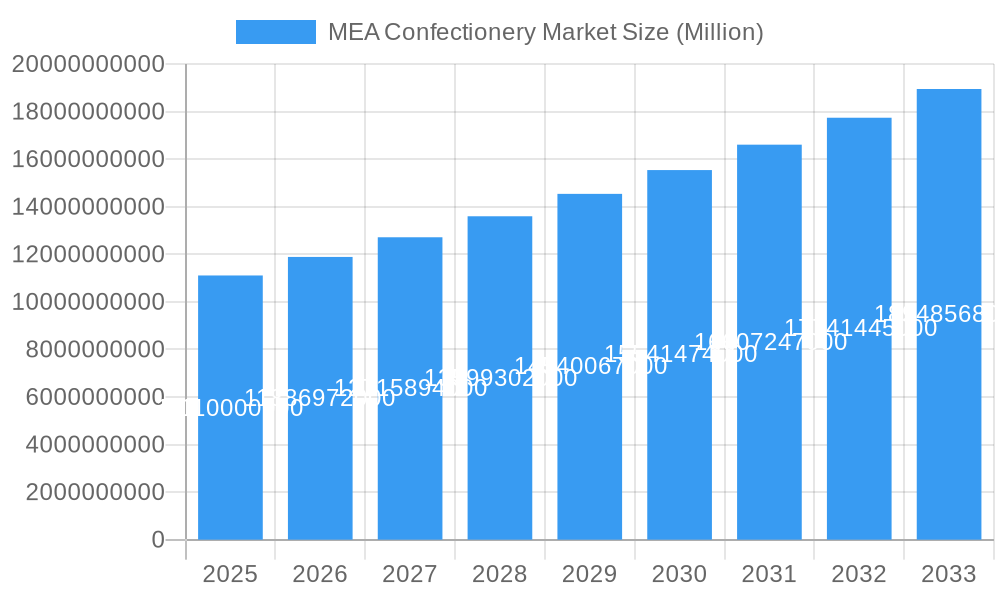

MEA Confectionery Market Company Market Share

MEA Confectionery Market Report: Unlocking Growth & Innovation (2019-2033)

Gain unparalleled insights into the burgeoning Middle East and Africa (MEA) Confectionery Market. This comprehensive report, spanning 2019-2033 with a base year of 2025, provides in-depth analysis of market dynamics, consumer trends, and competitive strategies. Discover growth opportunities in this rapidly expanding sector, estimated to reach multi-billion dollar valuations.

MEA Confectionery Market Market Structure & Competitive Landscape

The MEA confectionery market is characterized by a moderate level of concentration, with major global players like Nestle SA, Mars Incorporated, and The Hershey Company holding significant shares. However, the landscape is increasingly dynamic, with the rise of regional players such as Afrikoa and strong performances from established confectionery giants like Perfetti Van Melle Group BV, Chocoladefabriken Lindt & Sprungli AG, Pladis Global, and Mondelez International. Innovation is a key driver, with companies focusing on healthier options, premiumization, and localized flavors to cater to diverse consumer preferences. Regulatory impacts, particularly concerning sugar content and labeling, are also shaping product development and market entry strategies. Product substitutes, including baked goods and fresh fruits, present a constant competitive challenge, driving confectionery manufacturers to differentiate through unique offerings and value propositions. End-user segmentation reveals a growing demand from younger demographics and an increasing appetite for convenient, on-the-go snacking solutions. Mergers and acquisitions (M&A) activity, while not at peak levels, are expected to continue as companies seek to expand their market reach and product portfolios. Current M&A volumes are estimated at several hundred million dollars annually, with a projected increase of 15% over the forecast period. The market concentration ratio for the top five players is approximately 60%, with opportunities for smaller, niche players to gain traction through specialized products.

MEA Confectionery Market Market Trends & Opportunities

The MEA Confectionery Market is poised for robust expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2025 and 2033. This growth is fueled by several interconnected trends. A significant driver is the increasing disposable income across various MEA nations, leading to higher consumer spending on discretionary items like confectionery. Urbanization and a growing middle-class population are further augmenting demand, especially for premium and convenience-oriented products. Technological advancements in manufacturing and packaging are enabling companies to produce a wider variety of products more efficiently and attractively. This includes innovations in sugar reduction technologies, allergen-free formulations, and sustainable packaging solutions, aligning with evolving consumer health consciousness and environmental concerns.

Consumer preferences are undergoing a notable shift. While traditional indulgence remains a core demand, there is a discernible rise in the demand for healthier confectionery options. This encompasses reduced sugar, natural ingredients, and functional benefits such as added vitamins or probiotics. The "snacking culture" is deeply ingrained in the MEA region, with consumers seeking convenient and portable treats throughout the day. Snack bars, in particular, are experiencing accelerated growth as consumers look for energy boosts and healthier alternatives to traditional sweets.

Competitive dynamics are intensifying. Global giants are actively expanding their presence through strategic partnerships, local production facilities, and targeted marketing campaigns. Simultaneously, local and regional brands are gaining prominence by leveraging their understanding of local tastes and cultural nuances. Online retail channels are rapidly gaining traction, presenting a significant opportunity for market penetration, especially in less urbanized areas. The convenience store segment continues to be a strong performer due to its accessibility and impulse purchase nature.

Market penetration rates for confectionery are steadily increasing, with estimates suggesting that over 80% of the target population now regularly purchases confectionery products. The market size is expected to surpass the xx billion dollar mark by 2028, with further substantial growth anticipated by 2033. Opportunities abound for companies that can effectively tap into the demand for personalized confectionery, ethical sourcing, and immersive brand experiences. Digital marketing and e-commerce platforms are crucial for reaching a wider audience and building direct consumer relationships.

Dominant Markets & Segments in MEA Confectionery Market

The MEA Confectionery Market exhibits distinct dominance across various regions and segments, driven by socio-economic factors, infrastructure, and evolving consumer behaviors.

Dominant Regions and Countries:

GCC (Gulf Cooperation Council) Countries: These nations, including the UAE, Saudi Arabia, and Qatar, consistently lead the market.

- Key Growth Drivers: High disposable incomes, a large expatriate population with diverse tastes, significant tourism influx, and well-developed retail infrastructure.

- Detailed Analysis: The GCC region's economic prosperity translates into a strong demand for premium and indulgence confectionery. Extensive hypermarket and supermarket chains ensure widespread availability, while a growing preference for gifting and special occasions further boosts sales of boxed assortments and premium chocolates. The strong online retail presence also caters to the convenience-driven lifestyles of its residents.

North Africa (Egypt, Algeria, Morocco): This sub-region represents a significant and growing market, characterized by a large and young population.

- Key Growth Drivers: Rapid population growth, increasing urbanization, a burgeoning youth demographic with growing purchasing power, and expanding distribution networks.

- Detailed Analysis: While per capita consumption might be lower than the GCC, the sheer volume of consumers makes North Africa a critical market. Traditional sugar confectionery remains popular, but there's a rising interest in chocolates and snack bars. Government initiatives aimed at improving retail infrastructure and foreign investment policies are further stimulating market growth.

Dominant Segments:

Product Type: Chocolates: This segment holds the largest market share and is projected to continue its dominance.

- Softlines/Selflines: Individual chocolate bars and smaller, single-serve chocolates are extremely popular for impulse purchases and on-the-go consumption.

- Boxed Assortments: These cater to gifting occasions and are particularly strong in the GCC region, offering premium and varied chocolate experiences.

- Countlines: Multi-piece chocolate confectionery continues to be a staple, appealing to families and shared consumption.

- Molded Chocolate: Versatile and adaptable, molded chocolates allow for innovative shapes and designs, appealing to both children and adults.

- Key Growth Drivers: Premiumization trends, demand for indulgent treats, and the introduction of new flavor profiles and healthier variants within the chocolate category.

Product Type: Sugar Confectionery: This broad category remains a significant contributor, especially in more price-sensitive markets.

- Mints, Pastilles, Jellies, and Chews: Popular for their affordability and variety, these offer consistent demand across various demographics.

- Toffees, Caramels, and Nougat: These traditional favorites continue to hold their ground, with a loyal consumer base.

- Key Growth Drivers: Affordability, wide availability, and consistent demand for familiar flavors and textures.

Distribution Channel: Supermarkets/Hypermarkets: These remain the primary distribution channels due to their extensive reach and product variety.

- Key Growth Drivers: One-stop shopping convenience, promotions, and the ability to cater to a broad spectrum of consumer needs.

Distribution Channel: Online Retail Stores: Experiencing exponential growth, online channels are becoming increasingly crucial.

- Key Growth Drivers: Convenience, wider selection, competitive pricing, and reaching consumers in remote areas.

MEA Confectionery Market Product Analysis

Product innovations in the MEA confectionery market are increasingly focused on health and wellness, premiumization, and localized tastes. Manufacturers are actively developing reduced-sugar and sugar-free alternatives, incorporating natural sweeteners and functional ingredients like probiotics and vitamins. For instance, a significant trend involves the introduction of dark chocolate variants with higher cocoa content and antioxidant benefits. The application of novel flavors, such as exotic fruits and regional spices, is enhancing the appeal of both chocolates and sugar confectionery. Competitive advantages are being built through unique formulations that cater to dietary restrictions (e.g., gluten-free, vegan) and by offering visually appealing and innovative packaging designs that resonate with gifting culture and modern aesthetics. Technological advancements in processing are enabling the creation of better textures and longer shelf-life, ensuring market fit and consumer satisfaction.

Key Drivers, Barriers & Challenges in MEA Confectionery Market

Key Drivers:

- Economic Growth and Rising Disposable Incomes: Increased purchasing power across key MEA countries fuels demand for discretionary goods like confectionery.

- Youthful Demographics and Urbanization: A large, young population and rapid urbanization drive consumption patterns, particularly for convenient and trendy snack options.

- Increasing Retail Infrastructure Development: Expansion of supermarkets, hypermarkets, and convenience stores ensures wider product accessibility.

- Growing Tourism and Expatriate Population: These demographic segments often have higher spending power and diverse taste preferences, boosting premium confectionery sales.

Barriers & Challenges:

- Price Sensitivity in Certain Markets: Affordability remains a key consideration for a significant portion of the population, limiting the penetration of premium products.

- Regulatory Landscape: Varying regulations on sugar content, import duties, and labeling across different countries can create complexities for market entry and product standardization.

- Supply Chain Inefficiencies: Logistical challenges, particularly in less developed regions, can impact product availability and shelf life.

- Intense Competition: The presence of both global giants and agile local players creates a highly competitive environment, demanding continuous innovation and effective marketing.

- Health Consciousness and Sugar Concerns: Growing awareness about the health impacts of sugar consumption poses a challenge, necessitating the development of healthier alternatives.

Growth Drivers in the MEA Confectionery Market Market

The MEA Confectionery Market's growth is significantly propelled by several key drivers. Economically, rising disposable incomes across the GCC and parts of North Africa directly translate into increased consumer spending on indulgence products. Demographically, the region's youthful population, coupled with ongoing urbanization, creates a substantial and expanding consumer base actively seeking convenient and appealing snack options. Technologically, advancements in food processing and ingredient innovation are enabling the development of healthier, yet equally appealing, confectionery products, such as low-sugar variants and those fortified with functional benefits. Regulatory shifts, when favorable, such as government initiatives to boost local manufacturing and trade agreements, can also act as powerful growth catalysts, encouraging investment and market expansion. The increasing adoption of e-commerce platforms and digital marketing strategies further amplifies reach and accessibility.

Challenges Impacting MEA Confectionery Market Growth

Despite the promising growth trajectory, the MEA Confectionery Market faces several significant challenges. Regulatory complexities, including varying import tariffs, food safety standards, and evolving labeling requirements across diverse countries, can pose considerable hurdles for market entry and operational efficiency. Supply chain inefficiencies, particularly in vast and developing regions, can lead to increased logistics costs, product spoilage, and limited availability, impacting market penetration. Competitive pressures are intensifying, with both global confectionery titans and emerging local brands vying for market share, demanding continuous product innovation and aggressive marketing strategies. Furthermore, growing consumer awareness and concerns regarding sugar intake and its health implications necessitate a strategic shift towards healthier product offerings, which can involve significant R&D investment and consumer education efforts. Price sensitivity in certain sub-regions also limits the widespread adoption of premium products.

Key Players Shaping the MEA Confectionery Market Market

- Nestle SA

- Afrikoa

- Perfetti Van Melle Group BV

- Chocoladefabriken Lindt & Sprungli AG

- Mars Incorporated

- Pladis Global

- The Hershey Company

- Mondelez International

Significant MEA Confectionery Market Industry Milestones

- 2019: Increased focus on sustainable sourcing of cocoa beans by major chocolate manufacturers.

- 2020: Introduction of sugar-reduced and plant-based confectionery options gaining traction.

- 2021: Significant investment in e-commerce infrastructure and direct-to-consumer (DTC) models by confectionery brands.

- 2022: Launch of innovative functional confectionery products incorporating vitamins and minerals.

- 2023: Strategic partnerships formed between confectionery companies and local snack producers to expand market reach.

- 2024: Growing demand for premium, single-origin chocolates and artisanal confectionery.

Future Outlook for MEA Confectionery Market Market

The future outlook for the MEA Confectionery Market is exceptionally bright, characterized by sustained growth and evolving consumer demands. Key growth catalysts will include the continued expansion of e-commerce, enabling wider access to a diverse range of products, and a persistent shift towards healthier confectionery options, driving innovation in sugar reduction and functional ingredients. The increasing disposable income and youthful demographics in key markets will ensure robust demand for both everyday treats and premium indulgence products. Strategic opportunities lie in leveraging localized flavors, embracing sustainable packaging solutions, and creating engaging digital marketing campaigns to connect with the region's digitally savvy population. The market is poised to witness increased product diversification and a heightened focus on personalized consumer experiences, further solidifying its position as a dynamic and lucrative sector within the global confectionery landscape.

MEA Confectionery Market Segmentation

-

1. Product Type

-

1.1. Chocolates

- 1.1.1. Softlines/Selflines

- 1.1.2. Boxed Assortments

- 1.1.3. Countlines

- 1.1.4. Molded Chocolate

- 1.1.5. Other Chocolates

- 1.2. Gums

-

1.3. Sugar Confectionery

- 1.3.1. Mints

- 1.3.2. Pastilles, Jellies, and Chews

- 1.3.3. Toffees, Caramels, and Nougat

- 1.3.4. Other Sugar Confectioneries

-

1.4. Snack Bars

- 1.4.1. Cereal Bars

- 1.4.2. Energy Bars

-

1.1. Chocolates

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

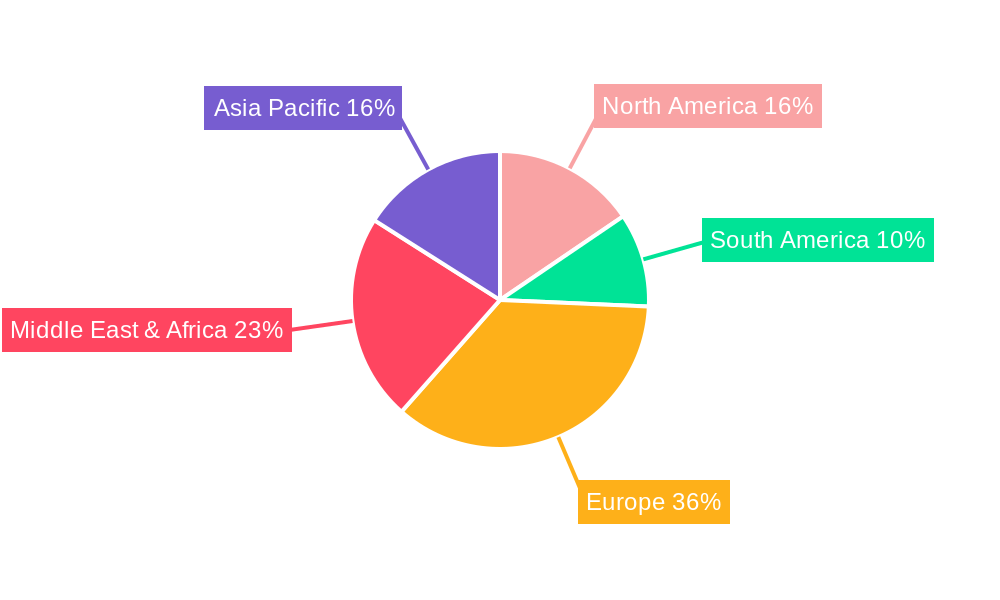

MEA Confectionery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Confectionery Market Regional Market Share

Geographic Coverage of MEA Confectionery Market

MEA Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. INCREASING DEMAND FOR PREMIUM AND ARTISAN CHOCOLATES

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Chocolates

- 5.1.1.1. Softlines/Selflines

- 5.1.1.2. Boxed Assortments

- 5.1.1.3. Countlines

- 5.1.1.4. Molded Chocolate

- 5.1.1.5. Other Chocolates

- 5.1.2. Gums

- 5.1.3. Sugar Confectionery

- 5.1.3.1. Mints

- 5.1.3.2. Pastilles, Jellies, and Chews

- 5.1.3.3. Toffees, Caramels, and Nougat

- 5.1.3.4. Other Sugar Confectioneries

- 5.1.4. Snack Bars

- 5.1.4.1. Cereal Bars

- 5.1.4.2. Energy Bars

- 5.1.1. Chocolates

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America MEA Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Chocolates

- 6.1.1.1. Softlines/Selflines

- 6.1.1.2. Boxed Assortments

- 6.1.1.3. Countlines

- 6.1.1.4. Molded Chocolate

- 6.1.1.5. Other Chocolates

- 6.1.2. Gums

- 6.1.3. Sugar Confectionery

- 6.1.3.1. Mints

- 6.1.3.2. Pastilles, Jellies, and Chews

- 6.1.3.3. Toffees, Caramels, and Nougat

- 6.1.3.4. Other Sugar Confectioneries

- 6.1.4. Snack Bars

- 6.1.4.1. Cereal Bars

- 6.1.4.2. Energy Bars

- 6.1.1. Chocolates

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America MEA Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Chocolates

- 7.1.1.1. Softlines/Selflines

- 7.1.1.2. Boxed Assortments

- 7.1.1.3. Countlines

- 7.1.1.4. Molded Chocolate

- 7.1.1.5. Other Chocolates

- 7.1.2. Gums

- 7.1.3. Sugar Confectionery

- 7.1.3.1. Mints

- 7.1.3.2. Pastilles, Jellies, and Chews

- 7.1.3.3. Toffees, Caramels, and Nougat

- 7.1.3.4. Other Sugar Confectioneries

- 7.1.4. Snack Bars

- 7.1.4.1. Cereal Bars

- 7.1.4.2. Energy Bars

- 7.1.1. Chocolates

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe MEA Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Chocolates

- 8.1.1.1. Softlines/Selflines

- 8.1.1.2. Boxed Assortments

- 8.1.1.3. Countlines

- 8.1.1.4. Molded Chocolate

- 8.1.1.5. Other Chocolates

- 8.1.2. Gums

- 8.1.3. Sugar Confectionery

- 8.1.3.1. Mints

- 8.1.3.2. Pastilles, Jellies, and Chews

- 8.1.3.3. Toffees, Caramels, and Nougat

- 8.1.3.4. Other Sugar Confectioneries

- 8.1.4. Snack Bars

- 8.1.4.1. Cereal Bars

- 8.1.4.2. Energy Bars

- 8.1.1. Chocolates

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa MEA Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Chocolates

- 9.1.1.1. Softlines/Selflines

- 9.1.1.2. Boxed Assortments

- 9.1.1.3. Countlines

- 9.1.1.4. Molded Chocolate

- 9.1.1.5. Other Chocolates

- 9.1.2. Gums

- 9.1.3. Sugar Confectionery

- 9.1.3.1. Mints

- 9.1.3.2. Pastilles, Jellies, and Chews

- 9.1.3.3. Toffees, Caramels, and Nougat

- 9.1.3.4. Other Sugar Confectioneries

- 9.1.4. Snack Bars

- 9.1.4.1. Cereal Bars

- 9.1.4.2. Energy Bars

- 9.1.1. Chocolates

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific MEA Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Chocolates

- 10.1.1.1. Softlines/Selflines

- 10.1.1.2. Boxed Assortments

- 10.1.1.3. Countlines

- 10.1.1.4. Molded Chocolate

- 10.1.1.5. Other Chocolates

- 10.1.2. Gums

- 10.1.3. Sugar Confectionery

- 10.1.3.1. Mints

- 10.1.3.2. Pastilles, Jellies, and Chews

- 10.1.3.3. Toffees, Caramels, and Nougat

- 10.1.3.4. Other Sugar Confectioneries

- 10.1.4. Snack Bars

- 10.1.4.1. Cereal Bars

- 10.1.4.2. Energy Bars

- 10.1.1. Chocolates

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Afrikoa

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Perfetti Van Melle Group BV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chocoladefabriken Lindt & Sprungli AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mars Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pladis Global

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Hershey Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mondelez International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global MEA Confectionery Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America MEA Confectionery Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America MEA Confectionery Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America MEA Confectionery Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America MEA Confectionery Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America MEA Confectionery Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America MEA Confectionery Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America MEA Confectionery Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: South America MEA Confectionery Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America MEA Confectionery Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America MEA Confectionery Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America MEA Confectionery Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America MEA Confectionery Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe MEA Confectionery Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Europe MEA Confectionery Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe MEA Confectionery Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe MEA Confectionery Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe MEA Confectionery Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe MEA Confectionery Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa MEA Confectionery Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa MEA Confectionery Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa MEA Confectionery Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa MEA Confectionery Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa MEA Confectionery Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa MEA Confectionery Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific MEA Confectionery Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Asia Pacific MEA Confectionery Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific MEA Confectionery Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific MEA Confectionery Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific MEA Confectionery Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific MEA Confectionery Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Confectionery Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global MEA Confectionery Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global MEA Confectionery Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global MEA Confectionery Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global MEA Confectionery Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global MEA Confectionery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global MEA Confectionery Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global MEA Confectionery Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global MEA Confectionery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Confectionery Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 17: Global MEA Confectionery Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global MEA Confectionery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global MEA Confectionery Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global MEA Confectionery Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global MEA Confectionery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global MEA Confectionery Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global MEA Confectionery Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global MEA Confectionery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific MEA Confectionery Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Confectionery Market?

The projected CAGR is approximately 6.92%.

2. Which companies are prominent players in the MEA Confectionery Market?

Key companies in the market include Nestle SA, Afrikoa, Perfetti Van Melle Group BV, Chocoladefabriken Lindt & Sprungli AG, Mars Incorporated, Pladis Global, The Hershey Company, Mondelez International.

3. What are the main segments of the MEA Confectionery Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

INCREASING DEMAND FOR PREMIUM AND ARTISAN CHOCOLATES.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Confectionery Market?

To stay informed about further developments, trends, and reports in the MEA Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence